Global Construction Product Certification Market

Market Size in USD Billion

CAGR :

%

USD

30.06 Billion

USD

55.22 Billion

2024

2032

USD

30.06 Billion

USD

55.22 Billion

2024

2032

| 2025 –2032 | |

| USD 30.06 Billion | |

| USD 55.22 Billion | |

|

|

|

|

What is the Global Construction Product Certification Market Size and Growth Rate?

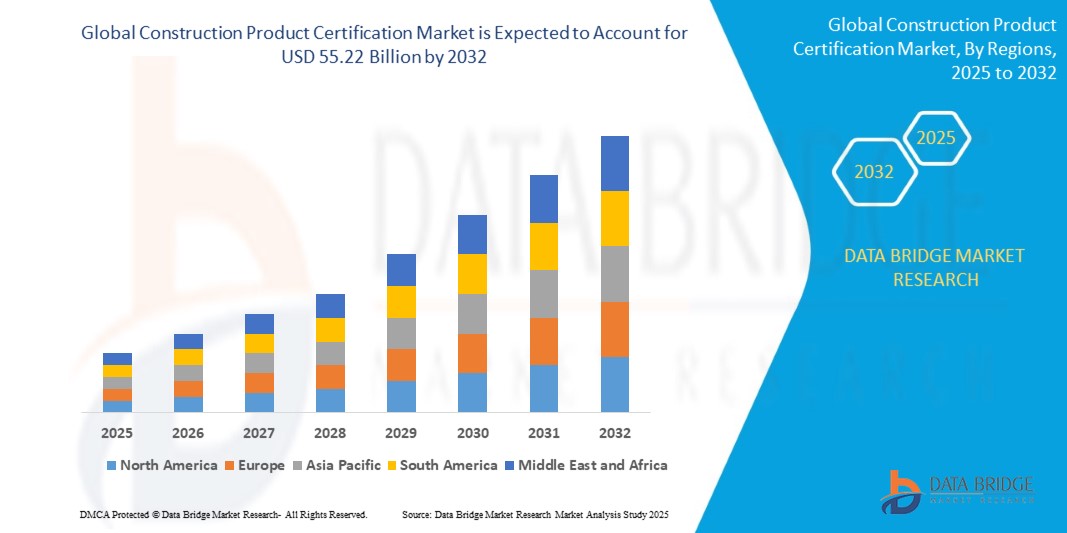

- The global construction product certification market size was valued at USD 30.06 billion in 2024 and is expected to reach USD 55.22 billion by 2032, at a CAGR of 7.90% during the forecast period

- In the construction product certification market, rigorous standards ensure quality, safety, and compliance. Certification processes validate materials and methods, guaranteeing performance and regulatory adherence

- This instils trust among stakeholders, promotes market transparency, and fosters innovation, driving sustainable practices and elevating industry standards for construction projects worldwide

What are the Major Takeaways of Construction Product Certification Market?

- The rise of green building initiatives fuels demand for certifications validating environmental performance, energy efficiency, and resource conservation. Stakeholders prioritize sustainable practices, pushing for certifications that ensure buildings meet stringent standards

- This emphasis reflects a growing commitment to eco-friendly construction methods and the preservation of natural resources in the built environment

- Europe held the largest revenue share of 31.7% in 2024 in the construction product certification market, driven by stringent regulatory frameworks and a strong focus on product safety and environmental sustainability

- North America is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, fueled by increasing awareness of safety regulations, environmental certifications, and digital construction practices

- The Construction and Building Products segment dominated the market with the largest revenue share of 32.6% in 2024, owing to its wide-ranging use in residential, commercial, and infrastructure projects

Report Scope and Construction Product Certification Market Segmentation

|

Attributes |

Construction Product Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Construction Product Certification Market?

“Digitalization and Automation of Compliance Processes”

- A major emerging trend in the global construction product certification market is the rapid digital transformation of certification procedures through the integration of automated compliance tools, blockchain-based verification, and AI-driven quality checks. These advancements are streamlining the traditionally time-consuming and paper-intensive certification processes

- For instance, SGS and Bureau Veritas are investing in cloud-based compliance platforms that allow manufacturers and construction firms to submit documentation, schedule inspections, and receive certification reports digitally, greatly reducing processing times

- AI-enabled software is increasingly being used to pre-screen construction products for regulatory compliance, helping stakeholders identify potential failures before formal testing begins, thus improving product readiness and reducing costs

- Blockchain technology is also being explored to create tamper-proof certification records. This enhances transparency across the construction value chain and reduces the risk of counterfeit or non-compliant materials entering regulated projects

- As sustainability certifications (e.g., LEED, BREEAM) gain traction, digital tools are aiding companies in real-time tracking of carbon footprints, material origin, and energy efficiency metrics to support green building compliance

- Overall, the shift towards automated, transparent, and traceable certification systems is redefining how construction product approvals are obtained, making them faster, more reliable, and globally accessible

What are the Key Drivers of Construction Product Certification Market?

- The rising emphasis on safety, sustainability, and regulatory compliance in the construction industry is a key driver fueling demand for certified products globally

- For instance, in March 2024, TÜV SÜD launched a new certification protocol aligned with the EU Construction Products Regulation (CPR), streamlining approvals for energy-efficient insulation materials across Europe

- The surge in green building initiatives and mandates across countries such as Germany, Canada, and the U.K. is pushing manufacturers to obtain third-party certifications that validate low-emission, non-toxic, and eco-friendly materials

- The global trend of urban infrastructure modernization and increased investments in commercial real estate and smart cities is boosting the demand for products that comply with fire safety, seismic resistance, and durability standards

- Certifications also act as market differentiators. Buyers and project owners are more inclined to source materials from certified suppliers due to assurance of quality and performance, which helps manufacturers expand into international markets more seamlessly

- With government contracts and public infrastructure projects increasingly demanding compliance with global certification bodies (e.g., BSI, Intertek, UL), certified products are becoming mandatory rather than optional in many regions

Which Factor is challenging the Growth of the Construction Product Certification Market?

- One of the most prominent challenges in the market is the high cost and complexity of multi-regional compliance. Manufacturers face hurdles in navigating the fragmented regulatory landscape, especially when expanding to new countries or regions

- For instance, a product certified under UL (U.S.) may still need separate testing to meet European (CE) or Asian (CCC) standards, resulting in redundant testing fees, extended timelines, and delayed market entry

- Small and medium enterprises (SMEs) often struggle with the financial burden and resource limitations involved in sustaining certification renewals, audits, and documentation requirements, especially across multiple product lines

- In addition, frequent changes in building codes, driven by evolving climate goals or regional policies, require manufacturers to update materials or re-certify products, which can lead to market disruptions and increased R&D costs

- There is also a skills gap in digital adoption for certification processes. Many firms, particularly in developing markets, lack trained personnel to manage digitized workflows, data analytics, or online audit platforms

- Overcoming these barriers will require greater harmonization of international standards, government-backed incentives for certified products, and capacity-building initiatives for SMEs to thrive in this rapidly evolving space

How is the Construction Product Certification Market Segmented?

The market is segmented on the basis of product, application, and end-user.

• By Product

On the basis of product, the construction product certification market is segmented into Construction and Building Products, Power Generation and Energy Storage, Industrial and Hazardous Location Equipment, Information and Communications Technology, Lighting Products, Medical and Laboratory Equipment, Personal Protective Equipment, Tools and Outdoor Equipment, and others. The Construction and Building Products segment dominated the market with the largest revenue share of 32.6% in 2024, owing to its wide-ranging use in residential, commercial, and infrastructure projects. Growing construction activity across developed and developing economies, combined with stricter building code enforcement, is driving certification demand for structural products such as cement, concrete, roofing, and framing materials.

The Personal Protective Equipment (PPE) segment is expected to witness the fastest CAGR of 19.4% from 2025 to 2032, fueled by rising workplace safety awareness, pandemic-driven regulatory pressure, and increased industrial compliance. Certifications for products such as helmets, masks, gloves, and safety eyewear are gaining prominence in both construction and manufacturing sectors.

• By Application

On the basis of application, the market is segmented into Interior Finishing, Insulation, Exterior Siding, Roofing, and others. The Interior Finishing segment held the largest market revenue share of 28.9% in 2024, attributed to the growing focus on fire resistance, air quality, and energy efficiency within interior environments. Products such as wallboards, floorings, coatings, and adhesives increasingly require certification to meet health and performance regulations.

The Insulation segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by energy efficiency mandates in residential and commercial buildings. Certification standards such as ASTM, ISO, and CE for thermal and acoustic insulation materials are being widely adopted, especially in Europe and North America, to meet green building requirements.

• By End-User

On the basis of end-user, the construction product certification market is segmented into Industrial, Commercial, and Residential. The Commercial segment dominated the market with the largest revenue share of 41.3% in 2024, supported by increasing demand for certified construction products in retail, offices, hotels, and institutional buildings. Safety, sustainability, and performance compliance are critical in commercial projects, making product certification a standard requirement.

The Residential segment is projected to exhibit the fastest CAGR during the forecast period, driven by the rising number of housing projects, DIY home renovations, and homeowner interest in certified, eco-friendly, and durable materials. Government incentives for energy-efficient certified home materials further boost this trend.

Which Region Holds the Largest Share of the Construction Product Certification Market?

- Europe held the largest revenue share of 31.7% in 2024 in the construction product certification market, driven by stringent regulatory frameworks and a strong focus on product safety and environmental sustainability

- Countries across the region require rigorous compliance with CE marking and EN standards, significantly contributing to the high demand for certified construction products across all major verticals including insulation, roofing, siding, and lighting

- The growing emphasis on energy-efficient buildings, green certifications, and smart infrastructure particularly in Germany, France, and the U.K. continues to position Europe as the leading market for construction product certifications

Germany Construction Product Certification Market Insight

The Germany market dominated the European region with the largest revenue share in 2024, driven by strong national building regulations, a thriving construction sector, and a cultural emphasis on quality and safety. The country's focus on energy efficiency, sustainable housing, and digital transformation supports widespread adoption of certified construction materials and components.

U.K. Construction Product Certification Market Insight

The U.K. construction product certification market is set to experience a notable CAGR during the forecast period, owing to increasing investments in infrastructure modernization and growing consumer demand for eco-certified building products. Post-Brexit regulatory adaptations are also pushing manufacturers to meet both U.K.-specific and international certification standards.

France Construction Product Certification Market Insight

France is witnessing steady growth in its construction product certification industry, supported by its ambitious climate policy and housing renovation programs. Government subsidies for energy-efficient construction and retrofitting projects are fueling the demand for certified insulation, HVAC systems, and smart construction products across both residential and commercial sectors.

Which Region is the Fastest Growing Region in the Construction Product Certification Market?

North America is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, fueled by increasing awareness of safety regulations, environmental certifications, and digital construction practices. Rising consumer demand for sustainable and fire-resistant building materials, the rapid expansion of smart home devices, and U.S. government initiatives to standardize green building practices are boosting certification adoption across the region. Moreover, updated codes such as LEED, ANSI, and UL compliance requirements are compelling both domestic manufacturers and international exporters to invest in construction product certification services.

U.S. Construction Product Certification Market Insight

The U.S. accounted for the largest market share of 80.2% in 2024 within North America, led by increased federal spending on infrastructure, growing emphasis on energy efficiency, and a booming housing market. Certification of materials used in insulation, roofing, lighting, and siding is increasingly mandated by state-level building codes and green construction incentives.

Canada Construction Product Certification Market Insight

Canada is showing rapid progress, supported by national sustainability initiatives such as the National Building Code of Canada and Energy Star programs. The demand for certified construction products is rising across the country’s residential and commercial sectors, especially in urban areas focused on eco-conscious development.

Which are the Top Companies in Construction Product Certification Market?

The construction product certification industry is primarily led by well-established companies, including:

- The British Standards Institution (U.K.)

- SGS Société Générale de Surveillance SA (Switzerland)

- QVC Certification Services Pvt Ltd (India)

- Centexbel (Belgium)

- RINA S.p.A. (Italy)

- Intertek Group plc (U.K.)

- CSA Group Testing & Certification Inc. (Canada)

- Det Norske Veritas group (Norway)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- ALS (Australia)

- DEKRA (Germany)

- TÜV SÜD (Germany)

- Applus+ (Spain)

- UL LLC (U.S.)

- TÜV Rheinland (Germany)

What are the Recent Developments in Global Construction Product Certification Market?

- In October 2024, Applus+ collaborated with Four Hills Services Pty Ltd to form Inspection Partners Pty Ltd, a joint initiative to offer inspection and testing services across Australia's construction and mining industries. This partnership focuses on job creation by empowering both Indigenous and non-Indigenous individuals to develop careers in the TIC (testing, inspection, and certification) sector. This initiative enhances Applus+'s footprint in the Asia-Pacific region while promoting inclusive workforce development

- In September 2024, Eurofins Scientific entered into a partnership with Pharmaoffer, a digital pharmaceutical platform provider, to enhance quality and safety audits across the pharmaceutical supply chain. This collaboration enables the integration of Eurofins Healthcare Assurance's audit libraries into Pharmaoffer’s platform, improving audit accessibility for API buyers and suppliers. The move reinforces Eurofins' role as a leading provider of digital quality assurance solutions in regulated industries

- In February 2022, Iguá, one of Brazil's largest sanitation firms, secured Climate Bonds Standard Certification for Water Infrastructure to fund operations in Mato Grosso and Paraná. The BRL 880 million raised will support water capture, treatment, and sewage collection in cities such as Cuiabá and Paranaguá. Bureau Veritas served as the verifier for this pioneering green bond issuance. This milestone marked Latin America's first certified green bond in sanitation, boosting Bureau Veritas’s reputation in sustainability-led certifications

- In October 2020, the British Standards Institution (BSI) launched a groundbreaking initiative to develop inclusive design guidelines for the built environment, focusing on individuals with sensory and neurological processing differences. Supported by Forbo Flooring Systems, Transport for London, BuroHappold, and the BBC, this project promotes human-centric design. This effort reinforces BSI’s leadership in shaping accessible and inclusive construction standards

- In September 2020, RINA S.p.A. committed to the European Commission’s Innovation Fund to support the development of low-carbon technologies. The company assisted firms in proposal drafting, showcasing its engagement with sustainability and forward-looking construction standards. This move amplified RINA’s visibility in the European sustainable innovation space

- In April 2020, SGS SA finalized the acquisition of Testing, Engineering and Consulting Services, Inc. (TEC Services), a U.S.-based firm specializing in construction industry quality testing. This strategic acquisition broadened SGS’s material testing capabilities and solidified its competitive edge in the U.S. construction market. The move significantly enhanced SGS’s service portfolio and regional presence in North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Construction Product Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Construction Product Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Construction Product Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.