The China explosion-proof equipment market is a dynamic industry driven primarily by the nation's increasing industrial activities. With rapid industrialization and growth across various sectors such as oil and gas, chemicals, mining, and manufacturing, there is a growing need for safety measures to prevent accidents caused by explosive atmospheres. This surge in demand for explosion-proof equipment is primarily fueled by stringent safety regulations, which require implementing protective devices and systems to mitigate the risk of explosions in hazardous environments. As a result, the market witnesses continuous growth and innovation in explosion-proof technologies and solutions to meet these safety requirements.

Access Full Report @ https://www.databridgemarketresearch.com/reports/china-explosion-proof-equipment-market

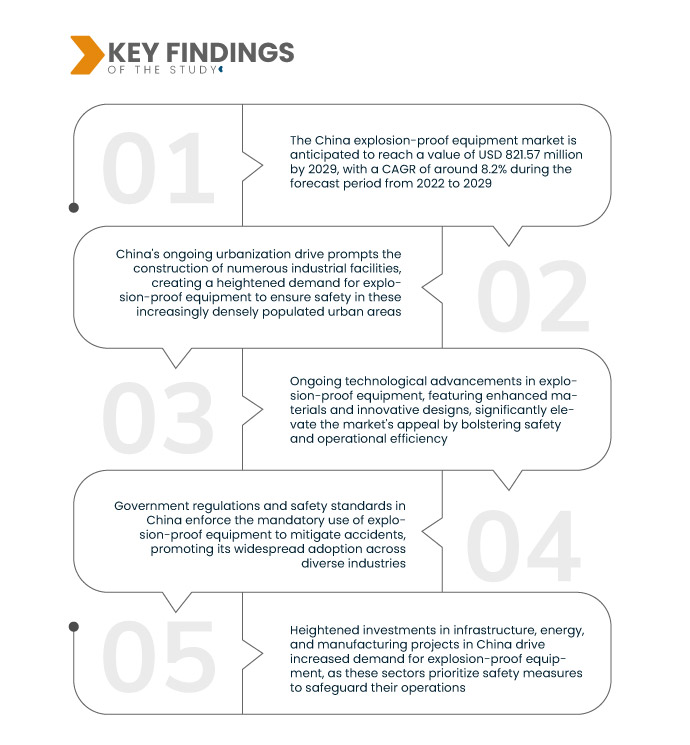

Data Bridge Market Research analyses that the China Explosion-Proof Equipment Market is expected to grow at a CAGR of 8.2% in the forecast period of 2022 to 2029 and is expected to reach USD 821.57million by 2029 from USD 437.34 million in 2021. The growing emphasis on workplace safety in China has increased demand for explosion-proof equipment. Businesses are now more committed to safeguarding employees from potential hazards, driving the adoption of protective solutions.

Key Findings of the Study

Industrial expansion is expected to drive the market's growth rate

China's industrial expansion, notably in oil and gas, chemicals, petrochemicals, mining, and manufacturing sectors, necessitates implementing explosion-proof equipment. These industries often operate in potentially explosive environments, underscoring the critical need for enhanced safety measures. As production and industrial activities surge, the demand for explosion-proof equipment grows in tandem, driven by regulatory compliance and a commitment to safeguarding personnel and assets, making it an essential component of China's booming industrial landscape.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Offering (Hardware, Software, Services), Method of Protection (Explosion Prevention, Explosion Proof, Explosion Segregation (Isolation)), Temperature Classes (T1 (> 450 °C), T2 (> 300 °C TO < 450 °C), T3 (> 200 °C TO < 300 °C), T4 (> 135 °C TO < 200 °C), T6 (> 85 °C TO < 100 °C), T5 (> 100 °C TO < 135 °C)), Zone (Zone 1, Zone 0, Zone 2, Zone 21, Zone 20, Zone 22), Class (Class I, Class II, Class III), Connectivity Service (Wired, Wireless), Location (Indoor, Outdoor), End User (Oil and Gas, Chemical and Petrochemical, Energy and Power, Mining, Construction, Manufacturing, Pharmaceutical, Food Processing, Marine, Aerospace, Military and Defense, Refining, Waste Management, Others).

|

|

Market Players Covered

|

Honeywell International Inc.(U.S.),ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Songbei Explosion-Proof Electric Co., Ltd. (China, R. STAHL AG (Germany), Changzhou Zuoan Electronics Co., Ltd. (China), Warom Technology Incorporated Company (China), Rockwell Automation, Inc. (U.S.), Phoenix Mecano AG (Switzerland), Hubbell (U.S.), CNC ELECTRIC GROUP CO., LTD. (China), Helon Explosion-Proof Electric Co., Ltd.(China), Feice Explosion-proof Electric Co., Ltd.(China), Jiangsu Xianda Explosion-Proof Co., Ltd. (China), NJZ Lighting Technology Co., Ltd. (China), Pepperl+Fuchs SE (Germany), Zhejiang Tormin Electrical Co., Ltd. (China)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The China explosion-proof equipment market is segmented on the basis of offering, method of protection, temperature class, zone, class, connectivity service, location, and end user.

- On the basis of offering, the China explosion-proof equipment market has been segmented into hardware, software, and services. In 2022, the hardware segment is expected to dominate the market during the forecast period of 2022 to 2029 due to the risk of explosion under the wrong ambient conditions

In 2022, the hardware segment is expected to dominate the China explosion-proof equipment market

In 2022, the hardware segment is expected to dominate the market during the forecast period of 2022 to 2029 as even the smallest work tools and objects could create a risk of explosion under the wrong ambient conditions. That is why only explosion-proof devices can be used in areas where dangerous explosive atmospheres are expected, leading to high usage of explosion-proof devices in various applications.

- On the basis of method of protection, the China explosion-proof equipment market has been segmented into explosion prevention, explosion proof, and explosion segregation (isolation). In 2022, explosion prevention segment is expected to dominate the market during the forecast period of 2022 to 2029 as explosion-proofing designs equipment to contain ignition hazards, prevent entry of hazardous substances, and/or, contain any fire/explosion that could occur, therefore explosion proof equipment prevents the explosion from taking place rather than protecting from outer explosions

- On the basis of temperature class, the China explosion-proof equipment market has been segmented into T1 (>450oC), T2 (>300 oC to <450 oC), T3 (>200 oC to <300 oC), T4 (>135 oC to <200 oC), T5 (>100 oC to <135 oC) and T6 (>85 oC to <100 oC). In 2022, T1 (> 450 °C) segment is expected to dominate the market from 2022 to 2029 as most of the gases and vapours fall under T1 temperature, making it the most referred temperature class for the explosion proof equipment

- On the basis of zone, the China explosion-proof equipment market has been segmented into zone 0, zone 1, zone 2, zone 20, zone 21 and zone 22. In 2022, Zone 1 segment is expected to dominate the market during the forecast period of 2022 to 2029 as these are typically process areas where gases are more such asly to be present. Most of the explosion proof equipment comply with Zone 1 areas, leading to the segment's high growth

- On the basis of class, the China explosion-proof equipment market has been segmented into class I, class II and class III. In 2022, Class I segment is expected to dominate the market during the forecast period of 2022 to 2029 as class I segment includes the location that has presence of flammable vapors and gases. Most of the hazardous places have large flammable gas emissions, leading to the segment's dominance

- On the basis of connectivity service, the China explosion-proof equipment market has been segmented into wired and wireless. In 2022, wired connectivity is expected to dominate the market during the forecast period of 2022 to 2029 due to the reduced number of attacks about network traffic interruptions, improved consistency, and reliability, and carry high data over longer distances. Moreover, the cables and switches are prone to explosion and therefore require explosion proof equipment

- On the basis of location, the China explosion-proof equipment market has been segmented into indoor and outdoor. In 2022, the indoor is expected to dominate the market during the forecast period of 2022 to 2029 due to maximum chances of hazards occurring in closed industrial plants and spaces of oil and gas, mining, chemical, energy and power, and other industries

- On the basis of end user, the China explosion-proof equipment market has been segmented into mining, energy and power, oil and gas, chemical and petrochemical, pharmaceutical, food processing, manufacturing, refining, marine, military and defense, construction, waste management, aerospace and others. In 2022, oil and gas are expected to dominate the market during the forecast period of 2022 to 2029 due to the stronger prevalence of vapors

In 2022, oil and gas segment is expected to dominate the China explosion-proof equipment market

In 2022, oil and gas are expected to dominate the market from 2022 to 2029 due to the stronger prevalence of vapors, high exposure to hazardous chemicals and gases, and risky operations such as oil and gas extraction, drilling fluids, and others.

Major Players Data Bridge Market Research recognizes the following companies as the major China explosion-proof equipment market players in China explosion-proof equipment market are Honeywell International Inc.(U.S.),ABB (Switzerland), Siemens (Germany), Eaton (Ireland), R. STAHL AG (Germany), Rockwell Automation, Inc. (U.S.), Phoenix Mecano AG (Switzerland), Hubbell (U.S.), Feice Explosion-proof Electric Co., Ltd.(China), NJZ Lighting Technology Co., Ltd. (China), Pepperl+Fuchs SE (Germany).

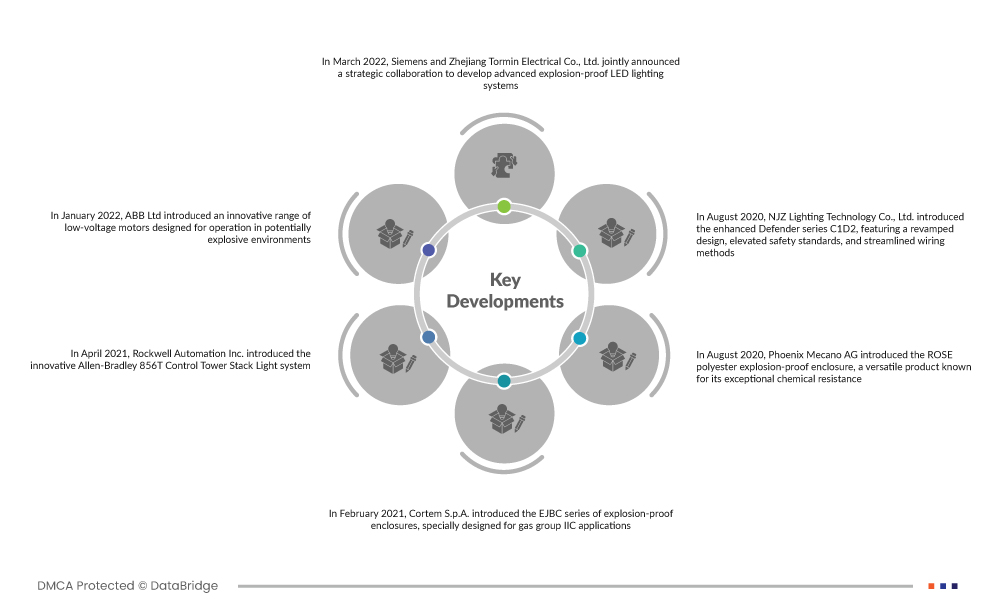

Market Developments

- In January 2022, ABB Ltd unveiled an innovative range of low-voltage motors designed for operation in potentially explosive environments. These flameproof motors enhance both reliability and reduce maintenance demands. Their introduction signifies a significant advancement in safety and efficiency for industries where explosion-proof equipment is vital, promising improved operational performance and lower maintenance costs

- In February 2021, Cortem S.p.A. unveiled the EJBC series of explosion-proof enclosures, specially designed for gas group IIC applications, enabling safe installation in potentially explosive environments. This innovative product release addresses the critical need for enhanced safety measures in hazardous areas, providing a reliable solution for industries dealing with flammable gases and vapors

- In August 2020, Phoenix Mecano AG unveiled the ROSE polyester explosion-proof enclosure, a versatile product known for its exceptional chemical resistance. Designed to be lightweight and ideal for outdoor applications, this innovation significantly expanded the company's product portfolio within the explosion-proof equipment market, catering to a broader range of industries and reinforcing their commitment to delivering high-quality safety solutions

- In August 2020, NJZ Lighting Technology Co., Ltd. introduced the enhanced Defender series C1D2, featuring a revamped design, elevated safety standards, and streamlined wiring methods. The Defender series had previously been a top-performing product for the company, and these improvements aimed to reinforce its position as the flagship offering, catering to the growing demand for reliable and innovative explosion-proof lighting solutions

For more detailed information about the China explosion-proof equipment market report, click here – https://www.databridgemarketresearch.com/reports/china-explosion-proof-equipment-market