医療研究に対する世界的な需要の高まり、純粋で安全な医薬品、投薬ミスの最小化、そして技術の進歩は、X線光電子分光法(XPS)市場を牽引する重要な要因です。医療研究がますます高度化するにつれ、新しい生体医学材料、薬物送達システム、診断機器の調査・開発のための高精度な分析技術に対するニーズが高まっています。XPSは、医療用途で使用される材料の表面組成と化学状態に関する詳細な情報を提供することで、この分野において重要な役割を果たしています。この機能は、薬物と生物系との相互作用の理解、インプラントや義肢用の生体材料の最適化、そして医療機器の品質と安全性の確保に不可欠です。

データブリッジ市場調査は、世界のX線光電子分光法(XPS)市場は2024年から2031年の予測期間に5.5%のCAGRで成長し、2031年までに784,136.56百万米ドルに達すると分析しています。元素検出セグメントは、さまざまなアプリケーションに正確で詳細な元素分析を提供するという重要な役割により、市場の成長を促進すると予測されています。

研究の主な結果

- 医療研究の需要の増加

医療研究に対する世界的な需要の高まり、純粋で安全な医薬品、投薬ミスの最小化、そして技術の進歩は、X線光電子分光法(XPS)市場を牽引する重要な要因です。医療研究がますます高度化するにつれ、新しい生体医学材料、薬物送達システム、診断機器の調査・開発のための高精度な分析技術に対するニーズが高まっています。XPSは、医療用途で使用される材料の表面組成と化学状態に関する詳細な情報を提供することで、この分野において重要な役割を果たしています。この機能は、薬物と生物系との相互作用の理解、インプラントや義肢用の生体材料の最適化、そして医療機器の品質と安全性の確保に不可欠です。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(百万米ドル)

|

対象セグメント

|

用途 (元素検出、汚染検出、密度推定、実験式の決定)、アプリケーション (材料科学、表面化学、医療機器、薄膜およびコーティング、マイクロエレクトロニクス デバイス、医療および生物学的サンプル、地質材料など)、X 線スポット サイズ (最大 50 μm、51~200 μm、200 μm 以上)、方法 (定性法、定量法、半定量法)、業界 (半導体および電子機器、金属およびエネルギー、ヘルスケア、化学、自動車、航空宇宙および防衛、パッケージング、印刷など)

|

対象となる市場プレーヤー

|

サーモフィッシャーサイエンティフィック社(米国)、堀場製作所(日本)、SPECS GmbH(英国)、Staib Instruments(ドイツ)、Scienta Omicron(ドイツ)、日立ハイテクインド社(日本)、日立製作所、Kratos Analytical Ltd.(英国)、Intertek Group plc(英国)、Nova Ltd.(イスラエル)、日本電子株式会社(日本)、Spectris(英国)、ULVAC-PHI(日本)、INCORPORATED.、LANScientific.(中国)、Bruker(米国)など

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析

X 線光電子分光法市場は、使用法、用途、X 線スポット サイズ、方法、および業界に基づいて 5 つの主要なセグメントに分類されます。

- 用途に基づいて、市場は元素検出、汚染検出、密度推定、経験式決定に分類されます。

2024年には元素検出セグメントが市場を支配すると予想されている。

2024年には、詳細な化学組成分析を提供する上での重要な役割により、元素検出セグメントが41.66%の市場シェアで市場を支配すると予想されています。

- アプリケーションに基づいて、市場は材料科学、表面化学、医療機器、薄膜およびコーティング、マイクロエレクトロニクスデバイス、医療および生物学的サンプル、地質材料、その他に分類されます。

2024年には材料科学分野が市場を支配すると予想されている

2024年には、原子レベルでの材料の分析と特性評価における重要な役割により、材料科学セグメントが31.61%の市場シェアで市場を支配すると予想されています。

- X線スポットサイズに基づいて、市場は50μm以下、51~200μm、200μm超に分類されます。2024年には、解像度とサンプル分析効率の最適なバランスにより、50μm以下のセグメントが61.21%の市場シェアを獲得し、市場をリードすると予想されます。

- 分析方法に基づいて、市場は定性分析、定量分析、半定量分析に分類されます。2024年には、定性分析セグメントが45.99%の市場シェアを獲得し、市場を席巻すると予想されます。これは、材料の化学組成と電子状態の特定と分析において重要な役割を果たすためです。

- 業界別に見ると、市場は半導体・エレクトロニクス、金属・エネルギー、ヘルスケア、化学、自動車、航空宇宙・防衛、包装、印刷、その他に分類されています。2024年には、半導体・エレクトロニクス分野が市場シェア28.08%で市場を牽引すると予想されています。これは、高度な技術アプリケーションにおける精密な材料特性評価と品質管理の必要性が高まっているためです。

主要プレーヤー

Data Bridge Market Research は、Thermo Fisher Scientific Inc. (米国)、HORIBA (日本)、SPECS GmbH (英国)、Staib Instruments (ドイツ)、Scienta Omicron (ドイツ) など、以下の企業を市場の主要プレーヤーとして認識しています。

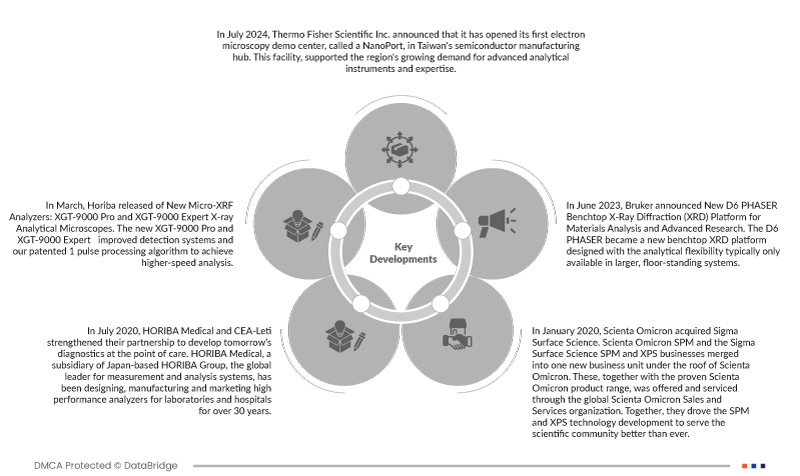

市場開発

- 2024年7月、サーモフィッシャーサイエンティフィックは、台湾の半導体製造拠点に同社初の電子顕微鏡デモセンター「NanoPort」を開設したことを発表しました。この施設は、同地域における高度な分析機器と専門知識に対する需要の高まりに対応しました。この戦略的な動きにより、サーモフィッシャーは半導体顧客との関係を強化し、同地域におけるプレゼンスを拡大することができました。

- 2023年3月、堀場製作所は新型マイクロ蛍光X線分析装置「XGT-9000 Pro」と「XGT-9000 Expert」を発売しました。新型XGT-9000 ProとXGT-9000 Expertは、改良された検出システムと特許取得済みの1パルス処理アルゴリズムを搭載し、分析速度の高速化を実現しています。これらの新機能は、材料分析の時間を短縮し、効率化に貢献します。

- 2020年7月、HORIBAメディカルとCEA-Letiは、未来のポイントオブケア診断の開発に向けてパートナーシップを強化しました。計測・分析システムの世界的リーダーである日本に拠点を置くHORIBAグループの子会社であるHORIBAメディカルは、30年以上にわたり、検査室や病院向けの高性能分析装置の設計、製造、販売を行ってきました。この専門知識により、同社は血液学分野における世界的リーダーの1つであり、血液凝固および臨床化学活動における主要プレーヤーとなっています。

- 2020年1月、Scienta OmicronはSigma Surface Scienceを買収しました。Scienta OmicronのSPM事業とSigma Surface ScienceのSPMおよびXPS事業は、Scienta Omicron傘下の新たな事業部門として統合されました。これらの事業部門は、実績のあるScienta Omicron製品群と併せて、Scienta Omicronのグローバルセールス&サービス組織を通じて提供・サービスされました。これらが一体となってSPMおよびXPS技術開発を推進し、科学コミュニティへの貢献をこれまで以上に強化しました。

- 2023年6月、ブルカーは材料分析および先端研究向けの新型ベンチトップX線回折(XRD)プラットフォーム「D6 PHASER」を発表しました。D6 PHASERは、通常は大型の床置き型システムでしか実現できない分析柔軟性を備えて設計された、新しいベンチトップXRDプラットフォームです。幅広い機能を備えたD6 PHASERは、新たな市場やユーザーコミュニティにおいて、より多くのXRDアプリケーションを可能にしました。

世界的なX線光電子分光法(XPS)市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/global-x-ray-photoelectron-spectroscopy-market