Global Bipolar Disorder Treatment Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

5.47 Billion

USD

6.72 Billion

2024

2032

USD

5.47 Billion

USD

6.72 Billion

2024

2032

| 2025 –2032 | |

| USD 5.47 Billion | |

| USD 6.72 Billion | |

|

|

|

|

Global Bipolar Disorder Treatment Market Segmentation, By Bipolar Disorders Type (Bipolar I and Bipolar II), Drug Class (Anticonvulsants, Antianxiety, Mood Stabilizers, Antipsychotic, Antidepressant and Others), Mechanism of Action (Selective Serotonin Reuptake Inhibitor, Serotonin Norepinephrine Reuptake Inhibitors, Tricyclic Antidepressants, Monoamine Oxidase Inhibitors, Benzodiazepines and Beta Blockers), Route of Administration (Oral, Parenteral and Others), End User (Hospitals, Homecare, Specialty Clinics, and Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy and Retail Pharmacy)- Industry Trends and Forecast to 2032

Bipolar Disorder Treatment Market Size

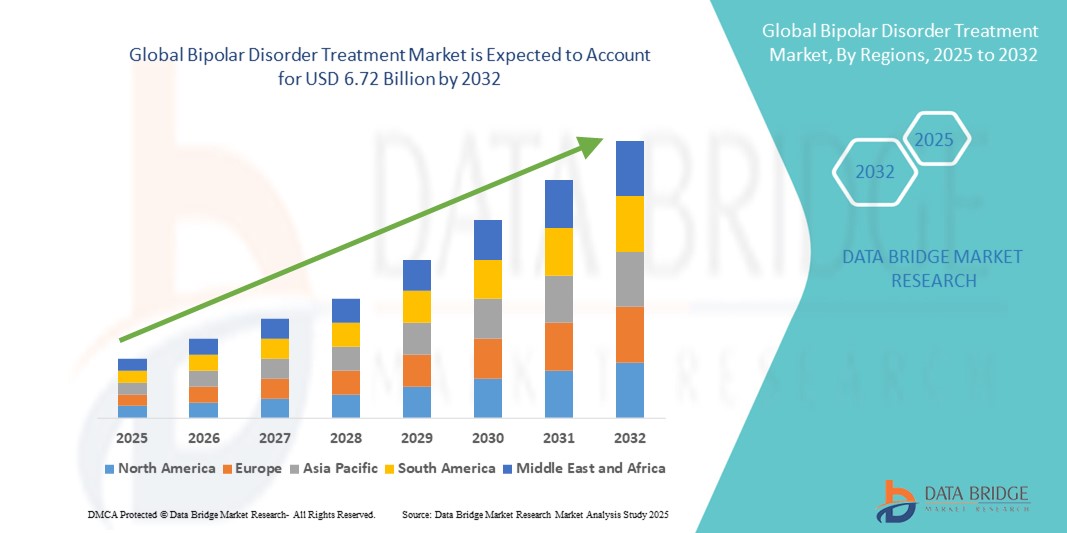

- The global bipolar disorder treatment market size was valued at USD 5.47 billion in 2024 and is expected to reach USD 6.72 billion by 2032, at a CAGR of 2.60% during the forecast period

- The market growth is primarily driven by the rising prevalence of bipolar disorder, increased awareness of mental health conditions, and greater access to psychiatric care across developed and emerging economies

- Furthermore, the growing adoption of advanced pharmacological therapies, such as atypical antipsychotics and mood stabilizers, along with expanding investments in innovative treatment approaches, is supporting market expansion. These converging factors are propelling demand for effective and patient-centric treatment solutions, thereby significantly enhancing the growth of the bipolar disorder treatment industry

Bipolar Disorder Treatment Market Analysis

- Bipolar disorder treatment, encompassing pharmacological therapies, psychotherapy, and emerging digital interventions, is a critical area of mental healthcare aimed at stabilizing mood swings, preventing relapses, and improving patient quality of life across diverse clinical settings

- The rising demand for effective treatment is primarily driven by the growing prevalence of mental health disorders, increasing awareness campaigns, improved diagnosis rates, and a shift toward long-term management of chronic psychiatric conditions

- North America dominated the bipolar disorder treatment market with the largest revenue share of 41.8% in 2024, attributed to high mental health awareness, strong healthcare infrastructure, favorable reimbursement policies, and the presence of leading pharmaceutical companies actively investing in novel therapies

- Asia-Pacific is expected to be the fastest growing region in the bipolar disorder treatment market during the forecast period, fueled by increasing healthcare expenditure, expanding access to psychiatric care, and rising government and NGO-led mental health initiatives

- The antipsychotics segment dominated the bipolar disorder treatment market with a market share of 45.1% in 2024, driven by their efficacy in managing acute mania, reducing relapse rates, and being widely prescribed as first-line therapy in both developed and developing markets

Report Scope and Bipolar Disorder Treatment Market Segmentation

|

Attributes |

Bipolar Disorder Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bipolar Disorder Treatment Market Trends

Shift Towards Personalized and Digital Mental Health Solutions

- A significant and accelerating trend in the global bipolar disorder treatment market is the growing focus on personalized treatment approaches supported by digital mental health platforms and telepsychiatry. This shift is improving access, adherence, and patient outcomes

- For instance, digital platforms such as Talkspace and BetterHelp provide virtual psychiatric consultations, allowing patients with bipolar disorder to receive timely medication management and therapy. Similarly, companies are developing AI-enabled apps that monitor mood fluctuations and provide early relapse alerts

- Advances in precision psychiatry and biomarker research are enabling more targeted therapies, tailoring medication and psychotherapy combinations to individual patient profiles, thereby improving treatment effectiveness and reducing side effects

- The integration of wearable devices and smartphone apps allows continuous monitoring of sleep, mood, and activity, which helps psychiatrists make data-driven adjustments to treatment plans

- This trend toward digital, personalized, and connected care is fundamentally reshaping expectations for mental healthcare delivery, pushing pharmaceutical companies and digital health startups to collaborate on hybrid treatment models

- The demand for integrated pharmacological and digital solutions is rapidly growing across both developed and emerging markets, as patients and providers increasingly value accessibility, continuity of care, and real-time monitoring capabilities

Bipolar Disorder Treatment Market Dynamics

Driver

Rising Prevalence and Expanding Awareness of Mental Health Disorders

- The increasing global prevalence of bipolar disorder, coupled with rising public awareness and early diagnosis initiatives, is a key driver of demand for effective treatments

- For instance, in 2024, the WHO highlighted bipolar disorder among the top 20 causes of disability worldwide, underscoring the urgent need for scalable treatment solutions. Such recognition by international bodies is fueling investments in novel therapies and healthcare infrastructure

- The shift toward destigmatizing mental illness and the inclusion of psychiatric services in national healthcare schemes are expanding patient access to treatment

- Furthermore, pharmaceutical advancements, such as the development of next-generation antipsychotics with fewer side effects, are driving adoption

- The integration of therapy with supportive care, lifestyle management, and digital monitoring tools makes treatment more comprehensive, boosting patient compliance and outcomes across various healthcare settings

Restraint/Challenge

Side Effects, Relapse Risks, and Regulatory Barriers

- A major challenge for the bipolar disorder treatment market is the persistence of drug-related side effects, risks of relapse, and strict regulatory requirements for psychiatric drugs

- For instance, commonly prescribed medications such as lithium and certain antipsychotics can cause weight gain, thyroid dysfunction, or cardiovascular issues, which discourage long-term adherence

- Relapse rates remain high due to inconsistent medication use and limited access to continuous therapy, posing a hurdle to effective disease management

- Regulatory hurdles for approving novel psychiatric drugs, coupled with lengthy clinical trial timelines, slow down the availability of innovative therapies

- In addition, the cost of long-term treatment can be prohibitive for patients in low- and middle-income countries, limiting market penetration. While generic drugs improve affordability, access to advanced therapies and digital support remains uneven globally

- Overcoming these barriers through drug innovation, stronger patient education, telemedicine adoption, and policy-level interventions will be critical for sustained market growth

Bipolar Disorder Treatment Market Scope

The market is segmented on the basis of bipolar disorder type, drug class, mechanism of action, route of administration, end user, and distribution channel.

- By Bipolar Disorder Type

On the basis of type, the bipolar disorder treatment is segmented into Bipolar I and Bipolar II. The Bipolar I segment dominated the market in 2024, supported by higher rates of acute manic episodes that require pharmacotherapy, emergency care, and frequent hospitalization. Payer attention and clinical guidelines often prioritize stabilization of mania, sustaining demand for antipsychotics and mood stabilizers commonly used in Bipolar I. Greater diagnostic visibility and established care pathways in tertiary centers further reinforce utilization. Pharma pipelines also skew toward agents with anti-manic efficacy, sustaining commercial focus on Bipolar I. Inpatient and intensive outpatient programs add meaningful revenue streams linked to this subtype.

The Bipolar II segment is anticipated to witness the fastest growth from 2025 to 2032, driven by improved screening for hypomania and depressive predominance in primary care and telepsychiatry. Rising awareness among clinicians of mixed features and soft bipolar spectrum broadens case identification. Patient preference for continuous, outpatient management aligns with digital monitoring and psychotherapy adjuncts commonly used in Bipolar II. As stigma declines, earlier help-seeking improves treatment initiation and adherence. Guidelines increasingly emphasize longitudinal mood stabilization beyond acute mania, expanding eligible populations.

- By Drug Class

On the basis of drug class, the bipolar disorder treatment is segmented into anticonvulsants, antianxiety, mood stabilizers, antipsychotic, antidepressant, and others. The antipsychotic segment dominated the market with market share of 45.1% in 2024, reflecting their first-line role for acute mania and maintenance, broad label coverage, and clinician familiarity. Second-generation antipsychotics offer rapid symptom control and are widely available in both oral and long-acting injectable forms. Favorable formulary positioning and extensive real-world evidence support continued use. Combination therapy with mood stabilizers enhances persistence in complex cases, bolstering volumes.

The mood stabilizers segment is expected to witness the fastest growth, propelled by optimization of classic agents (e.g., lithium, valproate) and newer options used for long-term relapse prevention. Renewed clinical emphasis on suicide risk reduction and neuroprotective potential of lithium lifts guideline prominence. Therapeutic drug monitoring advances and digital adherence tools improve tolerability and persistence. In emerging markets, cost-effective generics expand access in public systems. Combination strategies pairing mood stabilizers with SGAs broaden patient coverage.

- By Mechanism of Action

On the basis of mechanism, the bipolar disorder treatment is segmented into Selective Serotonin Reuptake Inhibitors (SSRIs), Serotonin Norepinephrine Reuptake Inhibitors (SNRIs), Tricyclic Antidepressants, Monoamine Oxidase Inhibitors, Benzodiazepines, and Beta Blockers. The SSRIs segment held the largest share in 2024, underpinned by extensive use in bipolar depression with mood-stabilizer co-therapy, broad prescriber familiarity, and favorable reimbursement. Their comparatively benign safety profile versus TCAs/MAOIs and abundant generic availability drive adoption. Primary care physicians are comfortable initiating SSRIs under psychiatric guidance, expanding the prescriber base. Ongoing post-marketing data and guideline references sustain confidence. Their role in comorbid anxiety and obsessive-compulsive symptoms further elevates utilization.

The SNRIs segment is projected to grow the fastest, supported by efficacy in treatment-resistant depressive phases and functional outcomes such as energy and cognition. As measurement-based care diffuses, clinicians tailor regimens toward symptom domains where SNRIs may confer benefit. Better education on co-prescription with mood stabilizers mitigates switch risk, encouraging use. Expanding generic penetration enhances affordability in price-sensitive markets. Real-world data registries increasingly capture favorable outcomes in selected patients, guiding nuanced adoption. This evidence-led, patient-segmented approach fuels accelerated uptake of SNRIs.

- By Route of Administration

On the basis of route, the bipolar disorder treatment is segmented into oral, parenteral, and others. The oral segment dominated the market in 2024, reflecting the prevalence of tablets/capsules for maintenance therapy and step-down care from acute settings. Oral dosing supports flexible titration, broad generic availability, and high patient acceptance. Pharmacies and telehealth models readily dispense or deliver oral regimens, raising adherence. Health systems prefer oral options for cost containment and scalability. Extensive guideline backing and clinician habit further entrench oral therapies. Consequently, oral routes account for the majority of chronic bipolar management.

The parenteral segment (notably long-acting injectables) is anticipated to be the fastest growing, driven by adherence advantages and reduced relapse/hospitalization risk. LAI antipsychotics enable steady plasma levels and fewer clinic visits, aligning with value-based care goals. Payers increasingly recognize downstream savings from fewer acute episodes, improving coverage. Integrated community mental health programs can administer LAIs efficiently, widening access. New product launches and expanded indications boost clinician confidence. As adherence remains a core unmet need, LAIs see accelerating adoption.

- By End User

On the basis of end user, the bipolar disorder treatment is segmented into hospitals, homecare, specialty clinics, and others. Hospitals dominated the market in 2024 due to the concentration of acute mania treatment, emergency admissions, and initiation of complex regimens. Multidisciplinary teams and diagnostic resources enable rapid stabilization and comorbidity management. Hospitals also anchor clinical trials and guideline dissemination, shaping prescribing patterns. Discharge planning frequently seeds long-term outpatient regimens, linking inpatient care to downstream utilization. Reimbursement mechanisms typically support higher-acuity interventions, sustaining revenue. Thus, hospitals remain pivotal in care pathways and market capture.

Specialty clinics are expected to witness the fastest growth, reflecting the shift toward outpatient, longitudinal management and collaborative care. These centers offer psychiatrist-led medication management, psychotherapy, and digital monitoring under one roof, improving adherence and outcomes. Shorter wait times and tailored programs for bipolar spectrum disorders attract patients. Payer incentives for ambulatory care and reduced readmissions strengthen the clinic model. Telepsychiatry integration extends reach to underserved areas. As health systems pivot to community-based care, specialty clinics scale rapidly.

- By Distribution Channel

On the basis of distribution channel, the bipolar disorder treatment is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment held the largest share in 2024, anchored by initiation of therapies during admissions and coordinated discharge dispensing. Complex regimens, restricted drugs, and LAI administration are typically managed through hospital pharmacies. Strong integration with inpatient formularies drives volume. Pharmacist-led counseling at discharge supports transitions of care, reinforcing channel preference. Clinical governance and inventory controls ensure availability of critical medications. Consequently, hospital pharmacies capture substantial value at key treatment moments.

The online pharmacy segment is projected to grow the fastest, propelled by telepsychiatry expansion, e-prescriptions, and doorstep delivery that improves adherence. Subscription refills and reminders reduce gaps in chronic therapy. Competitive pricing on generics and discreet service appeal to patients managing stigma. Digital platforms integrate drug information, side-effect tracking, and pharmacist chat, elevating patient experience. Regulatory support for e-pharmacy in many regions is strengthening post-pandemic. As digital care normalizes, online pharmacies gain significant incremental share across maintenance medications.

Bipolar Disorder Treatment Market Regional Analysis

- North America dominated the bipolar disorder treatment market with the largest revenue share of 41.8% in 2024, attributed to high mental health awareness, strong healthcare infrastructure, favorable reimbursement policies, and the presence of leading pharmaceutical companies actively investing in novel therapies

- Patients in the region benefit from broad access to advanced therapies, favorable reimbursement policies, and increasing awareness campaigns that encourage early diagnosis and long-term management of bipolar disorder

- The widespread adoption of digital health platforms, telepsychiatry, and long-acting injectable antipsychotics further strengthens treatment availability and adherence rates

U.S. Bipolar Disorder Treatment Market Insight

The U.S. bipolar disorder treatment market captured the largest revenue share of 83% in 2024 within North America, fueled by high diagnosis rates, extensive healthcare coverage, and the presence of leading pharmaceutical innovators. Patients increasingly benefit from advanced pharmacological therapies, psychotherapy access, and the rapid uptake of digital health platforms supporting remote monitoring and telepsychiatry. The strong role of private insurers and government programs such as Medicaid and Medicare in covering psychiatric treatments ensures broader access. Moreover, clinical trials and FDA approvals of novel mood stabilizers and long-acting injectables are further propelling market expansion.

Europe Bipolar Disorder Treatment Market Insight

The Europe bipolar disorder treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by national mental health programs, growing awareness campaigns, and supportive government reimbursement policies. Increasing urban stress levels and lifestyle changes are contributing to higher demand for effective bipolar therapies. European patients also benefit from widespread psychiatric infrastructure, academic research partnerships, and innovative treatment delivery models such as integrated community clinics. Adoption is rising across both inpatient and outpatient care, with digital monitoring platforms becoming increasingly popular for relapse prevention and long-term management.

U.K. Bipolar Disorder Treatment Market Insight

The U.K. bipolar disorder treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service (NHS) initiatives to expand access to psychiatric services and reduce mental health stigma. Rising awareness campaigns, such as “Time to Change,” are improving early diagnosis and treatment uptake. The country’s growing adoption of telepsychiatry and digital prescription platforms is streamlining treatment delivery. Furthermore, strong participation in clinical research and access to generics contribute to both affordability and innovation, strengthening the UK’s growth trajectory.

Germany Bipolar Disorder Treatment Market Insight

The Germany bipolar disorder treatment market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong healthcare infrastructure, universal insurance coverage, and emphasis on psychiatric research. Germany’s focus on innovative, sustainable healthcare solutions supports the adoption of both advanced pharmacological therapies and integrated digital tools. The growing use of long-acting injectables, combined with investments in precision psychiatry and biomarker-based diagnosis, enhances treatment efficiency. A rising emphasis on patient privacy and secure digital health applications aligns with the country’s strict regulatory standards.

Asia-Pacific Bipolar Disorder Treatment Market Insight

The Asia-Pacific bipolar disorder treatment market is poised to grow at the fastest CAGR of 23% during 2025–2032, fueled by increasing mental health awareness, government-led digital health initiatives, and rising healthcare expenditure across China, Japan, and India. Rapid urbanization and changing lifestyles have contributed to rising mental health burdens, boosting demand for treatment solutions. The affordability of generic medications and growing telepsychiatry adoption make treatment more accessible across both rural and urban populations. Pharmaceutical expansion and R&D collaborations in APAC further strengthen availability and affordability of therapies.

Japan Bipolar Disorder Treatment Market Insight

The Japan bipolar disorder treatment market is gaining momentum due to the country’s advanced healthcare infrastructure, strong focus on research, and rapid adoption of digital health technologies. Rising diagnosis rates, particularly among younger populations, are fueling demand for effective treatments. Japan emphasizes holistic approaches that integrate pharmacological therapy with psychotherapy and technology-enabled monitoring. An aging population also creates demand for simplified, adherence-friendly therapies. Integration with digital mental health apps and precision psychiatry research is expected to further support growth.

India Bipolar Disorder Treatment Market Insight

The India bipolar disorder treatment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its expanding healthcare access, growing middle-class population, and government initiatives to strengthen mental health infrastructure. Rising awareness campaigns and the rollout of the National Mental Health Programme have improved diagnosis and treatment rates. Affordable generics and local pharmaceutical manufacturing capabilities make treatment more accessible to a wide population. The rapid expansion of telepsychiatry platforms and e-pharmacy services is bridging gaps in psychiatric care delivery, significantly driving the adoption of bipolar disorder treatments in both urban and rural settings.

Bipolar Disorder Treatment Market Share

The bipolar disorder treatment industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- AbbVie Inc. (U.S.)

- Mallinckrodt (Ireland)

- Sun Pharmaceutical Industries Ltd. (India)

- Novartis AG (Switzerland)

- Endo Pharmaceuticals plc (Ireland)

- Zydus Cadila (India)

- Mayne Pharma Group Limited (Australia)

- Teva Pharmaceutical Industries Ltd (Israel)

- Amneal Pharmaceutical Inc. (U.S.)

- Avet Pharmaceuticals Inc. (U.S.)

- Lannett (U.S.)

- Aurobindo Pharma (India)

- Wockhardt (India)

- Currax Pharmaceuticals LLC (U.S.)

- AstraZeneca (U.K.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Lilly USA, LLC (U.S.)

What are the Recent Developments in Global Bipolar Disorder Treatment Market?

- In August 2025, BioXcel Therapeutics announced they received positive written feedback from the FDA following a pre-supplemental New Drug Application (pre-sNDA) meeting for BXCL501 (Igalmi). The goal: expanding its use for at-home treatment of acute agitation in patients with bipolar disorders or schizophrenia. This represents a potential shift toward decentralized, patient-managed interventions

- In July 2025, the U.S. Food and Drug Administration (FDA) granted an expansion of the indication for CAPLYTA (lumateperone) to formally include depressive episodes associated with bipolar I and II disorder—for both monotherapy and adjunctive use with lithium or valproate. This approval underscores lumateperone’s evolving role as a versatile atypical antipsychotic targeting depressive phases of bipolar disorder with potentially improved tolerability

- In April 2025, Vanda Pharmaceuticals submitted a New Drug Application for Bysanti (milsaperidone), an active metabolite of iloperidone, seeking FDA approval for treatment of acute bipolar I disorder and schizophrenia. If approved, Bysanti could be available in the US by 2026

- In April 2025, NRx Pharmaceuticals received Fast Track designation from the FDA for NRX-100, a preservative-free intravenous ketamine formulation, aimed at treating suicidal ideation in patients with depression, including bipolar depression. This highlights the urgent need for rapid-acting, life-saving interventions in acute crisis scenarios

- In February 2025, Teva Pharmaceuticals and Medincell announced that the FDA accepted their supplemental New Drug Application (sNDA) for UZEDY, an extended-release injectable formulation of risperidone, for maintenance treatment in adults with bipolar I disorder—previously approved only for schizophrenia. This long-acting injectible may help address medication nonadherence, a known barrier in bipolar I management

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。