Молодые люди активно участвуют в большем количестве спортивных мероприятий, что помогает улучшить показатели здоровья и ускорить рост рынка. Кроме того, легкая атлетика получила признание как практичный способ поддержания формы и защиты от нарушений образа жизни, поскольку проблемы со здоровьем стали более широко признанными. Эти инструменты выдерживают физическую нагрузку пользователя во время тренировок и защищают от перетренированности. Рост рынка значительно ускоряется всеми этими факторами.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/global-wearable-devices-in-sports-market

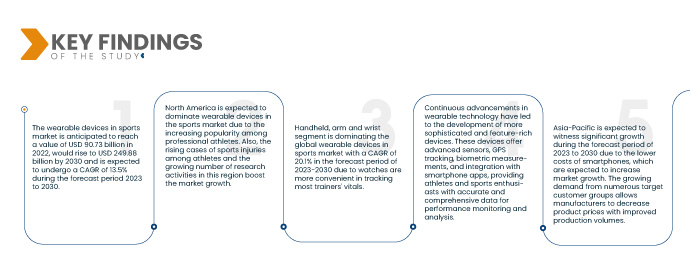

Data Bridge Market Research анализирует, что носимые устройства на спортивном рынке составили 90,73 млрд долларов США в 2022 году, вырастут до 249,88 млрд долларов США к 2030 году и, как ожидается, подвергнутся среднегодовому темпу роста в 13,5% в течение прогнозируемого периода с 2023 по 2030 год. Во всем мире растет внимание к фитнесу и активному образу жизни. Носимые устройства предлагают отслеживание в реальном времени различных показателей, таких как частота сердечных сокращений, пройденные шаги, сожженные калории и режим сна, что помогает пользователям контролировать уровень своей физической подготовки и сохранять мотивацию.

Основные выводы исследования

Ожидается, что интеграция с Интернетом вещей и аналитикой данных будет способствовать темпам роста рынка.

Интеграция с Интернетом вещей (IoT) позволяет носимым устройствам в спорте подключаться к другим устройствам и платформам, облегчая обмен данными. Такая связь позволяет проводить комплексный анализ данных, где показатели производительности анализируются для выявления тенденций и закономерностей. С помощью этой информации можно создавать персонализированные рекомендации по тренировкам, подгоняя программы тренировок под конкретные потребности отдельных спортсменов, оптимизируя производительность и улучшая общие результаты тренировок.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2023-2030

|

Базовый год

|

2022

|

Исторические годы

|

2021 (Можно настроить на 2015-2020)

|

Количественные единицы

|

Выручка в млрд долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Компонент (аппаратное обеспечение, программное обеспечение), тип продукта (шагомеры, фитнес-трекеры и мониторы сердечного ритма, умные ткани, умные камеры , трекеры кадров и т. д.), сайт (оголовье, карманные, на руку и запястье, зажим, датчик обуви и т. д.), приложение (счетчик шагов, сожженные калории, мониторинг сердечного ритма, отслеживание сна и т. д.), конечный пользователь (спортивные центры, фитнес-центры, настройки ухода на дому и т. д.), канал сбыта (независимый розничный магазин, гипермаркет/супермаркет, фирменный магазин, канал онлайн-продаж)

|

Страны, охваченные

|

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки.

|

Охваченные участники рынка

|

Apple Inc. (США), Huawei Technologies Co., Ltd. (Китай), Fitbit Inc. (Великобритания), Nike, Inc. (США), Under Armour, Inc (США), Koninklijke Philips NV (Нидерланды), Zepp Health Corporation (Китай), StretchSense (США), Catapult (США), Withings (Франция), Guangdong Transtek Medical Electronics Co., Ltd (Китай), Abbott (США), Medtronic (Ирландия), Apple Inc. (США), Virtual-Realties, LLC (Великобритания), Google LLC (США), Xiaomi (Китай), Sony Corporation (Япония), Garmin Ltd. (США), Honeywell International Inc. (США), LG Electronics (Южная Корея)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативную базу.

|

Анализ сегмента:

Носимые устройства на спортивном рынке сегментируются по компоненту, типу продукта, месту установки, применению, конечному пользователю и каналу сбыта.

- На основе компонентов глобальные носимые устройства на спортивном рынке сегментируются на аппаратное и программное обеспечение. Сегмент программного обеспечения доминирует на мировом рынке носимых устройств на спортивном рынке с долей рынка 65,0% в прогнозируемый период 2023-2030 гг. из-за широкого использования передового искусственного интеллекта и его практичности.

Сегмент программного обеспечения доминирует над сегментом компонентов на мировом рынке носимых устройств в спорте.

Сегмент программного обеспечения доминирует на мировом рынке носимых устройств в спорте благодаря своему всеобъемлющему применению и подходящему характеру внедрения прогрессивного искусственного интеллекта с долей рынка 65,0% в прогнозируемый период 2023–2030 гг.

- На основе типа продукта глобальные носимые устройства на спортивном рынке сегментируются на шагомеры, фитнес-мониторы и мониторы сердечного ритма, умные ткани, умные камеры, трекеры бросков и др. Сегмент шагомеров доминирует на мировом рынке носимых устройств на спортивном рынке с среднегодовым темпом роста 17,3% в прогнозируемый период 2023-2030 гг. за счет поощрения спортсменов тренироваться самостоятельно, отслеживая свои графики тренировок.

- На основе сайта глобальные носимые устройства на спортивном рынке сегментируются на головные повязки, карманные, наручные и запястные, зажимные, датчики для обуви и другие. Сегмент карманных, наручных и запястных устройств доминирует на мировом рынке носимых устройств на спортивном рынке со среднегодовым темпом роста 20,1% в прогнозируемый период 2023-2030 гг., поскольку показатели жизнедеятельности большинства тренеров удобнее отслеживать с помощью часов.

- На основе сферы применения мировые носимые устройства на спортивном рынке сегментируются на подсчет шагов, сожженных калорий, мониторинг сердечного ритма, отслеживание сна и др. Сегмент подсчета шагов доминирует на мировом рынке носимых устройств на спортивном рынке с долей рынка 38,4% в прогнозируемом периоде 2023-2030 гг. за счет использования часов для отслеживания во время пробежек и утренних прогулок.

- На основе конечного пользователя глобальный рынок носимых устройств на спортивном рынке сегментируется на спортивные центры, фитнес-центры, учреждения по уходу на дому и т. д. Сегмент спортивных центров доминирует на мировом рынке носимых устройств на спортивном рынке с долей рынка 59,1% в прогнозируемый период 2023-2030 гг., поскольку каждый спортсмен намерен отслеживать свои фитнес-программы для поддержания рекордов.

- На основе канала дистрибуции глобальный рынок носимых устройств на спортивном рынке сегментируется на независимые розничные магазины, гипермаркеты/супермаркеты, фирменные магазины и каналы онлайн-продаж. Сегмент независимых розничных магазинов доминирует на мировом рынке носимых устройств на спортивном рынке с долей рынка 53,5% в прогнозируемый период 2023-2030 гг. из-за легкой доступности для различных потребителей.

Сегмент розничных магазинов Independent доминирует в сегменте дистрибуции носимых устройств на мировом рынке спортивных товаров.

Сегмент розничных магазинов Independent доминирует на мировом рынке носимых устройств в спорте благодаря небольшим частным предприятиям, которые предлагают разнообразные продукты местным клиентам. Они часто специализируются на определенных нишах и обслуживают потребности местного сообщества с долей рынка в 53,5% в прогнозируемый период 2023-2030 гг.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве основных игроков на рынке носимых устройств для спорта: Apple Inc. (США), Huawei Technologies Co., Ltd. (Китай), Fitbit Inc. (Великобритания), Nike, Inc. (США), Under Armour, Inc (США), Koninklijke Philips NV (Нидерланды), Zepp Health Corporation (Китай), StretchSense (США), Catapult (США), Withings (Франция).

Развитие рынка

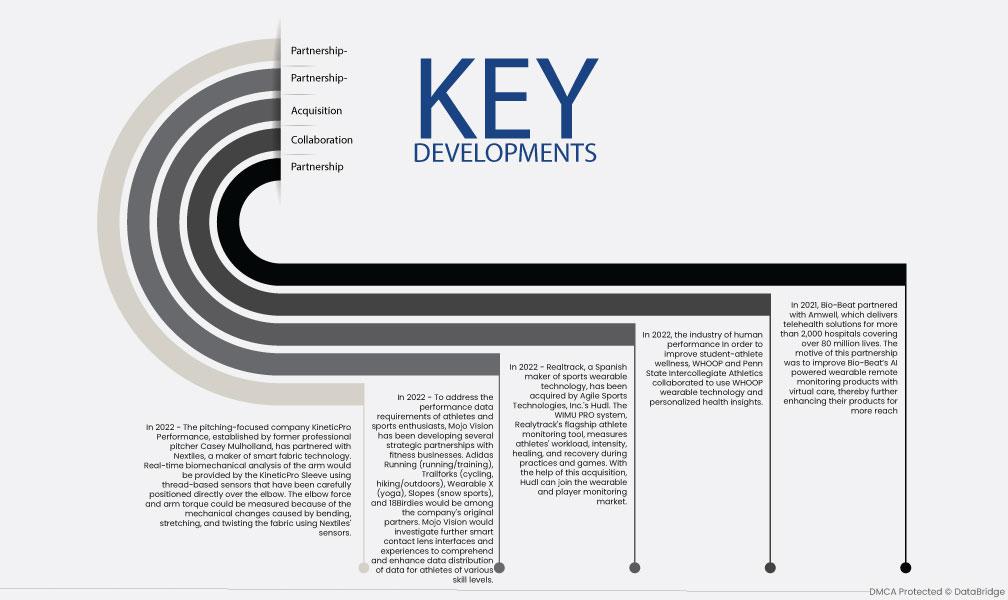

- В 2022 году - Компания KineticPro Performance, ориентированная на питчинг, основанная бывшим профессиональным питчером Кейси Малхолландом, начала сотрудничать с Nextiles, производителем технологии умных тканей. Биомеханический анализ руки в реальном времени будет осуществляться рукавом KineticPro с использованием датчиков на основе нитей, которые были тщательно размещены непосредственно над локтем. Сила локтя и крутящий момент руки могут быть измерены из-за механических изменений, вызванных изгибом, растяжением и скручиванием ткани с помощью датчиков Nextiles.

- В 2022 году — для удовлетворения потребностей спортсменов и любителей спорта в данных о производительности компания Mojo Vision развивает несколько стратегических партнерств с фитнес-компаниями. Adidas Running (бег/тренировки), Trailforks (велоспорт, пешие прогулки/активный отдых), Wearable X (йога), Slopes (зимние виды спорта) и 18Birdies будут среди первоначальных партнеров компании. Mojo Vision будет исследовать дополнительные интерфейсы и возможности интеллектуальных контактных линз, чтобы понимать и улучшать распределение данных для спортсменов разного уровня подготовки.

- В 2022 году Realtrack, испанский производитель спортивных носимых технологий, был приобретен компанией Hudl компании Agile Sports Technologies, Inc. Система WIMU PRO, флагманский инструмент мониторинга спортсменов от Realytrack, измеряет нагрузку, интенсивность, заживление и восстановление спортсменов во время тренировок и игр. Благодаря этому приобретению Hudl может выйти на рынок носимых устройств и мониторинга игроков .

- В 2022 году индустрия оценки работоспособности человека Чтобы улучшить благополучие студентов-спортсменов, WHOOP и Penn State Intercollegiate Athletics объединились для использования носимых технологий WHOOP и персонализированной информации о состоянии здоровья.

- В 2021 году Bio-Beat заключила партнерское соглашение с Amwell, которая предоставляет решения в области телемедицины для более чем 2000 больниц, охватывая более 80 миллионов жизней. Целью этого партнерства было усовершенствование носимых продуктов дистанционного мониторинга Bio-Beat на базе искусственного интеллекта с помощью виртуальной помощи, тем самым еще больше улучшая свои продукты для большего охвата

- В 2021 году Apple, Inc. представила свою новейшую торговую точку в историческом театре Tower в центре Лос-Анджелеса. Один из самых значительных проектов реставрации Apple на сегодняшний день, театр Apple Tower Theatre стремится вдохновить еще больше креативности в самом центре города.

- В 2021 году Fitbit объявила о Fitbit Luxe, модном фитнес-трекере, разработанном для того, чтобы помочь вам более комплексно подходить к здоровью и благополучию. Компания достигла значительных технологических успехов с Luxe, создав более компактный, тонкий, красиво оформленный трекер, оснащенный передовыми функциями, некоторые из которых ранее были доступны только в смарт-часах, что сделало эти инструменты доступными еще большему количеству людей по всему миру.

Региональный анализ

Географически в отчете о рынке носимых устройств в спорте рассматриваются следующие страны: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Согласно анализу Data Bridge Market Research:

Ожидается, что Северная Америка будет доминировать в регионе на рынке носимых устройств для спорта в прогнозируемый период 2023–2030 гг.

Северная Америка готова доминировать на рынке носимых устройств в спорте из-за высокой скорости их принятия среди профессиональных спортсменов. В регионе наблюдается значительное количество спортивных травм, что стимулирует спрос на носимые устройства для профилактики травм и реабилитации. Кроме того, наличие передовых исследовательских центров и растущая исследовательская деятельность в области спортивных технологий способствуют росту рынка, поскольку компании сосредотачиваются на разработке инновационных решений для удовлетворения особых потребностей спортсменов в Северной Америке.

По оценкам, Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке носимых устройств для спорта в прогнозируемый период 2023–2030 гг.

Ожидается, что Азиатско-Тихоокеанский регион испытает существенный рост носимых устройств на спортивном рынке из-за нескольких факторов. Более низкие цены на смартфоны в регионе делают их более доступными для большего количества населения, увеличивая потенциальный размер рынка. Производители могут использовать растущий спрос со стороны различных групп клиентов для достижения экономии масштаба, что приводит к улучшению объемов производства и повышению эффективности затрат. Это позволяет производителям снижать цены на продукцию, что еще больше стимулирует рост рынка в Азиатско-Тихоокеанском регионе.

Для получения более подробной информации об отчете о рынке носимых устройств в спорте нажмите здесь – https://www.databridgemarketresearch.com/reports/global-wearable-devices-in-sports-market