يُشكّل تزايد حالات اضطرابات المسالك البولية في أستراليا دافعًا رئيسيًا لسوق جراحة المسالك البولية، نظرًا لتزايد عدد المرضى الذين يحتاجون إلى تدخلات جراحية. وقد شهدت حالات مثل سرطان البروستاتا، وسرطان المثانة، وحصوات الكلى ، وسلس البول ، وتضخم البروستاتا الحميد (BPH) ارتفاعًا في معدلات الانتشار، لا سيما بين كبار السن. ومع ازدياد شيوع هذه الاضطرابات، غالبًا ما تُترك للمرضى خيارات محدودة للإدارة، مما يجعل الإجراءات الجراحية جزءًا أساسيًا من خطط علاجهم. يُحفّز هذا التوجه الطلب على العمليات الجراحية، ويستلزم تطوير مرافق جراحية متخصصة وتدريب متخصصي الرعاية الصحية، مما يُوسّع نطاق السوق بشكل أكبر.

على سبيل المثال،

- في يناير 2024، ووفقًا لمقال نُشر في مجلة Cancer Australia، كان سرطان البروستاتا أكثر أنواع السرطان شيوعًا في أستراليا. علاوة على ذلك، ووفقًا للمصدر نفسه، في عام 2022، يُقدر أن يكون لدى الرجل خطر إصابة بسرطان البروستاتا بنسبة 1 من 6 (أو 17%) بحلول سن 85.

- في يونيو 2022، ووفقًا لمقال نُشر في المكتبة الوطنية للطب، كان مرض حصوات الكلى (KSD) شائعًا ومتزايدًا في أستراليا، حيث يُقدر معدل حدوثه السنوي بـ 131 حالة لكل 100,000 نسمة. وقد دفع هذا الميل المرتفع لتكرار الإصابة إلى إعطاء الأولوية للتدخلات الوقائية والعلاجات.

علاوة على ذلك، يُبرز ارتفاع معدل الإصابة باضطرابات المسالك البولية أهمية التشخيص والتدخل المبكر، مما يُفضي غالبًا إلى خيارات جراحية أكثر فعالية وأقل تدخلاً. ومع تزايد الوعي العام والسريري بصحة المسالك البولية، من المرجح أن يسعى المزيد من المرضى للحصول على رعاية استباقية وعلاج في الوقت المناسب، مما يُسهم في نمو سوق الجراحة. ومع التقدم المستمر في التقنيات والتقنيات الجراحية، أصبح مُقدمو الرعاية الصحية أكثر جاهزية لمعالجة هذه الاضطرابات بشكل شامل. ونتيجةً لذلك، تُصبح المعدلات المُتزايدة لأمراض المسالك البولية نقطة محورية لدفع عجلة الابتكارات في خيارات العلاج، وتحسين نتائج المرضى، وزيادة الطلب الإجمالي في سوق جراحة المسالك البولية في أستراليا.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/australia-hpb-surgery-market

تحلل شركة Data Bridge Market Research أن سوق جراحة HPB في أستراليا من المتوقع أن يصل إلى 277.90 مليون دولار أمريكي بحلول عام 2032 من 160.55 مليون دولار أمريكي في عام 2024، بنمو بمعدل نمو سنوي مركب كبير بنسبة 7.1٪ في الفترة المتوقعة من 2025 إلى 2032.

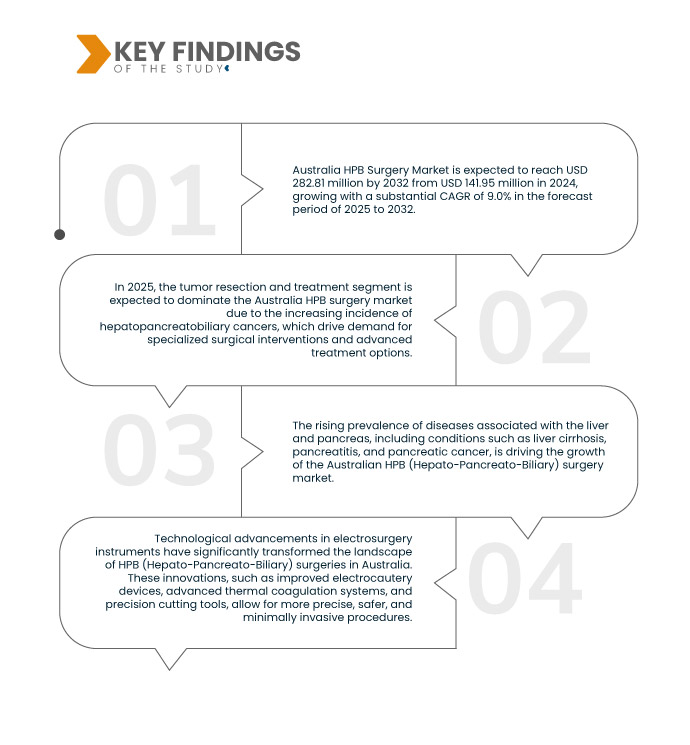

النتائج الرئيسية للدراسة

زيادة في عدد السكان المسنين

يُشكّل ارتفاع نسبة كبار السن في أستراليا دافعًا رئيسيًا لسوق جراحة المسالك البولية، إذ يُعدّ كبار السن أكثر عرضة للإصابة بمختلف اضطرابات المسالك البولية. وتُعدُّ حالات مثل تضخم البروستاتا الحميد (BPH)، وسرطان البروستاتا، وسلس البول، وحصوات الكلى أكثر شيوعًا بين كبار السن. ومع ارتفاع نسبة كبار السن في السكان، يزداد الطلب على جراحات المسالك البولية بالتبعية. ويؤدي هذا التوجه الديموغرافي إلى زيادة عدد المرضى الذين يحتاجون إلى تدخلات جراحية، ويُرهق نظام الرعاية الصحية لتوفير الموارد والمرافق والرعاية المتخصصة الكافية المُصمَّمة خصيصًا لتلبية الاحتياجات الفريدة لكبار السن.

على سبيل المثال،

- في أكتوبر 2023، ووفقًا لمقال نُشر في جامعة سيدني، من المتوقع أن تتقدم أستراليا في السن بوتيرة أسرع. علاوة على ذلك، من المتوقع أنه بحلول عام 2026، سيتجاوز عدد الأستراليين الذين تزيد أعمارهم عن 65 عامًا 22%، وهي نسبة أعلى من 16% في عام 2020.

علاوة على ذلك، غالبًا ما يؤدي شيخوخة السكان إلى زيادة التركيز على الرعاية الوقائية والتشخيص المبكر، بالإضافة إلى تزايد قبول الخيارات الجراحية لتحسين جودة الحياة. يسعى كبار السن عادةً إلى علاجات فعّالة لمشاكل المسالك البولية التي تؤثر بشكل كبير على أنشطتهم اليومية وصحتهم العامة. ونتيجةً لذلك، يُعزز شيخوخة السكان الطلب على جراحات المسالك البولية، ويُشجع على التقدم في التكنولوجيا الطبية وأساليب العلاج في سوق جراحة المسالك البولية في أستراليا.

استجابةً لهذا التوجه، يُركز مُصنِّعو الأجهزة الطبية على تطوير تقنيات مبتكرة لجمع الدم تضمن راحةً أفضل للمرضى، ودقةً أعلى، ونتائج أسرع. إضافةً إلى ذلك، يُعزز التوجه نحو الرعاية الصحية الوقائية الحاجة إلى فحوصات الدم، إذ يسعى الأفراد إلى التشخيص والمتابعة المُبكرين، مما يُعزز الطلب على أجهزة جمع الدم في المستشفيات ومرافق الرعاية المنزلية على حدٍ سواء.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2025 إلى 2032

|

سنة الأساس

|

2024

|

سنة تاريخية

|

2023 (قابلة للتخصيص 2013-2017)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية

|

القطاعات المغطاة

|

حسب التطبيق (استئصال الورم وعلاجه، استئصال المرارة بالمنظار، وغيرها)، والتكنولوجيا (أنظمة التنظير والأدوات الروبوتية المساعدة، وأنظمة الموجات فوق الصوتية أثناء الجراحة لتحديد موقع الورم، والأجهزة الجراحية الكهربائية والقائمة على الطاقة، وأنظمة التصوير المتقدمة)، ونوع الإجراء (الجراحة بالمنظار، والجراحة الروبوتية، والجراحة المفتوحة)، والمستخدم النهائي (المستشفيات، ومستشفيات السرطان المتخصصة، ومراكز الجراحة الخارجية، وغيرها)

|

الجهات الفاعلة في السوق المغطاة

|

شركة بوسطن العلمية (الولايات المتحدة)، شركة سيمنز هيلثينيرز إيه جي (ألمانيا)، شركة كوك (الولايات المتحدة)، شركة أوليمبوس (اليابان)، شركة سترايكر (الولايات المتحدة)، شركة ميدترونيك (أيرلندا)، شركة جي إي هيلث كير (الولايات المتحدة)، شركة جونسون آند جونسون للخدمات (الولايات المتحدة)، وشركة إنتويتيف سرجيكال أوبريشنز (الولايات المتحدة)

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات

يتم تقسيم سوق جراحة HPB في أستراليا إلى أربعة قطاعات بارزة تعتمد على التطبيق والإجراء والتكنولوجيا والمستخدم النهائي.

- على أساس التطبيق، يتم تقسيم سوق جراحة HPB في أستراليا إلى خزعة البروستاتا، واستئصال الكلية الجزئي، وغيرها

في عام 2025، من المتوقع أن يهيمن قطاع خزعة البروستاتا على السوق بحصة سوقية تبلغ 32.91٪

يُعد سرطان البروستاتا من أكثر أنواع السرطان شيوعًا بين الرجال في أستراليا. وتستدعي معدلات الإصابة المرتفعة إجراء خزعات متكررة من البروستاتا للكشف المبكر والتشخيص. كما يُسهم شيخوخة السكان في أستراليا في زيادة عدد حالات سرطان البروستاتا، حيث يرتفع خطر الإصابة به مع التقدم في السن. ونتيجةً لهذه العوامل، ستُهيمن خزعة البروستاتا على هذا القطاع بحلول عام ٢٠٢٥.

- على أساس التكنولوجيا، يتم تقسيم السوق إلى أنظمة تنظير البطن لجراحات الكلى، وتقنية دمج التصوير بالرنين المغناطيسي/الموجات فوق الصوتية لخزعات البروستاتا، وأنظمة الجراحة بمساعدة الروبوت، وتقنيات الاستئصال، وغيرها

في عام 2025، من المتوقع أن تهيمن أنظمة المناظير لجراحات الكلى على السوق بحصة سوقية تبلغ 28.22٪

تُوفر أنظمة التنظير خيارًا أقل تدخلًا لجراحات الكلى، مما يُقلل من إصابات المرضى، ويُقصر مدة إقامتهم في المستشفى، ويُسرّع من تعافيهم. وقد جعلت هذه المزايا من جراحات التنظير خيارًا مُفضّلًا لدى المرضى ومُقدّمي الرعاية الصحية على حدٍ سواء. وبالتالي، من المتوقع أن تُهيمن أنظمة التنظير لجراحات الكلى على السوق بحصة سوقية تبلغ 28.22%.

- بناءً على الإجراءات، يُقسّم السوق إلى جراحة المناظير، والجراحة بمساعدة الروبوت، والجراحة المفتوحة. في عام 2025، من المتوقع أن يهيمن قطاع أنظمة المناظير لجراحات الكلى على السوق بحصة سوقية تبلغ 28.22%.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مستشفيات وعيادات متخصصة في جراحة المسالك البولية وغيرها. في عام ٢٠٢٥، من المتوقع أن يهيمن قطاع المستشفيات على السوق بحصة سوقية تبلغ ٦١.٨٧٪.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركة Boston Scientific Corporation (الولايات المتحدة)، وشركة Siemens Healthineers AG (ألمانيا)، وشركة Olympus Corporation (اليابان)، وشركة Medtronic (أيرلندا)، وشركة Johnson & Johnson Services, Inc. (الولايات المتحدة) باعتبارها اللاعبين الرئيسيين في السوق.

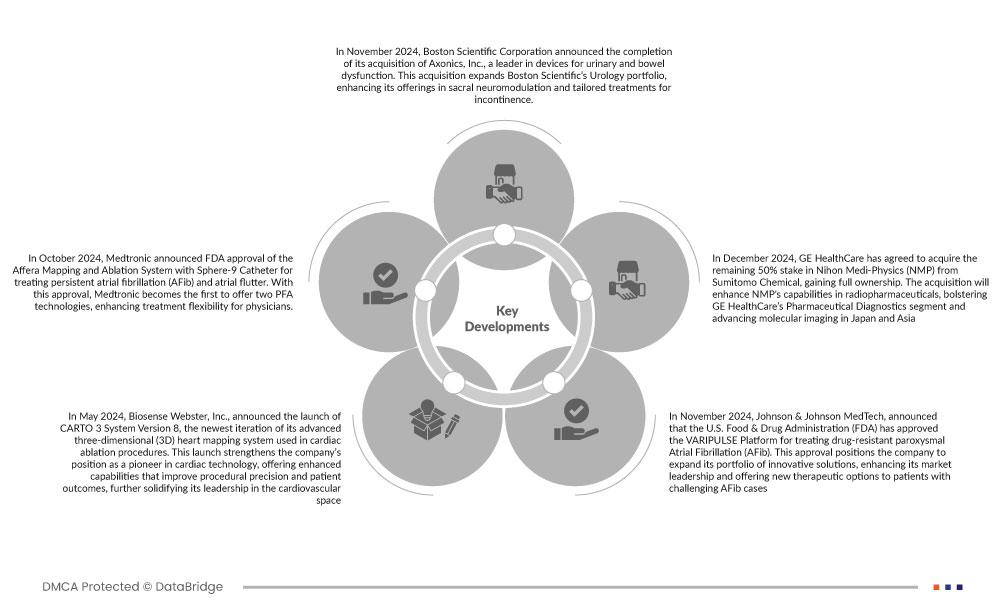

تطوير السوق

- في نوفمبر 2024، أعلنت شركة بوسطن ساينتفك عن إتمام استحواذها على شركة أكسونيكس، الشركة الرائدة في مجال أجهزة علاج اختلال وظائف الجهاز البولي والأمعاء. يُوسّع هذا الاستحواذ محفظة بوسطن ساينتفك في مجال طب المسالك البولية، مُعززًا عروضها في مجال تعديل الأعصاب العجزية والعلاجات المُصممة خصيصًا لسلس البول.

- في نوفمبر 2024، أعلنت شركة جونسون آند جونسون ميدتيك أن إدارة الغذاء والدواء الأمريكية (FDA) وافقت على منصة VARIPULSE لعلاج الرجفان الأذيني الانتيابي المقاوم للأدوية (AFib). يُمكّن هذا الاعتماد الشركة من توسيع نطاق حلولها المبتكرة، وتعزيز ريادتها في السوق، وتقديم خيارات علاجية جديدة للمرضى الذين يعانون من حالات رجفان أذيني صعبة.

- في أكتوبر 2024، أعلنت شركة بوسطن ساينتفك عن موافقة إدارة الغذاء والدواء الأمريكية على قسطرة FARAWAVE NAV Ablation، المصممة لعلاج الرجفان الأذيني الانتيابي (AF)، وحصولها على موافقة إدارة الغذاء والدواء الأمريكية 510(k) لبرنامج FARAVIEW. تتكامل هذه التقنيات مع نظامي FARAPULSE PFA ونظام OPAL HDx Mapping، مما يتيح رسم خرائط القلب والعلاج بكفاءة باستخدام قسطرة واحدة.

- في مايو 2024، أعلنت شركة بيوسينس ويبستر عن إطلاق نظام CARTO 3 الإصدار 8، وهو أحدث إصدار من نظامها المتطور لرسم خرائط القلب ثلاثية الأبعاد (3D) المستخدم في عمليات استئصال القلب. يُعزز هذا الإطلاق مكانة الشركة كرائدة في تكنولوجيا القلب، مُقدمًا قدرات مُحسّنة تُحسّن دقة الإجراءات ونتائج المرضى، مما يُعزز ريادتها في مجال أمراض القلب والأوعية الدموية.

- في مارس 2024، أعلنت شركة بيوسينس ويبستر عن تقديم طلب الحصول على موافقة ما قبل التسويق (PMA) لمنصة VARIPULSE إلى إدارة الغذاء والدواء الأمريكية (FDA). ويمثل هذا الطلب خطوة مهمة في سبيل الحصول على موافقة المنصة، مما سيمكن الشركة من توسيع عروض منتجاتها وتعزيز حضورها في سوق علاج الرجفان الأذيني المتنامي.

- في أكتوبر 2024، أعلنت ميدترونيك موافقة إدارة الغذاء والدواء الأمريكية على نظام أفيرا للتخطيط والاستئصال مع قسطرة سفير-9 لعلاج الرجفان الأذيني المستمر (AFib) والرفرفة الأذينية. بهذه الموافقة، أصبحت ميدترونيك أول شركة تقدم تقنيتين لتخطيط كهربية القلب (PFA)، مما يعزز مرونة العلاج للأطباء.

لمزيد من المعلومات التفصيلية حول تقرير سوق جراحة HPB في أستراليا، انقر هنا - https://www.databridgemarketresearch.com/reports/australia-hpb-surgery-market