Busy work schedules and rapid urbanization are leading toward a significant lifestyle change among consumers, which leads to an increasing popularity of the functional foods. Functional foods are rich in special nutrients such as dietary fibers, vitamins, minerals, and prebiotics to address the functional purposes of consumers. In addition, the inclination of a large population toward adopting a vegan lifestyle will further enhance the demand for functional foods. The increasing preference toward healthy and functional foods among consumers will boost the growth of the food processing and food material handling equipment market. As a result, this can be considered one of the major drivers for global food processing and material handling equipment market growth.

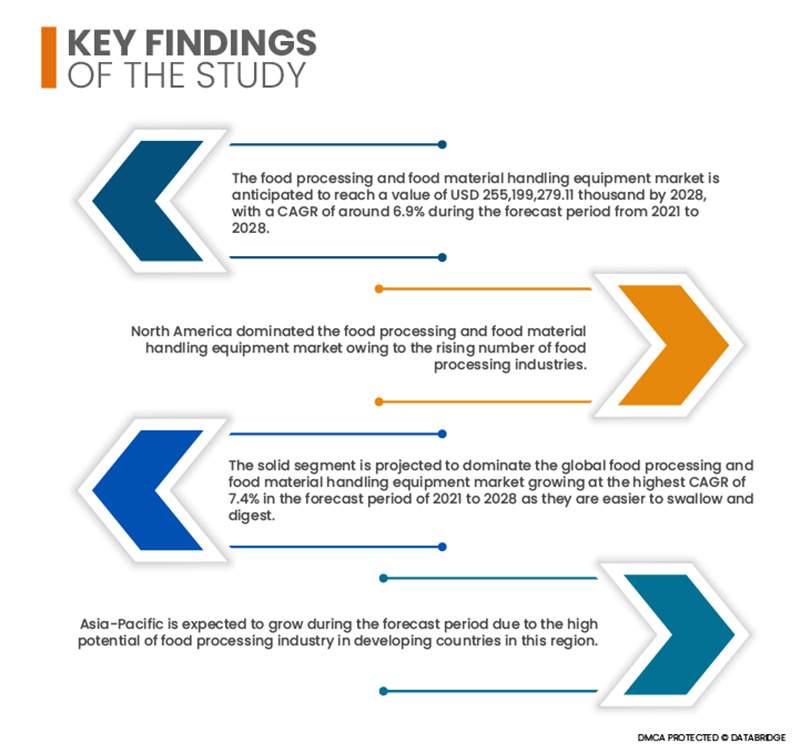

Data Bridge Market Research analyses that the food processing and food material handling equipment market is expected to grow at a CAGR of 6.9% in the forecast period of 2021 to 2028 and is expected to reach USD 255,199,279.11 thousand by 2028. The rising food safety management concerns across food industry for providing safe and nutrition rich food across the globe is expected to increase the demand for food processing and food material handling equipment.

High Preference of Convenience Food Packaging Is Expected to Drive the Market's Growth Rate

The busy life of working professionals has also shifted their preference toward convenience in daily-use products. The change in the pattern of consumer behavior and the growth of the processed-food industry with increased demand for convenience foods and fast food, which need lightweight packaging, are leading to a rise in demand for convenience food packaging. The packaging of a product plays an essential role in the demand for the product and the life cycle of a product, and processed foods require easy and flexible packaging material, which is convenient for the customer and ensures product safety. Quality and integrity in convenience food packaging are essential elements to assist the sale of convenience food products. Trends within the market focus more on convenience. For example, there is the prospect of ready-to-cook products that are easy to prepare. The ability of convenience food packaging to preserve freshness and extend shelf life adds value to the product, which also leads to shifting preference toward convenience food packaging across the globe. Features offered by convenience food packagings, such as easy opening and efficient usability, enhance the use of convenience food packaging. The respective factor can be considered a major driver for the growth of the global food processing & food material handling equipment market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Thousands, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Equipment Type (Food Processing Equipment, and Food Packaging Equipment), Application (Bakery and Confectionery Products, Meat and Poultry Products, Dairy Products, Alcoholic Beverages, Non-Alcoholic Beverages, Fish and Seafood Products, and Others ), Form (Solid, Liquid, and Semi-Solid)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

Marel (Iceland), GEA Group (Germany), Bühler (Switzerland), JBT (U.S.), The Middleby Corporation (U.S.), Heat and Control, Inc. (U.S.), Alfa Laval (Sweden), TNA Australia Pty Ltd. (Australia), Bucher Industries (Switzerland), Equipamientos Cárnicos, S.L (Spain), Clextral (France), SPX FLOW (U.S.), Bigtem Makine (Turkey), FENCO Food Machinery (Italy), Krones Group (Germany), Finis Food Processing Equipment B.V. (Netherlands), Bettcher Industries, Inc. (U.S.), Anko Food Machine Co. Ltd. (Taiwan), Heat and Control, Inc. (U.S.), BAADER (Germany), and Dover Corporation (U.S.)

|

|

Data Points Covered in Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

Global food processing and food material handling equipment is segmented on the basis of equipment type, application and form.

- On the basis of equipment type, global food processing and food material handling equipment is segmented into food processing equipment and food packaging equipment. In 2021, the food processing equipment segment is expected to dominate the market, growing at the highest CAGR of 7.1% in the forecast period of 2021 to 2028 as this equipment can provide a variety of food products.

- On the basis of application, the global food processing and food material handling equipment market is segmented into bakery and confectionery products, meat and poultry products, dairy products, alcoholic beverages, non-alcoholic beverages, fish and seafood products, and others. In 2021, meat and poultry products is projected to dominate the global food processing and food material handling equipment market growing at the highest CAGR of 7.8%

The meat and poultry products is projected to dominate the market growing at the highest CAGR of 7.8%

In 2021, meat and poultry products is projected to dominate the global food processing and food material handling equipment market growing at the highest CAGR of 7.8% in the forecast period of 2021 to 2028 as they are mostly used in almost all the hotels and restaurants.

- On the basis of form, the global food processing and food material handling equipment market is segmented into solid, liquid, and semi-solid. In 2021, solid segment is projected to dominate the global food processing and food material handling equipment market growing at the highest CAGR of 7.4% in the forecast period of 2021 to 2028 as they are easier to swallow and digest.

Major Players

Data Bridge Market Research recognizes the following companies as the major food processing and food material handling equipment market players in food processing and food material handling equipment market are Marel (Iceland), GEA Group (Germany), Bühler (Switzerland), JBT (U.S.), The Middleby Corporation (U.S.), Heat and Control, Inc. (U.S.), Alfa Laval (Sweden), TNA Australia Pty Ltd. (Australia), Bucher Industries (Switzerland), Equipamientos Cárnicos, S.L (Spain), Clextral (France), SPX FLOW (U.S.), Bigtem Makine (Turkey), FENCO Food Machinery (Italy), Krones Group (Germany), Finis Food Processing Equipment B.V. (Netherlands), Bettcher Industries, Inc. (U.S.), Anko Food Machine Co. Ltd. (Taiwan), Heat and Control, Inc. (U.S.), BAADER (Germany), and Dover Corporation (U.S.).

Market Development

- In November, 2020, SPX FLOW announced that they release new metal and X-ray detectable seats for food and beverage, critical dairy, and personal care processes. With this announcement company has increased brand awareness in the world

- In September, 2021, TNA Australia Pty Limited launched a 'tna robag 3e' product. This product has a new CXE integrated display controller, smart diagnostic tools and intuitive time-saving components, delivering up to 250 bags per minute (bpm) with less wastage. This new product helps to attract new customers and helps to enhance the product revenue.

Regional Analysis

Geographically, the countries covered in the food processing and food material handling equipment market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa(MEA) as a part of Middle East and Africa(MEA).

As per Data Bridge Market Research analysis:

North America is the dominant region in food processing and food material handling equipment market during the forecast period

North America dominated the food processing and material handling equipment market due to the rising number of food processing industries. North America will continue to dominate the food processing and food material handling equipment market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

Asia-Pacific is estimated to be the fastest-growing region in food processing and food material handling equipment market

Asia-Pacific is expected to grow during the forecast period due to the high potential of the food processing industry in developing countries. In addition, increasing demand for high-quality packaging is also expected to propel the market's growth rate in this region.

For more detailed information about the food processing and food material handling equipment market report, click here – https://www.databridgemarketresearch.com/reports/global-food-processing-and-food-material-handling-equipment-market