The Middle East Dredging Market is currently experiencing a notable rise in mining activities, indicating a rapid and substantial market expansion across the region. This robust growth can be attributed to the increasing demand for dredging services and associated activities. The Middle East region is witnessing a significant increase in dredging operations, indicating a thriving industry that extends beyond local borders.

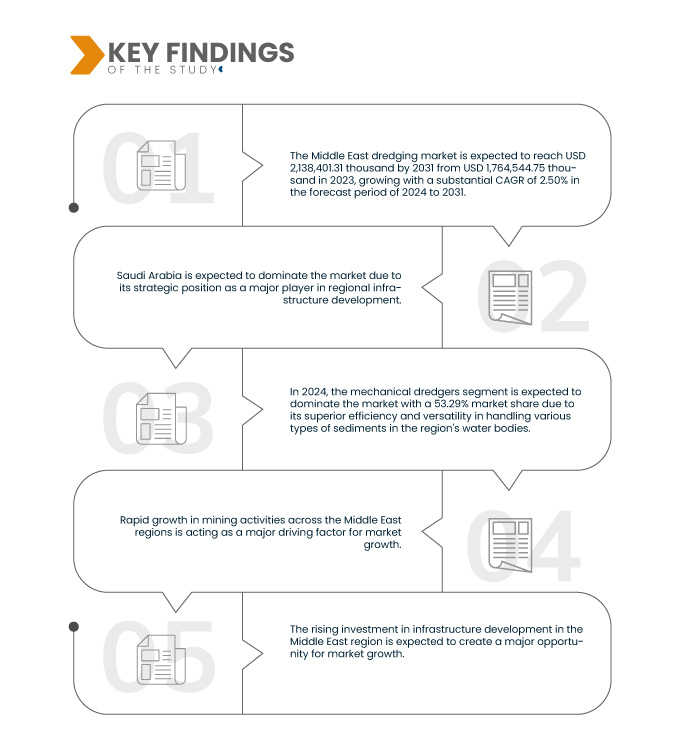

The rapid growth of mining activities across the Middle East region has significantly contributed to the market expansion. The escalating demand for minerals and resources has driven extensive dredging operations, leading to increased infrastructure development and economic prosperity. This rise in mining-related projects underscores the pivotal role of dredging in facilitating navigation, harbor maintenance, and reclaiming land for ambitious ventures. The dredging industry is positioned to play a vital role in maintaining and enriching the region's economic environment in the years ahead as the mining sector in the Middle East continues to thrive.

Access Full Report @ https://www.databridgemarketresearch.com/reports/middle-east-dredging-market

Data Bridge Market Research analyzes that the Middle East Dredging Market is expected to reach USD 2,138,401.31 thousand by 2031 from USD 1,764,544.75 thousand in 2023, growing with a substantial CAGR of 2.50% during the forecast period of 2024 to 2031.

Key Findings of the Study

Rising Demand for Efficient and Cost-Effective Solutions

The dredging sector has become a crucial component to facilitate economic growth and international trade as countries in the Middle East continue to invest heavily in infrastructure development, particularly in coastal areas and ports. The rising demand for efficient dredging solutions is attributed to the necessity of maintaining navigable waterways, expanding port capacities, and mitigating the impact of sedimentation on maritime activities.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Offering (Mechanical Dredgers, Hydraulic Dredgers, Mechanical/Hydraulic Dredgers, Hydrodynamic Dredgers, and Auxiliary Equipment), Service Type (Maintenance Dredging, Capital Dredging, and Remedial Dredging), Material (Sandy & Gravel, Clay & Slit, Rock, and Others), Dredging Depth (Shallow Water Dredging and Deep Water Dredging), Area of Operation (Sea, Harbour, River, Lakes & Canals, and Others), Transportation Mode (Pipeline and Barges), Deployment (Offshore and Onshore), Application (Urban Development, Trade Activity, Trade Maintenance, Coastal Protection, Energy Infrastructure, Land Reclamation, and Leisure), End-User (Oil & Gas, Metal & Mining, Renewables, Government, Food & Agriculture and Others)

|

|

Countries Covered

|

Saudi Arabia, U.A.E., Egypt, Israel, Qatar, Bahrain, Kuwait, Oman, and Rest of Middle East

|

|

Market Players Covered

|

Boskalis (Netherlands), Tidewater Co. (Iran), Holland Dredging Industries BV (Netherlands), DEME (Belgium), Jan De Nul (Belgium), ARCHIRODON S.A. (Belgium), National Marine Dredging Company (U.A.E.), Union Dredgers & Marine Contracting LLC (U.A.E.), Gulf Cobla (L.L.C.) (U.A.E.), Van Oord nv (Netherlands), Xylem (U.A.E.), LAGERSMIT (Netherlands), and Al Nasser Holdings LLC (U.A.E.) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

|

Segment Analysis

The Middle East dredging market is segmented into nine notable segments based on offering, service type, material, dredging depth, area of operation, transportation mode, application, deployment, and end-user.

- On the basis of offering, the market is segmented into mechanical dredgers, hydraulic dredgers, mechanical/hydraulic dredgers, hydrodynamic dredgers, and auxiliary equipment

In 2024, the mechanical dredgers segment is expected to dominate the Middle East dredging market

In 2024, the mechanical dredgers segment is expected to dominate the market with a 53.29% market share due to its superior efficiency and versatility in handling various types of sediments in the region's water bodies.

- On the basis of service type, the market is segmented into maintenance dredging, capital dredging, and remedial dredging

In 2024, the maintenance dredging segment is expected to dominate the Middle East dredging market

In 2024, the maintenance dredging segment is expected to dominate the market with a 47.61% market share due to its operational efficiency and cost-effectiveness.

- On the basis of material, the market is segmented into sand & gravel, clay & slit, rock, and others. In 2024, the sand & gravel segment is expected to dominate the market with a 41.40% market share

- On the basis of dredging depth, the market is segmented into shallow water dredging and deep water dredging. In 2024, the shallow water dredging segment is expected to dominate the market with a 55.64% market share

- On the basis of area of operation, the market is segmented into sea, harbour, river, lakes & canals, and others. In 2024, the sea segment is expected to dominate the market with a 43.65% market share

- On the basis of transportation mode, the market is segmented into pipeline and barges. In 2024, the pipeline segment is expected to dominate the market with a 56.44% market share

- On the basis of deployment, the market is segmented into offshore and onshore. In 2024, the offshore segment is expected to dominate the market with a 79.29% market share

- On the basis of application, the market is segmented into urban development, trade activity, trade maintenance, coastal protection, energy infrastructure, land reclamation, and leisure. In 2024, the urban development segment is expected to dominate the market with a 30.40% market share

- On the basis of end-user, the market is segmented into oil & gas, metal & mining, renewables, government, food & agriculture, and others. In 2024, the oil & gas segment is expected to dominate the market with a 38.19% market share

Major Players

Data Bridge Market Research analyzes National Marine Dredging Company (U.A.E.), Jan De Nul (Belgium), ARCHIRODON S.A. (Belgium), Boskalis (Netherlands), DEME (Belgium) as major market players in Middle East dredging market.

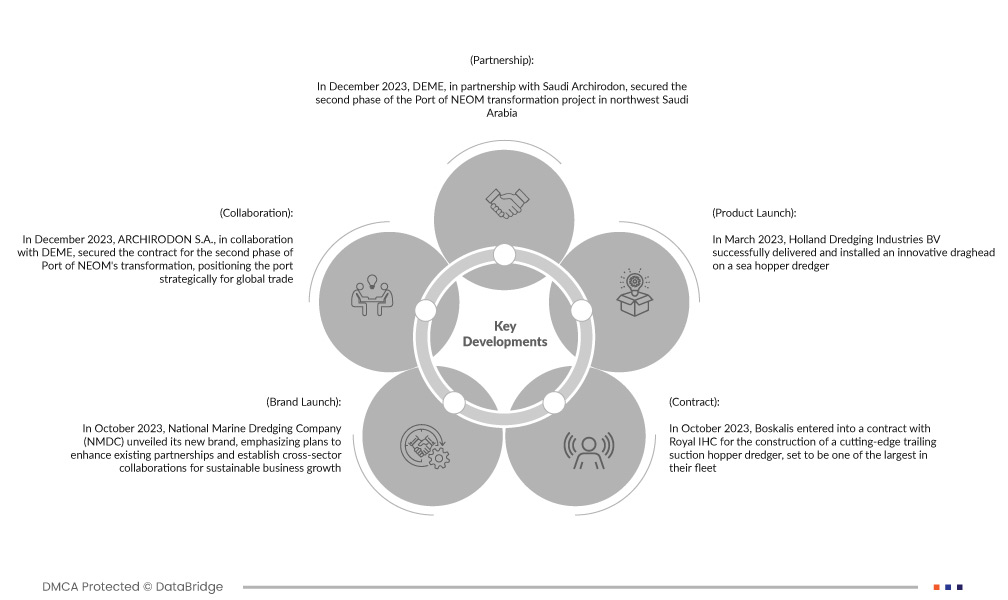

Market Developments

- In December 2023, DEME, in partnership with Saudi Archirodon, secured the second phase of the Port of NEOM transformation project in northwest Saudi Arabia. The strategic development, crucial for NEOM's economic goals, involves constructing a sustainable port basin that can accommodate the world's largest ships, reflecting DEME's technical prowess and engineering expertise

- In December 2023, ARCHIRODON S.A., in collaboration with DEME, secured the contract for the second phase of Port of NEOM's transformation, positioning the port strategically for global trade. The initiative, which commenced in December 2023, aimed to create a basin facilitating the entry of the world's largest ships, contributing to NEOM's economic ambitions and regional significance

- In October 2023, National Marine Dredging Company (NMDC) unveiled its new brand, emphasizing plans to enhance existing partnerships and establish cross-sector collaborations for sustainable business growth. NMDC Group's CEO, Mr. Yasser Zaghloul, highlighted a commitment to a sustainable energy future through innovation and strategic alliances. The Abu Dhabi-based dredging leader aims to explore collaborations with governments and the private sector to contribute to industry-wide decarbonization targets. NMDC remains dedicated to fostering growth while aligning with Abu Dhabi's cultural renaissance and the U.A.E.'s sustainable initiatives

- In October 2023, Boskalis entered into a contract with Royal IHC for the construction of a cutting-edge trailing suction hopper dredger, set to be one of the largest in their fleet. Featuring a 31,000 m3 hopper capacity, the vessel will boast energy-efficient innovations, including full diesel-electric installation, Azipods propulsion, and the ability to utilize (green) methanol as an alternative fuel. With anticipated service commencement in mid-2026, this development underscores Boskalis' commitment to a more sustainable dredging fleet

- In March 2023, Holland Dredging Industries BV successfully delivered and installed an innovative draghead on a sea hopper dredger. The new draghead, featuring replaceable nozzles, plates, and teeth, includes stainless steel plates on the visor for rubber protection. HDD reports a remarkable 30% reduction in loading time with this enhancement, showcasing the company's commitment to efficiency. HDD also highlights its capability to supply all components for transforming existing ships into hopper dredgers, collaborating with Dutch shipyards for the process. The addition of stainless steel plates on the visor enhances rubber protection. This innovative draghead has proven to reduce loading times by 30%, showcasing HDD's commitment to efficiency in dredging activities. HDD also offers comprehensive components for TSHDs, enabling the transformation of existing ships into efficient hopper dredgers through collaborations with Dutch shipyards

Regional Analysis

Geographically, the countries covered in this market report are Saudi Arabia, U.A.E., Egypt, Israel, Qatar, Bahrain, Kuwait, Oman, and Rest of Middle East.

As per Data Bridge Market Research analysis:

Saudi Arabia is expected to dominate and is estimated to be the fastest-growing country in the Middle East dredging market

Saudi Arabia is expected to dominate and fastest growing in the market due to its strategic position as a major player in regional infrastructure development. The country's substantial investments in dredging initiatives align with its ambitious Vision 2030, fostering economic diversification and maritime trade expansion. Saudi Arabia's leadership in the oil & gas sector further propels infrastructure dredging, solidifying its central role in shaping the market.

For more detailed information about the Middle East dredging market report, click here – https://www.databridgemarketresearch.com/reports/middle-east-dredging-market