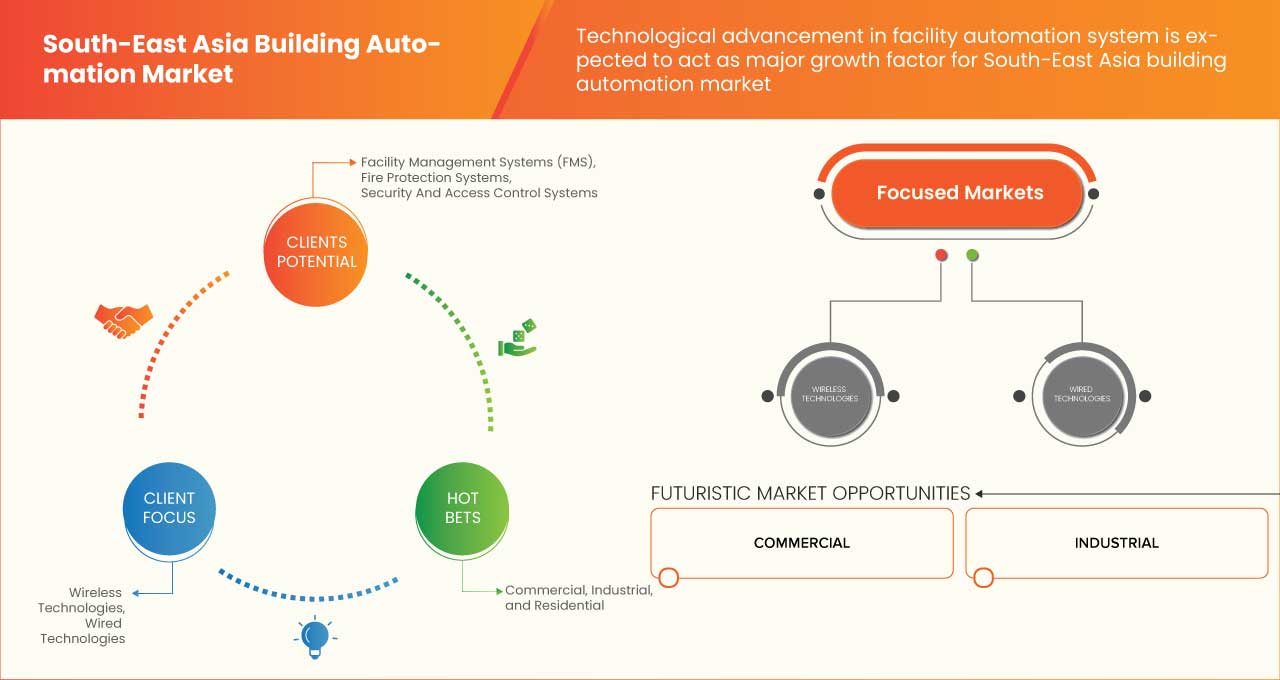

Marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est, par type de système (systèmes de gestion des installations (FMS), systèmes de protection incendie , systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS) et autres), technologie (technologies sans fil et technologies filaires), application (commerciale, industrielle et résidentielle), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est

Les systèmes d'automatisation des bâtiments combinent les systèmes de chauffage, de ventilation et de climatisation, d'éclairage, de sécurité et d'autres systèmes pour interagir sur une seule et même plateforme. Il s'agit de systèmes intelligents qui incluent à la fois du matériel et des logiciels. Dans cette approche, le système d'automatisation améliore la sécurité et le confort des occupants tout en fournissant des informations vitales sur l'efficacité opérationnelle d'un bâtiment. Les principaux objectifs de ce type d'infrastructure sont d'accroître la sécurité, de réduire les coûts et d'accroître l'efficacité du système. Tous ces éléments sont réunis dans une plateforme de gestion de bâtiment consolidée.

Data Bridge Market Research analyse que le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est connaîtra un TCAC de 6,2 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par type de système (systèmes de gestion des installations (FMS), systèmes de protection incendie, systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS) et autres), technologie (technologies sans fil et technologies filaires), application (commerciale, industrielle et résidentielle). |

|

Pays couverts |

Myanmar, Cambodge, Indonésie, Laos, Malaisie, Philippines, Singapour, Thaïlande, Vietnam et le reste de l’Asie du Sud-Est. |

|

Acteurs du marché couverts |

Français Carrier, Robert Bosch GmbH, Hubbell, ABB, Emersen Electric Co., Hitachi Ltd., Delta Electronics, Inc., Neckoff Automation, Rockwell Automation, Inc., Honeywell International Inc., Jhonson Controls, Siemens, Mitsubishi Electric Corporation, Azbil Vietnam Co., ltd., SYREFL HOLDINGS SDN BHD, Lutron Electronics Co., Inc, et Huawei Technologies Co., ltd. entre autres. |

Définition du marché

L'automatisation des bâtiments est le contrôle automatique centralisé par un logiciel ou une application qui permet de contrôler le chauffage, la ventilation et la climatisation (CVC), l'électricité, l'éclairage, l'ombrage, le contrôle d'accès, les systèmes de sécurité et d'autres systèmes interdépendants d'un bâtiment. Cela se fait par le biais d'un système de gestion du bâtiment (BMS) ou d'un système d'automatisation des bâtiments (BAS). Cela permet d'améliorer le confort des occupants, l'efficacité des opérations des systèmes du bâtiment, de réduire la consommation d'énergie et les coûts d'exploitation et de maintenance, d'assurer une sécurité accrue, la collecte et la conservation des données historiques et l'accès/le contrôle/l'exploitation à distance du système. Il existe différents types de systèmes de BAS.

Dynamique du marché des systèmes d'automatisation des bâtiments

Conducteurs

-

Augmentation de la demande de solutions d'automatisation pour une expérience client fluide

De nos jours, les bâtiments destinés à diverses utilisations ont connu une évolution significative au cours des deux dernières décennies. Dans les bâtiments modernes, la demande de systèmes automatisés à la pointe de la technologie est croissante. La raison en est que des analyses prédictives sont utilisées dans ces systèmes pour permettre au système de s'adapter aux conditions changeantes, en veillant à ce que les systèmes CVC soient gérés efficacement grâce au contrôle automatique des équipements pour garantir que le climat des bâtiments reste dans des limites acceptables. La maintenance proactive des équipements défectueux est un autre avantage de l'automatisation des bâtiments. En outre, ces technologies peuvent augmenter le niveau de confort des occupants, ce qui se traduit par des travailleurs plus heureux et plus efficaces.

-

Intégration des systèmes d'automatisation des bâtiments dans la région

La technologie des systèmes d'automatisation des bâtiments a fait des progrès considérables ces dernières années et elle est désormais intégrée dans les structures des bâtiments anciens et nouveaux du monde entier. L'automatisation et les commandes des bâtiments deviennent de plus en plus populaires, ce qui devrait aider le marché à se développer dans les pays émergents, en particulier dans la région Asie-Pacifique, où le secteur de la construction connaît un boom ces dernières années.

-

Progrès technologique dans le système d'automatisation des installations

Tout comme Internet, les commandes numériques des bâtiments se sont également développées. Leur adoption a commencé avec un nombre relativement restreint de personnes avant de se répandre vers une utilisation apparemment universelle. La façon dont beaucoup d’entre nous interagissent avec Internet et nos bâtiments, en revanche, est complètement différente si l’on considère les smartphones. Les smartphones mettent le potentiel d’Internet entre les mains des gens d’une manière utilisable et accessible en condensant et en assimilant l’immense panorama de possibilités dans des applications simples à utiliser. En ce qui concerne la façon dont leurs bâtiments et les données qu’ils contiennent interagissent avec eux, de nombreux gestionnaires comparent cela aux premières autoroutes de l’information, qui étaient une vaste étendue de potentiel et de données sans aucun outil pour les aider à en tirer un sens.

-

Croissance rapide des infrastructures intelligentes

En termes d’automatisation et d’intégration des bâtiments, les années à venir devraient apporter de l’accessibilité. Cela comprend l’accès entre des systèmes qui ont historiquement fonctionné de manière indépendante, l’accès au personnel technique qui assiste les bâtiments et l’accès des décideurs aux données détenues par le bâtiment sur l’utilisation et les performances. Cet accès aidera les propriétaires et les exploitants de bâtiments à utiliser l’espace de manière plus judicieuse, à améliorer l’atmosphère pour les utilisateurs et à atteindre les objectifs de réduction de la consommation d’énergie et de carbone.

Opportunités

-

Introduction à l'intelligence artificielle

En raison des progrès technologiques, le secteur de la gestion des installations évolue continuellement. Les technologies d’automatisation transforment actuellement l’entreprise en rationalisant et en simplifiant les processus de travail, ainsi qu’en allégeant les responsabilités routinières des gestionnaires d’installations. Parmi les autres avantages de la mise en œuvre de la technologie d’automatisation, citons la réduction des coûts de réparation et de maintenance de plus de 30 %, l’amélioration des relations avec les sous-traitants et l’augmentation de la fiabilité et de la durabilité des actifs. Lorsqu’elle est liée au système logiciel de gestion des installations, l’IA, ou intelligence artificielle , permet des notifications, des alarmes et la résolution des problèmes en temps réel.

-

Besoin croissant de technologies de bâtiments connectés

Les infrastructures intelligentes sont une nouvelle technologie qui modifie de plus en plus la façon dont les gens vivent et travaillent dans les bâtiments. Ces technologies de pointe et les structures qu'elles produisent sont plus demandées que jamais en raison de l'augmentation constante du nombre d'entreprises de construction intelligente. Les bâtiments intelligents utilisent des systèmes économes en énergie, sont plus respectueux de l'environnement et favorisent la sécurité, ce qui peut améliorer à la fois le bien-être des occupants et la stabilité financière des propriétaires. Tout ce que vous devez savoir sur ces structures sera abordé dans ce livre, y compris une discussion approfondie des avantages, une liste des principales fonctionnalités de sécurité pour les infrastructures intelligentes et des détails sur la procédure d'installation.

Contraintes/Défis

- Complexité dans l'installation/l'exploitation du système d'automatisation du bâtiment

Les décisions d'installation prises peuvent avoir un impact significatif sur la durée de vie d'un système d'automatisation de bâtiment. Pour un système CVC, par exemple, le placement des conduits, le placement des évents, une bonne étanchéité et l'ordre approprié des composants sont essentiels pour que le système d'automatisation de bâtiment fonctionne efficacement au fil du temps. Par conséquent, une installation correcte et bien planifiée doit être la première étape. Le manque de formation est l'un des facteurs de sous-performance des systèmes d'automatisation de bâtiment. La raison en est leur complexité. Les systèmes d'automatisation et de contrôle des bâtiments sont devenus plus complexes en raison de leurs fonctionnalités accrues. Cependant, un système plus complexe nécessite également une formation plus approfondie pour ceux qui l'utilisent. Les opérateurs doivent comprendre la signification des informations et si elles indiquent un système ou un composant fonctionnant correctement ou non.

- Manque de systèmes d’automatisation conviviaux pour l’utilisateur final

L'utilisateur final doit prendre soin du système d'automatisation du bâtiment. Les systèmes d'automatisation et de contrôle des bâtiments sont devenus de plus en plus complexes à mesure que leurs capacités ont augmenté. Des systèmes plus contrôlables, des environnements plus confortables et une consommation d'énergie réduite résultent de cette complexité.

Impact du COVID-19 sur le marché des systèmes d'automatisation des bâtiments

La COVID-19 a eu un impact considérable sur toutes les grandes industries du monde. Pendant la pandémie, la plupart des industries ont été complètement fermées. De plus, le comportement des individus a certainement changé pendant la pandémie, ce qui a entraîné une diminution du processus de production et de fabrication. La pandémie a entraîné une chute considérable des ventes sur le marché des systèmes d'automatisation des bâtiments, car le confinement prévalait dans la plupart des régions. Le confinement a conduit les fabricants et les consommateurs à arrêter complètement les processus pendant quelques mois. La demande de produits d'automatisation des infrastructures a connu une chute drastique en raison de la fermeture de diverses industries. En outre, le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est a connu une baisse sans précédent. Cependant, les choses redeviennent normales de jour en jour ; la demande d'automatisation et la croissance du marché des systèmes d'automatisation des bâtiments sont désormais obsolètes.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer les performances et les ventes. Grâce à cela, les entreprises mettront sur le marché des produits de pointe.

Développements récents

- En novembre 2022, Siemens a annoncé son partenariat avec Qualcomm Technologies, Inc. Les deux entreprises travailleront ensemble pour développer l'automatisation en appliquant un réseau privé 5G (PN). Cela a aidé l'entreprise à accroître sa présence sur le marché.

- En juin 2022, Mitsubishi Electric Corporation a annoncé qu'elle investirait environ 2,2 milliards INR, soit 3,1 milliards de yens, dans sa filiale Mitsubishi Electric India Pvt. Ltd. pour établir une nouvelle usine en Inde. Cette usine produit des onduleurs et d'autres produits de système de contrôle d'automatisation industrielle (FA). Cela a aidé l'entreprise à accroître sa présence sur les marchés de l'Asie du Sud et de l'Asie du Sud-Est.

Portée du marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est

Le marché des systèmes d'automatisation des bâtiments est segmenté en fonction du type de système, de la technologie et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de système

- Systèmes de gestion des installations (FMS)

- Systèmes de protection contre les incendies

- Systèmes de sécurité et de contrôle d'accès

- Systèmes de gestion de l'énergie

- Logiciel de gestion de bâtiment (BMS)

- Autres

Sur la base du type de système, le marché des systèmes d'automatisation des bâtiments est segmenté en systèmes de gestion des installations (FMS), systèmes de protection incendie, systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS) et autres.

Technologie

- Technologies sans fil

- Technologies câblées

Sur la base de la technologie, le marché des systèmes d'automatisation des bâtiments est segmenté en technologies sans fil et technologies filaires.

Application

- Commercial

- Industriel

- Résidentiel

Sur la base des applications, le marché des systèmes d'automatisation des bâtiments est segmenté en commercial, industriel et résidentiel.

Analyse/perspectives régionales du marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est

Le marché des systèmes d’automatisation des bâtiments est analysé et des informations sur la taille du marché et les tendances sont fournies par le type de système, la technologie, l’application et les pays référencés ci-dessus.

Le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est couvre des pays tels que le Myanmar, le Cambodge, l'Indonésie, le Laos, la Malaisie, les Philippines, Singapour, la Thaïlande, le Vietnam et le reste de l'Asie du Sud-Est. Singapour devrait dominer le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est, car Singapour est un leader régional dans l'adoption de produits et de solutions d'automatisation des bâtiments. En Thaïlande, Delta Controls et LOYTEC continuent de développer des produits innovants de gestion et de contrôle des bâtiments. Les synergies de leurs technologies d'automatisation des bâtiments avec les capacités d'économie d'énergie de base de Delta intègrent divers systèmes de construction sur une plate-forme de gestion unique, ce qui contribuera à étendre la croissance du marché de l'automatisation des bâtiments du pays sur le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est. Tous ces facteurs ont contribué à la croissance du pays sur le marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est.

La section pays du rapport sur le marché des systèmes d'automatisation des bâtiments fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes d'automatisation des bâtiments en Asie du Sud-Est

Le paysage concurrentiel du marché des systèmes d'automatisation des bâtiments fournit des détails sur le concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des systèmes d'automatisation des bâtiments.

Certains des principaux acteurs opérant sur le marché des systèmes d'automatisation des bâtiments sont Carrier, Robert Bosch GmbH, Hubbell, ABB, Emersen Electric Co., Hitachi Ltd., Delta Electronics, Inc., Neckoff Automation, Rockwell Automation, Inc., Honeywell International Inc., Jhonson Controls, Siemens, Mitsubishi Electric Corporation, Azbil Vietnam Co., ltd., SYREFL HOLDINGS SDN BHD, Lutron Electronics Co., Inc et Huawei Technologies Co., ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS:

4.2 PRICING ANALYSIS:

4.3 BUILDING AUTOMATION SYSTEM ECOSYSTEM :

4.3.1 IOT SENSORS

4.3.2 ANALYTICS SOFTWARE

4.3.3 USER INTERFACE

4.3.4 COMMUNICATION

4.4 REGULATORY FRAMEWORK AND STANDARDS:

4.4.1 ISO/IEC JOINT TECHNICAL COMMITTEE 1

4.5 PATENT ANALYSIS:

4.6 PORTER’S FIVE FORCES:

4.7 TOP WINNING STRATEGIES:

4.8 TECHNOLOGICAL TRENDS:

5 REGIONAL SUMMARY

5.1 SUMMARY WRITE-UP (SOUTH-EAST ASIA)

5.1.1 OVERVIEW

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

6.1.2 INTEGRATION OF BUILDING AUTOMATION SYSTEMS IN THE REGION

6.1.3 TECHNOLOGICAL ADVANCEMENT IN FACILITY AUTOMATION SYSTEM

6.1.4 RAPID GROWTH IN SMART INFRASTRUCTURE

6.2 RESTRAINTS

6.2.1 COMPLEXITY IN INSTALLATION/OPERATION OF BUILDING AUT0MATION SYSTEM

6.2.2 VERY HIGH COST ATTACHED

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF ARTIFICIAL INTELLIGENCE

6.3.2 GROWING NEED FOR CONNECTED BUILDING TECHNOLOGIES

6.3.3 INCREASING CONSTRUCTION ACTIVITIES IN THE REGION

6.3.4 STRATEGIC ALLIANCES & PARTNERSHIP BETWEEN ORGANIZATIONS

6.4 CHALLENGES

6.4.1 LACK OF END-USER-FRIENDLY AUTOMATION SYSTEMS

6.4.2 VERY HIGH COMPETITION

7 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE

7.1 OVERVIEW

7.2 FACILITY MANAGEMENT SYSTEMS (FMS)

7.2.1 HVAC CONTROL SYSTEMS

7.2.1.1 SENSORS

7.2.1.2 ACTUATORS

7.2.1.2.1 ELECTRIC

7.2.1.2.2 HYDRAULIC

7.2.1.2.3 PNEUMATIC

7.2.1.3 CONTROL VALVES

7.2.1.4 HEATING AND COOLING COILS

7.2.1.5 SMART THERMOSTATS

7.2.1.6 PUMPS AND FANS

7.2.1.7 DAMPERS

7.2.1.7.1 PARALLEL AND OPPOSED BLADE DAMPERS

7.2.1.7.2 LOW-LEAKAGE DAMPERS

7.2.1.7.3 ROUND DAMPERS

7.2.1.8 OTHERS

7.2.2 SMART DEVICES

7.2.2.1 SMART APPLIANCES

7.2.2.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

7.2.2.3 SMART METER

7.2.3 LIGHTING CONTROL SYSTEMS

7.2.3.1 HARDWARE

7.2.3.1.1 RECEIVERS

7.2.3.1.2 ACTUATORS

7.2.3.1.3 TRANSMITTERS

7.2.3.1.4 SENSORS

7.2.3.1.5 TIMERS

7.2.3.1.6 RELAY

7.2.3.2 SOFTWARE

7.2.3.3 SERVICES

7.2.3.3.1 INSTALLATION

7.2.3.3.2 SUPPORT AND MAINTENANCE

7.3 SECURITY AND ACCESS CONTROL SYSTEMS

7.3.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

7.3.1.1 HARDWARE

7.3.1.1.1 MULTI FACTOR AUTHENTICATION

7.3.1.1.2 SINGLE FACTOR AUTHENTICATION

7.3.1.2 SOFTWARE

7.3.1.3 SERVICES

7.3.1.3.1 INSTALLATION

7.3.1.3.2 SUPPORT & MAINTENANCE

7.3.1.3.3 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.3.1.3.3.1 HARDWARE

7.3.1.3.3.2 CAMERAS

7.3.1.3.3.3 STORAGE SYSTEMS

7.3.1.3.3.4 ACCESSORIES

7.3.1.3.3.5 MONITORS

7.3.1.3.3.6 SOFTWARE

7.3.1.3.3.7 SERVICES

7.3.1.3.3.8 INSTALLATION

7.3.1.3.3.9 SUPPORT & MAINTENANCE

7.3.1.3.3.10 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.3.2 VIDEO SURVEILLANCE SYSTEMS

7.4 ENERGY MANAGEMENT SYSTEMS

7.5 BUILDING MANAGEMENT SOFTWARE (BMS)

7.6 FIRE PROTECTION SYSTEMS

7.6.1 SENSORS AND DETECTORS

7.6.1.1 SMOKE DETECTORS

7.6.1.2 FLAME DETECTORS

7.6.1.2.1 SINGLE IR /SINGLE UV

7.6.1.2.2 DUAL IR /SINGLE UV

7.6.1.2.3 MULTI IR /SINGLE UV

7.6.2 EMERGENCY LIGHTING AND PUBLIC ALERT DEVICES

7.6.3 FIRE ALARMS

7.6.4 FIRE SPRINKLERS

7.7 OTHERS

8 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 WIRELESS TECHNOLOGIES

8.2.1 ZIGBEE

8.2.2 Z–WAVE

8.2.3 ENOCEAN

8.2.4 WI-FI

8.2.5 THREAD

8.2.6 BLUETOOTH

8.2.7 INFRARED

8.3 WIRED TECHNOLOGIES

8.3.1 KNX

8.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

8.3.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

8.3.4 LONWORKS

8.3.5 MODBUS

9 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 RESIDENTIAL, BY TYPE

9.2.1.1 APARTMENTS

9.2.1.2 MULTI-FAMILY HOME

9.2.1.3 SINGLE-FAMILY HOME

9.2.1.4 OTHERS

9.2.2 RESIDENTIAL, BY SYSTEM

9.2.2.1 DOOR ENTRY SYSTEM

9.2.2.2 VIDEO SURVEILLANCE

9.2.2.3 INTRUSION ALARM SYSTEM

9.2.2.4 ACCESS CONTROL

9.2.2.5 OTHERS

9.2.3 RESIDENTIAL, BY SYSTEM TYPE

9.2.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.2.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.2.3.3 ENERGY MANAGEMENT SYSTEMS

9.2.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.2.3.5 FIRE PROTECTION SYSTEMS

9.2.3.6 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL, BY TYPE

9.3.1.1 AIRPORTS AND RAILWAY STATIONS

9.3.1.2 GOVERNMENT

9.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

9.3.1.4 HOSPITALITY

9.3.1.5 OFFICE BUILDINGS

9.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

9.3.1.7 EDUCATION

9.3.1.8 OTHERS

9.3.2 COMMERCIAL, BY TECHNOLOGY

9.3.2.1 VENTILATION AND AIR CONDITIONING (HVAC)

9.3.2.2 LIGHTING

9.3.2.3 HEATING

9.3.2.4 SECURITY AND ACCESS CONTROLS

9.3.2.5 FIRE AND LIFE SAFETY

9.3.3 COMMERCIAL, BY SYSTEM TYPE

9.3.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.3.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.3.3.3 ENERGY MANAGEMENT SYSTEMS

9.3.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.3.3.5 FIRE PROTECTION SYSTEMS

9.3.3.6 OTHERS

9.4 INDUSTRIAL

9.4.1 INDUSTRIAL, BY TYPE

9.4.1.1 OIL AND GAS

9.4.1.2 ENERGY AND UTILITIES

9.4.1.3 AUTOMOTIVE

9.4.1.4 FOOD AND BEVERAGES

9.4.1.5 METAL AND MINING

9.4.1.6 OTHERS

9.4.2 INDUSTRIAL, BY SYSTEM TYPE

9.4.2.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.4.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.4.2.3 ENERGY MANAGEMENT SYSTEMS

9.4.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.4.2.5 FIRE PROTECTION SYSTEMS

9.4.2.6 OTHERS

10 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY

10.1 SINGAPORE

10.2 THAILAND

10.3 INDONESIA

10.4 MALAYSIA

10.5 VIETNAM

10.6 PHILIPPINES

10.7 MYANMAR

10.8 CAMBODIA

10.9 LAOS

10.1 REST OF SOUTH-EAST ASIA

11 SWOT

12 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SOUTH-EAST ASIA

13 COMPANY PROFILES

13.1 SIEMENS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 MITSUBISHI ELECTRIC CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 JOHNSON CONTROLS.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.1 PRODUCT PORTFOLIO

13.3.2 RECENT DEVELOPMENTS

13.4 HUAWEI TECHNOLOGIES CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 ROBERT BOSCH GMBH

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 SOLUTION PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 AZBIL VIETNAM CO., LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 BECKHOFF AUTOMATION

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CARRIER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 SOLUTION PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 DELTA ELECTRONICS (THAILAND) PCL.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 EMERSON ELECTRIC CO.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HITACHI ENERGY LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 SOLUTION PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 HONEYWELL INTERNATIONAL INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 SOLUTION PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 HUBBELL

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 LUTRON ELECTRONICS CO., INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SYREFL HOLDINGS SDN BHD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 SOUTH-EAST ASIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 SOUTH-EAST ASIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 SOUTH-EAST ASIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SOUTH-EAST ASIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 SOUTH-EAST ASIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 SOUTH-EAST ASIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 8 SOUTH-EAST ASIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 9 SOUTH-EAST ASIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 10 SOUTH-EAST ASIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SOUTH-EAST ASIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 12 SOUTH-EAST ASIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 13 SOUTH-EAST ASIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 14 SOUTH-EAST ASIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 SOUTH-EAST ASIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 16 SOUTH-EAST ASIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 17 SOUTH-EAST ASIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 SOUTH-EAST ASIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SOUTH-EAST ASIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH-EAST ASIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 22 SOUTH-EAST ASIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 24 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 26 SOUTH-EAST ASIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 29 SOUTH-EAST ASIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 SOUTH-EAST ASIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SOUTH-EAST ASIA INDUSTRIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 33 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 SINGAPORE FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 SINGAPORE HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 SINGAPORE ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 SINGAPORE DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 SINGAPORE SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 SINGAPORE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 40 SINGAPORE HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 41 SINGAPORE SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 42 SINGAPORE SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 SINGAPORE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 44 SINGAPORE HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 45 SINGAPORE SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 46 SINGAPORE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 SINGAPORE HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 48 SINGAPORE SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 49 SINGAPORE FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 SINGAPORE SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 SINGAPORE FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 53 SINGAPORE WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SINGAPORE WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SINGAPORE BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 56 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 58 SINGAPORE RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 61 SINGAPORE COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SINGAPORE INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SINGAPORE INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 THAILAND FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 THAILAND HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 THAILAND ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 THAILAND DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 THAILAND SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 THAILAND LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 71 THAILAND HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 72 THAILAND SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 73 THAILAND SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 THAILAND BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 84 THAILAND WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 THAILAND WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 THAILAND BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 89 THAILAND RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 92 THAILAND COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 THAILAND INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 THAILAND INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 INDONESIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 INDONESIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 INDONESIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 INDONESIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 INDONESIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 INDONESIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 102 INDONESIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 103 INDONESIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 104 INDONESIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 INDONESIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 106 INDONESIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 107 INDONESIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 108 INDONESIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 INDONESIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 110 INDONESIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 111 INDONESIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 INDONESIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 INDONESIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 115 INDONESIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 INDONESIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 INDONESIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 120 INDONESIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 123 INDONESIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 INDONESIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 INDONESIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MALAYSIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MALAYSIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MALAYSIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 MALAYSIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 MALAYSIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MALAYSIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 133 MALAYSIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 134 MALAYSIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 135 MALAYSIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 MALAYSIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 137 MALAYSIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 138 MALAYSIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 139 MALAYSIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MALAYSIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 141 MALAYSIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 142 MALAYSIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MALAYSIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MALAYSIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 146 MALAYSIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MALAYSIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MALAYSIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 149 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 151 MALAYSIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 154 MALAYSIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 MALAYSIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 MALAYSIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 VIETNAM FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 VIETNAM HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 VIETNAM ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 VIETNAM DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 VIETNAM SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 VIETNAM LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 164 VIETNAM HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 165 VIETNAM SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 166 VIETNAM SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 VIETNAM BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 168 VIETNAM HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 169 VIETNAM SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 170 VIETNAM VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 VIETNAM HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 172 VIETNAM SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 173 VIETNAM FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 VIETNAM SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 VIETNAM FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 177 VIETNAM WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 VIETNAM WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 VIETNAM BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 180 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 182 VIETNAM RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 185 VIETNAM COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 VIETNAM INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 VIETNAM INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 PHILIPPINES FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 PHILIPPINES HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 PHILIPPINES ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 192 PHILIPPINES DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 PHILIPPINES SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 PHILIPPINES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 195 PHILIPPINES HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 196 PHILIPPINES SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 197 PHILIPPINES SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 PHILIPPINES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 199 PHILIPPINES HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 200 PHILIPPINES SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 201 PHILIPPINES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 PHILIPPINES HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 203 PHILIPPINES SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 204 PHILIPPINES FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 PHILIPPINES SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 PHILIPPINES FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 208 PHILIPPINES WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 209 PHILIPPINES WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 PHILIPPINES BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 211 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 213 PHILIPPINES RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 214 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 216 PHILIPPINES COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 PHILIPPINES INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 218 PHILIPPINES INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 MYANMAR FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 MYANMAR HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 MYANMAR ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 223 MYANMAR DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 MYANMAR SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 MYANMAR LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 226 MYANMAR HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 227 MYANMAR SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 228 MYANMAR SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 MYANMAR BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 230 MYANMAR HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 231 MYANMAR SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 232 MYANMAR VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 MYANMAR HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 234 MYANMAR SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 235 MYANMAR FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 MYANMAR SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 MYANMAR FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 239 MYANMAR WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 MYANMAR WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 241 MYANMAR BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 242 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 244 MYANMAR RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 245 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 246 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 247 MYANMAR COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 MYANMAR INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 MYANMAR INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 CAMBODIA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 CAMBODIA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 CAMBODIA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 254 CAMBODIA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 CAMBODIA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 CAMBODIA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 257 CAMBODIA HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 258 CAMBODIA SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 259 CAMBODIA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 CAMBODIA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 261 CAMBODIA HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 262 CAMBODIA SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 263 CAMBODIA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 CAMBODIA HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 265 CAMBODIA SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 266 CAMBODIA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 CAMBODIA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 CAMBODIA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 270 CAMBODIA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 CAMBODIA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 272 CAMBODIA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 273 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 274 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 275 CAMBODIA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 278 CAMBODIA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 279 CAMBODIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 CAMBODIA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 LAOS FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 LAOS HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 LAOS ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 285 LAOS DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 286 LAOS SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 LAOS LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 288 LAOS HARDWARE LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 289 LAOS SERVICES LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 290 LAOS SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 LAOS BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 292 LAOS HARDWARE BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 293 LAOS SERVICES BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 294 LAOS VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 LAOS HARDWARE VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 296 LAOS SERVICES VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2021-2030 (USD THOUSAND)

TABLE 297 LAOS FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 LAOS SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 LAOS FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 301 LAOS WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 LAOS WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 303 LAOS BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 304 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 306 LAOS RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 308 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 309 LAOS COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 LAOS INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 LAOS INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 REST OF SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 2 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 8 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: CHALLENGE MATRIX

FIGURE 12 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY IS DRIVING THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 FACILITY MANAGEMENT SYSTEMS (FMS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET IN 2022 & 2030

FIGURE 15 BUILDING AUTOMATION SYSTEM - VALUE CHAIN ANALYSIS

FIGURE 16 AVERAGE SELLING PRICE ANALYSIS FOR BUILDING AUTOMATION SYSTEM

FIGURE 17 INCREASING PATENT ACTIVITY RELATED TO BUILDING AUTOMATION FROM 2012 TO 2020

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF THE SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET

FIGURE 19 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE, 2022

FIGURE 20 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY TECHNOLOGY, 2022

FIGURE 21 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY APPLICATION, 2022

FIGURE 22 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: SNAPSHOT (2022)

FIGURE 23 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2022)

FIGURE 24 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE (2023-2030)

FIGURE 27 SOUTH-EAST ASIA BUILDING AUTOMATION SYSTEM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.