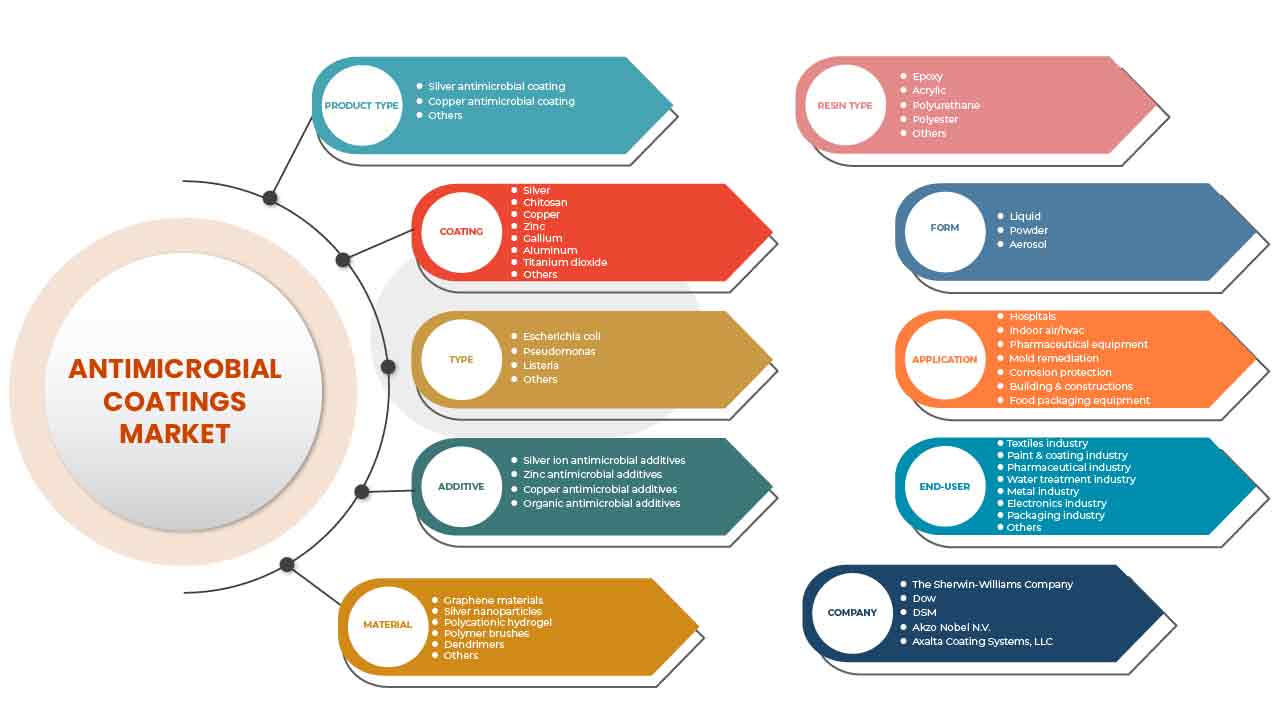

North America Antimicrobial Coatings Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

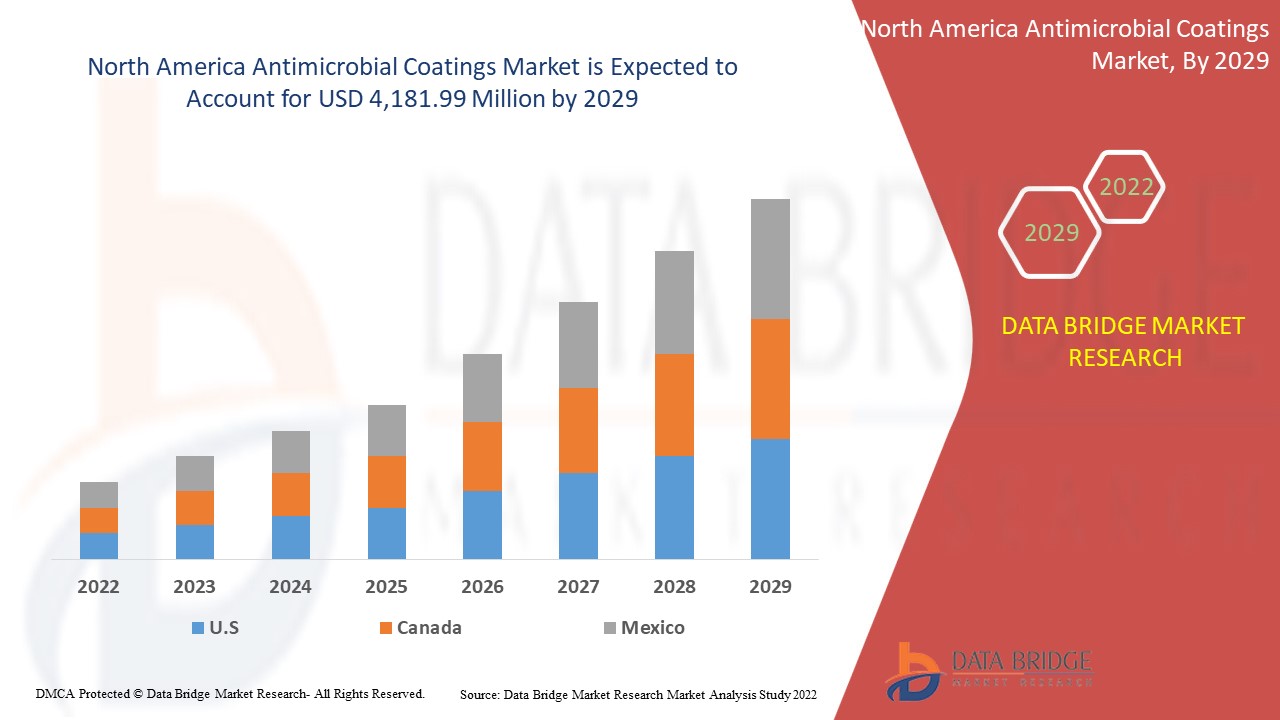

The North America antimicrobial coatings market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.5% in the forecast period of 2022 to 2029 and is expected to reach USD 4,181.99 million by 2029. The major factor driving the growth of the North America antimicrobial coatings market is the growing demand for heating, ventilation, and air conditioning to improve indoor air quality

Antimicrobial coatings assist in maintaining the quality of applied surfaces by preventing the growth of microorganisms such as fungi, parasites, and bacteria. The usage of these antimicrobial coatings provides improved cleanliness and hygiene as they end the requirement of frequent cleaning. As a result, antimicrobial coatings are more cost-effective and offer lasting protection against pathogens. These coatings are generally applied on walls, vents, counters, and door handles. Moreover, as these coatings help sterilize medical tools, surgical masks, gloves, and clothing, they find vast applications in clinics, hospitals, and healthcare centers.

The application of antimicrobial coatings improves the durability and appearance of the applied surface and aids in shielding the surface from the attack of microbes. As a result, these coatings are widely used to eliminate the germination of pathogens that can cause infectious diseases such as Ebola, influenza, mumps, measles, chickenpox, and rubella.

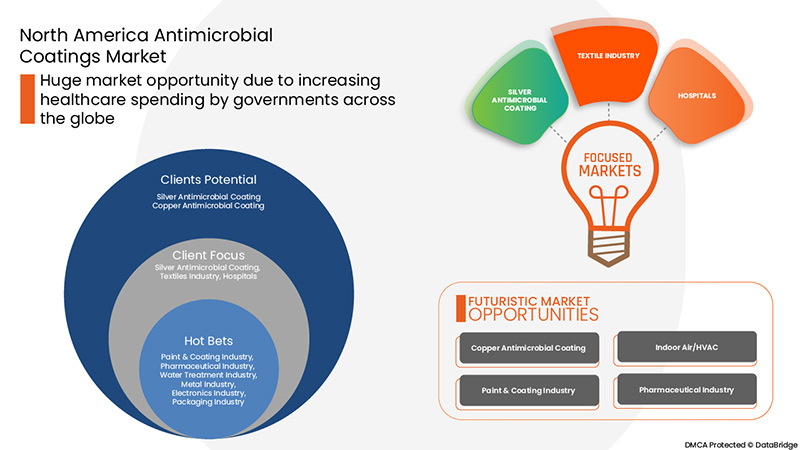

Growing demand for heating, ventilation, and air conditioning to improve indoor air quality and rising awareness regarding healthcare-associated infections (HCAI) are expected to boost market antimicrobial coatings demand. With the increasing consumption of antimicrobial coatings globally, major companies are expanding their production capacities in different countries to strengthen their presence of these products in the market.

The major restraint which may impact the market is stringent regulations associated with antimicrobial coatings. Also, the emission of active ingredients into the environment is a restraining factor for the North America antimicrobial coatings market.

North America antimicrobial coatings market report provides details of market share, new developments, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), By Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), By Type (Escherichia Coli, Pseudomonas, Listeria, Others), By Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), By Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), By Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), By Form (Liquid, Powder, Aerosol), By Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), By End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others |

Market Definition

Les revêtements antimicrobiens sont des revêtements résistants aux microbes qui comprennent des agents antimicrobiens empêchant les impuretés microbiennes. Ils sont largement utilisés dans les secteurs de la construction, de l'alimentation et de la santé. Ils sont appliqués sur les portes, les panneaux de verre, les murs, les portes, les tentes CVC, les comptoirs, etc. Le revêtement antimicrobien est une application d'un agent chimique sur la surface qui peut arrêter la croissance des micro-organismes pathogènes. En dehors de cela, le revêtement antimicrobien contribue à augmenter la durabilité de la surface, l'apparence, la résistance à la corrosion, etc. Ces revêtements sont utilisés pour les dispositifs médicaux afin de détruire ou d'inhiber la croissance des micro-organismes et de protéger les humains contre l'infection par des maladies infectieuses. Le revêtement antimicrobien est connu pour être une arme puissante contre les infections liées aux soins de santé. Le revêtement antimicrobien présente un revêtement antimicrobien viable très efficace et des modifications précisément dosées et délivrées directement à partir de la surface du dispositif médical. Le revêtement antimicrobien se concentre sur la réduction de l'accumulation sur les dispositifs biomédicaux en modifiant les caractéristiques interfaciales.

Dynamique du marché des revêtements antimicrobiens en Amérique du Nord

Conducteurs

- Demande croissante de chauffage, de ventilation et de climatisation pour améliorer la qualité de l'air intérieur

L'Amérique du Nord abrite de nombreux grands bâtiments qui abritent d'immenses bureaux et des logements. Avec le développement croissant des infrastructures dans la région, la prise de conscience de la nécessité d'une bonne qualité de l'air intérieur s'est accrue en raison de la propagation accrue des maladies. Ainsi, il existe une demande accrue de chauffage, de ventilation et de climatisation efficaces pour améliorer la qualité de l'air intérieur, ce qui devrait stimuler le marché nord-américain des revêtements antimicrobiens.

- Forte demande de la part de l'industrie des dispositifs médicaux

La capacité et le potentiel des revêtements antimicrobiens à prévenir et à contrôler la croissance des agents pathogènes sur n’importe quelle surface, en particulier dans le secteur de la santé, augmentent la demande dans l’industrie des dispositifs médicaux. Ainsi, la demande importante du secteur de la santé et des établissements tels que les cliniques et les hôpitaux pour l’industrie des dispositifs médicaux devrait agir comme un moteur pour le marché des revêtements antimicrobiens en Amérique du Nord.

Opportunités

- Utilisation croissante dans de nouvelles applications clés

En raison de la préoccupation croissante et de la sensibilisation croissante à la sécurité et à l'hygiène dans les pays développés tels que les États-Unis et le Canada, diverses entreprises se concentrent sur le développement de produits antimicrobiens et antibactériens pour garantir la sécurité de leurs clients. De plus, cela permet de se conformer aux préférences changeantes des consommateurs et d'accroître la demande du marché pour les produits à revêtement antimicrobien, offrant ainsi une opportunité lucrative pour la croissance du marché nord-américain des revêtements antimicrobiens.

- Progrès technologiques dans le domaine des revêtements antimicrobiens

Le développement rapide de la technologie des revêtements antimicrobiens, associé à la demande croissante de produits de revêtements antimicrobiens avancés destinés à être utilisés dans différentes industries, devrait créer une opportunité pour le marché des revêtements antimicrobiens au cours de la période de prévision.

Contraintes/Défis

- Émission de principes actifs dans l'environnement

Les revêtements antimicrobiens sont appliqués sur tout produit ou surface pour empêcher la propagation d'infections aux êtres humains et à d'autres organismes. Cependant, l'utilisation de revêtements antimicrobiens peut également entraîner des risques pour la santé lorsqu'ils sont utilisés pendant une très longue période. La plupart des revêtements antimicrobiens sont constitués d'ingrédients tels que le zinc, l'argent et le cuivre et rejettent activement ces ingrédients dans l'environnement. Ces ingrédients actifs pénètrent lentement dans l'air ambiant et dans d'autres plans d'eau et nuisent à l'écosystème.

Ainsi, les effets néfastes des revêtements antimicrobiens sur l’environnement, associés à un manque de sensibilisation et d’information concernant la minimisation de leurs effets néfastes sur l’environnement, peuvent restreindre le marché nord-américain des revêtements antimicrobiens.

- Réglementations strictes associées aux revêtements antimicrobiens

Les réglementations strictes sur l’utilisation des revêtements antimicrobiens par diverses organisations telles que l’Agence de protection de l’environnement (EPA), la FDA et REACH, entre autres, sont susceptibles d’entraver la croissance du marché nord-américain des revêtements antimicrobiens.

- Inquiétudes croissantes concernant la toxicité des nanoparticules

Une exposition prolongée à la toxicité des nanoparticules libérées par les revêtements antimicrobiens peut entraîner de graves problèmes de santé, ce qui suscite des inquiétudes et peut remettre en cause la croissance du marché nord-américain des revêtements antimicrobiens.

- Coût élevé des produits et perturbations de la chaîne d'approvisionnement en raison de la pandémie de COVID-19

L'épidémie de COVID-19 devrait constituer un défi pour la croissance du marché nord-américain des revêtements antimicrobiens au cours de la période de prévision en raison des confinements à l'échelle nationale, qui ont eu un impact négatif sur la demande et les ventes de revêtements antimicrobiens. Cependant, avec l'assouplissement du confinement, le flux de travail a commencé à augmenter, ce qui a aidé les fabricants à faire un retour sur le marché. En outre, les réglementations gouvernementales favorables à la croissance de l'économie et à l'essor des startups pourraient faire augmenter la demande pour le marché des revêtements antimicrobiens au cours de la période de prévision.

Développements récents

- En mars 2021, Specialty Coating Systems, Inc., leader mondial des services et technologies de revêtement conforme au Parylène, a annoncé l'acquisition de Diamond-MT, Inc., un fournisseur de services de revêtement conforme au Parylène et aux liquides. Ce développement offrira de nouvelles opportunités de croissance à l'entreprise.

- En novembre 2021, DuPont a conclu un accord définitif pour acquérir Rogers Corporation (« Rogers ») pour 5,2 milliards USD. DuPont a annoncé une série d'actions faisant progresser sa stratégie en tant qu'entreprise multi-industrielle de premier plan axée sur des activités à forte croissance et à marge élevée, leaders du marché, dotées de caractéristiques technologiques et financières complémentaires. Ce développement aidera DuPont à développer ses activités avec l'aide de Rogers Corporation.

Portée du marché des revêtements antimicrobiens en Amérique du Nord

Le marché nord-américain des revêtements antimicrobiens est classé en fonction du type de produit, du revêtement, du type, du matériau, de l'additif, du type de résine, de la forme, de l'application et des utilisateurs finaux.

Type de produit

- Revêtements antimicrobiens à base d'argent

- Revêtements antimicrobiens en cuivre

- Autres

Sur la base du type de produit, le marché nord-américain des revêtements antimicrobiens est segmenté en revêtements antimicrobiens en argent, revêtements antimicrobiens en cuivre et autres.

Revêtement

- Argent

- Chitosane

- Cuivre

- Zinc

- Gallium

- Aluminium

- Dioxyde de titane

- Autres

Sur la base du revêtement, le marché nord-américain des revêtements antimicrobiens est segmenté en argent, chitosane, cuivre, zinc, gallium, aluminium, dioxyde de titane et autres.

Taper

- Escherichia coli

- Pseudomonas

- Listeria

- Autres

Sur la base du type, le marché nord-américain des revêtements antimicrobiens est segmenté en Escherichia coli, pseudomonas, listeria et autres.

Additif

- Additifs antimicrobiens à base d'ions d'argent

- Additifs antimicrobiens à base de zinc

- Additifs antimicrobiens à base de cuivre

- Additifs antimicrobiens biologiques

Sur la base des additifs, le marché nord-américain des revêtements antimicrobiens est segmenté en additifs antimicrobiens à base d'ions argent, additifs antimicrobiens à base de zinc, additifs antimicrobiens à base de cuivre et additifs antimicrobiens organiques.

Matériel

- Matériaux à base de graphène

- Hydrogel polycationique

- Nanoparticules d'argent

- Brosses en polymère

- Dendrimères

- Autres

Sur la base du matériau, le marché nord-américain des revêtements antimicrobiens est segmenté en matériaux à base de graphène, nanoparticules d'argent, hydrogel polycationique, brosses polymères, dendrimères et autres.

Type de résine

- Acrylique

- Polyester

- Polyuréthane

- Époxy

- Autres

Sur la base du type de résine, le marché nord-américain des revêtements antimicrobiens est segmenté en époxy, acrylique, polyuréthane, polyesters et autres.

Formulaire

- Liquide

- Aérosol

- Poudre

Sur la base de la forme, le marché nord-américain des revêtements antimicrobiens est segmenté en liquide, aérosol et poudre.

Application

- Hôpitaux

- Air intérieur/CVC

- Equipements pharmaceutiques

- Traitement des moisissures

- Protection contre la corrosion

- Bâtiment et construction

- Équipement d'emballage alimentaire

- Autres

Sur la base de l'application, le marché nord-américain des revêtements antimicrobiens est segmenté en hôpitaux, air intérieur/CVC, équipements pharmaceutiques, assainissement des moisissures, protection contre la corrosion, bâtiment et construction, équipements d'emballage alimentaire et autres.

Utilisateurs finaux

- Industrie pharmaceutique

- Industrie de la peinture et des revêtements

- Industrie de l'emballage

- Industrie textile

- Industrie électronique

- Industrie métallurgique

- Industrie du traitement de l'eau

- Autres

On the basis of end-users, North America antimicrobial coatings market is segmented into the pharmaceutical industry, paint and coating industry, packaging industry, textiles industry, electronics industry, metal industry, water treatment industry, and others.

North America Antimicrobial Coatings Regional Analysis/Insights

The North America antimicrobial coatings market is categorized based on country, product type, coating, type, material, additive, resin type, form, application, and end-users.

North America antimicrobial coatings market is further segmented into the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America antimicrobial coatings market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the increasing need for safe environments in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Antimicrobial Coatings Market Share Analysis

North America antimicrobial coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America antimicrobial coatings market.

Some of the prominent participants operating in the North America antimicrobial coatings market are Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY

5.1.2 RISING AWARENESS REGARDING HEALTHCARE ASSOCIATED INFECTIONS (HCAI)

5.1.3 SIGNIFICANT DEMAND FROM THE MEDICAL DEVICE INDUSTRY

5.1.4 INCREASING ADOPTION ACROSS VARIOUS INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 EMISSION OF ACTIVE INGREDIENTS INTO THE ENVIRONMENT

5.2.2 STRINGENT REGULATIONS ASSOCIATED WITH ANTIMICROBIAL COATINGS

5.3 OPPORTUNITIES

5.3.1 RISING USAGE ACROSS KEY NOVEL APPLICATIONS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN ANTIMICROBIAL COATINGS

5.3.3 INCREASING HEALTHCARE SPENDING BY GOVERNMENTS ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INCREASING CONCERNS REGARDING THE TOXICITY OF NANOPARTICLES

5.4.2 HIGH COST OF PRODUCTS AND SUPPLY CHAIN DISRUPTIONS DUE TO COVID-19 PANDEMIC

6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATINGS

6.3 COPPER ANTIMICROBIAL COATINGS

6.4 OTHERS

7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 NON-FOULING POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 HOSPITALS

13.3 INDOOR AIR/HVAC

13.4 PHARMACEUTICAL EQUIPMENT

13.5 MOLD REMEDIATION

13.6 CORROSION PROTECTION

13.7 BUILDING & CONSTRUCTIONS

13.8 FOOD PACKAGING EQUIPMENT

13.9 OTHERS

14 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER

14.1 OVERVIEW

14.2 TEXTILES INDUSTRY

14.2.1 SILVER ANTIMICROBIAL COATING

14.2.2 COPPER ANTIMICROBIAL COATING

14.2.3 OTHERS

14.3 PAINT & COATING INDUSTRY

14.3.1 SILVER ANTIMICROBIAL COATING

14.3.2 COPPER ANTIMICROBIAL COATING

14.3.3 OTHERS

14.4 PHARMACEUTICAL INDUSTRY

14.4.1 SILVER ANTIMICROBIAL COATING

14.4.2 COPPER ANTIMICROBIAL COATING

14.4.3 OTHERS

14.5 WATER TREATMENT INDUSTRY

14.5.1 SILVER ANTIMICROBIAL COATING

14.5.2 COPPER ANTIMICROBIAL COATING

14.5.3 OTHERS

14.6 METAL INDUSTRY

14.6.1 SILVER ANTIMICROBIAL COATING

14.6.2 COPPER ANTIMICROBIAL COATING

14.6.3 OTHERS

14.7 ELECTRONICS INDUSTRY

14.7.1 SILVER ANTIMICROBIAL COATING

14.7.2 COPPER ANTIMICROBIAL COATING

14.7.3 OTHERS

14.8 PACKAGING INDUSTRY

14.8.1 SILVER ANTIMICROBIAL COATING

14.8.2 COPPER ANTIMICROBIAL COATING

14.8.3 OTHERS

14.9 OTHERS

14.9.1 SILVER ANTIMICROBIAL COATING

14.9.2 COPPER ANTIMICROBIAL COATING

14.9.3 OTHERS

15 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.2 MERGERS & ACQUISITIONS

16.3 EXPANSIONS

16.4 NEW PRODUCT DEVELOPMENTS

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 THE SHERWIN-WILLIAMS COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 DOW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AKZO NOBEL N.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 AXALTA COATING SYSTEMS, LLC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 AEREUS TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT UPDATES

18.7 ARXADA AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 BURKE INDUSTRIAL COATINGS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT UPDATE

18.9 DUPONT

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATE

18.1 FIBERLOCK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 FLOWCRETE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATE

18.12 GBNEUHAUS GMBH

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 LINETEC

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT UPDATE

18.14 KASTUS TECHNOLOGIES COMPANY LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT UPDATE

18.15 KATILAC COATINGS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT UPDATE

18.16 MICROBAN INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 NANO CARE DEUTSCHLAND AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT UPDATE

18.18 SANITIZED AG

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT UPDATES

18.19 SPECIALTY COATING SYSTEMS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT UPDATES

18.2 PPG INDUSTRIES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 3 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 5 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 7 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SILVER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHITOSAN IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ALUMINUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA COPPER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ZINC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GALLIUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ESCHERICHIA COLI IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PSEUDOMONAS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LISTERIA IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DENDRIMERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA EPOXY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACRYLIC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA POLYURETHANE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA POLYESTER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LIQUID IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA POWDER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AEROSOL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDOOR AIR/HVAC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MOLD REMEDIATION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORROSION PROTECTION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BUILDING & CONSTRUCTIONS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD PACKAGING EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (KILO TONNES)

TABLE 74 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 76 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 95 U.S. ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 96 U.S. ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 98 U.S. ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 U.S. POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 U.S. ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 U.S. ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.S. WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 114 CANADA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 115 CANADA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 CANADA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 CANADA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 CANADA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CANADA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 CANADA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 133 MEXICO ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 134 MEXICO ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 MEXICO POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY IS EXPECTED TO DRIVE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SILVER ANTIMICROBIAL COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

FIGURE 18 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 19 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COATINGS, 2021

FIGURE 21 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY ADDITIVE, 2021

FIGURE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY MATERIAL, 2021

FIGURE 24 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY RESIN TYPE, 2021

FIGURE 25 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY FORM, 2021

FIGURE 26 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.