The integration of IoT and AI in pipeline monitoring solutions is transforming corrosion management across the U.A.E., Saudi Arabia, Russia, Kazakhstan, and Uzbekistan. With extensive oil and gas infrastructure, real-time IoT sensors enable continuous monitoring of pipeline conditions, while AI-driven predictive analytics detect early signs of corrosion. These technologies optimize maintenance strategies, reduce operational risks, and enhance pipeline longevity. As regional energy and industrial investments expand, AI and IoT-driven corrosion monitoring ensures cost-effective, proactive maintenance, strengthening infrastructure reliability and efficiency.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-uae-russia-kazakhstan-and-uzbekistan-pipeline-corrosion-monitoring-market

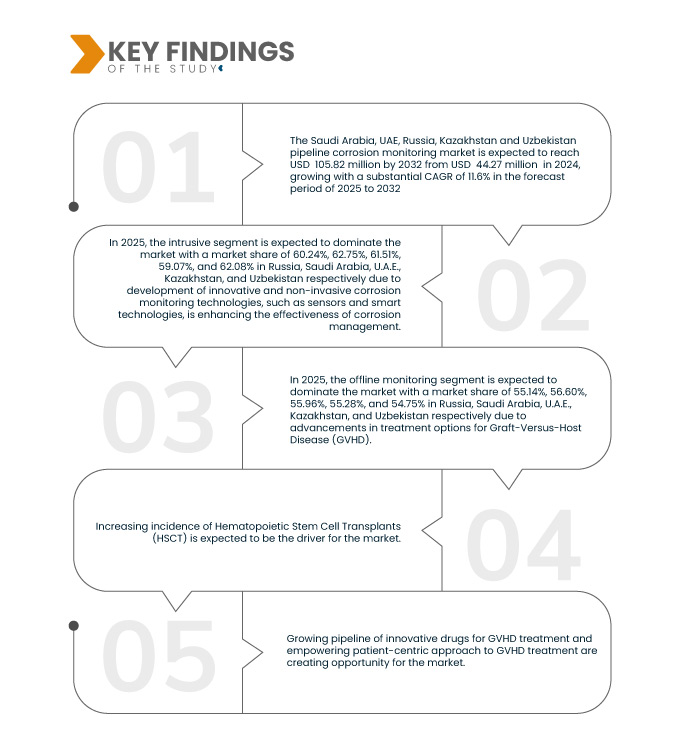

Data Bridge Market Research analyses that the Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan Pipeline Corrosion Monitoring Market is expected to reach USD 105.82 million by 2032 from USD 44.27 million in 2024, growing with a CAGR of 11.6% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rapid Expansion of Energy Development

The rapid expansion of energy development in the Middle East, fueled by growing oil and gas exploration, production, and large-scale infrastructure projects, is driving the demand for advanced pipeline corrosion monitoring solutions. Aging pipelines in the Middle East are increasing the demand for advanced corrosion monitoring technologies to maintain safety and efficiency. Countries such as U.A.E., Saudi Arabia, Russia, Kazakhstan, and Uzbekistan face pipeline integrity challenges due to extreme temperatures and corrosive environments.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2025 to 2032

|

Base Year

|

2024

|

Historic Years

|

2023 (Customizable from 2018-2023)

|

Quantitative Units

|

Revenue in USD Million

|

Segments Covered

|

By Type (Intrusive and Non-Intrusive), Method (Direct Monitoring and Indirect Monitoring), End-Use (Oil and Gas, Chemical Processing, Water and Wastewater, Power Generation, and Others), Monitoring (Offline Monitoring and Online Monitoring), Components (Hardware, Software, and Services)

|

Countries Covered

|

Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan

|

Market Players Covered

|

Baker Hughes Company (U.S.), Emerson Electric Co. (United States), Honeywell International Inc. (U.S.), ROSEN-GROUP Stans (Switzerland), SOGEC Dammam (Saudi Arabia), AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES (U.A.E), KROHNE Messtechnik GmbH (Germany), T.D. Williamson, Inc. (United States), BSS Technologies (U.A.E.), Monicor (Russia), Eiwaa Saudi New (France), PSS CORPORATION (Russia), SMARTCORR (U.S.), ChemService, Inc. (U.S.), Awtada (Saudi Arabia), CTS Group Holding SA (Switzerland), Al Shoumoukh Group (U.A.E.), Ducorr (U.S.), and SensorLink Corporation (Norway) among others

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan pipeline corrosion monitoring market is segmented into five notable segments based on the type, method, end-use, monitoring and components.

- On the basis of type, the pipeline corrosion monitoring market is segmented into intrusive and non-intrusive.

In 2025, the intrusive segment is expected to dominate the pipeline corrosion monitoring market

In 2025, the intrusive segment is expected to dominate the market with a market share of 60.24%, 62.75%, 61.51%, 59.07%, and 62.08% in Russia, Saudi Arabia, U.A.E., Kazakhstan, and Uzbekistan respectively due to development of innovative and non-invasive corrosion monitoring technologies, such as sensors and smart technologies, is enhancing the effectiveness of corrosion management.

- On the basis of method, the pipeline corrosion monitoring market is segmented into direct monitoring and indirect monitoring.

In 2025, the direct monitoring segment is expected to dominate the pipeline corrosion monitoring market

In 2025, the direct monitoring segment is expected to dominate the market with a market share of 62.55%, 64.12%, 62.34%, 61.13%, and 63.15% in Russia, Saudi Arabia, U.A.E., Kazakhstan, and Uzbekistan respectively.

- On the basis of end use, the pipeline corrosion monitoring market is segmented into oil and gas, chemical processing, water and wastewater, power generation, and others. In 2025, the oil and gas segment is expected to dominate the market with a market share of 51.48%, 52.64%, 50.84%, 47.52%, and 49.09% in Russia, Saudi Arabia, U.A.E., Kazakhstan, and Uzbekistan respectively.

- On the basis of monitoring technique, the pipeline corrosion monitoring market is segmented into offline monitoring and online monitoring. In 2025, the offline monitoring segment is expected to dominate the market with a market share of 55.14%, 56.60%, 55.96%, 55.28%, and 54.75% in Russia, Saudi Arabia, U.A.E., Kazakhstan, and Uzbekistan respectively.

- On the basis of components, the pipeline corrosion monitoring market is segmented into hardware, software, and services. In 2025, the hardware segment is expected to dominate the market with a market share of 47.50%, 47.58%, 47.18%, 50.80%, and 47.25% in Russia, Saudi Arabia, U.A.E., Kazakhstan, and Uzbekistan respectively.

Major Players

Data Bridge Market Research analyses Baker Hughes Company (U.S.), Honeywell International Inc. (U.S.), SOGEC Dammam (Saudi Arabia), AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES (U.A.E), BSS Technologies (U.A.E.) as the major players operating in the market.

Market Developments

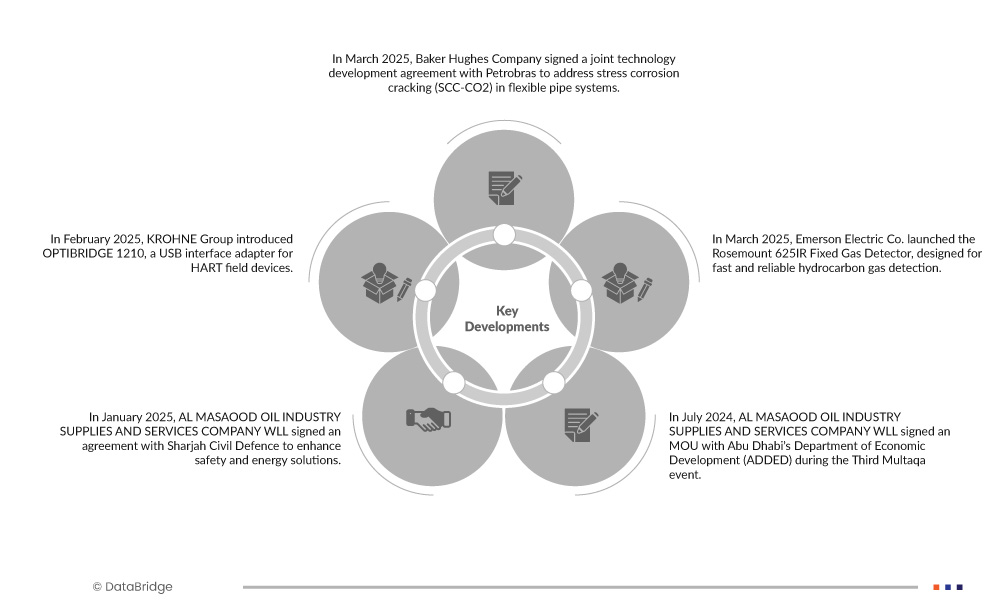

- In January 2025, AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES COMPANY WLL signed an agreement with Sharjah Civil Defence to enhance safety and energy solutions. This partnership reinforced the company's commitment to supporting public safety initiatives. By collaborating with government entities, the company expanded its influence in the energy sector. The agreement also positioned Al Masaood as a key player in providing advanced safety solutions. Strengthening ties with civil defense authorities improved its credibility and market reach. This move aligned with its strategy to contribute to regional energy and safety advancements.

- In March 2025, Baker Hughes Company launched a joint technology program with Petrobras to address stress corrosion cracking (SCC-CO2) in flexible pipe systems. The agreement included development, testing, and an option to purchase next-generation flexible pipes with a 30-year service life. The project took place at Baker Hughes’ Energy Technology Innovation Center in Rio de Janeiro. This strengthened Baker Hughes' position as a key supplier of corrosion-resistant pipeline solutions. The partnership enhanced its role in Brazil’s offshore market and reinforced its expertise in sustainable energy technologies.

- In May 2023, MONICOR participated in the Gas, Oil, Technologies exhibition in Ufa, presenting its report on the "Automated Corrosion Protection System." The company took part in the discussion panel on corrosion protection for oil and gas equipment and pipelines. Experts shared insights on identifying and mitigating corrosion-related risks. The event provided a platform to exchange knowledge and explore innovative solutions. Monicor’s participation reinforced its position as a key player in corrosion protection technologies. This engagement helped strengthen industry connections and promote its advanced solutions

- In February 2025, KROHNE Group introduced OPTIBRIDGE 1210, a USB interface adapter for HART field devices. It enabled communication, calibration, and maintenance of 2- and 4-wire HART devices via PC, laptop, or Windows tablet. The device functioned as a calibration tool, a 24 VDC power source, and a HART modem without process interruption. Its plug-and-play design simplified field operations and sensor management. This launch enhanced KROHNE’s offerings in digital device communication and process automation

- In February 2024, KROHNE Group introduced the OPTIBAR FC 1000, a high-performance flow computer for measuring volumetric flow and heat quantity in liquids, gases, and steam. It expanded KROHNE’s differential pressure (DP) flow measurement portfolio, ensuring compliance with IAPWS-97 and ISO 5167 for accurate steam and water calculations. The device featured real-time correction of linearity errors, enhancing measurement precision and efficiency. This launch reinforced KROHNE’s market position by offering advanced solutions for energy and process industries.

Regional Analysis

Geographically, the countries covered in the market are Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan.

As per Data Bridge Market Research analysis:

Russia is expected to be the dominant country in the Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan pipeline corrosion monitoring market

Russia is expected to dominate the pipeline corrosion monitoring market among Saudi Arabia, UAE, Russia, Kazakhstan, and Uzbekistan due to several key factors. Russia's vast pipeline infrastructure, particularly in its oil and gas sector, necessitates robust corrosion management solutions to ensure the integrity and longevity of its extensive network. The country’s extreme weather conditions and the size of its pipeline systems make advanced corrosion monitoring crucial for preventing costly repairs and minimizing downtime.

Russia is expected to be the fastest growing Country in the Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan pipeline corrosion monitoring market

Russia is the fastest-growing country in the pipeline corrosion monitoring market due to its vast and aging pipeline network, harsh environmental conditions that accelerate corrosion, and significant investments in advanced monitoring technologies.

For more detailed information about Saudi Arabia, U.A.E., Russia, Kazakhstan, and Uzbekistan pipeline corrosion monitoring market click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-uae-russia-kazakhstan-and-uzbekistan-pipeline-corrosion-monitoring-market