North America Stem Cell Manufacturing Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

11.07 Billion

USD

23.90 Billion

2025

2033

USD

11.07 Billion

USD

23.90 Billion

2025

2033

| 2026 –2033 | |

| USD 11.07 Billion | |

| USD 23.90 Billion | |

|

|

|

|

North America Stem Cell Manufacturing Market, By Products (Stem Cell Lines, Instruments, Consumables & Kits), Application (Research Applications, Clinical Applications, Cell and Tissue Banking and Others),End User (Biotechnology & Pharmaceutical Companies, Research Institutes and Academic Institutes, Cell Banks and Tissue Banks, Hospital & Surgical Centers and Others), Distribution Channel (Direct Sales and Third Party Distributor), Country (U.S., Canada & Mexico) Industry Trends and Forecast to 2028.

Market Analysis and Insights: North America Stem Cell Manufacturing Market

Market Analysis and Insights: North America Stem Cell Manufacturing Market

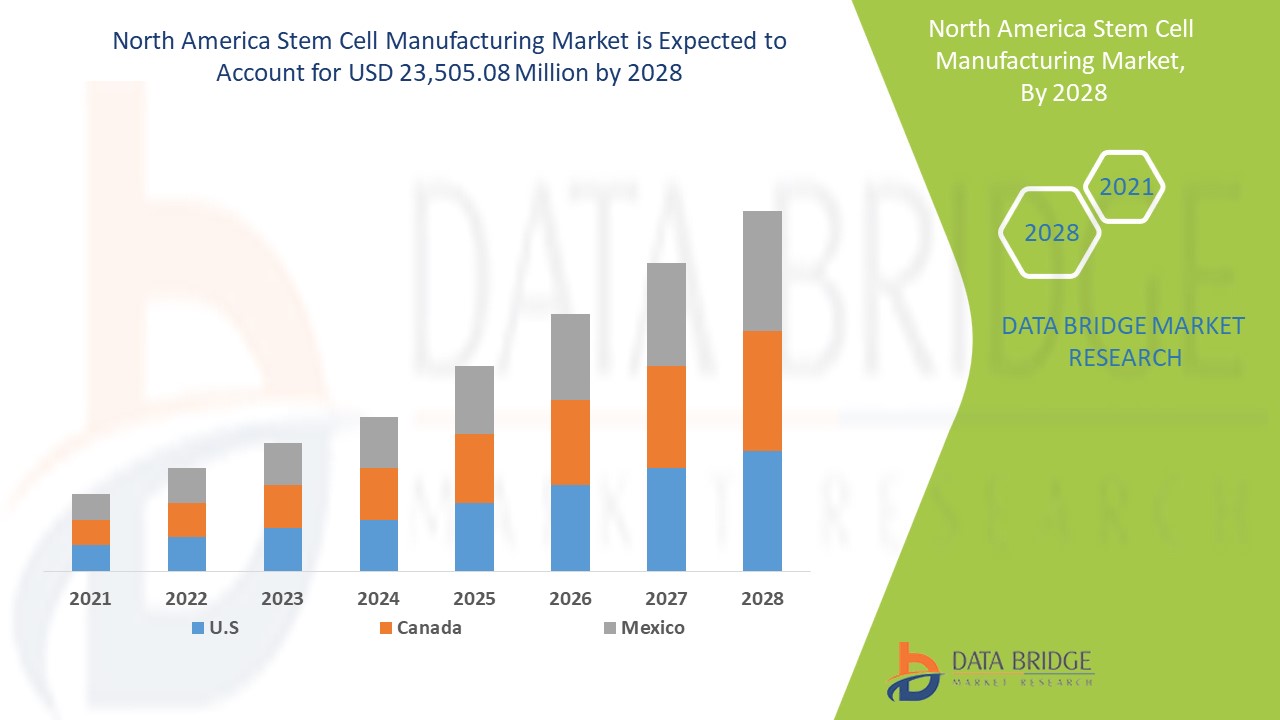

North America stem cell manufacturing market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 10.1% in the forecast period of 2021 to 2028 and is expected to reach USD 23,505.08 million by 2028 from USD 11,076.78 million in 2020. The rising prevalence of cancer and stem cell transplant, growth of novel technological advancements for stem cell transplant is likely to be the major drivers which propel the demand of the market in the forecast period.

Stem cells are body’s raw material which can differentiate into variety of cells. It means cells from which all other cells with specialized functions are generated. Stem Cell therapies are defined as treatment for medical condition which involves the use of any type of human stem cells including embryonic stem cells, adult stem cells for allogenic and autologous therapies.

The advent of stem cell research revealed the therapeutic potential of stem cells and derivatives. The successful manufacturing of stem cells and their derivatives is giving positive impact in healthcare arena. These stem cell products are used to restore the function of damaged tissue and organ and to develop stem cell based cellular therapies for the treatment of cancer, haematological disorder, genetic disorder, autoimmune and inflammatory diseases.

Increasing research & development by key industry players for development of innovative products, support by government, and growing adoption of stem cells are driving the growth of the market. Advanced methodologies present in the field are also propelling the growth of the global stem cell manufacturing market. However, high cost of therapies, availability of alterntives for tumor treatment may restrain the market. The presence of large number of pipelines products along with strategic initiatives taken by market players are acting as opportunity for the market. Lack of skilled professional may act as challenge for the market.

The global stem cell manufacturing market report provides details of market share, new developments, and impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Stem Cell Manufacturing Market Scope and Market Size

Stem Cell Manufacturing Market Scope and Market Size

The stem cell manufacturing market is categorized into four notable segments which are based on products, application, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of products, stem cell manufacturing market is segmented into stem cell lines, instruments, consumables & kits. In 2021, consumables & kits segment is expected to dominate the market due to the frequent purchase of consumables, rising stem cell research, and increasing demand for stem cell therapies

- On the basis of application, cell manufacturing market is segmented into research applications, clinical applications, cell and tissue banking and others. In 2021, research applications segment is expected to dominate market because due to the rising focus on stem cell cytology & pathophysiology research, and growing public-private funding to support stem cell product development and commercialization.

- On the basis of end user, stem cell manufacturing market is segmented into biotechnology & pharmaceutical companies, research institutes and academic institutes, cell banks and tissue banks, hospital & surgical centers and others. In 2021, pharmaceutical & biotechnology companies segment is expected to dominate the market due to the growing emphasis on strategic initiatives (such as acquisitions, partnerships, and collaborations) by pharma and biotech companies to expand their capabilities in stem cell research.

- On the basis of distribution channel, stem cell manufacturing market is segmented into direct sales and third party distributors. In 2021, direct sales segment is expected to dominate the market because of large number of players in the market.

North America Stem Cell Manufacturing Market Country Level Analysis

The stem cell manufacturing market is analysed and market size information is provided by products, application, end user and distribution channel.

The countries covered in the North Ammerica stem cell manufacturing market report are U.S., Canada, and Mexico.

The U.S. is dominating the global stem cell manufacturing in the North America region due to presence largest consumer market with high GDP, rise in chronic diseases and large number of players presence in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

The Growing Adoption of Stem Cell Therapy along with Public-Private Funding are Creating Opportunities in the Stem Cell Manufacturing Market

The stem cell manufacturing market also provides you with detailed market analysis for every country growth in particular industry with wound debridement device sales, impact of advancement in the ELISpot and FluorSpot assayand changes in regulatory scenarios with their support for the ELISpot and FluorSpot assay market. The data is available for historic period 2019 to 2020.

Competitive Landscape and North America Stem Cell Manufacturing Market Share Analysis

North America stem cell manufacturing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the stem cell manufacturing market.

The major companies providing the stem cell manufacturing are Thermo Fisher Scientific Inc., Merck KGaA, BD, Organogenesis Inc., Vericel Corporation, ANTEROGEN. CO., LTD., VistaGen Therapeutics, Inc., FUJIFILM Cellular Dynamics, Inc., American CryoSystem Corporation, PromoCell GmbH, Sartorius AG, ViaCyte, Inc., STEM CELL Technologies, Inc., Takeda Pharmaceutical Company Limited, DAIICHI SANKYO COMPANY, LIMITED, Bio-Techne, REPROCELL Inc., Catalent, Inc, Mesoblast Ltd, Astellas Pharma Inc. among others.

The strategic initiatives by market players along with new technological advancements for stem cell manufacturing is bridging the gap for various treatments.

For instance,

- In June 2021, REPROCELL Inc. announced that it has opened new seed iPSC manufacture suite to meet the increasing demand of Ipsc-derived master cell banks. This will help the company to address the rising demand and to grow in coming years.

- In June 2021, Catalent Inc. announced that is has acquired RheinCell Therapeuics which is a manufaxcturer of human induced pluripotent stem cells. This will help the company to build up the company’s existing custom cell herapy process development.

- In June 2021, Bio-Techne announced that is has enhanced its gene engineering and cell and gene therapy manufacturing capability. This will help the company to further expand its business.

Collaboration, joint ventures, and other strategies by the market player is enhancing the company market in the stem cell manufacturing market, which also provides the benefit for the organization to improve their offering for stem cell manufacturing market.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.