High-speed internet connectivity is becoming a foundational requirement across the Asia-Pacific region, driven by the rapid adoption of digital services, cloud computing, remote work, and data-intensive applications. As consumer expectations for seamless streaming, instant communication, and real-time access continue to rise, the demand for faster, more reliable global data transmission is surging. Submarine cable systems—responsible for carrying over 95% of international internet traffic—are now central to enabling this digital transformation, particularly in emerging economies with growing online populations.

To meet escalating bandwidth demands, governments, telecom providers, and tech companies are investing heavily in new and upgraded undersea cable infrastructure. These systems not only improve network speed and reduce latency but also support the growth of smart cities, digital commerce, and cross-border data exchange. As digital connectivity becomes an economic and strategic priority across the region, high-speed internet demand is firmly positioning submarine cables as a critical driver of market expansion.

Access Full Report @ https://www.databridgemarketresearch.com/reports/asia-pacific-submarine-cable-system-market

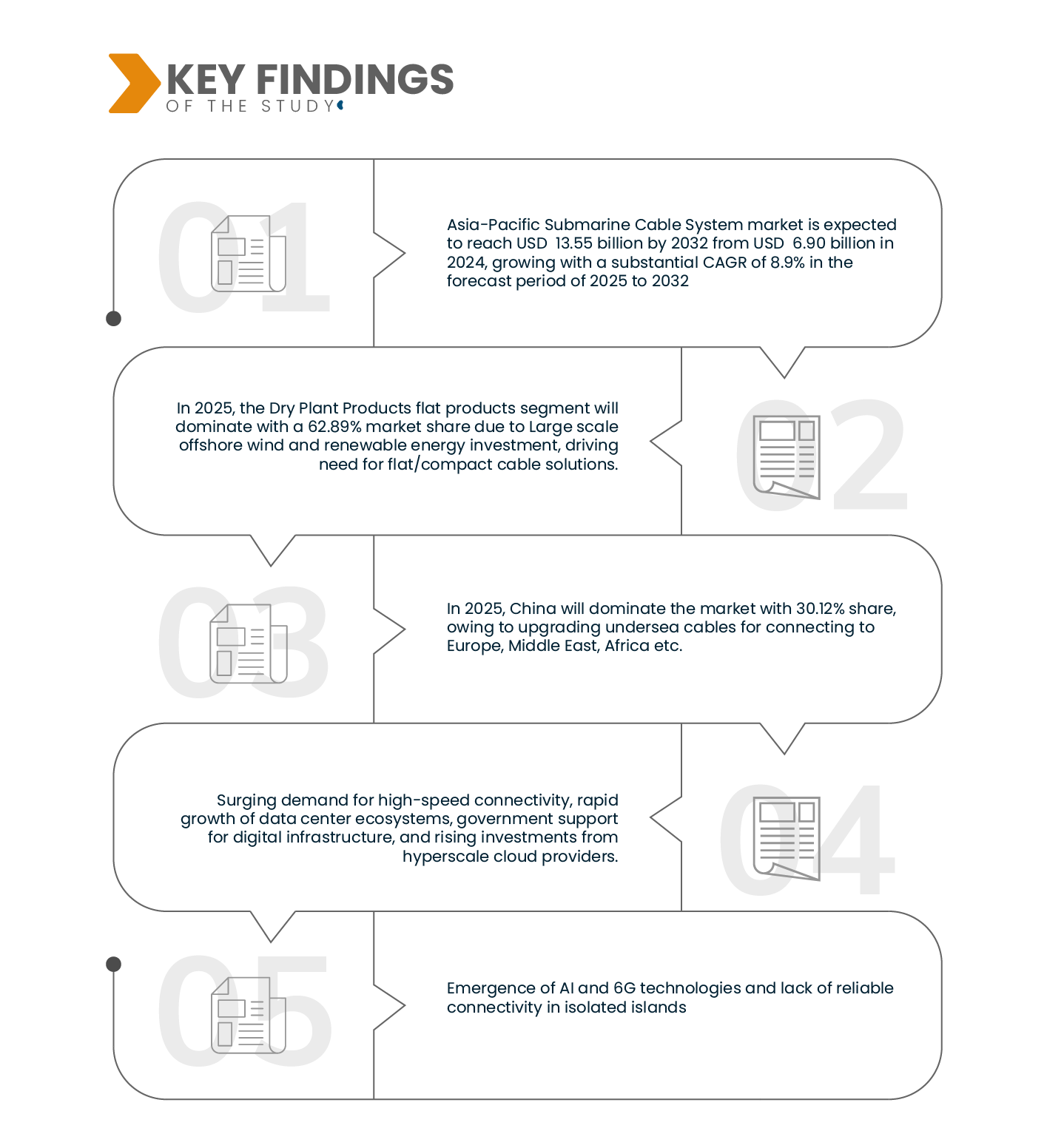

Data Bridge market research analyzes that the Asia-Pacific Submarine Cable System Market is expected to reach USD 13.55 billion by 2032 from USD 6.90 billion in 2024, growing with a substantial CAGR of 8.9% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rapid growth of data center ecosystems

The Asia-Pacific region is witnessing unprecedented growth in data center ecosystems, driven by the escalating demand for cloud computing, big data analytics, and digital services. As businesses and consumers increasingly rely on online platforms, the need for localized, scalable, and energy-efficient data centers has surged. This expansion is especially pronounced in tech hubs such as Singapore, Hong Kong, Japan, and India, where hyperscale data centers are being developed to handle massive data traffic volumes. The proliferation of edge computing and IoT devices further fuels the need for robust infrastructure that can process data closer to end-users, reducing latency and improving performance.

This rapid data center growth directly impacts the submarine cable market by significantly increasing demand for high-capacity, low-latency international data transmission. Data centers require reliable, high-bandwidth connections to connect with global networks, cloud providers, and other data hubs. Consequently, submarine cable operators and consortiums are scaling up capacity and investing in new routes to support this expanding ecosystem. The symbiotic relationship between data center growth and submarine cable deployment reinforces the strategic importance of undersea networks in enabling the region’s digital economy and future technological advancements.

The accelerating expansion of data centers across the Asia-Pacific region is significantly boosting demand for high-capacity, low-latency submarine cable systems. As enterprises and cloud providers scale their operations, seamless international data exchange becomes essential. Submarine cables provide the critical infrastructure to connect these facilities across borders and continents. With the rise of edge computing, AI, and 5G, data center growth will continue to drive long-term investment in undersea networks. This synergy positions data centers as a core driver of market expansion in the region’s digital infrastructure landscape.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product (Dry Plant Products and Wet Plant Products), By Voltage (High Voltage, Extra High Voltage, and Medium Voltage), By Offering (Installation and Commissioning, Repair and Maintenance, Upgrades, and Designing), By Fiber Class (Unrepeatered and Repeatered), By Cable Types (Loose Tube Cables, Ribbon Cables, and Others), By Armor Type (Single Armor, Double Armor, Light Weight Armor, and Rock Armor), By Depth (1000m-5000m, 500m-1000m, 0m-500m, and Others), By Operation (Consortium Cables, Private Cables, and Government-Owned Cables), and By Application (Communication Cables and Power Cables)

|

|

Countries Covered

|

China

Japan

South Korea

India

Singapore

Australia

Indonesia

Thailand

Malaysia

Philippines

Taiwan

Vietnam

New Zealand

Rest of Asia-Pacific

|

|

Market Players Covered

|

ZTT (China)

HENGTONG GROUP CO. LTD. (China)

NEC Corporation (Japan)

Sumitomo Electric Industries, Ltd. (Japan)

SSGCABLE (China)

APAR Industries Ltd (India)

OCC Corporation (United States)

Taihan Cable & Solution Co., Ltd. (South Korea)

Furukawa Electric Co., Ltd. (Japan)

Ningbo Orient Wires & Cables Co., Ltd. (China)

Qingdao Hanhe Cable Co. (China)

LS Cable & System Ltd. (South Korea)

OPTIC MARINE GROUP (Malaysia)

SubCom, LLC (United States)

Nusantara Marine (Malaysia)

Xtera Inc. (United States)

Prima Navalink (Indonesia)

PT TWINK INDONESIA (Indonesia)

Pure Pro Technology Co., Ltd. (China)

PT NICA Globalmarin Indonesia (Indonesia)

PT. Nautic Maritime Salvage (Indonesia)

PT INFRASTRUKTUR TELEKOMUNIKASI INDONESIA (TELKOMINFRA) (Indonesia)

PT Ketrosden Triasmitra Tbk (Indonesia)

PT Voksel Electric Tbk (Indonesia)

PT Communication Cable Systems Indonesia (CCSI) (Indonesia)

Prysmian Group (Italy)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Asia-Pacific Submarine Cable System market is segmented into product, voltage, offering, fiber class, cable type, armor type, depth, operation, and application.

- On the basis of product, the market is segmented into Dry Plant Products and Wet Plant Products.

In 2025, the Dry Plant Products segment will dominate the market

In 2025, the Dry Plant Products segment will dominate with a 62.89% market share due to Large scale offshore wind and renewable energy investment, driving need for flat/compact cable solutions.

- On the basis of voltage type, the market is segmented into High Voltage, Extra High Voltage, and Medium Voltage.

In 2025, the High Voltage segment will dominate the market

In 2025, the High Voltage segment will dominate the market with a 47.99% share due to rapid expansion of offshore wind farms.

- On the basis of offering, the market is segmented into Installation and Commissioning, Repair and Maintenance, Upgrades, and Designing.

In 2025, the Installation and Commissioning segment will dominate the market

In 2025, the Installation and Commissioning segment will dominate the market with a 51.36% share due to rapid growth of offshore renewables, grid interconnections and submarine power/communication links.

- On the basis of fiber class, the market is segmented into Unrepeatered and Repeatered.

In 2025, the Unrepeatered segment will dominate the market

In 2025, the Unrepeatered segment will dominate the market with 61.91% share because systems avoid powered repeaters, reducing complexity and cost, making them attractive for shorter routes (e.g., island links).

- On the basis of cable type, the market is segmented into loose tube cables, ribbon cables and others.

In 2025, the loose tube cables segment will dominate the market

In 2025, the loose tube cables segment will dominate the market with a 52.24% share due to it offers strong protection against sea water, pressure changes, temperature, strain — ideal for submarine deployments.

- On the basis of armor type, the market is segmented into Single Armor, Double Armor, Light Weight Armor, and Rock Armor.

In 2025, Single Armor finish will dominate the market

In 2025, Single Armor will dominate the market with a 49.48% share. Single-armour cables require only one layer of armor (steel wires or tape) instead of two. In shallower waters with moderate risk (e.g., continental shelf, relatively stable seabed) typical in many Asia-Pacific island/inter-coastal links, single-armour offers a cost-effective solution.

- On the basis of depth, the market is segmented into a 0m–500m, 500m–1000m, 1000m–5000m, and Others.

In 2025, 1000m-5000m will dominate the market

In 2025, 1000m-5000m will dominate the market with a 46.33% share due to Long-haul intercontinental or inter-island links.

- On the basis of operation, the market is segmented into a Consortium Cables, Private Cables, and Government-Owned Cables.

In 2025, Consortium Cables will dominate the market

In 2025, Consortium Cables will dominate the market with a 52.85% share due to offers a balanced approach to managing the complexities and costs associated with submarine cable projects.

- On the basis of application, the market is segmented into a Communication Cables and Power Cables.

In 2025, Communication Cables will dominate the market

In 2025, Communication Cables will dominate the market with a 59.08% share due to substantial financial investments and shared risks associated with deploying and maintaining these critical infrastructures.

Major Players

ZTT (China), HENGTONG GROUP CO. LTD. (China), NEC Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), SSGCABLE (China), APAR Industries Ltd (India), OCC Corporation (United States), Taihan Cable & Solution Co., Ltd. (South Korea), Furukawa Electric Co., Ltd. (Japan), Ningbo Orient Wires & Cables Co., Ltd. (China), Qingdao Hanhe Cable Co. (China), LS Cable & System Ltd. (South Korea), OPTIC MARINE GROUP (Malaysia), SubCom, LLC (United States), Nusantara Marine (Malaysia), Xtera Inc. (United States), Prima Navalink (Indonesia), PT TWINK INDONESIA (Indonesia), Pure Pro Technology Co., Ltd. (China), PT NICA Globalmarin Indonesia (Indonesia), PT. Nautic Maritime Salvage (Indonesia), PT INFRASTRUKTUR TELEKOMUNIKASI INDONESIA (TELKOMINFRA) (Indonesia), PT Ketrosden Triasmitra Tbk (Indonesia), PT Voksel Electric Tbk (Indonesia), PT Communication Cable Systems Indonesia (CCSI) (Indonesia), Prysmian Group (Italy), among others as the major market players of the market.

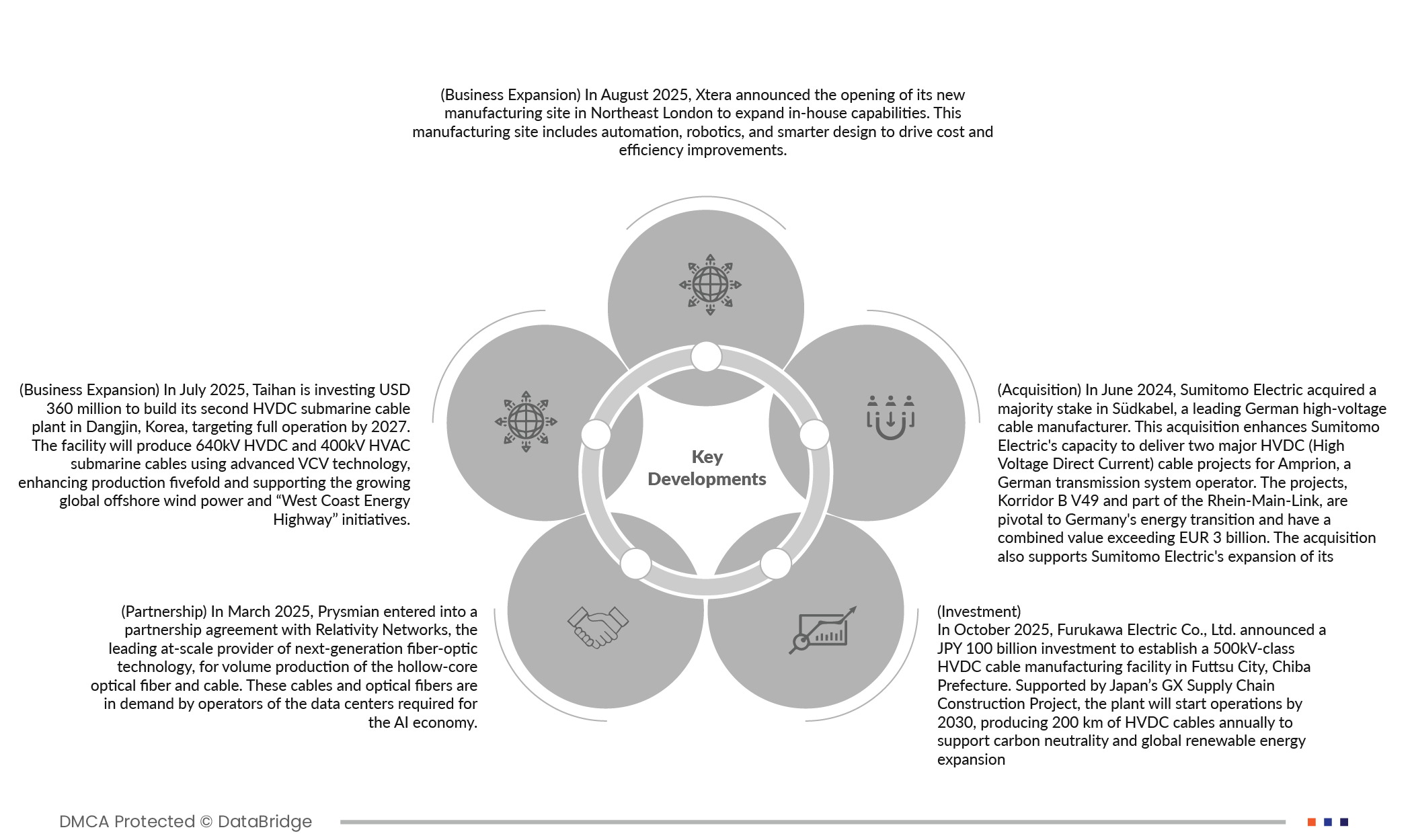

Market Developments

- In August 2025, Xtera announced the opening of its new manufacturing site in Northeast London to expand in-house capabilities. This manufacturing site includes automation, robotics, and smarter design to drive cost and efficiency improvements.

- In July 2025, Taihan is investing USD 360 million to build its second HVDC submarine cable plant in Dangjin, Korea, targeting full operation by 2027. The facility will produce 640kV HVDC and 400kV HVAC submarine cables using advanced VCV technology, enhancing production fivefold and supporting the growing global offshore wind power and “West Coast Energy Highway” initiatives.

- In March 2025, Prysmian entered into a partnership agreement with Relativity Networks, the leading at-scale provider of next-generation fiber-optic technology, for volume production of the hollow-core optical fiber and cable. These cables and optical fibers are in demand by operators of the data centers required for the AI economy.

- In October 2025, Furukawa Electric Co., Ltd. announced a JPY 100 billion investment to establish a 500kV-class HVDC cable manufacturing facility in Futtsu City, Chiba Prefecture. Supported by Japan’s GX Supply Chain Construction Project, the plant will start operations by 2030, producing 200 km of HVDC cables annually to support carbon neutrality and global renewable energy expansion.

- In April 2025, APAR Industries Limited is expanding the cable manufacturing capacity at its Khatalwada facility in Gujarat, which is one of its key production units. This facility already produces a wide range of cables, including submarine cables, specialty marine cables, and elastomeric cables. The expansion project aims to enhance APAR’s ability to meet growing domestic and international demand for high-performance cable systems across sectors like power, renewable energy, defense, and marine infrastructure. However, it's important to note that this development is an internal capacity expansion initiative, not the result of any partnership, joint venture, or acquisition.

As per Data Bridge Market Research analysis:

For more detailed information about the Asia-Pacific Submarine Cable System market report, click here – https://www.databridgemarketresearch.com/reports/asia-pacific-submarine-cable-system-market