Global Hospital Bed Management Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.96 Billion

USD

4.00 Billion

2024

2032

USD

1.96 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.96 Billion | |

| USD 4.00 Billion | |

|

|

|

|

Hospital Bed Management Systems Market Size

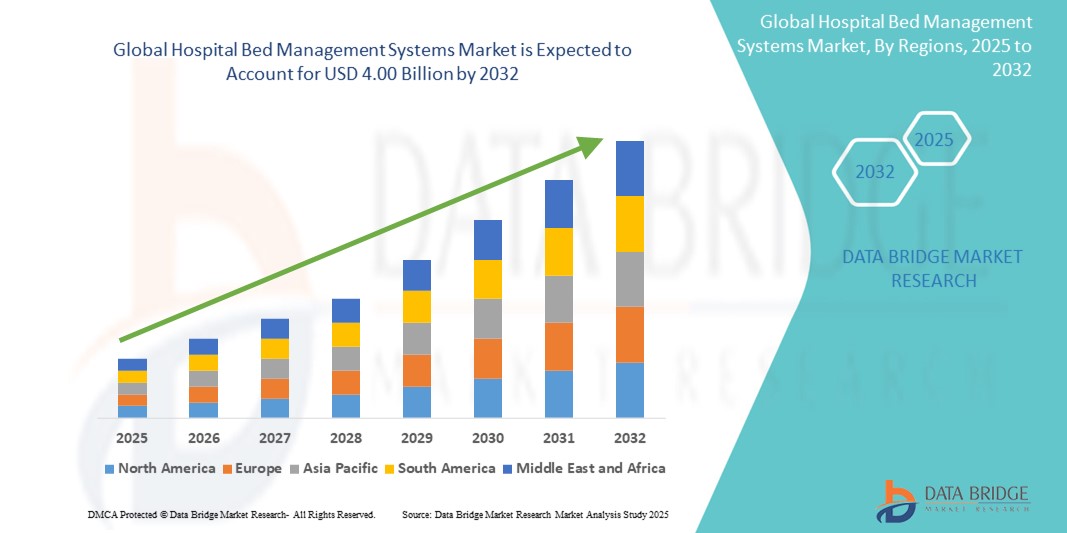

- The global hospital bed management systems market size was valued at USD 1.96 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by increasing pressure on healthcare infrastructure, rising patient admissions, and the growing need for streamlined operations and real-time data in hospitals to enhance patient care and bed utilization

- Furthermore, rising adoption of digital healthcare technologies and automation in hospital operations is establishing bed management systems as critical tools for operational efficiency. These converging factors are accelerating the integration of smart bed tracking and allocation systems, thereby significantly boosting the industry's growth

Hospital Bed Management Systems Market Analysis

- Hospital bed management systems, offering digital tracking and allocation of hospital beds, are increasingly vital components of modern healthcare infrastructure in both public and private hospitals due to their ability to optimize patient flow, reduce wait times, and enhance operational efficiency

- The escalating demand for hospital bed management systems is primarily fueled by increasing hospital admissions, pressure to improve resource utilization, and the rising adoption of healthcare IT solutions for real-time data and patient management

- North America dominated the hospital bed management systems market with the largest revenue share of 41.4% in 2024, characterized by advanced healthcare infrastructure, strong government support for digital healthcare transformation, and the presence of major health IT vendors, with the U.S. leading adoption in response to capacity challenges and the need for improved care coordination

- Asia-Pacific is expected to be the fastest growing region in the hospital bed management systems market during the forecast period due to expanding healthcare infrastructure, rising patient volumes, and growing investment in hospital automation technologies

- Cloud and Web-based segment dominated the hospital bed management systems market with a market share of 62.6% in 2024, driven by its scalability, cost-effectiveness, and ability to enable real-time remote access and integration with hospital IT systems

Report Scope and Hospital Bed Management Systems Market Segmentation

|

Attributes |

Hospital Bed Management Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hospital Bed Management Systems Market Trends

“Real-Time Bed Tracking and Integration with Hospital IT Systems”

- A significant and accelerating trend in the global hospital bed management systems market is the integration of real-time bed tracking solutions with broader hospital information systems (HIS), electronic health records (EHRs), and IoT-enabled infrastructure. This integration is drastically improving operational visibility, patient throughput, and bed utilization

- For instance, companies such as TeleTracking Technologies and Cerner Corporation offer advanced bed management platforms that automatically update bed status and availability in real-time, facilitating faster admissions, discharges, and transfers

- These systems employ AI and predictive analytics to forecast bed demand and optimize patient flow, helping hospitals minimize overcrowding and reduce emergency department wait times. Automated alerts and dashboards also support proactive bed turnover management and infection control compliance

- The seamless interface between bed management systems and clinical databases allows centralized control over bed occupancy, staffing, patient assignment, and room sanitation, which is critical for operational efficiency and quality of care

- This trend is fundamentally reshaping hospital operations, making digital bed management systems a strategic necessity. Vendors such as Epic Systems and Allscripts are developing AI-driven platforms with real-time dashboards, predictive analytics, and mobile access, helping hospital administrators make timely, data-driven decisions

- The demand for intelligent, integrated bed management systems is rising rapidly across both public and private healthcare sectors, driven by the need to enhance patient care, reduce costs, and improve hospital resource utilization

Hospital Bed Management Systems Market Dynamics

Driver

“Rising Hospital Admissions and Demand for Operational Efficiency”

- The increasing number of hospital admissions due to aging populations, chronic diseases, and post-pandemic healthcare backlogs is a major driver accelerating demand for hospital bed management systems

- For instance, in 2024, several large hospital chains in North America and Europe adopted AI-powered bed tracking platforms to address bottlenecks and reduce patient wait times in emergency departments

- These systems enhance transparency in bed availability, reduce delays in patient transfers, and automate bed turnover tasks, significantly improving the overall patient experience

- Furthermore, growing emphasis on digital transformation in healthcare, coupled with government initiatives to implement health information technology, is pushing hospitals toward adopting intelligent bed management solutions

- The systems also support better staff coordination, real-time decision-making, and resource allocation, making them indispensable tools for modern hospital operations

Restraint/Challenge

“High Initial Costs and Interoperability Issue”

- Despite their benefits, high upfront costs associated with implementing hospital bed management systems particularly cloud-based platforms with advanced features—pose a challenge to adoption, especially in smaller hospitals and resource-limited settings

- For instance, many healthcare facilities in developing regions continue to rely on manual or semi-digital systems due to budgetary constraints and lack of technical infrastructure

- Interoperability with existing hospital IT infrastructure is another major hurdle, as not all systems are compatible with older EHR platforms or administrative tools. Custom integration and staff training add to implementation costs and complexity

- In addition, concerns about data privacy and compliance with healthcare regulations such as HIPAA and GDPR can slow down deployment and require additional security investments

- Overcoming these challenges through cost-effective modular solutions, improved interoperability standards, and cloud-based platforms tailored to different hospital sizes will be critical for expanding market reach and ensuring long-term growth

Hospital Bed Management Systems Market Scope

The market is segmented on the basis of deployment mode, type, and end-use.

- Deployment Mode

On the basis of deployment mode, the hospital bed management systems market is segmented into Cloud & Web-based and On-Premises. The Cloud & Web-based segment dominated the market with the largest revenue share of 62.6% in 2024, driven by its scalability, cost-efficiency, and the ability to offer real-time data access across departments and devices. This deployment model supports remote accessibility and seamless integration with hospital information systems (HIS), electronic health records (EHRs), and mobile devices—enhancing hospital responsiveness and operational coordination.

The On-Premises segment is expected to maintain a steady presence in the market during forecast period, primarily in large institutions that prioritize data control, offline capability, and internal IT management. Hospitals with legacy systems or strict data compliance requirements often prefer on-premise deployment for greater customization and security control.

- By Type

On the basis of type, the hospital bed management systems market is segmented into acute care bed, critical care bed, and long-term care bed. The Acute Care Bed segment dominated the market with over 43% share in 2024, due to the high volume of short-term medical admissions, surgical procedures, and emergency cases that demand rapid turnover and real-time bed availability tracking. Acute care beds are most commonly found in general wards, surgical units, and post-operative recovery, driving higher adoption of automated bed tracking solutions to optimize flow and resource use.

The Critical Care Bed segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increased investment in intensive care units (ICUs) and high-dependency units (HDUs), particularly in response to rising rates of complex chronic illnesses and infectious disease outbreaks. Automation in these critical areas ensures timely intervention, better monitoring, and efficient triage.

- By End-Use

On the basis of end-use, the hospital bed management systems market is segmented into hospitals and clinics. The Hospitals segment accounted for the largest market share of 57% in 2024, owing to their large-scale operations, higher patient volumes, and growing reliance on real-time data for decision-making. Multi-specialty and government hospitals often adopt advanced bed management systems to reduce patient wait times, streamline bed assignments, and comply with healthcare regulations.

The Clinics segment is expected to grow at a steady pace, supported by the increasing digitalization of mid-sized healthcare facilities. Clinics are investing in basic or modular bed management systems that allow efficient patient scheduling and resource utilization, particularly in urban and semi-urban regions where patient volumes are steadily increasing.

Hospital Bed Management Systems Market Regional Analysis

- North America dominated the hospital bed management systems market with the largest revenue share of 41.4% in 2024, characterized by advanced healthcare infrastructure, strong government support for digital healthcare transformation, and the presence of major health IT vendors

- Hospitals and healthcare facilities in the region prioritize operational efficiency and patient flow optimization, making bed management systems a critical tool in managing capacity and ensuring quality care delivery

- This widespread adoption is further supported by government initiatives promoting healthcare IT integration, the presence of major industry players, and high investment in AI-driven solutions, positioning North America as a leader in hospital automation and bed tracking innovation

U.S. Hospital Bed Management Systems Market Insight

The U.S. hospital bed management systems market captured the largest revenue share of 78.4% in 2024 within North America, driven by the rising demand for efficient patient flow management and the rapid adoption of healthcare IT solutions. Hospitals across the U.S. are integrating AI-based platforms and real-time tracking tools to reduce emergency room wait times and optimize bed utilization. Federal incentives for digital health adoption and the presence of key industry players further strengthen the country’s leadership in the segment, making the U.S. a central hub for innovation in hospital automation.

Europe Hospital Bed Management Systems Market Insight

The Europe hospital bed management systems market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent healthcare regulations and growing pressure on hospitals to optimize operations. Increasing hospital admissions, aging populations, and a push for real-time patient monitoring are accelerating the demand for automated bed tracking solutions. Government-led digital health initiatives across countries such as Germany, the U.K., and France are boosting adoption, especially in public healthcare systems focused on improving efficiency and reducing administrative burdens.

U.K. Hospital Bed Management Systems Market Insight

The U.K. hospital bed management systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the digital transformation of the National Health Service (NHS) and the country’s push for healthcare modernization. As hospitals focus on reducing wait times and improving bed turnover, real-time tracking and integrated management systems are becoming vital tools. Initiatives aimed at achieving paperless healthcare environments are expected to further fuel the adoption of intelligent bed tracking solutions.

Germany Hospital Bed Management Systems Market Insight

The Germany hospital bed management systems market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s strong focus on healthcare efficiency, digitization, and regulatory compliance. Hospitals in Germany are increasingly investing in AI-driven bed management platforms that improve patient allocation and resource utilization. The emphasis on precision healthcare and real-time data access is encouraging the adoption of integrated systems in both public and private hospitals.

Asia-Pacific Hospital Bed Management Systems Market Insight

The Asia-Pacific hospital bed management systems market is poised to grow at the fastest CAGR of 10.7% during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing healthcare investments, and government support for digital health infrastructure. Countries such as China, Japan, and India are witnessing rising demand for hospital automation, with the integration of bed management systems seen as a solution to improve care coordination and reduce bottlenecks. Expanding hospital networks and growing awareness of digital health benefits are key contributors to the region’s strong growth.

Japan Hospital Bed Management Systems Market Insight

The Japan hospital bed management systems market is gaining momentum due to the country’s aging population, technological advancement, and focus on improving healthcare delivery. Hospitals are adopting smart systems that track bed occupancy and automate discharge planning, helping to improve efficiency amid rising demand for elderly care services. Japan’s tech-forward approach and emphasis on IoT integration across healthcare facilities make it a growing market for intelligent bed management solutions.

India Hospital Bed Management Systems Market Insight

The India hospital bed management systems market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by expanding healthcare infrastructure, increasing hospital admissions, and government initiatives such as Ayushman Bharat promoting digital health adoption. With public and private hospitals seeking operational efficiency, demand for cost-effective, cloud-based bed management systems is rapidly increasing. Domestic vendors and technology partnerships are further accelerating growth, especially in urban and semi-urban healthcare centers.

Hospital Bed Management Systems Market Share

The hospital bed management systems industry is primarily led by well-established companies, including:

- TeleTracking Technologies, Inc. (U.S.)

- Oracle (U.S.)

- Epic Systems Corporation (U.S.)

- Veradigm LLC. (U.S.)

- GE HealthCare (U.S.)

- McKesson Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- IBM Corporation (U.S.)

- SAS Institute Inc. (U.S.)

- DXC Technology Company (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- eHealth Queensland (Australia)

- Health Catalyst, Inc. (U.S.)

- Medical Information Technology, Inc. (U.S.)

- E*HealthLine.com, Inc. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Orion Health Group Limited (New Zealand)

What are the Recent Developments in Global Hospital Bed Management Systems Market?

- In May 2024, TeleTracking Technologies, Inc. expanded its partnership with the National Health Service (NHS) in the U.K. to implement an advanced real-time hospital bed management and patient flow system across multiple NHS Trusts. This initiative aims to enhance operational efficiency, reduce emergency department wait times, and improve patient outcomes by providing hospitals with intelligent bed tracking and automated resource allocation tools. The collaboration reinforces TeleTracking’s role in driving digital transformation across large-scale public healthcare systems

- In April 2024, Cerner Corporation (a part of Oracle Health) announced the integration of its hospital bed management module with Oracle’s AI-powered analytics engine, enhancing predictive capabilities in hospital operations. The upgraded solution enables hospitals to forecast bed occupancy, plan discharges efficiently, and optimize staff allocation. This development highlights Cerner’s strategic focus on combining data intelligence with real-time resource management to improve hospital responsiveness and care delivery

- In March 2024, GE HealthCare launched its next-generation Command Center in select U.S. hospitals, incorporating advanced hospital bed management features such as live bed tracking, discharge readiness analytics, and patient transport coordination. The solution utilizes AI and machine learning to manage capacity constraints and streamline patient movement across departments. This innovation is aimed at reducing length of stay and increasing hospital throughput in high-demand environments

- In February 2024, Epic Systems Corporation introduced enhancements to its bed management software, including mobile accessibility for hospital staff and interoperability with third-party EHR systems. These updates are designed to support flexible workflows, real-time updates, and improved communication between departments, ultimately improving care coordination and bed utilization. The new features reflect Epic’s commitment to making hospital operations more agile and data-driven

- In January 2024, Allscripts Healthcare Solutions Inc. partnered with a major hospital network in Southeast Asia to implement a cloud-based hospital bed management system integrated with electronic health records. This initiative aims to support operational efficiency in rapidly growing healthcare markets by enabling digital resource tracking, smart room assignments, and occupancy analytics. The project highlights the increasing demand for scalable and cost-effective digital solutions in emerging healthcare economies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.