Australia Hpb Surgery Market

Market Size in USD Million

CAGR :

%

USD

141.95 Million

USD

282.81 Million

2024

2032

USD

141.95 Million

USD

282.81 Million

2024

2032

| 2025 –2032 | |

| USD 141.95 Million | |

| USD 282.81 Million | |

|

|

|

HPB Surgery Market Analysis

According to the article published by NCBI, the projected 25% increase in NAFLD cases and 40% rise in NASH cases by 2030, along with an 85% rise in advanced liver disease and NAFLD-related deaths, underscores the growing burden of liver conditions in Australia. This escalating prevalence of liver diseases drives the demand for advanced surgeries, acting as a key driver for the HPB surgery market’s growth.In August 2023, according to WILEY Online LIbraray, the significant rise in NAFLD prevalence, from 32.7% to 38.8%, alongside the growing rates of obesity and unhealthy diets, particularly among women, highlights the increasing burden of liver diseases in Australia. As NAFLD progresses, many patients require additional tests for fibrosis, driving the demand for specialized treatments and surgeries. This trend acts as a major driver for the HPB surgery market The growing incidence of liver and pancreatic diseases, such as liver cirrhosis, pancreatitis, and pancreatic cancer, is significantly driving the Australian HPB surgery market. As these conditions become more common due to factors like unhealthy lifestyles, aging populations, and rising alcohol consumption, the demand for advanced surgical procedures like liver transplants, pancreatic resections, and biliary surgeries increases. This surge in disease prevalence is pushing the healthcare sector to focus on specialized surgical treatments and innovative solutions. The expanding need for such services is fueling growth in the HPB surgery market, acting as a major market driver.

HPB Surgery Market Size

Australia HPB surgery market is expected to reach USD 282.81 million by 2032 from USD 141.95 million in 2024, growing with a substantial CAGR of 9.0% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

HPB Surgery Market Trends

“Increasing Number Of Diseases Associated With The Liver And Pancreas”

The Australia HPB (Hepato-Pancreato-Biliary) surgery market is witnessing significant growth, primarily driven by the increasing prevalence of liver and pancreatic diseases. Emerging trends indicate a rise in conditions such as liver cirrhosis, hepatocellular carcinoma (HCC), pancreatitis, and pancreatic cancer, fueled by changing lifestyle patterns, an aging population, and escalating rates of obesity and diabetes. Lifestyle factors like high alcohol consumption, unhealthy diets, and sedentary behavior contribute to diseases like alcoholic liver disease (ALD) and non-alcoholic fatty liver disease (NAFLD). Additionally, the growing obesity and diabetes epidemic, both significant risk factors for NAFLD and pancreatic cancer, has heightened the need for advanced surgical interventions. The aging population in Australia further amplifies the prevalence of these conditions, while advancements in diagnostic technologies and increased awareness have facilitated earlier detection and intervention. Trends such as the adoption of minimally invasive and robotic surgical techniques, a focus on personalized medicine, and collaboration in global research initiatives are also shaping the market, making HPB surgeries a vital component of Australia's healthcare landscape.

Report Scope and HPB Surgery Market Segmentation

|

Attributes |

HPB Surgery Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Boston Scientific Corporation (U.S.), Siemens Healthineers AG (Germany), Cook (U.S.), Olympus Corporation (Japan), Stryker (U.S.), Medtronic (Ireland), GE HealthCare (U.S.), Johnson & Johnson Services, Inc. (U.S.), and Intuitive Surgical Operations, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

HPB Surgery Market Definition

Hepatopancreatobiliary (HPB) surgery refers to a specialized branch of surgical medicine that focuses on the diagnosis, treatment, and surgical management of disorders related to the liver, pancreas, gallbladder, and biliary tract. This field encompasses a wide range of complex procedures, including liver resections, pancreaticoduodenectomies (Whipple procedures), cholangiocarcinoma resections, and surgeries addressing various forms of liver disease, including tumors, infections, and liver transplants. HPB surgery is typically performed by surgeons with advanced training in surgical oncology and hepatobiliary surgery, and it often involves multidisciplinary approaches to ensure comprehensive patient care, integrating the expertise of gastroenterologists, oncologists, radiologists, and pathologists. The goal of HPB surgery is to improve clinical outcomes and enhance quality of life for patients suffering from various HPB-related conditions.

HPB Surgery Market Dynamics

Drivers

- Increasing Number Of Diseases Associated With The Liver And Pancreas

The rising prevalence of diseases associated with the liver and pancreas, including conditions such as liver cirrhosis, pancreatitis, and pancreatic cancer, is driving the growth of the Australian HPB (Hepato-PancreatoBiliary) surgery market. With these diseases becoming more widespread, the demand for specialized surgical treatments, including liver transplants, pancreatic resections, and biliary surgeries, is rapidly increasing. A combination of factors such as lifestyle changes, rising alcohol consumption, poor dietary habits, and aging populations are contributing to the surge in liver and pancreatic diseases. As the healthcare system faces the challenge of addressing these complex conditions, there is a heightened focus on advanced surgical techniques, precision medicine, and post-surgical care. This growing need for specialized surgeries and treatments is propelling innovation and investment in the HPB surgery sector, acting as a key driver for the market's expansion.

For instance,

- In September 2020, according to the article published by NCBI, the projected 25% increase in NAFLD cases and 40% rise in NASH cases by 2030, along with an 85% rise in advanced liver disease and NAFLD-related deaths, underscores the growing burden of liver conditions in Australia. This escalating prevalence of liver diseases drives the demand for advanced surgeries, acting as a key driver for the HPB surgery market’s growth

- In August 2023, according to WILEY Online LIbraray, the significant rise in NAFLD prevalence, from 32.7% to 38.8%, alongside the growing rates of obesity and unhealthy diets, particularly among women, highlights the increasing burden of liver diseases in Australia. As NAFLD progresses, many patients require additional tests for fibrosis, driving the demand for specialized treatments and surgeries. This trend acts as a major driver for the HPB surgery market

The growing incidence of liver and pancreatic diseases, such as liver cirrhosis, pancreatitis, and pancreatic cancer, is significantly driving the Australian HPB surgery market. As these conditions become more common due to factors like unhealthy lifestyles, aging populations, and rising alcohol consumption, the demand for advanced surgical procedures like liver transplants, pancreatic resections, and biliary surgeries increases. This surge in disease prevalence is pushing the healthcare sector to focus on specialized surgical treatments and innovative solutions. The expanding need for such services is fueling growth in the HPB surgery market, acting as a major market driver.

- Growing Trend of Gall Bladder Concerns In Younger Adults

The growing trend of gallbladder issues among younger adults in Australia is becoming a significant concern, driven by factors such as poor dietary habits, increased obesity rates, and sedentary lifestyles. Conditions like gallstones, cholecystitis, and other gallbladder-related diseases are increasingly being diagnosed in individuals under 40, previously considered uncommon in this age group. With the rise in fast food consumption, high-fat diets, and insufficient physical activity, the incidence of gallbladder problems is expected to continue to grow. As a result, there is an increased demand for surgical interventions, including laparoscopic cholecystectomies and other treatments for gallbladder diseases. This trend is fueling the need for specialized HPB surgeries in Australia, acting as a key driver for the market's expansion.

For instance,

- In February 2022, according to the article published by NCBI, the incidence of gallbladder cancer (GBC) in Australia increased, particularly in males aged 60-80. While mortality rates decreased, the rising incidence among younger adults highlights a growing trend in gallbladder-related diseases. This shift in age demographics for GBC fuels the demand for advanced diagnostic and surgical treatments, acting as a driver for the Australian HPB surgery market

- In August 2022, according to the article published by Annals of Hepato-Biliary- Pancreatic Surgery, between 1982 and 2018, gallbladder cancer (GBC) incidence in Australia showed notable regional and gender shifts, with increasing rates in males and specific states like NSW and QLD. As the incidence rises, particularly in younger adults, the demand for early detection and surgical intervention is growing. This trend drives the need for specialized HPB surgeries, acting as a key market driver The rising prevalence of gallbladder issues among younger adults in Australia, driven by poor diets, higher obesity rates, and inactive lifestyles, is becoming a growing concern. Conditions like gallstones and cholecystitis, once rare in this age group, are now more common. This trend increases the need for surgical treatments, boosting the demand for HPB surgeries and acting as a significant driver for the market.

Opportunities

- Technological Advancements In Electrosurgery Instruments

Technological advancements in electrosurgery instruments have significantly transformed the landscape of HPB (Hepato-Pancreato-Biliary) surgeries in Australia. These innovations, such as improved electrocautery devices, advanced thermal coagulation systems, and precision cutting tools, allow for more precise, safer, and minimally invasive procedures. Electrosurgery now enables surgeons to perform complex liver, pancreas, and biliary surgeries with reduced complications, faster recovery times, and minimal tissue damage. These breakthroughs have enhanced surgical outcomes, reduced operating times, and contributed to a lower risk of bleeding. As healthcare providers increasingly adopt these advanced instruments, the demand for specialized HPB surgical procedures rises, positioning technological advancements as a key driver for the growth of the Australian HPB surgery market.

For instance,

- In August 2022, according to the article published by MDPI, A study explored the potential of an electrocautery device to automatically detect energy events and settings, such as mode and energy level. Tested on two devices, the method achieved 95.56% accuracy in classifying cautery states across various tissue types. This innovation in electrosurgery instruments enhances surgical precision, improving outcomes and safety, thus driving growth in the Australian HPB surgery market

- In April 2024, according to the article published by Advanced Energy, Technological advancements in electrosurgery, such as minimally invasive surgery (MIS), integration with robotics, and pulsed field ablation (PFA), are reshaping HPB surgeries. Electrosurgery enables precise tissue handling, reducing trauma and recovery times, while robotics and PFA enhance surgical precision and expand treatment options. These innovations are driving the growth of the Australian HPB surgery market by improving outcomes and broadening procedural capabilities Advancements in electrosurgery instruments have revolutionized HPB surgeries in Australia. New technologies, such as precision electrocautery and thermal coagulation tools, enable safer, more effective, and minimally invasive procedures. These innovations improve surgical accuracy, reduce recovery times, and minimize tissue damage. As healthcare providers increasingly adopt these technologies, the demand for HPB surgeries grows, making these advancements a key driver for the market's expansion.

Rise Of Minimally Invasive Susrgery

The rise of minimally invasive surgery (MIS) is poised to exert a substantial influence on driving the market for Hepato-Pancreatico-Biliary (HPB) surgeries and surgical devices. Minimally invasive surgical techniques, which include laparoscopic and robotic-assisted procedures, have gained immense popularity due to their numerous patient benefits. These techniques offer reduced postoperative pain, shorter hospital stays, faster recovery times, and smaller incisions, resulting in improved overall patient outcomes. In the context of HPB surgeries, the adoption of minimally invasive approaches has expanded, allowing for intricate procedures involving the liver, pancreas, and bile ducts to be performed with greater precision and reduced morbidity. Patients, too, increasingly prefer these minimally invasive options, driving the demand for specialized surgical devices and instruments tailored to these techniques

- For instance, n In December 2022, according to the article published by MDPI, In the past 15 years, there have been notable advancements in minimally invasive techniques for hepatobiliary surgery. The study showed that laparoscopic liver resection (LLR) and robotic liver resection (RLR) could be carried out with acceptable perioperative safety and without having a negative impact on overall survival. Furthermore, in patients who present with synchronous stage- four disease, improvements in laparoscopic techniques and expertise may make it easier to simultaneously remove colorectal and liver tumors

- In November 2022, according to the article published by NCBI, New developments in minimally invasive surgery include SILS (single incision laparoscopic surgery) and NOTES (natural orifice transluminal endoscopic surgery). Biliary or hydatid cysts were removed, and liver resections for hepatocellular carcinoma or colorectal metastases were performed. The lesions had an average diameter of 5 cm, and the procedure took 95 to 205 minutes on average. Transvaginal liver resection is possible and safe when performed by multidisciplinary teams. Less invasive, more tolerable, and aesthetically pleasing procedures are the aims of SILS (single incision laparoscopic surgery) and NOTES (natural orifice transluminal endoscopic surgery) Thus, the market for surgical devices that cater to these procedures is expected to grow significantly as healthcare providers and surgeons continue to embrace MIS for HPB surgeries.. The ongoing development of cutting-edge technologies and instruments to enhance the efficiency and safety of MIS in HPB surgeries further underscores the pivotal role that minimally invasive surgery plays in propelling the HPB surgeries surgical devices market forward.

Restraints/Challenges

- Rising Attention To Healthy Diet

The rising attention to healthy diets has become a prominent factor in reshaping healthcare priorities in Australia. With growing public awareness of the link between diet and diseases such as liver cirrhosis, pancreatitis, and gallbladder conditions, many individuals are now opting for preventive measures like improved nutrition, regular exercise, and weight management. This shift towards lifestyle changes and health-conscious behavior reduces the prevalence of severe conditions that would typically require invasive surgeries. As more Australians focus on maintaining a healthy diet to manage their health, there is less demand for surgical interventions like HPB surgeries. This trend, while beneficial for overall health, limits the market for HPB surgical procedures and acts as a significant restraint to market growth.

For instance,

- In March 2022, according to the article published by Australian Government, Department of Health and Aged Care, Poor diet contributes to 7% of Australia’s disease burden, prompting initiatives like the National Preventive Health Strategy and the Australian Dietary Guidelines to encourage healthier eating. These efforts help reduce the prevalence of diet-related diseases, leading individuals to focus more on prevention than surgical treatments. As a result, the growing emphasis on healthy diets acts as a restraint on the Australian HPB surgery market

- In June 2024, according to the article published by Australian Institute of Health and Welfare, dietary risk factors were the third leading cause of ill health and premature deaths in Australia, with males experiencing a higher disease burden. The National Preventive Health and Obesity Strategies aim to improve diet through measurable targets. As more Australians focus on improving their diets to prevent health issues, the demand for HPB surgeries decreases, acting as a restraint on the market As awareness of the link between diet and various health conditions grows, there has been a significant shift towards healthier eating habits in Australia. Many individuals are focusing on preventive measures such as improved nutrition, exercise, and weight control to avoid diseases like liver cirrhosis, pancreatitis, and gallbladder issues. This emphasis on lifestyle changes reduces the need for invasive surgeries, including HPB procedures. While these efforts benefit overall health, they limit the demand for HPB surgeries, acting as a restraint on the market’s growth.

Lack Of Proper Healthcare Facilities In Developing Region

The lack of adequate healthcare facilities in certain regions of Australia serves as a significant restraint for the Hepatopancreatobiliary (HPB) surgery market. While major metropolitan areas generally provide a range of advanced surgical services, rural and remote communities often suffer from a shortage of specialized surgical centers equipped to handle complex HPB procedures. This disparity in healthcare access can result in delays in diagnosis and treatment for patients in underserved areas, ultimately leading to poorer health outcomes. As a consequence, many patients may need to travel long distances to access appropriate care, which can deter timely intervention and exacerbate health issues, thereby limiting the overall patient pool that can be effectively treated using HPB surgical techniques.

For instance,

- In February 2020, NursingAnswers.net stated, the availability of services, their affordability, and acceptability have all been identified as challenges for access to healthcare in developing nations. Many communities in developing nations face obstacles to receiving services.

These obstacles can be attributed to the distance between the community and the healthcare facility, a lack of funds for transportation and service payments Moreover, inadequate healthcare facilities may hinder the recruitment and retention of skilled healthcare professionals specializing in HPB surgery. When surgical centers lack the necessary infrastructure, advanced technology, and comprehensive support services, they may struggle to attract top surgical talent who seek to work in environments that foster professional growth and capability. This can lead to a shortage of trained surgeons and allied healthcare staff, constraining the number of HPB procedures that can be performed and limiting the overall capacity of the market. Such systemic challenges can also make it difficult for new entrants, including innovative medical device companies and specialized training programs, to establish themselves in regions where the demand for HPB services is high but the necessary facilities are lacking. As a result, the growth potential of the HPB surgery market is significantly undermined, creating a pressing need for investment in healthcare infrastructure across Australia.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

HPB Surgery Market Scope

The market is segmented on the basis of application, technology, procedure type, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Tumor Resection And Treatment

- Liver Tumors

- Hepatocellular Carcinoma

- Metastasis

- Liver Tumors

- Pancreatic Tumors

- Pancreatic Adenocarcinoma

- Neuroendocrine Tumors

- Biliary Tract Cancers

- Cholangiocarcinoma

- Gallbladder Carcinoma

- Laparoscopic Cholecystectomy

- Gallstone Management

- Acute Cholecystitis

- Chronic Cholecystitis

- Others

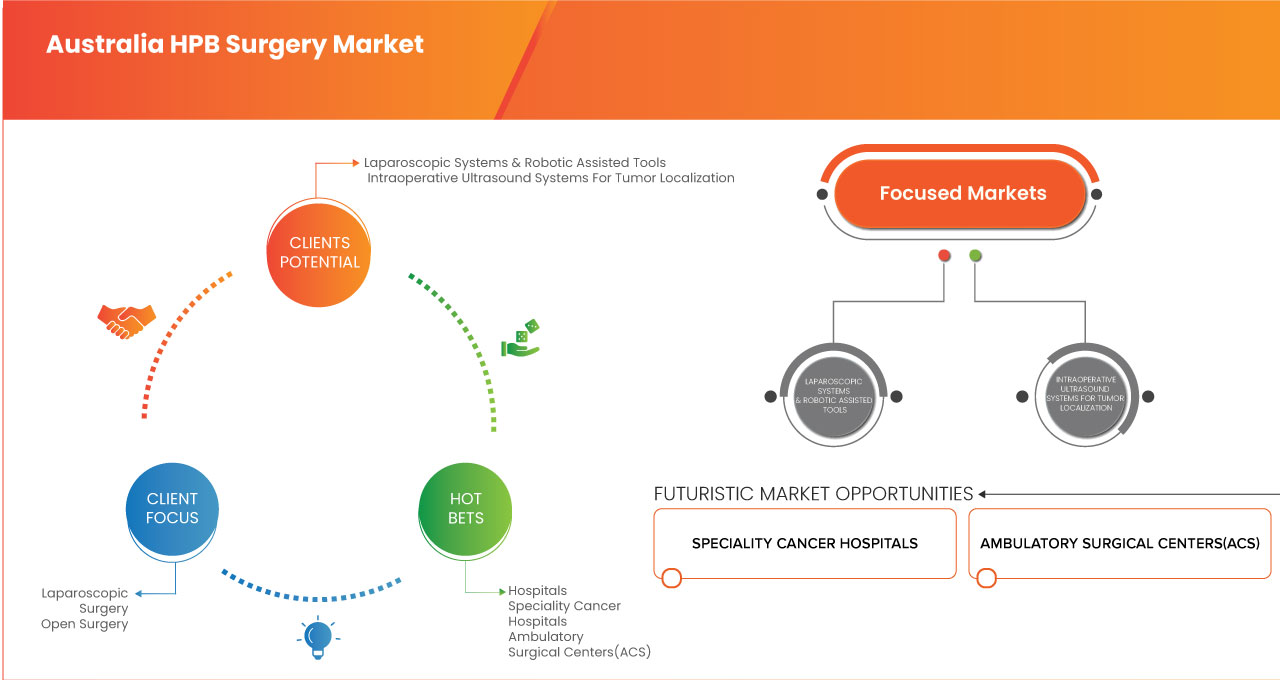

Technology

- Laparoscopic Systems & Robotic Assisted Tools

- Intraoperative Ultrasound Systems For Tumor Localization

- Electrosurgical And Energy-Based Devices

- Advanced Imaging Systems

Procedure Type

- Laparoscopic Surgery

- Open Surgery

- Robotic-Assisted Surgery

End User

- Hospitals

- Speciality Cancer Hospitals

- Ambulatory Surgical Centers(Acs)

- Other

HPB Surgery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

HPB Surgery Market Leaders Operating in the Market Are:

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Cook (U.S.)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Intuitive Surgical Operations, Inc. (U.S.)

Latest Developments in HPB Surgery Market

- In October 2024, Medtronic announced FDA approval of the Affera Mapping and Ablation System with Sphere-9 Catheter for treating persistent atrial fibrillation (AFib) and atrial flutter. With this approval, Medtronic becomes the first to offer two PFA technologies, enhancing treatment flexibility for physicians

- In November 2024, Johnson & Johnson MedTech, announced that the U.S. Food & Drug Administration (FDA) has approved the VARIPULSE Platform for treating drug-resistant paroxysmal Atrial Fibrillation (AFib). This approval positions the company to expand its portfolio of innovative solutions, enhancing its market leadership and offering new therapeutic options to patients with challenging AFib cases

- In May, Biosense Webster, Inc., announced the launch of CARTO 3 System Version 8, the newest iteration of its advanced three-dimensional (3D) heart mapping system used in cardiac ablation procedures. This launch strengthens the company’s position as a pioneer in cardiac technology, offering enhanced capabilities that improve procedural precision and patient outcomes, further solidifying its leadership in the cardiovascular space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE AUSTRALIA HPB SURGERY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 HEALTHCARE EXPENDITURE WITH A FOCUS ON HPB SURGERY

4.3.1 PROCEDURES:

4.3.2 CHOLECYSTECTOMY

4.3.3 COLONOSCOPY

4.4 HEPATO-PANCREATO-BILIARY SURGERY VOLUME TREND

4.5 EPIDEMIOLOGY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NUMBER OF DISEASES ASSOCIATED WITH THE LIVER AND PANCREAS

5.1.2 GROWING TREND OF GALL BLADDER CONCERNS IN YOUNGER ADULTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN ELECTROSURGERY INSTRUMENTS

5.1.4 RISE OF MINIMALLY INVASIVE SUSRGERY

5.2 RESTRAINTS

5.2.1 RISING ATTENTION TO HEALTHY DIET

5.2.2 CONCERNS ASSOCIATED WITH POST-SURGERY COMPLICATIONS

5.2.3 INCORPORATION OF AI TECHNOLOGY IN SURGICAL DEVICES

5.2.4 INCREASING COLLABORATIONS AND PARTNERSHIPS

5.2.5 INCREASED NUMBER OF TRAINING AND EDUCATION PROGRAMS

5.3 CHALLENGES

5.3.1 LACK OF PROPER HEALTHCARE FACILITIES IN DEVELOPING REGION

5.3.2 SHORTAGE OF TRAINED PROFESSIONALS

6 AUSTRALIA HPB SURGERY MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 TUMOR RESECTION AND TREATMENT

6.2.1 LIVER TUMORS

6.2.1.1 HEPATOCELLULAR CARCINOMA

6.2.1.2 METASTASIS

6.2.2 PANCREATIC TUMORS

6.2.2.1 PANCREATIC ADENOCARCINOMA

6.2.2.2 NEUROENDOCRINE TUMORS

6.2.3 BILIARY TRACT CANCERS

6.2.3.1 CHOLANGIOCARCINOMA

6.2.3.2 GALLBLADDER CARCINOMA

6.3 LAPAROSCOPIC CHOLECYSTECTOMY

6.4 OTHERS

7 AUSTRALIA HPB SURGERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LAPAROSCOPIC SYSTEMS & ROBOTIC ASSISTED TOOLS

7.3 INTRAOPERATIVE ULTRASOUND SYSTEMS FOR TUMOR LOCALIZATION

7.4 ELECTROSURGICAL AND ENERGY-BASED DEVICES

7.5 ADVANCED IMAGING SYSTEMS

8 AUSTRALIA HPB SURGERY MARKET, BY PROCEDURE TYPE

8.1 OVERVIEW

8.2 LAPAROSCOPIC SURGERY

8.3 OPEN SURGERY

8.4 ROBOTIC-ASSISTED SURGERY

9 AUSTRALIA HPB SURGERY MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 SPECIALITY CANCER HOSPITALS

9.4 AMBULATORY SURGICAL CENTERS(ACS)

9.5 OTHERS

10 AUSTRALIA HPB SURGERY MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: AUSTRALIA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 OLYMPUS CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 JOHNSON & JOHNSON SERVICES, INC

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 SIEMENS HEALTHINEERS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 BOSTON SCIENTIFIC CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 FUJIFILM HOLDINGS CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 GE HEALTHCARE

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 INTUITIVE SURGICAL OPERATIONS, INC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 KARL STORZ

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 STRYKER

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 FEES AND COSTS BY STATE AND TERRITORY:

TABLE 2 FEES AND COSTS BY STATE AND TERRITORY:

TABLE 3 FEES AND COSTS BY STATE AND TERRITORY:

TABLE 4 AUSTRALIA HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 5 AUSTRALIA TUMOR RESECTION AND TREATMENT IN HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 6 AUSTRALIA LIVER TUMORS IN HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 7 AUSTRALIA PANCREATIC TUMORS IN HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 8 AUSTRALIA BILIARY TRACT CANCERS IN HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 9 AUSTRALIA LAPAROSCOPIC CHOLECYSTECTOMY IN HPB SURGERY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 10 AUSTRALIA HPB SURGERY MARKET, BY PROCEDURE TYPE, 2018-2032 (USD MILLION)

TABLE 11 AUSTRALIA HPB SURGERY MARKET, BY END USER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 AUSTRALIA HPB SURGERY MARKET

FIGURE 2 AUSTRALIA HPB SURGERY MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA HPB SURGERY MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA HPB SURGERY MARKET: COUNTRY-WISE ANALYSIS

FIGURE 5 AUSTRALIA HPB SURGERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA HPB SURGERY MARKET: MULTIVARIATE MODELLING

FIGURE 7 AUSTRALIA HPB SURGERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA HPB SURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AUSTRALIA HPB SURGERY MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 AUSTRALIA HPB SURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 AUSTRALIA HPB SURGERY MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE AUSTRALIA HPB SURGERY MARKET, BY APPLICATION

FIGURE 13 GROWING TREND OF GALL BLADDER CONCERNS IN YOUNGER ADULT IS EXPECTED TO DRIVE THE AUSTRALIA HPB SURGERY MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 14 THE TUMOR RESECTION AND TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA HPB SURGERY MARKET IN 2025 AND 2032

FIGURE 15 MARKET OVERVIEW

FIGURE 16 AUSTRALIA HPB SURGERY MARKET: BY APPLICATION, 2024

FIGURE 17 AUSTRALIA HPB SURGERY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 18 AUSTRALIA HPB SURGERY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 19 AUSTRALIA HPB SURGERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 20 AUSTRALIA HPB SURGERY MARKET: BY TECHNOLOGY, 2024

FIGURE 21 AUSTRALIA HPB SURGERY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 22 AUSTRALIA HPB SURGERY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 AUSTRALIA HPB SURGERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 AUSTRALIA HPB SURGERY MARKET: BY PROCEDURE TYPE, 2024

FIGURE 25 AUSTRALIA HPB SURGERY MARKET: BY PROCEDURE TYPE, 2025-2032 (USD MILLION)

FIGURE 26 AUSTRALIA HPB SURGERY MARKET: BY PROCEDURE TYPE, CAGR (2025-2032)

FIGURE 27 AUSTRALIA HPB SURGERY MARKET: BY PROCEDURE TYPE, LIFELINE CURVE

FIGURE 28 AUSTRALIA HPB SURGERY MARKET: BY END USER, 2024

FIGURE 29 AUSTRALIA HPB SURGERY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 30 AUSTRALIA HPB SURGERY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 AUSTRALIA HPB SURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 AUSTRALIA HPB SURGERY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.