The role of electric power transmission and distribution (T&D) plays an important link between generating stations and customers. Growing loads and stress created by the aging equipment and increasing the risk of widespread blackouts are a few of the factors which help generates the need for heat shrink tubes. Electricity delivery that is both dependable and cost-effective is critical in today's society. The U.S. transmission and distribution (T&D) is comprised of numerous economic drivers, organizational structures, technologies, and forms of regulatory oversight. Federal, and municipal governments and state and customer-owned cooperatives are all part of these systems. However, about 80 percent of power transactions occur on lines owned by investor-owned regulated utilities (IOUs).

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-heat-shrink-tubing-market

Data Bridge Market Research analyses that the Global Heat Shrink Tubing Market is expected to grow at a CAGR of 6.1% in the forecast period of 2023 to 2030 and is expected to reach USD 3,112.10 million by 2030. Heat shrink tubes are commonly used in the electrical industry, including the transmission and distribution sector, for insulation, protection, and sealing applications.

Key Findings of the Study

Increase in the Capacity for Power Generation across the Globe

A two-step process is used to create heat shrink tubing. The first step is standard extrusion followed by a secondary process that makes the tubing heat-shrinkable. Although this secondary process's specifics are kept confidential, heat and force are used to expand the tubing's diameter. While still expanded, the tubing is cooled to room temperature. If the tubing is rigid, it is going to shrink down to its original size. The up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents).

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Type (Single Wall and Dual Wall), Product Type (Spools, Pre-Cut Length, and Others), Voltage (Low, Medium, and High), Shrink Ratio (2:01, 3:01, 4:01, 6:01, and Others), Material (Polyolefin, Perfluoroalkoxy Alkanes (PFA), Polytetrafluoroethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyetheretherketone (PEEK) and Others), End User (Utilities, IT and Telecommunication, Automotive, Electronics, Aerospace, Healthcare, Oil and Gas, Marine, Food and Beverages, Construction, Chemical, and Others)

|

|

Countries Covered

|

China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and Rest of Asia-Pacific, U.S., Canada, and Mexico. Germany, France, U.K., Italy, Spain, Netherlands, Belgium, Russia, Switzerland, Turkey, and the Rest of Europe, Saudi Arabia, U.A.E., Egypt, South Africa, Israel, and the Rest of the Middle East and Africa. Brazil, Argentina, and the Rest of South America

|

|

Market Players Covered

|

ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd.(China) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis

The global heat shrink tubing market is segmented into six notable segments which are based on the type, product type, material, voltage, shrink ratio, and end user.

- On the basis of type, the global heat shrink tubing market is segmented into single wall and dual wall. In 2023, the single wall segment is expected to dominate the global heat shrink tubing market with 67.23% market share.

In 2023, the single wall of type segment is expected to dominate the global heat shrink tubing market due to rising usage of products with advanced infrastructure and technology

- On the basis of product type, the global heat shrink tubing market is segmented into spools, pre-cut length and others. In 2023, the spools segment is expected to dominate the global heat shrink tubing market with a 53.29% market share.

In 2023, the spools segment of product type is expected to dominate the global heat shrink tubing market due to increasing penetration of electric vehicles.

- On the basis of voltage the global heat shrink tubing market is segmented into low, medium and high. In 2023, the low segment is expected to dominate the global heat shrink tubing market with a 50.92% market share.

- On the basis of shrink ratio, the global heat shrink tubing market is segmented into 2:01, 3:01, 4:01, 6:01, and others In 2023, the 2:1 segment is expected to dominate the global heat shrink tubing market with 45.25% market share.

- On the basis of material, the global heat shrink tubing market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (peek), and others.

In 2023, polyolefin segment is expected to dominate the global heat shrink tubing market with 38.77% market share.

- On the basis of end user, the global heat shrink tubing market is segmented into utilities, IT and telecommunication, automotive, electronics, aerospace, healthcare, oil and gas, marine, food and beverages, construction, chemical, and others. In 2023, the utilities segment is expected to dominate the global heat shrink tubing market with 23.59% market share.

Major Players

Data Bridge Market Research recognizes the following companies as the major key players in the Global heat shrink tubing market are ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd. (China) among others.

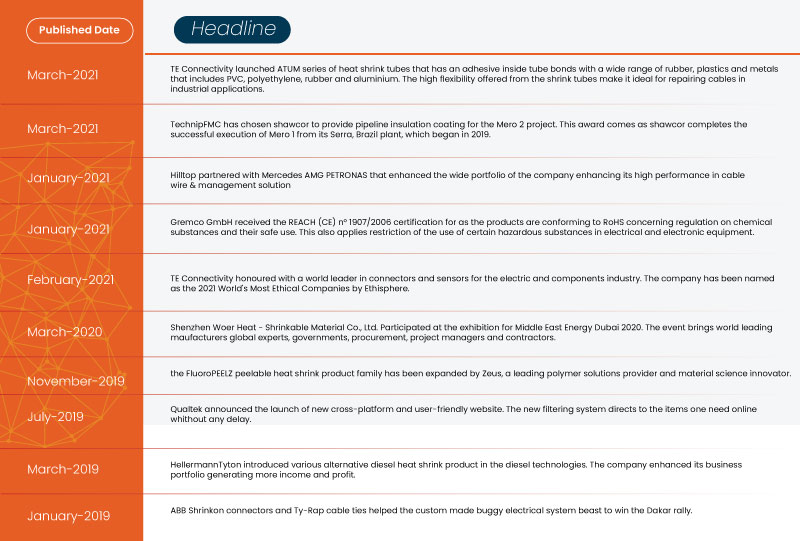

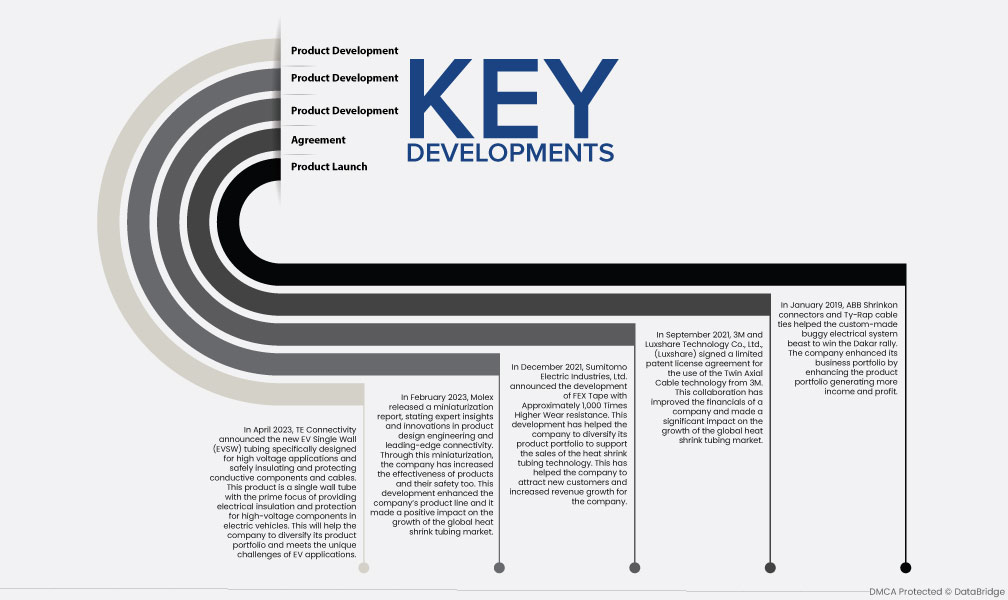

Market Development

- In April 2023, TE Connectivity announced the new EV Single Wall (EVSW) tubing specifically designed for high voltage applications and safely insulating and protecting conductive components and cables. This product is a single wall tube with the prime focus of providing electrical insulation and protection for high-voltage components in electric vehicles. This will help the company to diversify its product portfolio and meets the unique challenges of EV applications.

- In February 2023, Molex released a miniaturization report, stating expert insights and innovations in product design engineering and leading-edge connectivity. Through this miniaturization, the company has increased the effectiveness of products and their safety too. This development enhanced the company’s product line and it made a positive impact on the growth of the global heat shrink tubing market.

- In December 2021, Sumitomo Electric Industries, Ltd. announced the development of FEX Tape with Approximately 1,000 Times Higher Wear resistance. This development has helped the company to diversify its product portfolio to support the sales of heat shrink tubing technology. This has helped the company to attract new customers and increased revenue growth for the company.

- In September 2021, 3M and Luxshare Technology Co., Ltd., (Luxshare) signed a limited patent license agreement for the use of the Twin Axial Cable technology from 3M. This collaboration has improved the financials of a company and made a significant impact on the growth of the global heat shrink tubing market.

- In January 2019, ABB Shrinkon connectors and Ty-Rap cable ties helped the custom-made buggy electrical system beast to win the Dakar rally. The company enhanced its business portfolio by enhancing the product portfolio generating more income and profit.

Regional Analysis

Geographically, the countries covered in the Global heat shrink tubing market report are North America, U.S., Canada and Mexico. Europe, Germany, U.K., France, Spain, Italy, Turkey, Russia, Belgium, Netherlands, Switzerland, Denmark, Sweden, Norway, Finland, Poland, and Rest of Europe. Asia-Pacific, China, Japan, South Korea, Australia, Malaysia, New Zealand, Singapore, India, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and the Rest of Asia Pacific. Middle East and Africa, U.A.E., Saudi Arabia, Egypt, Israel, South Africa, Oman, Bahrain, Kuwait, Qatar, and Rest of Middle East and Africa. South America, Brazil, Argentina, and the Rest of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the heat shrink tubing market globally during the forecast period 2023 - 2030

Asia-Pacific region dominates the heat shrink tubing market globally as the region has the maximum investment in electric automobiles and the oil and gas industry, which results in higher growth for the region. In addition, the region is progressing towards digitalization which thrives on the implications of electrical and electronic components.

Asia-Pacific is estimated to be the fastest growing region in the global heat shrink tubing market in the forecast period 2023 - 2030

Asia-Pacific is expected to grow during the forecast period due to the increasing adoption of advanced technologies in industries such as automotive and aerospace is expected to drive the demand for hoses in the region. In addition, the region has a high level of infrastructure development, which further drives the demand for hoses.

For more detailed information about the heat shrink tubing market report, click here – https://www.databridgemarketresearch.com/reports/global-heat-shrink-tubing-market