Middle East And Africa Ready To Eat Food Market

Taille du marché en milliards USD

TCAC :

%

USD

22.59 Billion

USD

43.82 Billion

2024

2032

USD

22.59 Billion

USD

43.82 Billion

2024

2032

| 2025 –2032 | |

| USD 22.59 Billion | |

| USD 43.82 Billion | |

|

|

|

|

Segmentation du marché des aliments prêts à consommer au Moyen-Orient et en Afrique, par type de produit (produits carnés, produits à base de céréales, produits laitiers, produits de boulangerie, confiseries salées, produits à base de légumes, soupes instantanées, snacks salés, aliments réfrigérés, snacks à base de viande végétale et plats préparés), catégorie (conventionnelle et spécialisée), type d'emballage (sachets, boîtes, bocaux et contenants, bouteilles, boîtes et autres), taille de l'emballage (moins de 250 grammes, 251-500 grammes, 501-750 grammes, 751-1000 grammes et plus de 1000 grammes), technologie d'emballage (désoxygénants, contrôle de l'humidité, antimicrobiens, indicateurs de temps et de température et films comestibles), type de stockage (congelé/réfrigéré, longue conservation, en conserve et autres), canal de distribution (en magasin et hors magasin), utilisateur final (industrie alimentaire) Services, ménages et autres) – Tendances et prévisions du secteur jusqu'en 2032

Analyse du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Le marché des aliments prêts à consommer (PAM) au Moyen-Orient et en Afrique connaît une croissance constante, portée par la demande croissante des consommateurs pour des options de repas pratiques et rapides. L'urbanisation, les modes de vie effrénés et l'évolution des habitudes alimentaires sont des facteurs clés de cette évolution. Les plats surgelés, les snacks instantanés et les produits prêts à consommer emballés gagnent en popularité auprès de divers groupes démographiques. Si l'Amérique du Nord et l'Europe dominent le marché, l'Asie-Pacifique s'impose comme un concurrent de poids grâce à la hausse des revenus disponibles et à l'évolution des préférences alimentaires. Les consommateurs soucieux de leur santé recherchent des options biologiques, sans conservateurs et nutritives. L'innovation en matière d'emballage, de durabilité et de qualité des ingrédients façonne l'avenir du marché, malgré les défis de la chaîne d'approvisionnement.

Taille du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

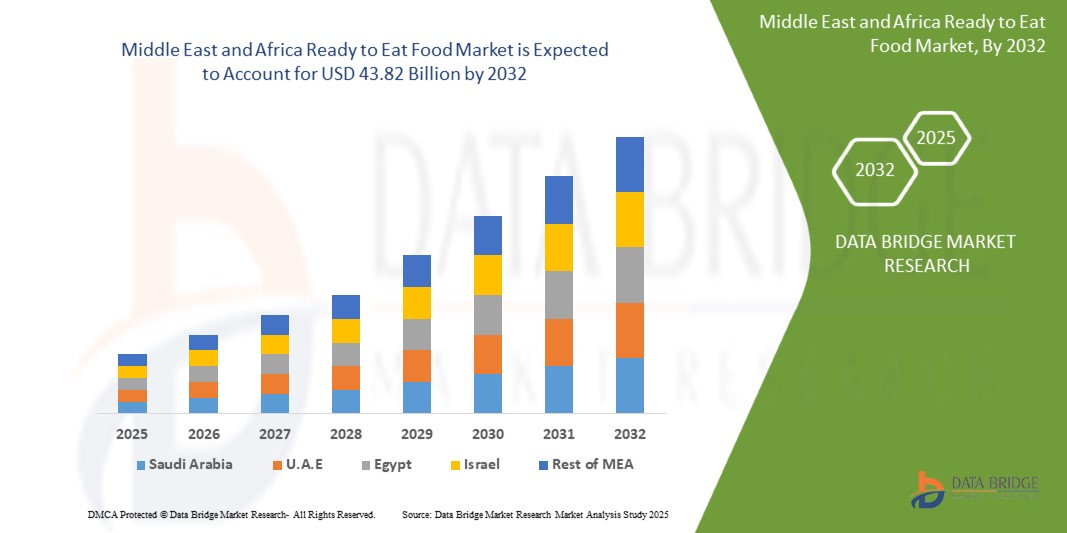

Français La taille du marché des aliments prêts à consommer au Moyen-Orient et en Afrique était évaluée à 22,59 milliards USD en 2024 et devrait atteindre 43,82 milliards USD d'ici 2032, avec un TCAC de 9,48 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

« Augmentation des heures de travail et rythme de vie effréné »

Alors que les individus s'efforcent de concilier leurs engagements professionnels et personnels, la demande de solutions de repas pratiques a explosé. Selon un rapport de l'Organisation internationale du Travail (OIT), la durée moyenne du travail au Moyen-Orient et en Afrique a augmenté d'environ 8 % au cours de la dernière décennie, soulignant la pression croissante sur la gestion du temps. Par conséquent, les consommateurs optent pour des options de repas rapides et simples, nécessitant une préparation minimale et offrant un gain de temps substantiel.

Le marché des plats préparés a largement bénéficié de cette évolution, car ces produits répondent aux besoins des personnes pressées en quête de repas pratiques, nutritifs et immédiatement consommables. Ce rythme de vie effréné est particulièrement répandu dans les populations urbaines, où les emplois du temps chargés laissent peu de temps pour la préparation des repas traditionnels. Cela a incité les fabricants à innover et à proposer une large gamme de produits prêts à consommer, répondant à des préférences gustatives et des exigences alimentaires variées.

De plus, le nombre croissant de ménages à double revenu a contribué à l'expansion du marché. Dans des pays comme les États-Unis et le Royaume-Uni, plus de 60 % des ménages comptent désormais les deux partenaires comme salariés, ce qui laisse moins de temps pour préparer des repas élaborés. Cette évolution démographique a entraîné une forte demande de produits prêts à consommer, faciles à consommer au travail, dans les transports ou à la maison après de longues heures de travail.

Par exemple,

- En mars 2023, l'Organisation internationale du Travail (OIT) a déclaré que le Cambodge travaillait en moyenne environ 2 456 heures par an en 2017, soit près de 47 heures par semaine, soit le nombre le plus élevé parmi les 66 pays étudiés. Cela témoigne d'une contrainte de temps importante pour la préparation des repas, ce qui stimule la demande de produits alimentaires prêts à consommer.

Dans des pays comme le Mexique et la République tchèque, les employés travaillent souvent plus de 2 000 heures par an, ce qui entraîne une forte préférence pour les options de repas rapides et sans tracas, y compris les produits prêts à manger.

Alors que les modes de vie actifs deviennent de plus en plus répandus dans le monde entier, le marché des aliments prêts à consommer est sur le point de connaître une croissance robuste, porté par le besoin inébranlable de solutions de repas rapides, accessibles et satisfaisantes.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché des aliments prêts à consommer au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Koweït, Oman, Qatar, Bahreïn et reste du Moyen-Orient et de l'Afrique |

|

Acteurs clés du marché |

Mondelēz International, Inc. (États-Unis), The Kraft Heinz Company (États-Unis), General Mills Inc (États-Unis), Nestlé (Suisse), Kellanova (États-Unis), McCain Foods Limited (Canada), Hormel Foods, LLC (États-Unis), Unilever (Royaume-Uni), Lamb Weston, Inc. (États-Unis), Simplot (États-Unis), Tyson Foods, Inc. (États-Unis), Nomad Foods (Angleterre), Greencore Group plc (Irlande), 2 Sisters Food Group (Angleterre), ITC Limited (Inde), Agristo (Belgique), Premier Foods plc (Royaume-Uni), Bakkavor Group plc (Royaume-Uni), The Hain Celestial Group, Inc. (États-Unis), Orkla (Norvège), Farm Frites (Pays-Bas), Haldiram's (Inde), Greenyard (Belgique), Agrarfrost GmbH (Allemagne), Regal Kitchen Foods (Inde), GODREJ AGROVET LTD. (Inde), Gitsfood.com (Inde), LIGHT MASS (Brésil), Koyara Food (Inde), Genie Food Group (Inde), Himalaya Food International Ltd. (Inde), Vimal Agro Products Pvt Ltd (Inde), Vechem Organics (P) Limited (Inde), Eateasy New (Inde), Sankalpfoods.com (Inde), CSC Brands LP (Canada) et Priya Foods (Ushodaya Enterprises Pvt Ltd) (Inde) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Les aliments prêts à consommer (PAM) désignent des produits alimentaires précuits, préemballés et nécessitant peu ou pas de préparation avant consommation. Conçus pour être pratiques et adaptés aux modes de vie actifs, ces aliments offrent des solutions de repas rapides et faciles sans compromis sur le goût ni la qualité. Les PAM comprennent une grande variété de produits tels que les plats surgelés, les conserves, les produits réfrigérés et les snacks emballés longue conservation. On les trouve couramment dans les supermarchés, les hypermarchés, les supérettes et les plateformes de vente en ligne. Ils sont particulièrement appréciés des professionnels, des étudiants et des consommateurs urbains qui recherchent des options de repas rapides.

Dynamique du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Conducteurs

- Augmentation du revenu disponible des consommateurs et du pouvoir d'achat

À mesure que les économies continuent de croître, les consommateurs bénéficient d'une plus grande stabilité financière, ce qui leur permet de dépenser davantage en produits alimentaires pratiques et haut de gamme. Selon la Banque mondiale, le revenu disponible par habitant au Moyen-Orient et en Afrique a connu une croissance constante au cours de la dernière décennie, permettant aux consommateurs d'explorer une plus grande variété d'options alimentaires offrant à la fois commodité et qualité.

Cette hausse du revenu disponible a entraîné une évolution des préférences des consommateurs vers des solutions de repas rapides et simples. Alors que de plus en plus de personnes peuvent se permettre d'acheter des produits prêts à consommer haut de gamme et plus chers, les fabricants capitalisent sur cette tendance en proposant des options de repas diversifiées et innovantes qui répondent à diverses préférences alimentaires, notamment des variétés biologiques, sans gluten et végétales. Cette hausse du revenu disponible est particulièrement marquée dans les économies émergentes comme la Chine, l'Inde et le Brésil, où la classe moyenne en plein essor privilégie de plus en plus les choix alimentaires pratiques dans un contexte de vie urbaine effrénée. Rien qu'en Chine, le revenu disponible moyen des ménages a augmenté d'environ 5,3 % en 2024, contre 5,1 % l'année précédente, ce qui a considérablement stimulé la demande de produits prêts à consommer.

Par exemple,

- En février 2025, un article de The Economic Times soulignait qu'Adani Wilmar, connu pour des marques telles que le riz « Kohinoor » et les huiles de cuisson « Fortune », anticipait une croissance de 10 % de son volume de ventes au cours du prochain exercice. Le PDG Angshu Mallick attribue cette croissance attendue à l'augmentation des dépenses urbaines, stimulée par les baisses d'impôt sur le revenu des particuliers et par la demande croissante d'applications de livraison rapide de produits d'épicerie.

- En 2023, le revenu personnel disponible en Chine a atteint 7 200 USD, contre 6 900 USD en 2022. Sur la période 1978-2023, le revenu personnel disponible en Chine s'élevait en moyenne à 1 970 USD, atteignant un pic de 7 200 USD en 2023 et un niveau record de 0 048 USD en 1978.

De plus, l'augmentation du pouvoir d'achat a encouragé les consommateurs à privilégier la qualité, le goût et la nutrition, incitant les fabricants à développer des offres de plats prêts à consommer à valeur ajoutée. Avec la hausse continue du revenu disponible au Moyen-Orient et en Afrique, le marché des plats préparés devrait prospérer, porté par la volonté des consommateurs d'investir dans des solutions de repas haut de gamme et pratiques.

- Canaux de vente au détail et de commerce électronique en pleine expansion

Les fabricants capitalisent sur les formats de vente modernes et les solutions d'achat numériques pour améliorer la visibilité et l'accessibilité des produits, à mesure que les consommateurs les adoptent. La présence croissante des supermarchés, hypermarchés, commerces de proximité et plateformes de vente en ligne d'épicerie a rendu les produits alimentaires prêts à consommer plus accessibles, s'adaptant ainsi au rythme de vie effréné des consommateurs urbains.

Le e-commerce, en particulier, a transformé le paysage de la distribution alimentaire en offrant la possibilité d'acheter des plats prêts à consommer depuis chez soi. Actuellement, environ 2,77 milliards de personnes dans le monde effectuent des achats en ligne via des plateformes e-commerce dédiées ou des boutiques sur les réseaux sociaux, ce qui reflète une préférence croissante pour les achats en ligne. Cette tendance est également soutenue par la pénétration croissante des smartphones et l'amélioration de la connectivité internet, notamment dans les économies émergentes. Les géants de la distribution et les plateformes numériques capitalisent sur cette opportunité en élargissant leur portefeuille de produits prêts à consommer, notamment les plats surgelés, les snacks instantanés et les kits repas santé. Des collaborations stratégiques entre des fabricants de produits alimentaires et des plateformes e-commerce comme Amazon et Walmart, ainsi que des acteurs régionaux comme BigBasket en Inde et JD.com en Chine, ont permis aux consommateurs d'accéder plus facilement à une grande variété de plats prêts à consommer en quelques clics, ce qui a rationalisé la distribution, réduit les délais de livraison et amélioré la satisfaction client. De plus, l'adoption du commerce omnicanal, intégrant les ventes physiques et numériques, s'est avérée très efficace pour répondre aux diverses demandes des consommateurs modernes.

Par exemple,

- Les résultats de SellersCommerce indiquent qu'avec plus de 33 % de la population mondiale effectuant ses achats en ligne, le e-commerce représente désormais un secteur de 6 800 milliards de dollars américains et devrait atteindre 8 000 milliards de dollars américains d'ici 2027. Environ 2,77 milliards de personnes dans le monde effectuent des achats via des plateformes e-commerce dédiées ou des boutiques sur les réseaux sociaux. La Chine et les États-Unis dominent le marché des achats en ligne, créant ainsi de vastes opportunités pour les marques de produits prêts à consommer. Face à la préférence croissante des consommateurs pour des achats simples, les produits prêts à consommer sont bien placés pour prospérer.

- BigBasket, la plateforme leader de l'épicerie en ligne en Inde, a élargi sa gamme de produits prêts à consommer afin de répondre à la demande croissante de plats préparés. En mettant l'accent sur la livraison de produits frais et de qualité, l'entreprise entend répondre à la demande croissante des consommateurs pour des repas rapides et faciles. Cette décision stratégique permet à BigBasket de capitaliser sur la popularité croissante des plats prêts à consommer sur le marché indien.

- En Chine, les magasins Hema Fresh d'Alibaba combinent vente en ligne et vente hors ligne, permettant aux consommateurs de commander des plats préparés via une application et de les recevoir en 30 minutes. Hema a enregistré une hausse de 20 % de son chiffre d'affaires brut en 2022.

Cette expérience d'achat fluide, associée à des réductions attractives et à des formules d'abonnement, a fait du e-commerce un canal privilégié pour les consommateurs pressés. Par conséquent, les fabricants s'associent de plus en plus à des plateformes en ligne pour étendre leur présence, stimulant ainsi la croissance et l'innovation du marché.

Opportunités

- Demande croissante d'aliments prêts à consommer à base de plantes et végétaliens

La tendance actuelle est à la prise de conscience croissante des bienfaits pour la santé, de la durabilité environnementale et des considérations éthiques associés aux régimes alimentaires à base de plantes. Alors que de plus en plus de consommateurs adoptent un mode de vie végétalien ou flexitarien, la demande de repas pratiques et prêts à consommer, adaptés à ces choix, ne cesse de croître.

Les acteurs du marché capitalisent sur cette tendance en lançant des produits prêts à consommer innovants, savoureux et riches en nutriments, dérivés d'ingrédients d'origine végétale. Selon un rapport du Good Food Institute, le secteur des aliments d'origine végétale a connu une croissance à deux chiffres ces dernières années, portée par l'intérêt croissant des consommateurs et une disponibilité accrue des produits. Les grands fabricants de produits alimentaires et les startups investissent de plus en plus dans des solutions de repas végétaliennes, des currys et pâtes végétales aux desserts sans produits laitiers et aux salades riches en protéines. Les réseaux sociaux et les tendances alimentaires influencées par les influenceurs ont également joué un rôle essentiel dans la promotion des plats prêts à consommer végétaliens, les rendant plus courants et plus accessibles. De plus, l'expansion des canaux de vente au détail et du e-commerce a encore accru la visibilité et la portée des offres végétales.

Par exemple,

- En novembre 2021, une étude NielsenIQ a révélé que 2,7 millions de foyers britanniques comptaient au moins un végan ou végétarien. De plus, 10,5 millions de foyers optaient pour des alternatives véganes ou végétariennes au moins une fois par semaine plutôt que des repas à base de viande. Parmi les personnes interrogées, 40 % ont cité les bienfaits pour la santé comme motivation, tandis que 31 % estimaient que c'était meilleur pour la planète.

- En 2022, une étude Ipsos a révélé une demande croissante de plats prêts à consommer (PAM) d'origine végétale et végétalienne, les consommateurs recherchant de plus en plus des options plus saines et durables. Selon une étude Ipsos, près de la moitié (46 %) des Britanniques âgés de 16 à 75 ans envisagent de réduire leur consommation de produits d'origine animale, et 48 % utilisent déjà des alternatives végétales au lait, comme le lait d'amande, d'avoine et de coco. Le marché des PAM peut capitaliser sur cette tendance en proposant des solutions de repas pratiques, nutritives et végétales.

- L'enquête européenne de consommation sur les aliments d'origine végétale de 2021, réalisée par ProVeg International, a révélé que le Royaume-Uni est le premier pays européen à acheter et à consommer des produits d'origine végétale, notamment des plats préparés et des plats à emporter végétaliens. Alors que les consommateurs accordent de plus en plus d'importance à la santé et au développement durable, le marché des plats prêts à consommer peut capitaliser sur cette tendance en proposant des options de repas d'origine végétale pratiques et variées.

Face à l'intérêt croissant des consommateurs soucieux de leur santé et à la recherche d'aliments nutritifs et éthiques, les fabricants disposent d'une marge de manœuvre importante pour innover et diversifier leurs gammes de produits. Les collaborations avec des fournisseurs d'ingrédients d'origine végétale et les investissements en recherche et développement peuvent renforcer l'attrait des aliments prêts à consommer végétaliens. Face à l'évolution du marché, l'adoption du mouvement végétal offre une opportunité prometteuse de croissance et de rentabilité durables.

- Progrès technologiques dans la transformation et l'emballage des aliments

Les innovations en matière de procédés de transformation, telles que le traitement haute pression (HPP) et la stérilisation thermique assistée par micro-ondes (MATS), ont permis aux fabricants de prolonger la durée de conservation des produits tout en préservant leur fraîcheur, leur saveur et leur valeur nutritionnelle. Ces techniques de pointe répondent à la demande des consommateurs pour des produits peu transformés et sans additifs, sans compromettre la sécurité et la qualité.

Côté emballage, l'adoption de solutions intelligentes et durables gagne du terrain. Les technologies d'emballage actives et intelligentes, notamment les absorbeurs d'oxygène et les indicateurs de temps et de température, améliorent la sécurité des produits et préservent leur qualité tout au long de la chaîne d'approvisionnement. De plus, l'adoption de matériaux écologiques, tels que les emballages biodégradables et recyclables, séduit les consommateurs soucieux de l'environnement, tout en s'alignant sur les objectifs de développement durable du Moyen-Orient et de l'Afrique. L'automatisation et la digitalisation de la transformation alimentaire révolutionnent également l'efficacité de la production. Les systèmes automatisés de tri, de portionnement et de contrôle qualité réduisent les coûts de main-d'œuvre et garantissent la régularité, permettant aux fabricants d'augmenter leur production tout en maintenant des normes élevées. De plus, les machines d'emballage de pointe, dotées de fonctionnalités telles que le scellage sous vide et le conditionnement sous atmosphère protectrice (MAP), renforcent encore l'attrait des produits en préservant leur texture et leur saveur plus longtemps.

L'intégration de solutions de traçabilité, notamment la technologie blockchain et les codes QR sur les emballages, permet aux consommateurs d'obtenir des informations en temps réel sur l'origine des produits et leur qualité. Cette transparence renforce la confiance et la fidélité à la marque, rendant les produits prêts à consommer plus attractifs pour les consommateurs exigeants.

Par exemple,

- Tetra Pak a révolutionné l'emballage alimentaire grâce à sa technologie aseptique, permettant de conserver les produits sans réfrigération pendant de longues périodes tout en préservant leur valeur nutritionnelle et leur goût. Cette innovation a joué un rôle crucial dans l'amélioration de la distribution et de la durée de conservation des produits prêts à consommer, notamment dans les régions dépourvues d'infrastructures de chaîne du froid.

- La stérilisation thermique assistée par micro-ondes (MATS) est une technologie de pointe qui utilise une combinaison d'eau chaude sous pression et de micro-ondes à grande longueur d'onde pour stériliser les produits alimentaires. Contrairement à la stérilisation classique en autoclave, la MATS réduit considérablement le temps de traitement, minimisant ainsi les pertes de nutriments et préservant la qualité des aliments. Des leaders du Moyen-Orient et de l'Afrique comme Eka Middle East and Africa exploitent cette innovation pour améliorer leurs solutions d'emballage et répondre aux besoins changeants de l'industrie agroalimentaire.

- La technologie des capteurs intelligents révolutionne le contrôle qualité dans la transformation alimentaire en permettant une surveillance en temps réel de la température, de l'humidité et des niveaux de contamination. Ces capteurs détectent instantanément les écarts, permettant des ajustements rapides pour maintenir la qualité et la sécurité des produits. L'enregistrement automatisé des données garantit la traçabilité et le respect des normes de sécurité alimentaire, rendant la production plus fiable et plus efficace.

Ces avancées renforcent non seulement l'attrait des produits, mais ouvrent également de nouveaux marchés en relevant les défis logistiques, notamment dans les zones reculées. Par conséquent, les innovations technologiques stimulent la croissance, permettant aux fabricants de répondre à l'évolution des demandes des consommateurs tout en maintenant leur rentabilité.

Contraintes/Défis

- Coût élevé des plats prêts à consommer (PAM) par rapport aux plats cuisinés à la maison

Les consommateurs, notamment dans les régions sensibles aux prix, trouvent souvent les aliments prêts à consommer nettement plus chers que les repas préparés maison. Cette disparité de prix peut s'expliquer par plusieurs facteurs, notamment l'utilisation d'ingrédients de qualité supérieure, les coûts d'emballage, de transformation et de logistique.

Selon le Bureau of Labor Statistics, le coût moyen d'un repas fait maison aux États-Unis est d'environ 4 dollars par portion, tandis que le prix d'un seul repas prêt à consommer peut varier de 7 à 15 dollars, selon la marque et les ingrédients utilisés. Cet écart de prix rend difficile pour de nombreux consommateurs, notamment ceux issus des classes moyennes et faibles, de justifier des achats fréquents de produits prêts à consommer. De plus, l'idée que les repas prêts à consommer offrent un rapport qualité-prix inférieur à celui des plats maison fraîchement préparés limite encore la pénétration du marché. Les consommateurs étant de plus en plus attentifs à leurs dépenses, notamment dans un contexte d'incertitude économique, ils ont tendance à privilégier les options économiques et faites maison. De plus, les préférences culturelles pour les plats fraîchement préparés dans de nombreux pays continuent d'influencer les choix des consommateurs, les familles privilégiant les plats faits maison aux alternatives préemballées. Cette tendance à privilégier les méthodes de cuisson traditionnelles représente un défi pour les fabricants qui cherchent à conquérir une plus grande part de marché.

Par exemple,

- Un article du New York Times de janvier 2025 soulignait comment les individus réalisaient des économies substantielles chaque année en réduisant leur dépendance à la restauration rapide et en optant pour des repas faits maison. Une personne a économisé près de 11 000 dollars américains en un an en préparant ses repas à la maison plutôt qu'en achetant des plats préparés.

- En août 2023, une étude mise en avant par Real Plans indique que les kits de livraison de repas peuvent être jusqu'à trois fois plus chers que l'achat d'ingrédients dans les épiceries locales et la préparation des repas à la maison

Advance Financial a indiqué que le coût élevé des plats prêts à consommer par rapport aux plats cuisinés maison demeure une préoccupation pour de nombreux consommateurs. En moyenne, un repas fait maison coûte entre 4 et 6 dollars par personne, tandis qu'un repas au restaurant ou prêt à consommer peut coûter entre 15 et 20 dollars, voire plus. Cette différence de prix significative, d'au moins 10 dollars par repas, peut rapidement s'alourdir, surtout pour les consommateurs réguliers.

Le coût élevé des produits alimentaires prêts à consommer (PAM) par rapport aux plats cuisinés maison demeure un obstacle majeur à la croissance du marché. Alors que les consommateurs privilégient de plus en plus les options économiques et fraîchement préparées, le marché se heurte à des difficultés persistantes pour s'imposer à grande échelle, notamment dans les régions sensibles aux prix.

- Concurrence intense sur le marché entre les grandes marques alimentaires et les acteurs régionaux

Les grandes marques multinationales s'appuient sur leurs réseaux de distribution robustes et leur capital marque bien établi pour maintenir leur domination, tandis que les acteurs régionaux capitalisent sur les préférences locales et les avantages en termes de coûts. Cette concurrence oblige les fabricants à innover et à différencier leurs offres afin de capter l'attention des consommateurs. Les marques investissent de plus en plus dans des stratégies marketing et une diversification de leurs produits pour se démarquer, introduisant souvent des saveurs uniques, des ingrédients enrichis et des formules axées sur la santé. Cependant, maintenir sa compétitivité face à des stratégies de prix et des campagnes promotionnelles agressives reste un défi majeur. Les petits fabricants et les fabricants régionaux peinent souvent à égaler les économies d'échelle dont bénéficient les géants du secteur, ce qui se traduit par des marges bénéficiaires plus faibles. De plus, l'émergence de marques distributeurs de grandes chaînes de distribution accentue la pression sur les produits de marque, les consommateurs optant de plus en plus pour des alternatives abordables sans compromis sur la qualité.

De plus, l'évolution des préférences des consommateurs et la popularité croissante des produits diététiques de niche, tels que les options végétales et sans gluten, obligent les marques à s'adapter et à élargir constamment leurs gammes. Trouver le juste équilibre entre innovation produit et rentabilité reste un défi de taille, surtout pour les petites entreprises aux ressources limitées.

Par exemple,

- En mars 2025, Reuters a publié un article indiquant que les consommateurs se tournent de plus en plus vers les petites marques alimentaires indépendantes, souvent perçues comme proposant des produits moins transformés et plus abordables. Cette évolution a eu des répercussions sur les grands conglomérats comme Unilever et Procter & Gamble, qui ont vu leurs parts de marché diminuer, les consommateurs préférant des alternatives comme Duke's Mayo et Mike's Amazing Mayo aux marques traditionnelles comme Hellmann's.

- Un article de novembre 2022 de Dow Jones & Company, Inc. (WALL STREET JOURNAL) soulignait que les distributeurs développent de plus en plus leurs propres produits alimentaires prêts à consommer sous marque distributeur, offrant ainsi aux consommateurs des alternatives économiques aux marques établies. Cette stratégie offre non seulement un plus grand choix aux consommateurs, mais intensifie également la concurrence, obligeant les grandes marques à réévaluer leurs prix et leurs propositions de valeur.

Dans un contexte de concurrence intense, maintenir la fidélité à la marque et la rentabilité est devenu de plus en plus difficile, car les acteurs établis et émergents évoluent dans un paysage en évolution rapide avec des attentes accrues des consommateurs.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse approfondie du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché, notamment en matière de pénurie de matières premières et de retards d'expédition. Cela permet d'évaluer les possibilités stratégiques, d'élaborer des plans d'action efficaces et d'aider les entreprises à prendre des décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets anticipés du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse de marché et les services de veille proposés par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leur chiffre d'affaires, et estimer leurs dépenses de résultat.

Portée du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Le marché est segmenté selon le type de produit, la catégorie, le type et la taille d'emballage, la technologie d'emballage, le type de stockage, le canal de distribution et l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments à faible croissance des secteurs et à fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, les aidant ainsi à prendre des décisions stratégiques pour identifier les applications clés du marché.

Type de produit

- Produits carnés

- Produits à base de céréales

- Produits laitiers

- Produits de boulangerie

- Bonbons salés

- Produits de confiserie

- Produits à base de légumes

- Soupes instantanées, collations salées

- aliments réfrigérés

- Collations à base de viande végétale

- Plats prêts à manger

Catégorie

- Conventionnel

- Spécialité

Type d'emballage

- Sachets

- Canettes

- Bocaux et contenants

- Bouteilles

- Boîtes

- Autres

Taille de l'emballage

- Moins de 250 grammes

- 251-500 grammes

- 501-750 grammes

- 751-1000 grammes

- Plus de 1000 grammes

Technologie d'emballage

- Pièges à oxygène

- Contrôle de l'humidité

- Antimicrobiens

- Indicateurs de température et de temps

- Films comestibles

Type de source

- Congelé/Réfrigéré

- Stable à température ambiante

- En conserve

- Autres

Canal de distribution

- Basé sur le magasin

- Canal hors magasin

Utilisateur final

- Services à l'industrie alimentaire

- ménages

- Autres

Analyse régionale du marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type de produit, catégorie, type d'emballage, taille d'emballage, technologie d'emballage, type de stockage, canal de distribution et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le marché sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, le Koweït, Oman, le Qatar, Bahreïn et le reste du Moyen-Orient et de l’Afrique.

L'Arabie saoudite devrait dominer le marché des aliments prêts à consommer (PAM) grâce à sa population urbaine en forte croissance, à l'augmentation de ses revenus disponibles et à la demande croissante de repas pratiques. Un rythme de vie effréné, le développement des infrastructures de vente au détail et l'essor du e-commerce stimulent la croissance du marché. De plus, la présence de grands fabricants de produits alimentaires, une forte préférence pour les aliments halal conditionnés et une tendance croissante à une alimentation saine contribuent à la position de leader du pays dans le secteur des PAM.

L'Arabie saoudite devrait connaître la croissance la plus rapide sur le marché des aliments prêts à consommer (PAM), en raison de l'urbanisation croissante, de la hausse des revenus disponibles et de la transition vers les aliments prêts à consommer. Le développement des supermarchés, des hypermarchés et des plateformes de commerce électronique améliore l'accessibilité des produits. Un mode de vie actif et la demande de plats cuisinés certifiés halal stimulent également l'expansion du marché. De plus, la sensibilisation croissante aux questions de santé stimule la demande d'options biologiques et sans conservateurs, tandis que l'innovation continue des marques alimentaires renforce le secteur des PAM du pays.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions réglementaires nationales qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique, ainsi que les défis auxquels elles sont confrontées en raison de la forte ou de la faible concurrence des marques locales et nationales, de l'impact des tarifs douaniers nationaux et des routes commerciales, sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché des aliments prêts à consommer au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché fournit des informations détaillées par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence au Moyen-Orient et en Afrique, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché des aliments prêts à consommer au Moyen-Orient et en Afrique opérant sur le marché sont :

- Lamb Weston (États-Unis)

- Simplot (États-Unis)

- Haldiram (Inde)

- Frites de la Ferme (Pays-Bas)

- Greenyard (Belgique)

- Agrarfrost GmbH (Allemagne)

- Agristo (Belgique)

- CSC Brands LP (Canada)

- The Hain Celestial Group, Inc. (États-Unis)

- Bakkavor Group plc (Royaume-Uni)

- McCain Foods Limitée (Canada)

- Premier Foods plc (Royaume-Uni)

- gitsfood.com (Inde)

- Nomad Foods (Royaume-Uni)

- General Mills (États-Unis)

- Greencore Group plc (Irlande)

- Orkla (Norvège)

- ITC Limited (Inde)

- Himalaya Food International Ltd. (Inde)

- Mondelēz International Group (États-Unis)

- Kraft Heinz (États-Unis)

- Tyson Foods, Inc. (États-Unis)

- Unilever Food Solutions (Royaume-Uni)

- Nestlé (Suisse)

- Messe légère (Brésil)

- Kellanova (États-Unis)

- Hormel Foods, LLC. (États-Unis)

- Koyara Food (Inde)

- Priya Foods (Inde)

- Genie Food Group (Inde)

- Vechem Organics (P) Limited (Inde)

- Vimal Agro Products Pvt Ltd (Inde)

- sankalpfoods.com (Inde)

- Regal Kitchen Foods (Inde)

- eateasy nouveau (Inde)

- GODREJ AGROVET LTD. (Inde)

- 2 Sisters Food Group (Royaume-Uni)

Derniers développements sur le marché des aliments prêts à consommer au Moyen-Orient et en Afrique

- En janvier 2025, OREO lance six nouvelles saveurs exceptionnelles, en édition limitée et permanentes. Parmi les nouveautés, citons les biscuits OREO « Jour de match », ornés d'un motif en relief inspiré du football américain, parfaits pour les jours de match et les soirées cinéma. Les nouveaux biscuits OREO « Chargés », disponibles en permanence, offrent une crème Mega Stuf fourrée de morceaux d'OREO. Parmi les autres nouveautés permanentes, citons les Golden OREO Cakesters, les OREO Irish Creme Thins et les OREO Minis Peanut Butter. Les Golden OREO Cakesters proposent des gâteaux dorés fourrés à la crème, les OREO Irish Creme Thins offrent une riche touche de crème irlandaise, et les OREO Minis Peanut Butter associent des biscuits au chocolat à une onctueuse crème au beurre de cacahuète. De plus, des friandises OREO glacées complètent cette gamme de nouveaux produits.

- En septembre 2024, le partenariat entre OREO et Coca-Cola inaugure une collaboration ludique et passionnante intitulée « Besties », célébrant le lien unique de l'amitié. Les marques s'associent pour proposer deux produits à durée limitée : le biscuit sandwich OREO Coca-Cola et l'édition limitée Coca-Cola OREO Zéro Sucre. Tous deux présentent des designs et des emballages distincts, alliant les éléments emblématiques des deux marques. Le biscuit sandwich OREO Coca-Cola associe une base de gâteau au chocolat à un arôme inspiré de Coca-Cola et une crème blanche parsemée de paillettes rouges comestibles, tandis que le Coca-Cola OREO Zéro Sucre offre un goût Coca-Cola rafraîchissant avec des notes d'OREO. Cette collaboration vise à fédérer les fans, à créer de nouvelles expériences et à célébrer la connexion et l'unité de manière ludique et inattendue.

- En avril 2024, les espiègles SOUR PATCH KIDS s'associent à OREO pour une collaboration amusante et inattendue, avec le lancement des biscuits OREO SOUR PATCH KIDS en édition limitée. Ces biscuits sont composés d'OREO dorés aromatisés SOUR PATCH KIDS, avec des inclusions colorées et une crème fourrée au sucre acidulé multicolore pour une expérience sucrée-salée. En plus des biscuits, les marques lancent une ligne exclusive de produits dérivés, comprenant un pull à col rond, un jogging, un bob, un sac bandoulière, des barrettes et des chaussettes. Cette collection célèbre l'esprit ludique des deux marques, offrant aux fans la possibilité de savourer le mariage sucré-salé ultime tout en portant des articles OREO et SOUR PATCH KIDS en édition limitée.

- En février 2023, Mondelēz International franchit une étape importante vers son objectif de neutralité carbone à l'horizon 2050 en annonçant un investissement majeur dans les énergies renouvelables issues de centrales photovoltaïques en Pologne. L'entreprise a signé un contrat d'achat d'électricité virtuelle d'une durée de 12 ans avec GoldenPeaks Capital, qui fournira environ 126 gigawattheures d'électricité renouvelable par an, provenant de diverses centrales solaires polonaises. Cet accord devrait permettre d'économiser plus d'un million de tonnes de CO2 et de compenser l'empreinte carbone liée à la production d'électricité de huit centrales Mondelēz en Pologne. La production d'énergie devrait débuter en mars 2023, marquant une étape majeure dans l'engagement de Mondelēz en faveur du développement durable et de la réduction de ses émissions. Cette collaboration illustre la volonté de l'entreprise de bâtir un avenir plus durable tout en continuant à proposer ses produits phares tels que Milka, Prince Polo et Delicje.

- En février 2025, Capri Sun a lancé sa première bouteille refermable depuis plus de 20 ans, offrant ainsi aux amateurs de tous âges une nouvelle façon pratique de savourer ses saveurs emblématiques en déplacement. Les bouteilles de 35 cl, disponibles en Punch aux Fruits, Pacific Cooler et Fraise Kiwi, contiennent l'équivalent de deux sachets et sont fabriquées à partir d'ingrédients entièrement naturels, sans colorants ni édulcorants artificiels. Ce lancement répond à la demande des consommateurs pour des portions plus généreuses et est conçu pour répondre aux besoins des familles actives, notamment dans les commerces de proximité où Capri Sun était auparavant moins disponible. Cette initiative élargit la gamme de produits de Capri Sun, s'appuyant sur le succès de précédentes innovations telles que les pichets Capri Sun Multi-Serve, et confirme l'engagement de la marque à évoluer avec les préférences des consommateurs.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 COMPETITIVE RIVALRY

4.2 IMPORT EXPORT SCENARIO

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL SOURCING

4.3.2 FOOD PROCESSING & MANUFACTURING

4.3.3 PACKAGING AND STORAGE

4.3.4 DISTRIBUTION AND LOGISTICS

4.3.5 MARKETING AND RETAILING

4.3.6 CONCLUSION

4.4 KEY FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.4.1 CONVENIENCE AND TIME-SAVING

4.4.2 HEALTH AND NUTRITION AWARENESS

4.4.3 PRICE SENSITIVITY AND ECONOMIC FACTORS

4.4.4 BRAND REPUTATION AND TRUST

4.4.5 PACKAGING AND PRODUCT PRESENTATION

4.4.6 DIGITAL INFLUENCE AND ONLINE RETAILING

4.4.7 CULTURAL AND REGIONAL PREFERENCES

4.4.8 SUSTAINABILITY AND ETHICAL CONSIDERATIONS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 PRODUCT INNOVATION AND DIVERSIFICATION

4.5.2 STRATEGIC ACQUISITIONS

4.5.3 INTERNATIONAL EXPANSION

4.5.4 TECHNOLOGICAL ADVANCEMENTS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 INDUSTRY TRENDS

4.6.1.1 GROWING CONSUMER DEMAND FOR CONVENIENCE

4.6.1.2 RISING POPULARITY OF HEALTHY AND NUTRITIOUS RTE FOODS

4.6.1.3 INNOVATIONS IN PACKAGING FOR EXTENDED SHELF LIFE

4.6.1.4 EXPANSION OF FROZEN AND CHILLED RTE SEGMENTS

4.6.1.5 RISE OF PLANT-BASED AND ALTERNATIVE PROTEIN OPTIONS

4.6.1.6 DIGITALIZATION AND E-COMMERCE GROWTH

4.6.1.7 FOCUS ON CLEAN LABEL AND TRANSPARENCY

4.6.2 FUTURE PERSPECTIVE

4.6.2.1 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING

4.6.2.2 SUSTAINABLE AND ETHICAL FOOD CHOICES

4.6.2.3 PERSONALIZATION IN RTE MEALS

4.6.2.4 REGULATORY AND COMPLIANCE CHALLENGES

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7.1 ADVANCED FOOD PROCESSING TECHNOLOGIES

4.7.2 SMART PACKAGING AND SUSTAINABLE MATERIALS

4.7.3 AUTOMATION AND ROBOTICS IN FOOD PRODUCTION

4.7.4 NUTRITIONAL ENHANCEMENT AND FUNCTIONAL INGREDIENTS

4.7.5 AI & BIG DATA FOR PERSONALIZATION AND SUPPLY CHAIN OPTIMIZATION

4.7.6 3D FOOD PRINTING AND CUSTOMIZATION

4.7.7 E-COMMERCE, CLOUD KITCHENS, AND LAST-MILE DELIVERY INNOVATIONS

4.7.8 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PROTEINS (MEAT, POULTRY, AND PLANT-BASED PROTEINS)

4.8.2 GRAINS AND CARBOHYDRATES

4.8.3 VEGETABLES AND FRUITS

4.8.4 PRESERVATIVES AND ADDITIVES

4.8.5 EMERGING TRENDS AND FUTURE SOURCING OPPORTUNITIES

4.8.6 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL SOURCING AND PROCUREMENT

4.9.2 PROCESSING AND MANUFACTURING

4.9.3 STORAGE AND INVENTORY MANAGEMENT

4.9.4 DISTRIBUTION AND LOGISTICS

4.9.5 RETAIL AND CONSUMER ACCESS

4.9.6 CHALLENGES IN THE RTE FOOD SUPPLY CHAIN

4.9.7 FUTURE TRENDS AND INNOVATIONS

4.9.8 CONCLUSION

4.1 PRICING ANALYSIS

4.11 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.12 BRAND OUTLOOK

4.12.1 BRAND COMPARATIVE ANALYSIS

4.12.2 PRODUCT VS BRAND OVERVIEW

4.12.2.1 PRODUCT OVERVIEW

4.12.2.2 BRAND OVERVIEW

4.12.2.3 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING WORK HOURS AND FAST-PACED LIFESTYLES

6.1.2 RISING CONSUMER DISPOSABLE INCOME AND HIGHER PURCHASING POWER

6.1.3 RAPIDLY EXPANDING RETAIL AND E-COMMERCE CHANNELS

6.1.4 RISING DEMAND FOR HEALTHY, ORGANIC AND FORTIFIED READY-TO-EAT FOODS

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS RELATED TO PROCESSED FOODS

6.2.2 HIGH COST OF READY-TO-EAT (RTE) COMPARED TO HOME-COOKED MEALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR PLANT-BASED AND VEGAN READY-TO-EAT FOODS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING AND PACKAGING

6.3.3 CUSTOMIZATION AND PERSONALIZATION OF READY-TO-EAT FOODS

6.4 CHALLENGES

6.4.1 INTENSE MARKET COMPETITION AMONGST MAJOR FOOD BRANDS AND REGIONAL PLAYERS

6.4.2 CONSUMER PERCEPTION OF ARTIFICIAL INGREDIENTS AND FLAVORS IN READY-TO-EAT FOODS

7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 MEAT PRODUCTS

7.3 CEREAL BASED PRODUCTS

7.4 DAIRY PRODUCTS

7.5 BAKERY PRODUCTS

7.6 SAVORY SWEETS

7.7 CONFECTIONERY PRODUCTS

7.8 VEGETABLES BASED PRODUCTS

7.9 INSTANT SOUPS

7.1 SAVORY SNACKS

7.11 REFRIGERATED FOODS

7.12 PLANT BASED MEAT SNACKS

7.13 READY TO EAT MEALS

8 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SPECIALTY

9 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES/SACHETS

9.3 CANS

9.4 JARS & CONTAINERS

9.5 BOTTLES

9.6 BOXES

9.7 OTHERS

10 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE

10.1 OVERVIEW

10.2 LESS THAN 250 GRAMS

10.3 251-500 GRAMS

10.4 501-750 GRAMS

10.5 751-1000 GRAMS

10.6 MORE THAN 1000 GRAMS

11 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY

11.1 OVERVIEW

11.2 OXYGEN SCAVENGERS

11.3 MOISTURE CONTROL

11.4 ANTIMICROBIALS

11.5 TIME TEMPERATURE INDICATORS

11.6 EDIBLE FILMS

12 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE

12.1 OVERVIEW

12.2 FROZEN/REFRIGERATED

12.3 SHELF-STABLE

12.4 CANNED

12.5 OTHERS

13 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED

13.3 NON-STORE BASED

14 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER

14.1 OVERVIEW

14.2 FOOD INDUSTRY SERVICES

14.3 HOUSEHOLDS

14.4 OTHERS

15 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 U.A.E.

15.1.3 SOUTH AFRICA

15.1.4 EGYPT

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 QATAR

15.1.8 BAHRAIN

15.1.9 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 MONDELĒZ INTERNATIONAL, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 RECENT FINANCIALS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 THE KRAFT HEINZ COMPANY

18.2.1 COMPANY SNAPSHOT

18.2.2 RECENT FINANCIALS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 GENERAL MILLS INC

18.3.1 COMPANY SNAPSHOT

18.3.2 RECENT FINANCIALS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 NESTLÉ

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KELLANOVA

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AGRISTO

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 2 SISTERS FOOD GROUP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT NEWS

18.8 AGRARFROST GMBH

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BAKKAVOR GROUP PLC

18.9.1 COMPANY SNAPSHOT

18.9.2 RECENT FINANCIALS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CSC BRANDS LP

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EATEASY NEW.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 FARM FRITES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GENIE FOOD GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GITSFOOD.COM

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 GODREJ AGROVET LIMITED

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 GREENCORE GROUP PLC

18.16.1 COMPANY SNAPSHOT

18.16.2 RECENT FINANCIALS

18.16.3 PRODUCT PORTFOLIO

18.16.4 NEWS TYPE

18.17 GREENYARD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 HALDIRAM’S

18.18.1 COMPANY SNAPSHOTS

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 HIMALAYA FOOD INTERNATIONAL LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 HORMEL FOODS CORPORATION.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 ITC LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 KOYARA FOODS

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 LAMB WESTON, INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 LIGHT MASS

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 MCCAIN FOODS LIMITED

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 NOMAD FOODS

18.26.1 COMPANY SNAPSHOT

18.26.2 RECENT FINANCIALS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 ORKLA

18.27.1 COMPANY SNAPSHOT

18.27.2 RECENT FINANCIALS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 PREMIER FOODS PLC

18.28.1 COMPANY SNAPSHOT

18.28.2 RECENT FINANCIALS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

18.29 PRIYA FOODS

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 REGAL KITCHEN FOODS

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 SANKALPFOODS.COM

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT/ NEWS TYPE

18.32 J.R. SIMPLOT COMPANY.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 THE HAIN CELESTIAL GROUP, INC.

18.33.1 COMPANY SNAPSHOT

18.33.2 REVENUE ANALYSIS

18.33.3 PRODUCT PORTFOLIO

18.33.4 RECENT DEVELOPMENTS

18.34 TYSON FOODS, INC.

18.34.1 COMPANY SNAPSHOT

18.34.2 RECENT FINANCIALS

18.34.3 PRODUCT PORTFOLIO

18.34.4 RECENT DEVELOPMENT

18.35 UNILEVER

18.35.1 COMPANY SNAPSHOT

18.35.2 REVENUE ANALYSIS

18.35.3 PRODUCT PORTFOLIO

18.35.4 RECENT DEVELOPMENTS

18.36 VECHEM ORGANICS (P) LIMITED

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

18.37 VIMAL AGRO PRODUCTS PVT LTD

18.37.1 COMPANY SNAPSHOT

18.37.2 PRODUCT PORTFOLIO

18.37.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 INCREASING DISPOSABLE INCOMES

TABLE 4 ESTIMATED SAVINGS USING READY TO EAT FOODS

TABLE 5 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 8 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 13 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 15 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 18 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 22 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 23 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 26 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 34 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 37 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 38 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 40 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 43 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032, (TONS)

TABLE 45 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 48 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 52 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 53 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION TYPE, 2018-2032, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 55 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 58 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 60 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 65 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 67 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 68 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 70 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 73 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 78 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 79 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 81 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 82 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 84 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 85 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 87 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (TONS)

TABLE 89 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD/KG)

TABLE 90 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 92 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 95 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 97 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 98 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (TONS)

TABLE 100 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 102 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 103 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA SPECIALITY IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA POUCHES/SACHETS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA CANS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA JARS & CONTAINERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA BOXES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA OTHERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA LESS THAN 250 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 251-500 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 501-750 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 751-1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA MORE THAN 1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA OXYGEN SCAVENGERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA MOISTURE CONTROL IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ANTIMICROBIALS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA TIME TEMPERATURE INDICATORS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA EDIBLE FILMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FROZEN/REFRIGERATED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA SHELF-STABLE IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CANNED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA NON-STORE BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA NON-STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA RESTAURANTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA HOUSEHOLDS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 145 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD/ KG)

TABLE 146 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 148 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 149 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 151 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 152 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 154 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 155 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 157 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 158 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 160 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 161 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 164 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 168 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 169 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 171 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 172 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 174 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 175 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 177 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 178 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 180 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 181 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 183 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 184 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 186 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 187 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 190 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 192 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 193 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 196 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 198 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 199 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 202 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 205 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 207 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 208 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 210 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)