Rapid urbanization across India is reshaping lifestyles, driving a surge in demand for convenient and time-saving food solutions. A popular baking blog notes that time-pressed consumers seek convenience without sacrificing taste, highlighting the appeal of bakery premixes—pre-measured blends ideal for cakes, breads, muffins, and more. Urban dwellers, especially busy professionals and dual-income households, find premixes attractive due to their minimal preparation time, consistent results, and reduced need for specialized skills or multiple ingredients.

In parallel, India’s massive informal workforce - 92 % of total employment, according to an academic study — often juggles long hours with limited time for home cooking. These workers, concentrated in urban centers, are increasingly turning to semi-processed, easy-to-use food options. Premixes cater to this need by providing a quick, reliable way to enjoy bakery-style treats without spending hours in the kitchen.

This combined force of urban environments, fostering faster-paced living, and a large working population with limited time, makes bakery premixes a practical solution. They offer the perfect blend of convenience, consistency, and taste in India’s evolving culinary landscape.

Access Full Report @ https://www.databridgemarketresearch.com/reports/india-bakery-premixes-market

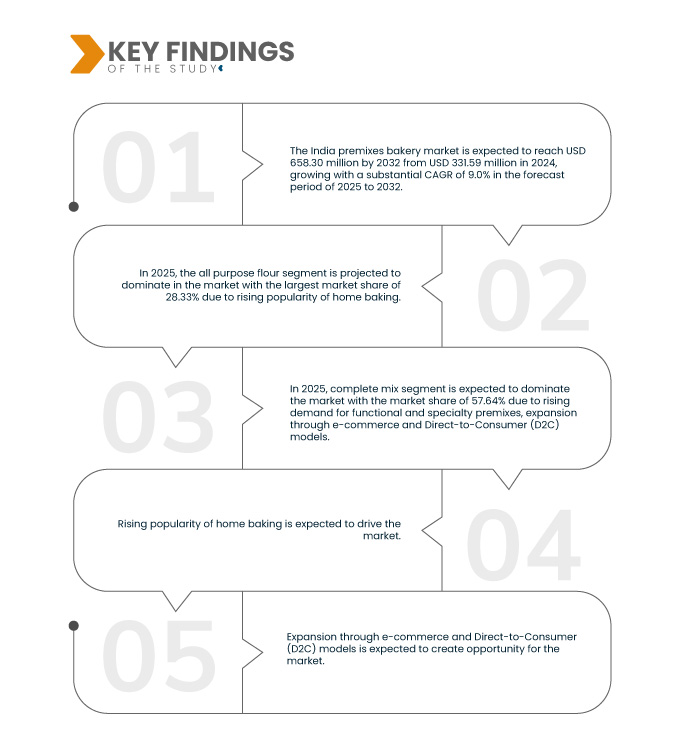

Data Bridge market research analyzes that the India Premixes Bakery Market is expected to reach USD 658.30 million by 2032 from USD 331.59 million in 2024, growing with a substantial CAGR of 9.0% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising Popularity of Home Baking

The growing popularity of home baking across urban India is a significant driver for the bakery premixes market. Triggered by lifestyle changes, social media inspiration, and pandemic-induced habits, many individuals—especially millennials and Gen Z—have embraced baking as a leisure activity or side hustle. This trend has accelerated the demand for convenient, time-saving, and consistent baking solutions. Bakery premixes simplify intricate recipes into user-friendly formats, making them accessible and manageable even for beginners in the kitchen.

Platforms like Instagram and YouTube have popularized aesthetic baking, encouraging experimentation with cakes, cupcakes, cookies, and breads. Ready-made premixes remove the need for measuring ingredients or having in-depth culinary knowledge, making them highly accessible to home bakers. Brands are also introducing healthier variants, such as multigrain, millet, and gluten-free premixes, to cater to wellness-conscious consumers.

The rise of home-based bakeries and micro-entrepreneurial ventures in metros and tier-2 cities further amplifies premix demand. These ventures depend on premixes for quality control, faster production, and recipe replication at scale. E-commerce and D2C channels have also expanded availability, making it easier for home bakers to explore and purchase specialized premix products.

Report Scope and India Premixes Bakery Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2018-2023 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product Type (Complete Mix, Dough Base Mix, and Dough Concentrate), Base Flour Ingredient (All Purpose Flour, Whole Wheat, Semolina, Multigrain, Rye, Oat, Chia, Millet, and Others), Product Category (Eggless and With Egg), Flavor (Flavored and Non Flavored), Nature (Conventional and Organic), Claim (Without Claim and With Claim), Form (Powder and Liquid), Brand Category (Branded and Private Labeled), Price (Mass and Premium), Packaging (Bag Packaging, Jars, Pouches, Boxes, Foil Packaging, and Others), Packaging Quantity (Above 1000 G, 500 1000 G, 150 500 G, 150 250 G, Up To 150 G), Application (Cake, Bread, Pastry, Cookie, Donut, Muffin, Waffle, Brownie, Croissant, Mousse, Pizza, Sourdough, and Others), End-Use (Food Service and Retail/Household), Distribution Channel (Retail (B2C) and Direct (B2B))

|

|

Countries Covered

|

India

|

|

Market Players Covered

|

KCG Corporation Public Company Limited (Thailand), IFFCO (UAE), Cargill Incorporated. (US), Puratos Group (Belgium), Bunge. (U.S), ADM (U.S.), General Mills Inc. (U.S.), Nimje Industries. (India). Bakels (Switzerland), DANBROFOOD. (India), AB Mauri India Pvt.Ltd (U.K), ZionFoods (India), Frigorifico Allana Pvt Ltd. (India), Amrut MR Kool Food Products Private Limited. (India), Delta Nutritives Pvt. Ltd. (India), Midas (U.S.), PURE TEMPTATION PVT. LTD. (India), L. Liladhar & Co. (India), Ikone Foods, Corbion (Netherlands), Aarkay Food Products Ltd. (India), Calpro Food Essentials Pvt. Ltd. (India), Addinova (India), Tropilite Foods Pvt. Ltd. (India), Surebake, Bijur Sooper Foods Pvt. Ltd (India), Biolaxi Enzymes. (India), Chef Zone International Food Private Limited. (India), Bakersville (India), Lesaffre (France)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The India premixes bakery market is segmented into fourteen notable segments based on product type, base flour ingredient, product category, flavor, nature, claim, form, brand category, price, packaging, packaging quantity, application, end-use, and distribution channel.

- On the basis of product type, the market is segmented into complete mix, dough base mix, dough concentrate

In 2025, the complete mix segment is expected to dominate the India premixes bakery market

In 2025, the complete mix isolates segment is expected to dominate the market with a market share of 57.64%, due to rising urbanization and working population, rising popularity of home baking.

- On the basis of base flour ingredient, the market is segmented into all purpose flour, whole wheat, semolina, multigrain, rye, oat, chia, millet, others.

In 2025, the all purpose flour is expected to dominate the India premixes bakery market

In 2025, the all purpose flour is expected to dominate the market with a market share of 28.33% due to its longer shelf life, cost-effectiveness, easy storage and transport, and wide use in processed foods.

- On the basis of product category, the market is segmented into eggless, with egg. In 2025, the, eggless is expected to dominate the market with a market share of 72.44%

- On the basis of flavor, the market is segmented into flavored, non-flavoured. In 2025, the flavored segment is expected to dominate the market with a market share of 54.42%

- On the basis of nature, the market is segmented into conventional, organic. In 2025, the conventional segment is expected to dominate the market with a market share of 69.77%

- On the basis of claim, the market is segmented into without claim, with claim. In 2025, the claim segment is expected to dominate the market with a market share of 54.82%

- On the basis of form, the market is segmented into powder, liquid. In 2025, the powder segment is expected to dominate the market with a market share of 73.45%

- On the basis of brand category, the market is segmented into branded, private labeled. In 2025, the branded segment is expected to dominate the market with a market share of 67.19%.

- On the basis of price, the market is segmented into mass, premium. In 2025, the mass segment is expected to dominate the market with a market share of 70.15%

- On the basis of packaging, the market is segmented into bag packaging, jars, pouches, boxes, foil packaging, others. In 2025, the bag packaging segment is expected to dominate the market with a market share of 36.33%

- On the basis of packaging quantity, the market is segmented into above 1000 g, 500 1000 g, 150 500 g, 150 250 g, up to 150 g. In 2025, the above 1000 g is expected to dominate the market with a market share of 43.40%

- On the basis of application, the market is segmented into cake, bread, pastry, cookie, donut, muffin, waffle, brownie, croissant, mousse, pizza, sourdough, others. In 2025, the cake segment is expected to dominate the market with a market share of 23.40%

- On the basis of end-use, the market is segmented into food service, retail/household. In 2025, the food service is expected to dominate the market with a market share of 78.88%

- On the basis of distribution channel, the market is retail (b2c), direct (b2b). In 2025, the retail (b2c) segment is expected to dominate the market with a market share of 68.91%

Major Players

Data Bridge Market Research Analyses KCG Corporation Public Company Limited. (Thailand), IFFCO (U.S.), Cargill, Incorporated. (U.S.), Puratos Group (Belgium), Bunge. (U.S.), among others as the major market players of the market.

Market Developments

- In June 2025, General Mills is accelerating its growth in the pet food category by expanding its Blue Buffalo brand into the fresh pet food segment, with products expected to hit U.S. shelves by late 2025. This move targets the rapidly growing fresh pet food market, which is projected to expand from around USD 3 billion today to USD 10 billion within the next decade.

- In March 2023, KCG Corporation Public Company Limited, a leading producer and importer of butter, cheese, and ready-to-eat products, unveiled its growth strategy aimed at innovation, production expansion, and sustainable business. With over 64 years in the food industry, KCG focuses on developing health-conscious products, enhancing production with advanced technology, and expanding distribution both locally and internationally. The company’s three main product groups include dairy products, food and bakery ingredients, and biscuits. Backed by strong brands like Allowrie, Imperial, and Dairygold, KCG plans to double cheese production and boost butter output by 2024 while promoting ESG practices and supporting the evolving lifestyles of modern consumers.

As per Data Bridge Market Research analysis:

For more detailed information about the India Premixes Bakery Market report, click here – https://www.databridgemarketresearch.com/reports/india-bakery-premixes-market