Global Lemon Juice Concentrate Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

3.93 Billion

USD

5.34 Billion

2024

2032

USD

3.93 Billion

USD

5.34 Billion

2024

2032

| 2025 –2032 | |

| USD 3.93 Billion | |

| USD 5.34 Billion | |

|

|

|

|

Global Lemon Juice Concentrate Market Segmentation, By Category (Organic and Conventional), Packaging (Paper Packaging and Plastic Packaging), End User (Food Service Industry, Food and Beverages Industry, Nutraceutical Industry, and Others), Form (Powdered and Liquid), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others) - Industry Trends and Forecast to 2032

What is the Global Lemon Juice Concentrate Market Size and Growth Rate?

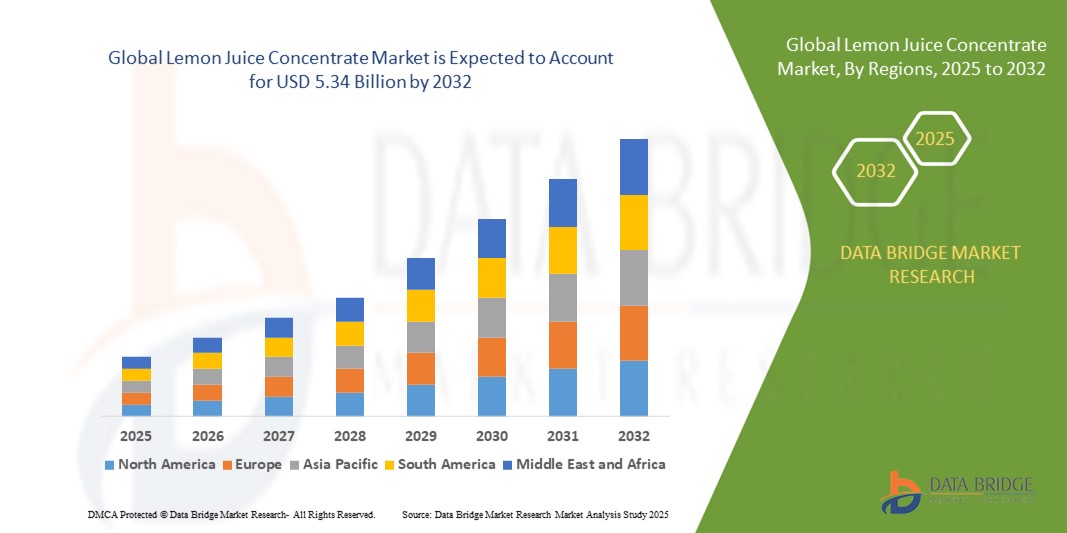

- The global lemon juice concentrate market size was valued at USD 3.93 billion in 2024 and is expected to reach USD 5.34 billion by 2032, at a CAGR of 3.90% during the forecast period

- The essential factors contributing to the growth of the global lemon juice concentrate market in the forecast period include increasing demand from the food and beverage industry, growth in industrial applications, technological advancements improving production efficiency, consumer preference for clean label and natural ingredients, and rising health consciousness is leading to the adoption of healthier food options, hence driving the market growth

What are the Major Takeaways of Lemon Juice Concentrate Market?

- With the rising awareness of health and wellness, consumers are seeking natural and clean label ingredients in their food and beverages. Lemon juice concentrate offers a natural source of flavour and acidity without artificial additives, making it attractive to health-conscious consumers

- In addition, lemon juice is perceived to have health benefits such as vitamin C content and antioxidant properties, further driving its demand in the global market. As consumers prioritize healthier options, the demand for lemon juice concentrate as a natural ingredient is expected to increase

- Europe dominated the lemon juice concentrate market with the largest revenue share of 42.74% in 2024, driven by increasing demand for natural and organic products, growing health awareness, and a strong preference for clean-label beverages

- Asia-Pacific lemon juice concentrate market is poised to grow at the fastest CAGR of 7.58% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing health awareness in countries such as China, Japan, and India

- Fluctuating raw material prices due to weather conditions, seasonal harvest variations, and global supply chain disruptions pose challenges to consistent supply

Report Scope and Lemon Juice Concentrate Market Segmentation

|

Attributes |

Lemon Juice Concentrate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lemon Juice Concentrate Market?

Rising Demand for Clean Label and Natural Ingredients

- A major and accelerating trend in the global lemon juice concentrate market is the growing consumer preference for clean label, natural, and organic products. Manufacturers are increasingly reformulating products to reduce additives, artificial flavors, and preservatives while emphasizing natural sourcing

- For instance, companies such as Döhler and SunOpta are introducing 100% natural lemon juice concentrates with no added sugars or preservatives, catering to the rising health-conscious consumer base

- Clean label Lemon Juice Concentrates also align with growing awareness about transparency in sourcing and production. Brands are leveraging AI-based supply chain analytics to ensure consistent quality and traceability from farm to packaging

- The integration of natural and organic claims into Lemon Juice Concentrates is influencing packaging design and marketing strategies, allowing products to stand out on supermarket shelves and e-commerce platforms

- This trend is reshaping consumer expectations, with end-users now prioritizing transparency, nutritional value, and minimal processing, prompting manufacturers to innovate with high-quality, natural formulations

What are the Key Drivers of Lemon Juice Concentrate Market?

- Increasing health awareness and demand for natural beverages are primary drivers of market growth. Consumers are seeking immunity-boosting, preservative-free, and functional beverage ingredients

- For instance, in 2023, Vinayak Ingredients India Pvt. Ltd. expanded its production of organic lemon juice concentrates, responding to a surge in demand from nutraceutical and food service industries

- Rising consumption in the food and beverage industry, including juices, smoothies, cocktails, and sauces, is driving bulk demand for high-quality lemon concentrates

- Expansion of e-commerce and modern retail channels has made Lemon Juice Concentrates more accessible to consumers globally, supporting higher consumption in both developed and emerging markets

- Convenience and multi-functionality using Lemon Juice Concentrates as flavoring agents, preservative alternatives, or functional ingredients further propel adoption across various industrial and commercial applications

Which Factor is Challenging the Growth of the Lemon Juice Concentrate Market?

- Fluctuating raw material prices due to weather conditions, seasonal harvest variations, and global supply chain disruptions pose challenges to consistent supply

- For instance, extreme weather events in lemon-producing regions such as Spain and India have historically affected production volumes, causing cost fluctuations

- Maintaining quality and natural composition while scaling production can increase manufacturing costs, particularly for organic or clean-label concentrates

- Competition from alternative citrus concentrates or synthetic flavorings may also limit market penetration in price-sensitive regions

- In addition, stringent regulatory standards for labeling, storage, and transportation add compliance costs, creating barriers for smaller manufacturers

- Overcoming these challenges through improved supply chain resilience, sustainable farming practices, and cost-efficient production technologies will be critical for sustained market growth

How is the Lemon Juice Concentrate Market Segmented?

The market is segmented on the basis of category, end user, packaging, form, and distribution channel.

- By Category

On the basis of category, the lemon juice concentrate market is segmented into Organic and Conventional. The Organic segment dominated the market with a revenue share of 57% in 2024, driven by rising consumer awareness of health benefits, chemical-free production, and clean-label preferences. Organic concentrates are increasingly favored in premium beverages, smoothies, and nutraceutical applications, as consumers demand natural and additive-free products. The increasing focus on traceability, quality assurance, and certifications is further encouraging manufacturers to adopt organic production practices, while conventional options continue to dominate bulk commercial applications.

The Conventional segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, propelled by affordability and large-scale industrial demand for processed lemon juice in food and beverage production. Conventional products remain popular in emerging markets where cost-sensitive buyers prioritize price over organic certification.

- By Packaging

On the basis of packaging, the market is segmented into Paper Packaging and Plastic Packaging. Plastic packaging dominated with a 62% revenue share in 2024, due to its durability, lightweight nature, and suitability for both retail and bulk distribution. Plastic packaging is widely preferred by commercial users and households for convenient storage and extended shelf life. The push for sustainability is prompting key manufacturers to innovate with recyclable and renewable materials, especially in Europe and North America, while maintaining product safety and freshness.

Paper packaging is expected to register the fastest CAGR of 21% from 2025 to 2032, driven by growing consumer demand for sustainable and eco-friendly solutions. Paper cartons, Tetra Pak, and biodegradable packaging are increasingly adopted to reduce environmental impact and align with clean-label and green initiatives.

- By End User

On the basis of end user, the lemon juice concentrate market is segmented into Food Service Industry, Food and Beverages Industry, Nutraceutical Industry, and Others. The Food and Beverages Industry dominated with 51% revenue share in 2024, driven by the widespread use of lemon juice concentrates in juices, beverages, sauces, and processed foods.

The Food Service Industry is expected to witness the fastest CAGR of 20% from 2025 to 2032, fueled by the growing number of restaurants, cafes, and catering services incorporating lemon concentrates for flavor, preservation, and nutritional benefits. The nutraceutical segment is also expanding, supported by increasing demand for functional beverages and immunity-boosting products. Manufacturers are increasingly customizing concentrates to meet specific industrial needs, such as high-purity or organic variants, while end-user diversification is enhancing market penetration across regions.

- By Form

On the basis of form, the lemon juice concentrate market is segmented into Powdered and Liquid. The Liquid segment dominated the market with a 64% revenue share in 2024, driven by its convenience, ready-to-use formulation, and compatibility with beverages and food processing. Liquid concentrates are preferred in restaurants, food processing units, and home kitchens for ease of use and consistent flavor.

The Powdered segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by its longer shelf life, lightweight nature, and ease of transportation. Powdered lemon concentrates are gaining traction in nutraceuticals, dry mixes, and instant beverage applications. Growing innovation in solubility, flavor retention, and organic variants is supporting adoption in both commercial and consumer segments.

- By Distribution Channel

On the basis of distribution channel, the lemon juice concentrate market is segmented into Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others. Supermarkets and Hypermarkets dominated with a 55% revenue share in 2024, benefiting from wide reach, bulk sales, and high consumer trust. These channels remain the primary source for both residential and commercial buyers.

The Online Retail segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, driven by growing e-commerce adoption, home delivery convenience, and the ability to access niche organic and premium concentrates. Online platforms also enable manufacturers to provide detailed product information, certifications, and subscription-based delivery models, enhancing consumer engagement. Convenience stores and specialty retailers contribute to market presence in urban and semi-urban regions, complementing the overall distribution network.

Which Region Holds the Largest Share of the Lemon Juice Concentrate Market?

- Europe dominated the lemon juice concentrate market with the largest revenue share of 42.74% in 2024, driven by increasing demand for natural and organic products, growing health awareness, and a strong preference for clean-label beverages

- Consumers in the region highly value sustainable production, high-quality ingredients, and certified organic options, further supporting widespread adoption across residential, commercial, and industrial sectors

- This dominance is further supported by a robust distribution infrastructure, high disposable incomes, and strict food quality regulations, establishing lemon juice concentrates as a preferred ingredient for both beverages and processed foods in Europe

Germany Lemon Juice Concentrate Market Insight

Germany lemon juice concentrate market captured the largest revenue share in Europe in 2024, driven by the country’s focus on health-conscious consumption, sustainability, and organic product adoption. Increasing demand from the food and beverage industry, coupled with regulatory support for quality and safety standards, is propelling market growth. Germany’s advanced manufacturing infrastructure and strong R&D capabilities encourage the production of high-purity and specialty lemon concentrates, contributing to the country’s dominance in Europe.

U.K. Lemon Juice Concentrate Market Insight

U.K. lemon juice concentrate market is expected to grow at a notable CAGR during the forecast period, fueled by the increasing popularity of functional beverages, organic products, and convenience-focused liquid concentrates. The growing trend of online retail, combined with expanding health-conscious consumer segments, supports adoption in both commercial and residential applications.

Which Region is the Fastest Growing Region in the Lemon Juice Concentrate Market?

Asia-Pacific lemon juice concentrate market is poised to grow at the fastest CAGR of 7.58% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing health awareness in countries such as China, Japan, and India. The region’s growing focus on functional foods and beverages, supported by government initiatives promoting nutrition and organic agriculture, is accelerating adoption.

China Lemon Juice Concentrate Market Insight

China lemon juice concentrate market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the expanding middle class, high consumption of processed and functional beverages, and rapid urbanization. The availability of affordable concentrates, strong domestic manufacturing, and the trend toward convenience-oriented liquid forms are key factors driving market growth.

Japan Lemon Juice Concentrate Market Insight

Japan lemon juice concentrate market is gaining traction due to a health-conscious population, demand for premium and functional ingredients, and widespread adoption of ready-to-use beverage solutions. Integration with commercial and household applications is promoting steady growth, particularly in organic and high-purity concentrate segments.

Which are the Top Companies in Lemon Juice Concentrate Market?

The lemon juice concentrate industry is primarily led by well-established companies, including:

- Asia Farm F&B Pte Ltd. (Singapore)

- Cardak Concentrate Fruit Juice (Turkey)

- CitroGlobe (U.S.)

- Cobell (U.K.)

- Döhler (Germany)

- Kiril Mischeff (U.K.)

- Lemon Concentrate (Spain)

- SunOpta (Canada)

- Vinayak Ingredients India Pvt. Ltd. (India)

- Yunnan Hongrui Lemon Development Co., Ltd. (China)

What are the Recent Developments in Global Lemon Juice Concentrate Market?

- In December 2023, NewTree Fruit Co. successfully removed all naturally occurring sugars from cranberry juice concentrate using a de-sugaring culturing method, targeting fructose, sucrose, and glucose, which marks a significant advancement in sugar-free juice technology

- In February 2024, Austria Juice showcased its range of organic juice concentrates at BioFach 2023, highlighting the company’s commitment to sustainable and high-quality juice solutions for global markets

- In January 2024, Better Juice, Ltd. announced its collaboration with Ingredion, Inc, to provide reduced sugar solutions to the U.S. juice market, reflecting the growing consumer demand for healthier beverage alternatives

- In April 2023, McDonald’s Canada launched three Fruit-Splash beverages containing lemon juice concentrate, expanding its product lineup and emphasizing fresh, fruit-based drink offerings

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。