Global Histone Deacetylase Inhibitors Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.30 Billion

USD

2.30 Billion

2024

2032

USD

1.30 Billion

USD

2.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 2.30 Billion | |

|

|

|

|

글로벌 히스톤 탈아세틸화효소 억제제 시장 세분화(분류: 1종 HDAC, 2종 HDAC, 3종 HDAC 및 기타), 응용 분야(종양학, 신경학 및 기타), 약물(보리노스타트, 로미뎁신, 벨리노스타트 및 기타), 투여 경로(경구, 주사 및 기타), 최종 사용자(병원, 재택 치료, 전문 클리닉 및 기타), 유통 채널(병원 약국, 온라인 약국, 소매 약국 및 기타) - 2032년까지의 산업 동향 및 예측

히스톤 탈아세틸화효소 억제제 시장

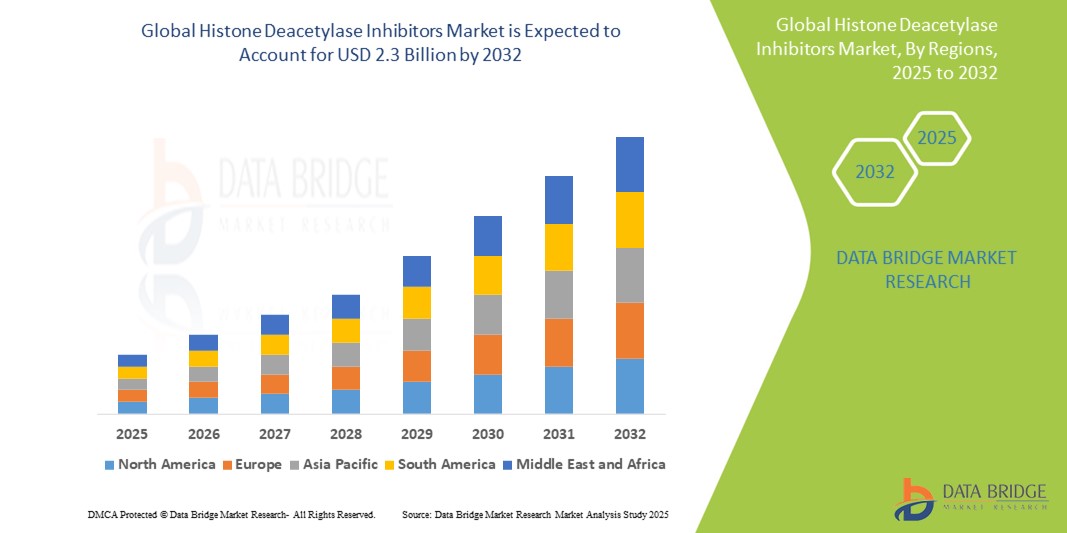

- 글로벌 히스톤 탈아세틸화효소 억제제 시장은 2024년에 13억 달러 규모로 평가되었으며, 예측 기간 동안 7.7%의 CAGR 로 2032년까지 23억 달러에 도달할 것으로 예상됩니다 .

- 시장 성장은 주로 암과 신경 질환의 유병률 증가에 기인하며, 이는 첨단 후성유전학 치료법에 대한 수요를 지속적으로 증가시키고 있습니다. 또한, HDAC 억제 연구 확대와 지속적인 임상 시험은 혁신을 촉진하고 치료 적용 분야를 확대하고 있습니다.

- 더욱이, 종양학 약물 개발에 대한 투자 증가와 맞춤 의학 및 표적 치료에 대한 관심 증가는 현대 치료 프로토콜에서 HDAC 억제제의 전략적 중요성을 더욱 강화하고 있습니다. 이러한 누적 추세는 HDAC 억제제 도입을 가속화하여 시장의 장기적인 성장에 크게 기여하고 있습니다.

히스톤 탈아세틸화효소 억제제 시장 분석

- 히스톤 아세틸화를 변경하여 유전자 발현을 조절하는 후성유전학 약물의 한 종류인 히스톤 탈아세틸화효소(HDAC) 억제제는 표적 작용 메커니즘과 분자 수준에서 비정상적인 세포 행동을 역전시킬 수 있는 잠재력으로 인해 암 및 신경 질환 치료에 점점 더 중요해지고 있습니다.

- HDAC 억제제에 대한 수요 급증은 전 세계적으로 암 발생률 증가, 후성유전학 기반 치료법에 대한 인식 제고, 그리고 새로운 HDAC 표적 제형에 초점을 맞춘 임상 시험 건수 증가에 따른 것입니다. HDAC 억제제의 사용은 신경계 및 염증성 질환으로 확대되어 시장 잠재력을 더욱 높이고 있습니다.

- 북미 지역은 2025년 45% 이상의 높은 매출 점유율로 HDAC 억제제 시장을 장악할 것으로 예상됩니다. 이는 이 지역의 탄탄한 R&D 인프라, 높은 암 유병률, 유리한 규제 지원, 그리고 제약 및 생명공학 기업의 활발한 투자 덕분입니다. 특히 미국은 선진적인 임상 연구 생태계와 정밀 종양학 치료 도입 증가로 시장을 선도하고 있습니다.

- 아시아 태평양 지역은 예측 기간 동안 HDAC 억제제 시장에서 가장 빠르게 성장하는 지역으로 예상되며, 이는 의료비 지출 증가, 암 발생률 증가, 중국, 인도, 한국과 같은 국가에서의 새로운 치료제 접근성 확대에 힘입은 것입니다.

- HDAC 억제제가 혈액암 및 고형 종양 치료에 널리 사용됨에 따라, 종양학 분야는 2025년까지 시장 점유율 60%를 돌파하며 시장을 주도할 것으로 예상됩니다. 보리노스타트, 로미뎁신, 벨리노스타트와 같은 약물은 피부 및 말초 T세포 림프종에서 입증된 효능으로 임상 적용 분야를 지속적으로 선도하고 있습니다.

보고서 범위 및 히스톤 탈아세틸화효소 억제제 시장 세분화

|

속성 |

히스톤 탈아세틸화효소 억제제 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

포함 국가 |

북아메리카

유럽

아시아 태평양

중동 및 아프리카

남아메리카

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 적용 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 가격 분석, 브랜드 점유율 분석, 소비자 설문 조사, 인구 통계 분석, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함되어 있습니다. |

Histone Deacetylase Inhibitors Market Trends

“Advancements in Isoform-Selective HDAC Inhibitors and Combination Therapies”

- A significant trend shaping the global HDAC inhibitors market is the development of isoform-selective inhibitors and their use in combination therapies to improve clinical efficacy and minimize toxicity. Traditional HDAC inhibitors often exhibit broad activity, leading to off-target effects and limited tolerability in patients

- To address this, biopharmaceutical companies are increasingly focusing on next-generation HDAC inhibitors that target specific HDAC isoforms associated with disease pathology. This precision-based approach is enhancing the safety profile and therapeutic effectiveness of these agents

- For instance, Regenacy Pharmaceuticals is developing selective HDAC1 and HDAC2 inhibitors aimed at treating peripheral neuropathy without the adverse effects commonly seen in pan-HDAC inhibitors. Similarly, Syndax Pharmaceuticals’ entinostat, an oral class I HDAC inhibitor, is being evaluated in combination with checkpoint inhibitors for breast and lung cancers

- The growing trend of combining HDAC inhibitors with immunotherapies, DNA-damaging agents, and hormone therapies is also gaining momentum. These synergistic approaches are showing promise in clinical trials by overcoming resistance mechanisms and enhancing response rates in various cancers

- Furthermore, the integration of HDAC inhibitors in personalized medicine frameworks—supported by biomarker-driven patient selection—is transforming their clinical application and expanding their use beyond hematologic malignancies to solid tumors, neurological disorders, and inflammatory diseases

- This shift toward more selective, targeted, and combinatory treatment strategies is reshaping the landscape of epigenetic therapy, making HDAC inhibitors a more versatile and promising class of therapeutics in oncology and beyond

Histone Deacetylase Inhibitors Market Dynamics

Driver

“Rising Cancer Burden and Expanding Applications in Epigenetic Therapies”

- The global HDAC inhibitors market is being significantly driven by the increasing incidence of cancer, particularly hematologic malignancies and certain solid tumors, where HDAC dysregulation plays a crucial role in disease progression

- According to the World Health Organization (WHO), global cancer cases are expected to increase by over 47% by 2040, creating substantial demand for innovative therapies like HDAC inhibitors

- For instance, FDA-approved HDAC inhibitors such as vorinostat (Zolinza), romidepsin (Istodax), and belinostat (Beleodaq) are already being used in the treatment of T-cell lymphomas, and further clinical trials are exploring their use in multiple myeloma, breast cancer, and glioblastoma

- The expansion of HDAC inhibitor use in non-oncology indications, such as neurodegenerative diseases (e.g., Huntington’s and Alzheimer’s), and inflammatory conditions, presents additional growth avenues. Epigenetic mechanisms are increasingly recognized in the pathogenesis of these diseases, and HDAC inhibitors are showing neuroprotective and anti-inflammatory effects in preclinical studies

- Additionally, increasing research funding, growing partnerships between academic institutions and pharmaceutical companies, and a robust clinical development pipeline are accelerating innovation and expanding the therapeutic landscape for HDAC inhibitors

Restraint/Challenge

“Safety Concerns and Limited Isoform Specificity”

- Despite their therapeutic promise, HDAC inhibitors face significant challenges related to safety and tolerability. The lack of isoform selectivity in many first-generation HDAC inhibitors can lead to widespread off-target effects, including fatigue, thrombocytopenia, and gastrointestinal disturbances, limiting their long-term use

- For instance, vorinostat and romidepsin, while effective, are often associated with dose-limiting toxicities, making them suitable only for a limited subset of patients

- This narrow therapeutic window presents a challenge for broader market adoption, especially in non-oncology settings where tolerance for side effects is lower

- Additionally, the complex mechanisms of action and uncertain long-term impact on epigenetic regulation raise concerns among clinicians, particularly regarding irreversible gene expression changes

- Another barrier is the high cost of HDAC inhibitor therapies, which can limit access in emerging markets and for patients without adequate insurance coverage

- Overcoming these challenges will require continued investment in selective HDAC inhibitor development, better biomarker identification, and more refined clinical trial designs to target the right patient populations and minimize adverse effects. The ability to demonstrate long-term safety and cost-effectiveness will be key to sustaining market growth

Histone Deacetylase Inhibitors Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Classification

On the basis of classification, the HDAC inhibitors market is segmented into Class I HDACs, Class II HDACs, Class III HDACs, and Others. The Class I HDACs segment is projected to hold the largest market revenue share of approximately 54.8% in 2025, driven by their strong association with oncogenic pathways and widespread use in approved therapies. These inhibitors, such as vorinostat and romidepsin, primarily target HDAC1, HDAC2, and HDAC3, and have demonstrated significant efficacy in treating hematologic malignancies, making them a preferred choice in clinical applications.

The Class II HDACs segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, attributed to expanding research efforts focusing on their role in non-oncology conditions such as neurological and inflammatory diseases. Their isoform-specific action and emerging therapeutic potential offer attractive opportunities for targeted drug development and future expansion beyond oncology.

• By Drug Type

On the basis of drug type, the market is segmented into Vorinostat, Romidepsin, Belinostat, and Others. Vorinostat accounted for the largest market revenue share in 2025, being the first FDA-approved HDAC inhibitor for cutaneous T-cell lymphoma (CTCL). Its established clinical use and continued relevance in both monotherapy and combination regimens contribute to its dominance.

The Belinostat segment is anticipated to register the highest CAGR from 2025 to 2032 due to its increasing adoption in peripheral T-cell lymphoma (PTCL) treatment and growing acceptance in emerging markets. Ongoing clinical evaluations for expanded indications are further accelerating its market presence.

• By Route of Administration

On the basis of route of administration, the market is categorized into Oral, Injectable, and Others. The Oral segment is expected to dominate the market with the largest revenue share in 2025, owing to better patient compliance, convenience, and an increasing number of orally administered HDAC inhibitors in development and approval stages.

The Injectable segment is projected to grow at the fastest CAGR during the forecast period, driven by its rapid onset of action and higher bioavailability, particularly in acute care settings and in the treatment of aggressive cancers where immediate drug response is critical.

• By Application

On the basis of application, the HDAC inhibitors market is segmented into Oncology, Neurology, and Others. The Oncology segment holds the largest market share in 2025, supported by strong clinical evidence, growing cancer prevalence, and robust demand for epigenetic therapies. HDAC inhibitors are widely used in hematologic malignancies and are increasingly being evaluated for various solid tumors.

The Neurology segment is anticipated to register the highest growth from 2025 to 2032, propelled by growing interest in HDACs as therapeutic targets in neurodegenerative diseases. Preclinical success in conditions like Huntington’s and Alzheimer’s diseases is stimulating development pipelines and research collaborations.

• By End User

On the basis of end user, the market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. Hospitals accounted for the largest market revenue share in 2025 due to the high volume of cancer treatments, availability of specialized oncology departments, and the presence of advanced drug administration facilities.

The Specialty Clinics segment is projected to exhibit the fastest growth during the forecast period, driven by the increasing trend toward personalized cancer care and the availability of targeted therapies in outpatient settings.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. Hospital Pharmacy dominated the market in 2025, benefiting from institutional drug procurement for oncology departments and close coordination with clinical oncologists.

The Online Pharmacy segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to the increasing digitalization of healthcare, home delivery preferences, and rising awareness of specialty drug availability through regulated e-commerce platforms.

Histone Deacetylase Inhibitors Market Regional Analysis

- North America dominates the histone deacetylase inhibitors market with the largest revenue share of approximately 45.6% in 2024, driven by a strong presence of leading pharmaceutical companies, high cancer incidence rates, and an advanced healthcare infrastructure

- The region’s proactive approach to oncology drug development, widespread availability of HDAC inhibitor therapies, and favorable regulatory support contribute significantly to market growth

- Additionally, the region benefits from increased investment in epigenetic research, a high level of clinical trial activity, and strong collaborations between academia and industry. The presence of key market players and access to cutting-edge treatment options have firmly positioned North America as the leading hub for HDAC inhibitor adoption, especially in cancer care and emerging neurological indications

U.S. Histone Deacetylase Inhibitors Market Insight

The U.S. HDAC inhibitors market captured the largest revenue share of approximately 84% within North America in 2025, driven by a high prevalence of cancer, robust pharmaceutical R&D activity, and a favorable regulatory landscape. The U.S. leads in clinical trials and FDA approvals for HDAC inhibitors, with major drugs such as vorinostat, romidepsin, and belinostat already approved for T-cell lymphomas.

Growing investment in precision oncology and epigenetic research, combined with strong academic-industry collaborations, continues to accelerate the development of both monotherapy and combination therapies. The U.S. market also benefits from extensive insurance coverage for oncology treatments and early adoption of innovative therapeutics, cementing its dominance in the global HDAC inhibitors landscape.

Europe HDAC Inhibitors Market Insight

The European HDAC inhibitors market is projected to expand at a substantial CAGR throughout the forecast period, supported by a rising cancer burden, increasing healthcare expenditure, and expanding epigenetic research infrastructure.

The region is witnessing a steady increase in clinical trials focusing on solid tumors and hematologic cancers using HDAC inhibitors. Additionally, regulatory bodies such as the European Medicines Agency (EMA) are showing growing openness to approving novel epigenetic therapies, facilitating broader access.

Collaborations between pharmaceutical companies and academic institutions in countries like Germany, France, and the U.K. are fostering innovation, while a growing demand for targeted and personalized therapies continues to boost adoption in oncology and neurology.

U.K. HDAC Inhibitors Market Insight

The U.K. HDAC inhibitors market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the country’s emphasis on precision medicine and cancer genomics.

The National Health Service (NHS)’s focus on innovation, early diagnosis, and advanced treatment options has created fertile ground for HDAC inhibitor uptake. Additionally, government-backed initiatives like Genomics England and research programs at institutions such as The Institute of Cancer Research are enabling HDAC inhibitor integration into modern cancer care strategies.

Heightened awareness about epigenetics and expanding clinical trial networks are expected to further propel the market.

Germany HDAC Inhibitors Market Insight

The German HDAC inhibitors market is expected to expand at a considerable CAGR during the forecast period, supported by a well-established healthcare infrastructure and a strong focus on R&D.

Germany’s pharmaceutical sector, known for innovation and regulatory compliance, is actively involved in the development and evaluation of next-generation HDAC inhibitors. Additionally, the country’s strategic role in pan-European clinical studies, coupled with growing public investment in oncology and neuroscience research, is fostering market growth.

Patient access to new therapies through specialty clinics and academic hospitals is also contributing to the steady rise in HDAC inhibitor use.

Asia-Pacific HDAC Inhibitors Market Insight

The Asia-Pacific HDAC inhibitors market is poised to grow at the fastest CAGR of over 9.2% in 2025, driven by increasing cancer prevalence, healthcare infrastructure improvements, and rising investments in pharmaceutical R&D across the region.

Countries such as China, Japan, and India are seeing a surge in demand for advanced cancer therapies, including epigenetic modulators. Government initiatives to promote clinical research and drug accessibility are further propelling growth.

As multinational companies expand their operations in APAC and domestic players invest in innovation, HDAC inhibitors are becoming more accessible and affordable, particularly in oncology care.

Japan HDAC Inhibitors Market Insight

The Japan HDAC inhibitors market is gaining momentum due to the nation’s aging population and rising cancer incidence. Japan’s emphasis on advanced therapeutics and strong regulatory support for novel oncology treatments are driving market expansion.

The integration of HDAC inhibitors into clinical research for hematologic malignancies and neurological disorders is being facilitated by institutions such as RIKEN and university hospitals with active pipelines.

Furthermore, Japan’s pharmaceutical companies are investing in developing isoform-selective and combination HDAC therapies, aligning with the national focus on personalized medicine and precision oncology.

China HDAC Inhibitors Market Insight

The China HDAC inhibitors market accounted for the largest market revenue share in Asia Pacific in 2025, bolstered by rapid healthcare modernization, a growing middle class, and increasing participation in global oncology drug development.

China’s biopharma sector is advancing rapidly, with domestic firms like Shenzhen Chipscreen Biosciences leading HDAC inhibitor innovation. Government policies promoting drug approval reforms and incentives for cancer drug research have made China a hotspot for clinical trials.

In addition, the inclusion of some HDAC inhibitors in national reimbursement drug lists and a high patient base for both cancer and neurological conditions make China a pivotal player in the regional market.

Histone Deacetylase Inhibitors Market Share

The Histone Deacetylase Inhibitors industry is primarily led by well-established companies, including:

- Midatech Pharma PLC (U.K.)

- Crystal Genomics Inc. (South Korea)

- CELGENE CORPORATION (U.S.)

- Novartis AG (Switzerland)

- Shenzhen Chipscreen Biosciences Co., Ltd. (China)

- Spectrum Pharmaceuticals, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Celleron Therapeutics (U.K.)

- FORUM Pharmaceuticals Inc. (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Eisai Co., Ltd. (Japan)

- REGENACY PHARMACEUTICALS, INC. (U.S.)

- Karyopharm (U.S.)

- Aurobindo Pharma (India)

- CARDIFF ONCOLOGY (U.S.)

- Wellness Pharma International (India)

- Syndax (U.S.)

- MEI Pharma, Inc. (U.S.)

- Onxeo (France)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.