Rudergeräte, auch Ergometer oder Ergometer genannt, beanspruchen bei jedem Ruderschlag Ober- und Unterkörper. Ein Indoor-Rudergerät ist ein Gerät, das die Ruderbewegung eines Wasserfahrzeugs simuliert und so für Rudertraining oder -übungen genutzt wird. Dies stärkt und strafft die Muskulatur und verbessert die Ausdauer. Rudern gilt als Ganzkörpertraining.

Acc Dashboard ess Vollständiger Bericht @ https://www.databridgemarketresearch.com/reports/global-rowing-machines-market

Data Bridge Market Research analysiert, dass der globale Markt für Rudergeräte im Prognosezeitraum von 2023 bis 2030 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,0 % wachsen und bis 2030 voraussichtlich 1.576.823,44 Tausend USD erreichen wird. Das Rudergerät hilft nicht nur dabei, die Fitness der Sportler zu verbessern, sondern unterstützt auch deren Rehabilitation und trägt somit zum Marktwachstum bei.

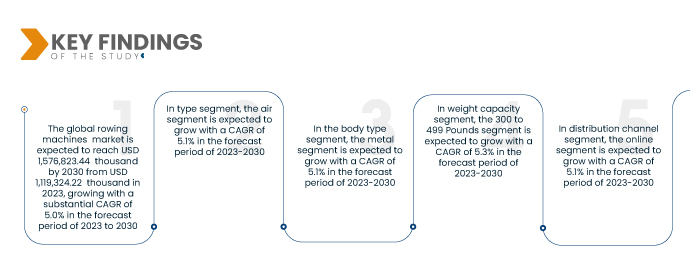

Wichtigste Ergebnisse der Studie

- Der globale Markt für Rudergeräte wird voraussichtlich von 1.119.324,22 Tausend USD im Jahr 2023 auf 1.576.823,44 Tausend USD im Jahr 2030 anwachsen und im Prognosezeitraum von 2023 bis 2030 mit einer beachtlichen jährlichen Wachstumsrate von 5,0 % wachsen.

- Auf der Grundlage des Typs wird erwartet, dass das Luftsegment im Prognosezeitraum 2023-2030 mit einer CAGR von 5,1 % wächst

- Auf der Grundlage des Karosserietyps wird für das Metallsegment im Prognosezeitraum 2023–2030 ein CAGR von 5,1 % erwartet.

- Auf der Grundlage der Gewichtskapazität wird erwartet, dass das Segment von 300 bis 499 Pfund im Prognosezeitraum 2023-2030 mit einer CAGR von 5,3 % wächst

- Auf der Grundlage des Vertriebskanals wird erwartet, dass das Online-Segment im Prognosezeitraum 2023-2030 von 2023 bis 2030 mit einer CAGR von 5,1 % wächst

Steigende Ausgaben für Profisport auf globaler Ebene dürften das Marktwachstum ankurbeln

Die steigende Nachfrage nach Rudergeräten liegt daran, dass sie eine wichtige Rolle im Training von Rudersportlern spielen. Das Gerät hilft Sportlern, ihre Rudertechnik zu verbessern, was durch die Simulation der vom Rudergerät erzeugten Bewegung möglich wird. Rudergeräte helfen dabei, die für lange Rennen erforderliche Ausdauer zu entwickeln. Darüber hinaus hilft das Training an Rudergeräten Profisportlern, eine hohe aerobe Kapazität für Kampfsportarten wie Boxen aufrechtzuerhalten. Rudern ermöglicht ein Ganzkörpertraining, das die meisten Muskelgruppen in Armen, Gesäß, Schultern, Beinen und Rücken stärkt. Aufgrund dieser Vorteile des Trainings an Rudergeräten wird es von Sportlern verschiedener Sportarten wie Laufen, Squash, Tennis, Schwimmen und Basketball bevorzugt.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015–2020)

|

Quantitative Einheiten

|

Umsatz in Tausend USD und Preise in USD

|

Abgedeckte Segmente

|

Nach Typ (Luft, Wasser, Magnetisch und Hydraulisch), Gehäusetyp (Metall und Massivholz), Gewichtskapazität (300 bis 499 Pfund, 200 bis 249 Pfund, 100 bis 199 Pfund und unter 100 Pfund), Vertriebskanal (Online und Offline), Widerstandsstufe (Weniger als 24 und Mehr als 24), Farbe (Schwarz, Hellgrau und Andere), Endbenutzer (Gewerbe und Privat)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, übriges Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, übriger Asien-Pazifik-Raum, Brasilien, Argentinien, übriges Südamerika, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel und übriger Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

BODYCRAFT (USA), Johnson Health Tech (Taiwan), Nautilus, Inc. (USA), Mr Captain Brand (China), Stamina Products, Inc. (USA), Sunny Health and Fitness (USA), iFIT Inc. (USA), York Fitness (Großbritannien), Infiniti (Australien), Concept2 inc. (USA), WaterRower (USA), RP3 Rowing (Niederlande), Peloton Interactive (USA), Inc., ERGATTA, AVIRON INTERACTIVE INC. (Kanada), TECHNOGYM SpA (Italien), Hydrow (Massachusetts), Oartec (Washington), Decathlon (Frankreich), Intense Enterprises (Indien), HAMMER Sport AG (Deutschland), Tunturi New Fitness (Niederlande), adidas AG. (Deutschland), Cosco (India) Limited (Indien), Life Fitness (USA), Pure Design Fitness (USA), TOPIOM (Niederlande), Modcon Industries Private Limited (Indien), Shandong DHZ Fitness Equipment Co., Ltd (China), KAYA (Indien), SHUA (China) und SHANDONG BAODELONG FITNESS CO., LTD (China) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der globale Markt für Rudergeräte ist auf der Grundlage von Typ, Körpertyp, Gewichtskapazität, Vertriebskanal, Widerstandsniveau, Farbe und Endbenutzer in sieben wichtige Segmente unterteilt.

- Auf der Grundlage des Typs ist der Markt in Luft, Wasser, Magnetismus und Hydraulik segmentiert.

Im Jahr 2023 wird das Luftsegment voraussichtlich den globalen Rudergerätemarkt dominieren

Im Jahr 2023 wird das Luftsegment voraussichtlich mit einem Marktanteil von 34,49 % den Markt dominieren. Bis 2030 wird ein Umsatz von 548.354,69 Tausend US-Dollar erwartet, mit der höchsten durchschnittlichen jährlichen Wachstumsrate von 5,1 % im Prognosezeitraum von 2023 bis 2030.

- Der Markt ist nach Typ in Luft-, Wasser-, Magnet- und Hydraulikgeräte segmentiert. Im Jahr 2023 wird das Luftsegment voraussichtlich den Markt mit dem größten Marktanteil von 34,49 % dominieren, da es das günstigste Indoor-Rudergerät auf dem Markt ist.

- Der Markt ist nach Karosserietyp in Metall und Massivholz segmentiert. Im Jahr 2023 wird Metall voraussichtlich den Markt mit einem Marktanteil von 68,02 % dominieren, da es über eine hohe Haltbarkeit, leichte Verfügbarkeit und breite Anwendungsmöglichkeiten verfügt.

- Basierend auf der Gewichtskapazität ist der Markt in 300 bis 499 Pfund, 200 bis 249 Pfund, 100 bis 199 Pfund und unter 100 Pfund segmentiert. Im Jahr 2023 wird das Segment 300 bis 499 Pfund voraussichtlich den Markt mit dem größten Marktanteil von 43,03 % dominieren, da dies das von den meisten Menschen bevorzugte maximale Benutzergewicht ist.

- Basierend auf den Vertriebskanälen wird der Markt in Offline und Online segmentiert. Im Jahr 2023 wird das Offline-Segment voraussichtlich den Markt mit dem größten Marktanteil von 87,59 % dominieren, da es in verschiedenen Verkaufsstellen, Fachgeschäften und Kaufhäusern erhältlich ist.

- Auf Grundlage des Widerstandsniveaus wird der Markt in weniger als 24 und mehr als 24 unterteilt. Im Jahr 2023 wird das Segment weniger als 24 den Markt voraussichtlich mit dem größten Marktanteil von 55,05 % dominieren, da Rudern mit 20 bis 24 Schlägen pro Minute am weitesten verbreitet ist.

- Der Markt ist farblich in Schwarz, Hellgrau und weitere Farben unterteilt. Im Jahr 2023 wird Schwarz voraussichtlich mit einem Marktanteil von 50,63 % dominieren, da es die am häufigsten erhältliche und gefragteste Farbe ist und für einen eleganten und stilvollen Look sorgt.

- Der Markt ist nach Endnutzern in Gewerbe- und Wohnimmobilien segmentiert. Das Gewerbesegment ist weiter nach Typ in Fitnessstudios, Sportanlagen, Hotels und Büros unterteilt. Aufgrund der rasanten Urbanisierung und des zunehmenden Gesundheitsbewusstseins der Verbraucher wird erwartet, dass das Gewerbesegment im Jahr 2023 mit einem Marktanteil von 69,89 % den Markt dominieren wird.

Im Jahr 2023 wird das kommerzielle Segment voraussichtlich den größten Anteil des Endverbrauchersegments auf dem globalen Rudergerätemarkt halten

Im Jahr 2023 hält das kommerzielle Segment aufgrund des zunehmenden Gesundheitsbewusstseins der Verbraucher den größten Marktanteil. Das kommerzielle Segment wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,9 %.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Rudergeräte-Akteure auf dem globalen Rudergerätemarkt an, darunter BODYCRAFT (USA), Johnson Health Tech (Taiwan), Nautilus, Inc. (USA), Mr Captain Brand (China), Stamina Products, Inc. (USA), Sunny Health and Fitness (USA), iFIT Inc. (USA), York Fitness (Großbritannien), Infiniti (Australien), Concept2 inc. (USA), WaterRower (USA), RP3 Rowing (Niederlande), Peloton Interactive (USA), Inc., ERGATTA, AVIRON INTERACTIVE INC. (Kanada), TECHNOGYM SpA (Italien), Hydrow (Massachusetts), Oartec (Washington), Decathlon (Frankreich), Intense Enterprises (Indien), HAMMER Sport AG (Deutschland), Tunturi New Fitness (Niederlande) und adidas AG. (Deutschland), Cosco (India) Limited (Indien), Life Fitness (USA), Pure Design Fitness (USA), TOPIOM (Niederlande), Modcon Industries Private Limited (Indien), Shandong DHZ Fitness Equipment Co., Ltd (China), KAYA (Indien), SHUA (China) und SHANDONG BAODELONG FITNESS CO., LTD (China) unter anderem.

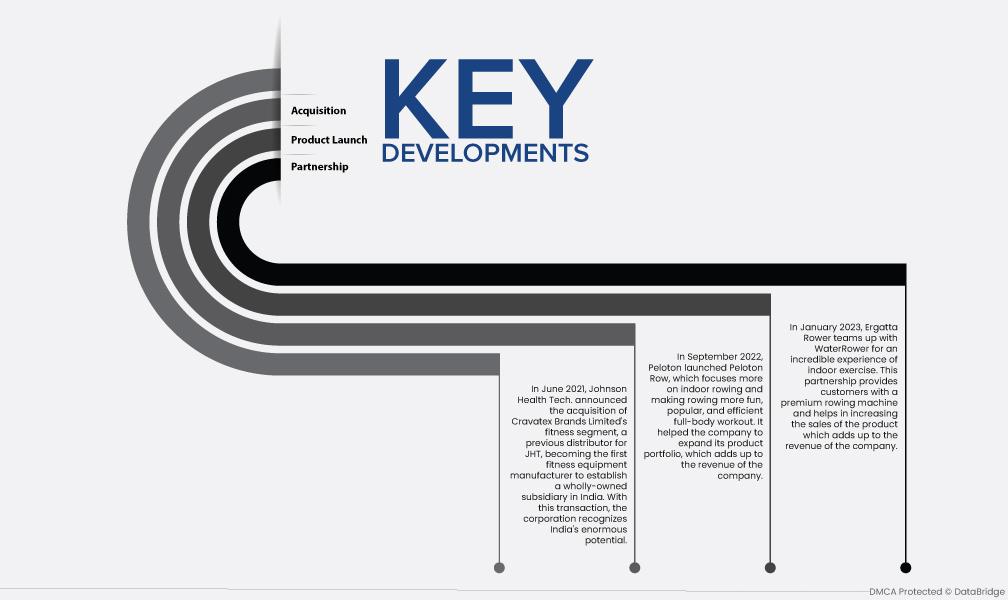

Marktentwicklung

- Im September 2022 brachte Peloton Peloton Row auf den Markt, ein Gerät, das sich stärker auf Indoor-Rudern konzentriert und Rudern zu einem unterhaltsameren, beliebteren und effizienteren Ganzkörpertraining macht. Es half dem Unternehmen, sein Produktportfolio zu erweitern, was den Umsatz des Unternehmens steigert.

- Im Januar 2023 kooperiert Ergatta Rower mit WaterRower für ein unglaubliches Indoor-Trainingserlebnis. Diese Partnerschaft bietet Kunden ein Premium-Rudergerät und trägt dazu bei, den Absatz des Produkts zu steigern, was wiederum den Umsatz des Unternehmens steigert.

- Im Juni 2022 gab Johnson Health Tech. die Übernahme des Fitnesssegments von Cravatex Brands Limited bekannt, einem früheren Vertriebspartner von JHT. Damit ist das Unternehmen der erste Fitnessgerätehersteller, der eine hundertprozentige Tochtergesellschaft in Indien gründet. Mit dieser Transaktion erkennt das Unternehmen das enorme Potenzial Indiens.

- Im Oktober 2022, am Welttag der psychischen Gesundheit, kündigte Adidas eine neue Partnerschaft mit Calm an, der weltweit führenden Plattform für psychische Gesundheit. Die beiden führenden Marken arbeiten zusammen, um die sportliche Leistung durch die Unterstützung der psychischen Gesundheit zu verbessern.

- Decathlon brachte 2022 ein multifunktionales Rudergerät mit modernster Technologie auf den Markt. Es handelt sich um ein eingebautes Rudergerät, das keine Installation erfordert. Mit der Markteinführung will das Unternehmen Fitnessbegeisterte ansprechen, die gerne zu Hause trainieren.

- Im Juni 2021 gab Johnson Health Tech. die Übernahme des Fitnesssegments von Cravatex Brands Limited bekannt, einem früheren Vertriebspartner von JHT. Damit ist Johnson Health Tech. der erste Fitnessgerätehersteller, der eine hundertprozentige Tochtergesellschaft in Indien gründet. Mit dieser Transaktion erkennt das Unternehmen das enorme Potenzial Indiens.

- Im Juni 2021 gab PEAR Sports die Übernahme von Aaptiv bekannt. Mit fast 13 Millionen Downloads und über 36 Millionen absolvierten Kursen ist Aaptiv eine der beliebtesten Trainings-Apps auf dem Markt. Aaptiv passt perfekt zu seinem personalisierten wissenschaftlichen Ansatz von PEAR für digitales Fitness- und Wellness-Coaching. Die Marke Aaptiv wird weitergeführt und profitiert von den vereinten Stärken von PEAR und Life Fitness.

- Im Juni 2021 erweitern Life Fitness und das Fitnessstudio-Vermietungsunternehmen ihre Partnerschaft als „offizieller Fitnessgerätelieferant“ bei den Wimbledon-Meisterschaften 2021. Auch die von den Sportlern verwendeten Cardiogeräte von Life Fitness werden von der Halo Fitness Cloud betrieben.

- Im Juli 2021 wurde Sweat, eine führende Plattform für Frauengesundheit und -training, von iFIT Inc. übernommen. Der Kauf durch Sweat stärkt iFITs globale Präsenz im digitalen Fitnessmarkt und beschleunigt die Bereitstellung erstklassiger interaktiver Fitnesserlebnisse für Kunden weltweit. Diese strategische Investition wird das Wachstum des Unternehmens und die Expansion im digitalen Fitnessbereich fördern.

- Im September 2021 gab Nautilus, Inc. die Unterzeichnung eines formellen Vertrags zur Übernahme von VAY, einem weltweit führenden Anbieter von Bewegungstechnologie, bekannt. Durch den Kauf kann Nautilus seine digitale JRNY-Plattform erweitern. Das Unternehmen bietet Kerntechnologien an, die die Vision- und Bewegungsverfolgungsfunktionen des Unternehmens unterstützen und so eine Echtzeit-Datenanalyse während des Trainings ermöglichen. Diese Funktionen werden in die JRNY-Plattform von Nautilus integriert, um individuell zugeschnittene Einzeltrainingseinheiten zu entwickeln und zu beschleunigen.

Regionale Analyse

Geografisch gesehen sind die folgenden Länder vom globalen Markt für Rudergeräte abgedeckt: USA, Kanada, Mexiko, Deutschland, Großbritannien, Polen, Schweden, Dänemark, Italien, Frankreich, Spanien, Schweiz, Russland, Türkei, Belgien, Niederlande, übriges Europa, Japan, China, Südkorea, Indien, Vietnam, Australien, Neuseeland, Hongkong, Taiwan, Singapur, Thailand, Indonesien, Malaysia, Philippinen, übriger asiatisch-pazifischer Raum, Brasilien, Argentinien und übriges Südamerika, Südafrika, Ägypten, Katar, Kuwait, Oman, Saudi-Arabien, Vereinigte Arabische Emirate und übriger Naher Osten und Afrika.

Laut Marktforschungsanalyse von Data Bridge:

Nordamerika ist die dominierende Region auf dem globalen Rudergerätemarkt im Prognosezeitraum 2023 – 2030

Im Jahr 2023 wird Nordamerika voraussichtlich den globalen Markt für Rudergeräte dominieren, da das Bewusstsein der Verbraucher für Fitness und Gesundheit steigt. Nordamerika wird den Markt in Bezug auf Marktanteil und Umsatz weiterhin dominieren und seine Dominanz im Prognosezeitraum weiter ausbauen. Dies ist auch auf das steigende Bewusstsein der Verbraucher in der Region für Fitness und Gesundheit zurückzuführen.

Für detailliertere Informationen zum globalen Marktbericht für Rudergeräte klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-rowing-machines-market