Middle East And Africa Long Chain Polyamide Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

140.11 Million

USD

192.82 Million

2024

2032

USD

140.11 Million

USD

192.82 Million

2024

2032

| 2025 –2032 | |

| USD 140.11 Million | |

| USD 192.82 Million | |

|

|

|

Middle East and Africa Long Chain Polyamide Market Segmentation, By Type (PA 11, PA 12, PA 610, PA 612, PA 410, PA 1010, PA 1012, and Others), Source (Artificially Made and Naturally Occuring), Form (Chips, Powder, and Others), Application (Engineering Plastics, Polyamide Fibers & Fabrics, Polyamide Films, Polyamide Adhesives, Coatings, and Others), End-Use (Electrical & Electronics, Healthcare, Industrial, Automotive, Consumer Goods, Packaging, Aerospace & Defense, Oil & Gas, Energy, and Others) - Industry Trends and Forecast to 2032

Long Chain Polyamide Market Analysis

The long chain polyamide (LCPA) market is experiencing steady growth due to its widespread use in automotive, electrical, electronics, and industrial applications. These high-performance materials, characterized by superior thermal stability, chemical resistance, and mechanical properties, are increasingly replacing traditional metals and polymers. The automotive sector drives demand, with LCPA being used in fuel systems, connectors, and under-the-hood applications. In addition, growing electric vehicle production and the trend toward lightweight components further boost market prospects. Asia-Pacific leads in market share, driven by industrial expansion, while North America and Europe also contribute significantly due to technological advancements and sustainable material innovations.

Long Chain Polyamide Market Size

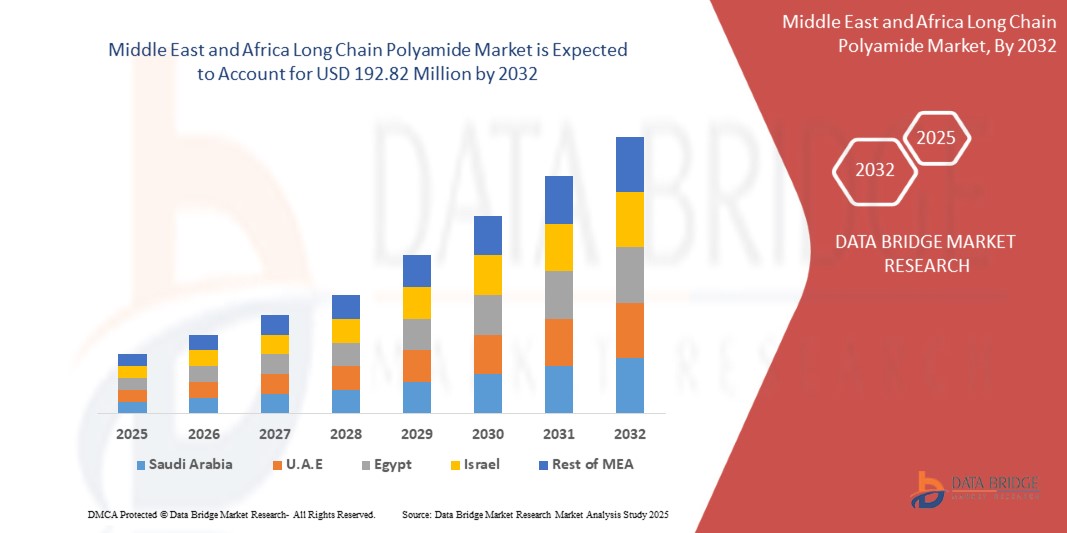

Middle East and Africa long chain polyamide market size was valued at USD 140.11 million in 2024 and is projected to reach USD 192.82 million by 2032, with a CAGR of 4.17% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Long Chain Polyamide Market

“Widespread Use in Automotive, Electrical, Electronics, And Industrial Applications”

Long Chain Polyamide (LCPA) is increasingly popular in automotive, electrical, electronics, and industrial applications due to its excellent thermal stability, mechanical strength, and chemical resistance. In the automotive industry, LCPA is used for lightweight components, fuel systems, connectors, and under-the-hood parts, contributing to improved fuel efficiency and vehicle performance. In electrical and electronics, LCPA’s insulating properties make it ideal for connectors, wires, and circuit boards. Its durability also benefits industrial applications, where LCPA is used in gears, bearings, and machinery parts. These attributes enable LCPA to replace traditional materials, driving efficiency and sustainability across diverse sectors.

Report Scope and Market Segmentation

|

Attributes |

Long Chain Polyamide Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Saudi Arabia, Egypt, U.A.E., South Africa, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

LG Chem (South Korea), BASF (Germany), Arkema (France), Evonik Industries AG (Germany), DuPont (U.S.), Asahi Kasei Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), MITSUI CHEMICALS AMERICA, INC. (Japan), KURARAY CO., LTD (Japan), Huntsman International LLC. (U.S.), Ascend Performance Materials (U.S.) Envalior (Germany) Domo Chemicals (Belgium), NYCOA (New York Chemicals) (U.S.), and Radici Partecipazioni SpA (Italy) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Long Chain Polyamide Market Definition

The Long Chain Polyamide (LCPA) market refers to the Middle East and Africa industry focused on the production, distribution, and consumption of polyamide polymers with longer molecular chains, typically containing 12 or more carbon atoms. These high-performance materials are known for their superior thermal stability, chemical resistance, mechanical strength, and durability. LCPAs are used in a wide range of applications, including automotive, electrical, electronics, industrial, and consumer goods, where their strength and resilience in harsh environments are essential. The market is driven by demand for lightweight, durable, and sustainable materials that offer better performance compared to conventional polymers and metals.

Biochar Market Dynamics

Drivers

- Surging Demand For Lightweight And High-Performance Materials From Automotive Industry

The surging demand for lightweight and high-performance materials from the automotive industry is a significant driver of the Middle East and Africa long-chain polyamide market. As automotive manufacturers increasingly focus on improving fuel efficiency, reducing emissions, and enhancing vehicle performance, the need for materials that are both lightweight and durable has escalated. Long-chain polyamides, with their exceptional strength-to-weight ratio, are ideal for these purposes, making them a preferred choice in various automotive applications.

Long-chain polyamides are used in the production of components such as engine parts, fuel lines, connectors, and electrical components. These materials not only reduce the overall weight of the vehicle but also provide the required strength and resistance to heat, chemicals, and wear, making them essential for modern automotive manufacturing. For example, in engine compartments, where components must withstand high temperatures and stress, long-chain polyamides offer superior thermal stability and mechanical strength compared to traditional materials.

Furthermore, the automotive industry’s shift toward electric vehicles (EVs) has also boosted the demand for high-performance polymers. EVs require lightweight materials to enhance battery efficiency and range, and long-chain polyamides, with their electrical insulating properties and robustness, are increasingly being integrated into the design of battery housings, connectors, and other crucial components.

- Fast Expanding Electrical And Electronics Sector

The fast-expanding electrical and electronics sector is a key driver for the Middle East and Africa long-chain polyamide market. As technology advances and the demand for electronic devices and systems grows, there is an increasing need for materials that offer excellent thermal stability, electrical insulation, and mechanical strength. Long-chain polyamides, known for their high-performance characteristics, meet these requirements and are widely used in electrical and electronic applications.

Long-chain polyamides are particularly valued in the production of components like connectors, switches, circuit boards, insulators, and cables. These materials provide superior electrical insulation, which is critical for ensuring the safe and efficient operation of electronic devices. Their resistance to heat and chemicals makes them ideal for use in high-performance electronics, where components often operate at elevated temperatures or are exposed to harsh conditions.

The rise in consumer electronics, such as smartphones, wearables, and smart home devices, is fueling the demand for long-chain polyamides. In addition, the growth of the Internet of Things (IoT) and smart technology in industries such as healthcare, automotive, and telecommunications is further driving the need for advanced materials. Long-chain polyamides are increasingly used in the manufacturing of miniature electronic components, where space constraints and performance demands are critical.

Opportunities

- Advancements in Bio-Based Polyamides

Advancements in bio-based polyamides present a significant opportunity for the growth of the Middle East and Africa long-chain polyamide (LCPA) market. As sustainability becomes an increasingly important focus across various industries, there is a growing demand for environmentally friendly alternatives to traditional petroleum-based polymers. Bio-based polyamides, which are derived from renewable resources like plant-based sugars, oils, and other biomass sources, offer an attractive solution to reduce reliance on fossil fuels while maintaining the high-performance characteristics that LCPAs are known for.

One of the key advantages of bio-based polyamides is their ability to reduce carbon emissions and energy consumption during production. By utilizing renewable raw materials, bio-based polyamides can help lower the environmental footprint of industries such as automotive, electronics, and textiles, which are major consumers of long-chain polyamides. This aligns with Middle East and Africa efforts to transition to a circular economy and meet stricter environmental regulations, particularly in regions like Europe and North America.

Moreover, bio-based polyamides can appeal to the growing consumer preference for sustainable products. As more consumers and businesses prioritize eco-friendly solutions, the demand for bio-based alternatives to conventional plastics is on the rise. For example, bio-based polyamides are gaining traction in automotive applications, where the industry seeks lighter, more sustainable materials to improve fuel efficiency and reduce emissions. In addition, bio-based polyamides are being explored for use in electronics, where their high thermal stability and electrical insulating properties can be beneficial in green technologies.

- Rising Demand For High-Performance Textiles

高性能繊維の需要の高まりは、中東およびアフリカの長鎖ポリアミド (LCPA) 市場の成長にとって大きなチャンスとなります。耐久性、強度、汎用性で知られる高性能繊維は、自動車、スポーツウェア、医療、工業用途など、さまざまな業界でますます求められています。長鎖ポリアミドは、機械的強度、耐摩耗性、熱安定性のユニークな組み合わせにより、これらの高性能生地に最適な素材です。

たとえば自動車分野では、LCPA はシートカバー、室内装飾品、エアバッグなど、軽量で耐久性のある自動車内装用繊維の製造に使用されています。これらの材料は、高温や紫外線暴露などの過酷な条件に必要な強靭性と耐性を提供し、自動車部品の安全性と寿命を向上させます。自動車メーカーは、先進的な機能を備えた燃費効率の高い自動車の製造に注力し続けているため、長鎖ポリアミドから作られた高性能繊維の需要は増加すると予想されます。

スポーツウェアやアクティブウェア市場も、高性能繊維の需要が高まっている分野です。LCPA は優れた強度と弾力性を備えているため、スポーツユニフォーム、靴、防具など、耐久性と快適性の両方が求められる衣類や用具の製造に適しています。消費者が高品質でパフォーマンスを向上させる製品にますます注目するようになるにつれ、長鎖ポリアミドベースの繊維はアクティブウェア業界のメーカーに競争上の優位性をもたらします。

制約/課題

- 複雑な製造プロセスとカプロラクタムや特殊添加剤などの原材料の高コスト

複雑な製造プロセスと、カプロラクタムや特殊添加剤などの原材料の高コストは、中東およびアフリカの長鎖ポリアミド (LCPA) 市場の成長にとって大きな制約となっています。LCPA の製造には、特殊な装置と技術を必要とする複雑なプロセスが伴います。重合、凝縮、押し出しなどのこれらのプロセスには、大量のエネルギー入力と技術的な専門知識が必要であり、製造コストが増加する可能性があります。製造の複雑さにより、生産の拡大も困難になり、供給が制限され、コストがさらに上昇する可能性があります。

長鎖ポリアミドの製造に使用される主な原材料の 1 つは、ナイロン合成の重要な前駆物質であるカプロラクタムです。カプロラクタムは石油由来で、原油価格の変動は直接そのコストに影響します。中東およびアフリカの原油価格が上昇すると、カプロラクタムの価格も上昇し、その結果、LCPA 製造の総コストが増加します。この価格変動は、競争力を維持するために製造コストと市場価格のバランスを取らなければならない製造業者にとって課題となります。

さらに、長鎖ポリアミドの特性を高めるために、可塑剤、安定剤、難燃剤などの特殊添加剤がよく使用されます。これらの添加剤も高価であり、LCPA 製造の全体的なコスト高につながる可能性があります。これらの高価な材料への依存は、特にコストを抑えながら高性能基準を維持しようとしている業界にとって、製造の経済性をさらに圧迫します。

- 原材料価格の変動

原材料価格の変動は、中東およびアフリカの長鎖ポリアミド (LCPA) 市場にとって大きな課題です。LCPA の生産は、石油由来の主要前駆体であるカプロラクタムや特殊添加剤などの主要原材料に大きく依存しています。これらの原材料の価格は、中東およびアフリカの石油価格の変動、サプライ チェーンの混乱、地政学的不安定性など、さまざまな要因により変動します。その結果、メーカーは不確実性とコスト圧力に直面し、収益性と市場の安定性に影響を及ぼす可能性があります。

カプロラクタムはポリアミドの製造に不可欠な原料であり、原油価格の変動に非常に敏感です。石油から得られるため、石油市場の変動はカプロラクタムのコストの大幅な上昇につながり、LCPA の全体的な製造コストを上昇させます。さらに、主要な石油生産地域で地政学的イベントや自然災害が発生すると、サプライ チェーンが混乱し、不足やさらなる価格上昇につながる可能性があります。

LCPA の特性を強化するために使用される難燃剤、安定剤、可塑剤などの特殊添加剤の価格も変動しやすい傾向があります。これらの添加剤は、多くの場合、特定の化学プロセスから生成されたり、限られたサプライヤーから調達されたりするため、サプライ チェーンの混乱の影響を受けやすくなります。これらの材料のコストが上昇すると、特に価格に敏感な業界やすでに激しい競争に直面している業界では、製造業者の経済的負担が増大する可能性があります。

原材料不足と出荷遅延の影響と現在の市場シナリオ

Data Bridge Market Research は、市場の高水準な分析を提供し、原材料不足や出荷遅延の影響と現在の市場環境を考慮した情報を提供します。これは、戦略的な可能性を評価し、効果的な行動計画を作成し、企業が重要な決定を下すのを支援することにつながります。

標準レポートの他に、予測される出荷遅延からの調達レベルの詳細な分析、地域別の販売代理店マッピング、商品分析、生産分析、価格マッピングの傾向、調達、カテゴリパフォーマンス分析、サプライチェーンリスク管理ソリューション、高度なベンチマーク、その他の調達および戦略サポートのサービスも提供しています。

経済減速が製品の価格と入手可能性に及ぼす予想される影響

経済活動が減速すると、業界は打撃を受け始めます。DBMR が提供する市場分析レポートとインテリジェンス サービスでは、景気後退が製品の価格設定と入手しやすさに及ぼす予測される影響が考慮されています。これにより、当社のクライアントは通常、競合他社より一歩先を行き、売上と収益を予測し、損益支出を見積もることができます。

中東およびアフリカの長鎖ポリアミド市場の範囲

中東およびアフリカの長鎖ポリアミド市場は、タイプ、ソース、形式、用途、および最終用途に基づいて 5 つの主要なセグメントに分割されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

タイプ

- PA12

- PA11

- 610 の

- 612 号

- 1010 の

- 1012 号

- 410 の

- その他

ソース

- 人工的に作られた

- 自然に発生する

形状

- チップス

- 粉

- その他

応用

- エンジニアリングプラスチック

- ポリアミド繊維と織物

- ポリアミドフィルム

- ポリアミド接着剤

- コーティング

- その他

最終用途

- 電気・電子

- ヘルスケア、産業

- 自動車、消費財

- パッケージ

- 航空宇宙および防衛

- 石油・ガス

- エネルギー

- その他

中東およびアフリカの長鎖ポリアミド市場の地域分析

市場は分析され、市場規模の洞察と傾向は、上記の国、タイプ、ソース、形式、アプリケーション、および最終用途に基づいて提供されます。

市場に含まれる国は、サウジアラビア、エジプト、UAE、南アフリカ、イスラエル、およびその他の中東およびアフリカです。

サウジアラビアは、高度な技術革新、強力な自動車産業とエレクトロニクス産業、持続可能性への重点、さまざまな用途における高性能材料への高い需要により、長鎖ポリアミド市場を支配すると予想されています。

エジプトは、自動車の技術革新、持続可能な製造方法、高性能材料の需要増加、工業および電子部門での強力な存在感に重点を置いていることから、長鎖ポリアミド市場で最も急速に成長する地域になると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響を考慮しながら、国別データの予測分析を提供します。

中東およびアフリカの長鎖ポリアミド市場シェア

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Long Chain Polyamide Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- BASF (Germany)

- Arkema (France)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- TORAY INDUSTRIES INC. (Japan)

- MITSUI CHEMICALS AMERICA INC. (Japan)

- KURARAY CO. LTD (Japan)

- Huntsman International LLC. (U.S.)

- Ascend Performance Materials (U.S.)

- Envalior (Germany)

- Domo Chemicals (Belgium)

- NYCOA (New York Chemicals) (U.S.)

- Radici Partecipazioni SpA (Italy)

Latest Developments in Middle East and Africa Long Chain Polyamide Market

- In November 2024, BASF’s Polyamide 6 (PA6) plant in Shanghai received the ISCC PLUS certification, enabling it to produce biomass-balanced and Ccycled PA6. This certification supports BASF’s commitment to sustainability, offering lower carbon footprint and circular product alternatives in the PA6 value chain

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business, a leading global producer. This move expanded Arkema's portfolio in flexible packaging, positioning the company as a key player in the market

- In November 2024, Asahi Kasei has announced its decision to absorb its wholly owned subsidiary, Asahi Kasei NS Energy, through a simplified absorption-type merger, effective April 1, 2025. This move aims to streamline operations after Asahi Kasei NS Energy became a fully owned subsidiary in April 2023

- In April 2024, Domo Chemicals has inaugurated a new factory in China with a USD 15.12 million investment, enhancing production capacity. The facility, located south of Shanghai, will double output in the short term and potentially triple it in the future.

- In September 2022, NYCOA announced the launch of NXTamid-L, a new family of specialty performance nylons designed as alternatives to Nylon 12 and 11. NXTamid-L offers comparable or superior properties, including flexibility, lower moisture absorption, higher glass transition temperatures, and enhanced chemical resistance. This innovative nylon family can also be customized to meet specific performance requirements, reinforcing NYCOA’s position as a leader in the nylon industry

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OVERVIEW: MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

4.7 VALUE CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT (MONOMERS & CHEMICALS)

4.7.2 POLYMERIZATION PROCESS (SYNTHESIS OF POLYAMIDE)

4.7.3 COMPOUNDING AND ADDITIVES

4.7.4 FABRICATION (PROCESSING INTO FINAL SHAPES)

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USE APPLICATIONS (FINAL PRODUCTS)

4.7.7 CONCLUSION

4.8 VENDOR SELECTION CRITERIA

4.9 CLIMATE CHANGE SCENARIO

4.9.1 ENVIRONMENTAL CONCERNS

4.9.2 INDUSTRY RESPONSE

4.9.3 GOVERNMENT’S ROLE

4.9.4 ANALYST RECOMMENDATIONS

4.1 MARKET SITUATION

4.10.1 PA 1010

4.10.2 PA 1012

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 DEVELOPMENT OF BIO-BASED POLYAMIDES

4.12.2 ADVANCED POLYMERIZATION TECHNIQUES

4.12.3 INTEGRATION OF RECYCLING TECHNOLOGIES

4.12.4 ADOPTION OF SMART MANUFACTURING

4.13 RAW MATERIAL COVERAGE

4.13.1 DICARBOXYLIC ACIDS

4.13.2 DIAMINES

4.13.3 LONG-CHAIN FATTY ACIDS

4.13.4 PETROCHEMICAL FEEDSTOCKS

4.13.5 EMERGING BIO-BASED ALTERNATIVES

4.13.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY

6.1.2 FAST EXPANDING ELECTRICAL AND ELECTRONICS SECTOR

6.1.3 ADVANCEMENTS AND INNOVATIONS IN SUSTAINABLE PRODUCTION TECHNOLOGIES FOR LONG CHAIN POLYAMIDE

6.2 RESTRAINTS

6.2.1 COMPLEX MANUFACTURING PROCESS AND HIGH COSTS OF RAW MATERIALS

6.2.2 COMPETITION FROM OTHER HIGH-PERFORMANCE POLYMERS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIO-BASED POLYAMIDES

6.3.2 RISING DEMAND FOR HIGH-PERFORMANCE TEXTILES

6.3.3 GROWING APPLICATIONS OF LONG CHAIN POLYAMIDE IN MEDICAL DEVICES

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL PRICES

6.4.2 STRINGENT REGULATIONS ON PLASTIC USE, RECYCLING AND DISPOSAL

7 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE

7.1 OVERVIEW

7.2 PA 11

7.3 PA 12

7.4 PA 610

7.5 PA 612

7.6 PA 410

7.7 PA 1010

7.8 PA 1012

7.9 OTHERS

8 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ARTIFICIALLY MADE

8.3 NATURALLY OCCURRING

9 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM

9.1 OVERVIEW

9.2 CHIPS

9.3 POWDER

9.4 OTHERS

10 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ENGINEERING PLASTICS

10.3 POLYAMIDE FIBERS & FABRICS

10.4 POLYAMIDE FILMS

10.5 POLYAMIDE ADHESIVES

10.6 COATINGS

10.7 OTHERS

11 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE

11.1 OVERVIEW

11.2 ELECTRICAL & ELECTRONICS

11.3 HEALTHCARE

11.4 INDUSTRIAL

11.5 AUTOMOTIVE

11.6 CONSUMER GOODS

11.7 PACKAGING

11.8 AEROSPACE & DEFENSE

11.9 OIL & GAS

11.1 ENERGY

11.11 OTHERS

12 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 EGYPT

12.1.3 UNITED ARAB EMIRATES

12.1.4 SOUTH AFRICA

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EVONIK INDUSTRIES AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ARKEMA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ASAHI KASEI CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASCEND PERFORMANCE MATERIALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DOMO CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENVALIOR

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 HUNTSMAN INTERNATIONAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 KURARAY CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 LG CHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MITSUI CHEMICALS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NYCOA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 RADICI PARTECIPAZIONI SPA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 TORAY INDUSTRIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF TOP COMPANIES: MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 5 MIDDLE EAST AND AFRICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA PA 11 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PA 12 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 9 MIDDLE EAST AND AFRICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA PA 610 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 11 MIDDLE EAST AND AFRICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PA 612 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PA 410 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 15 MIDDLE EAST AND AFRICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA PA 1010 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA PA 1012 IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 21 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2018-2032 (TONS)

TABLE 23 MIDDLE EAST AND AFRICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ARTIFICIALLY MADE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA NATURALLY OCCURRING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 27 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CHIPS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 MIDDLE EAST AND AFRICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA POWDER IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 37 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA POLYAMIDE FIBERS & FABRICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 MIDDLE EAST AND AFRICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA POLYAMIDE FILMS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 MIDDLE EAST AND AFRICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA POLYAMIDE ADHESIVES IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 MIDDLE EAST AND AFRICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COATINGS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 49 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 61 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 69 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 73 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 79 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 82 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 85 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY COUNTRY, 2018-2032 (TON)

TABLE 88 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 90 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 92 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 96 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 98 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 115 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 117 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 119 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 121 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 123 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 EGYPT LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 EGYPT LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 140 EGYPT LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 141 EGYPT LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 142 EGYPT LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 143 EGYPT LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 144 EGYPT LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 EGYPT LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 146 EGYPT LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 147 EGYPT LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 148 EGYPT ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 EGYPT ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 EGYPT HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 EGYPT HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 EGYPT AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 EGYPT CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 EGYPT PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 EGYPT OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 EGYPT OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 165 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 166 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 167 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 168 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 169 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 UNITED ARAB EMIRATES LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 173 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 174 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 UNITED ARAB EMIRATES HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 UNITED ARAB EMIRATES HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 UNITED ARAB EMIRATES INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 UNITED ARAB EMIRATES INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 UNITED ARAB EMIRATES AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 180 UNITED ARAB EMIRATES AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 UNITED ARAB EMIRATES CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 UNITED ARAB EMIRATES CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 UNITED ARAB EMIRATES PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 UNITED ARAB EMIRATES OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 UNITED ARAB EMIRATES ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 UNITED ARAB EMIRATES OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 190 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 191 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 192 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 194 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 196 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 197 SOUTH AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 198 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SOUTH AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 SOUTH AFRICA INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SOUTH AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 SOUTH AFRICA AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SOUTH AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 SOUTH AFRICA CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SOUTH AFRICA PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SOUTH AFRICA AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SOUTH AFRICA OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SOUTH AFRICA ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SOUTH AFRICA OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 215 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 216 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 217 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 218 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 219 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 221 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 222 ISRAEL LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2018-2032 (TONS)

TABLE 223 ISRAEL ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 ISRAEL ELECTRICAL & ELECTRONICS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ISRAEL HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 ISRAEL HEALTHCARE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ISRAEL INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 ISRAEL INDUSTRIAL IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 ISRAEL AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 ISRAEL AUTOMOTIVE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ISRAEL CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 232 ISRAEL CONSUMER GOODS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 ISRAEL PACKAGING IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ISRAEL AEROSPACE & DEFENSE IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 ISRAEL OIL & GAS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ISRAEL ENERGY IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ISRAEL OTHERS IN LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 REST OF MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 REST OF MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE, 2018-2032 (TONS)

그림 목록

FIGURE 1 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 SURGING DEMAND FOR LIGHTWEIGHT AND HIGH-PERFORMANCE MATERIALS FROM AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PA 11 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 VALUE CHAIN ANALYSIS FOR MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET

FIGURE 24 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY TYPE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: BY SOURCE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY FORM, 2024

FIGURE 27 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY APPLICATION, 2024

FIGURE 28 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, BY END-USE, 2024

FIGURE 29 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: SNAPSHOT (2024)

FIGURE 30 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.