Global Active Medical Implantable Devices Market

Market Size in USD Billion

CAGR :

%

USD

17.87 Billion

USD

34.83 Billion

2024

2032

USD

17.87 Billion

USD

34.83 Billion

2024

2032

| 2025 –2032 | |

| USD 17.87 Billion | |

| USD 34.83 Billion | |

|

|

|

|

Active Medical Implantable Devices Market Size

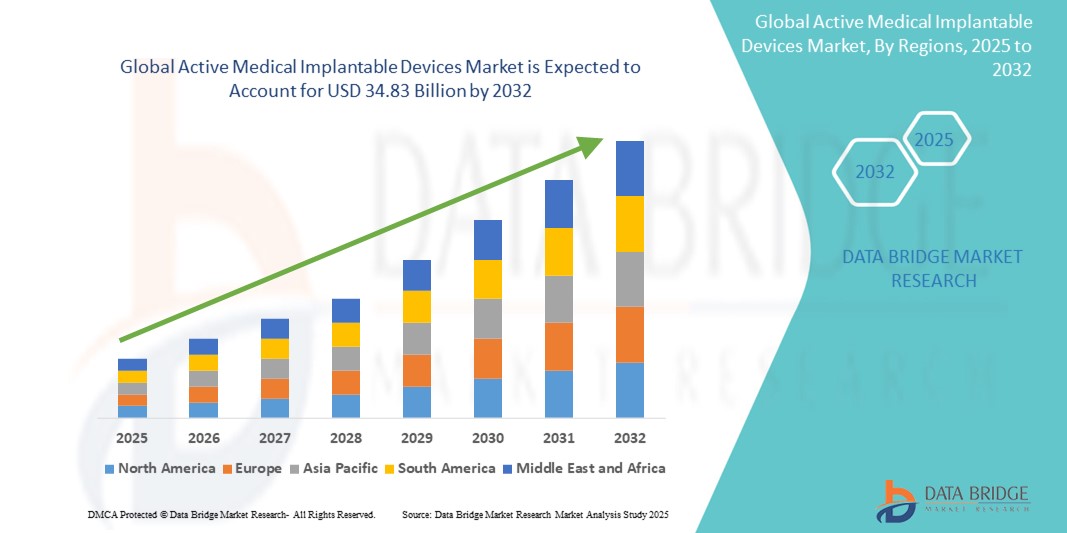

- The global active medical implantable devices market size was valued at USD 17.87 billion in 2024 and is expected to reach USD 34.83 billion by 2032, at a CAGR of 8.70% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases such as cardiovascular disorders and neurological conditions, necessitating advanced therapeutic and monitoring solutions

- In addition, technological innovations in miniaturization, wireless communication, and battery life are making devices more efficient and patient-friendly. These advancements, combined with a rising aging population and greater healthcare spending, are driving the demand for active implantable devices, thereby significantly contributing to market expansion

Active Medical Implantable Devices Market Analysis

- Active medical implantable devices, which include technologies such as pacemakers, defibrillators, neurostimulators, and cochlear implants, are becoming increasingly essential in managing chronic conditions and improving patient quality of life through continuous monitoring and therapeutic intervention

- The growing demand for these devices is primarily fueled by the rising incidence of cardiovascular and neurological disorders, an aging global population, and increasing patient preference for minimally invasive and long-term treatment solutions

- North America dominated the active medical implantable devices market with the largest revenue share of 40% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, high healthcare spending, and early adoption of innovative implantable technologies, particularly in the United States

- Asia-Pacific is projected to be the fastest growing region in the active medical implantable devices market, during the forecast period due to expanding healthcare access, improving diagnostic capabilities, and growing awareness of chronic disease management

- The minimally invasive surgery segment dominated the active medical implantable devices with a market share of 61.7% in 2024, driven by its reduced recovery time, lower risk of complications, and growing patient preference for less invasive procedures

Report Scope and Active Medical Implantable Devices Market Segmentation

|

Attributes |

Active Medical Implantable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Active Medical Implantable Devices Market Trends

“Advancement in Miniaturization and Wireless Connectivity”

- A significant and accelerating trend in the global active medical implantable devices market is the growing integration of miniaturization technologies and wireless communication capabilities, enabling more efficient real-time health monitoring and patient-centric care delivery

- For instance, Medtronic’s Micra AV, a leadless pacemaker, represents a breakthrough in cardiac rhythm management by offering atrioventricular synchrony without the need for transvenous leads. Similarly, Abbott’s Confirm Rx Insertable Cardiac Monitor uses Bluetooth and a mobile app to transmit patient data remotely to healthcare providers

- Wireless-enabled implants allow for automatic data transmission, earlier clinical intervention, and reduced hospital visits, improving patient outcomes while streamlining clinician workflows. N addition, AI-enabled neurostimulators can adjust stimulation levels based on individual behavior and physiological feedback

- These advancements enhance patient experience and optimize long-term therapeutic outcomes, while reducing the burden on healthcare systems. The seamless integration with cloud-based diagnostics and remote monitoring platforms enables more proactive, personalized treatment strategies

- This shift toward smaller, smarter, and more connected implants is shaping a future where real-time data-driven care becomes standard, particularly in cardiology, neurology, and endocrinology

- As healthcare providers and patients increasingly embrace these innovations, the demand for next-generation implantable devices continues to grow across global markets, transforming chronic disease management and preventive care

Active Medical Implantable Devices Market Dynamics

Driver

“Rising Chronic Disease Burden and Aging Population”

- The increasing global prevalence of chronic conditions, particularly cardiovascular and neurological disorders, alongside the rapidly aging population, is a key driver behind the growing demand for active medical implantable devices

- For instance, in February 2024, Boston Scientific launched its next-generation Vercise Neural Navigator 5 platform for deep brain stimulation, designed to improve therapy precision and clinical outcomes in patients with Parkinson’s disease and other movement disorders

- As older adults are more susceptible to chronic conditions, the demand for continuous and minimally invasive therapeutic solutions such as implantable defibrillators, pacemakers, and neurostimulators is surging globally

- In addition, growing awareness of implantable solutions among physicians and patients, combined with expanding healthcare access and better insurance coverage in both developed and emerging markets, is strengthening market penetration

- The appeal of long-term, patient-friendly treatments and the clinical benefits of early intervention and personalized care continue to make active implantable devices a cornerstone of chronic disease management strategies

Restraint/Challenge

“High Cost and Regulatory Complexities”

- The high cost of active medical implantable devices, along with complex regulatory approval processes, represents a significant challenge to widespread adoption, particularly in developing economies

- For instance, advanced devices such as cochlear implants or implantable cardioverter defibrillators often involve not only premium product pricing but also require skilled surgical procedures, post-operative care, and long-term monitoring, all contributing to financial barriers for patients

- Furthermore, navigating strict regulatory pathways across regions—such as FDA approvals in the United States or CE marking in Europe—can delay product launches and increase compliance costs for manufacturers, especially for emerging AI-integrated technologies

- The need to ensure long-term safety, durability, and performance further adds to the time and resources required for development, limiting innovation pace and patient accessibility

- Addressing these issues through accelerated regulatory frameworks, innovative pricing models, and greater public-private collaboration in healthcare infrastructure will be critical for ensuring broader market access and sustainable growth across global regions

Active Medical Implantable Devices Market Scope

The market is segmented on the basis of product, surgery type, procedure, and end user.

- By Product

On the basis of product, the active medical implantable devices market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), implantable cardioverter defibrillators, implantable cardiac pacemakers, eye implants, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/insertable loop recorders, brachytherapy, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps, and implantable accessories. The Implantable Cardioverter Defibrillators (ICDs) segment dominated the market with the largest revenue share of 27.3% in 2024, driven by the high global prevalence of sudden cardiac arrest and arrhythmias. The capability of ICDs to deliver life-saving therapy automatically in critical cardiac events has made them a cornerstone in cardiovascular disease management. Ongoing advancements in battery life, device size, and real-time telemetry further bolster adoption.

The Neurostimulators segment is anticipated to witness the fastest growth rate of 22.4% from 2025 to 2032, fueled by increasing incidences of neurological disorders such as Parkinson’s disease, chronic pain, and epilepsy. Rising acceptance of neuromodulation therapy, combined with technological enhancements such as closed-loop stimulation and remote programming, contributes to th rapid growth of this segment.

- By Surgery Type

On the basis of surgery type, the active medical implantable devices market is segmented into traditional surgical methods and minimally invasive surgery. The Minimally Invasive Surgery segment held the largest market revenue share of 61.7% in 2024, driven by reduced patient recovery time, fewer complications, and the growing preference for less invasive approaches. Advances in surgical instruments, imaging guidance, and implant design have made these procedures safer and more effective, particularly in cardiology and neurology.

The Traditional Surgical Methods segment is expected to witness the fastest CAGR from 2025 to 2032, primarily in regions with limited access to advanced surgical technologies or where complex anatomical challenges necessitate open procedures.

- By Procedure

On the basis of procedure, the active medical implantable devices market is segmented into neurovascular, cardiovascular, hearing, and others. The cardiovascular segment dominated the market with a share of 49.3% in 2024, supported by the global rise in heart-related conditions, including arrhythmias, heart failure, and ischemic diseases. The widespread clinical use of devices such as pacemakers, ICDs, and CRTs plays a crucial role in this segment’s dominance.

The neurovascular segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing cases of neurological disorders, aging populations, and expanded indications for implantable neurostimulation devices in chronic pain and epilepsy management.

- By End User

On the basis of end user, the active medical implantable devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. The Hospitals segment led the market with a revenue share of 53.8% in 2024, attributed to advanced infrastructure, skilled personnel, and the capacity to manage complex surgical implantations and post-operative care. Hospitals are the primary setting for most cardiovascular and neurovascular implantation procedures.

The Ambulatory Surgical Centers (ASCs) segment is projected to grow at the fastest pace during the forecast period due to increasing demand for outpatient surgical services, reduced healthcare costs, and growing availability of minimally invasive procedures in lower-acuity settings.

Active Medical Implantable Devices Market Regional Analysis

- North America dominated the active medical implantable devices market with the largest revenue share of 40% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, high healthcare spending, and early adoption of innovative implantable technologies, particularly in the United States

- Patients and providers in the region prioritize high-precision, minimally invasive, and remotely monitored therapeutic solutions offered by devices such as pacemakers, neurostimulators, and cochlear implants

- The region's growth is further supported by favorable reimbursement policies, high healthcare expenditure, and a strong presence of key market players, solidifying North America’s position as a global leader in the adoption and advancement of active implantable medical technologies

U.S. Active Medical Implantable Devices Market Insight

The U.S. active medical implantable devices market captured the largest revenue share of 82% in 2024 within North America, driven by the high prevalence of chronic conditions such as heart disease and neurological disorders. Strong investment in healthcare innovation, widespread availability of skilled medical professionals, and favorable reimbursement frameworks contribute to high procedural volumes. The integration of remote monitoring, AI-enabled devices, and minimally invasive implantation methods further strengthens the country’s leadership in adoption and innovation.

Europe Active Medical Implantable Devices Market Insight

The Europe active medical implantable devices market is projected to grow at a substantial CAGR over the forecast period, supported by a growing elderly population, stringent medical device regulations, and the expansion of universal healthcare systems. High acceptance of technologies such as cochlear implants, neurostimulators, and cardiac devices across both public and private healthcare institutions drives the market. Technological innovation, combined with an increased focus on quality-of-life improvements, is accelerating market growth across major economies.

U.K. Active Medical Implantable Devices Market Insight

The U.K. active medical implantable devices market is anticipated to witness a noteworthy CAGR, fueled by a robust NHS framework, rising healthcare funding, and growing incidences of age-related disorders. The country shows increasing adoption of cardiac and hearing implants, supported by national screening and early diagnosis programs. The U.K.’s strong regulatory oversight and push for innovative medical technology adoption also contribute to market expansion, particularly in the neurovascular and cardiovascular segments.

Germany Active Medical Implantable Devices Market Insight

The Germany active medical implantable devices market is expected to expand at a considerable CAGR during the forecast period, driven by a well-established healthcare infrastructure and high levels of investment in medtech R&D. Germany's strong emphasis on innovation, patient safety, and digital health integration makes it a key market for implantable devices such as insulin pumps, cardiac monitors, and neurostimulators. Demand is growing in both public hospitals and private specialty clinics due to rising cases of lifestyle-related diseases.

Asia-Pacific Active Medical Implantable Devices Market Insight

The Asia-Pacific active medical implantable devices market is projected to grow at the fastest CAGR of 24.1% from 2025 to 2032, fueled by rapid urbanization, improving healthcare access, and increasing awareness of chronic disease treatments in countries such as China, Japan, and India. Government health reforms and the expansion of insurance coverage in emerging economies are boosting procedural volumes. Moreover, the presence of regional manufacturing hubs is improving the affordability and availability of advanced implants across diverse patient populations.

Japan Active Medical Implantable Devices Market Insight

The Japan active medical implantable devices market is experiencing steady growth, driven by the country’s aging population, high standard of care, and early adoption of medical technologies. Japan is a leader in implantable hearing devices and neurostimulators, with rising usage in managing degenerative conditions such as Alzheimer’s and Parkinson’s disease. The integration of implantable devices with digital health platforms and home-based care systems is also advancing, enabling more efficient chronic disease management in a tech-forward healthcare environment.

India Active Medical Implantable Devices Market Insight

The India active medical implantable devices market held the largest market share in Asia Pacific in 2024, propelled by a growing middle-class population, expanding healthcare infrastructure, and increased access to advanced treatments. Rising awareness of cardiovascular and neurological diseases, combined with domestic production of cost-effective devices, is enhancing availability and affordability. Public health initiatives and an expanding private healthcare sector are also driving the adoption of implants in both urban and tier-2/3 regions.

Active Medical Implantable Devices Market Share

The active medical implantable devices industry is primarily led by well-established companies, including:

- NeuroPace, Inc. (U.S.)

- Axonics, Inc. (U.S.)

- NEVRO CORP (U.S.)

- BIOTRONIK (Germany)

- ABIOMED (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Eckert & Ziegler (Germany)

- Sonova Holding AG (Switzerland)

- Demant A/S (Denmark)

- Cochlear Ltd (Australia)

- Microson S.A.U. (Spain)

- Oticon Medical A/S (Denmark)

- Nano Retina (Israel)

- MED-EL Medical Electronics (Austria)

- Masimo (U.S.)

- Hologic, Inc. (U.S.)

- Varian Medical Systems, Inc. (U.S.)

What are the Recent Developments in Global Active Medical Implantable Devices Market?

- In April 2023, Medtronic plc, a global leader in medical technology, launched the Micra AV2 and VR2, next-generation leadless pacemakers designed to offer longer battery life and improved programming capabilities. These advanced devices enable more personalized therapy for patients with bradycardia and atrioventricular block, reinforcing Medtronic's leadership in minimally invasive cardiac implantables and expanding patient access to leadless pacing solutions worldwide

- In March 2023, Abbott Laboratories received expanded FDA approval for its Proclaim XR spinal cord stimulation system, now indicated for use in diabetic peripheral neuropathy. This development underscores Abbott’s commitment to addressing the growing burden of chronic pain through advanced neurostimulation solutions, enhancing the therapeutic reach of implantable devices in managing complex neurological conditions

- In March 2023, Boston Scientific Corporation unveiled its Vercise Neural Navigator 5 platform in Europe, enhancing precision and ease of programming for deep brain stimulation therapies. The system supports patients with Parkinson’s disease and dystonia by delivering more targeted and adaptable stimulation, highlighting the company's innovation in neurotechnology and its focus on improving patient outcomes in movement disorders

- In February 2023, Cochlear Limited announced the launch of the Cochlear Nucleus SmartNav System, a digital surgical guidance tool that provides real-time feedback during cochlear implant surgery. This solution is designed to improve placement accuracy and surgical outcomes, marking a significant advancement in implantable hearing devices and surgical navigation for audiology professionals

- In January 2023, Biotronik SE & Co. KG introduced the BIOMONITOR IV, an insertable cardiac monitor with enhanced detection algorithms and remote monitoring capabilities. The device enables continuous, long-term heart rhythm assessment and is part of Biotronik’s expanding portfolio of intelligent, patient-centric cardiac care solutions. This innovation supports proactive care management and reinforces the role of smart implantable technologies in cardiology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.