Global Battery Separator Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

6.01 Billion

USD

16.99 Billion

2024

2032

USD

6.01 Billion

USD

16.99 Billion

2024

2032

| 2025 –2032 | |

| USD 6.01 Billion | |

| USD 16.99 Billion | |

|

|

|

|

Global Battery Separator Market Segmentation, By Battery Type (Li-Ion, Lead Acid, and Others), Material Type (Polypropylene, Polyethylene, and Others), End User (Automotive, Industrial, Consumer Electronics, and Others) - Industry Trends and Forecast to 2032

What is the Global Battery Separator Market Size and Growth Rate?

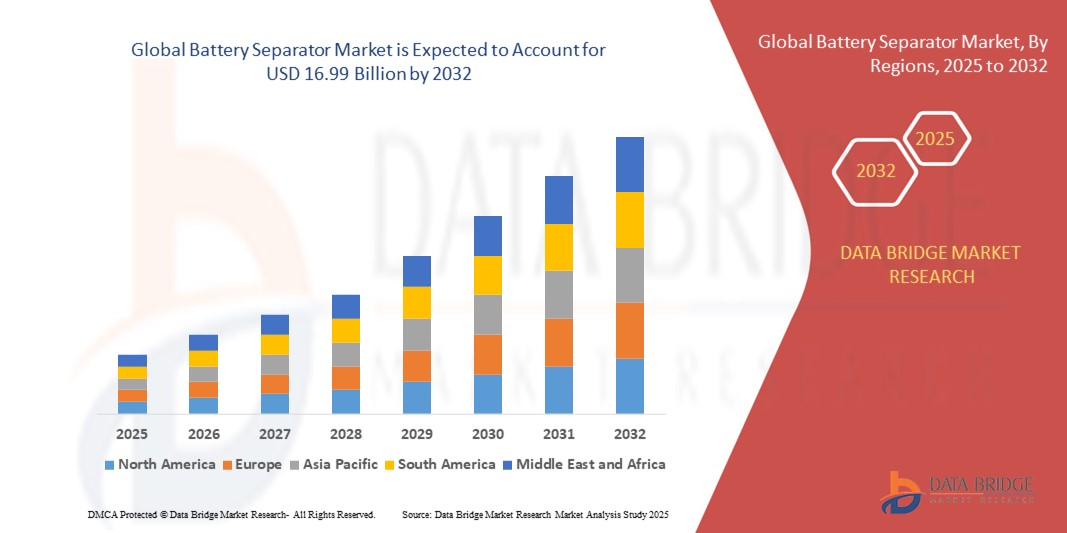

- The global battery separator market size was valued at USD 6.01 billion in 2024 and is expected to reach USD 16.99 billion by 2032, at a CAGR of 13.87% during the forecast period

- Consumer electronic gadgets have largely gained popularity, and as a result, they are highly demand across the globe. The consumer electronics sector is, however, the primary consumer of lithium-ion batteries. Moreover, electric vehicles (EVs) sales have increased and they are also becoming the largest consumers of lithium-ion batteries in recent years

- Consequently, the surge in demand for consumer electronics as well as electric vehicles (EVs) will further boost the global battery separator market which drives the market in the forecast period of 2025 to 2032. Also, Advances in consumer electronic gadgets is significantly contributing to the market’s growth

What are the Major Takeaways of Battery Separator Market?

- The growing adoption of wet separators and micro grids in the automotive industry is expected to drive the battery separators market share. The increasing use of electronic vehicles will increase demand for lithium-ion batteries, which will drive the use of battery separators. In line with this, the increasing demand for EVs is acting as a key determinant favoring the growth of the battery separator market over forecast period of 2025 to 2032

- Moreover, the rapid increase in demand for highly efficient batteries in various end-use industries is positively impacting the growth of the global battery separator market

- Asia-Pacific dominated the battery separator market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, the expansion of the electric vehicle (EV) market, and increasing adoption of energy storage systems (ESS)

- Europe Battery Separator market is projected to grow at the fastest CAGR of 12.30% during the forecast period, driven by stringent environmental regulations, EV adoption incentives, and increasing demand for renewable energy storage

- The Li-Ion segment dominated the market with a revenue share of 52.4% in 2024, driven by the rapid adoption of electric vehicles (EVs), energy storage systems (ESS), and portable electronics

Report Scope and Battery Separator Market Segmentation

|

Attributes |

Battery Separator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Battery Separator Market?

Enhanced Performance Through Advanced Materials and Safety Features

- A notable trend in the global battery separator market is the increasing adoption of advanced materials such as ceramic-coated separators, high-performance polyethylene (PE), and polypropylene (PP) membranes. These innovations are enhancing battery safety, thermal stability, and electrochemical performance, which are crucial for lithium-ion and next-generation battery systems

- For instance, Entek’s ceramic-coated separators are being widely adopted in EV and energy storage systems, offering improved shutdown functionality and reduced risk of thermal runaway. Similarly, Toray and Asahi Kasei are introducing next-generation PE/PP separators with higher porosity and mechanical strength, supporting longer battery life and faster charging

- The trend is further driven by the integration of separators with high-voltage battery systems, enabling batteries to achieve higher energy densities while maintaining safety standards. Companies such as SK Innovation and Freudenberg SE are developing separators with multifunctional coatings that enhance ionic conductivity and thermal resistance

- Moreover, the adoption of thin, lightweight separators is enabling manufacturers to improve cell efficiency and reduce battery weight, a key requirement for EV and portable electronics applications

- This focus on material innovation and multifunctional performance is reshaping the industry’s expectations, with demand accelerating for safer, longer-lasting, and higher-performance battery systems

What are the Key Drivers of Battery Separator Market?

- The growing demand for electric vehicles (EVs) and energy storage systems (ESS) is a major driver, as battery performance and safety rely heavily on high-quality separators. Increasing adoption of lithium-ion and solid-state batteries is fueling market growth

- For instance, in April 2024, Entek International announced capacity expansion for high-performance battery separators to meet rising EV and ESS demand, expected to drive revenue growth in the market

- Battery separators enhance battery safety by preventing short circuits, managing thermal stability, and improving ionic conductivity, making them essential in modern battery systems

- The rapid growth of portable electronics, including smartphones, laptops, and wearable devices, is boosting demand for advanced separators with high energy efficiency and longer lifecycle performance

- In addition, the trend toward EV battery recycling and sustainable manufacturing practices is encouraging companies to adopt separators that are recyclable and environmentally friendly, further promoting market expansion

Which Factor is Challenging the Growth of the Battery Separator Market?

- High production costs and technological complexity of advanced separators remain key challenges, particularly for ceramic-coated or multifunctional membranes. Manufacturers face pressure to balance performance improvements with cost efficiency

- The availability of low-cost alternatives in developing regions can limit market penetration for high-performance separators, as price-sensitive battery producers may opt for cheaper options

- In addition, stringent regulatory requirements for battery safety, particularly in automotive applications, demand rigorous testing and compliance, which can delay product commercialization

- Material supply constraints, especially for high-purity polymers or ceramic powders, may also impact production timelines and scalability for separator manufacturers

- Addressing these challenges through material innovation, process optimization, and strategic partnerships will be critical for sustained market growth and wider adoption of high-performance battery separators globally

How is the Battery Separator Market Segmented?

The market is segmented on the basis of battery type, material type, and end-user.

- By Battery Type

On the basis of battery type, the battery separator market is segmented into Li-Ion, Lead Acid, and Others. The Li-Ion segment dominated the market with a revenue share of 52.4% in 2024, driven by the rapid adoption of electric vehicles (EVs), energy storage systems (ESS), and portable electronics. Li-Ion batteries demand high-performance separators that provide thermal stability, mechanical strength, and high ionic conductivity, making them critical for safety and efficiency. Innovations such as ceramic-coated and ultra-thin separators further enhance the performance and lifespan of Li-Ion batteries, fueling demand in automotive and industrial applications.

The Lead Acid segment is anticipated to witness the fastest growth at a CAGR of 18.6% from 2025 to 2032, as advancements in lead-acid technology, cost-effectiveness, and growing industrial and backup power applications drive adoption across emerging markets. The market sees strong expansion potential as industries balance performance requirements with affordability.

- By Material Type

On the basis of material type, the battery separator market is segmented into Polypropylene (PP), Polyethylene (PE), and Others. The Polypropylene segment dominated the market with a revenue share of 46.8% in 2024, owing to its excellent chemical stability, high melting point, and wide usage in Li-Ion and lead-acid batteries. PP separators are widely preferred for automotive and industrial applications due to their mechanical strength, porosity, and thermal shutdown properties, ensuring battery safety and longevity.

The Polyethylene segment is expected to register the fastest CAGR of 19.2% from 2025 to 2032, driven by its high ionic conductivity, flexibility in thin-film formats, and growing incorporation in advanced lithium-ion and solid-state batteries. The trend toward multifunctional coatings and composite separators is further boosting the demand for PE-based materials, particularly in EV and energy storage applications.

- By End User

On the basis of end user, the battery separator market is segmented into Automotive, Industrial, Consumer Electronics, and Others. The Automotive segment dominated the market with a revenue share of 55.1% in 2024, fueled by the accelerated adoption of electric vehicles and hybrid cars globally. Battery separators in automotive applications require high-performance materials with superior thermal and mechanical properties to ensure battery safety, durability, and extended cycle life.

The Consumer Electronics segment is anticipated to witness the fastest growth at a CAGR of 21.3% from 2025 to 2032, driven by the proliferation of smartphones, laptops, wearable devices, and portable power banks, all of which require lightweight, thin, and efficient separators for high energy density batteries. Industrial applications, such as backup power systems and energy storage, also contribute to growing demand, making the battery separator an indispensable component across multiple sectors.

Which Region Holds the Largest Share of the Battery Separator Market?

- Asia-Pacific dominated the battery separator market with the largest revenue share of 42.7% in 2024, driven by rapid industrialization, the expansion of the electric vehicle (EV) market, and increasing adoption of energy storage systems (ESS)

- Consumers and industries in the region highly value high-performance separators that enhance battery safety, energy efficiency, and longevity, especially in Li-Ion and lead-acid battery applications

- This widespread adoption is further supported by government incentives for EVs and renewable energy storage, growing technological expertise, and the presence of strong domestic manufacturers, establishing Asia-Pacific as the primary hub for Battery Separator production and consumption

China Battery Separator Market Insight

The China battery separator market captured the largest revenue share of 55% in 2024 within Asia-Pacific, driven by the country’s expanding EV market, rapid urbanization, and increasing demand for energy storage solutions. Rising government initiatives supporting renewable energy and smart manufacturing further accelerate adoption. High rates of technological adoption and affordable, locally manufactured battery separators make China a central market for both residential and industrial applications.

Japan Battery Separator Market Insight

The Japan battery separator market is witnessing substantial growth due to the country’s advanced automotive and consumer electronics sectors, alongside a strong focus on energy efficiency. Adoption is propelled by smart mobility trends, industrial automation, and high-tech consumer devices. Japan’s aging population also drives demand for safer, easy-to-use battery solutions in both residential and commercial sectors.

Europe Battery Separator Market Insight

Europe battery separator market is projected to grow at the fastest CAGR of 12.30% during the forecast period, driven by stringent environmental regulations, EV adoption incentives, and increasing demand for renewable energy storage. Industrial and automotive sectors are fueling the demand for high-performance separators, while government initiatives encourage innovation and sustainable manufacturing practices. The region is also witnessing growth in residential energy storage solutions, particularly in Germany, France, and the U.K.

Germany Battery Separator Market Insight

The Germany battery separator market is expanding steadily due to the country’s robust automotive industry, industrial base, and sustainability-focused policies. Germany emphasizes advanced, eco-friendly separator technologies that enhance battery efficiency and safety. The integration of battery separators in EVs, industrial systems, and energy storage applications is becoming increasingly prevalent, supporting the region’s strong adoption trajectory.

U.K. Battery Separator Market Insight

The U.K. battery separator market is expected to grow significantly due to increasing EV penetration, renewable energy storage projects, and government-backed sustainability initiatives. The adoption of high-performance separators in automotive and industrial applications is further driving the market, with residential energy storage systems contributing to overall growth.

Which are the Top Companies in Battery Separator Market?

The battery separator industry is primarily led by well-established companies, including:

- Toray Industries Inc. (Japan)

- Asahi Kasei Corporation (Japan)

- SK Innovation Co. Ltd. (South Korea)

- Freudenberg SE (Germany)

- ENTEK International LLC (U.S.)

- Hollingsworth & Vose (U.S.)

- AMER-SIL S.A. (Luxembourg)

- B&F Technology (U.S.)

- W-Scope Corporation (Japan)

- Ube Corporation (Japan)

- Sumitomo Chemical Co. Ltd. (Japan)

- Dreamweaver International (U.S.)

- Bernard Dumas (France)

- Electrovaya (Canada)

- DuPont (U.S.)

- Eaton (Ireland)

- Targray (Canada)

- TEIJIN LIMITED (Japan)

What are the Recent Developments in Global Battery Separator Market?

- In April 2024, Nissan unveiled its in-construction all-solid-state battery pilot line at the Yokohama Plant in Kanagawa Prefecture, aiming to advance innovation and development in battery manufacturing technologies, marking a significant step toward next-generation battery solutions

- In April 2024, Bounce Infinity launched its portable liquid-cooled battery technology for e-scooters in collaboration with Clean Electric, an energy storage solution startup, designed to enhance usability and performance, strengthening the company’s presence in the electric mobility sector

- In April 2024, Lectrix EV, an electric mobility division of the SAR Group, introduced the revolutionary E2W at a price of INR 49,999, becoming the first OEM in India to offer a service where the battery can be separated from the vehicle, increasing convenience and customer accessibility

- In January 2022, Entek Manufacturing acquired Adaptive Engineering & Fabrication, a manufacturer of material handling equipment, enabling the rebranded entity, Entek Adaptive, to offer an expanded product line for all material handling businesses with the support of Entek’s project management and engineering teams, strengthening its market position

- In March 2021, Asahi Kasei announced plans to expand the production capacity of its Hipore Li-ion battery separators at the Miyazaki plant in Japan, leveraging its wet-process facilities in Japan and dry-process plants in the U.S., to reinforce its leadership in the LIB separator market and meet growing global demand

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。