Global demand for FIBC — heavy-duty bags and containers used to transport bulk chemicals, food ingredients, agro-chemicals, and raw materials — is being significantly fueled by a sharp uptick in cross-border trade of chemicals and food ingredients. As global supply chains have rebounded post-pandemic, import/export volumes of chemicals (organic, inorganic, agrochemicals, dyes, etc.) have surged, leading to more bulk shipments needing safe, efficient, durable transportation and storage. This trend is especially prominent in emerging economies with growing chemical consumption and manufacturing bases, where FIBC offers a cost-effective, scalable solution for bulk transport. The growing trade intensity thus directly translates into higher demand for FIBC solutions across chemical and food-ingredient supply chains.

For instances,

- In December 2024, the United Nations Conference on Trade and Development (UNCTAD) reported that global merchandise trade was set to hit nearly USD 33 trillion in 2024, up by USD 1 trillion from the previous year, reflecting a broad surge in goods trade across sectors including chemicals and food ingredients.

- In July 2025, UNCTAD indicated that global trade grew by approximately USD 300 billion in the first half of the year, driven in part by continued imports and exports from major economies — a growth that implies increased cross-border commodity flows requiring bulk packaging solutions.

- The 2024 edition of the World Trade Organization (WTO) “World Trade Report 2024” underscored that growth in international trade remains a central driver for trade-dependent industries, including chemicals and bulk food commodities, which typically utilize bulk containers and FIBCs for shipping.

- The 2024 “Key statistics and trends in international trade” dataset, produced by UNCTAD, identified that among major economies, countries such as China and India experienced some of the highest export growth rates over recent years — a pattern consistent with growing exports of chemicals and food-related products that demand bulk packaging for cross-border shipping.

The documented surge in Global Trade of Goods Including Chemicals and Food-Related Ingredients has materially increased the volume of cross-border shipments. This trade expansion has heightened the demand for reliable, large-volume, and regulation-compliant packaging solutions, thereby reinforcing the role of FIBCs as a critical enabler for safe, efficient, and cost-effective bulk transport across international supply chains

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-fibc-packaging-market

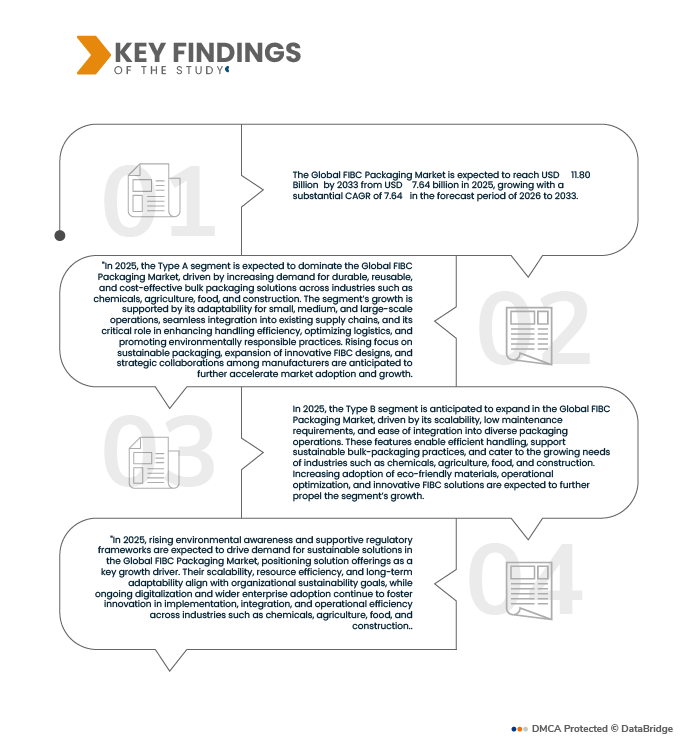

Data Bridge market research analyzes that Global FIBC Packaging Market is expected to reach USD 11.80 billion by 2033 from USD 7.64 billion in 2025, growing with a substantial CAGR of 5.6% in the forecast period of 2025 to 2035.

Key Findings of the Study

RFID and Track-and-Trace Adoption Enhances Fibc Efficiency

Integration of advanced RFID / track-and-trace technologies into flexible intermediate bulk containers (FIBCs) and similar bulk packaging solutions is emerging as a strong growth lever for the global FIBC market. As supply chains become more complex and regulatory, quality, safety, and transparency demand rise — especially in sectors like chemicals, food, pharmaceuticals and hazardous materials — there is growing interest in embedding RFID tags and other digital traceability tools into bulk bags and containers. Such integration enables real-time visibility of contents and location, batch-level traceability, improved inventory & quality control, counterfeit prevention, and easier compliance with evolving regulatory and customer-driven traceability requirements. For FIBC suppliers, offering RFID-enabled or track-and-trace–ready containers represent a differentiated, value-added product, opening up higher-margin market segments and facilitating adoption across regulated or high-stakes industries.

For instances,

- In December 2023, a published case study in Applied Sciences detailed implementation of an RFID traceability system in the packaging section of an industrial company — showing that RFID significantly improved efficiency and traceability compared with traditional barcode-based systems.

- In June 2025, sciencedirect systematic literature review of supply-chain digitization concluded that RFID integration is a key enabler of modern supply-chain management — underscoring growing academic and industrial interest in RFID-based traceability for packaging and containers.

- In December 2022, a peer-reviewed study demonstrated not only identification & tracking, but also embedding of environmental sensors (humidity, temperature, integrity) together with RFID tags for food packaging — illustrating how “smart packaging” can go beyond simple identification to full-condition monitoring.

- In March 2025, a research publication on sustainable packaging highlighted how integrating RFID (and IoT) into pallets, bins and containers supports reuse, circular-economy practices, and lifecycle traceability — aligning with growing regulatory and environmental pressures globally.

The growing imperative for transparency, traceability, regulatory compliance and supply-chain resilience is driving broader opportunity in RFID / track-and-trace–enabled bulk packaging. For the FIBC market, this technological integration offers a clear opportunity by enabling higher-value, compliance-ready, smart containers that fulfill modern supply-chain demands, FIBC producers can expand into regulated and tech-savvy market segments, enhance competitiveness, and future-proof their offerings.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Product Type (Type A, Type B, Type C (Conductive), Type D (Static Dissipative)), By Bag Construction (Baffle (Q-Bag), U-Panel, Four-Panel

Circular / Tubular), By Application (Chemicals (2000), Food & Beverages (1000 & 1100), Agriculture (0100), Pharmaceuticals (2100), Construction (4100), Mining & Minerals (0100 & 0001), Waste & Recycling (3800), Others), By End User (Chemical Manufacturers (2000), Agricultural Producers & Co-Ops (0100), Food Processors &, Ingredient Suppliers (1000 & 1100), Construction Contractors (4100), Mining Companies (0100 & 0001), Pharmaceutical Companies (2100), Waste Management & Recycling Firms (3800), Others), By Distribution Channel (Indirect, Direct)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East And Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

Global FIBC Packaging market is categorized into five notable segments which are based on product type, bag construction, application, end use, distribution channel.

- On the basis of product type, the global FIBC Packaging market is segmented into Type A, Type B, Type C (Conductive), Type D (Static Dissipative).

In 2026, the Type A segment is expected to dominate the market

In 2026, the Type A segment is expected to dominate the global FIBC Packaging market share of 37.89% due to its simple, cost-effective design that makes it suitable for dry, non-hazardous bulk materials. Type A FIBCs are widely preferred for industries such as agriculture, food, and construction because they offer reliable bulk handling without the need for specialized safety features. Their ease of manufacturing, lower production costs, and compatibility with standard filling and discharge equipment further contribute to their strong market adoption.

- On the basis of bag construction, the global FIBC Packaging market is segmented into Baffle (Q-Bag), U-Panel, Four-Panel, Circular / Tubular.

In 2026, the Baffle (Q-Bag) segment is expected to dominate the market

In 2026, Baffle (Q-Bag) segment is expected to dominate the global FIBC Packaging market share of 36.47% due to its superior load stability and shape retention, which prevent bulging during storage and transport. Its square, stable design allows more efficient space utilization, making it ideal for stacking and bulk handling. The versatility of Baffle bags across industries such as chemicals, agriculture, and construction, along with technological improvements in materials and manufacturing, further drives their adoption in the growing global bulk packaging market.

- On the basis of application, the global FIBC Packaging market is segmented into Chemicals (2000), Food & Beverages (1000 & 1100), Agriculture (0100), Pharmaceuticals (2100), Construction (4100), Mining & Minerals (0100 & 0001), Waste & Recycling (3800), Others.

In 2026, the Chemicals (2000) segment is expected to dominate the market

In 2026, the Chemicals (2000) segment is anticipated to dominate the global FIBC Packaging market share of 36.70% due to growing global demand for petrochemicals, polymers, dyes, pigments, industrial chemicals, and specialty additives that rely heavily on high-performance FIBCs for bulk storage and transport. The chemical industry requires UN-approved, static-dissipative, and contamination-resistant FIBCs to handle sensitive and hazardous materials, leading to accelerated adoption. Additionally, rapid chemical production expansion in Asia-Pacific and rising export volumes further reinforce the segment’s leadership position.

- On the basis of end use, the global FIBC Packaging market is segmented into Chemical Manufacturers (2000), Agricultural Producers & Co-Ops (0100), Food Processors & Ingredient Suppliers (1000 & 1100), Construction Contractors (4100), Mining Companies (0100 & 0001), Pharmaceutical Companies (2100), Waste Management & Recycling Firms (3800), Others.

In 2026, the Chemical Manufacturers (2000) segment is expected to dominate the market

In 2026, the Chemical Manufacturers (2000) segment is anticipated to dominate the global FIBC Packaging market share of 35.50% due to the critical need for robust, static-controlled, and contamination-resistant bulk packaging solutions in chemical transportation. The chemical industry relies heavily on FIBCs for powders, intermediates, resins, catalysts, solvents, and specialty additives, where safe handling and UN-compliant packaging are mandatory. Additionally, rising chemical production in Asia-Pacific, coupled with increased global trade of petrochemicals and specialty chemicals, further reinforces the dominance of this segment.

- On the basis of distribution channel, the global FIBC Packaging market is segmented into Indirect, Direct.

In 2026, the Indirect segment is expected to dominate the market

In 2026, the Indirect segment is anticipated to dominate the global FIBC Packaging market share of 62.49% due to the extensive role of distributors, dealers, and online procurement channels in offering wider product accessibility, competitive pricing, and shorter lead times. Many small and mid-sized industries—including agriculture, food ingredients, construction, and waste management—prefer indirect channels for their ability to supply varied bag types in smaller volumes, ensure quicker replenishment, and provide region-specific logistical support. This broad end-user dependency significantly strengthens the segment’s market leadership.

Major Players

Amcor plc (Switzerland), IPG (U.S.), Greif (U.S.), LC Packaging (Netherlands), Sonoco Products Company (U.S.) among others.

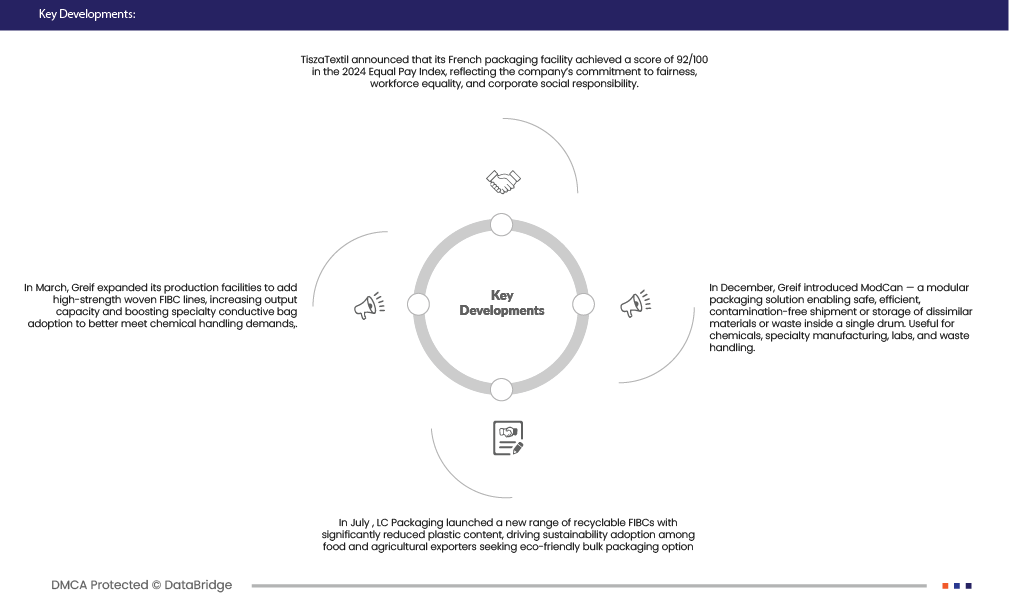

Latest Developments in Global FIBC Packaging Market

- In February 2023, LC packaging announced partnership with Buenassa (DRC) and Shankar Packagings (India) for FIBC distribution and local production in DRC mining sector.

- In February 2025, United Bags, Inc. acquired BAG Corp, expanding FIBC product offerings including SUPER SACK® bulk bags for enhanced customer value in bulk packaging.

- In August 2025, Sackmaker boosted its filled-sandbag stock to over 4,000 units for immediate dispatch, improving readiness for emergency response, flood defence and construction requirements. The increase in stock and rapid-delivery capability enhances operational reliability during demand surges.

- In March, Greif completed acquisition of Ipackchem — a global leader in high‑performance barrier and non‑barrier jerrycans and small plastic containers — in a cash transaction worth US $538 M. This expands Greif’s small‑plastics / jerrycan footprint globally and adds barrier‑packaging capabilities.

- In 2025, Jumbo Bag Limited strengthened its production capabilities through its fully integrated manufacturing facilities in Chennai and Mumbai with an annual production capacity exceeding 4.3 million jumbo bags (FIBCs), and continued focus on clean-room FIBC production for food and pharma applications — reflecting its commitment to expanding high-quality, customer-focused bulk packaging solutions.

As per Data Bridge Market Research analysis:

Geographically, the country covered in the Global FIBC Packaging Market are North America, Europe, Asia-Pacific, South America, Middle East & Africa. Asia-Pacific FIBC Packaging market is further segmented into the China, India, Japan, South Korea, Indonesia, Thailand, Malaysia, Australia, Philippines, Taiwan, Singapore, New Zealand, Hong Kong, Rest of Asia-Pacific. Europe market is further segmented into Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Belgium, Sweden, Norway, Denmark, Finland, Switzerland, Rest of Europe. North America market is further segmented into U.S., Canada and Mexico. South America market is further segmented into Brazil, Argentina, Peru, Chile, Colombia, Ecuador, Venezuela, Uruguay, Paraguay, Bolivia, Rest of South America. Middle East and Africa market is further segmented into Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Qatar, Oman, Kuwait, Bahrain, Rest of Middle East and Africa.

Asia-Pacific is the dominating region in Global FIBC Packaging Market

Asia-Pacific is the dominating region in the Global FIBC Packaging Market, driven by the rapid industrialization and urbanization, strong growth in agricultural and chemical production, and expanding demand from food processing, construction, and mining industries. Moreover, large-scale investments in manufacturing, logistics, and export-oriented industries—along with the strong presence of major raw material suppliers and FIBC manufacturers in countries such as China, India, and Japan—further consolidate the region’s dominance in global FIBC production.

Asia-Pacific is expected to be the fastest growing region in Global FIBC Packaging Market

rapid industrialization and urbanization, expanding agriculture and food-processing activities, rising chemical and pharmaceutical production, and substantial investments in manufacturing and logistics infrastructure. This growth is further supported by the region’s well-established polypropylene and petrochemical supply chain, competitive production costs, and the presence of large FIBC manufacturers across China, India, and Japan — all of which strengthen regional export capacity, enhance supply-chain efficiency, and accelerate large-scale adoption of bulk packaging solutions across diverse end-use industries.

For more detailed information about the Global FIBC Packaging Market report, click here – https://www.databridgemarketresearch.com/reports/global-fibc-packaging-market