There has been a rising trend in recent years towards the use of robots on construction sites. This can be recognized to several factors, including advancements in technology, growing labor costs, and a shortage of skilled labor in some areas. Robots can be used for a variety of tasks on construction sites, such as excavation, demolition, material handling, and 3D printing. They can work 24/7, without breaks, and can be programmed to perform tasks with precision and efficiency. This can lead to increased productivity, reduced labor costs, and improved safety on the job site. . Therefore, the global construction robot market is estimated to increase rapidly in the near future.

Access full Report @ https://www.databridgemarketresearch.com/reports/global-construction-robot-market

Data Bridge Market Research analyses that the Global Construction Robot Market is expected to grow at a CAGR of 8.7% in the forecast period of 2023 to 2030 and is expected to reach USD 731,510.00 thousand by 2030. Construction robot are widely used in the construction industry, as construction robots can perform repetitive tasks at a much faster rate than humans, resulting in increased efficiency.

Key Findings of the Study

- The global construction robot market is expected to reach USD 731,510.00 thousand by 2030 with a substantial CAGR of 8.7% in the forecast period of 2023 to 2030

- The articulated robots is dominating the global construction robot market owing to their flexibility and range of motion. Articulated robots are composed of multiple linked segments or arms that are connected through rotary joints, allowing them to move and reach a wide range of areas and angles with high precision. This makes them suitable for performing tasks such as welding, painting, and material handling

- The less than 500 Kg is dominating the global construction robot market owing to the nature of construction tasks that require smaller and more precise movements rather than heavy lifting. The majority of construction tasks involve handling smaller objects such as bricks, tools, and materials, which can be easily managed by robots with lower payload capacity

- The 4 axis is dominating the global construction robot market owing to its superior applicability and ease of control for the construction robots from the market players

- The semi-automated is dominating the global construction robot market owing to various factor such as the market player can train easily and provide additional services with this type of robots. Furthermore, the businesses incline more toward semi-automated as it cost effective as compared to fully autonomous construction robots

Increasing strategic partnership and collaboration among market players

The construction robot industry is still comparatively young and rapidly evolving, with a sustainable range of technologies and solutions emerging to meet the needs of the industry. As a result, there is a significant opportunity for increasing partnership and collaboration among market players in this industry. One potential benefit of increased collaboration is that it could help accelerate innovation in the construction robot industry. By working together, companies can share ideas and knowledge, pool resources, and leverage each other's strengths to develop new solutions and technologies faster.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million, and Pricing in USD

|

|

Segments Covered

|

By Robot Type (Articulated Robots, Cartesian Robots, Automated Guided Vehicle, Exoskeleton, Others), Payload Capacity (Less Than 500 Kg, 500-3000 Kg, 3001 Kg & Above), Axis Type (3 Axis, 4 Axis, 5 Axis, Others), Automation (Fully Automated, Semi-Autonomous), Function (Demolition, Structural Processes, Material Handling, Finishing Processes, Fabrication & Assembling, 3d Printing, Quality Inspection, Layout, Others), Vertical (Commercial & Residential Infrastructure, Public Infrastructure, Energy & Utility, Others), Product Type (On-Site Production Robots, Pre-Fab Construction Robots)

|

|

Countries Covered

|

North America, U.S., Canada and Mexico. Europe, Germany, U.K., France, Spain, Italy, Turkey, Russia, Belgium, Netherlands, Switzerland and Rest of Europe. Asia-Pacific, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines and the Rest of Asia Pacific. Middle East and Africa, U.A.E., Saudi Arabia, South Africa, Egypt, Israel and Rest of Middle East and Africa. South America, Brazil, Argentina and the Rest of South America.

|

|

Market Players Covered

|

ABB (Switzerland), Husqvarna AB (Sweden), Komatsu Ltd. (Japan), Fujita Corporation (Japan), FBR Ltd (Australia), Conjet (Sweden), Contour Crafting Corporation (U.S.), MX3D (The Netherlands), CyBe Construction The Netherlands), KEWAZO (Germany), BROKK GLOBAL (Sweden), RobotWorx (U.S.), Built Robotics (U.S.), ICON Technology, inc. (U.S.), Dusty Robotics (U.S.), MUDBOTS 3D CONCRETE PRINTING, LLC (U.S.), Advanced Construction Robotics, Inc. (Pennsylvania), NASKA.AI (Spain), nLink AS (Norway), Okibo (Israel) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The global construction robot market is segmented into seven notable segments, which are based on the robots type, instrument\product type, payload capacity, axis type, automation, function, vertical and product type.

- On the basis of robot type, the global construction robot market is segmented into articulated robots, cartesian robots, automated guided vehicle, exoskeleton and others. In 2023, articulated robots is expected to dominate the global construction robot market with a 41.19% share.

In 2023, less than 500 kg is expected to dominate the global construction robot market

In 2023, less than 500 Kg is dominating the global construction robot market owing to the nature of construction tasks that require smaller and more precise movements rather than heavy lifting. The majority of construction tasks involve handling smaller objects such as bricks, tools, and materials, which can be easily managed by robots with lower payload capacity

- In 2023, 4 axis is expected to dominate the global construction robot market with a 44.19% share

- In 2023, semi-autonomous is expected to dominate the global construction robot market with a 61.20% share

- In 2023, demolition is expected to dominate the global construction robot market with a 32.05% share

- In 2023, commercial & residential building is expected to dominate the global construction robot market with a 48.13% share

In 2023, on-site production robots is dominating the global construction robot market owing to huge adoption of construction robot in the segment across the globe.

In 2023, on-site production is expected to dominate the global construction robot market with a 62.16% share and is expected to reach USD 428,150.05 thousand by 2030 growing with the highest CAGR of 7.8% in the forecast period of 2023 to 2030.

Major Players

Data Bridge Market Research recognizes the following companies as the major key players in the global construction robot market are ABB, Husqvarna AB, Komatsu Ltd., Fujita Corporation, FBR Ltd, Conjet, Contour Crafting Corporation, MX3D, CyBe Construction, KEWAZO BROKK GLOBAL, RobotWorx, Built Robotics, ICON Technology, inc., Dusty Robotics, MUDBOTS 3D CONCRETE PRINTING, LLC, Advanced Construction Robotics, Inc., NASKA.AI, nLink AS, Okibo among others.

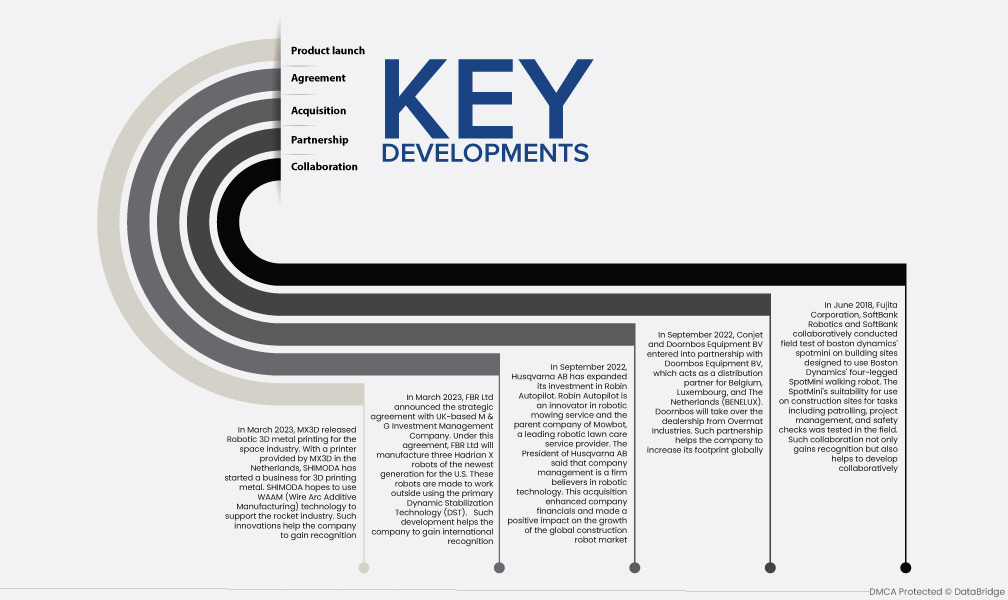

Market Development

- In March 2023, MX3D released Robotic 3D metal printing for the space industry. With a printer provided by MX3D in the Netherlands, SHIMODA has started a business for 3D printing metal. SHIMODA hopes to use WAAM (Wire Arc Additive Manufacturing) technology to support the rocket industry. Such innovations help the company to gain recognition

- In March 2023, FBR Ltd announced the strategic agreement with UK-based M & G Investment Management Company. Under this agreement, FBR Ltd will manufacture three Hadrian X robots of the newest generation for the U.S. These robots are made to work outside using the primary Dynamic Stabilization Technology (DST). Such development helps the company to gain international recognition

- In September 2022, Husqvarna AB has expanded its investment in Robin Autopilot. Robin Autopilot is an innovator in robotic mowing service and the parent company of Mowbot, a leading robotic lawn care service provider. The President of Husqvarna AB said that company management is a firm believers in robotic technology. This acquisition enhanced company financials and made a positive impact on the growth of the global construction robot market

- In September 2022, Conjet and Doornbos Equipment BV entered into partnership with Doornbos Equipment BV, which acts as a distribution partner for Belgium, Luxembourg, and The Netherlands (BENELUX). Doornbos will take over the dealership from Overmat Industries. Such partnership helps the company to increase its footprint globally

- In June 2018, Fujita Corporation, SoftBank Robotics and SoftBank collaboratively conducted field test of boston dynamics' spotmini on building sites designed to use Boston Dynamics' four-legged SpotMini walking robot. The SpotMini's suitability for use on construction sites for tasks including patrolling, project management, and safety checks was tested in the field. Such collaboration not only gains recognition but also helps to develop collaboratively

- In March 2018, Contour Crafting Corporation received award from the federal government for rapid response construction. The result of this financed R&D program is anticipated to be a technology that would efficiently respond to disaster relief situations with quick, safe, and long-lasting structures and buildings. Such recognition helps the company to gain customer's attention globally

Regional Analysis

Geographically, the countries covered in the global construction robot market report are North America, U.S., Canada and Mexico. Europe, Germany, U.K., France, Spain, Italy, Turkey, Russia, Belgium, Netherlands, Switzerland and Rest of Europe. Asia-Pacific, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines and the Rest of Asia Pacific. Middle East and Africa, U.A.E., Saudi Arabia, South Africa, Egypt, Israel and Rest of Middle East and Africa. South America, Brazil, Argentina and the Rest of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global construction robot market globally during the forecast period 2023 - 2030

In 2023, North America region is expected to dominate the global construction robot market with a 36.12% share and is expected to reach USD 265,702.77 thousand by 2030 growing with the highest CAGR of 8.8% in the forecast period of 2023 to 2030.

North America is estimated to be the fastest growing region in the global construction robot market in the forecast period 2023 - 2030

North America is expected to grow during the forecast period due to the presence of major market players and the rapid development of industrial facilities in emerging economies in this region. In addition to this, the rising level of investment expenditure and increasing per-capita income are expected to propel the market's growth rate in this region.

For more detailed information about the surgical visualization products market report, click here – https://www.databridgemarketresearch.com/reports/global-construction-robot-market