Global Battery Additives Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.96 Billion

USD

4.01 Billion

2024

2032

USD

1.96 Billion

USD

4.01 Billion

2024

2032

| 2025 –2032 | |

| USD 1.96 Billion | |

| USD 4.01 Billion | |

|

|

|

|

Global Battery Additives Market Segmentation, By Type (Conductive Additive, Porous Additive, Nucleating Additive, Sulfur-Containing Additives, Electrolyte Additives, Ionic Liquid Additives, and Boron-Containing Additives), Application (Lithium-Ion Battery, Lead Acid Battery, and Others), End- User (Electronics, Automotive, and Others) - Industry Trends and Forecast to 2032

Battery Additives Market Size

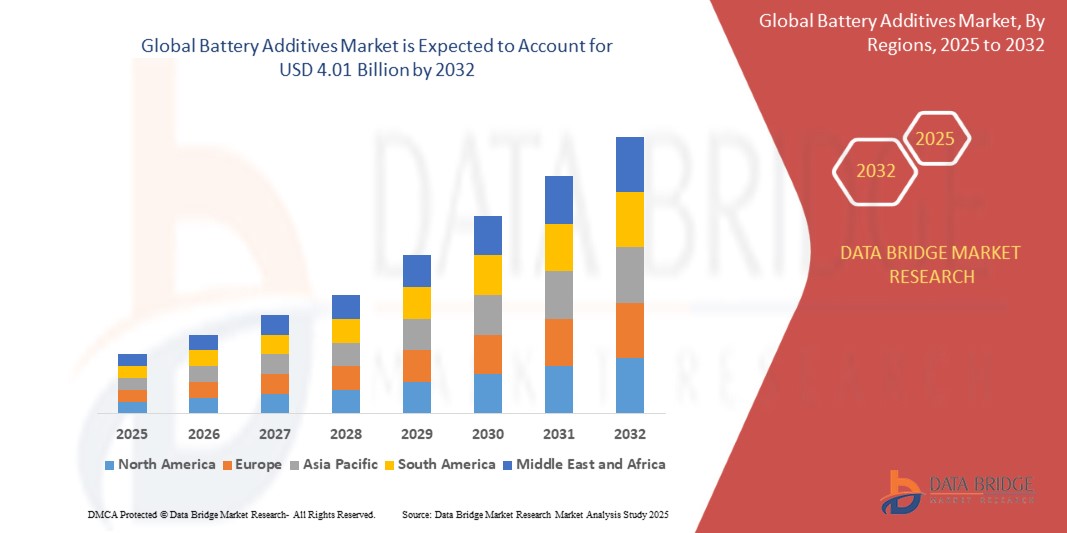

- The global battery additives market was valued atUSD 1.96 billion in 2024and is expected to reachUSD 4.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 9.33%,primarily driven by rising demand forelectric vehicles(EVs)

- This growth is driven by the growing renewable energy sector and increasing the need for battery additives that improve conductivity, stability, andthermal management

Battery Additives Market Analysis

- Battery Additives have gained widespread acceptance due to their ability to enhance conductivity, stability, and thermal management, driving demand in electric vehicles (EVs), renewable energy storage, and portable electronics. Their proven capability to extend battery lifespan, improve charge retention, and optimize performance has solidified their role in modern energy storage solutions

- The market is primarily driven by the rising adoption of EVs, increasing energy storage needs, and stringent environmental regulations. In addition, advancements innanotechnology, electrolyte additives, and lithium-ion battery innovations are further accelerating market growth

- Asia-Pacific dominatesthebattery additives market due to its strong battery manufacturing base, expanding EV production, and growing focus on sustainable energy solutions

- For instance, in China and India, demand for advanced battery additives has surged due to increasing EV sales, government incentives, and investments in high-performance energy storage systems

- Globally, Battery Additives remain critical for next-generation battery technologies, with innovations such as solid-state electrolytes,graphene-based materials, and bio-derived additives driving industry transformation and ensuring long-term market sustainability

Report Scope and Battery Additives Market Segmentation

|

Attributes |

Battery Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Battery Additives Market Trends

“Rising Integration of Battery Additives in Sustainable Energy Storage”

- The growing focus on sustainability is driving demand for battery additives, widely recognized for their role in enhancing battery efficiency, longevity, and thermal stability

- Manufacturers are expanding the use ofhigh-performance additives in lithium-ion batteries (Li-ion), solid-state batteries, and energy storage systems to optimize charge retention and durability while reducing environmental impact

- The increasing adoption of graphene-based materials and bio-derived additives is accelerating the shift towards eco-friendly battery production, aligning with stringent government regulations on energy storage and emissions

For instance,

- In February 2024, Teslaintegrated next-generation electrolyte additives in its latest EV batteries, improving charging speed and thermal performance

- In October 2023, Panasoniclaunched a new high-performance lithium-ion battery, utilizing advanced conductive additives for better energy density and lifespan

- In July 2023, LG Energy Solutionpartnered with key automakers to develop sustainable battery materials, ensuring higher efficiency and reduced carbon footprint

- As the energy storage industry continues to prioritize sustainability, Battery Additives will play a crucial role in next-generation battery innovation, driving efficiency, durability, and compliance with global environmental standards

Battery Additives Market Dynamics

Driver

“Growing Demand for High-Performance Battery Additives”

- Enhancing battery efficiency, lifespan, and thermal stability has become a priority for electric vehicles (EVs), energy storage systems, and consumer electronics, driving the adoption of advanced Battery Additives

- Manufacturers are incorporatinghigh-performance electrolyte additives, conductive agents, and stabilizers to improve charge retention, cycling performance, and overall safety in next-generation battery technologies

- The rising penetration of EVs and renewable energy storage solutions further accelerates the need for optimized battery formulations, ensuring higher energy density and long-term reliability

For instance,

- In March 2024, Teslaintroduced next-gen electrolyte additives in its new EV battery lineup, improving thermal stability and charging efficiency

- In November 2023, Panasonicpartnered withLG Energy Solutionto develop high-performance lithium-ion batteries, integrating advanced conductive additives for better energy retention

- In August 2023,Samsung SDIannounced the use of graphene-based battery additives in its latest solid-state battery, enhancing durability and power output

- With the growing adoption of EVs and grid-scale energy storage, the demand for Battery Additives will continue to rise, driving innovation in battery chemistry and sustainable energy solutions

Opportunity

“Expansion of Bio-Based and Recyclable Battery Additives”

- Growing environmental concerns and stringent government regulations are creating opportunities for bio-based and recyclable Battery Additives, reducing reliance on synthetic and fossil fuel-derived materials

- Battery manufacturersare investing insustainable additivesto improvebattery longevity, recyclability, and overall eco-friendliness, aligning withcarbon neutrality goalsand global sustainability efforts

- The increasing adoption of circular economy principles in battery production is driving demand for recycled and biodegradable additives, minimizing waste generation and reducing manufacturing costs

For instance,

- In January 2024, Teslalaunched a new initiative to incorporate recycled electrolyte additives into its next-generation EV batteries, supporting its sustainability strategy

- In September 2023, Panasonicpartnered with biopolymer manufacturers to integrate plant-based conductive additives into its upcoming solid-state battery models

- In June 2023, LG Energy Solutioncommitted to using at least 50% recycled battery additives in its next-gen lithium-ion batteries, reducing environmental impact

- As the energy storage industry accelerates its shift towards eco-friendly materials, bio-based and recyclable Battery Additives will unlock new growth avenues, enhancing sustainability, innovation, and regulatory compliance

Restraint/Challenge

“Supply Chain Disruptions in Battery Additives”

- Global supply chain constraints, including raw material shortages, geopolitical tensions, and transportation delays, are significantly impacting the availability and pricing of battery additives

- Battery manufacturersare struggling withfluctuating costsofkey materialssuch asconductive agents, electrolyte additives, and stabilizers, leading toproduction slowdowns and higher operational expenses

- The rising dependence on specific regions for critical battery components has heightened market vulnerabilities, pushing companies to explore alternative sourcing strategies and localized manufacturing

For instance,

- In February 2024, LG Energy Solutionreported delays in securing lithium-based additives, affecting its battery production timelines and increasing manufacturing costs

- Mitigating supply chain risks will be essential for the battery additives industry, ensuring stable material availability, reducing cost fluctuations, and supporting the scalability of next-generation energy storage solutions

Battery Additives Market Scope

The market is segmented on the basis of type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-User |

|

Battery Additives Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Battery Additives Market”

- Asia-Pacific leadsthe global battery additives market, driven by rapid industrialization, increasing automobile production, and strong demand for lightweight materials

- ChinaandIndia dominatethe region due to their expanding automotive manufacturing, rising vehicle sales, and strong government incentives for fuel efficiency

- Advancements in polymer technology, increasing adoption of electric vehicles (EVs), and rising consumer preference for sustainable materials have further accelerated market growth

- In addition, the presence of major automotive suppliers, expanding OEM production, and growing investments in research & development contribute to the region’s market leadership

“Europe is projected to register the Highest Growth Rate”

- Europeis expected to witness thehighest growth ratein the battery additives market, driven by rapid urbanization, increasing vehicle production, and growing demand for lightweight components

- GermanyandFranceare emerging as key markets due to strong automotive manufacturing, supportive government policies, and rising investments in electric mobility

- Germany leadsthe region in Battery Additives production, with advanced polymer processing technologies and increasing adoption of sustainable materials for vehicle components

- Franceis experiencingstrong market growthdue to rising automobile exports, expanding EV infrastructure, and growing consumer preference for fuel-efficient vehicles

- Stringent emission regulations, increasing R&D in bioplastics, and strategic collaborations between automotive OEMs further contribute to Europe’s market expansion

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cabot Corporation (U.S.)

- The Hammond Group (U.S.)

- Orion S.A. (Luxembourg)

- Imerys S.A. (France)

- 3M (U.S.)

- Altana AG (Germany)

- Borregaard AS (Norway)

- HOPAX (Taiwan)

- PENOX S.A. (Germany)

- SGL Carbon (Germany)

- Vibrantz (U.S.)

- Re-Tron Technologies (U.S.)

- MSC Industrial Direct Co., Inc. (U.S.)

- Atomized Products Group, Inc. (U.S.)

- Tableting Pro LLC. (U.S.)

- Fastenal Company (U.S.)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- Total Battery (Canada)

- US Research Nanomaterials, Inc. (U.S.)

Latest Developments in Global Battery Additives Market

- In March 2025, EOS Energya U.S.-based start-up, introduced its latest Z3 battery, designed for 3-to-12-hour discharge durations, featuring a zinc hybrid cathode for enhanced performance

- In November 2024, Graphene Manufacturing Group LtdunveiledSUPER G, a graphene slurry engineered to improve lithium-ion battery performance, boosting efficiency, power, and longevity

- In May 2022, Orion Engineered Carbonsexpanded its credit facility by 108 million USD, increasing its senior secured revolving facility to 379 million USD

- In May 2022, Univar Solutions Inc.was appointed as the exclusive distributor of Cobalt Corporation’s specialty carbon black products, catering to the Brazilian plastics and battery industries

- In November 2021, Cabot Corporationfinalized an agreement to sell its Purification Solutions business, a global leader in high-performance activated carbon used in environmental, health, safety, and industrial applications

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.