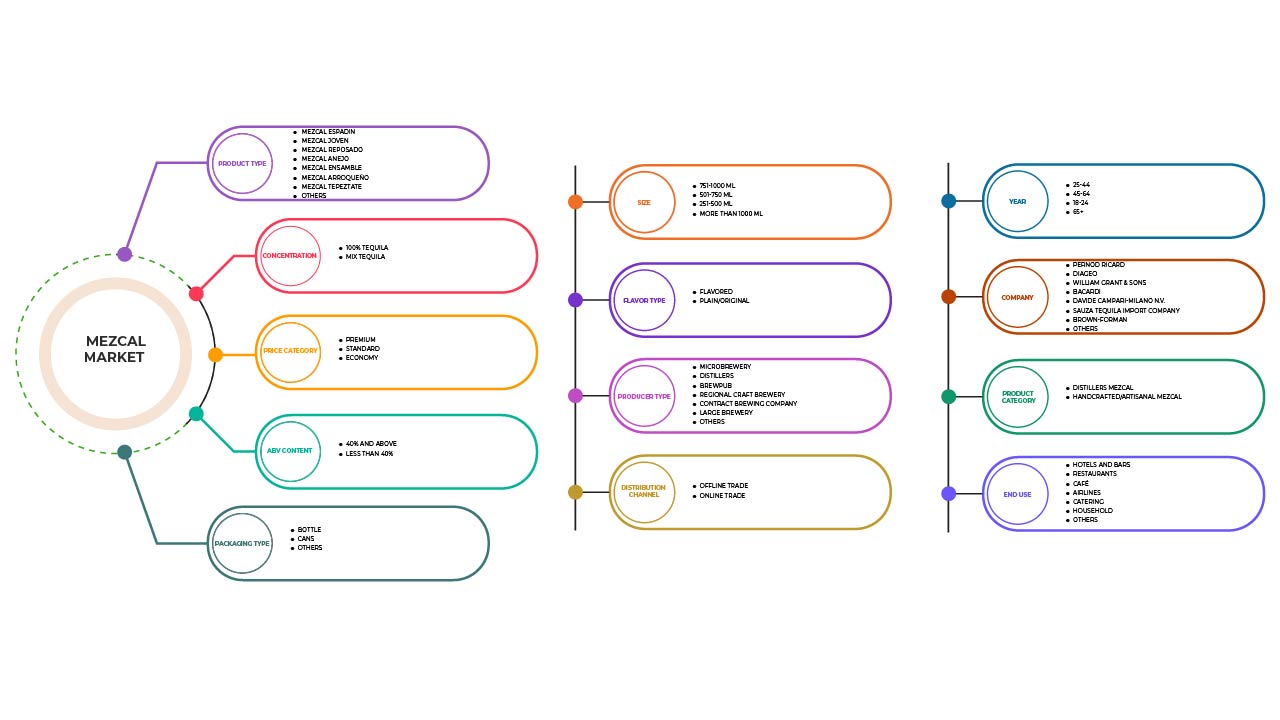

Middle East and Africa Mezcal Market, By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) – Industry Trends and Forecast to 2029.

Middle East and Africa Mezcal Market Analysis and Size

The different agave species used, which have a wide variety of terpene compounds, the ability to use agave leaves in mezcal fermentation, variations in the ripening stage of agave, cooking of agave that can be done in ground holes with burning wood and heated stones that produce furans and smoky volatiles and are retained in the agave, and some herbs or other natural materials (such as worms) can all contribute to the flavor differences between mezcal.

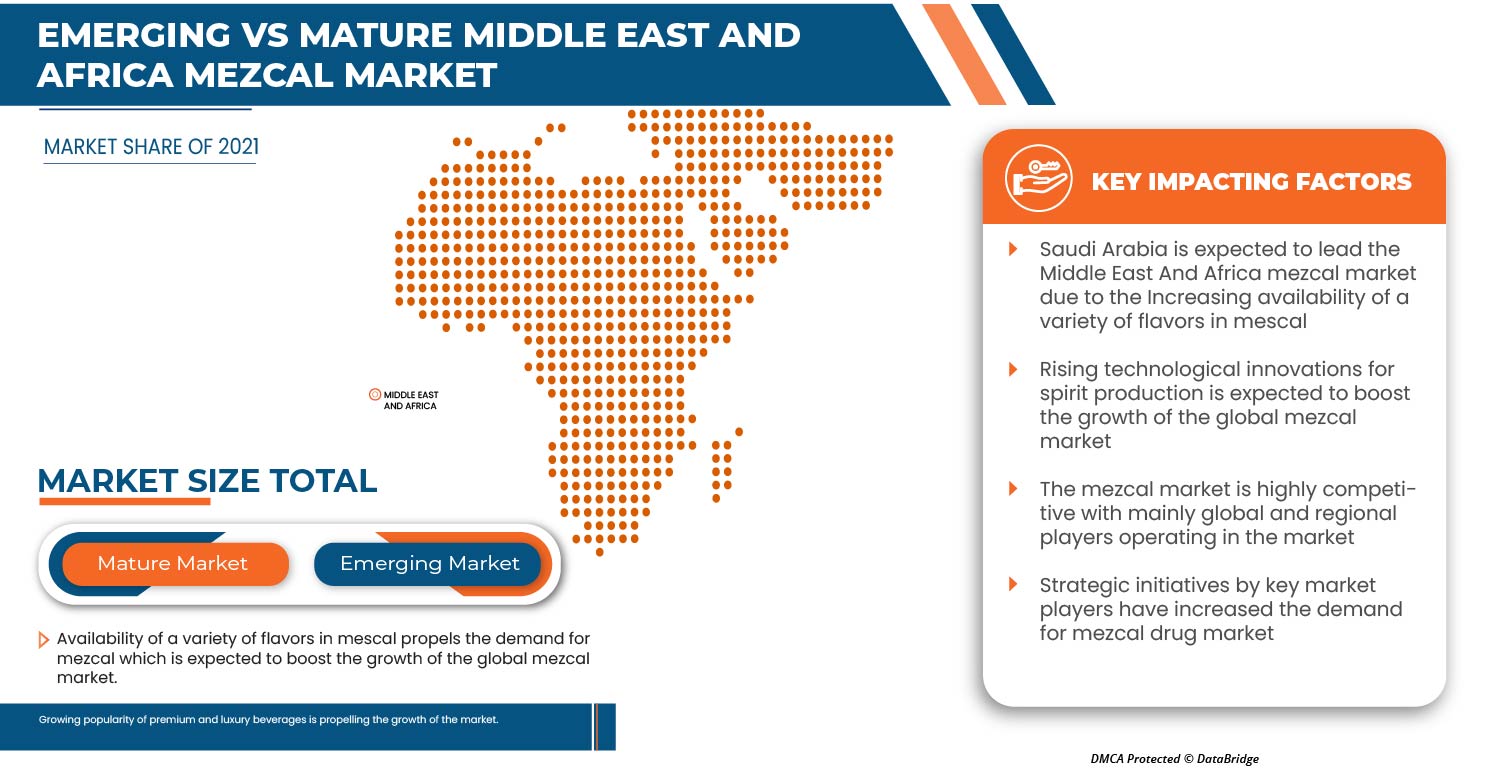

The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market in the forecast period. However, the heavy taxation and duties and stringent rules and regulations are expected to hamper the mezcal market growth in the forecast period.

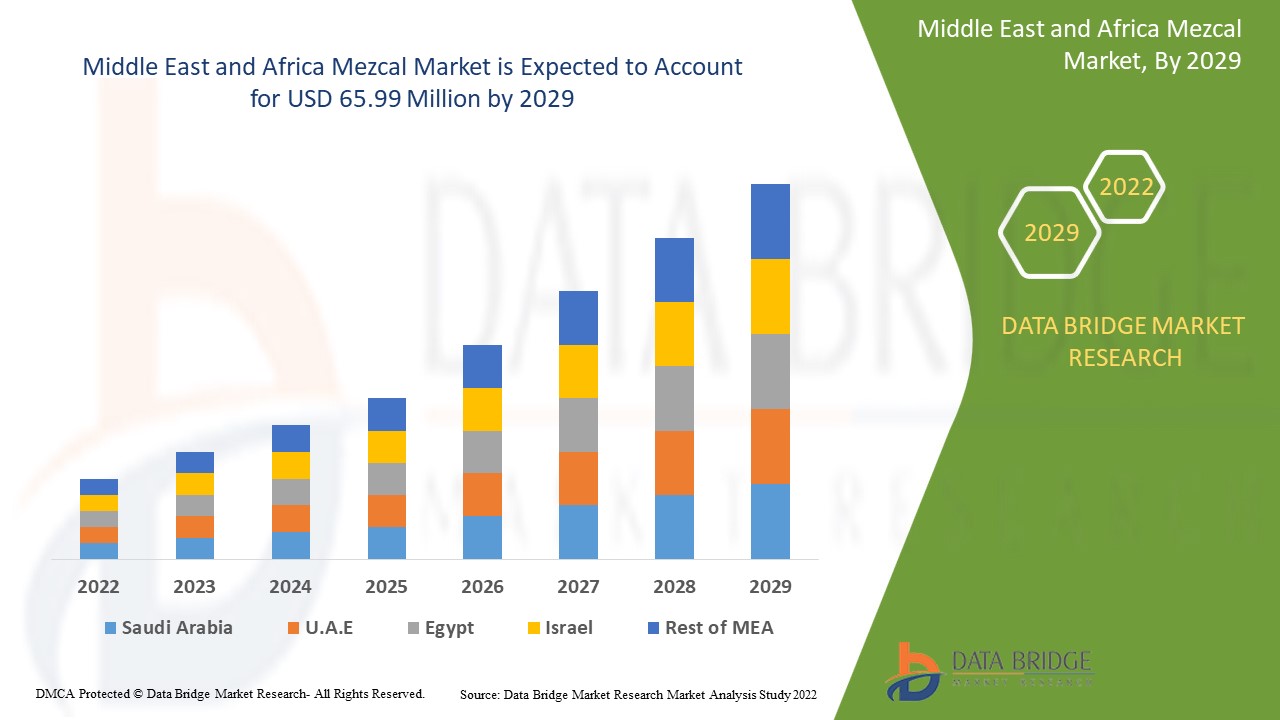

Data Bridge Market Research analyses that the mezcal market is expected to reach a value of USD 65.99 million by 2029, at a CAGR of 19.7% during the forecast period. The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market. The mezcal market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Liters |

|

Segments Covered |

By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) |

|

Countries Covered |

South Africa, Saudi Arabia, the U.A.E., Israel, Egypt, the Rest of the Middle East and Africa |

|

Market Players Covered |

The major companies which are dealing in the market are Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal among others. |

Market Definition

Mezcal is the name given to traditional distilled alcoholic beverages made in various rural areas of Mexico, from certain northern states up to south states, which is nahuatl mexcalli, "baked agave." These alcoholic beverages are made from the cooked stems of species of the genus Agave, also known as "maguey," which have fermented sugars. It is a traditional Mexican distilled beverage produced from the fermented juices of the cooked agave plant core. It is a type of distilled alcoholic beverage made from the cooked and fermented hearts, or piñas, of agave plants.

Mezcal Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

The quality and authenticity of mezcal are highly crucial because of the beverage's unique alcoholic flavor, which results from the volatile and non-volatile compounds, the direct precursors of which come from the raw agave itself. These include fatty acids, ranging from capric to lignoceric, free fatty acids, β-sitosterol, and groups of mono-, di-, and triacylglycerols, as well as fructans, the principal carbohydrate of the Agave. Due to higher temperatures and a lower pH in the agave cooking process, fructans could form Maillard compounds, such as furans, pyrans, and ketones.

De plus, le paramètre important qui définit la qualité des boissons à base d'agave est le système de distillation utilisé. La composition de l'arôme du mezcal est extrêmement complexe. Les similitudes et les différences entre les échantillons de mezcal peuvent être attribuées aux conditions et aux matières premières utilisées, en plus de l'origine et de la saison de production.

En raison de la disponibilité de diverses saveurs de mezcal, les consommateurs le préfèrent aux autres spiritueux artisanaux. De plus, l'intérêt croissant des consommateurs pour les produits d'origine éthique et la tendance à promouvoir des boissons telles que la bière artisanale, les jus pressés à froid et les smoothies à base d'ingrédients naturels comme étant de qualité supérieure devraient stimuler la croissance du marché au cours de la période de prévision.

- INNOVATIONS TECHNOLOGIQUES EN CROISSANCE POUR LA PRODUCTION DE SPIRITUEUX

L'agave est extraite et utilisée dans la fabrication de spiritueux, enrichissant le profil volatil du mezcal. Le processus d'extraction traditionnel entraîne souvent une consommation de solvants plus élevée, des temps d'extraction plus longs, des rendements plus faibles et une qualité d'extraction plus médiocre. La distillation du maguey fermenté est nécessaire pour produire plusieurs boissons alcoolisées distillées, telles que la bacanora, la tequila et le mezcal. Ainsi, les progrès technologiques ont créé une opportunité pour une production durable d'extraits et de spiritueux. Les fabricants sont engagés dans des innovations de produits et technologiques pour réduire les coûts d'extraction et de fabrication. Les entreprises peuvent améliorer la traçabilité des produits en utilisant des technologies innovantes qui peuvent considérablement améliorer l'efficacité et l'efficience des chaînes d'approvisionnement, en particulier dans des secteurs tels que l'alimentation et les boissons, les produits pharmaceutiques et les soins de santé.

Le processus de fermentation génère de l'éthanol, des alcools supérieurs, des esters, des acides organiques et d'autres. Certains de ces composés volatils sont plus importants que d'autres en raison de leurs concentrations ou de leurs caractéristiques aromatiques ; certains pourraient être spécifiques à l'espèce d'agave. Ainsi, la technologie de pointe croissante pour la production devrait stimuler le marché du mezcal au Moyen-Orient et en Afrique.

- PERSPECTIVES POSITIVES ENVERS DES SOLUTIONS D'EMBALLAGE AVANCÉES ET INTELLIGENTES

L’industrie de l’emballage du vin adopte des solutions intelligentes et durables pour rendre l’emballage des produits plus orienté vers le consommateur et plus respectueux de l’environnement. La premiumisation rend une marque ou un produit plus attrayant pour les consommateurs en soulignant sa qualité supérieure et son exclusivité dans la catégorie des boissons à base d’agave, ce qui rend une marque plus attrayante et, par conséquent, plus chère. Cela peut provenir de nouveaux emballages, d’une production artisanale, d’ingrédients de meilleure qualité, de nouvelles saveurs et de messages sociaux/environnementaux.

De plus, l'emballage imprimé numériquement offre un potentiel d'économies considérable par rapport aux autres procédés d'impression et des coûts de configuration réduits. Les fabricants peuvent se passer de commandes en gros grâce à de grands tirages et à la conservation de stocks. Les entreprises de conception de marques populaires préfèrent les bouteilles en verre pour l'emballage du mezcal. Les avantages de l'impression numérique sont essentiels pour le secteur de l'emballage d'aujourd'hui. L'impression numérique est le procédé idéal pour les petits et moyens tirages et permet la création d'impressions personnalisées pour les emballages et les présentoirs. De plus, la plupart du mezcal disponible en ligne est conditionné dans des bouteilles en verre.

Ainsi, en raison des lancements et des développements de nouveaux produits, une augmentation de la demande d’emballages avancés et intelligents devrait agir comme un moteur pour le marché du mezcal au Moyen-Orient et en Afrique.

Restrictions

- TAXATION ET DROITS LOURDS

La demande croissante de boissons alcoolisées dans le monde entier a entraîné une augmentation des importations sur ce marché en pleine croissance. Cependant, les lourdes taxes et droits de douane devraient freiner ce marché, car ils limitent la croissance du marché et rendent le produit cher. Cela devrait par conséquent restreindre la demande pour ces produits.

Ainsi, la forte taxation et les droits d'accise augmentent automatiquement les prix des produits et rendent l'alcool plus cher, ce qui entraîne une baisse de la demande pour ce produit. Cela entraîne même une perte de clientèle, ce qui entrave directement le marché dans son ensemble et devrait limiter sa croissance.

Opportunités/ Défis

- POPULARITÉ CROISSANTE DES BOISSONS HAUT DE GAMME ET DE LUXE

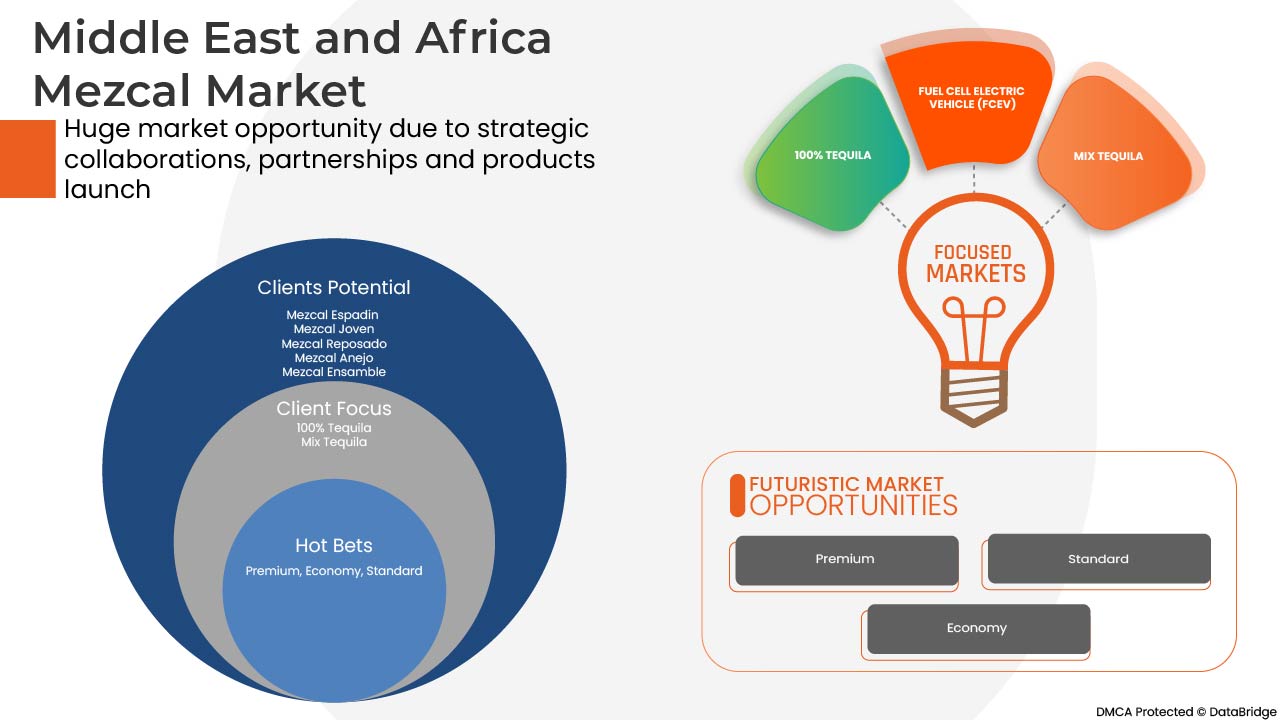

La capacité de surveiller le taux de cholestérol et de sucre dans le sang. La croissance du marché est encore alimentée par l'augmentation du revenu disponible et du pouvoir d'achat des consommateurs, qui renforcent tous deux la demande des consommateurs pour une variété de produits. La demande de mezcal augmente en raison de la tendance à la premiumisation, encourageant la consommation de boissons alcoolisées et non alcoolisées haut de gamme. La consommation d'alcool ne fait pas que faire partie de la tendance à la premiumisation. Parmi les clients de la génération du millénaire, il existe une demande croissante de produits mezcal haut de gamme. En raison de l'augmentation du revenu disponible dans les pays développés comme l'Amérique du Nord et l'Europe occidentale, ils sont prêts à dépenser beaucoup d'argent pour des produits haut de gamme et super premium. En raison de l'augmentation du revenu disponible des consommateurs par personne et de l'expansion continue de l'économie, le marché des spiritueux haut de gamme a augmenté de 5 à 6 % par an en volume de 2019 à 2021.

Le marché devrait connaître une expansion au cours de la période de prévision, car la demande de mezcal a considérablement augmenté au cours des dernières années. La demande croissante de mezcal de qualité supérieure constitue une opportunité de croissance pour le marché du mezcal du Moyen-Orient et de l'Afrique.

- POPULARITÉ CROISSANTE DES BOISSONS SAINES ET NON ALCOOLISÉES

L'un des secteurs qui connaît le plus fort développement est celui des boissons, qui consiste à fabriquer diverses boissons telles que le mezcal. La prise de conscience croissante des consommateurs quant à l'utilisation de composants naturels et biologiques dans les aliments et les boissons devrait constituer un défi pour le taux de croissance de l'industrie du mezcal à l'avenir.

De nombreux aliments et boissons fermentés contiennent du carbamate d'éthyle (EC), un cancérigène génotoxique connu. Le carbamate d'éthyle est non seulement cancérigène, mais aussi un agent toxique pour le foie chez l'homme. De plus, la consommation de boissons gazeuses a été associée aux calculs rénaux, tous facteurs de risque de maladie rénale chronique. Le nombre croissant de maladies chroniques du foie et des reins incite les consommateurs à boire sainement. Les gens préfèrent aujourd'hui davantage les boissons non alcoolisées en raison de ces problèmes de santé.

Ainsi, l’augmentation des maladies chroniques incite les consommateurs à consommer des boissons non alcoolisées, ce qui peut constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché du mezcal

L’épidémie de COVID-19 a eu un impact significatif sur l’industrie du mezcal. Le confinement a porté préjudice à la production au Moyen-Orient et en Afrique et aggravera l’incertitude commerciale et le marasme manufacturier actuel. En comparaison, la pandémie a eu peu d’effet sur les opérations du secteur de l’alimentation et des boissons, mais sa chaîne d’approvisionnement au Moyen-Orient et en Afrique a été gravement perturbée, ce qui a empêché toute nouvelle croissance. Le changement de mode de consommation a eu un impact négatif sur le comportement d’achat des consommateurs. Le secteur a subi des effets à court et à long terme en raison de l’émergence de nombreux obstacles, notamment la suspension de nombreuses opérations, le ralentissement de la croissance des entreprises et d’autres problèmes. Ces problèmes ont eu un impact significatif sur l’offre et la demande. Le secteur de l’alimentation et des boissons a été l’un de ceux touchés par les interruptions de production et d’approvisionnement en matières premières.

Les chaînes d’approvisionnement mondiales ont été entravées par la fermeture de nombreuses industries, ce qui a interrompu les activités industrielles, les calendriers de livraison et la vente de divers produits. Un certain nombre d’entreprises ont déjà averti que tout retard dans les livraisons de produits pourrait nuire aux ventes futures de leurs produits. La perturbation des voyages affecte le secteur industriel car elle interfère avec la planification et le travail d’équipe de l’entreprise. Les détaillants hors ligne et en ligne fournissent du mezcal ; le secteur hors ligne a subi des pertes importantes en raison des fermetures et des avertissements contre les déplacements à l’extérieur pour atténuer l’effet du COVID-19, mais l’industrie en ligne a connu une croissance accrue. De plus, la situation s’améliore car il y a moins de cas de COVID dans le monde et le marché croît rapidement et continuera de le faire pendant la période de projection. En conséquence, il est prévu que le marché se développera considérablement après le COVID-19.

Développements récents

- En janvier 2022, Diageo PLC a acquis Mezcal Union via l'acquisition de Casa UM. Mezcal Union est l'une des principales marques de production de mezcal. La société a utilisé cette acquisition pour développer son activité de boissons au mezcal

- En avril 2021, Madre Mezcal, l'une des marques de mezcal connaissant la croissance la plus rapide en Amérique, a levé 3 millions de dollars pour appliquer la stratégie de croissance réussie de la marque à de nouveaux produits et marchés. Le tour de financement de série A a été mené par Room 9, un studio de capital-risque basé à New York et spécialisé dans l'investissement dans le secteur de la consommation

Portée du marché du mezcal au Moyen-Orient et en Afrique

Le marché du mezcal au Moyen-Orient et en Afrique est segmenté en fonction du type de produit, du concentré, de la catégorie de prix, de la teneur en alcool, de l'année, du type d'emballage, de la taille, du type de saveur, du type de producteur, de la catégorie de produit, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Mezcal Espadin

- Mezcal Jeune

- Mezcal reposé

- Mezcal Añejo

- Ensemble Mezcal

- Mezcal Arroqueño

- Mezcal Tepeztate

- Autres

Sur la base du type de produit, le marché du mezcal du Moyen-Orient et de l'Afrique est segmenté en mezcal joven, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño, mezcal ensamble et autres.

SE CONCENTRER

- 100% Téquila

- Mélanger la tequila

Sur la base du concentré, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en tequila 100 % et tequila mélangée.

CATÉGORIE DE PRIX

- Prime

- Standard

- Économie

Sur la base de la catégorie de prix, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en premium, standard et économique.

TENEUR EN ABV

- 40% et plus

- Moins de 40%

Sur la base de la teneur en ABV, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en moins de 40 %, plus de 40 % et moins de 40 %.

ANNÉE

- 18-24

- 25-44

- 45-64

- 65+

Sur la base de l'année, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en 18-24 ans, 25-44 ans, 45-64 ans et 65 ans et plus.

TYPE D'EMBALLAGE

- Bouteille

- Canettes

- Autres

Sur la base du type d'emballage, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en bouteilles, canettes et autres.

TAILLE

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- plus de 100 ml

Sur la base de la taille, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en 251-500 ml, 501-750 ml, 751-1000 ml, plus de 100 ml

TYPE DE SAVEUR

- Plaine/Originale

- Parfumé

Sur la base du type de saveur, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en nature/original et aromatisé.

TYPE DE PRODUCTEUR

- Microbrasserie

- Distillateurs

- Brasserie

- Entreprise de brassage sous contrat

- Brasserie artisanale régionale

- Grande Brasserie

- Autres

Sur la base du type de producteur, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en microbrasseries, distilleries, brasseries, sociétés de brassage sous contrat, brasseries artisanales régionales, grandes brasseries et autres.

CATÉGORIE DE PRODUIT

- Distillateurs Mezcan

- Mezcan artisanal / Mezcan artisanal

Sur la base de la catégorie de produits, le marché du mezcal du Moyen-Orient et de l'Afrique a été segmenté en mezcan de distillerie et mezcan artisanal

UTILISATION FINALE

- Restaurants

- Hôtels et bars

- Café

- Restauration

- Compagnies aériennes

- Ménage

- Autres

On the basis of end user, the Middle East and Africa mezcal market has been segmented into Restaurants, Hotels & bars, Café, Catering, Airlines, Household, and Others

DISTRIBUTION CHANNEL

- Offline- Trade

- Online Trade

On the basis of distribution channel, the Middle East and Africa mezcal market has been segmented into offline trade and online trade.

Mezcal Market Regional Analysis/Insights

The mezcal market is analyzed, and market size insights and trends are provided by country, product type, concentrate, price category, abv content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel, as referenced above.

The countries covered in the Middle East and Africa mezcal market report are South Africa, Saudi Arabia, the U.A.E., Israel, Egypt, and the rest of the Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA)

South Africa is dominating the Middle East and Africa mezcal market with a CAGR of around 22.2%. The broad base of the beverage industry in the country is set to drive market growth.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mezcal Market Share Analysis

The mezcal market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the mezcal market.

Some of the major players operating in the mezcal market are Davide Campari-Milano N.V., BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE:

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF MIDDLE EAST & AFRICA MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 MIDDLE EAST & AFRICA MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT:

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 MIDDLE EAST & AFRICA MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

7.2 REGULATION IN EUROPE

7.3 REGULATION IN AUSTRALIA

8 MIDDLE EAST & AFRICA MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 EXPORT AND IMPORT TRADE ANALYSIS

9.1 EXPORT ANALYSIS OF SPIRIT DRINKS

9.2 IMPORT ANALYSIS OF SPIRIT DRINKS

10 MIDDLE EAST & AFRICA MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

10.1 OVERVIEW

10.2 SOCIAL FACTORS

10.3 CULTURAL FACTORS

10.4 PSYCHOLOGICAL FACTORS

10.5 PERSONAL FACTORS

10.6 ECONOMIC FACTORS

10.7 PRODUCT TRAITS

10.8 MARKET ATTRIBUTES

10.9 MIDDLE EAST & AFRICA CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

10.1 CONCLUSION

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

11.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

11.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

11.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS MIDDLE EAST & AFRICALY

11.2 RESTRAINTS

11.2.1 HEAVY TAXATION AND DUTIES

11.2.2 STRINGENT RULES AND REGULATIONS

11.3 OPPORTUNITIES

11.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

11.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

11.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

11.4 CHALLENGES

11.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

11.4.2 HIGH COST OF MEZCAL

12 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 MEZCAL ESPADIN

12.2.1 BY CONCENTRATION

12.2.1.1 100% TEQUILA

12.2.1.2 MIX TEQUILA

12.2.2 BY ABV CONTENT

12.2.2.1 40% AND ABOVE

12.2.2.2 LESS THAN 40%

12.3 MEZCAL JOVEN

12.3.1 BY CONCENTRATION

12.3.1.1 100% TEQUILA

12.3.1.2 MIX TEQUILA

12.3.2 BY ABV CONTENT

12.3.2.1 40% AND ABOVE

12.3.2.2 LESS THAN 40%

12.3.3 BY DISTILLATION

12.3.3.1 COPPER

12.3.3.2 STEEL

12.4 MEZCAL REPOSADO

12.4.1 BY CONCENTRATION

12.4.1.1 100% TEQUILA

12.4.1.2 MIX TEQUILA

12.4.2 BY ABV CONTENT

12.4.2.1 40% AND ABOVE

12.4.2.2 LESS THAN 40%

12.4.3 BY DISTILLATION

12.4.3.1 COPPER

12.4.3.2 STEEL

12.5 MEZCAL ANEJO

12.5.1 BY CONCENTRATION

12.5.1.1 100% TEQUILA

12.5.1.2 MIX TEQUILA

12.5.2 BY ABV CONTENT

12.5.2.1 40% AND ABOVE

12.5.2.2 LESS THAN 40%

12.5.3 BY DISTILLATION

12.5.3.1 COPPER

12.5.3.2 STEEL

12.6 MEZCAL ENSAMBLE

12.6.1 BY CONCENTRATION

12.6.1.1 100% TEQUILA

12.6.1.2 MIX TEQUILA

12.6.2 BY ABV CONTENT

12.6.2.1 40% AND ABOVE

12.6.2.2 LESS THAN 40%

12.7 MEZCAL ARROQUEÑO

12.7.1 BY CONCENTRATION

12.7.1.1 100% TEQUILA

12.7.1.2 MIX TEQUILA

12.7.2 BY ABV CONTENT

12.7.2.1 40% AND ABOVE

12.7.2.2 LESS THAN 40%

12.8 MEZCAL TEPEZTATE

12.8.1 BY CONCENTRATION

12.8.1.1 100% TEQUILA

12.8.1.2 MIX TEQUILA

12.8.2 BY ABV CONTENT

12.8.2.1 40% AND ABOVE

12.8.2.2 LESS THAN 40%

12.9 OTHERS

12.9.1 BY CONCENTRATION

12.9.1.1 100% TEQUILA

12.9.1.2 MIX TEQUILA

12.9.2 BY ABV CONTENT

12.9.2.1 40% AND ABOVE

12.9.2.2 LESS THAN 40%

13 MIDDLE EAST & AFRICA MEZCAL MARKET, BY CONCENTRATION

13.1 OVERVIEW

13.2 100% TEQUILA

13.3 MIX TEQUILA

14 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRICE CATEGORY

14.1 OVERVIEW

14.2 PREMIUM

14.3 STANDARD

14.4 ECONOMY

15 MIDDLE EAST & AFRICA MEZCAL MARKET, BY ABV CONTENT

15.1 OVERVIEW

15.2 40% AND ABOVE

15.3 LESS THAN 40%

16 MIDDLE EAST & AFRICA MEZCAL MARKET, BY YEAR

16.1 OVERVIEW

16.2 25-44

16.3 45-64

16.4 18-24

16.5 65+

17 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 BOTTLE

17.3 CANS

17.4 OTHERS

18 MIDDLE EAST & AFRICA MEZCAL MARKET, BY SIZE

18.1 OVERVIEW

18.2 751-1000 ML

18.3 501-750 ML

18.4 251-500 ML

18.5 MORE THAN 1000 ML

19 MIDDLE EAST & AFRICA MEZCAL MARKET, BY FLAVOR TYPE

19.1 OVERVIEW

19.2 FLAVORED

19.2.1 CITRUS FRUITS

19.2.1.1 ORANGE

19.2.1.2 LEMON

19.2.1.3 GRAPE FRUIT

19.2.1.4 OTHERS

19.2.2 FLORALS

19.2.3 SMOKED

19.2.4 GREEN PEPPER

19.2.5 OTHERS

19.3 PLAIN/ORIGINAL

20 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCER TYPE

20.1 OVERVIEW

20.2 MICROBREWERY

20.3 DISTILLERS

20.4 BREWPUB

20.5 REGIONAL CRAFT BREWERY

20.6 CONTRACT BREWING COMPANY

20.7 LARGE BREWERY

20.8 OTHERS

21 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCT CATEGORY

21.1 OVERVIEW

21.2 DISTILLERS MEZCAL

21.3 HANDCRAFTED/ARTISANAL MEZCAL

22 MIDDLE EAST & AFRICA MEZCAL MARKET, BY END USE

22.1 OVERVIEW

22.2 HOTELS AND BARS

22.3 RESTAURANTS

22.3.1 RESTAURANTS, BY TYPE

22.3.1.1 CHAIN RESTAURANTS

22.3.1.2 INDEPENDENT RESTAURANTS

22.3.2 RESTAURANTS, BY SERVICE CATEGORY

22.3.2.1 FULL SERVICE RESTAURANTS

22.3.2.2 QUICK SERVICE RESTAURANTS

22.4 CAFE

22.4.1 AIRLINES

22.4.2 CATERING

22.4.3 HOUSEHOLD

22.4.4 OTHERS

23 MIDDLE EAST & AFRICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 OFFLINE TRADE

23.2.1 NON-STORE BASED RETAILERS

23.2.1.1 VENDING MACHINE

23.2.1.2 OTHERS

23.2.2 STORE BASED RETAILER

23.2.2.1 HYPERMARKET/SUPERMARKET

23.2.2.2 CONVENIENCE STORES

23.2.2.3 SPECIALTY STORES

23.2.2.4 GROCERY STORES

23.2.2.5 OTHERS

23.3 ONLINE TRADE

23.4 COMPANY OWNED WEBSITE

23.5 E-COMMERCE

24 MIDDLE EAST & AFRICA MEZCAL MARKET, BY REGION

24.1 MIDDLE EAST AND AFRICA

24.1.1 SOUTH AFRICA

24.1.2 U.A.E

24.1.3 SAUDI ARABIA

24.1.4 EGYPT

24.1.5 ISRAEL

24.1.6 REST OF MIDDLE EAST AND AFRICA

25 MIDDLE EAST & AFRICA MEZCAL MARKET: COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

26 SWOT ANALYSIS

27 COMPANY PROFILE

27.1 PERNOD RICARD

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 COMPANY SHARE ANALYSIS

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENT

27.2 DIAGEO

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 COMPANY SHARE ANALYSIS

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WILLIAM GRANT & SONS

27.3.1 COMPANY SNAPSHOT

27.3.2 COMPANY SHARE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT DEVELOPMENTS

27.4 BACARDI

27.4.1 COMPANY SNAPSHOT

27.4.2 COMPANY SHARE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT DEVELOPMENT

27.5 DAVIDE CAMPARI-MILANO N.V.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 COMPANY SHARE ANALYSIS

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENT

27.6 BROWN-FORMAN

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT DEVELOPMENT

27.7 BOZAL MEZCAL

27.7.1 COMPANY SNAPSHOT

27.7.2 PRODUCT PORTFOLIO

27.7.3 RECENT DEVELOPMENT

27.8 CRAFT DISTILLERS

27.8.1 COMPANY SNAPSHOT

27.8.2 PRODUCT PORTFOLIO

27.8.3 RECENT DEVELOPMENTS

27.9 DOS HOMBRES LLC.

27.9.1 COMPANY SNAPSHOT

27.9.2 PRODUCT PORTFOLIO

27.9.3 RECENT DEVELOPMENTS

27.1 DEL MAGUEY SINGLE VILLAGE MEZCAL

27.10.1 COMPANY SNAPSHOT

27.10.2 PRODUCT PORTFOLIO

27.10.3 RECENT DEVELOPMENTS

27.11 DESTILERÍA TLACOLULA

27.11.1 COMPANY SNAPSHOT

27.11.2 PRODUCT PORTFOLIO

27.11.3 RECENT DEVELOPMENT

27.12 EL SILENCIO HOLDINGS, INC.

27.12.1 COMPANY SNAPSHOT

27.12.2 PRODUCT PORTFOLIO

27.12.3 RECENT DEVELOPMENTS

27.13 FAMILIA CAMARENA

27.13.1 COMPANY SNAPSHOT

27.13.2 PRODUCT PORTFOLIO

27.13.3 RECENT DEVELOPMENTS

27.14 ILEGAL MEZCAL

27.14.1 COMPANY SNAPSHOT

27.14.2 PRODUCT PORTFOLIO

27.14.3 RECENT DEVELOPMENTS

27.15 KING CAMPERO

27.15.1 COMPANY SNAPSHOT

27.15.2 PRODUCT PORTFOLIO

27.15.3 RECENT DEVELOPMENTS

27.16 MADRE MEZCAL

27.16.1 COMPANY SNAPSHOT

27.16.2 PRODUCT PORTFOLIO

27.16.3 RECENT DEVELOPMENTS

27.17 MEZCAL SOMBRA

27.17.1 COMPANY SNAPSHOT

27.17.2 PRODUCT PORTFOLIO

27.17.3 RECENT DEVELOPMENT

27.18 PENSADOR MEZCAL

27.18.1 COMPANY SNAPSHOT

27.18.2 PRODUCT PORTFOLIO

27.18.3 RECENT DEVELOPMENTS

27.19 SAUZA TEQUILA IMPORT COMPANY

27.19.1 COMPANY SNAPSHOT

27.19.2 PRODUCT PORTFOLIO

27.19.3 RECENT DEVELOPMENTS

27.2 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

27.20.1 COMPANY SNAPSHOT

27.20.2 PRODUCT PORTFOLIO

27.20.3 RECENT DEVELOPMENTS

27.21 WAHAKA MEZCAL

27.21.1 COMPANY SNAPSHOT

27.21.2 PRODUCT PORTFOLIO

27.21.3 RECENT DEVELOPMENT

28 QUESTIONNAIRE

29 RELATED REPORTS

Liste des tableaux

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029, VOLUME (KILO LITERS)

TABLE 4 MIDDLE EAST & AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA 100% TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA MIX TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PREMIUM IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA STANDARD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA ECONOMY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA 40% AND ABOVE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA LESS THAN 40% IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA 25-44 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA 45-64 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA 18-24 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA 65+ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA BOTTLES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA CANS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA 751-1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA 501-750 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA 251-500 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA MORE THAN 1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA FLAVORED IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PLAIN/ORIGINAL IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA MICROBREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA DISTILLERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA BREWPUB IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA REGIONAL CRAFT BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA CONTRACT BREWING COMPANY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA LARGE BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA DISTILLERS MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA HANDCRAFTED/ARTISANAL MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA HOTELS AND BARS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA RESTAURANTS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA CAFÉ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA AIRLINES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA CATERING IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA HOUSEHOLD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA OFFLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA ONLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 91 MIDDLE EAST AND AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 SOUTH AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 SOUTH AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 131 SOUTH AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 132 SOUTH AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 149 SOUTH AFRICA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 150 SOUTH AFRICA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 151 SOUTH AFRICA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 152 SOUTH AFRICA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 SOUTH AFRICA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 154 SOUTH AFRICA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 155 SOUTH AFRICA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 156 SOUTH AFRICA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH AFRICA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 158 SOUTH AFRICA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH AFRICA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH AFRICA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH AFRICA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 162 SOUTH AFRICA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH AFRICA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH AFRICA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 165 SOUTH AFRICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 SOUTH AFRICA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 SOUTH AFRICA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 SOUTH AFRICA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 SOUTH AFRICA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 U.A.E. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.A.E. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 172 U.A.E. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 173 U.A.E. MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 174 U.A.E. MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 175 U.A.E. MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 176 U.A.E. MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 177 U.A.E. MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 178 U.A.E. MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 179 U.A.E. MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 180 U.A.E. MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 181 U.A.E. MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 182 U.A.E. MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 183 U.A.E. MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 184 U.A.E. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 185 U.A.E. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 186 U.A.E. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 187 U.A.E. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 188 U.A.E. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 189 U.A.E. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 190 U.A.E. OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 191 U.A.E. OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 192 U.A.E. MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 193 U.A.E. MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 194 U.A.E. MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 195 U.A.E. MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 196 U.A.E. MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.A.E. MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 198 U.A.E. MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 199 U.A.E. FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 200 U.A.E. CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 U.A.E. MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 202 U.A.E. MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 U.A.E. MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 204 U.A.E. RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 U.A.E. RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 206 U.A.E. MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 U.A.E. OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 208 U.A.E. NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 U.A.E. STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 U.A.E. ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 SAUDI ARABIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 SAUDI ARABIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 213 SAUDI ARABIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 214 SAUDI ARABIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 215 SAUDI ARABIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 216 SAUDI ARABIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 217 SAUDI ARABIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 218 SAUDI ARABIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 219 SAUDI ARABIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 220 SAUDI ARABIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 221 SAUDI ARABIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 222 SAUDI ARABIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 223 SAUDI ARABIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 224 SAUDI ARABIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 225 SAUDI ARABIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 226 SAUDI ARABIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 227 SAUDI ARABIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 229 SAUDI ARABIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 231 SAUDI ARABIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 232 SAUDI ARABIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 233 SAUDI ARABIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 234 SAUDI ARABIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 SAUDI ARABIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 236 SAUDI ARABIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 237 SAUDI ARABIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 238 SAUDI ARABIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 239 SAUDI ARABIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 240 SAUDI ARABIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 241 SAUDI ARABIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SAUDI ARABIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 243 SAUDI ARABIA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 244 SAUDI ARABIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 245 SAUDI ARABIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SAUDI ARABIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 247 SAUDI ARABIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 SAUDI ARABIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 SAUDI ARABIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 250 SAUDI ARABIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 251 SAUDI ARABIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 EGYPT MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 253 EGYPT MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 254 EGYPT MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 255 EGYPT MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 256 EGYPT MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 257 EGYPT MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 258 EGYPT MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 259 EGYPT MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 260 EGYPT MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 261 EGYPT MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 262 EGYPT MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 263 EGYPT MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 264 EGYPT MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 265 EGYPT MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 266 EGYPT MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 267 EGYPT MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 268 EGYPT MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 269 EGYPT MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 270 EGYPT MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 271 EGYPT MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 272 EGYPT OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 273 EGYPT OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 274 EGYPT MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 275 EGYPT MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 276 EGYPT MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 277 EGYPT MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 278 EGYPT MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 279 EGYPT MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 280 EGYPT MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 281 EGYPT FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 282 EGYPT CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 EGYPT MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 284 EGYPT MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 285 EGYPT MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 286 EGYPT RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 EGYPT RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 288 EGYPT MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 EGYPT OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 290 EGYPT NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 EGYPT STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 292 EGYPT ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 ISRAEL MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 ISRAEL MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 295 ISRAEL MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 296 ISRAEL MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 297 ISRAEL MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 298 ISRAEL MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 299 ISRAEL MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 300 ISRAEL MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 301 ISRAEL MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 302 ISRAEL MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 303 ISRAEL MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 304 ISRAEL MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 305 ISRAEL MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 306 ISRAEL MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 307 ISRAEL MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 308 ISRAEL MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 309 ISRAEL MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 310 ISRAEL MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 311 ISRAEL MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 312 ISRAEL MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 313 ISRAEL OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 314 ISRAEL OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 315 ISRAEL MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 316 SRAEL MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 317 ISRAEL MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 318 ISRAEL MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 319 ISRAEL MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 320 ISRAEL MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 321 ISRAEL MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 322 ISRAEL FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 323 ISRAEL CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 ISRAEL MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 325 ISRAEL MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 326 ISRAEL MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 327 ISRAEL RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 ISRAEL RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 329 ISRAEL MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 ISRAEL OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 331 ISRAEL NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 332 ISRAEL STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 333 ISRAEL ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 334 REST OF MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 335 REST OF MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 336 REST OF MIDDLE EAST AND AFRICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEZCAL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEZCAL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEZCAL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEZCAL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEZCAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEZCAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEZCAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEZCAL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA MEZCAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MEZCAL MARKET: SEGMENTATION

FIGURE 11 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS MIDDLE EAST & AFRICALY AND INCREASING CONSUMER DEMAND FOR MEZCAL IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEZCAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MEZCAL ESPADIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEZCAL MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA MEZCAL MARKET: EXPORT ANALYSIS OF SPIRIT DRINKS USD

FIGURE 14 MIDDLE EAST & AFRICA MEZCAL MARKET: IMPORT ANALYSIS OF SPIRIT DRINKS USD

FIGURE 15 MIDDLE EAST & AFRICA MEZCAL MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA MEZCAL MARKET

FIGURE 17 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 19 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 20 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA MEZCAL MARKET: BY CONCENTRATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA MEZCAL MARKET: BY CONCENTRATION, 2022-2029 (USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA MEZCAL MARKET: BY CONCENTRATION, CAGR (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA MEZCAL MARKET: BY CONCENTRATION, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRICE CATEGORY, 2021

FIGURE 26 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRICE CATEGORY, 2022-2029 (USD MILLION)

FIGURE 27 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRICE CATEGORY, CAGR (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRICE CATEGORY, LIFELINE CURVE

FIGURE 29 MIDDLE EAST & AFRICA MEZCAL MARKET: BY ABV CONTENT, 2021

FIGURE 30 MIDDLE EAST & AFRICA MEZCAL MARKET: BY ABV CONTENT, 2020-2029 (USD MILLION)

FIGURE 31 MIDDLE EAST & AFRICA MEZCAL MARKET: BY ABV CONTENT, CAGR (2022-2029)

FIGURE 32 MIDDLE EAST & AFRICA MEZCAL MARKET: BY ABV CONTENT, LIFELINE CURVE

FIGURE 33 MIDDLE EAST & AFRICA MEZCAL MARKET: BY YEAR, 2021

FIGURE 34 MIDDLE EAST & AFRICA MEZCAL MARKET: BY YEAR, 2020-2029 (USD MILLION)

FIGURE 35 MIDDLE EAST & AFRICA MEZCAL MARKET: BY YEAR, CAGR (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA MEZCAL MARKET: BY YEAR, LIFELINE CURVE

FIGURE 37 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PACKAGING TYPE, 2021

FIGURE 38 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PACKAGING TYPE, 2022-2029 (USD MILLION)

FIGURE 39 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PACKAGING TYPE, CAGR (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PACKAGING TYPE, LIFELINE CURVE

FIGURE 41 MIDDLE EAST & AFRICA MEZCAL MARKET: BY SIZE, 2021

FIGURE 42 MIDDLE EAST & AFRICA MEZCAL MARKET: BY SIZE, 2020-2029 (USD MILLION)

FIGURE 43 MIDDLE EAST & AFRICA MEZCAL MARKET: BY SIZE, CAGR (2022-2029)

FIGURE 44 MIDDLE EAST & AFRICA MEZCAL MARKET: BY SIZE, LIFELINE CURVE

FIGURE 45 MIDDLE EAST & AFRICA MEZCAL MARKET: BY FLAVOR TYPE, 2021

FIGURE 46 MIDDLE EAST & AFRICA MEZCAL MARKET: BY FLAVOR TYPE, 2022-2029 (USD MILLION)

FIGURE 47 MIDDLE EAST & AFRICA MEZCAL MARKET: BY FLAVOR TYPE, CAGR (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA MEZCAL MARKET: BY FLAVOR TYPE, LIFELINE CURVE

FIGURE 49 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCER TYPE, 2021

FIGURE 50 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCER TYPE, 2020-2029 (USD MILLION)

FIGURE 51 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCER TYPE, CAGR (2022-2029)

FIGURE 52 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCER TYPE, LIFELINE CURVE

FIGURE 53 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 54 MIDDLE EAST & AFRICA MEZCAL MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 55 MIDDLE EAST & AFRICA MEZCAL MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 56 MIDDLE EAST & AFRICA MEZCAL MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 57 MIDDLE EAST & AFRICA MEZCAL MARKET: BY END USE, 2021

FIGURE 58 MIDDLE EAST & AFRICA MEZCAL MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 59 MIDDLE EAST & AFRICA MEZCAL MARKET: BY END USE, CAGR (2022-2029)

FIGURE 60 MIDDLE EAST & AFRICA MEZCAL MARKET: BY END USE, LIFELINE CURVE

FIGURE 61 MIDDLE EAST & AFRICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 62 MIDDLE EAST & AFRICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 63 MIDDLE EAST & AFRICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 64 MIDDLE EAST & AFRICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 65 MIDDLE EAST AND AFRICA MEZCAL MARKET: SNAPSHOT (2021)

FIGURE 66 MIDDLE EAST AND AFRICA MEZCAL MARKET: BY COUNTRY (2021)

FIGURE 67 MIDDLE EAST AND AFRICA MEZCAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 68 MIDDLE EAST AND AFRICA MEZCAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 69 MIDDLE EAST AND AFRICA MEZCAL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 70 MIDDLE EAST & AFRICA MEZCAL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.