자금세탁방지(AML) 소프트웨어 시장은 금융 보안 강화, 규제 위험 감소, 효율적인 AML 규정 준수 등의 이점을 제공합니다. 특히 은행 및 금융 서비스 분야는 엄격한 AML 규정으로 인해 견고한 규정 준수 솔루션이 필수적입니다. AML 소프트웨어는 금융기관이 거래를 모니터링 및 분석하고, 의심스러운 활동을 탐지하고, 정확한 보고서를 제출할 수 있도록 지원하여 금융 범죄 위험을 완화합니다. AML 소프트웨어 도입을 통해 신뢰도 향상, 벌금 감면, 불법 금융 활동으로부터의 보호 효과를 얻을 수 있습니다.

https://www.databridgemarketresearch.com/reports/europe-anti-money-laundering-software-market 에서 전체 보고서를 확인하세요.

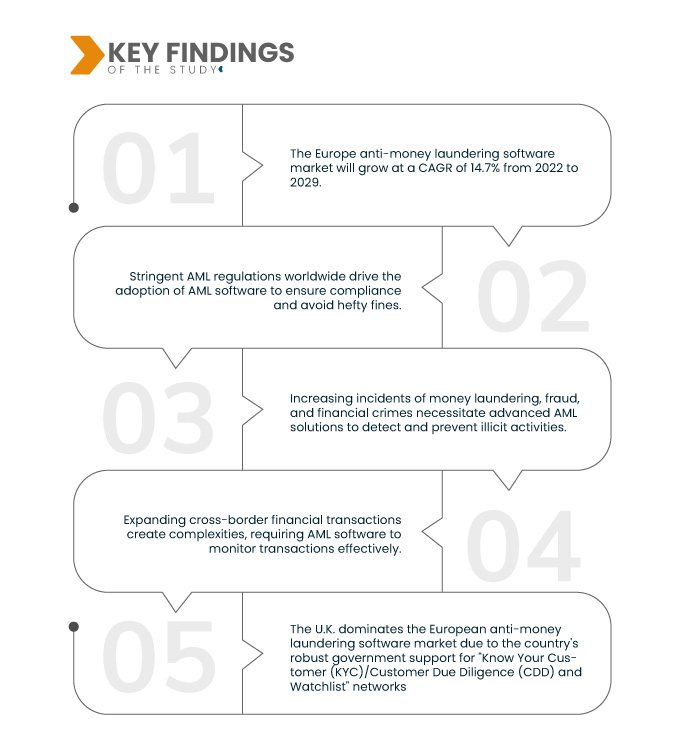

데이터 브리지 시장 조사(Data Bridge Market Research)는 유럽 자금세탁방지 소프트웨어 시장이 2022년부터 2029년까지 연평균 14.7% 성장할 것으로 전망했습니다. 금융 부문의 데이터 급증으로 인해 수동 분석은 사실상 불가능합니다. 자동화된 자금세탁방지(AML) 도구는 이러한 방대한 양의 데이터를 효율적으로 처리하고 분석하여 불법 금융 활동을 적발하고 예방하는 데 필수적입니다.

연구의 주요 결과

블록체인과 암호화폐가 시장 성장률을 견인할 것으로 예상

블록체인 기술과 암호화폐의 도입은 익명성 강화 및 국경 간 거래 등 금융 거래에 새로운 복잡성을 야기했습니다. 이러한 과제로 인해 자금세탁방지(AML) 솔루션은 블록체인 분석 및 암호화폐 추적 기능을 도입하고 통합하는 것이 필수적입니다. AML 도구는 의심스러운 활동을 모니터링하고 식별하여 규정 준수를 보장하고 금융 범죄에 암호화폐와 블록체인 기술이 불법적으로 사용되는 것을 방지하는 데 필수적입니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2022년부터 2029년까지

|

기준 연도

|

2021

|

역사적인 해

|

2020 (2014-2019년으로 맞춤 설정 가능)

|

다루는 세그먼트

|

제공(솔루션 및 서비스), 기능(규정 준수 관리, 통화 거래 보고, 고객 ID 관리, 거래 모니터링 등), 배포 모드(클라우드 및 온프레미스), 기업 규모(대기업, 중소기업), 도박 유형(복권, 스포츠 베팅, 빙고, 추첨/풀, 카지노), 애플리케이션(오프라인/지상 및 라이브 엔터테인먼트/온라인), 도박 기관(조직, 개인 사업자/파트너십 등)

|

포함 국가

|

독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 나머지 유럽

|

시장 참여자 포함

|

Microsoft(미국), Intel Corporation(미국), Fiserv, Inc.(미국), BAE Systems(영국), Wolters Kluwer NV(네덜란드), Experian Information Solutions, Inc.(미국), SAS Institute Inc.(미국), IBM(미국), Temenos(스위스), Comarch SA(폴란드), Open Text Corporation(캐나다), FICO(미국), ACI Worldwide(미국), NICE(이스라엘), Acuant, Inc.(미국), Featurespace Limited(영국), Protiviti Inc.(미국), Actico GmbH(독일), Caseware International Inc.(캐나다), Sanction Scanner(영국)

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, 유봉 분석이 포함되어 있습니다.

|

세그먼트 분석:

자금세탁방지 소프트웨어 시장은 제공 서비스, 기능, 배포 모드, 기업 규모, 도박 유형, 애플리케이션 및 도박 주체별로 세분화됩니다.

- 유럽 자금세탁방지 소프트웨어 시장은 제공 품목을 기준으로 솔루션과 서비스로 구분됩니다.

- 기능을 기준으로 유럽 자금세탁방지 소프트웨어 시장은 규정 준수 관리, 통화 거래 보고, 고객 신원 관리, 거래 모니터링 및 기타로 구분됩니다.

- 유럽 자금세탁 방지 소프트웨어 시장은 배포 모드를 기준으로 클라우드와 온프레미스로 구분됩니다.

- 기업 규모를 기준으로 유럽 자금세탁 방지 소프트웨어 시장은 대기업, 중소기업으로 구분됩니다.

- 도박 유형을 기준으로 유럽 자금세탁방지 소프트웨어 시장은 복권, 스포츠 베팅, 빙고, 추첨/풀, 카지노로 구분됩니다.

- 유럽 자금세탁 방지 소프트웨어 시장은 응용 프로그램을 기준으로 오프라인/지상 기반 매체와 라이브 엔터테인먼트/온라인으로 구분됩니다.

- 도박 주체를 기준으로 유럽 자금세탁방지 소프트웨어 시장은 조직, 개인 사업자/파트너십 및 기타로 세분화되었습니다.

주요 플레이어

Data Bridge Market Research에서는 다음 회사를 유럽 자금세탁 방지 소프트웨어 시장 주체로 인식하고 있습니다. 유럽 자금세탁 방지 소프트웨어 시장의 주체는 Microsoft(미국), Intel Corporation(미국), Fiserv, Inc.(미국), BAE Systems(영국), Wolters Kluwer NV(네덜란드), Experian Information Solutions, Inc.(미국), SAS Institute Inc.(미국), IBM(미국), Temenos(스위스), Comarch SA(폴란드), Open Text Corporation(캐나다)입니다.

시장 개발

- 2022년 4월, Experian Information Solutions, Inc.는 혁신적인 사기 방지 솔루션을 출시했습니다. 이 솔루션은 더욱 엄격한 사기 방지 조치, 강력한 고객알기제도(KYC) 프로토콜, 그리고 자금세탁방지(AML) 검사를 통해 고객 신원 확인을 강화하는 것을 주요 목표로 했습니다. Experian은 이 솔루션을 통해 원활한 온보딩 경험을 제공하고 수많은 기업의 인증 절차를 간소화하는 데 기여했습니다.

- 2021년 2월, 나이스 시스템즈(NICE Systems Ltd)는 위험 관리 역량 강화를 위해 설계된 AI 기반 스크리닝 솔루션을 출시했습니다. 이 솔루션의 핵심 기능으로는 실시간 및 일괄 스크리닝 기능, 원활한 접근, 퍼지 매칭 기술 활용, 안면 생체 인식, 그리고 자금세탁방지(AML) 가치 사슬 전반에 걸친 지속적인 모니터링이 있습니다. 이러한 혁신을 통해 나이스 시스템즈는 최고 수준의 데이터 관리, 고급 스크리닝 기능, 그리고 향상된 고객 만족도를 제공할 수 있게 되었습니다.

지역 분석

지리적으로 주요 유럽 자금세탁 방지 소프트웨어 시장 보고서에서 다룬 국가는 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 나머지 지역입니다.

Data Bridge Market Research 분석에 따르면:

영국은 2022년부터 2029년까지 예측 기간 동안 유럽 자금세탁 방지 소프트웨어 시장을 장악할 것으로 예상됩니다.

영국은 유럽 자금세탁방지 소프트웨어 시장을 장악하고 있습니다. 이는 주로 "고객알기제도(KYC)/고객실사(CDD) 및 감시대상자 명단(Watchlist)" 네트워크에 대한 영국 정부의 강력한 지원 덕분입니다. 금융 범죄의 한 형태인 자금세탁은 자금의 불법적인 출처를 은폐하는 행위를 수반합니다. 자금세탁방지(AML) 활동은 금융기관이 의심스러운 거래를 모니터링, 보고 및 예방하는 활동을 수반합니다. 이 시장에서 영국의 성장은 유럽 금융 범죄 퇴치에 대한 영국의 의지를 보여줍니다.

유럽 자금세탁 방지 소프트웨어 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요. - https://www.databridgemarketresearch.com/reports/europe-anti-money-laundering-software-market