The GCC paper bags market refers to the industry focused on the production, distribution, and consumption of paper bags within the Gulf Cooperation Council (GCC) region. With an increasing emphasis on reducing plastic usage, paper bags have emerged as a viable alternative. The market's expansion is fueled by the region's booming retail sector, coupled with a rising awareness of environmental concerns. Paper bags offer durability and versatility, catering to diverse industries beyond retail, including food and beverage, pharmaceuticals, and textiles. The paper bags market in the GCC is positioned for sustained growth, aligning with global efforts to reduce the ecological footprint of packaging materials.

Access Full Report @ https://www.databridgemarketresearch.com/reports/gcc-paper-bags-market

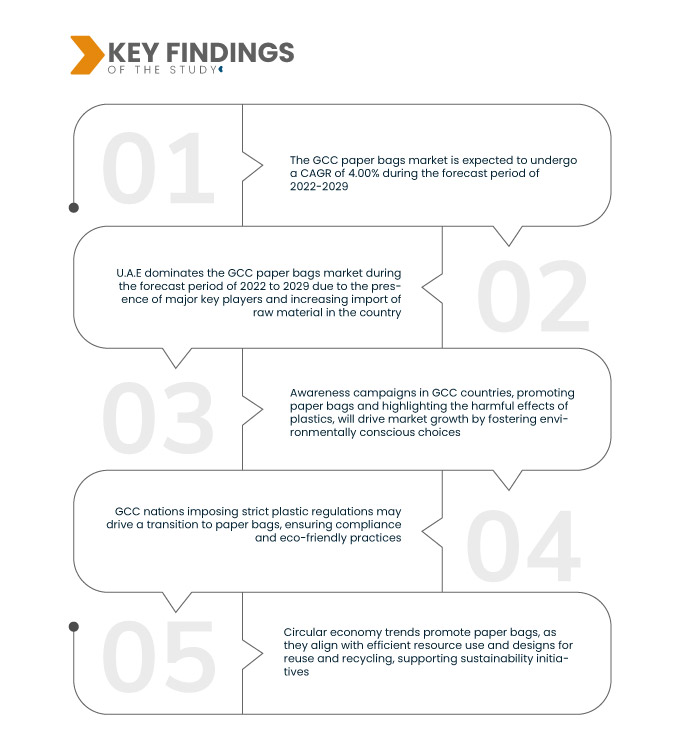

Data Bridge Market Research analyses that the GCC Paper Bags Market will grow at a CAGR of 4.00% during the forecast period of 2022 to 2029. Businesses integrate eco-friendly practices into corporate social responsibility (CSR), opting for paper bags to signal commitment to sustainability. This aligns with a broader trend of companies prioritizing environmental responsibility and contributing to a more sustainable future.

Key Findings of the Study

Product differentiation is expected to drive the market's growth rate

Companies aiming to stand out in the market opt for paper bags as a strategic choice for product differentiation. By leveraging the visual appeal and branding opportunities inherent in paper packaging, businesses enhance their overall image and create a unique identity for their products. The distinctive nature of paper bags contributes to a memorable consumer experience, fostering brand recognition and loyalty in a competitive market landscape.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Flat Paper Bags, Multi-Wall Paper Sacks, Open Mouth, Pasted Valve, Lock Paper Bags, Self-Opening-Style (SOS) Bags, Stand Up Pouch, Others), Usage (Single Use, Re-Usable), Capacity (Less Than 1 Kg, 1kg-5 Kg, 5kg-10 Kg, More Than 10 Kg), Size (Small Size, Medium Size, Large Size, Extra Large Size), Sealing & Handling (Heat Seal, Hand Length Handle, Ziplock, Twisted Handle, Flat Handle, Others), Shape (Rectangle, Square, Circular, Others), Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, Others), End-User (Food and Beverages, Animal Feed, Cosmetic Products, Agriculture, Construction, Pharmaceuticals, Chemicals, Others

|

|

Countries Covered

|

UAE, Saudi Arabia, Kuwait, Egypt, Qatar, Bahrain, Oman

|

|

Market Players Covered

|

Mondi Austria and (U.K.), International Paper (U.S.), Gulf East Paper and Plastic Industries LLC (U.A.E), Hotpack Packaging Industries LLC (U.A.E), CLASSYPAC MIDDLE EAST (U.A.E), middleeastdisposable (Saudi Arabia), Golden Pack for Packaging Industries (Saudi Arabia), RETQA PAPER BAGS (Saudi Arabia), Green Age Partners (U.A.E), Mada Trade Co. (Saudi Arabia), Shuaiba Industrial Company (K.P.S.C) (Kuwait), W A K S Paper Bags Manufacturing LLC. (U.A.E), Packteck (Lebanon), Logos Pack (Lebanon)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The GCC paper bags market is segmented into product, usage, capacity, size, sealing and handling, shape, distribution channel, and end-user.

- On the basis of product, the GCC paper bags market is segmented into flat paper bags, multi-wall paper sacks, open mouth, pasted valve, lock paper bags, self-opening-style (SOS) bags, stand up pouch, and others

- On the basis of usage, the GCC paper bags market is segmented into single use and re-usable

- On the basis of capacity, the GCC paper bags market is segmented into less than 1 kg, 1kg-5 kg, 5kg-10 kg, more than 10 kg

- On the basis of size, the GCC paper bags market is segmented into small size, medium size, large size, and extra large size

- On the basis of sealing and handling, the GCC paper bags market is segmented into heat seal, hand length handle, ziplock, twisted handle, flat handle, and others

- On the basis of shape, the GCC paper bags market is segmented into rectangle, square, circular, and others

- On the basis of distribution channel, the GCC paper bags market is segmented into convenience stores, supermarkets/hypermarkets, specialty stores, e-commerce, and others

- On the basis of end-user, the paper bags GCC market is segmented into food and beverages, animal feed, cosmetic products, agriculture, construction, pharmaceuticals, chemicals, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major GCC paper bags market players in GCC paper bags market are Green Age Partners (U.A.E), Mada Trade Co. (Saudi Arabia), Shuaiba Industrial Company (K.P.S.C) (Kuwait), W A K S Paper Bags Manufacturing LLC. (U.A.E), Packteck (Lebanon), Logos Pack (Lebanon)

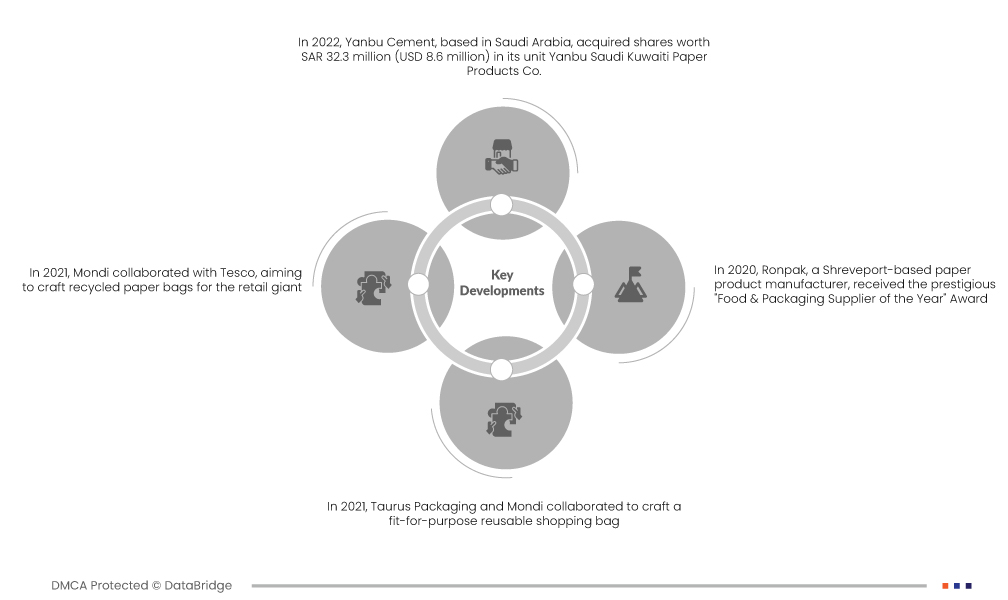

Market Developments

- In 2022, Yanbu Cement, based in Saudi Arabia, acquired shares worth SAR 32.3 million (USD 8.6 million) in its unit Yanbu Saudi Kuwaiti Paper Products Co., by obtaining a 40% stake in Kuwait's Shuaiba Industrial Co. The transaction, detailed in a bourse filing, solidified Yanbu Cement's ownership, making it the complete owner of the paper producer. This strategic move enhances Yanbu Cement's position in the paper products industry and aligns with its broader business objectives

- In 2021, Mondi collaborated with Tesco, aiming to craft recycled paper bags for the retail giant. This innovative collaboration involves utilizing Tesco's warehouse corrugated waste to produce environmentally friendly recycled paper shopping bags. By repurposing waste materials within Tesco's operations, the initiative aligns with sustainability goals, promoting responsible resource utilization and contributing to the circular economy. This collaborative effort underscores a shared commitment to eco-conscious practices in the packaging industry

- In 2021, Taurus Packaging and Mondi collaborated to craft a fit-for-purpose reusable shopping bag, designed to meet the rigorous demands of the Southern African retail market. Leveraging Mondi's Advantage Kraft Plus, this paper bag emerges as a superior alternative in a region where plastic bags have traditionally prevailed. Offering durability and functionality, this innovative solution aligns with sustainability goals, providing a compelling choice for consumers and addressing environmental concerns in the retail landscape

- In 2020, Ronpak, a Shreveport-based paper product manufacturer, received the prestigious "Food & Packaging Supplier of the Year" Award from Burger King for outstanding contributions. Recognized for their substantial collaboration in research and development, Ronpak exceeded expectations in delivering innovative, effective, and marketable goods. This partnership granted Burger King a competitive edge, showcasing the significance of supplier relationships in enhancing product quality and competitiveness in the fast-food industry

Regional Analysis

Geographically, the countries covered in the GCC paper bags market report are UAE, Saudi Arabia, Kuwait, Egypt, Qatar, Bahrain, Oman

As per Data Bridge Market Research analysis:

U.A.E is the dominant region in the GCC paper bags market during the forecast period 2022-2029

U.A.E dominates the GCC paper bags market, securing a substantial market share and revenue. Its continued dominance is attributed to major key players, a surge in raw material imports (wood pulp), and government initiatives. The UAE's proactive measures, including a ban on single-use plastic bags and a focus on sustainable packaging, significantly drive the escalating demand for paper bags in the country, reinforcing its leading position in the market.

For more detailed information about the GCC paper bags market report, click here – https://www.databridgemarketresearch.com/reports/gcc-paper-bags-market