The growth of packaging and commercial printing is increasingly shaping demand in the Global B1 sheetfed offset press market, as broader industry trends show that print applications tied to packaging and business communications remain resilient even amid digital shifts. Packaging print — including labels, folding cartons, and branded graphics — continues to expand globally, driven by factors such as e-commerce demand and consumer preference for visually engaging product experiences. Annual industry forecasts underscore robust growth in the overall packaging printing market, which is projected to increase substantially over the coming decade due to sustained demand for printed packaging across food, beverage, pharmaceutical, and consumer goods sectors.

Overall, the growth trajectories of packaging and commercial printing are pivotal drivers of the Global B1 sheetfed offset press market. Packaging’s robust expansion — propelled by product branding needs, regulatory drivers, and e-commerce — increasingly absorbs printing capacity and underpins demand for sheetfed offset equipment capable of high-quality, multi-color output. Meanwhile, commercial printing, though facing digital competition, remains a substantial market segment where offset technology delivers efficiency and visual quality advantages. Together, these forces suggest that investments in sheetfed offset press capacity are likely to continue, as printers balance legacy demand with evolving requirements for premium packaging and business print applications

Access Full Report @ http://databridgemarketresearch.com/reports/global-b1-sheetfed-offset-press-market

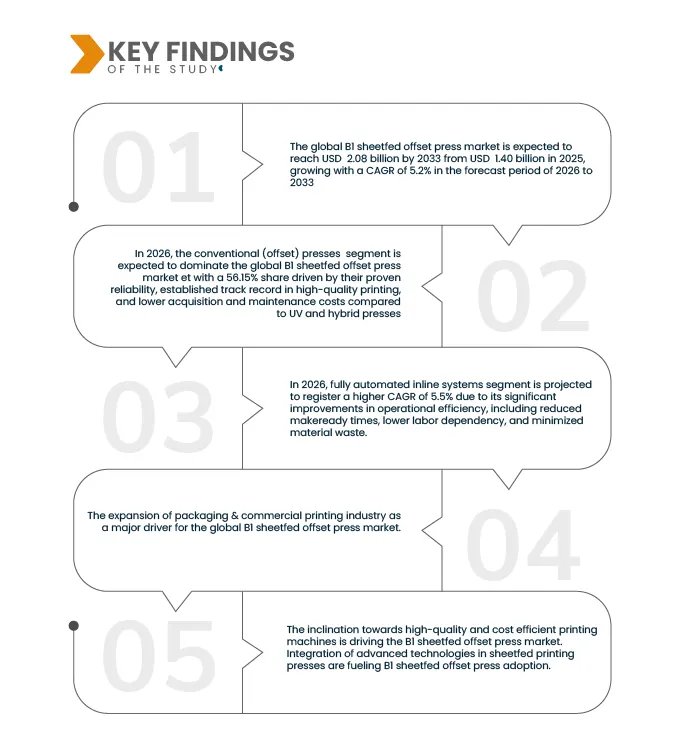

Data Bridge Market Research analyzes that the Global B1 Sheetfed Offset Press Market is expected to reach USD 2.09 billion by 2033 from USD 1.40 billion in 2025, growing at a substantial CAGR of 5.2% in the forecast period of 2026 to 2033.

Key Findings of the Study

Expansion and investments in emerging markets

The Global B1 sheetfed offset press market is poised to benefit significantly from expansion in emerging markets, driven by rapid industrialization, rising consumer demand, and growing commercial printing needs in regions such as Asia‑Pacific, Latin America, and the Middle East & Africa. Emerging economies account for a substantial portion of new offset printing press installations, supported by expanding packaging, publishing, and advertising sectors that demand high‑quality print solutions. For example, emerging markets in Asia‑Pacific and Latin America are experiencing strong growth due to a rising middle class, increasing disposable incomes, and rapid urbanization — all of which fuel demand for printed materials like packaging and promotional print products. This trend presents a substantial market opportunity as local printers upgrade existing equipment and adopt B1 sheetfed offset presses to meet diversified print needs, acting as a key growth driver for the B1 sheetfed offset press market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Year

|

2024 (Customizable 2018-2024)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Pres Type (Conventional (Offset) Presses, UV Curing Presses, Digital/Hybrid B1 Presses, and Others), By Automation Level (Fully Automated Inline Systems, Standalone Systems, and Semi-Automated / Manual), By Color Configuration (Multicolor Presses (4–8 Colors), Two-Color Press, Single Color Presses, and Others), By Application (Packaging Printing, Commercial Printing, and Publication Printing (Magazines, Books), Label Printing, Security Printing, and Others,) By End User (Packaging Converters, Printing Companies, Publishers, In-Plant Printers (Corporate/Institutional), and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Kuwait, Oman, Qatar, Bahrain, and rest of Middle East and Africa

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global B1 sheetfed offset press market is segmented into five notable segments based on the press type, automation level, color configuration, application, and end user.

- On the basis of press type, the global B1 sheetfed offset press market is segmented into conventional (offset) presses, UV curing presses, digital/hybrid B1 presses, others.

In 2026 the conventional (offset) presses segment is expected to dominate the global B1 sheetfed offset press market

In 2026 the conventional (offset) presses segment is expected to dominate the market with a market share of 56.15% due to their proven reliability, established track record in high-quality printing, and lower acquisition and maintenance costs compared to UV and hybrid presses. These presses offer wide substrate compatibility, supporting a variety of paper types, cardboards, and specialty materials, making them ideal for diverse commercial, packaging, and publication applications. Their ability to deliver consistent color accuracy, sharp image reproduction, and high-speed output for medium- to large-volume print runs further strengthens their adoption.

- On the basis of automation level, the global B1 sheetfed offset press market is segmented into fully automated inline systems, standalone systems, semi-automated / manual

In 2026, fully automated inline systems segment is expected to dominate the global B1 sheetfed offset press market

In 2026, fully automated inline systems segment is expected to dominate the market with a market share of 51.93% due to significant improvements in operational efficiency, including reduced makeready times, lower labor dependency, and minimized material waste. These systems offer higher throughput and consistent print quality, enabling printers to handle large-volume, complex jobs with greater precision and reliability.

- On the basis of color configuration, the global B1 sheetfed offset press market is segmented into multicolor presses (4–8 colors), two-color press, single color presses, others. In 2026, multicolor presses (4–8 colors) segment is expected to dominate the market with a market share of 66.59%

- On the basis of application, the global B1 sheetfed offset press market is segmented into packaging printing, commercial printing, publication printing (magazines, books), label printing, security printing, others. In 2026, the packaging printing segment is expected to dominate the market with a market share of 56.92%

- On the basis of end user, the global B1 sheetfed offset press market is segmented into packaging converters, printing companies, publishers, in-plant printers (corporate/institutional), others. In 2026, the packaging converters segment is expected to dominate the market with a market share of 42.68%

Major Players

Data Bridge Market Research analyzes HEIDELBERGER DRUCKMASCHINEN AG (Germany), Komori Corporation (Japan), KOENIG & BAUER AG (Germany), Langley Holdings plc (U.K.), RMGT (RYOBI MHI GRAPHIC TECHNOLOGY) (Japan) as the major market players of the global B1 sheetfed offset press market.

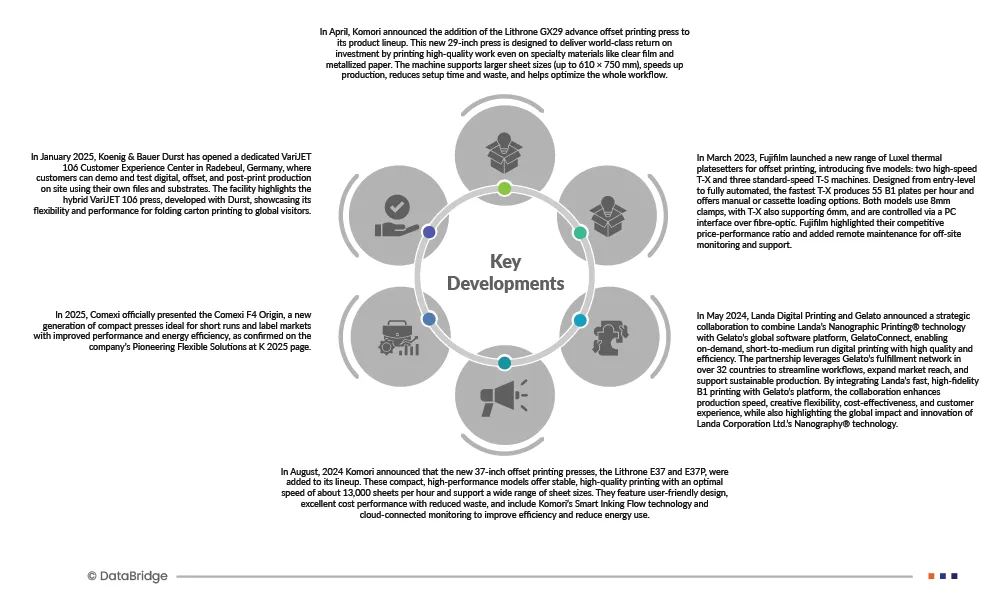

Market Developments

- In April, Komori announced the addition of the Lithrone GX29 advance offset printing press to its product lineup. This new 29‑inch press is designed to deliver world‑class return on investment by printing high‑quality work even on specialty materials like clear film and metallized paper. The machine supports larger sheet sizes (up to 610 × 750 mm), speeds up production, reduces setup time and waste, and helps optimize the whole workflow.

- In January 2025, Koenig & Bauer Durst has opened a dedicated VariJET 106 Customer Experience Center in Radebeul, Germany, where customers can demo and test digital, offset, and post-print production on site using their own files and substrates. The facility highlights the hybrid VariJET 106 press, developed with Durst, showcasing its flexibility and performance for folding carton printing to global visitors.

- In 2025, Comexi officially presented the Comexi F4 Origin, a new generation of compact presses ideal for short runs and label markets with improved performance and energy efficiency, as confirmed on the company’s Pioneering Flexible Solutions at K 2025 page.

- In August, 2024 Komori announced that the new 37‑inch offset printing presses, the Lithrone E37 and E37P, were added to its lineup. These compact, high‑performance models offer stable, high‑quality printing with an optimal speed of about 13,000 sheets per hour and support a wide range of sheet sizes. They feature user‑friendly design, excellent cost performance with reduced waste, and include Komori’s Smart Inking Flow technology and cloud‑connected monitoring to improve efficiency and reduce energy use.

- In May 2024, Landa Digital Printing and Gelato announced a strategic collaboration to combine Landa’s Nanographic Printing technology with Gelato’s global software platform, GelatoConnect, enabling on-demand, short-to-medium run digital printing with high quality and efficiency. The partnership leverages Gelato’s fulfillment network in over 32 countries to streamline workflows, expand market reach, and support sustainable production. By integrating Landa’s fast, high-fidelity B1 printing with Gelato’s platform, the collaboration enhances production speed, creative flexibility, cost-effectiveness, and customer experience, while also highlighting the global impact and innovation of Landa Corporation Ltd.’s Nanography technology.

Regional Analysis

Geographically, the countries covered in the global B1 sheetfed offset press market report are the U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Kuwait, Oman, Qatar, Bahrain, and rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

Asia-Pacific is expected to be the dominant and the fastest-growing region in the global B1 sheetfed offset press market

Asia-Pacific is expected to dominate and the fastest-growing region the global B1 sheetfed offset press market due to rapid industrialization, strong economic growth, and continuous expansion of packaging and commercial printing industries across emerging economies. Countries such as China, India, Japan, and South Korea benefit from large-scale manufacturing ecosystems, export-oriented production, and a high concentration of printing service providers, driving sustained demand for B1 sheetfed offset presses.

Asia-Pacific is expected to be the fastest-growing region the global B1 sheetfed offset press market due to Rising urbanization, growing middle-class populations, and increasing consumption of packaged food, beverages, pharmaceuticals, and consumer goods are further boosting demand for high-quality printed packaging.

For more detailed information about the global B1 sheetfed offset press market report, click here – http://databridgemarketresearch.com/reports/global-b1-sheetfed-offset-press-market