전자상거래와 소비자 직접 배송(DTC) 소포 배송이 기하급수적으로 증가함에 따라, 더 많은 운송업체의 운송 및 취급 시설에서 기존 운송 및 분류 장비와 프로세스의 변화를 모색하고 있습니다. 분류 시스템에서 소포의 대량 흐름은 무작위로 배치되고 크기가 다른 상자, 카톤, 폴리백, 패딩 처리된 봉투들이 컨베이어를 따라 무질서하게 움직이는 것을 의미하며, 이러한 소포들은 각각 수동으로 분류됩니다. 이러한 흐름은 자동화를 통해 크기와 구조가 유사한 소포들이 균일한 간격으로 질서 있게 이동하는 단일 소포 흐름(Singulated Parcel Flow)을 개발하고 도입하는 방향으로 전환할 수 있는 기회를 열어주었습니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/global-parcel-sortation-systems-market 에서 확인하세요.

글로벌 소포 분류 시스템 시장은 2021 년 21억 5,039만 달러에서 2029년 57억 9,232만 달러로 성장할 것으로 예상되며, 2022년부터 2029년까지 연평균 성장률(CAGR) 13.9%를 기록할 것으로 전망됩니다. 소포 분류 시스템 시장 성장을 견인하는 주요 요인은 글로벌 전자상거래 산업의 지속적인 발전, 수동 개입 최소화, 그리고 인건비 절감입니다. 소비자의 온라인 쇼핑 선호도 증가는 전자상거래 산업의 성장을 견인할 것으로 예상되며, 이는 시장의 소포 분류 시스템 수요 증가로 이어질 것입니다. 또한, 시장 참여자들은 시장 점유율 확대를 위해 다양한 협업, 제품 개발, 업데이트 및 인수를 활발히 진행하고 있습니다.

전 세계 IoT 기술을 활용한 도시 지역 전자상거래 배송 증가로 시장 성장률이 높아질 것입니다.

최근 전자상거래 산업의 호황과 온라인 쇼핑 증가 및 기술 발전에 따른 광범위한 도입으로 인해 이 분야는 혁신에 취약해졌습니다. AI, 머신러닝, 사물인터넷(IoT)과 같은 최신 기술 트렌드는 조달, 운송, 재고 관리, 소포 분류 등 공급망 관리의 다양한 영역에 영향을 미치고 있습니다. 이러한 모든 기술은 공급망의 효율성을 높이고 생산성을 향상하는 데 기여합니다. 물류 분야에 IoT를 도입하면 중요 데이터 수집이 가능해집니다. 따라서 IoT 도입은 현대 유통 센터의 효율성을 높이고 시장에서 소포 분류 시스템의 성장을 촉진합니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2022년부터 2029년까지

|

기준 연도

|

2021

|

역사적인 해

|

2020 (2014~2019년으로 맞춤 설정 가능)

|

양적 단위

|

매출(백만 달러), 볼륨(단위), 가격(달러)

|

다루는 세그먼트

|

유형(선형 소포 분류 시스템, 루프 소포 분류 시스템), 제공(하드웨어, 소프트웨어, 서비스), 트레이 크기(중형, 소형, 대형), 소포 처리 용량(시간당 20,000개 미만 소포, 시간당 20,000~30,000개 소포, 시간당 30,000개 이상 소포), 최종 사용자(전자 상거래, 물류, 제약 및 의료 용품, 식품 및 음료 , 기타)

|

포함 국가

|

미국, 캐나다 및 멕시코(북미), 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 기타 유럽 국가, 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주, 태국, 인도네시아, 필리핀, 아시아 태평양(APAC)의 기타 아시아 태평양 국가(APAC), 사우디 아라비아, UAE, 남아프리카 공화국, 이집트, 이스라엘, 중동 및 아프리카(MEA)의 일부인 기타 중동 및 아프리카(MEA), 브라질, 아르헨티나 및 남미의 일부인 기타 남미

|

시장 참여자 포함

|

Siemens Logistics GmbH(독일), Vanderlande Industries BV(네덜란드), BEUMER GROUP(독일), Bastian Solutions, LLC(미국), FIVES(프랑스), Murata Machinery, Ltd.(일본), Interroll Group(스위스), Invata Instralogistics(미국), viastore(독일), Okura Yusoki Co., Ltd.(일본), GBI Intralogistics, Inc.(미국), Daifuku Co., Ltd.(일본), Pitney Bowes Inc.(미국), MHS Global(미국), SOLYSTIC SAS(프랑스), BOWE SYSTEC GMBH(독일), Honeywell International Inc.(미국), Intralox(네덜란드) 등

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 상세하고 업데이트된 가격 추세 분석 및 공급망 및 수요의 적자 분석이 포함됩니다.

|

세그먼트 분석:

글로벌 소포 분류 시스템 시장은 유형, 제공 서비스, 트레이 크기, 소포 처리 용량 및 최종 사용자를 기준으로 5개의 주요 부문으로 구분됩니다.

- 글로벌 소포 분류 시스템 시장은 유형별로 선형 소포 분류 시스템과 루프 소포 분류 시스템으로 구분됩니다. 2022년에는 선형 소포 분류 시스템 부문이 55.91%의 시장 점유율로 글로벌 소포 분류 시스템 시장을 장악할 것으로 예상됩니다. 선형 소포 분류 시스템은 루프 소포 분류 시스템보다 높은 처리량과 다양한 종류의 소포 분류 기능 등 다양한 이점을 제공하며, 창고 및 유통 센터는 적시 입고 및 발송을 통해 재고를 크게 줄일 수 있어 시장 성장에 기여합니다.

- 글로벌 소포 분류 시스템 시장은 제공 분야를 기준으로 하드웨어, 소프트웨어, 서비스로 구분됩니다. 하드웨어 기반 분류 시스템이 분류 효율성을 향상시키면서 2022년에는 하드웨어 부문이 54.02%의 시장 점유율을 기록하며 글로벌 소포 분류 시스템 시장을 주도할 것으로 예상됩니다. 또한, 하드웨어 구현은 분류 애플리케이션의 속도를 높이고 매 클록 주기마다 동시 데이터 비교 및 스왑을 광범위하게 활용할 수 있도록 합니다.

- 트레이 크기를 기준으로 전 세계 소포 분류 시스템 시장은 소형, 중형, 대형으로 구분됩니다. 2022년에는 중형 트레이 크기가 50.03%의 시장 점유율을 기록하며 전 세계 소포 분류 시스템 시장을 장악할 것으로 예상됩니다. 이는 중형 크기의 소포와 패키지가 대량으로 생산되어 중형 트레이가 필요하고, 소포 분류 시스템 시장에서 중형 트레이 사용이 확대되고 있기 때문입니다.

- 소포 처리 용량 기준으로 전 세계 소포 분류 시스템 시장은 시간당 2만 건 미만, 2만~3만 건, 3만 건 이상 소포로 구분됩니다. 2022년에는 시간당 2만 건 미만 소포 처리 시스템 부문이 61.12%의 시장 점유율을 차지하며 전 세계 소포 분류 시스템 시장을 주도할 것으로 예상됩니다. 대부분의 공급업체가 시간당 2만 건 미만의 소포 처리 용량을 제공하기 때문입니다. 또한, 모든 소포 분류 시스템은 최소 처리 용량이 약 1만~2만 건입니다.

해상 터빈 부문은 소포 분류 시스템 시장의 소포 처리 용량 부문을 지배할 것입니다.

2022년에는 시간당 2만 건의 소포 처리가 가능한 소포 처리 용량 부문이 약 61%의 시장 점유율을 기록하며 가장 큰 비중을 차지할 것으로 예상됩니다. 이는 특히 개발도상국에서 인프라 개발 활동과 매장형 소매업체의 증가에 따른 것입니다. 또한, 전 세계적으로 반도체 산업의 성장과 확장은 이 부문의 성장을 더욱 가속화할 것입니다.

- 최종 사용자 기준으로 글로벌 소포 분류 시스템 시장은 물류, 전자상거래, 제약 및 의료 용품, 식음료 등으로 세분화됩니다. 최근 몇 년간 전자상거래 산업이 기하급수적으로 성장하면서 전 세계 고객에게 분류 및 배송되는 소포의 양도 증가함에 따라, 2022년에는 전자상거래 부문이 40.54%의 시장 점유율을 기록하며 글로벌 소포 분류 시스템 시장을 주도할 것으로 예상됩니다.

전자상거래 부문은 소포 분류 시스템 시장의 최종 사용자 부문을 지배할 것입니다.

전자상거래 부문은 2022년 최종 사용자 부문에서 가장 큰 비중을 차지하는 부문으로 부상할 것입니다. 이는 특히 개발도상국을 중심으로 전자상거래 플랫폼이 시장에 점점 더 많이 등장하고 있기 때문입니다. 또한, 전 세계적으로 연구개발 서비스가 성장하고 확장됨에 따라 전자상거래 부문의 성장은 더욱 가속화될 것입니다.

주요 플레이어

Data Bridge Market Research는 다음 회사를 소포 분류 시스템 시장의 주요 기업으로 인식합니다: Siemens Logistics GmbH(독일), Vanderlande Industries BV(네덜란드), BEUMER GROUP(독일), Bastian Solutions, LLC(미국), FIVES(프랑스), Murata Machinery, Ltd.(일본), Interroll Group(스위스), Invata Instralogistics(미국), viastore(독일), Okura Yusoki Co., Ltd.(일본), GBI Intralogistics, Inc.(미국), Daifuku Co., Ltd.(일본), Pitney Bowes Inc.(미국), MHS Global(미국), SOLYSTIC SAS(프랑스), BOWE SYSTEC GMBH(독일), Honeywell International Inc.(미국), Intralox(네덜란드).

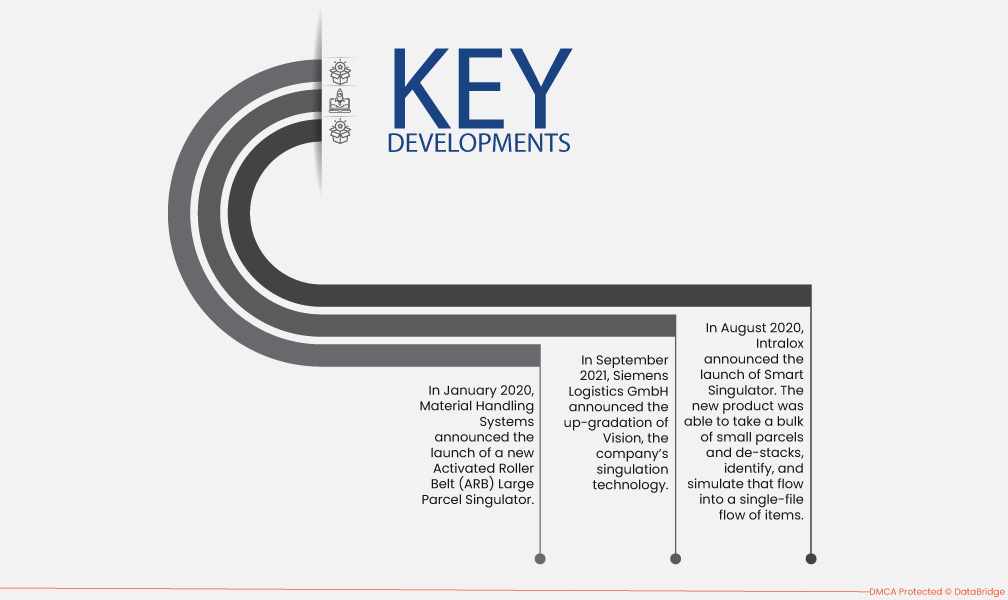

시장 개발

- 2020년 1월, Material Handling Systems는 새로운 ARB(Activated Roller Belt) 대형 소포 분리기 출시를 발표했습니다. 이 신제품은 자동 분류 시스템의 원활한 작동을 유지하도록 설계되었으며, 대량의 소포 흐름을 고처리량 작업에 필수적인 단일 파일 스트림으로 변환합니다. 시간당 12,000개의 소포를 처리할 수 있었습니다. 이를 통해 시장에서 회사의 제품 포트폴리오가 더욱 강화되었습니다.

- 2021년 9월, 지멘스 로지스틱스(Siemens Logistics GmbH)는 자사의 싱귤레이션 기술인 비전(Vision) 업그레이드를 발표했습니다. 이 업그레이드를 통해 시간당 최대 18,000개의 품목을 처리할 수 있게 되었습니다. 크기, 형태, 포장재 등 다양한 종류의 화물을 처리할 수 있게 되었습니다. 비전의 핵심 요소는 각 화물의 형태, 크기, 상대적 위치를 정확하게 감지하는 정교한 인공지능(AI) 기반 비전 시스템이었습니다. 이를 통해 지멘스는 기존 제품의 가치를 높이고 도입률을 높일 수 있었습니다.

- 2020년 8월, 인트랄록스는 스마트 싱귤레이터(Smart Singulator) 출시를 발표했습니다. 이 신제품은 대량의 소형 소포를 적재하고, 적재된 소포를 식별하여 단일 파일 방식으로 분류하고 시뮬레이션합니다. 이 제품은 비전 시스템과 검증된 액티브 롤러 벨트(ARB) 기술을 통합하여 업계 최고 속도인 최대 14,000PPH(Parse Time)를 구현했습니다. 이를 통해 인트랄록스는 단일 제품 포트폴리오를 강화할 수 있었습니다.

지역 분석

지리적으로 소포 분류 시스템 시장 보고서에서 다루는 국가는 북미의 미국, 캐나다 및 멕시코, 유럽의 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 기타 유럽, 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주, 태국, 인도네시아, 필리핀, 아시아 태평양(APAC)의 기타 아시아 태평양(APAC), 사우디 아라비아, UAE, 남아프리카 공화국, 이집트, 이스라엘, 중동 및 아프리카(MEA)의 일부인 기타 중동 및 아프리카(MEA), 남미의 일부인 기타 남미입니다.

Data Bridge Market Research 분석에 따르면:

아시아 태평양 지역은 2022년부터 2029년까지 의 예측 기간 동안 소포 분류 시스템 시장 에서 지배적인 지역입니다.

- 2021년에는 아시아 태평양 지역이 세계 소포 분류 시스템 시장을 주도할 것으로 예상됩니다. 아시아 태평양 지역은 소포 물량 기준 가장 큰 시장을 보유하고 있기 때문입니다. 또한, 아시아 태평양 지역의 전자상거래 매출이 매우 빠르게 성장하고 있어 아시아 태평양 지역 시장 성장세가 더욱 가속화되고 있습니다.

유럽은 2022년부터 2029년까지 소포 분류 시스템 시장 에서 가장 빠르게 성장하는 지역으로 추정됩니다.

유럽은 예측 기간 동안 매우 매력적인 지역으로 예상됩니다. 영국은 택배 및 소포 배송 건수가 증가하고 지역 내 시장 참여자가 증가함에 따라 높은 성장을 기록했습니다.

COVID-19 영향

SARS-CoV-2 팬데믹으로 인해 고객의 온라인 쇼핑 이용이 증가하면서 혁신적인 소포 분류 장비 개발에 새로운 기회가 생겼습니다. 이로 인해 라스트마일 배송 서비스에 대한 중요성이 더욱 커졌고, 물류 회사의 라스트마일 역량 강화가 필요해졌습니다. 더욱이, 배송 물량의 급격한 증가로 물류 회사들은 주문 분류 및 조립에 어려움을 겪고 있습니다. 이로 인해 여러 지역에서 효율적인 소포 분류 시스템에 대한 수요가 증가하고 있습니다.

소포 분류 시스템 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/global-parcel-sortation-systems-market