The building automation system (BAS) market offers numerous benefits, including enhanced energy efficiency, improved occupant comfort, and streamlined facility management. BAS integrates various systems such as HVAC, lighting, security, and more, optimizing their performance and reducing energy consumption. Among the dominating segments, the software and services sector is prominent. Cloud-based solutions, data analytics, and remote monitoring are becoming increasingly vital for smart building management, making software and services a key driver in the growth and functionality of BAS.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-building-automation-system-market

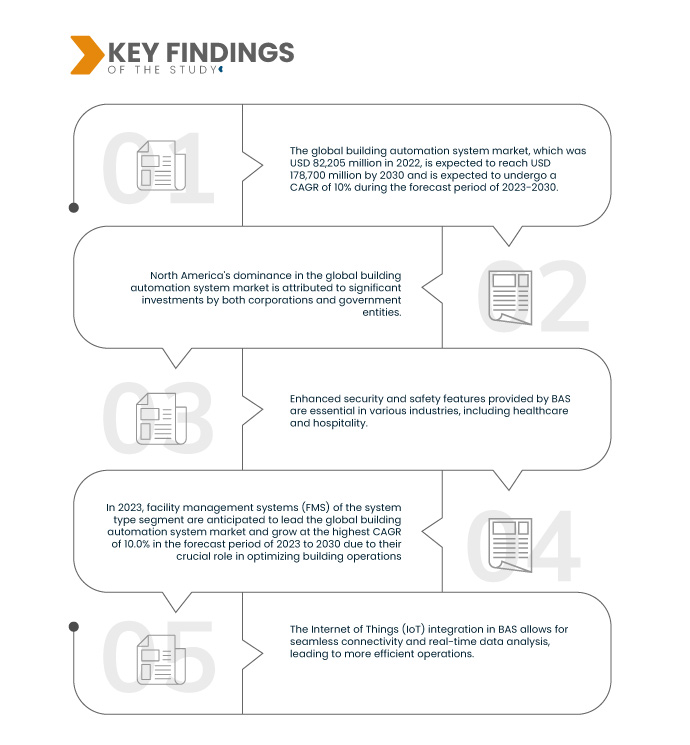

Data Bridge Market Research analyses that the Global Building Automation System Market, which was USD 82,205 million in 2022, is expected to reach USD 178,700 million by 2030, and is expected to undergo a CAGR of 10% during the forecast period of 2023-2030. Urbanization drives the need for smart buildings in cities. These buildings use technologies such as building automation systems (BAS) to enhance efficiency, comfort, and sustainability, meeting the demands of growing urban populations for modern, connected, and eco-friendly living and working spaces.

Key Findings of the Study

Government regulations are expected to drive the market's growth rate

Stringent energy efficiency and environmental regulations, imposed by governments and industry standards, compel building owners and designers to incorporate building automation systems (BAS) into their projects. BAS ensures compliance by optimizing energy consumption, reducing emissions, and meeting sustainability targets. By monitoring and controlling building systems efficiently, such as HVAC and lighting, BAS helps structures adhere to these regulations, avoid penalties, and contribute to a more environmentally responsible and energy-efficient built environment.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

System Type (Facility Management Systems (FMS), Fire Protection Systems, Security and Access Control Systems, Energy Management Systems, Building Management Software (BMS), and Others), Technology (Wireless Technologies and Wired Technologies), Application (Commercial, Residential, and Industrial)

|

Countries Covered

|

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки.

|

Охваченные участники рынка

|

Siemens AG (Германия), Honeywell International Inc. (США), Johnson Controls International PLC (Ирландия), Schneider Electric SE (Франция), ABB Ltd. (Швейцария), United Technologies Corporation (США), Mitsubishi Electric Corporation (Япония), Delta Controls Inc. (Канада), Eaton Corporation (Ирландия), Rockwell Automation Inc. (США), Legrand SA (Франция), Crestron Electronics Inc. (США), Beckhoff Automation GmbH & Co. KG (Германия), Lutron Electronics Co. Inc. (США), Ingersoll Rand Inc. (Ирландия)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента:

Мировой рынок систем автоматизации зданий сегментирован по типу системы, технологии и области применения.

- На основе типа системы глобальный рынок систем автоматизации зданий сегментируется на системы управления объектами (FMS), системы противопожарной защиты, системы безопасности и контроля доступа, системы управления энергопотреблением, программное обеспечение для управления зданиями (BMS) и другие. Ожидается, что в 2023 году системы управления объектами (FMS) будут лидировать на мировом рынке систем автоматизации зданий и будут расти с самым высоким среднегодовым темпом роста в 10,0% в прогнозируемый период с 2023 по 2030 год из-за их решающей роли в оптимизации эксплуатации зданий.

Ожидается, что в 2023 году системы управления объектами (FMS) системного типа будут доминировать на мировом рынке систем автоматизации зданий.

Ожидается, что в 2023 году системы управления объектами (FMS) станут лидерами мирового рынка систем автоматизации зданий и будут расти с самым высоким среднегодовым темпом роста в 10,0% в прогнозируемый период с 2023 по 2030 год из-за их решающей роли в оптимизации эксплуатации зданий. FMS оптимизируют обслуживание объектов, управление энергопотреблением и комфорт для жильцов, повышая эффективность и экономию средств, что делает их ключевым компонентом современных стратегий автоматизации зданий.

- На основе технологий глобальный рынок систем автоматизации зданий сегментируется на беспроводные технологии и проводные технологии. В 2023 году сегмент беспроводных технологий, как ожидается, будет доминировать на мировом рынке систем автоматизации зданий и расти с самым высоким среднегодовым темпом роста в 9,9% в прогнозируемый период с 2023 по 2030 год. Это доминирование возникает из-за гибкости и масштабируемости, предлагаемых беспроводными решениями, что обеспечивает бесперебойную связь и управление различными системами здания.

Ожидается , что в 2023 году сегмент технологий систем беспроводных технологий ( FMS) будет доминировать на мировом рынке систем автоматизации зданий.

Сегмент беспроводных технологий, как ожидается, будет доминировать на мировом рынке систем автоматизации зданий в 2023 году и расти с самым высоким среднегодовым темпом роста в 9,9% в прогнозируемый период с 2023 по 2030 год. Это доминирование обусловлено гибкостью и масштабируемостью, которые обеспечивают беспроводные решения, обеспечивая бесперебойную связь и управление различными системами здания, такими как HVAC и освещение, при одновременном снижении затрат на установку и количества сбоев, что в конечном итоге способствует их широкому внедрению.

- На основе применения глобальный рынок систем автоматизации зданий сегментируется на коммерческий, жилой и промышленный. Прогнозируется, что жилой сегмент будет лидировать на мировом рынке систем автоматизации зданий в 2023 году и будет расти с самым высоким среднегодовым темпом роста в 10,0% в прогнозируемый период с 2023 по 2030 год. Это обусловлено растущим спросом на решения для умных домов, которые предлагают удобство, энергоэффективность и безопасность домовладельцам. Растущая осведомленность и принятие технологий автоматизации в жилом секторе являются ключевыми факторами, способствующими его доминированию.

Основные игроки

Data Bridge Market Research признает следующие компании в качестве игроков на мировом рынке систем автоматизации зданий: Siemens AG (Германия), Honeywell International Inc. (США), Johnson Controls International PLC (Ирландия), Schneider Electric SE (Франция), ABB Ltd. (Швейцария), United Technologies Corporation (США), Mitsubishi Electric Corporation (Япония), Delta Controls Inc. (Канада), Eaton Corporation (Ирландия), Rockwell Automation Inc. (США), Legrand SA (Франция), Crestron Electronics Inc. (США).

Развитие рынка

- In March 2023, Siemens unveiled the Connect Box, a smart IoT solution designed for the efficient management of small to medium-sized buildings. This offering, part of Siemens' Xcelerator portfolio, simplifies building performance optimization through seamless integration of wireless and wired devices. Utilizing a cloud-based interface, users can easily monitor and enhance building operations, including essential management tasks, alarm notifications, and historical trend analysis. The Connect Box achieves up to 30% improvement in energy efficiency and better indoor air quality. Its user-friendly online access and plug-and-play installation streamline system setup and operation. It supports various communication protocols and provides flexible licensing options for data management, whether in the cloud or on-premises.

- In January 2023, ABB unveiled the ABB Cylon Smart Building Management System during the Light Middle East and Intelligent Building Middle East 2023 event in Dubai. This system offers adaptable automation and energy management for buildings of various sizes, with the goal of making them carbon-neutral and reducing energy expenses through real-time monitoring and control. ABB provides a wide array of products and solutions to create more intelligent and efficient buildings, aligning with the mission to achieve carbon neutrality by 2030. The incorporation of Cylon Controls' portfolio into ABB's offerings strengthens its ability to provide effective and sustainable building management solutions.

Regional Analysis

Geographically, the countries covered in the global building automation system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global building automation system market during the forecast period 2023 - 2030

North America's dominance in the global building automation system market is attributed to significant investments by both corporations and government entities. This region leads in adopting advanced building automation technologies to improve energy efficiency, security, and occupant comfort. The commitment to sustainability and the promotion of smart buildings have further bolstered North America's position. These factors collectively contribute to its leadership in the global market for building automation systems.

Ожидается, что Азиатско-Тихоокеанский регион будет доминировать на мировом рынке систем автоматизации зданий в прогнозируемый период 2023–2030 гг.

Ожидается, что Азиатско-Тихоокеанский регион (APAC) будет доминировать на мировом рынке систем автоматизации зданий. Будучи одним из самых урбанизированных регионов в мире, эта тенденция будет сохраняться. Расширение городов стимулирует спрос на энергоэффективные и устойчивые здания. Системы автоматизации зданий (BAS) играют жизненно важную роль в повышении энергоэффективности, что приводит к экономии средств как для предприятий, так и для домовладельцев. Этот растущий акцент на экологически чистых и интеллектуальных зданиях позиционирует Азиатско-Тихоокеанский регион как самый быстрорастущий рынок систем автоматизации зданий.

Для получения более подробной информации об отчете о мировом рынке систем автоматизации зданий нажмите здесь – https://www.databridgemarketresearch.com/reports/global-building-automation-system-market