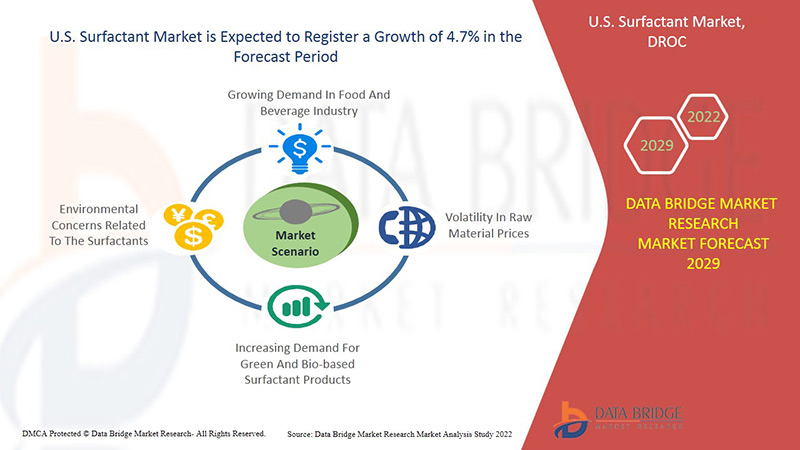

U.S. Surfactant Market is forecast to grow at 4.7% with factors such as increasing usage of surfactants in agrochemicals as it is used in formulations of agrochemicals for crop protection.

The high demand for the product due to the low prices and easy availability of surfactants is expected to further lead to the growth of the U.S. surfactant market.

U.S. Surfactant Market Scenario

According to Data Bridge Market Research, DOW accounts for an estimated market share of 11.23% in the U.S. surfactant market. The company has gained outstanding sales through innovative product development for various industries.

- In January 2022, Dow was awarded by the Business Intelligence Group with multiple 2022 BIG Innovation Awards. This honor is awarded to recognize organizations that bring new ideas to life. Dow also received three awards from the same organization in 2021.

- In January 2022, Dow earned the top spot in the Chemicals sector overall in the JUST 100 list and has been listed the third time in a row consecutively. In addition, the company also held the number one position in the Workers and Stakeholders & Governance categories versus industry peers. This has helped the company increase its reputation in the market.

U.S. surfactant market is becoming more competitive every year with companies such as DOW, 3M, and Nouryonare as these are the market leaders for surfactant products. The Data Bridge Market Research new reports highlight the major growth factors and opportunities in the U.S. surfactant market.

For more analysis on the U.S. surfactant market, request a briefing with our analysts : https://www.databridgemarketresearch.com/speak-to-analyst/?dbmr=u-s-surfactant-market

U.S. Surfactant Market Development

- In October 2021, DOW introduced the next generation of low cyclic, low volatile silicone VORASURF Surfactants and combined the performance and sustainability for bedding and furniture foam. This development has helped the company expand its product portfolio.

Scope of the U.S. Surfactant Market

U.S. surfactant market segmented into three notable segments product, origin and application.

- Based on product, the U.S. surfactant market is segmented into anionic surfactants, non-ionic surfactants, cationic surfactants, and amphoteric surfactants. On the basis of origin, the U.S. surfactant market is segmented into synthetic surfactants and bio-based surfactants. On the basis of application, the U.S. surfactant market is segmented into home care, textile, personal care, oilfield chemicals, food & beverage, agrochemicals, paints & coatings, pharmaceuticals, construction, pulp & paper, plastics, industrial & institutional cleaners, and others.

To know more about the study: https://www.databridgemarketresearch.com/reports/u-s-surfactant-market

Key Pointers Covered in U.S. Surfactant Industry Trends and Forecast to 2029

- Market Size

- Market Standards and Changes

- Market Trials in Different Regions

- Market Requirements in Different Regions

- Market Shares in Different Regions

- Recent Developments for Market Competitors

- Recent Market Value for Different regions

- Sales Data for Market Competitors

- Key Vendors and Disruptors Study

- Supply Chain Competitiveness

Key Market Competitors Covered in the Report

- DOW

- 3M

- Nouryon

- Evonik Industries AG

- BASF SE

- Arkema

- Solvay

- Clariant

- Ashland

- Kao Corporation

- Croda International Plc

Above are the key players covered in the report, to know about more and exhaustive list of U.S. surfactant market, contact us https://www.databridgemarketresearch.com/toc/?dbmr=u-s-surfactant-market

Research Methodology: U.S. Surfactant Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and forecasted using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. Please request an analyst call or drop down your inquiry to know more.

The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include vendor positioning grid, market timeline analysis, market overview and guide, company positioning grid, company market share analysis, standards of measurement, top to bottom analysis, and vendor share analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

Primary Respondents

- Demand Side: End Industries

- Supply Side: Product Managers, Marketing Managers, C-Level Executives, Distributors, Market Intelligence, and Regulatory Affairs Managers, among others.

Related Reports

- Global Biosurfactants Market - Industry Trends and Forecast to 2028

- Global Amphoteric Surfactant Market - Industry Trends and Forecast to 2029

Browse in Chemical and Materials Category Related Reports@ https://www.databridgemarketresearch.com/report-category/chemical-and-materials