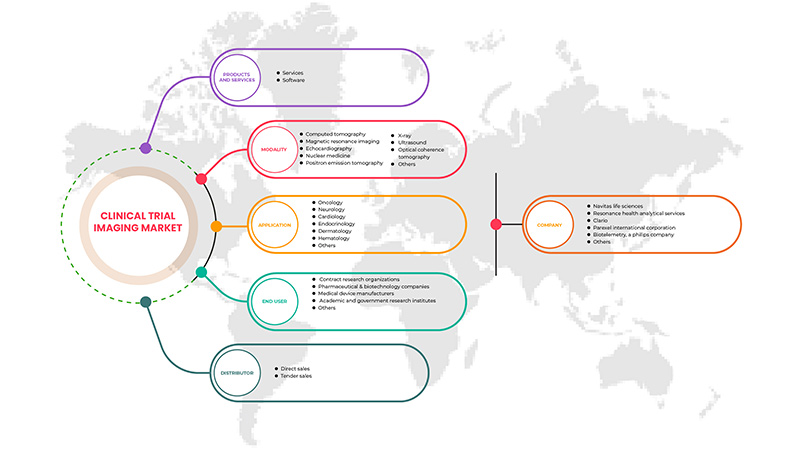

アジア太平洋臨床試験イメージング市場、製品およびサービス別(サービスおよびソフトウェア)、モダリティ別(コンピューター断層撮影、磁気共鳴画像、心エコー検査、核医学、陽電子放出断層撮影、X線、超音波、光干渉断層撮影など)、アプリケーション別(腫瘍学、神経学、内分泌学、心臓学、皮膚科、血液学など)、エンドユーザー別(製薬およびバイオテクノロジー企業、契約研究機関、医療機器メーカー、学術および政府研究機関など)、販売代理店別(直接販売および入札販売) - 2029年までの業界動向および予測。

アジア太平洋臨床試験イメージング市場の分析と洞察

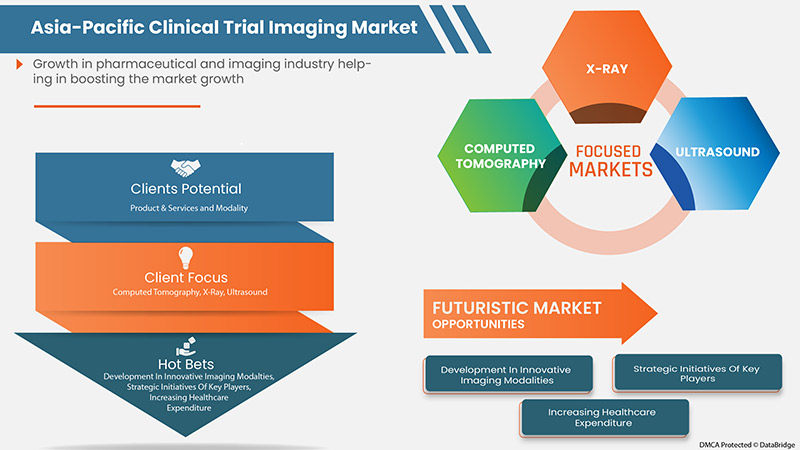

画像技術に対する需要の増加、それに続く高齢者人口の増加による慢性疾患の罹患率の増加、そして市場プレーヤーによる製品の発売、進歩、買収、契約などの戦略的取り組みが、市場の成長を牽引すると予想される要因です。

しかし、画像診断装置に対する不適切かつ不利な償還シナリオや、臨床試験用画像診断装置における明確な基準の欠如により、市場の成長は抑制されると予想されます。

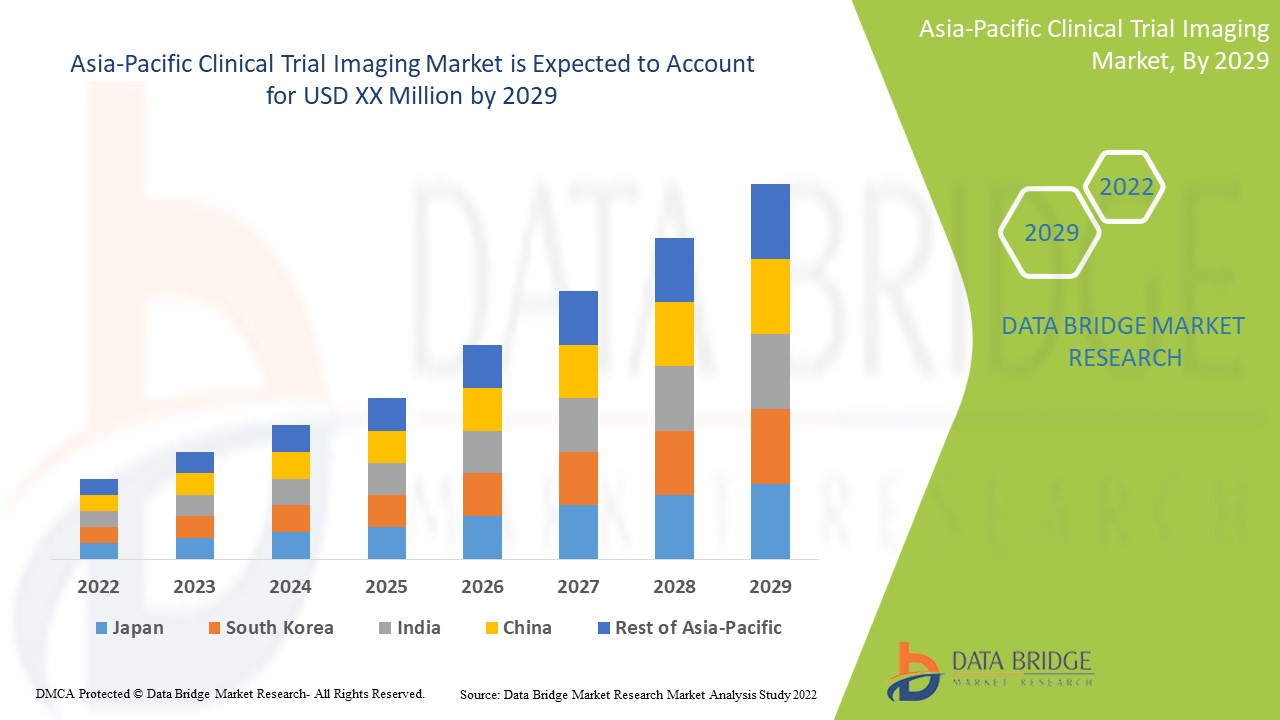

慢性疾患の診断と治療のための臨床試験イメージングにおける技術の進歩の高まりが、市場の成長を牽引すると予想されています。データブリッジマーケットリサーチは、アジア太平洋地域の臨床試験イメージング市場は、2022年から2029年の予測期間中に8.8%のCAGRで成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

収益は百万米ドル、価格は米ドル |

|

対象セグメント |

製品およびサービス別(サービスおよびソフトウェア)、モダリティ別(コンピューター断層撮影、磁気共鳴画像、心エコー、核医学、陽電子放出断層撮影、X線、超音波、光干渉断層撮影など)、アプリケーション別(腫瘍学、神経学、内分泌学、心臓学、皮膚科、血液学など)、エンドユーザー別(製薬およびバイオテクノロジー企業、受託研究機関、医療機器メーカー、学術および政府研究機関など)、販売代理店別(直接販売および入札販売) |

|

対象国 |

中国、日本、韓国、インド、オーストラリア、シンガポール、タイ、マレーシア、インドネシア、フィリピン、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

Navitas Life Sciences、Resonance Health Analytical Services、ICON plc、Image Core Lab、Radiant Sage LLC、WORLDCARE CLINICAL、Clario、Paraxel International Corporation、Median Technologies、Perspectum、Calyx、WIRB-Copernicus Group、Invicro.LLCなど |

市場の定義

臨床試験は、新薬を開発するプロセスです。潜在的な治療法と人間への効果を検証するために計画されます。新薬が商品化される前に、有望な化合物を特定するために広範な臨床試験が行われ、起こりうるリスクを判断するために安全性試験が行われます。

臨床試験では、より正確で効果的な結果を得るために、医療用画像診断が重要な役割を果たします。さまざまな画像診断技術を使用して、薬物の作用機序を解明し、実証することができます。臨床試験用画像診断とは、体の内部部分の画像表現を作成することによって臨床分析と医療介入を行うプロセスです。人体を観察して病状の監視、治療、診断を行うために使用されるさまざまな技術があります。

今後、新薬発見における臨床試験イメージングに関連する重要な決定は、生検を理解するだけでなく、臨床試験イメージングツールとそこから得られる知識を活用して仮説を立て、質の高いターゲットを特定できる人々によって行われるようになるでしょう。

アジア太平洋臨床試験イメージング市場の動向

ドライバー

- 研究開発費の増加

イメージングおよび製薬会社は、臨床試験イメージングの革新的なサービスを顧客に提供し、市場での存在感を高めるために、継続的に研究開発に投資しています。医療用イメージングは、臨床開発においてダイナミックな役割を果たしています。医療用イメージング業界は、市場への新技術の導入により常に変動していますが、製薬およびイメージング業界は成長を続けています。これは、医療用イメージング会社への投資の増加、合併および買収、医療機器の臨床試験をサポートするためのイメージング技術の革新の採用によるものです。製薬およびバイオテクノロジー会社の研究開発費の増加は、市場の成長を後押ししています。

これにより、バイオ医薬品業界で組織された新製品や高度な研究指向のプログラムの開発が促進され、ヒトゲノムの研究に対する高い選好が生まれています。研究開発活動への支出の増加により、慢性疾患を治療するための新薬や治療法も開発され、市場の成長が促進されます。これは、製薬会社やバイオテクノロジー会社が画像臨床試験の分野で新技術を開発するのに役立つため、研究開発費の増加が市場の成長を促進すると予想されます。

- 医薬品開発業務受託機関(CRO)の増加

Contract Research Organization (CRO) is an organization that gives support for clinical trials and other research services to imaging and pharmaceutical industries in the form of outsourced pharmaceutical research services in terms of both drugs and medical devices. CRO helps imaging and pharmaceutical industries with the drug development process to reduce the cost and initiate the process of bringing clinical trials to develop the drug for a particular disease segment by using clinical trial imaging and other processes to overcome capacity gaps of the in-house research team for pharmaceutical and clinical research.

A huge number of CROs are engaged in monitoring the drug development process such as PAREXEL (U.S.), PRA Health Sciences (U.S.), Labcorp (U.S.), PPD (U.S.), Syneos Health (U.S.), ICON plc (Ireland), Envigo (U.K.), Charles River (U.S.) and SGS (Switzerland) among others. These are some CROs that are engaged to give support for clinical trials and other research services to the imaging and pharmaceutical industries. The increasing number of CROs is expected to drive market growth.

Opportunities

- Rise in Healthcare Expenditure

Healthcare expenditure has increased across the world as people's disposable income in various countries is increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking the initiative by virtue of accelerating healthcare expenditure.

For instance,

- National Health Expenditure Accounts (NHEA) published a report which stated that the U.S. healthcare expenditure grew by 4.6% in 2019. This estimates USD 3.80 trillion for the overall U.S. population reported by U.S. Centers for Medicare (CMS) and GDP health, spending in the U.S. is accounted to reach 17.7%.

Growing healthcare expenditure is also beneficial for further growth in the economic and healthcare sector and it is primarily fruitful as it significantly affects the development of better and advanced medical products in the market. Therefore, the surge in healthcare expenditure is expected to create a greater opportunity for the market.

- Strategic Initiatives by Market Players

The demand for clinical trial imaging is increasing in the market owing to the increased levels of R&D along with the growth of clinical trial imaging market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new products and collaborating with other market players to improve business operations and profitability.

For instance,

- In February 2020, ICON plc acquired MedPass International, a European medical devices CRO, reimbursement and regulatory consultancy. This acquisition has reportedly helped in the expansion of the medical device and diagnostic research services of ICON in Europe.

These strategic initiatives by the market players, including acquisition, conferences and focused segment product launches, are helping them grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may act as an opportunity for market growth.

Restraints/Challenges

- High-Risk Radiation Causing Diseases

In clinical medical imaging, radiation is absorbed by the body which can harm molecular structures inside the patient’s body. High doses of radiation can affect human cells including loss of hair, skin burns and increased incidence of cancer. The estimated risk of developing fatal cancer is one in 2000 after going through a radiation dose of 10 mSv in a CT scan.

For instance,

- According to Radiological Society of America (RSNA), 1% to 2% of all cancers in the U.S. are caused by CT scans and the American Cancer Society identified CT scans and X-rays as one of the reasons for breast cancer, brain cancer and other cancers

- According to the Center for Disease Control and Prevention, exposure to high levels of radiation results in acute radiation syndrome. The amount of radiation that a person's body absorbs is called the radiation dose.

The high-risk radiation that occurs, would decrease the usage and sale of clinical trial imaging devices, thereby affecting the credibility of manufacturers involved in this market. Therefore, the high-risk radiation-causing diseases are expected to restrain the market growth.

- Strict Regulatory Policies

The healthcare industry is regulated by a structure of laws, rules & regulations that are extensive and complex.

For instance,

- In April 2018, the U.S. FDA released updated Guidance for Clinical Trial Imaging Endpoint Process Standards for the industry which includes the quality of imaging data obtained in clinical trials

- Biotechnology and pharmaceutical industries need to take first approval from the FDA for the process of drug development. They have to submit an Investigational New Drug (IND) application to the FDA before beginning clinical research.

COVID-19 Impact on the Asia-Pacific Clinical Trial Imaging Market

Diagnostic imaging services have been time-consuming and complicated by the need for strict infection control and prevention practices developed to contain the risk of transmission and protect healthcare personnel. Hence, the decision to image suspected patients or COVID-19-positive patients is based on their impact on the improvement of patient status. There have definitely been reduced volumes in outpatient medical imaging clinics due to social distancing regulations and lockdowns in Asia-Pacific region. This reduced the available appointments which led to longer waiting lists for exams such as ultrasound and interventional procedures.

Recent Developments

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and Positron Emission Tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

- In November 2021, Clario was formed. ERT and Bioclinica, merged to form Clario. The formation of a new company resulted in the distribution of clinical imaging software and services and rise in sales.

Asia-Pacific Clinical Trial Imaging Market Scope

Asia-Pacific clinical trial imaging market is segmented into five segments based on product and services, modality, application, end user and distributor. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product and Services

- Services

- Software

Based on product and services, the market is segmented into services and software.

Modality

- Computed Tomography

- Magnetic Resonance Imaging

- Echocardiography

- Nuclear Medicine

- Positron Emission Tomography

- X-ray

- Ultrasound

- Optical Coherence Tomography

- Others

Based on modality, the market is segmented into computed tomography, magnetic resonance imaging, echocardiography, nuclear medicine, positron emission tomography, X-ray, ultrasound, optical coherence tomography and others.

Application

- Oncology

- Neurology

- Cardiology

- Endocrinology

- Dermatology

- Hematology

- Others

Based on application, the market is segmented into oncology, neurology, cardiology, endocrinology, dermatology, hematology and others.

End user

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Academic and Government Research Institutes

- Others

Based on end user, the market is segmented into contract research organizations, pharmaceutical & biotechnology companies, medical device manufacturers, academic and government research institutes and others.

Distributor

- Direct Sales

- Tender Sales

Based on distributor, the market is segmented into direct sales and tender sales.

Asia-Pacific Clinical Trial Imaging Market Regional Analysis/Insights

Asia-Pacific clinical trial imaging market is analyzed and market size insights and trends are provided by regions, product and services, modality, application, end user and distributor as referenced above.

この市場レポートで取り上げられている国は、中国、日本、韓国、インド、オーストラリア、シンガポール、タイ、マレーシア、インドネシア、フィリピン、その他のアジア太平洋諸国です。臨床画像処理は安全で使いやすいため、中国が市場を独占すると予想されています。中国政府が中国国内の診断画像処理分野の国内ベンダーの設立と確立に果たす重要な役割は、市場の成長を牽引すると予想される主な要因の 1 つです。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、および販売チャネルに影響を与える地元および国内ブランドとの競争が激しいか少ないために直面する課題も考慮されます。

競争環境とアジア太平洋臨床試験イメージング市場シェア分析

アジア太平洋臨床試験イメージング市場の競争状況は、競合他社の詳細を提供します。会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などの詳細が含まれます。上記のデータ ポイントは、アジア太平洋臨床試験イメージング市場に関連する会社の重点にのみ関連しています。

この市場で活動している主要企業としては、Navitas Life Sciences、Resonance Health Analytical Services、ICON plc、Image Core Lab、Radiant Sage LLC、WORLDCARE CLINICAL、Clario、Paraxel International Corporation、Median Technologies、Perspectum、Calyx、WIRB-Copernicus Group、Invicro.LLC などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS AND SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING R&D EXPENDITURE

6.1.2 INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATIONS (CROS)

6.1.3 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.4 GROWTH IN THE PHARMACEUTICAL AND IMAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 HIGH-RISK RADIATION CAUSING DISEASES

6.2.2 HIGH IMPLEMENTATION COST OF IMAGING SYSTEMS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 DEVELOPMENT OF INNOVATIVE IMAGING MODALITIES AND CONTRAST AGENTS

6.4 CHALLENGES

6.4.1 STRICT REGULATORY POLICIES

6.4.2 COST OF CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES

7.1 OVERVIEW

7.2 SERVICES

7.2.1 OPERATIONAL IMAGING SERVICES

7.2.2 READ ANALYSIS SERVICES

7.2.3 TRIAL DESIGN CONSULTING SERVICES

7.2.4 SYSTEM AND TECHNICAL SUPPORT SERVICES

7.3 SOFTWARE

8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY

8.1 OVERVIEW

8.2 COMPUTED TOMOGRAPHY

8.3 MAGENTIC RESONANCE IMAGING

8.4 ECHOCARDIOGRAPHY

8.5 NUCLEAR MEDICINE

8.6 POSITRON EMISSION TOMOGRAPHY

8.7 X-RAY

8.8 ULTRASOUND

8.9 OPTICAL COHERENCE TOMOGRAPHY

8.1 OTHERS

9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 X-RAY

9.2.2 ULTRASOUND

9.2.3 COMPUTED TOMOGRAPHY

9.2.4 MAGNETIC RESONANCE IMAGING

9.2.5 NUCLEAR MEDICINE

9.2.6 POSITRON EMISSION TOMOGRAPHY

9.2.7 OPTICAL COHERENCE TOMOGRAPHY

9.2.8 ECHOCARDIOGRAPHY

9.2.9 OTHERS

9.3 NEUROLOGY

9.3.1 COMPUTED TOMOGRAPHY

9.3.2 MAGNETIC RESONANCE IMAGING

9.3.3 POSITRON EMISSION TOMOGRAPHY

9.3.4 NUCLEAR MEDICINE

9.3.5 X-RAY

9.3.6 ULTRASOUND

9.3.7 OPTICAL COHERENCE TOMOGRAPHY

9.3.8 ECHOCARDIOGRAPHY

9.3.9 OTHERS

9.4 CARDIOLOGY

9.4.1 ECHOCARDIOGRAPHY

9.4.2 MAGNETIC RESONANCE IMAGING

9.4.3 COMPUTED TOMOGRAPHY

9.4.4 POSITRON EMISSION TOMOGRAPHY

9.4.5 NUCLEAR MEDICINE

9.4.6 X-RAY

9.4.7 ULTRASOUND

9.4.8 OPTICAL COHERENCE TOMOGRAPHY

9.4.9 OTHERS

9.5 ENDOCRINOLOGY

9.5.1 COMPUTED TOMOGRAPHY

9.5.2 MAGNETIC RESONANCE IMAGING

9.5.3 ECHOCARDIOGRAPHY

9.5.4 POSITRON EMISSION TOMOGRAPHY

9.5.5 NUCLEAR MEDICINE

9.5.6 X-RAY

9.5.7 ULTRASOUND

9.5.8 OPTICAL COHERENCE TOMOGRAPHY

9.5.9 OTHERS

9.6 DERMATOLOGY

9.6.1 ULTRASOUND

9.6.2 X-RAY

9.6.3 MAGNETIC RESONANCE IMAGING

9.6.4 COMPUTED TOMOGRAPHY

9.6.5 OPTICAL COHERENCE TOMOGRAPHY

9.6.6 POSITRON EMISSION TOMOGRAPHY

9.6.7 NUCLEAR MEDICINE

9.6.8 ECHOCARDIOGRAPHY

9.6.9 OTHERS

9.7 HEMATOLOGY

9.7.1 ULTRASOUND

9.7.2 COMPUTED TOMOGRAPHY

9.7.3 MAGNETIC RESONANCE IMAGING

9.7.4 X-RAY

9.7.5 POSITRON EMISSION TOMOGRAPHY

9.7.6 NUCLEAR MEDICINE

9.7.7 OPTICAL COHERENCE TOMOGRAPHY

9.7.8 ECHOCARDIOGRAPHY

9.7.9 OTHERS

9.8 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATION

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.4 MEDICAL DEVICE MANUFACTURERS

10.5 ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES

10.6 OTHERS

11 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 TENDER SALES

12 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 NAVITAS LIFE SCIENCES

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 RESONANCE HEALTH ANALYTICAL SERVICES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CLARIO

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARAXEL

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BIOTELEMETRY, A PHILIPS COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ICON PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 MEDIAN TECHNOLOGIES

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PERSPECTUM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ANAGRAM 4 CLINICAL TRIALS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CALYX

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 IMAGE CORE LAB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 INVICRO. LLC. (A SUBSIDIARY OF KONICA MINOLTA)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 IXICO PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 QUOTIENT SCIENCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 RADIANT SAGE LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 WIRB-COPERNICUS GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WORLDCARE CLINICAL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 COST OF CLINICAL TRIAL PHASE 2 AND PHASE 3

TABLE 2 HUGE R&D COST IN THE U.S. FOR DIFFERENT PHASES

TABLE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SOFTWARE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC COMPUTED TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MAGNETIC RESONANCE IMAGING IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ECHOCARDIOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC NUCLEAR MEDICINE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC POSITRON EMISSION TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC X-RAY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ULTRASOUND IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OPTICAL COHERENCE TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATION IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MEDICAL DEVICE MANUFACTURERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC DIRECT SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC TENDER SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC NEUROLOGY CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION,2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 53 CHINA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CHINA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CHINA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 56 CHINA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CHINA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CHINA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CHINA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CHINA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 65 JAPAN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 JAPAN SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 JAPAN CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 JAPAN ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 JAPAN NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 JAPAN ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 JAPAN DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 JAPAN HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 JAPAN CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 89 INDIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 90 INDIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 91 INDIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 92 INDIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 INDIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 INDIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 INDIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 INDIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 125 THAILAND CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 THAILAND SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 127 THAILAND CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 THAILAND CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 THAILAND ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 THAILAND NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 THAILAND ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 THAILAND DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 THAILAND HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 138 MALAYSIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 139 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 140 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 149 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 150 INDONESIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 173 REST OF ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 11 THE INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATION AND RISING R&D EXPENDITURE ARE EXPECTED TO DRIVE THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

FIGURE 14 WORLDWIDE BIOPHARMA COMPANIES R&D EXPENDITURE (IN USD MILLION)

FIGURE 15 THE MARKET GROWTH IN CLINICAL CRO (IN USD MILLIONS)

FIGURE 16 THE FUNCTION OF CRO

FIGURE 17 ESTIMATED NEW CANCER CASES, 2022

FIGURE 18 VALUE OF THE PHARMACEUTICAL SECTOR, WORLDWIDE, 2021 BY COUNTRY (IN MILLION U.S. DOLLARS)

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2021

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2021

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2021

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2021

FIGURE 36 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 44 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。