Flexible Verpackungslösungen für Hochbarrierefolien umfassen Beutel, Tüten, Deckel, Schrumpffolien, laminierte Tuben und mehr. Beutel lassen sich mit Reißverschlüssen wiederverschließen und ersetzen starre Verpackungen wie Gläser und Metalldosen. Die steigenden Anforderungen der Kunden an Produktsicherheit und Komfort fördern die Verwendung von Beuteln in Hochbarrierefolien.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-high-barrier-packaging-films-market

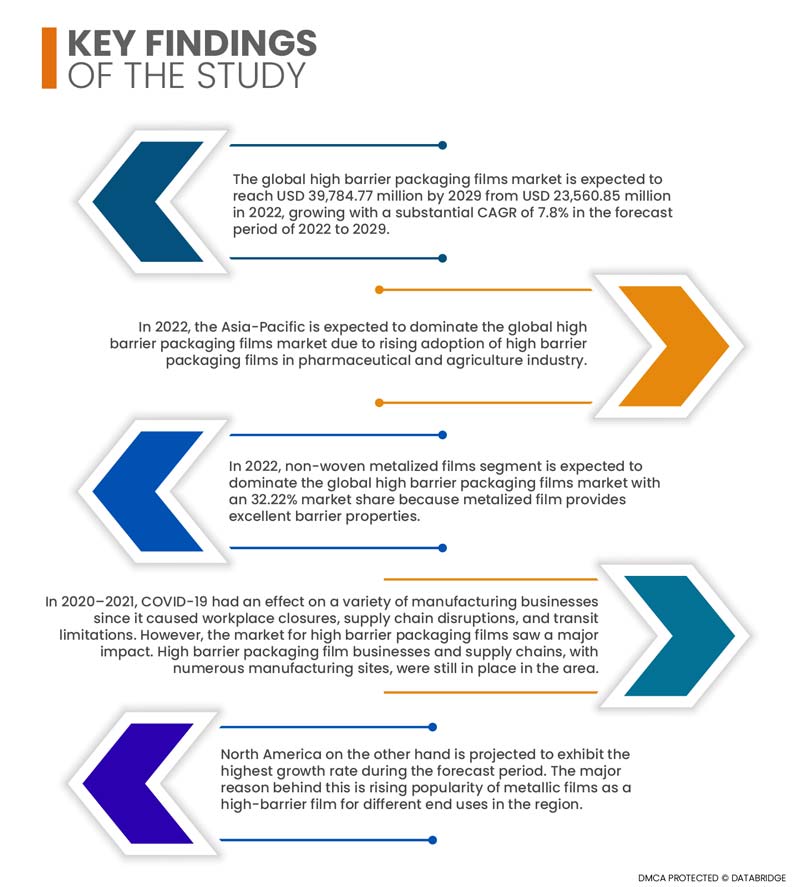

Der globale Markt für Hochbarriere-Verpackungsfolien wird voraussichtlich von 23.560,85 Millionen US-Dollar im Jahr 2022 auf 39.784,77 Millionen US-Dollar im Jahr 2029 anwachsen und im Prognosezeitraum 2022 bis 2029 mit einer deutlichen jährlichen Wachstumsrate von 7,8 % wachsen. Der veränderte Lebensstil der Verbraucher und die daraus resultierende Nachfrage nach praktischen Lebensmittelverpackungen treibt die Nachfrage nach Hochbarriere-Folien stetig an. Hochbarriere-Folien tragen dazu bei, die Haltbarkeit von Produkten zu verlängern und den Einsatz von Konservierungsstoffen bei der Herstellung und Verpackung zu reduzieren. Die steigende Nachfrage der Verbraucher nach länger haltbaren und hochwertigen Lebensmitteln hat in der Verpackungsindustrie zur Entwicklung immer anspruchsvollerer Mehrschichtfolienprodukte geführt.

Die weltweit steigende Nachfrage nach mehrschichtigen Verpackungen zur Verhinderung des Eindringens von Sauerstoff und Wasser wird das Marktwachstum ankurbeln

Mehrschichtfolien sind speziell für die Gasdiffusion konzipiert. Diese Barrierefolien schützen Lebensmittel vor Verderb, indem sie die Sauerstoff- und Wasserdampfdurchlässigkeit reduzieren oder ganz verhindern. Dies ist bei Endverbrauchern sehr gefragt. Daher wird erwartet, dass die steigende Nachfrage nach mehrschichtigen Hochbarriere-Verpackungsfolien zum Schutz verpackter Produkte vor Gasen und Feuchtigkeit die Nachfrage nach diesen Folien positiv beeinflusst und zum Wachstum des globalen Marktes für Hochbarriere-Verpackungsfolien führt.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2022 bis 2029

|

Basisjahr

|

2021

|

Historische Jahre

|

2020 (Anpassbar auf 2014 – 2019)

|

Quantitative Einheiten

|

Umsatz in Millionen USD, Mengen in Einheiten, Preise in USD

|

Abgedeckte Segmente

|

Typ (Vliesmetallisierte Folien, Klarsichtfolien, organische Beschichtungsfolien, anorganische Oxidbeschichtungsfolien, Sonstige), Material (Kunststoff, Aluminium, Oxide, Sonstige), Verpackungsart (Beutel, Säcke, Deckel, Schrumpffolien, laminierte Tuben, Sonstige), Endverbraucher (Lebensmittel, Getränke, Pharmazeutika, elektronische Geräte, medizinische Geräte , Landwirtschaft, Chemikalien)

|

Abgedeckte Länder

|

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) im Asien-Pazifik-Raum (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

|

Abgedeckte Marktteilnehmer

|

Amcor plc (Schweiz), Mondi (Großbritannien), Huhtamaki (Finnland), Sealed Air (USA), Jindal Poly Films Limited (Indien), Toppan Inc. (Japan), Kureha Corporation (Japan), HPM Global, Inc. (Südkorea), Flair Flexible Packaging Corporation (USA), Constantia Flexibles (Österreich), MULTIVAC (Deutschland), DuPont (USA), Wihuri Group (Finnland), BERNHARDT Packaging & Process (Frankreich), Borealis AG (Österreich), Schott (Deutschland), Dow (USA), Sonoco Products Company (USA), Bemis Company Inc. (USA), Huhtamaki Group (Finnland) und Uflex Limited (Indien) um nur einige zu nennen.

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse, Patentanalyse und technologische Fortschritte.

|

Segmentanalyse:

Der globale Markt für Verpackungsfolien mit hoher Barrierewirkung ist basierend auf Typ, Material, Verpackungsart und Endverbraucher in vier wichtige Segmente unterteilt.

- Der globale Markt für Hochbarriere-Verpackungsfolien wird nach Typ in sechs Segmente unterteilt: metallisierte Vliesfolien, transparente Folien, organische Beschichtungsfolien, anorganische Oxidbeschichtungsfolien und weitere. Es wird erwartet, dass das Segment der metallisierten Vliesfolien im Jahr 2022 den globalen Markt für Hochbarriere-Verpackungsfolien mit einem Marktanteil von 32,22 % dominieren wird, da metallisierte Folien hervorragende Barriereeigenschaften bieten. Darüber hinaus zeichnen sich metallisierte Folien durch hohe Festigkeit und Haltbarkeit, gute Dimensionsstabilität und ausgezeichnete chemische Beständigkeit sowie durch ihre Transparenz und Handhabungseigenschaften aus, was ihre Nachfrage als Hochbarriere-Verpackungsfolie erhöht.

- Der globale Markt für Hochbarriere-Verpackungsfolien wird nach Material in vier Segmente unterteilt: Kunststoff, Aluminium, Oxid und andere. Im Jahr 2022 wird das Kunststoffsegment voraussichtlich den globalen Markt für Hochbarriere-Verpackungsfolien mit einem Marktanteil von 52,36 % dominieren, da Kunststoffe den besten Schutz vor Sauerstoff und Geruch, Wasserdampfdurchlässigkeit, Feuchtigkeit, Verunreinigungen und Bakterien bieten und gleichzeitig kostengünstig sind.

- Der globale Markt für Hochbarriere-Verpackungsfolien wird nach Verpackungsart in sechs Segmente unterteilt: Beutel, Tüten, Deckel, Schrumpffolien, laminierte Tuben und weitere. Im Jahr 2022 wird das Beutelsegment voraussichtlich mit einem Marktanteil von 44,63 % den globalen Markt für Hochbarriere-Verpackungsfolien dominieren, da sie angemessene Schutz- und Barriereeigenschaften bieten. Sie sind einfach zu handhaben und beeinträchtigen die Produktqualität nicht.

Das Beutelsegment wird das Verpackungssegment des Marktes für Hochbarriere-Verpackungsfolien dominieren

Das Beutelsegment wird sich als dominierendes Verpackungssegment herauskristallisieren. Dies liegt an der steigenden Nachfrage nach Beuteln, insbesondere in Entwicklungsländern. Darüber hinaus werden das Wachstum und die Ausweitung der Forschungs- und Entwicklungsdienstleistungen auf globaler Ebene das Wachstum dieses Segments weiter fördern.

- Der globale Markt für Hochbarriere-Verpackungsfolien ist nach Endverbraucher in acht Segmente unterteilt: Lebensmittel, Getränke, Pharmazeutika, Elektronik, Medizinprodukte, Landwirtschaft, Chemie und andere. Aufgrund der zunehmenden Anzahl verzehrfertig verpackter Lebensmittel wird erwartet, dass das Lebensmittelsegment im Jahr 2022 den globalen Markt für Hochbarriere-Verpackungsfolien mit einem Marktanteil von 38,82 % dominieren wird. Hochbarriere-Verpackungen gewährleisten Lebensmittelsicherheit, verlängern die Haltbarkeit und verbessern die Lebensmittelqualität. Verzehrfertige Lebensmittel erfreuen sich zunehmender Beliebtheit.

Das Lebensmittelsegment wird das Endverbrauchersegment des Marktes für Hochbarriere-Verpackungsfolien dominieren

Das Lebensmittelsegment wird sich mit einem Marktanteil von rund 55 % als dominierendes Segment unter den Endverbrauchern herauskristallisieren. Dies ist auf die zunehmende Zahl infrastruktureller Entwicklungsaktivitäten im Markt, insbesondere in Entwicklungsländern, zurückzuführen. Darüber hinaus wird das weltweite Wachstum und die Expansion der Material- und Verpackungsindustrie das Wachstum dieses Segments weiter fördern.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als Marktteilnehmer auf dem Markt für Verpackungsfolien mit hoher Barrierewirkung an: Amcor plc (Schweiz), Mondi (Großbritannien), Huhtamaki (Finnland), Sealed Air (USA), Jindal Poly Films Limited (Indien), Toppan Inc. (Japan), Kureha Corporation (Japan), HPM Global, Inc. (Südkorea), Flair Flexible Packaging Corporation (USA), Constantia Flexibles (Österreich), MULTIVAC (Deutschland), DuPont (USA), Wihuri Group (Finnland), BERNHARDT Packaging & Process (Frankreich), Borealis AG (Österreich), Schott (Deutschland), Dow (USA), Sonoco Products Company (USA), Bemis Company Inc. (USA), Huhtamaki Group (Finnland) und Uflex Limited (Indien).

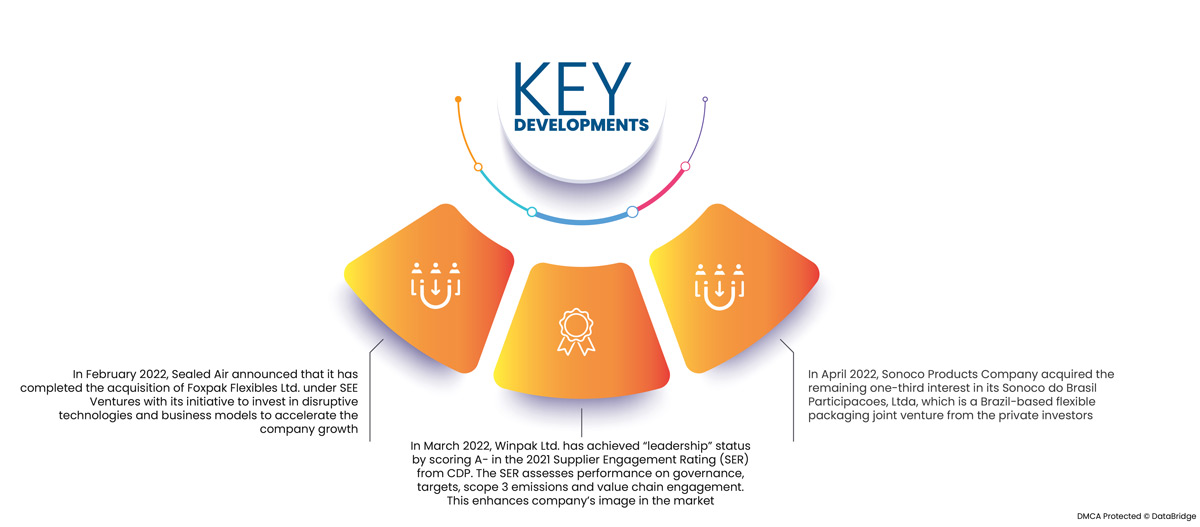

Marktentwicklung

- Im Februar 2022 gab Sealed Air bekannt, dass es die Übernahme von Foxpak Flexibles Ltd. unter SEE Ventures abgeschlossen hat. Ziel ist es, in disruptive Technologien und Geschäftsmodelle zu investieren, um das Unternehmenswachstum zu beschleunigen.

- Im März 2022 erreichte Winpak Ltd. mit der Note A- im Supplier Engagement Rating (SER) 2021 des CDP den Status „Leadership“. Das SER bewertet die Leistung in den Bereichen Governance, Ziele, Scope-3-Emissionen und Engagement in der Wertschöpfungskette. Dies stärkt das Image des Unternehmens am Markt.

- Im April 2022 erwarb die Sonoco Products Company das verbleibende Drittel der Anteile an ihrem in Brasilien ansässigen Joint Venture für flexible Verpackungen, Sonoco do Brasil Participacoes, Ltda, von den privaten Investoren.

Regionale Analyse

Geografisch betrachtet sind dies die folgenden Länder, die im Marktbericht für Verpackungsfolien mit hoher Barrierewirkung abgedeckt: USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Laut Marktforschungsanalyse von Data Bridge:

Der asiatisch-pazifische Raum ist im Prognosezeitraum 2022 – 2029 die dominierende Region auf dem Markt für Verpackungsfolien mit hoher Barriere

Im Jahr 2022 wird der asiatisch-pazifische Raum voraussichtlich den globalen Markt für Hochbarriere-Verpackungsfolien dominieren, da Hochbarriere-Verpackungsfolien in der Pharma- und Agrarindustrie zunehmend eingesetzt werden.

Nordamerika wird im Prognosezeitraum 2022 – 2029 voraussichtlich die am schnellsten wachsende Region im Markt für Hochbarriere-Verpackungsfolien sein.

Nordamerika hingegen wird im Prognosezeitraum voraussichtlich die höchste Wachstumsrate aufweisen. Hauptgrund dafür ist die steigende Beliebtheit von Metallfolien als Hochbarrierefolien für verschiedene Endanwendungen und die zunehmende Verbraucherpräferenz für Verpackungslösungen mit Hochbarrierefolien.

Auswirkungen von COVID-19

In den Jahren 2020–2021 beeinträchtigte COVID-19 verschiedene Fertigungsunternehmen, da es zu Arbeitsplatzschließungen, Lieferkettenunterbrechungen und Transportbeschränkungen kam. Der Markt für Hochbarriere-Verpackungsfolien war jedoch stark betroffen. Unternehmen und Lieferketten für Hochbarriere-Verpackungsfolien mit zahlreichen Produktionsstandorten waren in der Region weiterhin vorhanden. Auch nach COVID lieferten die Dienstleister weiterhin Hochbarriere-Verpackungsfolien, nachdem sie Hygiene- und Sicherheitsmaßnahmen eingeführt hatten.

Für detailliertere Informationen zum Marktbericht über Verpackungsfolien mit hoher Barrierewirkung klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-high-barrier-packaging-films-market