The growing adoption of mobile payment solutions and integration with POS systems. The market encompasses a specialized sector within the retail industry that focuses on providing transactional solutions tailored to the unique needs of fuel stations and convenience stores. This market primarily involves the development, distribution, and maintenance of point-of-sale systems specifically designed for businesses operating in the fuel and convenience retail space.

Moreover, these POS systems are equipped to handle a range of functionalities, including fuel dispensing transactions, convenience store sales, inventory management, and often integrate payment processing capabilities. Key features of fuel and convenience store POS solutions include real-time tracking of fuel sales, efficient management of diverse product lines, and compliance with industry-specific regulations such as those related to fuel pricing and card transactions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-and-middle-east-and-africa-fuel-and-convenience-store-point-of-sale-pos-market

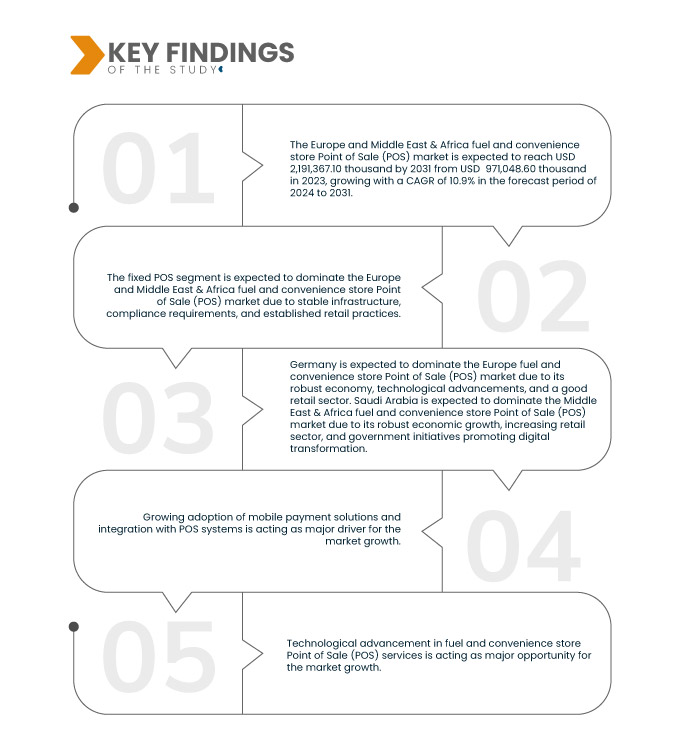

Data Bridge Market Research analyzes that the Europe and Middle East and Africa Fuel and Convenience Store Point of Sale (POS) Market is expected to reach USD 2,191,367.10 thousand by 2031 from USD 971,048.60 thousand in 2023, growing with a CAGR of 10.9% in the forecast period of 2024 to 2031.

Key Findings of the Study

Growing Adoption of Mobile Payment Solutions and Integration with POS Systems

Adoption of mobile payment solutions and their integration with POS systems is reshaping the retail landscape by offering consumers seamless and convenient payment options while streamlining operations for businesses. Mobile payment solutions have become a preferred choice for many customers, driving fuel and convenience store operators to upgrade their POS systems to accommodate these technologies with the rise of smartphone usage and the increasing demand for contactless transactions.

Mobile payments offer speed and convenience, allowing customers to complete transactions quickly and efficiently. This is particularly appealing in the fast-paced environment of fuel and convenience stores, where customers often prioritize convenience and efficiency. Retailers can cater to changing consumer preferences and stay ahead of the competition in the market by integrating mobile payment solutions with POS systems.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Components (Hardware, Software, and Services), Type (Fixed POS, Mobile POS, and Others), Deployment Mode (Cloud Based and On-Premise), Enterprise Size (Small & Medium Size Enterprise and Large Size Enterprise), Operating System (Windows, LINUX, Android, MAC, and Others), Application (Inventory Management, Operation Management, Cash Management, Reporting & Analytics, Customer Relationship Management (CRM), Tank Monitoring, Pump Management, and Others), Purchase Model (Subscription Based, Custom Contract, and One Time Purchase), End User (Convenience Store and Fuel Station)

|

|

Countries Covered

|

Germany, U.K., France, Spain, Italy, Russia, Poland, Turkey, Netherlands, Switzerland, Belgium, Sweden, Norway, Denmark, Finland, Slovenia, Rest of Europe, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Qatar, Kuwait, Bahrain, Oman, and Rest of Middle East & Africa

|

|

Market Players Covered

|

Global Payments Inc. (U.S.), NCR VOYIX Corporation (U.S.), Gilbarco Veeder-Root Company (U.S.), PDI Technologies, Inc.(U.S.), LS Retail ehf. (Iceland), Diebold Nixdorf, Incorporated. (U.S.), Toshiba Global Commerce Solutions (U.S.), VeriFone, Inc. (U.S.), Clover Network, LLC (U.S.), Loyverse (Lativa), Block, Inc. (U.S.), and Oracle (U.S.), among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

|

Segment Analysis:

The Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market are segmented on the basis of components, type, deployment mode, enterprise size, operating system, application, purchase model, and end user.

- On the basis of components, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into hardware, software, and services

In 2024, the hardware segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market

In 2024, the hardware segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 48.94% in Europe and 48.08% in Middle East & Africa due to demand for advanced, integrated systems, compliance requirements, and the need for durable, reliable POS terminals.

- On the basis of type, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into fixed POS, mobile POS, and others

In 2024, the fixed POS segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market

In 2024, the fixed POS segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 71.45% in Europe and 70.60% in Middle East & Africa due to stable infrastructure, compliance requirements, and established retail practices.

- On the basis of deployment mode, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into cloud based and on-premise. In 2024, the cloud based segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 65.04% in Europe and 64.70% in Middle East & Africa

- On the basis of enterprise size, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into small & medium size enterprise and large size enterprise. In 2024, small & medium size enterprise segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 74.56% in Europe and 74.15% in Middle East & Africa

- On the basis of operating system, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into windows, LINUX, android, MAC, and others. In 2024, windows segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 45.17% in Europe and 43.70% in Middle East & Africa

- On the basis of application, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into inventory management, operation management, cash management, reporting & analytics, Customer Relationship Management (CRM), tank monitoring, pump management, and others. In 2024, the inventory management segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 27.97% in Europe and 27.03% in Middle East & Africa

- On the basis of purchase model, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into subscription based, custom contract, and one time purchase. In 2024, the subscription based segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 52.47% in Europe and 51.64% in Middle East & Africa

- On the basis of end user, the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market is segmented into convenience store and fuel station. In 2024, convenience store segment is expected to dominate the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market with the market share of 62.11% in Europe and 61.69% in Middle East & Africa

Major Players

Data Bridge Market Research analyzes Global Payments Inc. (U.S.), Diebold Nixdorf, Incorporated. (U.S.), Toshiba Global Commerce Solutions (Subsidiary of Toshiba Tec Corporation) (U.S.), VeriFone, Inc. (U.S.), and Oracle (U.S.) as the major players operating in the Europe fuel and convenience store Point of Sale (POS) market.

Data Bridge Market Research analyzes NCR VOYIX Corporation (U.S.), Gilbarco Veeder-Root Company. (Subsidiary of Fortive Corp) (U.S.), Toshiba Global Commerce Solutions (Subsidiary of Toshiba Tec Corporation) (U.S.), VeriFone, Inc. (U.S.), and Oracle (U.S.) as the major players operating in the Middle East & Africa fuel and convenience store Point of Sale (POS) market.

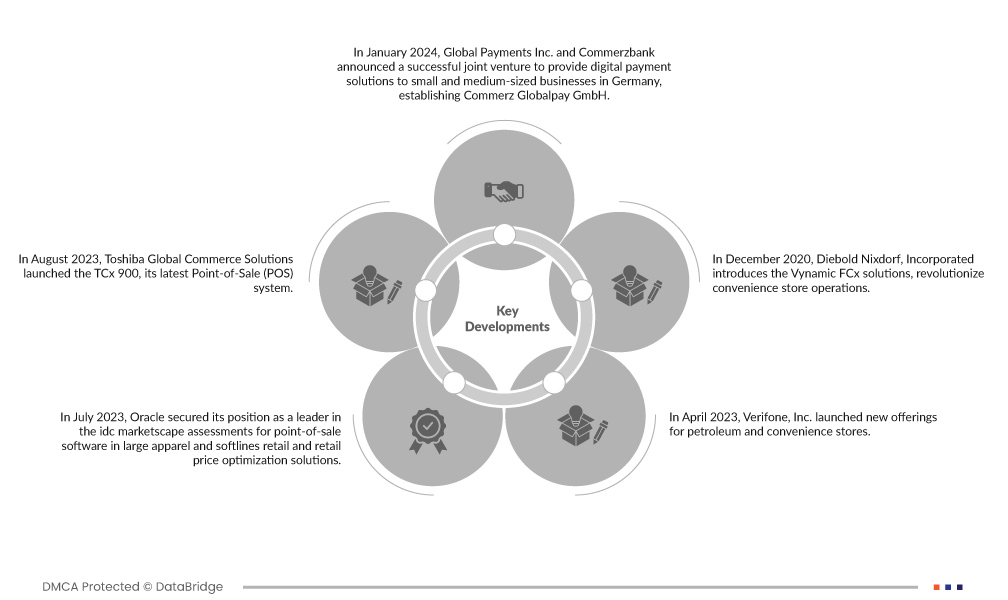

Market Developments

- In January 2024, Global Payments Inc. and Commerzbank announced a successful joint venture to provide digital payment solutions to small and medium-sized businesses in Germany, establishing Commerz Globalpay GmbH. The venture, launched in the first half of 2024, capitalized on Global Payments' leading payment technology and Commerzbank's strong market position. Global Payments held a 51% stake, and Commerzbank held 49%, offering innovative Omni channel payment solutions for efficient business operations. This strategic move significantly expanded Global Payments' services in Germany, tapping into the growing opportunities to digitize the payment experience for businesses

- In August 2023, Toshiba Global Commerce Solutions launched the TCx 900, its latest point-of-sale (POS) system. Featuring advanced technology with a powerful modular system in a durable, compact design, the TCx 900 enhances store productivity and reduces operational expenses. Equipped with a 13th Gen Intel Core processor, WiFi6 connectivity, and AI readiness, the system is a result of Toshiba's ongoing collaboration with Intel to meet retailers' flexible, scalable, high-performance, and secure requirements

- In July 2023, Oracle secured its position as a leader in the idc marketscape assessments for point-of-sale software in large apparel and softlines retail, as well as retail price optimization solutions. The recognition highlights Oracle's capability in providing cutting-edge solutions for the retail industry. This benefited the company by increasing customer loyalty towards the brand and result in increase in revenue

- In April 2023, Verifone, Inc. launched new offerings for petroleum and convenience stores. These include Verifone BackOffice, a cloud-based store management solution, Verifone Convenience for non-fuel convenience stores, Verifone FoodService for integrated food ordering, and the C18 Self-Checkout. These innovations enhance operational efficiency and customer experience, reinforcing Verifone's commitment to providing comprehensive solutions for convenience stores and fueling marketers worldwide. The introduction of Verifone Cloud Services further solidifies its position as a market-leading technology provider

- In December 2020, Diebold Nixdorf, Incorporated introduces the Vynamic FCx solutions, revolutionize convenience store operations. Vynamic FCx Self-Checkout enhances integration with POS device independence, allowing consumers to scan, pay, and order at a single station. The Payments Software unifies payment infrastructure, creating a connected network. Vynamic Operations streamlines forecourt and c-store operations, while Vynamic Engage powers personalized promotions and loyalty rewards. These innovations foster seamless, engaging, and efficient experiences, reinforcing Diebold Nixdorf's commitment to advancing retail technology

Regional Analysis

The countries covered in this market report are Germany, U.K., France, Spain, Italy, Russia, Poland, Turkey, Netherlands, Switzerland, Belgium, Sweden, Norway, Denmark, Finland, Slovenia, rest of Europe, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Qatar, Kuwait, Bahrain, Oman, and rest of Middle East & Africa.

As per Data Bridge Market Research analysis:

Europe is the dominant and the fastest-growing region in Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market

Europe is the dominating and the fastest-growing region in Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market due to its robust economy, technological advancements, and a good retail sector.

For more detailed information about the Europe and Middle East & Africa fuel and convenience store Point of Sale (POS) market report, click here – https://www.databridgemarketresearch.com/reports/europe-and-middle-east-and-africa-fuel-and-convenience-store-point-of-sale-pos-market