أدى تزايد دمج التكنولوجيا في مراكز إعادة التأهيل وخدمات العلاج إلى تحسين جودة وكفاءة العلاجات بشكل ملحوظ. يُعد الواقع الافتراضي ، وإعادة التأهيل عن بُعد، والأجهزة القابلة للارتداء من الأمثلة على التطورات التكنولوجية التي يمكن استكشافها بشكل أكبر لتحسين رعاية المرضى ونتائجها. ومن بين التطورات التكنولوجية في سوق مراكز إعادة التأهيل وخدمات العلاج ما يلي:

إعادة التأهيل عن بُعد، المعروف أيضًا بالعلاج عن بُعد أو إعادة التأهيل عن بُعد، ينطوي على استخدام تقنيات الاتصالات والمعلومات لتقديم خدمات إعادة التأهيل والعلاجات عن بُعد. وقد أتاح هذا للمرضى تلقي العلاج من منازلهم براحة تامة، مما قلل بدوره من الحاجة إلى زيارة مراكز إعادة التأهيل شخصيًا. ومن أمثلة تقنيات إعادة التأهيل عن بُعد مؤتمرات الفيديو، وتطبيقات الهاتف المحمول، والأجهزة القابلة للارتداء.

يُسهم ازدياد عدد الشراكات بشكل كبير في نمو سوق مراكز وخدمات إعادة التأهيل العالمية بطرق متعددة. ويمكن أن تكون هذه الشراكات بين مختلف الجهات المعنية، مثل مقدمي الرعاية الصحية، وشركات التأمين، والهيئات الحكومية، والمنظمات غير الربحية، وشركات التكنولوجيا. وهذا من شأنه أن يُسهم في تقليل وقت انتظار خدمات العلاج، وضمان حصول المرضى على الرعاية اللازمة في الوقت المناسب.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/europe-and-us-rehabilitation-centers-and-therapy-services-market

تحلل شركة Data Bridge Market Research أن سوق مراكز إعادة التأهيل وخدمات العلاج في أوروبا والولايات المتحدة من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 5.2٪ في الفترة المتوقعة من 2024 إلى 2031 ومن المتوقع أن يصل إلى 40،699.71 مليون دولار أمريكي بحلول عام 2031 من 27،525.00 مليون دولار أمريكي في عام 2023. من المتوقع أن ينمو سوق خدمات العلاج التأهيلي في أوروبا بمعدل نمو سنوي مركب قدره 4.0٪ في الفترة المتوقعة من 2024 إلى 2031 ومن المتوقع أن يصل إلى 21،931.21 مليون دولار أمريكي بحلول عام 2031 من 16،246.00 مليون دولار أمريكي في عام 2023. من المتوقع أن يدفع قطاع حلول عملاء المؤسسات نمو السوق بسبب ارتفاع اعتماد خدمات العلاج التأهيلي.

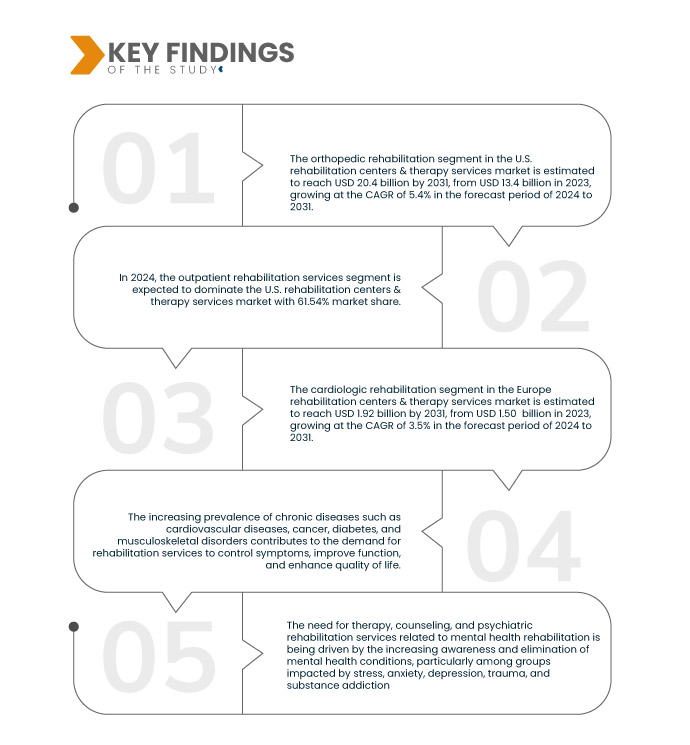

النتائج الرئيسية للدراسة

زيادة الطلب والتبني من أجل زيادة الوعي والقبول بالخدمات الصحية

إن الحاجة إلى خدمات العلاج والاستشارة وإعادة التأهيل النفسي المتعلقة بإعادة تأهيل الصحة العقلية مدفوع بالوعي المتزايد والقضاء على حالات الصحة العقلية، وخاصة بين المجموعات المتضررة من التوتر والقلق والاكتئاب والصدمات وإدمان المواد.

لقد خفّضت وصمة العار المرتبطة بالصحة النفسية بفضل الجهود المنسقة، وزيادة الاهتمام الإعلامي، وتشجيع المبادرات، مما ساعد على تطبيع هذه النقاشات وإزالة وصمة العار عنها. وقد كان لشفافية الجمهور والمشاهير بشأن معاناتهم من مشاكل الصحة النفسية دورٌ بالغ الأهمية في تعزيز القبول وغرس عادات المساعدة في طلب الرعاية. علاوةً على ذلك، أصبح علاج الصحة النفسية متاحًا على نطاق أوسع وبأسعار معقولة بفضل تطوير الخدمات ودمجها في أنظمة الرعاية الصحية. وتُعطى الوقاية والكشف المبكر أهمية متزايدة، مع التركيز بشكل خاص على تعزيز الوعي بالصحة النفسية وتقديم المساعدة عند ظهور أولى علامات الضيق.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

سنة تاريخية

|

2022 (قابلة للتخصيص للفترة 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية، والتسعير بالدولار الأمريكي

|

القطاعات المغطاة

|

حسب الخدمة ( العلاج الطبيعي ، العلاج المهني ، علاج النطق، العلاج السلوكي المعرفي، العلاج التنفسي وغيرها)، حسب الفئة العمرية (كبار السن، البالغين، والأطفال)، حسب نوع الخدمة (خدمات إعادة التأهيل للمرضى الخارجيين، خدمات إعادة التأهيل للمرضى الداخليين)، حسب التطبيق (خدمات إعادة التأهيل العظمي، خدمات إعادة التأهيل العصبي، خدمات إعادة التأهيل النطقي، خدمات إعادة التأهيل القلبي، الإصابات الرياضية، خدمات إعادة التأهيل الرئوي، وغيرها)، حسب المستخدم النهائي (مراكز إعادة التأهيل، مراكز مرافق الرياضة واللياقة البدنية، مرافق التمريض الماهرة، المستشفيات، وغيرها)، حسب قناة التوزيع (القناة المباشرة، القناة عبر الإنترنت)

|

الدول المغطاة

|

الولايات المتحدة وألمانيا والمملكة المتحدة وفرنسا وإيطاليا وإسبانيا وروسيا وهولندا وسويسرا وتركيا وبقية أوروبا

|

الجهات الفاعلة في السوق المغطاة

|

شركة ATI للعلاج الطبيعي (الولايات المتحدة)، وشركة Select Medical Corporation (الولايات المتحدة)، وشركة Bon Secours Health System (الولايات المتحدة)، وشركة Sutter Health (الولايات المتحدة)، ومجموعة Priory، وشركة Athletico للعلاج الطبيعي (حلول Pivot Health) (الولايات المتحدة)، وغيرها

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات

يتم تقسيم سوق مراكز إعادة التأهيل وخدمات العلاج في أوروبا والولايات المتحدة إلى خمسة قطاعات بارزة بناءً على الخدمة ونوع الخدمة والفئة العمرية والتطبيق والمستخدم النهائي وقناة التوزيع.

- على أساس الخدمة، يتم تقسيم السوق إلى العلاج الطبيعي، والعلاج المهني، وعلاج النطق، والعلاج السلوكي المعرفي، والعلاج التنفسي، وغيرها

في عام 2024، من المتوقع أن يهيمن قطاع خدمات العلاج التأهيلي على السوق

من المتوقع أن تهيمن خدمات العلاج الطبيعي في سوق مراكز إعادة التأهيل وخدمات العلاج في الولايات المتحدة في عام 2024 على السوق بحصة سوقية تبلغ 46.39٪ بسبب الطلب المتزايد على مراكز إعادة التأهيل وخدمات العلاج.

من المتوقع أن تهيمن خدمات العلاج الطبيعي في سوق مراكز إعادة التأهيل وخدمات العلاج في الولايات المتحدة في عام 2024 على السوق بحصة سوقية تبلغ 47.04٪ بسبب الطلب المتزايد على مراكز إعادة التأهيل وخدمات العلاج.

- بناءً على الخدمة، يُقسّم السوق إلى العلاج الطبيعي، والعلاج المهني، وعلاج النطق، والعلاج السلوكي المعرفي، والعلاج التنفسي، وغيرها. ويُقسّم قطاع العلاج الطبيعي إلى العلاج الطبيعي للعظام، والعلاج الطبيعي للأعصاب، والعلاج الطبيعي للقلب والأوعية الدموية، والعلاج الطبيعي الرياضي، والعلاج بالألعاب. ويُقسّم قطاع العلاج بالجيمينغ إلى العلاج الطبيعي القائم على الألعاب والعلاج الرقمي القائم على الألعاب. ويُقسّم قطاع علاج النطق إلى علاج النطق الصوتي (علاج النطق)، وعلاج اللغة، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع العلاج الطبيعي على السوق الأمريكية بحصة سوقية تبلغ 46.00٪ ومن المتوقع أن يصل إلى 19،623.58 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 5.8٪ في الفترة المتوقعة من 2024 إلى 2031. في عام 2024، من المتوقع أن يهيمن قطاع العلاج الطبيعي على السوق الأوروبية بحصة سوقية تبلغ 48.7٪ ومن المتوقع أن يصل إلى 10،701.58 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.6٪ في الفترة المتوقعة من 2024 إلى 2031.

- بناءً على الفئات العمرية، يُقسّم السوق إلى فئات كبار السن، والبالغين، والأطفال. في عام 2024، من المتوقع أن يهيمن قطاع كبار السن على السوق الأمريكية بحصة سوقية تبلغ 55.85%، وأن يصل إلى 25,513.72 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 5.7% خلال الفترة المتوقعة من 2024 إلى 2031. وفي عام 2024، من المتوقع أن يهيمن قطاع كبار السن على السوق الأوروبية بحصة سوقية تبلغ 56.72%، وأن يصل إلى 12,837.72 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.4% خلال الفترة المتوقعة من 2024 إلى 2031.

- بناءً على نوع الخدمة، يُقسّم السوق إلى خدمات إعادة التأهيل للمرضى الخارجيين وخدمات إعادة التأهيل للمرضى الداخليين. في عام 2024، من المتوقع أن يهيمن قطاع خدمات إعادة التأهيل للمرضى الخارجيين على السوق الأمريكية بحصة سوقية تبلغ 61.37%، وأن يصل إلى 25,534.58 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 5.5% خلال الفترة المتوقعة من 2024 إلى 2031. وفي نفس العام، من المتوقع أن يهيمن قطاع خدمات إعادة التأهيل للمرضى الخارجيين على السوق الأوروبية بحصة سوقية تبلغ 62.44%، وأن يصل إلى 13,970.08 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.3% خلال الفترة المتوقعة من 2024 إلى 2031.

- بناءً على التطبيق، يُقسّم السوق إلى خدمات إعادة تأهيل العظام، وخدمات إعادة تأهيل الأعصاب، وخدمات إعادة تأهيل النطق، وخدمات إعادة تأهيل القلب، والإصابات الرياضية، وخدمات إعادة تأهيل الرئة، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع خدمات إعادة تأهيل العظام على السوق الأمريكية بحصة سوقية تبلغ 50.25%، وأن يصل إلى 13,831.31 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 5.4% خلال الفترة المتوقعة من 2024 إلى 2031. وفي نفس العام، من المتوقع أن يهيمن قطاع خدمات إعادة تأهيل العظام على السوق الأوروبية بحصة سوقية تبلغ 50.95%، وأن يصل إلى 11,381.41 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.3% خلال الفترة المتوقعة من 2024 إلى 2031.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مراكز إعادة تأهيل، ومراكز رياضية ولياقة بدنية، ومرافق تمريض متخصصة، ومستشفيات، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع مراكز إعادة التأهيل على السوق الأمريكية بحصة سوقية تبلغ 60.08%، وأن يصل إلى 24,890.33 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 5.5% خلال الفترة المتوقعة من 2024 إلى 2031. وفي نفس العام، من المتوقع أن يهيمن قطاع مراكز إعادة التأهيل على السوق الأوروبية بحصة سوقية تبلغ 60.54%، وأن يصل إلى 13,502.77 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.2% خلال الفترة المتوقعة من 2024 إلى 2031.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى قناة مباشرة وقناة إلكترونية. في عام 2024، من المتوقع أن يهيمن قطاع القنوات المباشرة على السوق الأمريكية بحصة سوقية تبلغ 61.47%، وأن يصل إلى 24,442.49 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.9% خلال الفترة المتوقعة من 2024 إلى 2031. وفي عام 2024، من المتوقع أن يهيمن قطاع مراكز إعادة التأهيل على السوق الأوروبية بحصة سوقية تبلغ 63.53%، وأن يصل إلى 301.98 مليون دولار أمريكي بحلول عام 2031، بمعدل نمو سنوي مركب قدره 4.2% خلال الفترة المتوقعة من 2024 إلى 2031.

اللاعبون الرئيسيون

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في سوق خدمات العلاج التأهيلي في السوق والتي تشمل ATI Physical Therapy Inc. (الولايات المتحدة)، وSelect Medical Corporation (الولايات المتحدة)، وBon Secours Health System، Inc. (الولايات المتحدة)، وSutter Health (الولايات المتحدة)، وPriory Group، وAthletico Physical Therapy (Pivot Health Solutions) (الولايات المتحدة)، وFYZICAL (الولايات المتحدة)، وBanner Health (الولايات المتحدة)، وPriory Group، وCygnet (الولايات المتحدة)، وUS Physical Theory، وUS Rehabilitation Centers & Therapy Services (الولايات المتحدة)، وBenchmark Therapies (الولايات المتحدة)، وInterim Healthcare Inc. (الولايات المتحدة).

تطوير السوق

- في أبريل 2024، استحوذت بانر على أخصائيي جراحة العظام الجامعيين. وانضم أطباء جراحة العظام الجامعيون إلى بانر هيلث. حاليًا، سيتمكن المرضى الذين يفضلون الأطباء في جنوب أريزونا من الوصول إلى فريق جراحة العظام الوحيد في توسان، والذي يُعدّ أطباؤه أيضًا من أفضل الباحثين والمعلمين، ويقدمون رعاية عظام غير جراحية وجراحية ذكية ومتطورة وقائمة على الأدلة. بالإضافة إلى علاج البالغين والأطفال، يقدم فريق بانر لجراحي العظام أيضًا الرعاية للرياضيين المحترفين، بما في ذلك فرق المدارس الثانوية والكليات والدوريات المحترفة. يعزز هذا الاستحواذ خبرة بانر هيلث وخدماتها، ويوسع نطاق خدماتها لتشمل مواقع جديدة.

- في يوليو 2024، مهدت مراكز FYZICAL للعلاج والتوازن الطريق أمام أخصائيي العلاج الطبيعي لتحقيق ملكية العيادة: أعلنت مراكز FYZICAL للعلاج والتوازن، أسرع امتياز للعلاج الطبيعي نموًا في البلاد، رسميًا عن إطلاق برنامج Partnership Advantage Program، وهو برنامج خاص مصمم لربط أصحاب الأعمال ذوي الخبرة بأخصائيي العلاج الطبيعي المرخصين الذين يرغبون في إنشاء عياداتهم الخاصة.

- في فبراير 2024، خضعت هانترون لبرنامج "مساعدة القلوب على الشفاء وازدهار الأمل: إعادة التأهيل القلبي" في مركز هانترون الصحي. صُممت خدمات إعادة التأهيل القلبي التي تقدمها المؤسسة للمرضى الذين يتعافون من جراحات أمراض الشريان التاجي أو النوبات القلبية. كما أن الأفراد الذين خضعوا لعلاج داء الشرايين الطرفية (PAD)، أو خضعوا لعملية زرع قلب، أو خضعوا لاستبدال صمامات القلب، مؤهلون أيضًا لهذه الإجراءات. كما يقدم المعهد برنامجًا من إعداد الدكتور دين أورنيش، يعتمد على الغذاء وإدارة التوتر والتمارين الرياضية كجزء من نهج متعدد الجوانب للوقاية من أمراض القلب وإدارتها. يتكون المنهج الدراسي، الذي يستمر 12 أسبوعًا، من جلستين أسبوعيتين مدة كل منهما 3 ساعات.

- في أبريل 2024، افتتحت كيترينج هيلث مركزًا جديدًا للابتكار السريري. كان الهدف منه التواصل والتعاون والابتكار بما يعود بالنفع على المرضى والمجتمعات.

- في مارس 2024، التقييم العصبي البصري وإعادة التأهيل في التطبيب عن بُعد باستخدام AvDesk: جهاز طبي من الفئة الأولى يُسمى AvDesk لإنشاء علاجات إعادة التأهيل العصبي البصري. باستخدام أحدث تقنيات التطبيب عن بُعد، يُمكّن AvDesk المتخصصين الطبيين من إنشاء برنامج تدريب إدراكي يومي مُخصص بناءً على احتياجات الشخص المُساعد، مما يضمن تقدمًا ملحوظًا خلال أسبوعين من العلاج.

- في أبريل 2024، أسست شركة سيليكت ميديكال وجامعة فلوريدا الصحية، جاكسونفيل، مشروعًا مشتركًا لتقديم رعاية تأهيلية للمرضى الداخليين في منطقة شمال فلوريدا، بهدف إنشاء مستشفى تأهيلي للمرضى الداخليين بسعة 48 سريرًا في جامعة فلوريدا الصحية الشمالية في جاكسونفيل، فلوريدا. ونظرًا للزيادة المطردة في طلب فلوريدا على رعاية تأهيلية للمرضى الداخليين في أعقاب السكتة الدماغية وإصابات الدماغ الرضحية وغيرها من الأمراض والحالات الطبية المُعيقة، أسست سيليكت ميديكال هذا المشروع المشترك. ويخلق هذا التعاون الاستراتيجي بين الجهتين بيئة تأهيلية فريدة تُوفر للمرضى الرعاية الكاملة التي يحتاجونها للشفاء، واستئناف نمط حياة مستقل، وإعادة الاندماج في المجتمع.

- في نوفمبر 2023، أبرمت شركة كورا للعلاج الطبيعي شراكة مع شركة ميدسيندر، المزود الرائد لأدوات أتمتة المستندات بالذكاء الاصطناعي في مجال الرعاية الصحية. وقد تم ذلك بهدف تبسيط عملياتها الإدارية باستخدام الذكاء الاصطناعي في جميع المواقع.

- في أبريل، أعلنت USPh عن استحواذها على عيادة للعلاج الطبيعي وعلاج اليد تضم تسعة مواقع. مكّن هذا الاستحواذ المؤسسة من بناء حصة سوقية قوية في هذا القطاع وتعزيز محفظة خدماتها.

- في مارس 2018، أطلقت سيجنت خدمة إعادة التأهيل العصبي النفسي والتنكس العصبي الجديدة للرجال. الهدف الرئيسي هو تهيئة بيئة تلهم عملائنا وتشجعهم على الشفاء. تم تخطيط البيئة المادية في سيجنت سانت ويليام بعناية فائقة وتجهيزها لدعم إعادة التأهيل العصبي السلوكي لعملائها.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق مراكز إعادة التأهيل وخدمات العلاج في أوروبا والولايات المتحدة هي الولايات المتحدة والمملكة المتحدة وألمانيا وفرنسا وإسبانيا وإيطاليا وروسيا وسويسرا وهولندا وتركيا وبقية أوروبا.

وفقًا لتحليل Data Bridge Market Research:

الولايات المتحدة هي المنطقة المهيمنة والأسرع نموًا في سوق مراكز إعادة التأهيل وخدمات العلاج

في عام ٢٠٢٤، من المتوقع أن تهيمن الولايات المتحدة على السوق بفضل التطورات التكنولوجية المتقدمة، مثل الواقع الافتراضي، وإعادة التأهيل عن بُعد، والأجهزة القابلة للارتداء، والتي من شأنها تعزيز رعاية المرضى وتحسين النتائج. ويمكن أن تؤدي هذه العوامل إلى زيادة الكفاءة، وتحسين مشاركة المرضى، وتوفير رعاية أكثر سهولة، مما يتيح للكيانات السوقية فرصة الاستفادة من الاستثمارات في المستقبل القريب. وستواصل الولايات المتحدة هيمنتها على السوق من حيث حصتها السوقية وإيراداتها، وستواصل تعزيز هيمنتها خلال فترة التوقعات. ويعود ذلك إلى تزايد اعتماد التقنيات المتقدمة في هذه المنطقة، بالإضافة إلى تزايد خدمات العلاج التأهيلي فيها.

لمزيد من المعلومات التفصيلية حول تقرير سوق خدمات العلاج التأهيلي في الولايات المتحدة وأوروبا، انقر هنا - https://www.databridgemarketresearch.com/reports/europe-and-us-rehabilitation-centers-and-therapy-services-market