Saudi Arabia Uae Russia Kazakhstan And Uzbekistan Pipeline Corrosion Monitoring Market

Market Size in USD Million

CAGR :

%

USD

44.27 Million

USD

105.82 Million

2024

2032

USD

44.27 Million

USD

105.82 Million

2024

2032

| 2025 –2032 | |

| USD 44.27 Million | |

| USD 105.82 Million | |

|

|

|

|

Pipeline Corrosion Monitoring Market Size

- The pipeline corrosion monitoring market was valued at USD 44.27 million in 2024 and is expected to reach USD 105.82 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.6%, primarily driven by the increasing pipeline infrastructure

- This growth is driven by factors such as the Technological Advancements, Increasing Oil & Gas Infrastructure, and Economic Growth and Industrial Expansion.

Pipeline Corrosion Monitoring Market Analysis

- Saudi Arabia leads the pipeline corrosion monitoring market in the region due to its vast and mature oil and gas infrastructure. As one of the world’s largest oil producers, the country has a significant pipeline network that requires continuous monitoring for corrosion prevention to ensure operational safety and efficiency. Saudi Arabia’s large-scale infrastructure projects, combined with a focus on long-term pipeline integrity, have driven the adoption of advanced corrosion monitoring solutions.

- In January 2025, a report by Elsevier Ltd. revealed that the Middle East recorded 598 ongoing oil and gas projects, emphasizing the region’s expanding energy sector. The petrochemical industry leads with 290 projects, followed by 140 midstream projects, 89 refineries, and 79 upstream developments. This surge highlights the region’s strategic investment in production, refining, and logistics to meet global energy demand. The expansion reflects efforts to enhance infrastructure, integrate advanced technologies, and strengthen energy security while ensuring long-term sustainability in the oil and gas sector

- The U.A.E. holds a dominant position in the pipeline corrosion monitoring market over Kazakhstan due to its robust and modern oil and gas infrastructure. The U.A.E.’s oil and gas industry is characterized by cutting-edge technology adoption and significant investments in infrastructure development. As a major energy hub, the U.A.E.’s proactive approach toward advanced corrosion monitoring solutions, such as smart sensors and real-time monitoring systems, places it ahead of Kazakhstan

- In January 2025, the article by Elsevier Ltd. Stated that, the U.A.E., holding 4% of global oil and 3.5% of gas reserves, is expanding energy production to meet rising demand. ADNOC invests USD 1.83 billion to boost capacity, targeting five million b/d by 2030. Aiming for energy self-sufficiency, the U.A.E. discovered 80 trillion cubic feet of gas in 2020. Committed to net-zero emissions by 2050, it plans 50% clean energy by 2050. At COP28, the U.A.E. pledged USD 200 million for climate initiatives, reinforcing its sustainability efforts

- In contrast, Kazakhstan, despite growing its oil and gas sector, is still in the process of modernizing its pipeline infrastructure and may not yet have the same level of advanced technology integration, making the U.A.E. the dominant player in the region.

- Kazakhstan is a significant producer of coal, crude oil, and natural gas, and a major energy exporter. While coal dominates the country’s energy mix, renewable sources of energy are a small but growing share of Kazakhstan’s electricity generation. Gas pipeline network expansion remains a priority, in order to expand access and reduce reliance on coal and LPG for household consumption. Kazakhstan is part of the EU4Energy Progamme, an initiative focused on evidence-based policymaking for the energy sector

Report Scope and Pipeline Corrosion Monitoring Market Segmentation

|

Attributes |

Pipeline Corrosion Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Pipeline Corrosion Monitoring Market Trends

“Demand for Advanced Corrosion Management Solutions”

- Saudi Arabia is leading the pipeline corrosion monitoring market in the region due to its large oil and gas industry, which drives demand for advanced corrosion management solutions. The country’s focus on infrastructure development and its vast network of pipelines has prompted the adoption of state-of-the-art corrosion monitoring technologies. Saudi Arabia is investing heavily in research and development to enhance pipeline integrity, ensuring long-term durability and reducing maintenance costs.

- In January 2024, the "Pipelines Construction Outlook 2024" graph highlights regional pipeline expansion trends. The Middle East has 6,992 miles of planned or under-construction pipelines, primarily shorter connections to existing networks, with minimal major transmission projects. Key developments include QatarEnergy's USD 30 billion North Field expansion and Iraq’s stalled Basra-Aqaba pipeline. Russia/CIS leads in pipeline length, with 18,220 miles in development, including the Power of Siberia projects to boost gas exports to China and Novatek’s Murmansk LNG pipeline

- The U.A.E. is at the forefront of pipeline corrosion monitoring in the Middle East due to its modern infrastructure and proactive approach to adopting cutting-edge technology. With substantial investments in oil and gas projects, the U.A.E. focuses on the durability and protection of its pipelines, utilizing advanced corrosion monitoring systems. In contrast, Kazakhstan, while growing in its oil and gas sector, is still catching up in terms of infrastructure modernization and advanced corrosion technologies, making the U.A.E. a dominant player in the market.

- In 2025, a report published by Elsevier Ltd. highlighted the ongoing expansion of the Middle East’s oil and gas sector. Iran leads in project numbers, followed by Saudi Arabia, the U.A.E., and Iran. The data reveals a combination of new build and expansion projects from 2023 to 2027, emphasizing the region’s growing energy infrastructure. This surge reinforces the Middle East’s crucial role in global energy markets and future developments

Pipeline Corrosion Monitoring Market Dynamics

Driver

“Rising Energy Development Driving Demand for Pipeline Corrosion Monitoring Solutions”

- The rapid expansion of energy development in the Middle East and Russia, fueled by growing oil and gas exploration, production, and large-scale infrastructure projects, is driving the demand for advanced pipeline corrosion monitoring solutions.

- Key energy-producing nations such as the U.A.E., Saudi Arabia, and Qatar are significantly increasing their oil and gas output to meet rising global demand, making pipeline integrity a top priority. Corrosion-related failures can lead to costly maintenance, environmental hazards, and operational disruptions, necessitating robust monitoring technologies

- Real-time corrosion monitoring systems, predictive analytics, and advanced inspection methods help detect early signs of pipeline degradation, preventing leaks and minimizing downtime. These technologies not only improve safety and regulatory compliance but also contribute to cost-effective asset management

- As the region focuses on energy security and sustainability, the adoption of pipeline corrosion monitoring solutions is set to rise, ensuring long-term efficiency, reliability, and resilience in the energy

For instance,

- In June 2024, ITP Media Group reported that Aramco has implemented CorrosionRADAR’s advanced Corrosion Under Insulation (CUI) monitoring solution at key locations within the Ju’aymah NGL Fractionation Plant. This deployment aims to enhance safety and operational reliability by allowing engineers to detect and address CUI issues promptly. The technology also improves inspection planning, helping to optimize maintenance strategies while reducing costs associated with future repairs and shutdowns. By leveraging this innovative monitoring system, Aramco strengthens its commitment to operational efficiency, ensuring long-term asset integrity and minimizing potential risks linked to corrosion-related failures

- In January 2025, the article by Elsevier Ltd. Stated that, the U.A.E., holding 4% of global oil and 3.5% of gas reserves, is expanding energy production to meet rising demand. ADNOC invests USD 1.83 billion to boost capacity, targeting five million b/d by 2030. Aiming for energy self-sufficiency, the U.A.E. discovered 80 trillion cubic feet of gas in 2020. Committed to net-zero emissions by 2050, it plans 50% clean energy by 2050. At COP28, the U.A.E. pledged USD 200 million for climate initiatives, reinforcing its sustainability efforts

- The growing energy sector in the U.A.E., Saudi Arabia, Russia, Kazakhstan, and Uzbekistan is driving the need for advanced pipeline corrosion monitoring solutions to ensure infrastructure reliability and sustainability. With rising oil and gas production, proactive corrosion management is essential to prevent leaks, reduce maintenance costs, and enhance operational efficiency. As nations prioritize energy security and regulatory compliance, adopting real-time monitoring technologies will play a crucial role in safeguarding critical assets. This trend underscores the region’s commitment to long-term energy resilience and environmental sustainability

Opportunity

“Expansion Of Cross-Border Pipeline Projects Enhancing Demand for Corrosion Monitoring”

- The expansion of cross-border pipeline projects in the U.A.E., Saudi Arabia, Russia, Kazakhstan, and Uzbekistan is driving infrastructure opportunity and enhancing regional energy connectivity

- As these countries strengthen energy trade, new pipeline developments are facilitating the transportation of oil and gas across borders, supporting economic cooperation and energy security. Strategic investments in cross-border pipelines are increasing capacity and efficiency, enabling seamless energy flow between key markets

- This expansion reflects the region’s commitment to diversifying energy routes, reducing transit dependencies, and ensuring long-term sustainability in the global energy supply chain

For instance,

- In January 2024, the "Pipelines Construction Outlook 2024" graph highlights regional pipeline expansion trends. The Middle East has 6,992 miles of planned or under-construction pipelines, primarily shorter connections to existing networks, with minimal major transmission projects. Key developments include QatarEnergy's USD 30 billion North Field expansion and Iraq’s stalled Basra-Aqaba pipeline. Russia/CIS leads in pipeline length, with 18,220 miles in development, including the Power of Siberia projects to boost gas exports to China and Novatek’s Murmansk LNG pipeline.

- In April 2023, a news report by Palladian Publications Ltd., Inductosense Ltd announced, that it raised over USD 10 million, led by Aramco Ventures. Its WAND technology, featuring wireless, battery-free ultrasonic sensors, enables precise, automated wall thickness monitoring across industries such as oil and gas. After successful trials in six Aramco facilities, the technology is approved for wider use. With expanding energy infrastructure, demand is rising for cost-efficient monitoring solutions to ensure asset integrity and operational safety.

- The increasing development of cross-border pipelines in the Middle East, Russia, Kazakhstan, and Uzbekistan necessitates robust corrosion monitoring solutions. Extreme environmental conditions and regulatory standards are accelerating the adoption of advanced technologies to prevent asset deterioration. As energy exports rise, effective corrosion management will remain vital for ensuring pipeline longevity, operational efficiency, and environmental safety.

Restraint/Challenge

“Geopolitical Instability Affecting Pipeline Projects and Investments”

- Political unrest, regulatory uncertainties, and cross-border conflicts across the U.A.E., Saudi Arabia, Russia, Kazakhstan, and Uzbekistan pose significant restrain to infrastructure development, delaying pipeline projects and maintenance activities.

- In addition, sanctions and trade restrictions can disrupt the supply chain for corrosion monitoring equipment and services. As governments and investors navigate these instabilities, the demand for advanced corrosion monitoring solutions continues to rise, ensuring asset longevity and operational safety in an unpredictable political landscape

For instance,

- In January 2025, Pumps Africa News reported that political unrest, internal disputes, and governmental instability in the Middle East and Africa have severely impacted oil and gas production, posing significant threats to pipelines. Conflicts often stem from economic disagreements over transit terms, expense sharing, and taxation. Despite cross-border pipeline agreements, operators face tax risks, while increasingly complex international regulations add further challenges. In addition, military adversaries, oil smugglers, and armed rebels continue to threaten oil and gas plants and pipeline infrastructure.

- Geopolitical instability continues to hinder pipeline projects and investments, increasing risks for asset integrity and operational efficiency. Despite these challenges, the pipeline corrosion monitoring market remains crucial in mitigating potential failures. Advancements in monitoring technologies will be essential to ensuring pipeline safety, reliability, and long-term sustainability in volatile regions.

Pipeline Corrosion Monitoring Market Scope

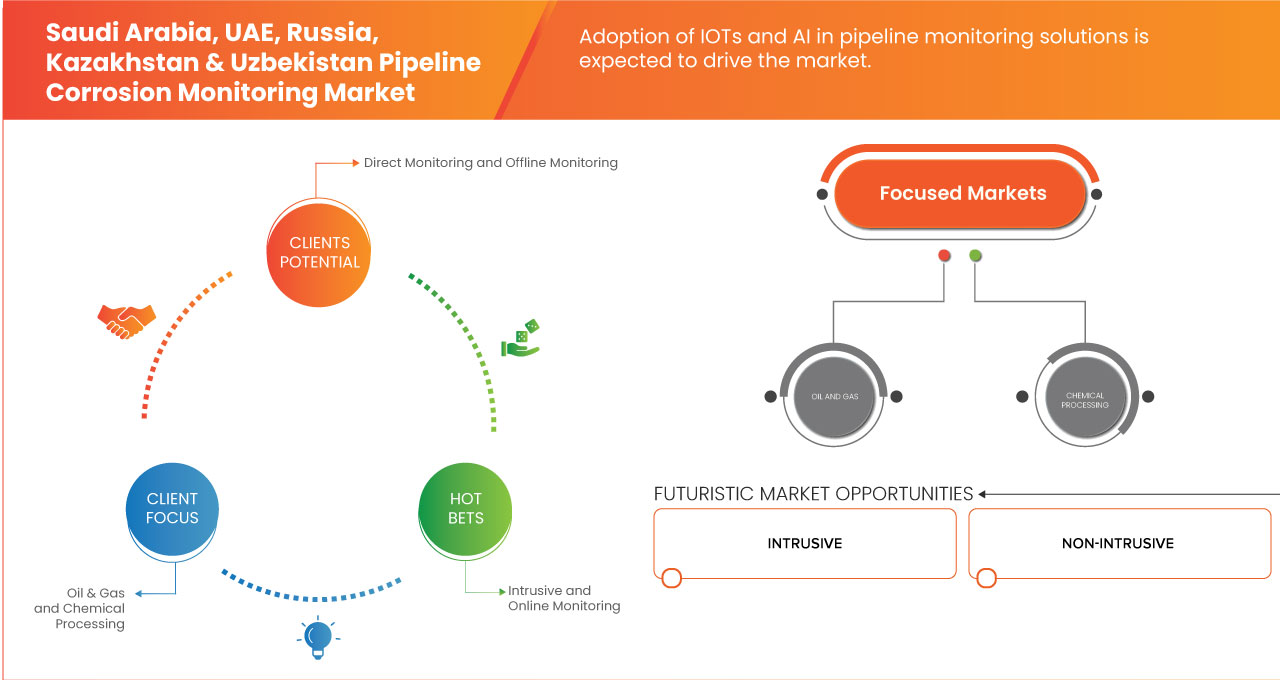

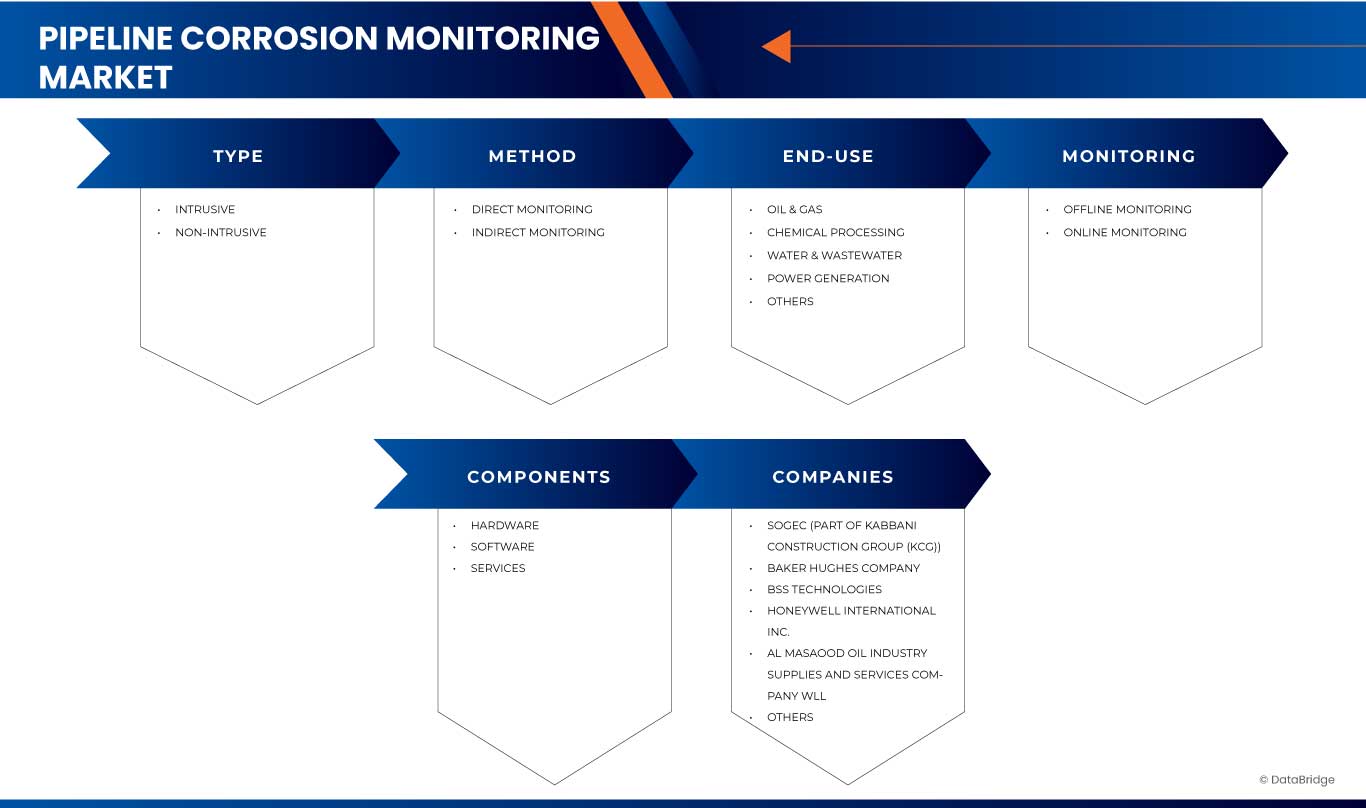

The market is segmented into five notable segments based on the type, method, end-use, monitoring and components as referenced above.

|

Segmentation |

Sub-Segmentation |

|

By Type |

By Type

|

|

By Method |

By Method

|

|

By End Use |

By End-Use

|

|

By Monitoring Technique |

By Monitoring Technique

|

|

By Components |

By Components

|

Pipeline Corrosion Monitoring Market Country Analysis

“Russia is the Dominant Country in the Pipeline Corrosion Monitoring Market”

- Russia has one of the largest and most complex pipeline networks in the world, spanning its vast territory from Siberia to Europe.

- Russia has been producing and transporting oil and gas for over a century. The sheer scale of its operations has led to the development of a highly specialized pipeline industry.

- Russia’s pipelines serve as the main conduit for oil and gas exports to Europe and other parts of the world. Ensuring the integrity of these pipelines is of utmost importance to the Russian government and energy companies, which makes corrosion monitoring a priority.

“Russia is Projected to Register the Highest Growth Rate”

- Russia is projected to register the highest growth rate in the pipeline corrosion monitoring market due to its vast pipeline network and ongoing investments in upgrading infrastructure.

- As one of the largest oil and gas producers, Russia faces constant challenges in maintaining its extensive pipeline systems, especially in harsh climates. This need for more advanced corrosion monitoring solutions is driving demand for new technologies and systems that ensure pipeline integrity and reduce maintenance costs.

- Furthermore, Russia’s focus on expanding its energy exports and improving pipeline safety is fueling market growth.

- The country’s emphasis on adopting cutting-edge technologies, along with government support for energy infrastructure projects.

Pipeline Corrosion Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES (U.A.E)

- Emerson Electric Co. (United States)

- KROHNE Messtechnik GmbH (Germany)

- Monicor (Russia)

- Baker Hughes Company (U.S.)

- Honeywell International Inc. (U.S.)

- SMARTCORR (U.S.)

- Eiwaa Saudi New (France)

- ChemService, Inc. (U.S.)

- Awtada (Saudi Arabia)

- PSS CORPORATION (Russia)

- T.D. Williamson, Inc. (United States)

- SOGEC (Saudi Arabia)

- ROSEN-GROUP (Switzerland)

- Ducorr (U.S.)

- CTS Group Holding SA (Switzerland)

- SensorLink Corporation (Norway)

- BSS Technologies (U.A.E.)

- Al Shoumoukh Group (U.A.E.)

Latest Developments in Saudi Arabia, U.A.E., Russia, Kazakhstan & Uzbekistan Pipeline Corrosion Monitoring Market

- In March 2025, Baker Hughes Company signed a joint technology development agreement with Petrobras to address stress corrosion cracking (SCC-CO2) in flexible pipe systems. The agreement included development, testing, and a purchase option for next-generation flexible pipes with a 30-year service life in high-CO2 environments. The project was conducted at Baker Hughes’ Rio de Janeiro Energy Technology Innovation Center. This collaboration strengthened Baker Hughes' role in Brazil’s offshore market and reinforced its expertise in corrosion-resistant pipeline solutions. The initiative supported Petrobras’ carbon capture goals while enhancing Baker Hughes' presence in sustainable energy technologies.

- In March 2025, Baker Hughes Company launched a joint technology program with Petrobras to address stress corrosion cracking (SCC-CO2) in flexible pipe systems. The agreement included development, testing, and an option to purchase next-generation flexible pipes with a 30-year service life. The project took place at Baker Hughes’ Energy Technology Innovation Center in Rio de Janeiro. This strengthened Baker Hughes' position as a key supplier of corrosion-resistant pipeline solutions. The partnership enhanced its role in Brazil’s offshore market and reinforced its expertise in sustainable energy technologies.

- In January 2025, AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES COMPANY WLL signed an agreement with Sharjah Civil Defence to enhance safety and energy solutions. This partnership reinforced the company's commitment to supporting public safety initiatives. By collaborating with government entities, the company expanded its influence in the energy sector. The agreement also positioned Al Masaood as a key player in providing advanced safety solutions. Strengthening ties with civil defense authorities improved its credibility and market reach. This move aligned with its strategy to contribute to regional energy and safety advancements.

- In March 2025, Emerson Electric Co. launched the Rosemount 625IR Fixed Gas Detector, designed for fast and reliable hydrocarbon gas detection. The detector used advanced dual IR technology to prevent false alarms and maintained factory calibration for life, reducing maintenance needs. It operated in harsh conditions with built-in heaters and protection accessories, ensuring continuous monitoring. Certified for hazardous and marine environments, it offered a five-year proof test interval and SIL2/SIL3 safety ratings. This release strengthened Emerson’s portfolio by enhancing plant safety, minimizing downtime, and lowering operational costs.

- In February 2025, Emerson Electric Co. partnered with Zitara Technologies to enhance battery management in its Ovation automation platform. The collaboration integrated Zitara’s advanced battery monitoring software, improving energy storage management, battery performance, and safety. This upgrade helped utilities optimize battery usage and forecast energy availability. Emerson expanded its energy storage solutions, supporting reliable and sustainable power. The partnership strengthened Emerson’s position in automation and energy storage technology.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SAUDI ARABIA TYPE TIMELINE CURVE

2.8 U.A.E. TYPE TIMELINE CURVE

2.9 RUSSIA TYPE TIMELINE CURVE

2.1 KAZAKHASTAN TYPE TIMELINE CURVE

2.11 UZBEKISTAN TYPE TIMELINE CURVE

2.12 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.13 DBMR MARKET POSITION GRID

2.14 DBMR VENDOR SHARE ANALYSIS

2.15 MARKET END USE COVERAGE GRID

2.16 SECONDARY SOURCES

2.17 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PENETRATION AND GROWTH PROSPECT MAPPING

4.4 COMPETITOR KEY PRICING STRATEGIES

4.5 SAFETY CONCERNS

4.6 ENVIRONMENTAL RISKS

4.7 ECONOMIC IMPACT

4.7.1 SAUDI ARABIA

4.7.2 UNITED ARAB EMIRATES (U.A.E.)

4.7.3 RUSSIA

4.7.4 KAZAKHSTAN

4.7.5 UZBEKISTAN

4.8 TECHNOLOGY ANALYSIS

4.9 KEY STRATEGIC RECOMMENDATIONS

4.1 COMPANY COMPETITIVE ANALYSIS

4.11 FUNDING DETAILS INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

4.12 USED CASES & ITS ANALYSIS

4.13 COST ANALYSIS OF CORROSION CONTROL AND IMPACT

4.14 ORISONIC TECHNOLOGY COMPANY ANALYSIS

4.15 MARKET SHARE ANALYSIS: SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET (2024-2032)

4.16 COMPANY BENCHMARKING: SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET (2024-2032)

4.17 COMPETITIVE STRATEGY & DEVELOPMENT SCENARIO: SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET (2024-2032)

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS

6.1.2 AGING PIPELINES REQUIRING ADVANCED CORROSION MONITORING TECHNOLOGIES

6.1.3 GROWING PETROCHEMICAL AND INDUSTRIAL INVESTMENTS INCREASING PIPELINE NEEDS

6.1.4 ADOPTION OF IOTS AND AI IN PIPELINE MONITORING SOLUTIONS

6.2 RESTRAINTS

6.2.1 GEOPOLITICAL INSTABILITY AFFECTING PIPELINE PROJECTS AND INVESTMENTS

6.2.2 CORROSION-INDUCED CRACKS ACCELERATE PIPELINE FAILURE RISK

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF CROSS-BORDER PIPELINE PROJECTS ENHANCING DEMAND FOR CORROSION MONITORING

6.3.2 EMERGENCE OF HYDROGEN PIPELINE INFRASTRUCTURE REQUIRING SPECIALIZED CORROSION PROTECTION

6.3.3 RISE OF PUBLIC-PRIVATE PARTNERSHIPS (PPP) BOOSTING INVESTMENT IN PIPELINE MAINTENANCE

6.4 CHALLENGES

6.4.1 DIFFICULTIES IN RETROFITTING OLD PIPELINES WITH MODERN TECHNOLOGY

6.4.2 HARSH WEATHER CONDITIONS INTENSIFY PIPELINE CORROSION AND MONITORING DIFFICULTIES

7 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY TYPE

7.1 OVERVIEW

7.2 INTRUSIVE

7.2.1 INTRUSIVE, BY TYPE

7.2.1.1 WEIGHT LOSS COUPONS

7.2.1.2 ELECTRICAL RESISTANCE

7.2.1.3 LINEAR POLARIZATION RESISTANCE

7.3 NON-INTRUSIVE

7.3.1 NON-INTRUSIVE, BY TYPE

7.3.1.1 ULTRASONIC THICKNESS MEASUREMENT

7.3.1.2 RADIOGRAPHIC TESTING

7.3.1.3 OTHERS

8 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY METHOD

8.1 OVERVIEW

8.2 DIRECT MONITORING

8.3 INDIRECT MONITORING

9 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY END USE

9.1 OVERVIEW

9.2 OIL AND GAS

9.2.1 OIL AND GAS, BY OPERATION

9.2.1.1 MIDSTREAM

9.2.1.2 DOWNSTREAM

9.2.1.3 UPSTREAM

9.2.2 OIL AND GAS, BY TYPE

9.2.2.1 INTRUSIVE

9.2.2.2 NON-INTRUSIVE

9.3 CHEMICAL PROCESSING

9.3.1 CHEMICAL PROCESSING, BY TYPE

9.3.1.1 INTRUSIVE

9.3.1.2 NON-INTRUSIVE

9.4 WATER AND WASTE WATER

9.4.1 WATER AND WASTE WATER, BY TYPE

9.4.1.1 INTRUSIVE

9.4.1.2 NON-INTRUSIVE

9.5 POWER GENERATION

9.5.1 POWER GENERATION, BY TYPE

9.5.1.1 INTRUSIVE

9.5.1.2 NON-INTRUSIVE

9.6 OTHERS

9.6.1 OTHERS, BY TYPE

9.6.1.1 INTRUSIVE

9.6.1.2 NON-INTRUSIVE

10 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE

10.1 OVERVIEW

10.2 OFFLINE MONITORING

10.3 ONLINE MONITORING

11 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS

11.1 OVERVIEW

11.2 HARDWARE

11.2.1 HARDWARE, BY TYPE

11.2.1.1 PROBES

11.2.1.2 SENSORS

11.2.1.3 DATA LOGGERS

11.3 SOFTWARE

11.4 SERVICES

11.4.1 SERVICES, BY TYPE

11.4.1.1 INSPECTION SERVICES

11.4.1.2 MAINTENANCE SERVICES

11.4.1.3 CONSULTING SERVICES

12 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: RUSSIA

12.2 COMPANY SHARE ANALYSIS: SAUDI ARABIA

12.3 COMPANY SHARE ANALYSIS: U.A.E.

12.4 COMPANY SHARE ANALYSIS: KAZAKHSTAN

12.5 COMPANY SHARE ANALYSIS: UZBEKISTAN

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 SOGEC (PART OF KABBANI CONSTRUCTION GROUP (KCG))

14.1.1 COMPANY SNAPSHOT

14.1.2 SERVICE PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.1.4 SWOT

14.1.5 GROWTH STRATEGY

14.2 BAKER HUGHES COMPANY

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SERVICE PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.2.5 SWOT

14.2.6 GROWTH STRATEGY

14.3 BSS TECHNOLOGIES

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.3.4 SWOT ANALYSIS

14.3.5 GROWTH STRATEGY

14.4 HONEYWELL INTERNATIONAL INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.4.5 SWOT ANALYSIS

14.4.6 GROWTH STRATEGY

14.5 AL MASAOOD OIL INDUSTRY SUPPLIES AND SERVICES COMPANY WLL

14.5.1 COMPANY SNAPSHOT

14.5.2 SERVICE PORTFOLIO

14.5.3 RECENT DEVELOPMENTS/NEWS

14.5.4 SWOT

14.5.5 GROWTH STRATEGY

14.6 AWTADA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS/NEWS

14.6.4 SWOT

14.6.5 GROWTH STRATEGY

14.7 AL SHOUMOUKH GROUP

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.7.4 SWOT

14.7.5 GROWTH STRATEGY

14.8 CHEMSERVICE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.8.4 SWOT

14.8.5 GROWTH STRATEGY

14.9 CTS GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS/NEWS

14.9.4 SWOT

14.9.5 GROWTH STRATEGY

14.1 DUCORR

14.10.1 COMPANY SNAPSHOT

14.10.2 SOLUTION PORTFOLIO

14.10.3 RECENT DEVELOPMENTS/NEWS

14.10.4 SWOT

14.10.5 GROWTH STRATEGY

14.11 EIWAA SAUDI NEW

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.11.4 SWOT

14.11.5 GROWTH STRATEGY

14.12 EMERSON ELECTRIC CO.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.12.5 SWOT

14.12.6 GROWTH STRATEGY

14.13 KROHNE GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS/NEWS

14.13.4 SWOT

14.13.5 GROWTH STRATEGY

14.14 MONICOR

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS/NEWS

14.14.4 SWOT

14.14.5 GROWTH STRATEGY

14.15 PSS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.15.4 SWOT

14.15.5 GROWTH STRATEGY

14.16 ROSEN GROUP (A PART OF PARTNERS GROUP)

14.16.1 COMPANY SNAPSHOT

14.16.2 BUSINESS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS/NEWS

14.16.4 SWOT

14.16.5 GROWTH STRATEGY

14.17 SENSORLINK AS

14.17.1 COMPANY SNAPSHOT

14.17.2 SOLUTION PORTFOLIO

14.17.3 RECENT DEVELOPMENTS/NEWS

14.17.4 SWOT

14.17.5 GROWTH STRATEGY

14.18 SMARTCORR

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS/NEWS

14.18.4 SWOT

14.18.5 GROWTH STRATEGY

14.19 T.D. WILLIAMSON, INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SOLUTION PORTFOLIO

14.19.3 RECENT DEVELOPMENTS/NEWS

14.19.4 SWOT

14.19.5 GROWTH STRATEGY

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 PENETRATION AND GROWTH PROSPECT MAPPING

TABLE 2 PRICING STRATEGIES

TABLE 3 TECHNOLOGY MATRIX

TABLE 4 COMPARATIVE ANALYSIS

TABLE 5 FUNDING DETAILS

TABLE 6 COST ANALYSIS OF CORROSION

TABLE 7 MARKET SIZE AND GROWTH PROJECTIONS (USD MILLION)

TABLE 8 COMPANY BENCHMARKING

TABLE 9 COMPETITIVE PRICING ANALYSIS

TABLE 10 RUSSIA PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.A.E. PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 RUSSIA INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 SAUDI ARABIA INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.A.E. INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 KAZAKHSTAN INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 UZBEKISTAN INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 RUSSIA NON-INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 SAUDI ARABIA NON-INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.A.E. NON-INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 KAZAKHSTAN NON-INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 UZBEKISTAN NON-INTRUSIVE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 RUSSIA PIPELINE CORROSION MONITORING MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 27 U.A.E. PIPELINE CORROSION MONITORING MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 28 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 29 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 30 RUSSIA PIPELINE CORROSION MONITORING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 31 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 32 U.A.E. PIPELINE CORROSION MONITORING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 33 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 34 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 35 RUSSIA OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 36 SAUDI ARABIA OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 37 U.A.E. OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 38 KAZAKHSTAN OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 39 UZBEKISTAN OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 40 RUSSIA OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 SAUDI ARABIA OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 U.A.E. OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 KAZAKHSTAN OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 UZBEKISTAN OIL AND GAS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 RUSSIA CHEMICAL PROCESSING IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 SAUDI ARABIA CHEMICAL PROCESSING IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.A.E. CHEMICAL PROCESSING IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 KAZAKHSTAN CHEMICAL PROCESSING IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 UZBEKISTAN CHEMICAL PROCESSING IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 RUSSIA WATER AND WASTE WATER IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SAUDI ARABIA WATER AND WASTE WATER IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.A.E. WATER AND WASTE WATER IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 KAZAKHSTAN WATER AND WASTE WATER IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 UZBEKISTAN WATER AND WASTE WATER IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 RUSSIA POWER GENERATION IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA POWER GENERATION IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.A.E. POWER GENERATION IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 KAZAKHSTAN POWER GENERATION IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 UZBEKISTAN POWER GENERATION IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 RUSSIA OTHERS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA OTHERS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.A.E. OTHERS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 KAZAKHSTAN OTHERS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 UZBEKISTAN OTHERS IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 RUSSIA PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 67 U.A.E. PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 68 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 69 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY MONITORING TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 70 RUSSIA PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E. PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 73 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 74 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 75 RUSSIA HARDWARE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA HARDWARE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E. HARDWARE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 KAZAKHSTAN HARDWARE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 UZBEKISTAN HARDWARE IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 RUSSIA SERVICES IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA SERVICES IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.A.E. SERVICES IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 KAZAKHSTAN SERVICES IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 UZBEKISTAN SERVICES IN PIPELINE CORROSION MONITORING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET

FIGURE 2 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.A.E. PIPELINE CORROSION MONITORING MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 6 RUSSIA PIPELINE CORROSION MONITORING MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 7 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 8 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 9 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 10 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: MULTIVARIATE MODELLING

FIGURE 11 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 12 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: DBMR MARKET POSITION GRID

FIGURE 13 U.A.E. PIPELINE CORROSION MONITORING MARKET: DBMR MARKET POSITION GRID

FIGURE 14 RUSSIA PIPELINE CORROSION MONITORING MARKET: DBMR MARKET POSITION GRID

FIGURE 15 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: DBMR MARKET POSITION GRID

FIGURE 16 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: DBMR MARKET POSITION GRID

FIGURE 17 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 18 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: END USE COVERAGE GRID

FIGURE 19 U.A.E. PIPELINE CORROSION MONITORING MARKET: END USE COVERAGE GRID

FIGURE 20 RUSSIA PIPELINE CORROSION MONITORING MARKET: END USE COVERAGE GRID

FIGURE 21 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: END USE COVERAGE GRID

FIGURE 22 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: APPLICATION COVERAGE GRID

FIGURE 23 SAUDI ARABIA, U.A.E., RUSSIA, KAZAKHSTAN, & UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: SEGMENTATION

FIGURE 24 TWO SEGMENTS COMPRISE THE SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET, BY TYPE (2024)

FIGURE 25 TWO SEGMENTS COMPRISE THE U.A.E. PIPELINE CORROSION MONITORING MARKET, BY TYPE (2024)

FIGURE 26 TWO SEGMENTS COMPRISE THE RUSSIA PIPELINE CORROSION MONITORING MARKET, BY TYPE (2024)

FIGURE 27 TWO SEGMENTS COMPRISE THE KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET, BY TYPE (2024)

FIGURE 28 TWO SEGMENTS COMPRISE THE UZBEKISTAN PIPELINE CORROSION MONITORING MARKET, BY TYPE (2024)

FIGURE 29 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET

FIGURE 30 U.A.E. PIPELINE CORROSION MONITORING MARKET

FIGURE 31 RUSSIA PIPELINE CORROSION MONITORING MARKET

FIGURE 32 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET

FIGURE 33 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET

FIGURE 34 STRATEGIC DECISIONS

FIGURE 35 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS IS EXPECTED TO DRIVE THE SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET IN THE FORECAST PERIOD

FIGURE 36 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS IS EXPECTED TO DRIVE THE U.A.E. PIPELINE CORROSION MONITORING MARKET IN THE FORECAST PERIOD

FIGURE 37 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS IS EXPECTED TO DRIVE THE RUSSIA PIPELINE CORROSION MONITORING MARKET IN THE FORECAST PERIOD

FIGURE 38 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS IS EXPECTED TO DRIVE THE KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET IN THE FORECAST PERIOD

FIGURE 39 RISING ENERGY DEVELOPMENT DRIVING DEMAND FOR PIPELINE CORROSION MONITORING SOLUTIONS IS EXPECTED TO DRIVE THE UZBEKISTAN PIPELINE CORROSION MONITORING MARKET IN THE FORECAST PERIOD

FIGURE 40 THE INTRUSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET IN 2025 AND 2032

FIGURE 41 THE INTRUSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.A.E. PIPELINE CORROSION MONITORING MARKET IN 2025 AND 2032

FIGURE 42 THE INTRUSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE RUSSIA PIPELINE CORROSION MONITORING MARKET IN 2025 AND 2032

FIGURE 43 THE INTRUSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET IN 2025 AND 2032

FIGURE 44 THE INTRUSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE UZBEKISTAN PIPELINE CORROSION MONITORING MARKET IN 2025 AND 2032

FIGURE 45 SAFETY CONCERNS PHASES

FIGURE 46 IMPACT OF OIL AND GAS SECTOR CONTRIBUTION TO GDP (%)

FIGURE 47 INVESTMENT TRENDS IN PIPELINE CORROSION MONITORING MARKET (2017-2024) IN (MILLIONS)

FIGURE 48 DROC ANALYSIS

FIGURE 49 NATURAL GAS PRODUCTION FOR MIDDLE EAST COUNTRIES IN 2019, WITH A FORECAST FOR 2050

FIGURE 50 MIDDLE EAST OIL AND GAS PROJECTS IN KEY COUNTRIES BETWEEN 2023 AND 2027

FIGURE 51 TOTAL ENERGY SUPPLY, KAZAKHSTAN, 2022

FIGURE 52 PETROCHEMICAL PROJECTS IN THE MIDDLE EAST BETWEEN 2022 AND 2026

FIGURE 53 FAILURE CASE STATISTICS OF SMALL-DIAMETER PIPES

FIGURE 54 PIPELINES CONSTRUCTION OUTLOOK 2024

FIGURE 55 RUSSIA PIPELINE CORROSION MONITORING MARKET: BY TYPE, 2024

FIGURE 56 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: BY TYPE, 2024

FIGURE 57 U.A.E. PIPELINE CORROSION MONITORING MARKET: BY TYPE, 2024

FIGURE 58 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: BY TYPE, 2024

FIGURE 59 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: BY TYPE, 2024

FIGURE 60 RUSSIA PIPELINE CORROSION MONITORING MARKET: BY METHOD, 2024

FIGURE 61 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: BY METHOD, 2024

FIGURE 62 U.A.E. PIPELINE CORROSION MONITORING MARKET: BY METHOD, 2024

FIGURE 63 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: BY METHOD, 2024

FIGURE 64 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: BY METHOD, 2024

FIGURE 65 RUSSIA PIPELINE CORROSION MONITORING MARKET: BY END USE, 2024

FIGURE 66 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: BY END USE, 2024

FIGURE 67 U.A.E. PIPELINE CORROSION MONITORING MARKET: BY END USE, 2024

FIGURE 68 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: BY END USE, 2024

FIGURE 69 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: BY END USE, 2024

FIGURE 70 RUSSIA PIPELINE CORROSION MONITORING MARKET: BY MONITORING TECHNIQUE, 2024

FIGURE 71 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: BY MONITORING TECHNIQUE, 2024

FIGURE 72 U.A.E. PIPELINE CORROSION MONITORING MARKET: BY MONITORING TECHNIQUE, 2024

FIGURE 73 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: BY MONITORING TECHNIQUE, 2024

FIGURE 74 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: BY MONITORING TECHNIQUE, 2024

FIGURE 75 RUSSIA PIPELINE CORROSION MONITORING MARKET: BY COMPONENTS, 2024

FIGURE 76 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: BY COMPONENTS, 2024

FIGURE 77 U.A.E. PIPELINE CORROSION MONITORING MARKET: BY COMPONENTS, 2024

FIGURE 78 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: BY COMPONENTS, 2024

FIGURE 79 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: BY COMPONENTS, 2024

FIGURE 80 RUSSIA PIPELINE CORROSION MONITORING MARKET: COMPANY SHARE 2024 (%)

FIGURE 81 SAUDI ARABIA PIPELINE CORROSION MONITORING MARKET: COMPANY SHARE 2024 (%)

FIGURE 82 U.A.E. PIPELINE CORROSION MONITORING MARKET: COMPANY SHARE 2024 (%)

FIGURE 83 KAZAKHSTAN PIPELINE CORROSION MONITORING MARKET: COMPANY SHARE 2024 (%)

FIGURE 84 UZBEKISTAN PIPELINE CORROSION MONITORING MARKET: COMPANY SHARE 2024 (%)

Saudi Arabia Uae Russia Kazakhstan And Uzbekistan Pipeline Corrosion Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Saudi Arabia Uae Russia Kazakhstan And Uzbekistan Pipeline Corrosion Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Saudi Arabia Uae Russia Kazakhstan And Uzbekistan Pipeline Corrosion Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.