According to a study published in the International Journal of Drug Policy in December 2021, mean monthly cannabis sales in all four states increased during the pandemic in 2020 compared to the same period prior to the pandemic. In 2020, sales in Washington, Alaska, Colorado, and Oregon reached a three-year high. The study discovered that cannabidiol sales surged during the epidemic, which benefited the market under consideration. This trend is expected to continue throughout the forecast period, as the prevalence of neurological illnesses rises.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-cannabidiol-market

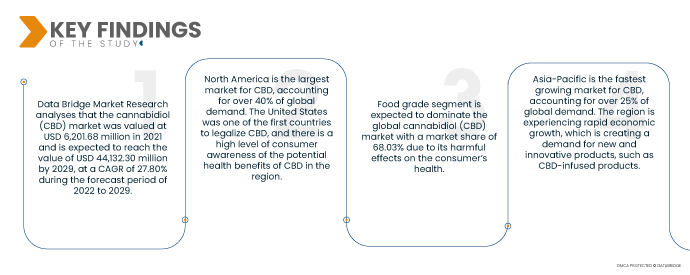

Data Bridge Market Research analyses that the Cannabidiol (CBD) Market was valued at USD 6,201.68 million in 2021 and is expected to reach the value of USD 44,132.30 million by 2029, at a CAGR of 27.80% during the forecast period of 2022 to 2029. There is a growing body of research that suggests that CBD may be effective in treating a variety of ailments, including pain, anxiety, and insomnia. This is driving consumer demand for CBD products. The legalization of CBD in many countries has made it more accessible to consumers. This has also led to an increase in the number of CBD products on the market. CBD is increasingly being infused into a variety of products, such as food, beverages, and cosmetics. This is making CBD more accessible to consumers and is driving market growth.

Growing approval by the governments around the world is expected to drive the market's growth rate

Given the official approvals, the increased acceptance and use of CBD products is likely to improve production and sales, consequently driving market growth. Anxiety, seizures, and pain are all efficiently treated with CBD. The key element driving market expansion is the need for CBD for health and wellness. Furthermore, CBD oil is becoming increasingly popular as a component in skincare products for the treatment of acne and wrinkles. Sephora, for example, just launched a line of CBD skincare products to its stores, while Ultra Beauty plans to launch a CBD-based product line. Many new companies are also entering the CBD-infused cosmetics sector.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014- 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Source (Hemp And Marijuana), Grade (Food Grade And Therapeutics Grade), Nature (Organic And Inorganic), Application (Tincture, Food, Beverages, Pharmaceutical, Topicals, Dietary Supplements And Others), Product Type (CBD Oil, CBD Concentrates, CBD Isolates And Others)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

CV Sciences, Inc. (U.S.), VIVO Cannabis Inc. (Canada), Gaia Herbs Hemp (U.S.), Phoena Holdings Inc. (U.S.), Medical Marijuana, Inc. (U.S.), The Cronos Group (Canada), CHARLOTTE’S WEB (U.S.), HEXO Corp. (Canada), Aurora Cannabis (Canada), Canopy Growth Corporation (Canada), Jazz Pharmaceuticals, Inc. (U.S.), Tilray (U.S.), Curaleaf (U.S.), KAZMIRA (U.S.), Freedom Leaf, Inc. (U.S.), Koi CBD (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

The cannabidiol (CBD) market is segmented into five notable segments based on source, grade, application, product type, nature.

- On the basis of source, the global cannabidiol (CBD) market is segmented into hemp and marijuana. Hemp segment is expected to dominate the global cannabidiol (CBD) market with a market share of 55.38% due to its ability to cure a variety of illnesses, including anxiety, seizures, neurological problems, cancer-related nausea, chronic pain, and more.

- On the basis of grade, the global cannabidiol (CBD) market is segmented into food grade and therapeutics grade. Food grade segment is expected to dominate the global cannabidiol (CBD) market with a market share of 68.03% due to its harmful effects on the consumer’s health.

- On the basis of nature, the global cannabidiol (CBD) market is segmented into organic and inorganic.

Organic segment is expected to dominate the global cannabidiol (CBD) market

The organic segment is expected to dominate the global cannabidiol (CBD) market with a market share of 75.91% due to largest consumer market with high GDP. Organic fertilizers come from natural sources like animal or plant waste. Non-organic fertilizers are chemically derived.

- On the basis of application, the global cannabidiol (CBD) market is segmented into tincture, food, beverages, pharmaceutical, topicals, dietary supplements and others.

Tincture is expected to dominate the global cannabidiol (CBD) market

The tincture is expected to dominate the global cannabidiol (CBD) market with a market share of 31.99% due to increasing demand for CBD-infused wellness drinks, increasing disposable income of consumers, and improving living standards are a few of the factors driving this market's rapid growth during the forecast period.

- On the basis of product type, the global cannabidiol (CBD) market is segmented into CBD oil, CBD concentrates, CBD isolates and others. CBD oil segment is expected to dominate the global cannabidiol (CBD) market with a market share of 49.70% due to CBD products that are gaining popularity as an alternative to traditional analgesics like ibuprofen, aspirin, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the major market players: CV Sciences, Inc. (U.S.), VIVO Cannabis Inc. (Canada), Gaia Herbs Hemp (U.S.), Phoena Holdings Inc. (U.S.), Medical Marijuana, Inc. (U.S.), The Cronos Group (Canada), CHARLOTTE’S WEB (U.S.), HEXO Corp. (Canada), Aurora Cannabis (Canada), Canopy Growth Corporation (Canada), Jazz Pharmaceuticals, Inc. (U.S.), Tilray (U.S.), Curaleaf (U.S.), KAZMIRA (U.S.), Freedom Leaf, Inc. (U.S.), Koi CBD (U.S.).

Market Development

- In 2022, Hemp Bombs, a leading manufacturer of CBD and THC products, announced the launch of its newest offering, Delts-9 THC Gummies. The gummies are available in a variety of flavors, including strawberry, watermelon, and grape. They are also available in different strengths, from 10mg to 50mg of THC per gummy. Delts-9 THC Gummies are currently available at select retail locations and online. These gummies are made with a blend of THC and CBD, which can provide a variety of benefits, including relaxation, pain relief, and improved sleep. They are also vegan and gluten-free.

- In 2022, Puration, Inc., a leading manufacturer of CBD products, and PAO Group Inc., a leading manufacturer of nutraceuticals, announced that they are working together to develop a new line of CBD nutraceuticals under PURA's Farmersville hemp brand name. The new line of products will be designed to help consumers improve their overall health and well-being. They are expected to be available in early 2023. These nutraceuticals will be made with high-quality CBD extracted from hemp plants grown in PURA's own farms. They are expected to be available in a variety of forms, including capsules, powders, and liquids.

Regional Analysis

Geographically, the countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

As per Data Bridge Market Research analysis:

North America is the dominant region in the cannabidiol (CBD) market during the forecast period 2022-2029

North America is the largest market for CBD, accounting for over 40% of global demand. The United States was one of the first countries to legalize CBD, and there is a high level of consumer awareness of the potential health benefits of CBD in the region. The region is home to a number of major players in the CBD market, such as Canopy Growth, Aurora Cannabis, and GW Pharmaceuticals.

Asia-Pacific is estimated to be the fastest-growing region in the cannabidiol (CBD) market in the forecast period 2022-2029

Asia-Pacific is the fastest growing market for CBD, accounting for over 25% of global demand. The region is experiencing rapid economic growth, which is creating a demand for new and innovative products, such as CBD-infused products. The region is becoming more aware of the potential health benefits of CBD, and there is a growing demand for natural remedies.

For more detailed information about the cannabidiol (CBD) market report, click here – https://www.databridgemarketresearch.com/reports/global-cannabidiol-market