Global Kraft Paper Packaging Market

Market Size in USD Billion

CAGR :

%

USD

4.57 Billion

USD

7.39 Billion

2024

2032

USD

4.57 Billion

USD

7.39 Billion

2024

2032

| 2025 –2032 | |

| USD 4.57 Billion | |

| USD 7.39 Billion | |

|

|

|

|

Kraft Paper Packaging Market Size

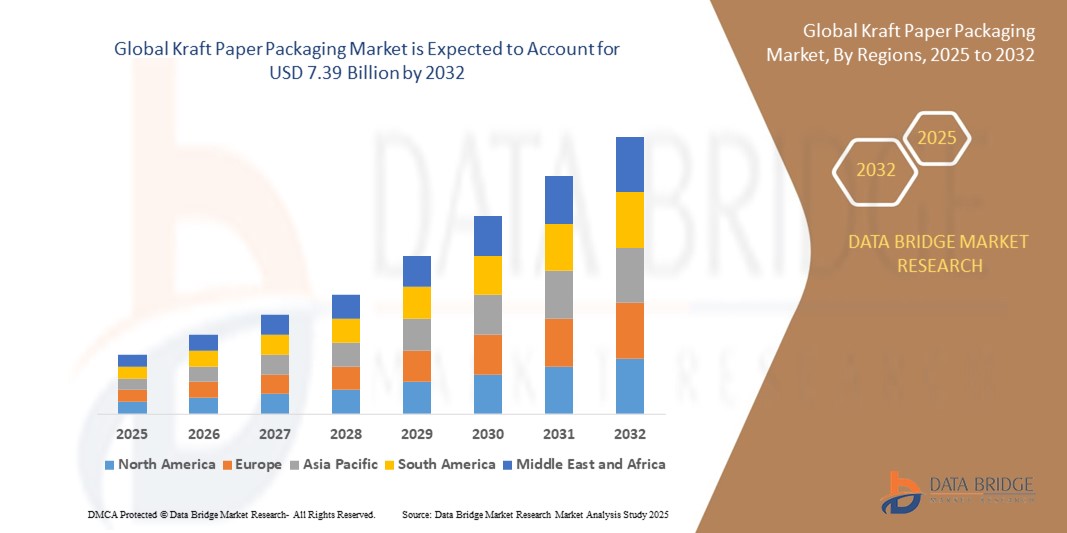

- The global kraft paper packaging market was valued at USD 4.57 billion in 2024 and is expected to reach USD 7.39 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.20%, primarily driven by expansion of the e-commerce industry

- This growth is driven by factors such as easy branding and customization and growth in doorstep deliveries

Kraft Paper Packaging Market Analysis

- Kraft paper packaging refers to durable, biodegradable, and recyclable paper-based materials used across a range of industries for wrapping, boxing, and bagging products. Produced mainly from wood pulp via the kraft process, it includes specialty kraft, sack kraft, bleached and unbleached variants. Kraft paper is widely utilized in food and beverage, construction, electronics, personal care, and e-commerce sectors for its strength, versatility, and eco-friendly properties

- The market is witnessing strong growth driven by rising environmental concerns, growing restrictions on plastic use, and the surge in e-commerce and retail industries. Businesses are increasingly adopting kraft paper packaging to align with sustainability goals, improve brand image, and comply with government regulations targeting single-use plastics

- The kraft paper packaging market is evolving through innovations in paper processing, lightweight materials, and printing technologies. With increasing consumer preference for sustainable and minimalistic packaging, manufacturers are focusing on enhancing paper strength, visual appeal, and recyclability. The market is also seeing developments in barrier coatings and biodegradable liners to extend kraft paper’s usability across moisture-sensitive applications

- For instance, companies such as Mondi Group and Smurfit Kappa are investing in advanced paper-based packaging solutions, including water-resistant kraft paper and customizable branded bags, to serve industries seeking plastic alternatives without compromising functionality

- The kraft paper packaging market is projected to maintain steady growth due to expanding applications in food service, online retail, and industrial packaging. Supported by growing consumer awareness, government initiatives, and technological advancements in sustainable materials, the market is expected to experience continued momentum in the years ahead

Report Scope and Kraft Paper Packaging Market Segmentation

|

Attributes |

Kraft Paper Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Kraft Paper Packaging Market Trends

Increasing Adoption of Smart Packaging Solutions

- One prominent trend in the global kraft paper packaging market is the increasing adoption of smart packaging solutions

- This trend is driven by the rising need for supply chain transparency, enhanced product tracking, and consumer engagement, leading brands to integrate technologies such as QR codes, RFID tags, and NFC labels into kraft paper packaging

- For instance, companies such as Smurfit Kappa and Mondi are exploring digitally interactive kraft paper solutions that offer real-time tracking, authentication, and access to product information through mobile devices

- The integration of smart features into kraft paper not only adds functional value but also supports sustainable branding by aligning with eco-conscious consumer expectations

- As packaging evolves beyond protection and presentation, smart kraft paper packaging is expected to play a growing role in e-commerce, retail, and food service sectors, helping brands differentiate themselves, ensure safety, and deliver richer customer experiences while maintaining sustainability commitments

Kraft Paper Packaging Market Dynamics

Driver

Rising Consumer Awareness of Plastic Hazards

- Rising consumer awareness of plastic hazards is a key driver of growth in the kraft paper packaging market. Growing concerns over plastic pollution, marine waste, and the long-term environmental impact of non-biodegradable materials are pushing consumers to seek sustainable packaging alternatives

- This shift in consumer preference is especially evident in sectors such as food and beverage, personal care, and e-commerce, where eco-conscious buyers are demanding recyclable, compostable, and non-toxic packaging options

- In response, brands are increasingly replacing plastic with kraft paper solutions to align with sustainability values, meet regulatory standards, and improve public perception. This transition is also reinforced by consumer expectations for transparency and environmental responsibility

- Features such as biodegradability, recyclability, and a lower carbon footprint are making kraft paper packaging a preferred choice for companies looking to reduce their environmental impact and appeal to green-minded consumers

- Companies are actively rebranding their packaging strategies to incorporate natural-looking, plastic-free alternatives and are investing in product development to enhance the durability and versatility of kraft paper solutions

For instance

- Nestlé and Unilever have introduced kraft paper-based packaging in select product lines as part of their plastic reduction goals

- E-commerce platforms such as Amazon are expanding their use of paper-based mailers and wrapping materials to minimize plastic usage across their delivery networks

- With rising public pressure, policy reforms, and consumer demand for sustainable lifestyles, the awareness of plastic hazards is expected to remain a powerful force driving the growth of the kraft paper packaging market in the coming years

Opportunity

Growing Demand for Premium Custom Food Packaging

- The growing demand for premium custom food packaging presents a significant opportunity for expansion in the kraft paper packaging market. As food and beverage brands prioritize product differentiation and sustainable presentation, kraft paper is emerging as a preferred material for high-end, eco-conscious packaging solutions

- Kraft paper’s natural texture, strong printability, and compatibility with minimalist and rustic designs make it ideal for packaging artisanal, organic, and gourmet food products that emphasize quality and authenticity

- This shift is especially prominent among small and medium-sized food producers, as well as premium retail and direct-to-consumer brands, who seek packaging that reflects their commitment to sustainability and enhances customer experience

For instance

- Companies such as Huhtamaki and WestRock are expanding their kraft paper packaging portfolios with customized formats, embossing, and eco-friendly coatings to cater to the premium food segment

- Boutique coffee, tea, and snack brands are adopting kraft pouches and boxes with tailored prints and finishes to strengthen brand appeal and eco-positioning

- As consumer expectations shift toward aesthetic, functional, and environmentally responsible packaging, investment in premium kraft paper solutions is expected to grow, offering manufacturers new avenues for innovation and market differentiation

Restraint/Challenge

Effects of Deforestation on Paper Packaging

- The effects of deforestation present a significant challenge for the kraft paper packaging market. As global paper production depends heavily on wood pulp sourced from forests, increased deforestation raises environmental concerns and puts pressure on raw material sustainability

- The kraft process primarily uses virgin fiber derived from trees, and continued deforestation not only contributes to biodiversity loss and climate change but also affects the long-term availability of forest resources, impacting the paper packaging supply chain

- Growing regulatory restrictions on logging, along with rising public scrutiny and demand for ethical sourcing, are forcing manufacturers to adopt more responsible forestry practices and shift toward recycled or certified materials, often at a higher cost and with operational limitations

For instance

- Companies such as International Paper and Stora Enso have faced increased pressure to ensure traceability and certification of their wood sources, adding complexity to their sourcing and compliance strategies

- As environmental challenges linked to deforestation persist, the kraft paper packaging market is likely to face continued scrutiny and volatility in its supply chain and resource accessibility

Kraft Paper Packaging Market Scope

The market is segmented on the basis of product, type, grade, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Grade |

|

|

By End User

|

|

Kraft Paper Packaging Market Regional Analysis

North America is the Dominant Region in the Kraft Paper Packaging Market

- North America dominates the Kraft Paper Packaging market, driven by the robust expansion of the food and beverage industry, increasing preference for sustainable packaging, and the widespread shift away from single-use plastics

- The U.S. holds a significant share due to its strong retail infrastructure, consumer demand for eco-friendly packaging, and presence of major packaging manufacturers investing in paper-based alternatives

- High paper recycling rates and well-developed recycling infrastructure in countries such as the U.S. and Canada are supporting the production of recycled kraft paper, further reinforcing the region’s leadership position in sustainable packaging solutions. In addition, the region benefits from proactive regulatory policies that promote environmental responsibility and encourage the use of renewable and recyclable packaging materials

- With increasing adoption of kraft paper in fast-moving consumer goods, e-commerce shipping, and premium food packaging, North America is expected to maintain its dominance in the global kraft paper packaging market throughout the forecast period 2025–2032

Asia-Pacific is Projected to Register the Highest Growth Rate

- The Asia-Pacific region is expected to witness the highest growth rate in the Kraft Paper Packaging market, driven by rapid industrialization, population growth, and a rising shift toward recyclable and biodegradable packaging solutions

- Countries such as China, India, and Japan are leading the regional expansion, supported by increasing demand for eco-friendly packaging in food delivery, retail, and online commerce sectors

- Government initiatives promoting sustainable materials and investments in circular economy models are driving the replacement of plastic packaging with kraft paper alternatives across industries. Southeast Asian countries are also emerging as high-growth markets due to the growing awareness of environmental issues, urban lifestyle changes, and a rise in consumption of packaged foods

- With the ongoing transformation of supply chains, increasing local manufacturing, and a strong push toward sustainable development, Asia-Pacific is expected to register the highest growth rate in the kraft paper packaging market during the forecast period 2025–2032

Kraft Paper Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amcor plc (Australia)

- DS Smith (U.K.)

- Pactiv Evergreen Inc. (U.S.)

- Holmen (Sweden)

- Hood Packaging Corporation (U.S.)

- Huhtamaki Oyj (Finland)

- International Paper (U.S.)

- Kapstone Technologies, Inc. (U.S.)

- Mayr-Melnhof Karton AG (Austria)

- Mondi (U.K.)

- Pratt Industries, Inc. (U.S.)

- Gascogne (France)

- Natron-Hayat d.o.o. (Slovenia)

- Canadian Kraft Paper Ltd. (Canada)

- Smurfit Kappa (Ireland)

- SCG PACKAGING (Thailand)

- Forest Company (U.S.)

- COPAME (Spain)

Latest Developments in Global Kraft Paper Packaging Market

- In May 2024, Mondi introduced a new sustainable secondary paper packaging solution, ‘TrayWrap,’ designed to replace plastic shrink film for bundling food and beverage products. This innovative packaging, crafted from Mondi’s Advantage StretchWrap range, is currently being utilized by a coffee brand in Sweden to secure 12 coffee packages for transportation. The introduction of TrayWrap is expected to significantly impact the market by offering an eco-friendly alternative, aligning with the growing demand for sustainable packaging solutions in the food and beverage sector

- In February 2023, ProAmpac, a leader in flexible packaging and material science, introduced ProActive Recyclable Paper-1000, a significant addition to its ProActive Recyclable product line. As the first in a series of curbside recyclable, paper-based packaging solutions, RP-1000 offers heat sealability, strong moisture resistance, and excellent directional tear properties. This launch strengthens ProAmpac’s position in the sustainable packaging segment and reflects the growing market demand for eco-friendly alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Kraft Paper Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Kraft Paper Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Kraft Paper Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.