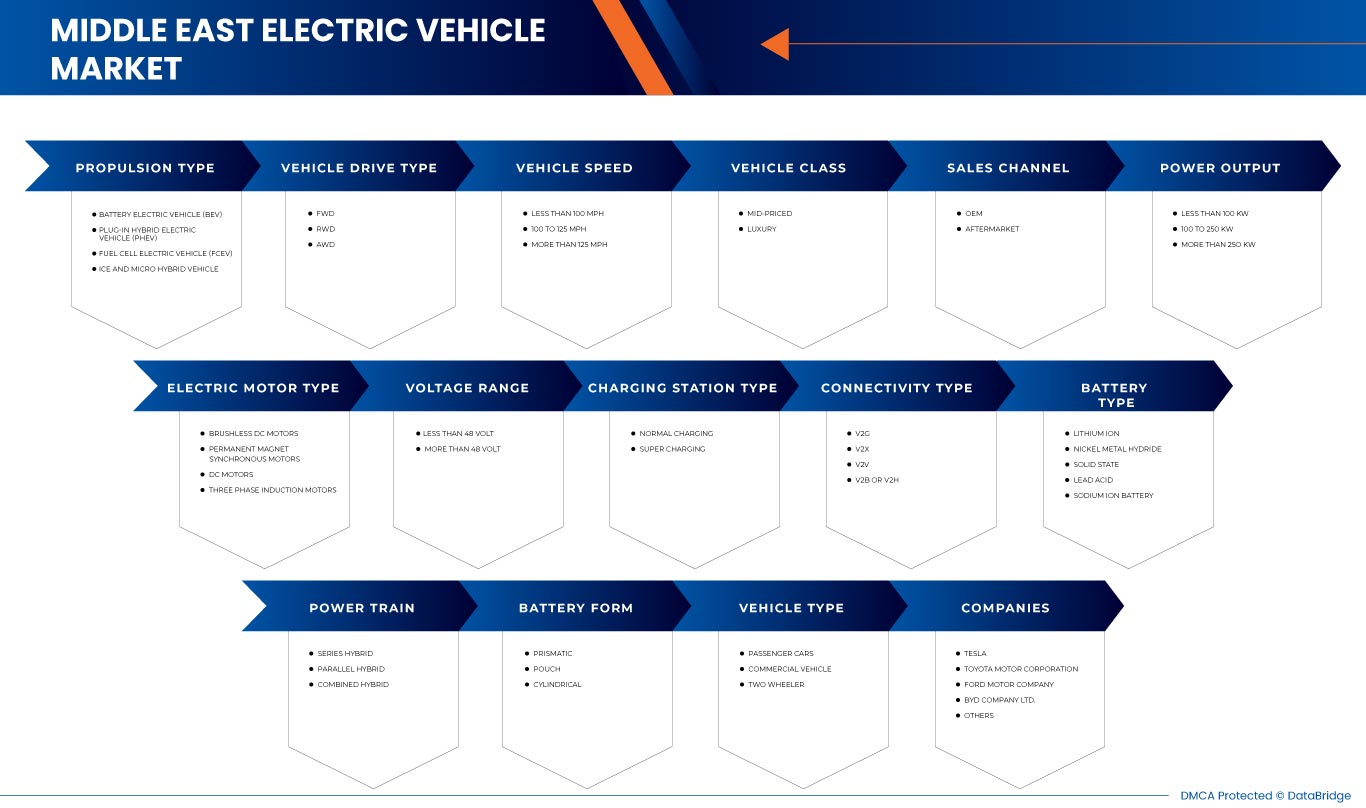

Marché des véhicules électriques au Moyen-Orient, par type de propulsion (véhicule électrique à batterie (BEV), véhicule électrique hybride rechargeable (PHEV), véhicule électrique à pile à combustible (FCEV) et véhicule ICE et micro-hybride), type de transmission du véhicule (traction avant, propulsion arrière et traction intégrale), vitesse du véhicule (moins de 100 mi/h, de 100 à 125 mi/h et plus de 125 mi/h), catégorie de véhicule (prix moyen et luxe), canal de vente (OEM et marché secondaire), puissance de sortie (moins de 100 kW, de 100 à 250 kW et plus de 250 kW), type de moteur électrique (moteurs à courant continu sans balais, moteurs synchrones à aimant permanent, moteurs à courant continu et moteurs à induction triphasés), plage de tension (moins de 48 volts et plus de 48 volts), type de station de charge (charge normale et super charge), type de connectivité (V2G, V2X, V2V et V2B ou V2H), groupe motopropulseur (hybride série, parallèle) Hybride et hybride combiné, type de véhicule (voitures particulières, véhicule utilitaire et deux-roues), type de batterie (batterie lithium-ion, nickel-hydrure métallique, semi-conducteur, plomb-acide et sodium-ion), forme de batterie (prismatique, poche et cylindrique), tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des véhicules électriques au Moyen-Orient

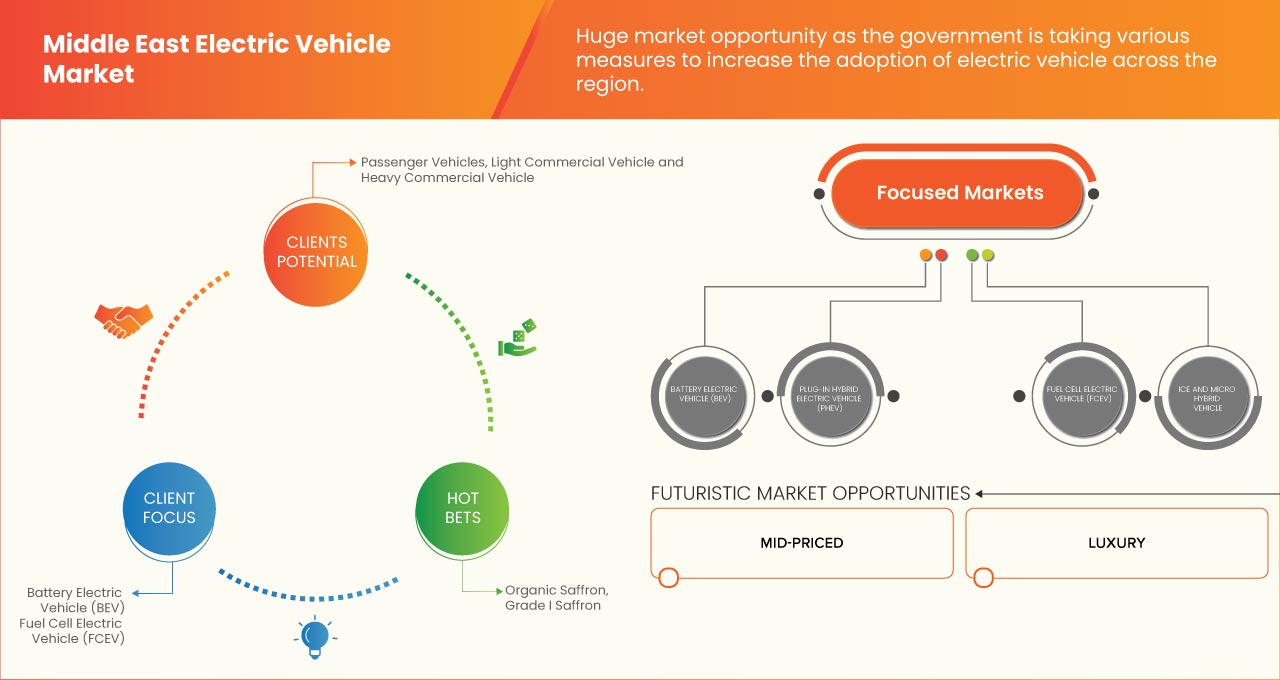

Les véhicules électriques sont une alternative prometteuse aux véhicules à essence pour la protection de l'environnement. De nombreux gouvernements prennent des initiatives pour promouvoir les véhicules électriques et offrent des réductions d'impôts et des remboursements. L'essor du marché des véhicules électriques au Moyen-Orient est dû au fait que la technologie évolue à un rythme rapide, ce qui entraîne une augmentation de la demande de véhicules électriques sur le marché. Certains des facteurs qui stimulent le marché sont l'augmentation de la demande de véhicules électriques, les incitations et subventions gouvernementales pour les véhicules électriques, et les préoccupations environnementales croissantes. Cependant, le coût initial élevé freine la croissance du marché.

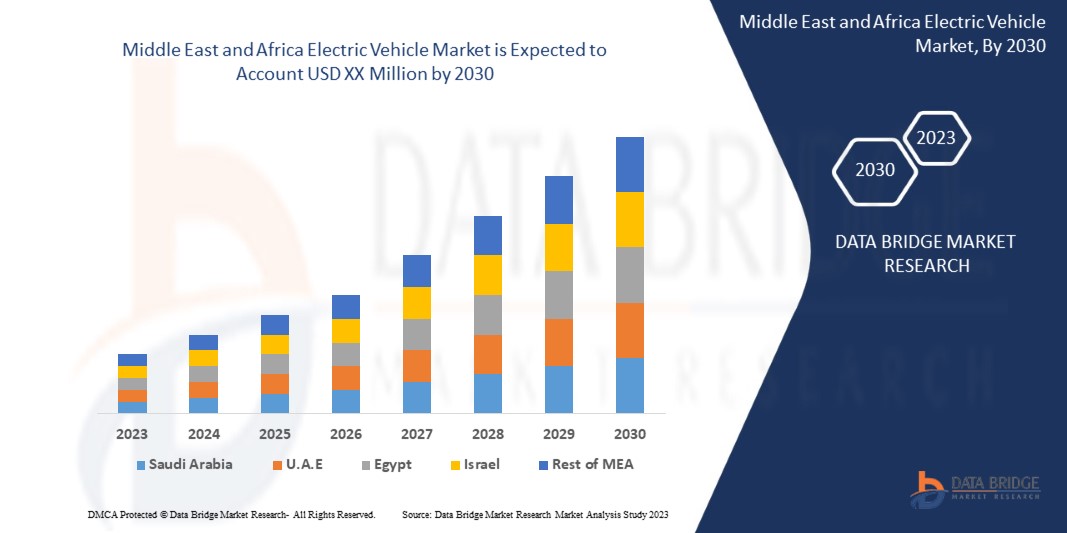

Data Bridge Market Research analyse que le marché des véhicules électriques au Moyen-Orient connaîtra un TCAC de 28,1 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Année de base |

2022 |

|

Période de prévision |

2023 - 2030 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en milliers d'unités, prix en USD |

|

Segments couverts |

Par type de propulsion (véhicule électrique à batterie (BEV), véhicule électrique hybride rechargeable (PHEV), véhicule électrique à pile à combustible (FCEV) et véhicule ICE et micro hybride), type de transmission du véhicule (traction avant, propulsion arrière et traction intégrale), vitesse du véhicule (moins de 100 mi/h, de 100 à 125 mi/h et plus de 125 mi/h), catégorie de véhicule (prix moyen et luxe), canal de vente (OEM et marché secondaire), puissance de sortie (moins de 100 kW, de 100 à 250 kW et plus de 250 kW), type de moteur électrique ( moteurs à courant continu sans balais , moteurs synchrones à aimant permanent, moteurs à courant continu et moteurs à induction triphasés), plage de tension (moins de 48 volts et plus de 48 volts), type de station de charge (charge normale et super charge), type de connectivité (V2G, V2X, V2V et V2B ou V2H), groupe motopropulseur (hybride série, hybride parallèle et hybride combiné), Type de véhicule (voitures particulières, véhicule utilitaire et deux-roues), type de batterie (batterie lithium-ion, batterie nickel-hydrure métallique , batterie à semi-conducteurs, batterie plomb-acide et batterie sodium-ion), forme de batterie (prismatique, poche et cylindrique). |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Bahreïn, Qatar, Koweït, Oman et reste du Moyen-Orient. |

|

Acteurs du marché couverts |

BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Groupe Renault, Geely Automobile Holdings Limited., Lucid Group, Inc., entre autres. |

Définition du marché

Un véhicule électrique est un véhicule qui fonctionne entièrement ou partiellement à l'électricité. Contrairement aux véhicules conventionnels qui utilisent uniquement des combustibles fossiles, les véhicules électriques utilisent un moteur électrique alimenté par une pile à combustible ou des batteries. Les termes « véhicule électrique » ou « VE » sont les termes couramment utilisés pour désigner un véhicule électrique. Dans la plupart des cas, le terme inclut à la fois les BEV et les PHEV. Les lettres BEV signifient véhicules électriques à batterie, tandis que PHEV signifie véhicules électriques hybrides rechargeables. Un véhicule électrique (VE) fonctionne avec un moteur électrique au lieu d'un moteur à combustion interne qui produit de l'énergie en brûlant un mélange de carburant et de gaz. Par conséquent, les véhicules électriques sont considérés comme un remplacement possible des automobiles de génération actuelle pour résoudre le problème de la pollution croissante, du réchauffement climatique et de l'épuisement des ressources naturelles. L'autonomie d'un véhicule électrique est la distance qu'il peut parcourir avec une seule charge.

Dynamique du marché des véhicules électriques au Moyen-Orient

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande de véhicules électriques

L'industrie automobile connaît une croissance énorme au fil des ans en raison de la demande croissante de véhicules électriques de luxe. Parmi les facteurs qui stimulent les ventes de véhicules électriques, on peut citer les réglementations gouvernementales strictes concernant les émissions des véhicules, la demande croissante de véhicules à faible consommation de carburant, à hautes performances et à faibles émissions.

- Incitations et subventions gouvernementales pour les véhicules électriques

Il a été observé que les gouvernements de nombreux États sensibilisent davantage les citoyens aux véhicules électriques et offrent davantage d'avantages tels que des réductions ou des réductions d'impôts. Les gens se tournent vers des véhicules électriques plus automatisés et technologiquement mis à jour, car un nombre croissant de véhicules électriques ont été observés sur les routes.

Opportunité

-

Bornes de recharge basées sur le cloud (recharge intelligente de véhicules électriques)

La recharge basée sur le cloud permet aux stations de recharge de véhicules électriques connectées à Internet de communiquer en permanence avec un système central. En cas de panne du serveur, le système cloud utilise simplement l'un des nombreux serveurs secondaires et votre station de recharge ne remarquera même aucun changement. Les stations de recharge basées sur le cloud créent une énorme opportunité car elles présentent de nombreux avantages, comme une connexion plus facile aux données de l'utilisateur et du véhicule, des calculs beaucoup plus rapides, un remplacement plus facile et une mise à niveau facile.

Retenue/Défi

- Manque d’infrastructures de recharge pour véhicules électriques dans les pays sous-développés

La principale condition pour la croissance des véhicules électriques est la disponibilité de stations de recharge appropriées à une distance adéquate. Cependant, il existe un énorme manque d'infrastructures dans les pays sous-développés, ce qui limite la croissance du marché des véhicules électriques. Il y a une pénurie de stations de recharge et les entreprises ne prennent pas d'initiatives pour lancer de nouveaux véhicules et vélos électriques en raison de la pénurie actuelle de stations de recharge.

Impact du COVID-19 sur le marché des véhicules électriques

La COVID-19 a eu un impact considérable sur les transports publics. Pendant la période de distanciation sociale, les voyageurs ont été priés d'éviter de voyager à moins que cela ne soit absolument nécessaire. De plus, le comportement des individus a certainement changé pendant la pandémie, ce qui a entraîné une diminution des ventes de véhicules automobiles. La pandémie a entraîné une chute considérable des ventes sur le marché des véhicules électriques, car le confinement prévalait dans la plupart des régions. Le confinement a conduit les fabricants et les consommateurs à arrêter complètement les processus pendant quelques mois. La demande de véhicules électriques a connu une chute drastique en raison de la fermeture de diverses industries de l'automobile, du transport et de l'électronique. En outre, les ventes mondiales de voitures électriques ont connu une baisse sans précédent. Cependant, les choses redeviennent normales de jour en jour et la croissance des véhicules électriques est désormais obsolète.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer les performances et les ventes des véhicules électriques. Grâce à cela, les entreprises mettront sur le marché des véhicules électriques de pointe.

Par exemple,

- En avril 2021, selon la Society of Electric Vehicle Manufacturers (SMEV), l'immatriculation de tous les véhicules électriques au cours de l'année 2021 a diminué de 20 % par rapport aux unités vendues au cours de l'exercice 2020. Les deux-roues électriques ont connu une baisse de 6 %. Les trois-roues électriques (E3W) ont connu une baisse de 37 % par rapport aux unités vendues au cours de l'exercice 2020.

Ainsi, le COVID-19 a gravement impacté la demande de véhicules électriques sur le marché, l’offre limitée et la pénurie de semi-conducteurs et de gadgets ont considérablement affecté l’offre de véhicules électriques sur le marché.

Développements récents

- En avril 2022, TOYOTA MOTOR CORPORATION a annoncé le lancement de son SUV entièrement électrique bZ4X. Il sera disponible avec un choix entre une traction avant (FWD) et une traction arrière (RWD), toutes deux dotées d'une batterie de 71,4 kWh. Ainsi, l'entreprise proposera à ses clients un SUV avec une autonomie de conduite plus longue.

- En janvier 2022, Mercedes-Benz Group AG a annoncé que sa division EQ lancerait les SUV EQA, EQB et EQC ainsi que les berlines de luxe EQE et EQS dans la région. Les voitures seront vendues et entretenues par l'intermédiaire de 36 concessionnaires spécialement désignés dans le pays. L'entreprise étendra ainsi sa présence dans la région.

Portée du marché des véhicules électriques au Moyen-Orient

Le marché des véhicules électriques est segmenté en fonction du type de propulsion, du type de conduite du véhicule, de la vitesse du véhicule, de la classe du véhicule, du canal de vente, du type de moteur électrique, de la puissance de sortie, de la plage de tension, du type de borne de recharge, du type de connectivité, du groupe motopropulseur, de la forme de la batterie, du type de batterie et du type de véhicule. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de propulsion

- Véhicule électrique à batterie (VEB)

- Véhicule électrique hybride rechargeable (PHEV)

- Véhicule électrique à pile à combustible (FCEV)

- Véhicule ICE et micro-hybride

Sur la base du type de propulsion, le marché des véhicules électriques du Moyen-Orient est segmenté en véhicule électrique à batterie (BEV), véhicule électrique hybride rechargeable (PHEV), véhicule électrique à pile à combustible (FCEV) et véhicule ICE et micro hybride.

Type de véhicule à propulsion

- Traction avant

- RWD

- Transmission intégrale

Sur la base du type de conduite du véhicule, le marché des véhicules électriques du Moyen-Orient est segmenté en FWD, RWD et AWD.

Vitesse du véhicule

- Moins de 100 MPH

- 100 À 125 MPH

- Plus de 125 MPH

Sur la base de la vitesse du véhicule, le marché des véhicules électriques du Moyen-Orient est segmenté en moins de 100 MPH, 100 à 125 MPH et plus de 125 MPH.

Classe de véhicule

- Prix moyen

- Luxe

Sur la base de la catégorie de véhicule, le marché des véhicules électriques du Moyen-Orient est segmenté en modèles de milieu de gamme et de luxe.

Canal de vente

- Fabricant d'équipement d'origine

- Pièces de rechange

On the basis of sales channel, the Middle East electric vehicle market is segmented into OEM and aftermarket.

Electric Motor Type

- DC Motors

- Brushless DC Motors

- Permanent Magnet Synchronous Motors

- Three Phase Induction Motors

On the basis of electric motor type, the Middle East electric vehicle market is segmented into DC motors, brushless DC motors, permanent magnet synchronous motors, and three phase induction motors.

Power Output

- Less Than 100 KW

- 100 TO 250 KW

- More Than 25O KW

On the basis of power output, the Middle East electric vehicle market is segmented into less than 100 KW, 100 to 250 KW, and more than 100 KW.

Voltage Range

- Less Than 48 Volt

- More Than 48 Volt

On the basis of voltage range, the Middle East electric vehicle market is segmented into less than 48 Volt and more than 48 Volt.

Charging Station Type

- Normal Charging

- Super Charging

On the basis of charging station type, the Middle East electric vehicle market is segmented into normal charging and super charging.

Connectivity Type

- V2B OR V2H

- V2G

- V2V

- V2X

On the basis of connectivity type, the Middle East electric vehicle market is segmented into V2B OR V2H, V2G, V2V, and V2X.

Power Train

- Parallel Hybrid

- Series Hybrid

- Combined Hybrid

On the basis of power train, the Middle East electric vehicle market is segmented into parallel hybrid, series hybrid, and combined hybrid.

Vehicle Type

- Passenger Cars

- Commercial Vehicle

- Two Wheeler

On the basis of vehicle type, the Middle East electric vehicle market is segmented into passenger vehicles, commercial vehicle, and Two Wheeler.

Battery Type

- Lithium Ion

- Nickel Metal Hydride

- Solid State

- Lead Acid

- Sodium Ion Battery

On the basis of battery type, the Middle East electric vehicle market is segmented into lithium ion, nickel metal hydride, solid state, lead acid, and sodium ion battery.

Battery Form

- Prismatic

- Pouch

- Cylindrical

On the basis of battery form, the Middle East electric vehicle market is segmented into prismatic, pouch, and cylindrical.

Middle East Electric Vehicle Market Analysis

The electric vehicle market is analyzed, and market size insights and trends are provided by the propulsion type, vehicle drive type, vehicle speed, vehicle class, sales channel, electric motor type, power output, voltage range, charging station type, connectivity type, power train, vehicle type, battery type, battery form, and countries as referenced above.

Middle East electric vehicle market is covers countries such as Saudi Arabia, U.A.E., Bahrain, Qatar, Kuwait, Oman, and the Rest of the Middle East.

Saudi Arabia is expected to dominate the Middle East electric vehicle market as Saudi Arabia is a regional leader in adopting EVs. The Saudi Arabia government aims to boost its own EV use by 20 percent in the year 2021, which will help to extend EV growth and the growth of the country in the Middle East electric vehicle market. Moreover, Saudi Arabia has the largest number of EV charging stations in the Middle East region. The highest concentration of charging stations is in Dubai. Initiatives such as Dubai Green Mobility which promotes the use of low-carbon transportation, motivate their residents and businesses to use electric and hybrid vehicles is promoting the growth of EVs. Also, the Dubai Supreme Council of Energy mandated that 10 percent of all new cars in the Emirate must be electric or hybrid by 2020, and 10 percent of all cars should be green by 2030. Saudi Arabia has also established an incentive system such as free charging stations, discounted car registrations and renewal, toll exemptions, bonus warranties for EVs, free parking in certain areas and other perks to boost EV adoption in the country. All these factors were contributing to the growth of the country in the Middle East electric vehicle market.

The country section of the electric vehicle market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East Electric Vehicle Market Share Analysis

The electric vehicle market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the electric vehicle market.

Some of the major players operating in the Middle East electric vehicle market are BMW AG, Nissan Motor Co., Ltd., MITSUBISHI MOTORS CORPORATION, Hyundai Motor Company, Mercedes-Benz Group AG, Tesla, TOYOTA MOTOR CORPORATION, Ford Motor Company, BYD Motors Inc., General Motors Company, Mahindra & Mahindra Ltd., MG MOTOR, JAGUAR LAND ROVER AUTOMOTIVE PLC, Renault Group, Geely Automobile Holdings Limited., Lucid Group, Inc., among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 EHAIL TECHNOLOGIES TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 EHAIL TECHNOLOGIES MARKET POSITION GRID

2.7 THE MARKET CHALLENGE MATRIX

2.8 MULTIVARIATE MODELING

2.9 VEHICLE CLASS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 XPENG INC. SWOT ANALYSIS

4.2 XPENG INC. BRAND AND COST ANALYSIS AND POSITIONING IN THE GLOBAL MARKET

4.3 OPPORTUNITIES FOR MARKET INTRODUCTION OF THE XPENG BRAND IN THE MIDDLE EAST

4.4 BRAND ANALYSIS OF XPENG INC.

4.5 PORTERS FIVE FORCE MODEL

4.6 TECHNOLOGICAL ADVANCEMENT

4.6.1 CHARGING TECHNOLOGY

4.6.2 AUTONOMOUS DRIVING

4.6.3 BATTERY TECHNOLOGY

4.7 REGULATORY STANDARDS

4.7.1 UAE

4.7.2 SAUDI ARABIA

4.8 SUPPLY CHAIN ANALYSIS

4.9 PESTLE ANALYSIS

4.9.1 POLITICAL FACTORS

4.9.2 ECONOMIC FACTORS

4.9.3 SOCIAL FACTORS

4.9.4 TECHNOLOGICAL FACTORS:

4.9.5 ENVIRONMENTAL FACTORS:

4.9.6 LEGAL FACTORS:

4.1 VENDOR SELECTION CRITERIA

4.11 COMPANY/BRAND COMPARATIVE ANALYSIS

4.11.1 BRAND COMPARATIVE ANALYSIS

4.11.2 TESLA

4.11.3 AUDI

4.11.4 TOYOTA

4.12 RAW MATERIAL PRODUCTION COVERAGE

4.13 SCENARIO-BASED ON PRODUCT ADOPTION

4.14 CONSUMER BEHAVIOUR PATTERN

4.15 FACTORS INFLUENCING THE BUYING DECISION

4.16 GOVERNMENT INCENTIVES TOWARD ELECTRIC VEHICLE

4.16.1 U.A.E.

4.17 TOP SELLING EV MODEL SALES IN 2022

4.18 PRICING ANALYSIS AND PROPOSED MANUFACTURER'S SUGGESTED RETAIL PRICE (MSRP) OF VARIOUS BRANDS OFFERING ELECTRIC VEHICLES

4.19 MARKETING STRATEGY OF MAJOR PLAYERS

4.2 SALES DATA OF ELECTRIC VEHICLES IN THE MIDDLE EAST REGION

4.21 AVAILABILITY OF CHARGING STATION INFRASTRUCTURE IN THE MIDDLE EAST REGION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES & SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

5.1.4 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.1.5 HIGH FLUCTUATION IN FUEL PRICES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN THE MEA REGION

5.3 OPPORTUNITIES

5.3.1 CLOUD BASED CHARGING STATIONS (SMART ELECTRIC VEHICLE CHARGING)

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGE

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BATTERY ELECTRIC VEHICLE (BEV)

6.2.1 LESS THAN 100 KW

6.2.2 100 TO 250 KW

6.2.3 MORE THAN 250 KW

6.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

6.3.1 LESS THAN 100 KW

6.3.2 100 TO 250 KW

6.3.3 MORE THAN 250 KW

6.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

6.4.1 LESS THAN 100 KW

6.4.2 100 TO 250 KW

6.4.3 MORE THAN 250 KW

6.5 ICE AND MICRO HYBRID VEHICLE

6.5.1 LESS THAN 100 KW

6.5.2 100 TO 250 KW

6.5.3 MORE THAN 250 KW

7 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

7.1 OVERVIEW

7.2 FWD

7.3 RWD

7.4 AWD

8 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED

8.1 OVERVIEW

8.2 LESS THAN 100 MPH

8.3 100 TO 125 MPH

8.4 MORE THAN 125 MPH

9 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS

9.1 OVERVIEW

9.2 MID-PRICED

9.3 LUXURY

10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT

11.1 OVERVIEW

11.2 LESS THAN 100 KW

11.3 100 TO 250 KW

11.4 MORE THAN 250 KW

12 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE

12.1 OVERVIEW

12.2 BRUSHLESS DC MOTORS

12.3 PERMANENT MAGNET SYNCHRONOUS MOTORS

12.4 DC MOTORS

12.5 THREE PHASE INDUCTION MOTORS

13 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE

13.1 OVERVIEW

13.2 LESS THAN 48 VOLT

13.3 MORE THAN 48 VOLT

14 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE

14.1 OVERVIEW

14.2 NORMAL CHARGING

14.2.1 LEVEL 2

14.2.2 LEVEL 3

14.2.3 LEVEL 1

14.3 SUPER CHARGING

14.3.1 LEVEL 2

14.3.2 LEVEL 3

14.3.3 LEVEL 1

15 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE

15.1 OVERVIEW

15.2 V2G

15.3 V2X

15.4 V2V

15.5 V2B OR V2H

16 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN

16.1 OVERVIEW

16.2 SERIES HYBRID

16.3 PARALLEL HYBRID

16.4 COMBINED HYBRID

17 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

17.1 OVERVIEW

17.2 PASSENGER CARS

17.2.1 HATCHBACK

17.2.2 SEDAN

17.2.3 SUV

17.2.4 COUPE

17.2.5 MUV

17.2.6 SPORTS CAR

17.2.7 CONVERTIBLE

17.2.8 OTHERS

17.3 COMMERCIAL VEHICLE

17.3.1 LIGHT COMMERCIAL VEHICLE (LCV)

17.3.1.1 VANS

17.3.1.2 MINI BUS

17.3.1.3 PICK UP TRUCKS

17.3.1.4 OTHERS

17.3.2 HEAVY COMMERCIAL VEHICLE (HCV)

17.3.2.1 BUS

17.3.2.2 TRUCKS

17.4 TWO WHEELER

18 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM

18.1 OVERVIEW

18.2 PRISMATIC

18.3 POUCH

18.4 CYLINDRICAL

19 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE

19.1 OVERVIEW

19.2 LITHIUM ION

19.3 NICKEL METAL HYDRIDE

19.4 SOLID STATE

19.5 LEAD ACID

19.6 SODIUM ION BATTERY

20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY

20.1 SAUDI ARABIA

20.2 U.A.E.

20.3 BAHRAIN

20.4 QATAR

20.5 KUWAIT

20.6 OMAN

20.7 REST OF MIDDLE EAST

21 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 XPENG INC.

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 TESLA

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENT

23.3 TOYOTA MOTOR CORPORATION

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENT

23.4 FORD MOTOR COMPANY

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 BYD COMPANY LTD

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENT

23.6 BMW AG

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENT

23.7 GEELY AUTOMOBILE HOLDINGS LIMITED

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 GENERAL MOTORS

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENT

23.9 HYUNDAI MOTOR COMPANY

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENT

23.1 JAGUAR LAND ROVER AUTOMOTIVE PLC

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 LUCID GROUP, INC.

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 MERCEDES-BENZ GROUP AG

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 MAHINDRA ELECTRIC MOBILITY LIMITED

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 MG MOTOR

23.14.1 COMPANY SNAPSHOT

23.14.2 PRODUCT PORTFOLIO

23.14.3 RECENT DEVELOPMENTS

23.15 MITSUBISHI MOTORS CORPORATION

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 NISSAN MOTOR CO., LTD.

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENT

23.17 RENAULT GROUP

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENT

24 QUESTIONNAIRE

Liste des tableaux

TABLE 1 XPENG EV MODELS IN THE MARKET

TABLE 2 MSRP RANGE FOR XPENG EV MODELS

TABLE 3 MSRP COMPARISON AS MAKE

TABLE 4 BRAND ANALYSIS

TABLE 5 FOLLOWING ARE THE UAE STANDARDS FOR ELECTRICAL MOTOR VEHICLES:

TABLE 6 ADDITIONAL STANDARDS:

TABLE 7 COMPETITIVE EV BRANDS IN THE GLOBAL MARKET

TABLE 8 BEV PRICE TABLE

TABLE 9 PHEV PRICE TABLE

TABLE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 14 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 16 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 18 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 20 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 24 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 26 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 36 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 38 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 46 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 48 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 50 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 52 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 56 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 58 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 60 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 62 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 64 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 68 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 70 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 72 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 76 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 79 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 80 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 81 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 82 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 83 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 84 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 85 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 86 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 87 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 88 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 89 SAUDI ARABIA BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 90 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 92 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 94 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 96 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 98 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SAUDI ARABIA PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 100 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SAUDI ARABIA COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 102 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 104 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 106 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 107 SAUDI ARABIA ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 108 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 109 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 110 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 111 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 112 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.A.E. ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 114 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 115 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 116 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 117 U.A.E. ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 118 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.A.E. NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 120 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 121 U.A.E. SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 122 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 123 U.A.E. ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 124 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 125 U.A.E. ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 126 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 127 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 128 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 130 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 131 U.A.E. ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 132 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 133 U.A.E. ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 134 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.A.E. ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 136 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 137 U.A.E. BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 138 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 139 U.A.E. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 140 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 141 U.A.E. FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 142 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 143 U.A.E. ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 144 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.A.E. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 146 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.A.E. PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 148 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.A.E. COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 150 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 U.A.E. LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 152 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 U.A.E. HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 154 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 155 U.A.E. ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 156 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 158 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 159 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 160 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 161 BAHRAIN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 162 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 163 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 164 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 165 BAHRAIN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 166 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 167 BAHRAIN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 168 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 169 BAHRAIN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 170 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 171 BAHRAIN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 172 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 173 BAHRAIN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 174 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 175 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 176 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 177 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 178 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 179 BAHRAIN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 180 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 181 BAHRAIN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 182 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 183 BAHRAIN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 184 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 185 BAHRAIN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 186 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 187 BAHRAIN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 188 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 189 BAHRAIN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 190 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 191 BAHRAIN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 192 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 193 BAHRAIN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 194 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 BAHRAIN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 196 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 BAHRAIN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 198 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 BAHRAIN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 200 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 BAHRAIN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 202 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 BAHRAIN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 204 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 205 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 206 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 207 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 208 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 209 QATAR ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 210 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 211 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 212 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 213 QATAR ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 214 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 215 QATAR NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 216 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 217 QATAR SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 218 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 219 QATAR ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 220 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 221 QATAR ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 222 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 223 QATAR ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 224 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 225 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 226 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 227 QATAR ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 228 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 229 QATAR ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 230 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 231 QATAR ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 232 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 233 QATAR BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 234 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 235 QATAR PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 236 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 237 QATAR FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 238 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 239 QATAR ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 240 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 241 QATAR ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 242 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 QATAR PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 244 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 QATAR COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 246 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 QATAR LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 248 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 QATAR HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 250 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 251 QATAR ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 252 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 253 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 254 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 255 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 256 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 257 KUWAIT ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 258 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 259 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 260 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 261 KUWAIT ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 262 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 263 KUWAIT NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 264 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 265 KUWAIT SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 266 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 267 KUWAIT ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 268 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 269 KUWAIT ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 270 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 271 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 272 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 273 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 274 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 275 KUWAIT ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 276 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 277 KUWAIT ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 278 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 279 KUWAIT ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 280 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 281 KUWAIT BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 282 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 283 KUWAIT PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 284 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 285 KUWAIT FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 286 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 287 KUWAIT ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 288 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 289 KUWAIT ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 290 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 KUWAIT PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 292 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 KUWAIT COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 294 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 KUWAIT LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 296 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 KUWAIT HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 298 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 299 KUWAIT ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 300 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 301 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

TABLE 302 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (USD MILLION)

TABLE 303 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 304 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (USD MILLION)

TABLE 305 OMAN ELECTRIC VEHICLE MARKET, BY ELECTRIC MOTOR TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 306 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (USD MILLION)

TABLE 307 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE SPEED, 2021-2030 (THOUSAND UNITS)

TABLE 308 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (USD MILLION)

TABLE 309 OMAN ELECTRIC VEHICLE MARKET, BY CHARGING STATION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 310 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 311 OMAN NORMAL CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 312 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (USD MILLION)

TABLE 313 OMAN SUPER CHARGING IN ELECTRIC VEHICLE MARKET, BY LEVEL TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 314 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (USD MILLION)

TABLE 315 OMAN ELECTRIC VEHICLE MARKET, BY VOLTAGE RANGE, 2021-2030 (THOUSAND UNITS)

TABLE 316 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (USD MILLION)

TABLE 317 OMAN ELECTRIC VEHICLE MARKET, BY CONNECTIVITY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 318 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 319 OMAN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 320 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 321 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 322 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (USD MILLION)

TABLE 323 OMAN ELECTRIC VEHICLE MARKET, BY BATTERY FORM, 2021-2030 (THOUSAND UNITS)

TABLE 324 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (USD MILLION)

TABLE 325 OMAN ELECTRIC VEHICLE MARKET, BY POWER TRAIN, 2021-2030 (THOUSAND UNITS)

TABLE 326 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 327 OMAN ELECTRIC VEHICLE MARKET, BY PROPULSION TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 328 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 329 OMAN BATTERY ELECTRIC VEHICLE (BEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 330 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 331 OMAN PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 332 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 333 OMAN FUEL CELL ELECTRIC VEHICLE (FCEV) IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 334 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (USD MILLION)

TABLE 335 OMAN ICE AND MICRO HYBRID VEHICLE IN ELECTRIC VEHICLE MARKET, BY POWER OUTPUT, 2021-2030 (THOUSAND UNITS)

TABLE 336 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 337 OMAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 338 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 OMAN PASSENGER CARS IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 340 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 OMAN COMMERCIAL VEHICLE IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 342 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 OMAN LIGHT COMMERCIAL VEHICLE (LCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 344 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 OMAN HEAVY COMMERCIAL VEHICLE (HCV) IN ELECTRIC VEHICLE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 346 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 347 OMAN ELECTRIC VEHICLE MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNITS)

TABLE 348 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (USD MILLION)

TABLE 349 REST OF MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2021-2030 (THOUSAND UNITS)

Liste des figures

FIGURE 1 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST ELECTRIC VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST ELECTRIC VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST ELECTRIC VEHICLE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST ELECTRIC VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MARKET POSITION GRID

FIGURE 8 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES CHALLENGE MATRIX

FIGURE 9 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST ELECTRIC VEHICLE MARKET: EHAIL TECHNOLOGIES VEHICLE CLASS

FIGURE 11 MIDDLE EAST ELECTRIC VEHICLE MARKET: SEGMENTATION

FIGURE 12 GOVERNMENT INITIATIVE TOWARDS LOWER DOWN THE EMISSION CONTRIBUTE TO DEMAND FOR EVS IS EXPECTED TO DRIVE MIDDLE EAST ELECTRIC VEHICLE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 MID-PRICED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET IN 2023 & 2030

FIGURE 14 SWOT ANALYSIS

FIGURE 15 TIME OF DELIVERY AND PLANNED PRICE POSITIONING OF THE COMPANY'S FUTURE SMART EV MODELS

FIGURE 16 EV SALES BY UNITS FOR THE YEAR 2020 & 2021

FIGURE 17 PORTER'S FIVE FORCE ANALYSIS

FIGURE 18 FACTORS INFLUENCING BUYING DECISIONS OF CONSUMERS

FIGURE 19 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN CHINA IN 2021 (IN THOUSANDS)

FIGURE 20 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN CHINA IN 2021

FIGURE 21 ELECTRIC VEHICLE REGISTRATIONS AND SALES SHARE IN EUROPE IN 2021 (IN THOUSANDS)

FIGURE 22 ELECTRIC CAR (PEVS AND PHEVS) SALES SHARE BY MODELS IN EUROPE IN 2021

FIGURE 23 ELECTRIC CAR REGISTRATIONS AND SALES SHARE IN THE USA IN 2021 (IN THOUSANDS)

FIGURE 24 ELECTRIC VEHICLE (PEVS AND PHEVS) SALES SHARE BY MODELS IN THE US IN 2021

FIGURE 25 TOP-SELLING ELECTRIC CARS IN 2022 (JANUARY-OCTOBER) (UNITS)

FIGURE 26 MERCEDES-BENZ GROUP AG

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST ELECTRIC VEHICLE MARKET

FIGURE 28 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY PROPULSION TYPE, 2022

FIGURE 29 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE DRIVE TYPE, 2022

FIGURE 30 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE SPEED, 2022

FIGURE 31 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS, 2022

FIGURE 32 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY SALES CHANNEL, 2022

FIGURE 33 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER OUTPUT, 2022

FIGURE 34 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY ELECTRIC MOTOR TYPE, 2022

FIGURE 35 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VOLTAGE RANGE, 2022

FIGURE 36 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CHARGING STATION TYPE, 2022

FIGURE 37 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY CONNECTIVITY TYPE, 2022

FIGURE 38 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY POWER TRAIN, 2022

FIGURE 39 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE TYPE, 2022

FIGURE 40 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY FORM, 2022

FIGURE 41 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY BATTERY TYPE, 2022

FIGURE 42 MIDDLE EAST ELECTRIC VEHICLE MARKET: SNAPSHOT (2022)

FIGURE 43 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022)

FIGURE 44 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 45 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 MIDDLE EAST ELECTRIC VEHICLE MARKET: BY VEHICLE CLASS (2023-2030)

FIGURE 47 MIDDLE EAST ELECTRIC VEHICLE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.