Three isomers of the aromatic isocyanate methylene diphenyl di-isocyanate (MDI) exist. The isocyanate group is positioned differently around the rings 2, 2’MDI, 2, 4’MDI, and 4, 4’MDI, due to which the isomers are created. The purest and most popular of these isomers is 4, 4’-MDI. It has a broad range of consumer and large-scale commercial use. Aniline is combined with formaldehyde to create methylenedianiline (MDA), which reacts with phosgene to create MDI. To create polyurethane, an important polymer, MDI reacts with polyols.

Access full Report @ https://www.databridgemarketresearch.com/reports/global-methylene-diphenyl-diisocyanate-mdi-market

The major applications of MDI are foams, coatings, elastomers, adhesives and sealants, and other applications. The main end-users of the MDI are building and construction, automotive, footwear, furniture, home appliances, textile, healthcare, electrical and electronics, packaging, industrial machinery, and others.

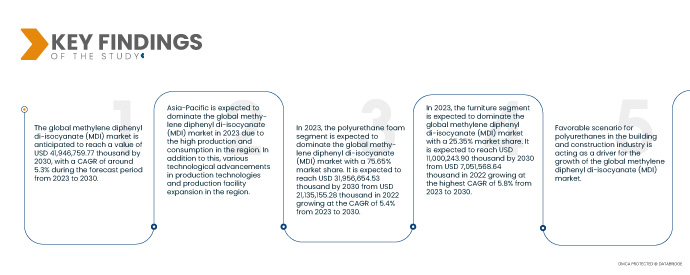

Data Bridge Market Research analyzes that the Global Methylene Diphenyl Di-Isocyanate (MDI) Market is expected to grow with a CAGR of 5.3% from 2023 to 2030 and is expected to reach USD 41,946,759.77 thousand by 2030.

Key Findings of the Study

Rising adoption of polyurethanes in the furniture industry is expected to drive the market growth

One of the most often used materials for furniture, beds, and carpet underlay is polyurethane, typically in the form of flexible foam. Flexible polyurethane foam adds padding to upholstered furniture to increase its sturdiness, comfort, and support. Several upholstery applications for foam include seat cushions, arms, backs, leg rests, and others.

The main advantages of MDI-based flexible foams are inherent hardness, pleasant feel, fast reactivity and cure, excellent density, quick demolding, no sagging, and low vapor pressure. Flexible foams based on MDI offer excellent block yields, which provide extremely nice block shapes and less waste. Improved durability causes waste to be reduced, while better consumption habits reduce environmental impact. It may be reused and used to make new items with value added.

Hence, products, including mattresses, toppers, pillows, upholstered furniture, office furniture, and others, may be made using extremely flexible polyurethane-based materials. Therefore, it is anticipated that increasing polyurethane use in the bedding and furniture industries would fuel the expansion of the MDI market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand and Volume in Tons

|

|

Segments Covered

|

Application (Polyurethane Foam, Polyurethane Elastomers, Polyurethane Adhesives and Sealants, Polyurethane Coatings, and Others), End-Use (Footwear, Furniture, Automotive, Building and Construction, Home Appliances, Textile, Healthcare, Electrical and Electronics, Packaging, Industrial Machinery, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, and Rest of South America, Germany, Italy, U.K., France, Spain, Poland, Turkey, Netherlands, Belgium, Sweden, and Rest of Europe, Japan, China, India, South Korea, Australia & New Zealand, Vietnam, Malaysia, Thailand, Indonesia, Taiwan, and Rest of Asia-Pacific, Saudi Arabia, United Arab Emirates, South Africa, Egypt, Nigeria, and Rest of Middle East and Africa

|

|

Market Players Covered

|

BASF SE (Germany), SABIC (Saudi Arabia), Wanhua. (China), Covestro AG (Germany), DOW (U.S.), Tosoh Corporation (Japan), LANXESS (Germany), Huntsman International LLC (U.S.), Tokyo Chemical Industry (India) Pvt. Ltd. (India), KUMHO MITSUI CHEMICALS (South Korea), Sadara (Saudi Arabia), Karun Petrochemical Company (Iran), Henkel Polybit (A subsidiary of Henkel AG & Co. KGaA) (Germany), KURMY CORPORATIONS (India), and Era Polymers Pty Ltd (Australia)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, material handling and storage, transport and precautions and hazard identification.

|

Segment Analysis

The global methylene diphenyl di-isocyanate (MDI) market is segmented into two notable segments based on application, and end-use.

- Based on end-use, the market is segmented into footwear, furniture, automotive, building and construction, home appliances, textile, healthcare, electrical and electronics, packaging, industrial machinery, and others.

In 2023, the furniture segment of end-use is anticipated to dominate the global methylene diphenyl di-isocyanate (MDI) market.

In 2023, the furniture segment is expected to dominate the market with 25.35% market share due to its adaptability, lightness, affordability, and capacity to give additional durability and support.

- Based on application, the market is segmented into polyurethane foam, polyurethane elastomers, polyurethane adhesives and sealants, polyurethane coatings, and others.

In 2023, the polyurethane foam segment of application is anticipated to dominate the global methylene diphenyl di-isocyanate (MDI) market.

In 2023, the polyurethane foam segment is expected to dominate the market with a 75.65% market share as it offers a home's permanent and damage-resistant insulation, enhancing comfort and lowering heating costs

Major Players

Data Bridge Market Research recognizes the following companies as the major players in the global methylene diphenyl di-isocyanate (MDI) market that includes BASF SE (Germany), SABIC (Saudi Arabia), Wanhua. (China), Covestro AG (Germany), Dow (U.S.), Tosoh Corporation (Japan), LANXESS (Germany), Huntsman International LLC (U.S.), Tokyo Chemical Industry (India) Pvt. Ltd. (India), KUMHO MITSUI CHEMICALS (South Korea), Sadara (Saudi Arabia), Karun Petrochemical Company (Iran), Henkel Polybit (A subsidiary of Henkel AG & Co. KGaA) (Germany), KURMY CORPORATIONS (India), and Era Polymers Pty Ltd (Australia).

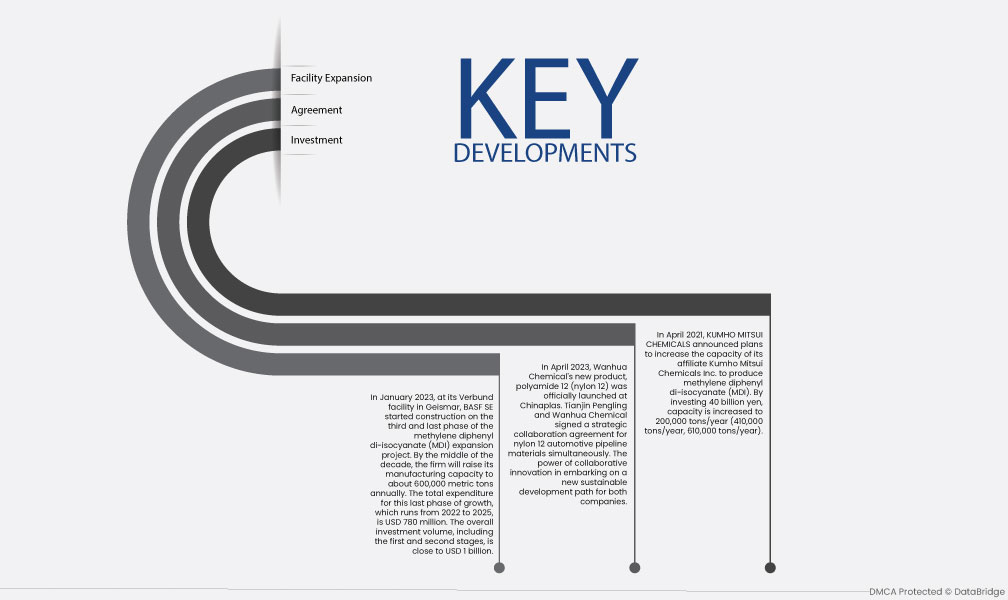

Market Developments

- In April 2023, Wanhua Chemical's new polyamide 12 (nylon 12) was officially launched at Chinaplas. Tianjin Pengling and Wanhua Chemical signed a strategic collaboration agreement for nylon 12 automotive pipeline materials simultaneously. The power of collaborative innovation in embarking on a new sustainable development path for both companies.

- In January 2023, at its Verbund facility in Geismar, BASF SE started construction on the third and last phase of the methylene diphenyl di-isocyanate (MDI) expansion project. By mid-decade, the firm will raise its manufacturing capacity to about 600,000 metric tons annually. The total expenditure for this last phase of growth, which runs from 2022 to 2025, is USD 780 million. The overall investment volume, including the first and second stages, is close to USD 1 billion.

- In April 2021, Mitsui Chemicals, Inc. announced today plans to increase the capacity of its affiliate Kumho Mitsui Chemicals Inc. to produce methylene diphenyl di-isocyanate (MDI). By investing 40 billion yen, the capacity is increased to 200,000 tons/year (410,000 tons/year, 610,000 tons/year).

Regional Analysis

Geographically, the regions covered in the global methylene diphenyl di-isocyanate (MDI) market report are U.S., Canada, Mexico, Brazil, Argentina, and Rest of South America, Germany, Italy, U.K., France, Spain, Poland, Turkey, Netherlands, Belgium, Sweden, and Rest of Europe, Japan, China, India, South Korea, Australia & New Zealand, Vietnam, Malaysia, Thailand, Indonesia, Taiwan, and Rest of Asia-Pacific, Saudi Arabia, United Arab Emirates, South Africa, Egypt, Nigeria, and Rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the global methylene diphenyl di-isocyanate (MDI) market during the forecast period 2023-2030

In 2023, Asia-Pacific is expected to dominate the global methylene diphenyl di-isocyanate (MDI) market due to favourable scenarios for polyurethanes in the building and construction industry. Asia-Pacific will continue to dominate the global methylene diphenyl di-isocyanate (MDI) market in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. The rising adoption of polyurethanes in the furniture and automobile industries in the region further boosts the market demand.

Asia-Pacific is estimated to be the fastest-growing region in the global methylene diphenyl di-isocyanate (MDI) market for the forecast period 2023-2030

Asia-Pacific is expected to grow during the forecast period due to the high production and consumption in the region. In addition, various technological advancements in production technologies and production facility expansion in the region.

For more detailed information about the global methylene diphenyl di-isocyanate (MDI) market report, click here –