Global Battery As A Service Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

750.00 Million

USD

5,218.04 Million

2024

2032

USD

750.00 Million

USD

5,218.04 Million

2024

2032

| 2025 –2032 | |

| USD 750.00 Million | |

| USD 5,218.04 Million | |

|

|

|

|

Global Battery as a Service Market Segmentation, By Service Type (Subscription Model and Pay-Per-Use Model), Energy Storage Capacity (Less than 50 kWh, 50-100 kWh, and Over 100 kWh), Applications (Energy Storage, Automotive and Transport, Industrial Applications, and Others), End-User (Automotive, Telecommunications, Energy & Utilities, Residential, Commercial & Industrial, and Others) - Industry Trends and Forecast to 2032

What is the Global Battery as a Service Market Size and Growth Rate?

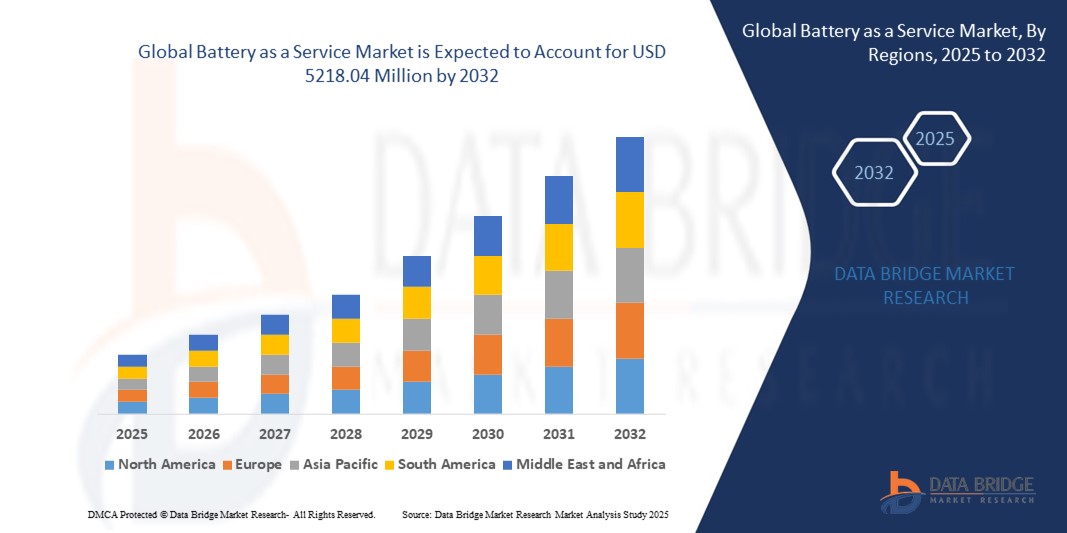

- The global battery as a service market size was valued at USD 750 million in 2024 and is expected to reach USD 5218.04 million by 2032, at a CAGR of 27.44% during the forecast period

- Growth is primarily driven by the rising adoption of electric vehicles (EVs) and the need to overcome high upfront battery costs, making BaaS an attractive model for both consumers and fleet operators

- In addition, advancements in battery-swapping infrastructure, strategic partnerships between automakers and energy providers, and supportive government incentives are accelerating large-scale adoption of BaaS solutions worldwide, significantly propelling industry expansion

What are the Major Takeaways of Battery as a Service Market?

- Battery as a Service solutions allow EV owners to lease batteries separately from vehicles, enabling lower upfront purchase costs, faster battery swaps, and improved energy efficiency management

- The demand for BaaS is mainly fueled by the rising penetration of EVs, the push for sustainable energy solutions, and the need for flexible ownership models that reduce consumer burden

- With increasing investments in swapping station networks, growing collaborations across automotive and energy sectors, and consumer demand for cost-effective EV ownership, BaaS is emerging as a transformative model in the global EV ecosystem

- Asia-Pacific dominated the battery as a service market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, growing adoption of electric vehicles, and supportive government initiatives encouraging battery swapping infrastructure

- The North America battery as a service market is projected to grow at the fastest CAGR of 10.6% from 2025 to 2032, driven by accelerating EV adoption, rising environmental awareness, and strong investments in charging and swapping infrastructure

- The subscription model segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its predictable cost structure and convenience for both individual EV owners and fleet operators

Report Scope and Battery as a Service Market Segmentation

|

Attributes |

Battery as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Battery as a Service Market?

Integration of IoT and AI for Smart Energy Management

- A major trend shaping the global battery as a service (BaaS) market is the integration of artificial intelligence (AI) and Internet of Things (IoT) platforms to optimize energy usage, monitor battery performance, and extend lifecycle efficiency. This trend is driving greater adoption among electric vehicle (EV) users and energy storage operators

- For instance, companies such as NIO and Gogoro have embedded AI-powered predictive analytics in their battery swapping networks to assess user behavior, charging cycles, and grid demand, enabling smarter energy distribution and cost efficiency

- AI-based solutions allow service providers to predict maintenance needs, prevent sudden breakdowns, and offer real-time insights into battery health, while IoT connectivity enables remote monitoring and seamless integration with EV fleets

- This shift toward intelligent, connected BaaS platforms is redefining user expectations by offering convenience, cost transparency, and reliability

- Companies are increasingly investing in smart, AI-enabled BaaS solutions to strengthen user trust, improve operational efficiency, and support the broader shift toward electrification

- The growing demand for predictive, AI-driven, and IoT-integrated BaaS models is expected to accelerate adoption across EV and renewable energy applications in the coming years

What are the Key Drivers of Battery as a Service Market?

- The rising adoption of electric vehicles (EVs), coupled with government incentives promoting green mobility, is a primary driver of the Battery as a Service market

- For instance, in 2024, Gogoro partnered with Enel X to expand its battery swapping infrastructure in Europe, aiming to accelerate EV adoption through scalable and cost-efficient solutions

- The high upfront cost of EV batteries makes BaaS an attractive option by lowering initial purchase prices and shifting to a subscription-based ownership model. This affordability factor is a key enabler for both individual consumers and fleet operators

- Growing urbanization and demand for sustainable public and commercial transportation are further boosting adoption of BaaS, as it ensures reduced downtime and easy battery replacement

- The convenience of battery swapping, predictable subscription costs, and support for energy storage integration are all propelling the market forward

- In addition, the rising focus on circular economy models and recycling of used batteries is reinforcing the sustainability appeal of Battery as a Service solutions

Which Factor is Challenging the Growth of the Battery as a Service Market?

- High infrastructure costs associated with establishing large-scale battery swapping stations and service networks remain a major barrier to market expansion

- For instance, several EV startups in Southeast Asia have struggled to expand swapping networks due to high capital expenditure requirements, limiting adoption beyond urban centers

- Concerns around battery standardization across different EV manufacturers pose another challenge, as the lack of interoperability restricts scalability and discourages cross-brand adoption

- Consumer skepticism regarding the reliability and availability of swap stations, especially in less-developed regions, adds to adoption hurdles

- In addition, fluctuations in raw material prices for lithium, nickel, and cobalt increase operational costs, making service pricing less stable

- Overcoming these challenges will require greater collaboration among EV manufacturers, governments, and energy providers to build standardized platforms, expand infrastructure, and ensure long-term affordability

How is the Battery as a Service Market Segmented?

The market is segmented on the basis of service type, energy storage capacity, applications, and end-user.

- By Service Type

On the basis of service type, the battery as a service market is segmented into subscription model and pay-per-use model. The subscription model segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its predictable cost structure and convenience for both individual EV owners and fleet operators. Subscriptions allow customers to swap or upgrade batteries as required, ensuring flexibility while reducing the burden of high upfront ownership costs. The rising popularity of EV leasing programs and government-backed subscription pilots further support this model’s dominance.

The pay-per-use model is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032, as it offers cost-effectiveness for users who prefer on-demand services without long-term commitments. This model is gaining traction in shared mobility services, ride-hailing fleets, and regions with limited but expanding infrastructure. Its appeal lies in affordability, scalability, and suitability for emerging markets.

- By Energy Storage Capacity

On the basis of energy storage capacity, the battery as a service market is segmented into less than 50 kWh, 50–100 kWh, and over 100 kWh. The 50–100 kWh segment accounted for the largest revenue share of 48.7% in 2024, primarily due to its suitability for mainstream electric cars, two-wheelers, and light commercial vehicles. This capacity range offers a balance between range, cost efficiency, and charging/swapping convenience, making it the most widely adopted by both consumers and fleet operators.

The over 100 kWh segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, fueled by rising adoption in heavy-duty trucks, buses, and long-range electric vehicles. With commercial logistics and intercity transport increasingly shifting toward electrification, higher-capacity battery services are in demand to meet endurance and operational efficiency requirements. Growing investment in high-capacity battery swapping stations will further accelerate this segment.

- By Applications

On the basis of applications, the battery as a service market is segmented into energy storage, automotive & transport, industrial applications, and others. The automotive & transport segment dominated with the largest revenue share of 55.2% in 2024, driven by the surge in electric vehicle adoption, particularly in urban mobility, public transportation, and delivery services. BaaS addresses consumer concerns about high battery costs and charging delays, making it an attractive solution for the automotive sector.

The energy storage segment is projected to witness the fastest CAGR of 21.8% from 2025 to 2032, supported by its role in balancing renewable energy integration and providing grid stability. Utility providers and energy companies are increasingly adopting BaaS models to deploy modular storage units, offering flexibility and cost savings. This trend is closely linked with the global push toward clean energy and decentralized power generation.

- By End-User

On the basis of end-user, the battery as a service market is segmented into automotive, telecommunications, energy & utilities, residential, commercial & industrial, and others. The automotive segment accounted for the largest market revenue share of 58.6% in 2024, fueled by the rising penetration of EVs and the preference for cost-saving, subscription-based battery ownership. EV manufacturers and mobility service providers increasingly partner with BaaS operators to enhance user convenience and accelerate adoption.

The telecommunications segment is expected to grow at the fastest CAGR of 22.9% from 2025 to 2032, as telecom companies adopt BaaS for backup power solutions in 5G towers and data centers. The need for reliable, uninterrupted power to maintain high-speed network connectivity is driving demand in this sector. Partnerships between telecom operators and energy service providers are such asly to expand this application further.

Which Region Holds the Largest Share of the Battery as a Service Market?

- Asia-Pacific dominated the battery as a service market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, growing adoption of electric vehicles, and supportive government initiatives encouraging battery swapping infrastructure. Countries such as China, Japan, and India are spearheading the expansion of BaaS due to their strong manufacturing ecosystems, expanding EV fleets, and focus on sustainable energy solutions

- Consumers in the region are drawn to the cost-efficiency, flexibility, and reduced charging downtime offered by Battery as a Service models, particularly in densely populated urban areas where EV penetration is rising sharply

- Favorable policies, local innovation in EV technologies, and the dominance of regional players have positioned Asia-Pacific as the global hub for BaaS adoption, shaping it into the largest and most influential market for the industry

China Battery as a Service Market Insight

The China battery as a service market captured the largest revenue share of 68% in Asia-Pacific in 2024, fueled by its vast EV user base, strong government backing, and large-scale rollout of battery-swapping stations. Affordable subscription models and the presence of domestic giants such as NIO and CATL are accelerating adoption. The country’s smart city initiatives and preference for shared mobility services further drive market expansion.

Japan Battery as a Service Market Insight

The Japan battery as a service market is anticipated to grow at a significant CAGR during the forecast period, driven by the nation’s advanced technology infrastructure and growing EV penetration. Japan’s aging population and emphasis on reliability, safety, and convenience are fueling demand for seamless battery-swapping solutions. Integration of BaaS with connected devices and smart mobility services is also enhancing adoption across both residential and commercial sectors.

India Battery as a Service Market Insight

The India battery as a service market is witnessing robust growth, supported by rising urbanization, government subsidies for EV adoption, and the booming two-wheeler and three-wheeler EV segment. Startups and local manufacturers are investing in low-cost, scalable battery-swapping networks to cater to the growing demand for affordable mobility. Increasing focus on reducing vehicular emissions and enhancing last-mile connectivity is expected to further strengthen BaaS adoption.

Which Region is the Fastest Growing Region in the Battery as a Service Market?

The North America battery as a service market is projected to grow at the fastest CAGR of 10.6% from 2025 to 2032, driven by accelerating EV adoption, rising environmental awareness, and strong investments in charging and swapping infrastructure. Consumers in the U.S. and Canada are increasingly prioritizing cost-effective energy solutions, while fleet operators benefit from reduced downtime and predictable subscription-based ownership models.

U.S. Battery as a Service Market Insight

The U.S. market accounted for nearly 79% of North America’s revenue share in 2024, propelled by high EV penetration, strong consumer preference for subscription services, and growing collaborations between automakers and energy providers. Federal initiatives supporting EV infrastructure, combined with the widespread adoption of connected technologies, are positioning the U.S. as the key growth engine for the region.

Canada Battery as a Service Market Insight

The Canada battery as a service market is gaining momentum, fueled by its clean energy policies, government subsidies for EV adoption, and emphasis on sustainable transport solutions. The growing demand for long-range EVs, coupled with investments in urban mobility infrastructure, is pushing utilities and mobility service providers to adopt flexible battery-swapping models.

Which are the Top Companies in Battery as a Service Market?

The Battery as a Service industry is primarily led by well-established companies, including:

- NIO (China)

- VinFast (Vietnam)

- Lectrix E-Vehicle Pvt. Ltd (India)

- Gogoro (Taiwan)

- Mahindra&Mahindra Ltd. (India)

- Hyundai Motor Company (South Korea)

- XPENG INC (China)

- Bounce Infinity (India)

- Yamaha Motor Co., Ltd. (Japan)

- SAIC Motor Corporation Limited (China)

- Vinson Green Technologies (Malaysia)

- Nissan Motor Co., Ltd. (Japan)

What are the Recent Developments in Global Battery as a Service Market?

- In January 2025, JSW MG Motor India partnered with Kotak Mahindra Prime (India) to offer financing solutions for its battery as a service program, aiming to reduce the upfront cost of EV ownership and encourage sales. This move is expected to make EV adoption more financially accessible for Indian consumers

- In December 2024, Last Mile Mobility, a subsidiary of Mahindra & Mahindra Ltd. (India), collaborated with Vidyut (India) to launch a battery as a service program for electric vehicles, covering models such as Mahindra’s ZEO (4W), Zor Grand, and Treo Plus (3Ws). This initiative is anticipated to significantly lower EV ownership barriers and boost sales in India’s growing mobility sector

- In September 2024, MG Motor India joined hands with Vidyut (India) to roll out a new financing model for passenger cars, integrating a battery as a service option for EVs such as the MG Comet EV, MG Windsor EV, and MG ZS EV. This collaboration is expected to enhance affordability and accelerate EV adoption in India

- In August 2024, VinFast (Vietnam) introduced a battery subscription model in the Philippines for its VF5 electric vehicle, allowing customers to lease batteries rather than pay high upfront costs. This approach is designed to make EVs more appealing and financially viable in Southeast Asian markets

- In July 2024, Hyundai Motor Company (South Korea) unveiled a new subscription service tied to its electric vehicles, with initial availability planned for 2025 in South Korea. Currently in its demonstration phase, this program is expected to strengthen Hyundai’s EV strategy once fully implemented

- In April 2024, VinFast (Vietnam) launched a battery subscription policy in Indonesia to address consumer concerns about battery health and long-term maintenance costs. This program is positioned to increase consumer confidence and drive higher EV adoption in the region

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.