Several well-known construction certification programs are provided by businesses, such as ISO 45001, which evaluates occupational safety and health management systems to prevent workplace accidents and illness, ISO 9001, ISO 14001, and ISO 55001 Asset Management, to meet quality and environmental management regulations. The largest independent testing facility for building materials in the UK, SOCOTEC follows UKAS-accredited procedures and test methods, and all of its sampling and testing techniques are based solely on the most recent British and European Standards.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-construction-product-certification-market

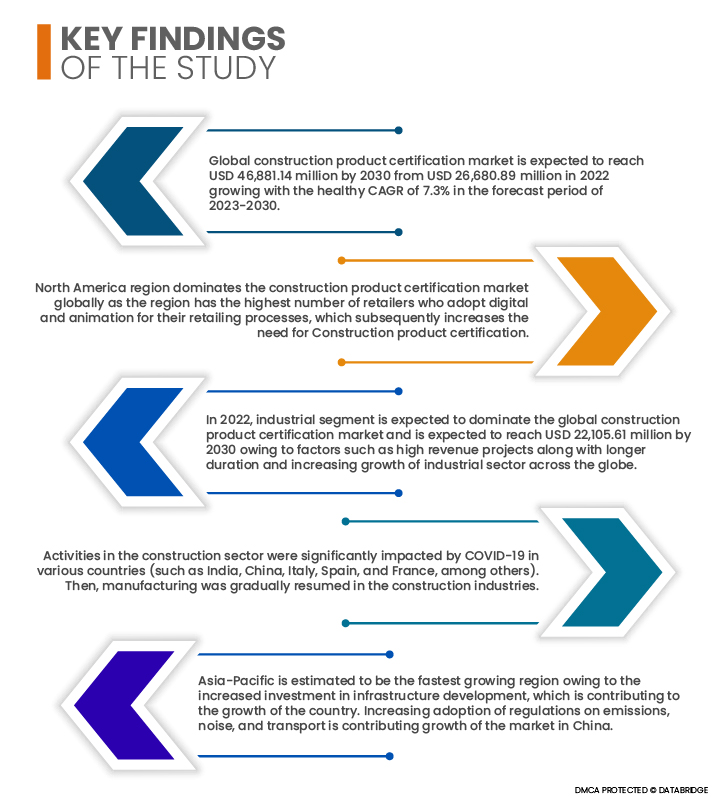

Global Construction Product Certification Market is expected to reach USD 46,881.14 million by 2030 from USD 26,680.89 million in 2022 growing with the healthy CAGR of 7.3% in the forecast period of 2023-2030. The growth of the market has been highly boosted by growing adaption of digital advertising in the advertising sector. Growing technological innovations in display technologies is boosting the growth of the global digital out of home (OOH) advertising market. The digital out of home (OOH) advertising requires high capital requirement for installation, maintenance, and other technical expertise costs which acts as major restraint factor for global digital out of home advertising market.

Growing need to ensure product safety and performance attributes across the world will drive the market's growth rate

Product certification is required in construction industry areas where a failure can have serious consequences. Certification of construction products indicates that the product is fit for any particular use and does not incur failure cost. Certification of construction products affirms that the product compliance with the relevant legislation and the product can be sold anywhere in the particular area. Thus, there is a growing need to ensure product safety and performance attributes as any product failure can incur a huge loss, which creates need of certification of products and acts as a driving factor for the market's growth.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

Product (Construction and Building Products, Power Generation and Energy Storage, Industrial and Hazardous Location Equipment, Information and Communications Technology, Lighting Products, Medical and Laboratory Equipment, Personal Protective Equipment, Tools and Outdoor Equipment and others), Application (Interior Finishing, Insulation, Exterior Siding, Roofing and others), End-User (Industrial, Commercial and Residential)

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

Market Players Covered

|

British Standards Institution (U.K.), SGS SA (Switzerland), Centexbel (Belgium), RINA S.p.A. (Italy), Intertek Group plc (U.K.), CSA Group (Canada), DNV GL (Norway), Bureau Veritas (France), Eurofins Scientific (Luxembourg), ALS Limited (Australia), DEKRA CERTIFICATION B.V. (New Zealand), TÜV SÜD (Germany), Applus+ (Spain), UL LLC (U.S.), TÜV Rheinland (Germany) among others

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

Global construction product certification market is segmented into three notable segments which are based on the product, application and end user.

- On the basis of product, the construction product certification market is segmented into construction and building products, power generation and energy storage, industrial and hazardous location equipment, information and communications technology, lighting products, medical and laboratory equipment, personal protective equipment, tools and outdoor equipment and others. In 2022, construction and building products segment is expected to dominate the global construction product certification market and is expected to reach USD 10,065.07 million by 2030 due to extreme focus on the safety and quality, surging need to comply with construction regulations, growing emphasis toward environment certification, encourage energy saving, and evaluating the sustainability for such products.

- On the basis of application, the construction product certification market is segmented into insulation, roofing, exterior siding, interior finishing and others. In 2022, interior finishing segment is expected to dominate the global construction product certification market and is expected to reach USD 15,308.43 million by 2030 mainly attributed to rising number of construction certification projects pertaining to interior finishing, inclusion of interior space elements such as door, ceiling, lightings, staircase, and more.

The interior finishing segment will dominate the application segment of the construction product certification market

The interior finishing segment will emerge as the dominating segment under application segment. This is because of the growing number of technological advancements in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

- On the basis of end user, the construction product certification market is segmented into industrial, commercial and residential. In 2022, industrial segment is expected to dominate the global construction product certification market and is expected to reach USD 22,105.61 million by 2030 owing to factors such as high revenue projects along with longer duration and increasing growth of industrial sector across the globe.

The industrial segment will dominate the end user segment of the construction product certification market

The industrial segment will emerge as the dominating segment under end user. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the semiconductors and electronics industry all around the globe will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in market: British Standards Institution (U.K.), SGS SA (Switzerland), Centexbel (Belgium), RINA S.p.A. (Italy), Intertek Group plc (U.K.), CSA Group (Canada), DNV GL (Norway), Bureau Veritas (France), Eurofins Scientific (Luxembourg), ALS Limited (Australia), DEKRA CERTIFICATION B.V. (New Zealand), TÜV SÜD (Germany), Applus+ (Spain), UL LLC (U.S.), TÜV Rheinland (Germany)

Market Development

- In October 2020, British Standards Institution announced launch of new project to develop the first set of guidance for the design of the built environment. This new project includes the needs of people for sensory and neurological processing difficulties and differences to be overcome. This new project of the company was sponsored by Forbo Flooring Systems, Transport for London (TfL), BuroHappold and the BBC. This has helped the company better meet customers' needs, enhance offerings and grow in the market.

- In April 2020, SGS SA announced the acquisition of Testing, Engineering and Consulting Services, Inc. (TEC Services), based in U.S. TEC Services focused on meeting the quality requirements of construction industry. This acquisition has helped the company to broaden their materials testing offerings and to enhance their position in the U.S. market.

Regional Analysis

Geographically, the countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

As per Data Bridge Market Research analysis:

North America is the dominant region in construction product certification market during the forecast period 2023 - 2030

North America region dominates the construction product certification market globally as the region has the highest number of retailers who adopt digital and animation for their retailing processes which subsequently increases the need for Construction product certification.

Asia-Pacific is estimated to be the fastest-growing region in construction product certification market the forecast period 2023 - 2030

Asia-Pacific is estimated to be the fastest growing region owing to the increased investment in infrastructure development, contributing to the country's growth. Increasing adoption of regulations on emissions, noise, and transport is contributing growth of the market in China.

COVID-19 Impact

Activities in the construction sector were significantly impacted by COVID-19 in various countries (such as India, China, Italy, Spain, and France, among others). Then, manufacturing was gradually resumed in the construction industries. However, a number of issues emerged because of the travel restrictions and confinement measures, including labor shortages, supply chain interruptions that resulted in a shortage of building supplies, and increased expenses because of health that is more stringent and security procedures.

For more detailed information about the construction product certification on market report, click here – https://www.databridgemarketresearch.com/reports/global-construction-product-certification-market