800,000 Americans lost their lives to cardiovascular disease in 2017, according to the American College of Cardiology. One person in the US passes away from cardiovascular disease every 40 seconds. Coronary heart disease (CHD) is the second most prevalent factor in CVD mortality, behind heart failure and stroke. According to the European Heart Network, cardiovascular disease (CVD) claims the lives of about 1.8 million individuals in the European Union and 3.9 million people in Europe each year (EU). The market for implanted pacemakers is growing quickly as a result of rising healthcare R&D spending and rising R&D trends in developing markets.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-active-medical-implantable-devices-market

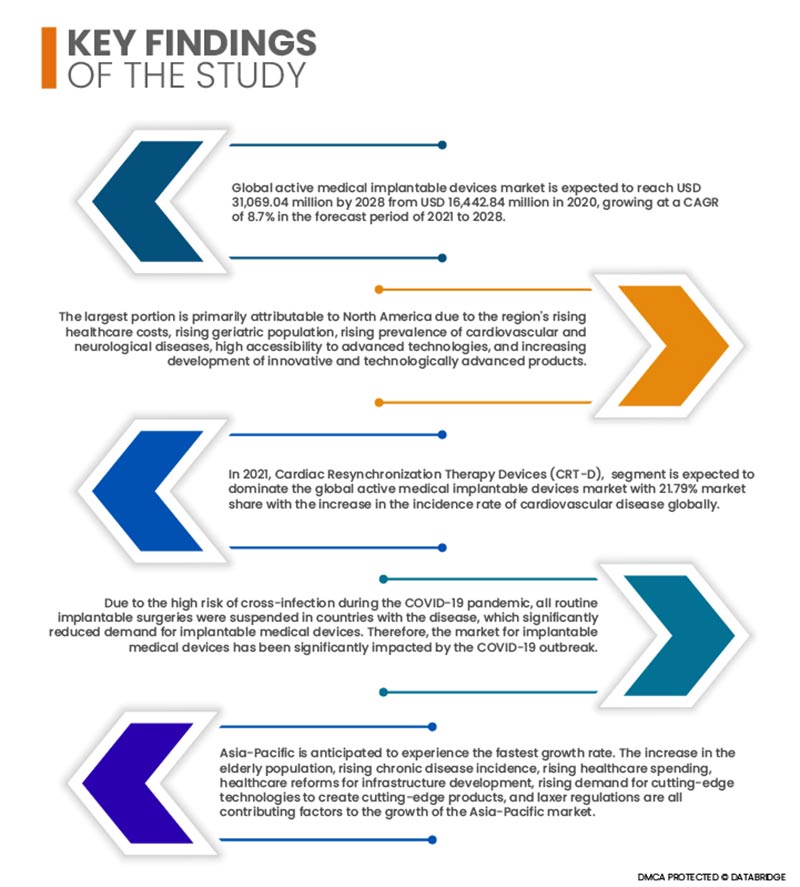

Global active medical implantable devices market is expected to reach USD 31,069.04 million by 2028 from USD 16,442.84 million in 2020, growing at a CAGR of 8.7% in the forecast period of 2021 to 2028. One of the key factors fueling the growth of the market for implantable medical devices is the rising prevalence of cardiovascular illnesses in the world. The market is growing quickly thanks to investments in funding the development of technologically improved devices and excellent reimbursement conditions for ENT treatments in industrialized nations. The market is also impacted by the increase in neurological illnesses and the expansion of applications for neuro-stimulators. Additionally, the market for implantable medical devices is positively impacted by the rise in the prevalence of the senior population, surge in healthcare spending, improvements in healthcare infrastructure, and high disposable income.

The increasing technological advancement will drive the market's growth rate

Technological developments in active medical implants result in additional functionality, higher success rate, and newer materials, depending on their use in different procedures. The increasing application of advanced technology-based active implants combined with minimally invasive procedures is propelling the demand of the active medical implants in the market. Technological advancements in active medical implantable devices would lead to global recognition among the market players and increased investments with R & D for developing and producing these devices.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2021 to 2028

|

|

Base Year

|

2020

|

|

Historic Years

|

2019 (Customizable to 2013 - 2018)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Implantable Cardioverter Defibrillators, Ventricular Assist Devices, Implantable Cardiac Pacemakers, Dental Implants, Implantable Hearing Devices, Ventricular Assist Devices, Neurostimulators), End User (Hospitals, Ambulatory Centers, Cardiac Centers, Dental Clinics, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Boston Scientific Corporation (U.S.), Cochlear Ltd. (Australia), Zimmer Biomet (U.S.), Smith & Nephew (U.K.), Johnson & Johnson Services, Inc. (U.S.), BIOTRONIK SE & Co. KG (Germany), LivaNova PLC (U.K.), Abbott (U.S.), Straumann AG (Switzerland), Medtronic (Ireland), Integra Lifesciences Holdings Corporation (U.S.), Stryker (U.S.), William Demant Holding A/S (Denmark), Nurotron Biotechnology Co. Ltd. (China), Sonova Holding AG (Switzerland), C.R. Bard Inc. (U.S.), 3M (U.S.), Dentsply Sirona (U.S.), Allergan Inc. (U.S.), NuVasive, Inc. (U.S.), Cardinal Health, Inc. (U.S.), Microport Scientific Corporation (China), CONMED Corporation (U.S.), Globus Medical, Inc. (U.S.), and MED-EL (Austria) among others.

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

Global active medical implantable devices market is categorized into four notable segments based on product, surgery type, procedure and end users.

- On the basis of product, the global active medical implantable devices market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), implantable cardioverter defibrillators, implantable cardiac pacemakers, eye implants, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/ insertable loop recorders, brachytheraphy, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps and implantable accessories. In 2021, Cardiac Resynchronization Therapy Devices (CRT-D), segment is expected to dominate the global active medical implantable devices market with 21.79% market share with the increase in the incidence rate of cardiovascular disease globally.

- On the basis of surgery type, the global active medical implantable devices market is segmented into traditional surgical methods and minimally invasive surgery. In 2021, the traditional surgical methods segment is expected to dominate the global active medical implantable devices market with 75.72% market share as it has reasonable cost and treatment expense.

- On the basis of procedure, the global active medical implantable devices market is segmented into neurological, cardiovascular, hearing and others. In 2021, cardiovascular segment is expected to dominate the global active medical implantable devices market with 59.44% market share with the increase in cardiovascular disease.

The cardiovascular segment will dominate the procedure segment of the active medical implantable devices market

The cardiovascular segment will emerge as the dominating segment under procedure segment in 2021. This is because of the growing number of cardiovascular patients in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

- On the basis of end-users, the global active medical implantable devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. In 2021, hospital segment is expected to dominate the global active medical implantable devices market with 51.15% market share due to growing demand of active medical implantable devices.

The hospitals segment will dominate the end-user segment of the active medical implantable devices market

The hospitals segment will emerge as the dominating segment under end-user in 2021 with approximately 51% market share. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the healthcare industry all around the globe will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in active medical implantable devices market: Boston Scientific Corporation (U.S.), Cochlear Ltd. (Australia), Zimmer Biomet (U.S.), Smith & Nephew (U.K.), Johnson & Johnson Services, Inc. (U.S.), BIOTRONIK SE & Co. KG (Germany), LivaNova PLC (U.K.), Abbott (U.S.), Straumann AG (Switzerland), Medtronic (Ireland), Integra Lifesciences Holdings Corporation (U.S.), Stryker (U.S.), NuVasive, Inc. (U.S.), Cardinal Health, Inc. (U.S.), Microport Scientific Corporation (China), CONMED Corporation (U.S.), Globus Medical, Inc. (U.S.), and MED-EL (Austria).

Market Development

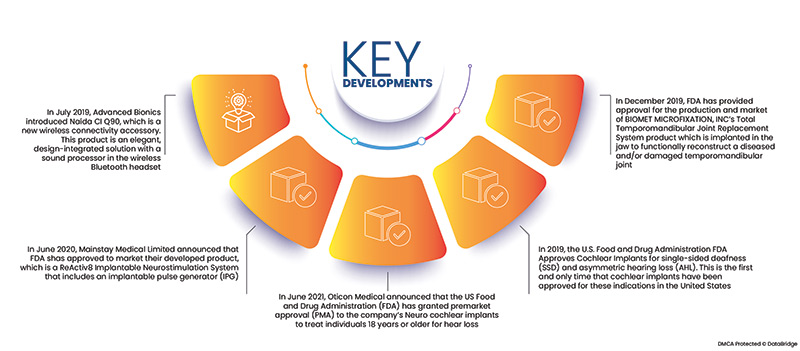

- In July 2019, Advanced Bionics introduced Naída CI Q90, which is a new wireless connectivity accessory. This product is an elegant, design-integrated solution with a sound processor in the wireless Bluetooth headset

- In June 2020, Mainstay Medical Limited announced that FDA shas approved to market their developed product, which is a ReActiv8 Implantable Neurostimulation System that includes an implantable pulse generator (IPG), two stimulation leads, a magnet, and a wireless remote, its IPG delivers electrical stimulation pulses to specific nerves responsible for activating the lumbar multifidus muscle

- In June 2021, Oticon Medical announced that the US Food and Drug Administration (FDA) has granted premarket approval (PMA) to the company’s Neuro cochlear implants to treat individuals 18 years or older for hear loss

- In 2019, the U.S. Food and Drug Administration FDA Approves Cochlear Implants for single-sided deafness (SSD) and asymmetric hearing loss (AHL). This is the first and only time that cochlear implants have been approved for these indications in the United States

- In December 2019, FDA has provided approval for the production and market of BIOMET MICROFIXATION, INC’s Total Temporomandibular Joint Replacement System product which is implanted in the jaw to reconstruct a diseased and/or damaged temporomandibular joint functionally

Regional Analysis

Geographically, the countries covered in the active medical implantable devices market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in active medical implantable devices market during the forecast period 2021 - 2028

The largest portion is primarily attributable to North America due to the region's rising healthcare costs, rising geriatric population, rising prevalence of cardiovascular and neurological diseases, high accessibility to advanced technologies, and increasing development of innovative and technologically advanced products.

Asia-Pacific is estimated to be the fastest-growing region in active medical implantable devices market the forecast period 2021 - 2028

Asia-Pacific is anticipated to experience the fastest growth rate. The increase in the elderly population, rising chronic disease incidence, rising healthcare spending, healthcare reforms for infrastructure development, rising demand for cutting-edge technologies to create cutting-edge products, and laxer regulations are all contributing factors to the growth of the Asia-Pacific market.

COVID-19 Impact

Due to the high risk of cross-infection during the COVID-19 pandemic, all routine implantable surgeries were suspended in countries with the disease, which significantly reduced demand for implantable medical devices. Additionally, patients undergoing implant procedures were also at a high risk of infection during the pandemic. Therefore, the market for implantable medical devices has been significantly impacted by the COVID-19 outbreak.

For more detailed information about the active medical implantable devices on market report, click here – https://www.databridgemarketresearch.com/reports/global-active-implantable-medical-devices-market