Electric vehicle heat shrink tubing finds versatile applications in various automotive tubing systems. It provides essential protection and insulation in fuel line protection tubing, ABS tubing, air conditioning aluminum tubing, power steering return hoses, water drain tubing, ATF tubing for automotive engines, water-cooling system tubing, fuel system tubing, and air conditioning hoses. The heat shrink tubing ensures the durability, reliability, and performance of these critical automotive components, enhancing the overall efficiency and safety of electric vehicles.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-electric-vehicle-heat-shrink-tubing-market

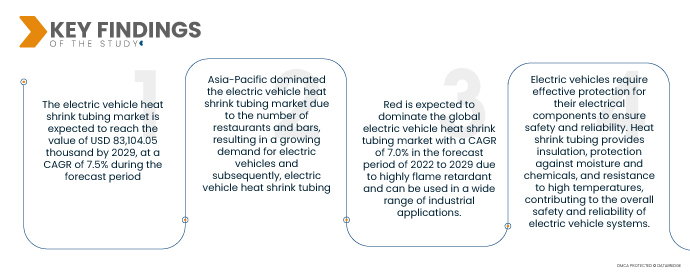

Data Bridge Market Research analyses that the Electric Vehicle Heat Shrink Tubing Market is expected to reach the value of USD 83,104.05 thousand by 2029, at a CAGR of 7.5% during the forecast period. The global shift towards electric vehicles is a major driver for the electric vehicle heat shrink tubing market. As the demand for electric vehicles rises, the need for efficient and reliable electrical insulation solutions, such as heat shrink tubing, also increases.

Increasing investment in charging infrastructure is expected to drive the market's growth rate

As the charging infrastructure for electric vehicles expands, the need for reliable and durable electrical connections becomes paramount. Heat shrink tubing plays a critical role in this regard by providing insulation and protection to electrical connections. It safeguards against moisture, dust, and other environmental factors, ensuring the safety and efficiency of the charging infrastructure. Heat shrink tubing enhances the durability and longevity of the electrical connections, enabling seamless and secure charging experiences for electric vehicle users.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Application (Hoses, Connectors, Ring Terminals, In-line Splices, Under Bonnet Cable Protection, Gas Pipes and Miniature Splices), Material (Polyolefin, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoroalkoxy Alkanes, Ethylene Tetrafluoroethylene and Others), Color (Red, Yellow and Others), Connector Application (HTAT, ATUM, CGPT, LSTT<150 C and Others), Type (Single Wall Shrink Tubing and Dual Wall Shrink Tubing), Voltage (Low Voltage, Medium Voltage and High Voltage), Sales Channel (OEM and Aftermarket), Vehicle Type (BEV(Battery Electric Vehicles), PHEV (Plug-In Hybrid Electric Vehicle), Hybrid Electric Vehicle (HEVS))

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Sumitomo Electric Industries, Ltd. (Japan), Dasheng, Inc. (China), TE Connectivity (Switzerland), Shenzhen Woer Heat-Shrinkable Material Co., Ltd. (China), SHAWCOR (Canada), ABB (Switzerland), Techflex, Inc. (U.S.), Paras Enterprises (India), HellermannTyton (U.K.), Alpha Wire (U.S.), WireMasters, Inc. (U.S.), Zeus Industrial Products, Inc. (U.S.), 3M (U.S.), The Zippertubing (U.S.), Panduit (U.S.), Dee Five (India), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (China), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Texcan (Canada), Autosparks (U.K.), NELCO (U.S.), Insultab (U.S.), PEXCO (U.S.), WiringProducts, Ltd. (U.S.), IS-Rayfast Ltd. (U.K.), Flex Wires Inc. (U.S.), Thermosleeve USA (U.S.), Molex (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The electric vehicle heat shrink tubing market is segmented on the basis of application, material, type, connector application, sales channel, color, voltage, and vehicle type.

- On the basis of application, the electric vehicle heat shrink tubing market is segmented into hoses, connectors, and ring terminals, in-line splices, under bonnet cable protection, gas pipes and miniature splices. The hoses segment is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 8.2% in the forecast period of 2022 to 2029 due to they carry fluids through the air or fluid environments. In addition, these are typically used with clamps, spigots, flanges, and nozzles to control fluid flow.

- On the basis of material, the electric vehicle heat shrink tubing market is segmented into polyolefin, polytetrafluoroethylene, fluorinated ethylene propylene, perfluoroalkoxy alkanes, ethylene tetrafluoroethylene and others. The polyolefin segment is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 8.5% in the forecast period of 2022 to 2029 due to it has excellent physical, chemical, and electrical characteristics and is resistant to abrasion and flame. Moreover, polyolefin-based heat shrink tubing is suited to the broadest range of general-purpose needs, leading to more revenue generation.

In 2022, the polyolefin segment is expected to dominate the material segment in the global electric vehicle heat shrink tubing market

In 2022, the polyolefin segment is expected to dominate the global electric vehicle heat shrink tubing market owing to t has excellent physical, chemical, and electrical characteristics and is resistant to abrasion and flame. Moreover, polyolefin-based heat shrink tubing is suited to the broadest range of general-purpose needs, leading to more revenue generation with a CAGR of 8.5% in the forecast period of 2022 to 2029.

- On the basis of connector application, the electric vehicle heat shrink tubing market is segmented into HTAT, ATUM, CGPT, LSTT<150 c and others. HTAT segment is expected to dominate the global electric vehicle heat shrink tubing market and is expected to reach USD 31,283.13 thousand by 2029 due to its increasing usage of private mobility.

- On the basis of vehicle type, the electric vehicle heat shrink tubing market is segmented into BEV (battery electric vehicles), PHEV (plug-in hybrid electric vehicle), and hybrid electric vehicle (HEVS). BEV (Battery Electric Vehicle) segment is expected to dominate due to zero emissions, advancing battery technology, and increasing charging infrastructure.

- On the basis of voltage, the electric vehicle heat shrink tubing market is segmented into low, medium, and high. The low segment is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 8.2% in the forecast period of 2022 to 2029 due to its increased utilization of heat shrink tubing, mainly for sealing cables and insulation.

- On the basis of color, the electric vehicle heat shrink tubing market is segmented into red, yellow and others. Red is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 7.0% in the forecast period of 2022 to 2029 due to highly flame retardant and can be used in a wide range of industrial applications.

- On the basis of type, the electric vehicle heat shrink tubing market is segmented into single wall shrink tubing and double wall shrink tubing. The single wall shrink tubing segment is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 7.0% in the forecast period of 2022 to 2029 due to offers superior insulation strain relief and protection against mechanical damage and abrasion versus taping and molding. Moreover, it also provides quick insulation and protection.

In 2022, the single wall shrink tubing segment is expected to dominate the type segment of the global electric vehicle heat shrink tubing market

In 2022, the single wall shrink tubing segment is expected to dominate the global electric vehicle heat shrink tubing owing to its offers superior insulation strain relief and protection against mechanical damage and abrasion versus taping and molding. Moreover, it also provides quick insulation and protection with a CAGR of 7.0% in the forecast period of 2022 to 2029.

- On the basis of sales channel, the electric vehicle heat shrink tubing market is segmented into OEM and aftermarket. In 2022, the OEM segment is expected to dominate the global electric vehicle heat shrink tubing market with a CAGR of 8.1% in the forecast period of 2022 to 2029 due to greater transparency of product specifications and better lucrative deals.

Major Players

Data Bridge Market Research recognizes the following companies as the major electric vehicle heat shrink tubing market players in electric vehicle heat shrink tubing market are Sumitomo Electric Industries, Ltd. (Japan), Dasheng, Inc. (China), TE Connectivity (Switzerland), Shenzhen Woer Heat-Shrinkable Material Co., Ltd. (China), SHAWCOR (Canada), ABB (Switzerland), Techflex, Inc. (U.S.), Paras Enterprises (India), HellermannTyton (U.K.), Alpha Wire (U.S.).

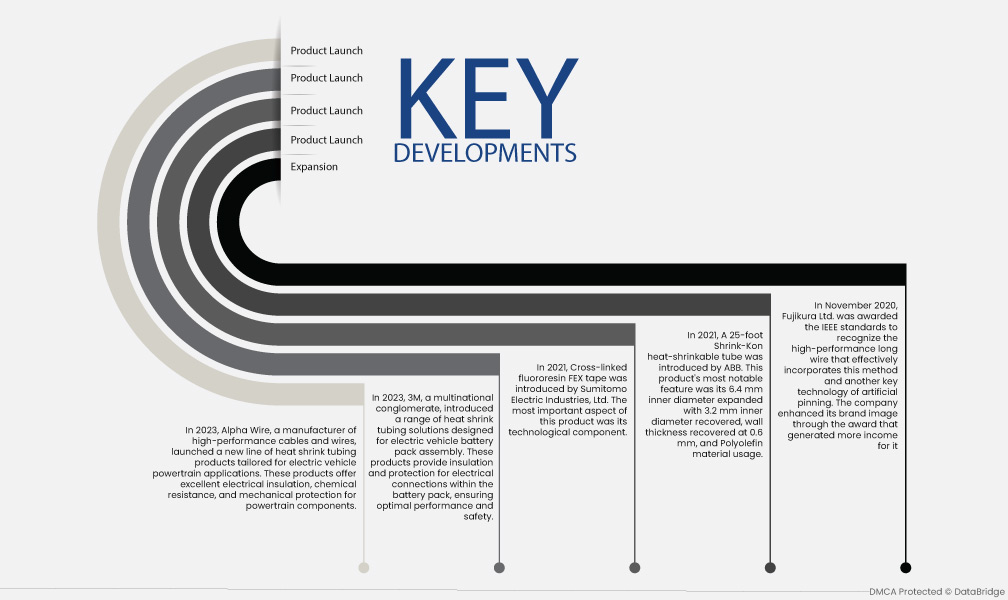

Market Development

- In 2023, Alpha Wire, a manufacturer of high-performance cables and wires, launched a new line of heat shrink tubing products tailored for electric vehicle powertrain applications. These products offer excellent electrical insulation, chemical resistance, and mechanical protection for powertrain components.

- In 2023, 3M, a multinational conglomerate, introduced a range of heat shrink tubing solutions designed for electric vehicle battery pack assembly. These products provide insulation and protection for electrical connections within the battery pack, ensuring optimal performance and safety.

- In 2021, Cross-linked fluororesin FEX tape was introduced by Sumitomo Electric Industries, Ltd. The most important aspect of this product was its technological component.

- In 2021, A 25-foot Shrink-Kon heat-shrinkable tube was introduced by ABB. This product's most notable feature was its 6.4 mm inner diameter expanded with 3.2 mm inner diameter recovered, wall thickness recovered at 0.6 mm, and Polyolefin material usage.

- In November 2020, Fujikura Ltd. was awarded the IEEE standards to recognize the high-performance long wire that effectively incorporates this method and another key technology of artificial pinning. The company enhanced its brand image through the award that generated more income for it

Regional Analysis

Geographically, the countries covered in the electric vehicle heat shrink tubing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in electric vehicle heat shrink tubing market during the forecast period 2022-2029

Asia-Pacific is poised to dominate the global electric vehicle heat shrink tubing market due to several factors. The region's rapid economic development has led to an increase in the number of restaurants and bars, resulting in a growing demand for electric vehicles and subsequently, electric vehicle heat shrink tubing. Asia-Pacific is experiencing significant infrastructural developments and government initiatives to promote electric vehicle adoption, which further drives the demand for heat shrink tubing in the region. These factors position Asia-Pacific as the fastest-growing market for electric vehicle heat shrink tubing worldwide.

For more detailed information about the electric vehicle heat shrink tubing market report, click here – https://www.databridgemarketresearch.com/reports/global-electric-vehicle-heat-shrink-tubing-market