في السنوات الأخيرة، شهد العالم ارتفاعًا ملحوظًا في انتشار مرض السيلياك، ليصبح مصدر قلق صحي كبير. مرض السيلياك هو اضطراب مناعي ذاتي يتميز بعدم تحمل الغلوتين، وهو بروتين موجود في القمح والشعير والجاودار. وقد ازداد انتشار مرض السيلياك في السنوات الأخيرة، وهناك عدة عوامل تساهم في هذا الارتفاع.

للداء البطني عامل وراثي قوي. الأفراد الذين لديهم تاريخ عائلي للإصابة بالمرض أكثر عرضة للإصابة به. ويتمثل أقوى عامل خطر وراثي للإصابة بالداء البطني في وجود جينات محددة لمستضد الكريات البيضاء البشرية (HLA)، وخاصةً HLA-DQ2 وHLA-DQ8. ويتم تحديد المزيد من الأفراد المعرضين للخطر، مما يؤدي إلى زيادة التشخيصات مع تزايد شيوع الفحص الجيني.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/north-america-and-europe-celiac-disease-market

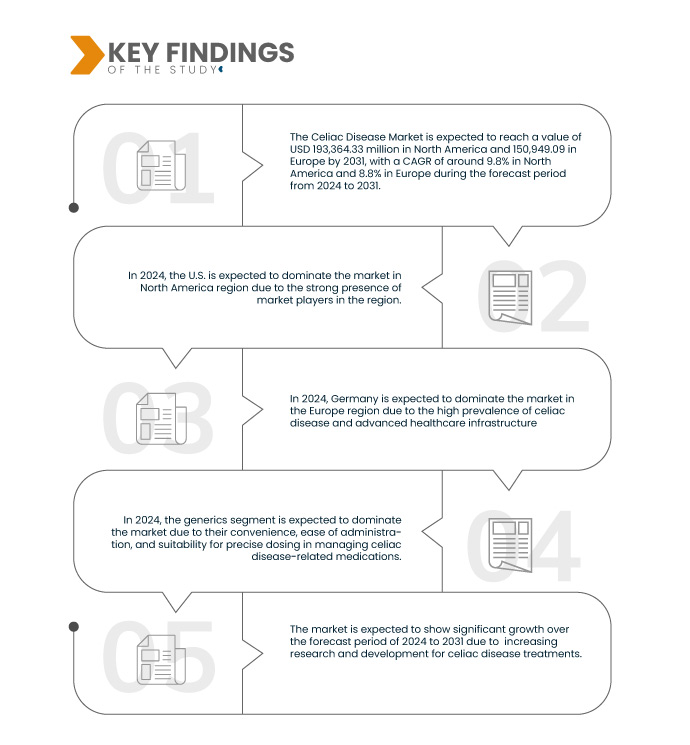

تحلل شركة Data Bridge Market Research أن سوق مرض الاضطرابات الهضمية في أمريكا الشمالية وأوروبا من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 9.8٪ في أمريكا الشمالية و8.8٪ في أوروبا في الفترة المتوقعة من 2024 إلى 2031 ومن المتوقع أن يصل إلى 193،364.33 ألف دولار أمريكي في أمريكا الشمالية و150،949.09 ألف دولار أمريكي في أوروبا بحلول عام 2031. ومن المتوقع أن يدفع قطاع الكورتيكوستيرويدات نمو السوق بسبب خصائصه المضادة للالتهابات، والتي تخفف الأعراض بشكل فعال وتعزز التئام الغشاء المخاطي لدى الأفراد المصابين بمرض الاضطرابات الهضمية.

النتائج الرئيسية للدراسة

العلاجات البيولوجية الناشئة لمرض الاضطرابات الهضمية

تُمثل العلاجات البيولوجية الناشئة لداء السيلياك سبيلاً واعداً لتطوير علاجات بديلة تتجاوز معيار الرعاية الحالي، وهو اتباع نظام غذائي خالٍ من الغلوتين مدى الحياة. ورغم أن هذه العلاجات لا تزال في مراحلها التجريبية وتخضع للتجارب السريرية ، إلا أنها تحمل في طياتها إمكانية معالجة التعقيدات المرتبطة بداء السيلياك، مما يُتيح إمكانيات جديدة للأفراد المصابين بهذا الاضطراب المناعي الذاتي.

بعض العلاجات البيولوجية الناشئة لمرض الاضطرابات الهضمية هي:

- العلاجات المُعدِّلة للمناعة : تُركِّز بعض العلاجات البيولوجية على تعديل الاستجابة المناعية المرتبطة بالداء البطني. ويشمل ذلك تدخلات تهدف إلى تثبيط الاستجابة المناعية الشاذة الناتجة عن تناول الغلوتين. ويستكشف الباحثون استخدام عوامل تعديل المناعة لتحقيق تحمُّل الغلوتين دون التسبب في كبت مناعي عام.

- العلاج المناعي الخاص بالغلوتين : العلاج المناعي الخاص بالغلوتين هو نهج مُستهدف يهدف إلى تحفيز تحمل الجهاز المناعي لبروتينات الغلوتين. يتضمن ذلك تعريض المصابين بالداء البطني لكميات مُتحكم بها ومتزايدة تدريجيًا من الغلوتين لتقليل حساسية الجهاز المناعي. تُجري التجارب السريرية حاليًا دراسات حول سلامة وفعالية أشكال مُختلفة من العلاج المناعي للغلوتين، بما في ذلك الإعطاء عن طريق الفم وتحت اللسان وعن طريق الجلد.

- العلاجات الإنزيمية: تُستكشف العلاجات القائمة على الإنزيم كوسيلة لتكسير الغلوتين في الجهاز الهضمي، مما قد يُخفف من الاستجابة المناعية. وتُجرى أبحاث لتطوير إنزيمات قادرة على تفكيك الغلوتين بكفاءة إلى شظايا غير مناعية، مما يُقلل من احتمالية إثارة رد فعل مناعي. يمكن إعطاء هذه الإنزيمات مع الوجبات للمساعدة في هضم الغلوتين غير المقصود.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2020-2021)

|

الوحدات الكمية

|

الإيرادات بالألف دولار أمريكي، الأحجام بالوحدات

|

القطاعات المغطاة

|

نوع العلاج (الكورتيكوستيرويدات، مثبطات المناعة ، وغيرها)، نوع المرض (داء سيلياك الكلاسيكي، داء سيلياك غير الكلاسيكي، داء سيلياك المقاوم، داء سيلياك المحتمل، والتهاب الجلد الحلئي)، نوع الدواء (الأدوية الجنيسة والعلامات التجارية)، نوع الوصفة الطبية (الوصفة الطبية وبدون وصفة طبية)، شكل الجرعة (أقراص، كبسولات، حقن، وغيرها)، طريقة الإعطاء (عن طريق الفم، عن طريق الوريد، وموضعي)، نوع السكان (الأطفال، والبالغون، وكبار السن)، المستخدم النهائي (المستشفيات، والعيادات، ومراكز التشخيص، وإعدادات الرعاية المنزلية، وغيرها)، قناة التوزيع (صيدلية المستشفى، صيدلية التجزئة، صيدلية الإنترنت، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة، كندا، المكسيك، المملكة المتحدة، ألمانيا، فرنسا، إيطاليا، إسبانيا، روسيا، تركيا، بلجيكا، هولندا، سويسرا، الدنمارك، النرويج، السويد، فنلندا، بولندا وبقية أوروبا

|

الجهات الفاعلة في السوق المغطاة

|

شركة GSK plc. (المملكة المتحدة)، شركة Janssen Pharmaceuticals, Inc. (الولايات المتحدة)، شركة Pfizer Inc. (الولايات المتحدة)، شركة Teva Pharmaceuticals USA, Inc. (إسرائيل)، شركة Tillotts Pharma AG. (سويسرا)، شركة Novartis AG (سويسرا)، شركة Amgen Inc. (الولايات المتحدة)، شركة Salix Pharmaceuticals AdvaCare Pharma (الولايات المتحدة)، شركة ImmunogenX., Inc. (الولايات المتحدة)، شركة ANOKION (سويسرا)، شركة Topas Therapeutics (ألمانيا)، شركة Immunic Therapeutics (الولايات المتحدة)، شركة Equillium Bio. (الولايات المتحدة)، وشركة Takeda Pharmaceutical Company Limited (اليابان).

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات:

يتم تقسيم سوق مرض الاضطرابات الهضمية في أمريكا الشمالية وأوروبا إلى تسعة قطاعات بارزة بناءً على نوع العلاج ونوع المرض ونوع الدواء ونوع الوصفة الطبية وشكل الجرعة وطريقة الإدارة ونوع السكان والمستخدم النهائي وقناة التوزيع.

- على أساس نوع العلاج، يتم تقسيم السوق إلى الكورتيكوستيرويدات ومثبطات المناعة وغيرها

في عام 2024، من المتوقع أن يهيمن قطاع الكورتيكوستيرويدات على سوق مرض الاضطرابات الهضمية في أمريكا الشمالية وأوروبا

في عام 2024، من المتوقع أن تهيمن شريحة الكورتيكوستيرويدات على سوق أمريكا الشمالية بحصة سوقية تبلغ 69.01% وسوق أوروبا بحصة سوقية تبلغ 71.56%، وذلك بسبب خصائصها المضادة للالتهابات، والتي تخفف الأعراض بشكل فعال وتعزز التئام الغشاء المخاطي لدى الأفراد المصابين بمرض الاضطرابات الهضمية.

- على أساس نوع المرض، يتم تقسيم السوق إلى مرض الاضطرابات الهضمية المقاوم، والتهاب الجلد الحلئي، ومرض الاضطرابات الهضمية المحتمل، ومرض الاضطرابات الهضمية الكلاسيكي، ومرض الاضطرابات الهضمية غير الكلاسيكي.

في عام 2024، من المتوقع أن يهيمن قطاع مرض الاضطرابات الهضمية المقاوم على سوق مرض الاضطرابات الهضمية في أمريكا الشمالية وأوروبا

في عام 2024، من المتوقع أن تهيمن شريحة مرض الاضطرابات الهضمية المقاوم على سوق أمريكا الشمالية بحصة سوقية تبلغ 50.39% وسوق أوروبا بحصة سوقية تبلغ 54.47%، وذلك بسبب طبيعتها الصعبة والمستمرة، والتي تتطلب إدارة متخصصة وتساهم في عبء رعاية صحية كبير في هذه المناطق.

- بناءً على نوع الدواء، يُقسّم السوق إلى أدوية ذات علامات تجارية وأدوية جنيسة. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأدوية الجنيسة على سوق أمريكا الشمالية بحصة سوقية تبلغ ٧٩.٢٤٪، وسوق أوروبا بحصة سوقية تبلغ ٨٠.٩٥٪.

- بناءً على نوع الوصفة الطبية، يُقسّم السوق إلى أدوية بوصفة طبية وأدوية بدون وصفة طبية. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأدوية بوصفة طبية على سوق أمريكا الشمالية بحصة سوقية تبلغ ٩٢.٤٥٪، وسوق أوروبا بحصة سوقية تبلغ ٩٣.٠٧٪.

- بناءً على شكل الجرعة، يُقسّم السوق إلى أقراص وكبسولات وحقن وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأقراص على سوق أمريكا الشمالية بحصة سوقية تبلغ ٧٥.٩٤٪، وسوق أوروبا بحصة سوقية تبلغ ٧٧.٩٢٪.

- بناءً على طريقة الإعطاء، يُقسّم السوق إلى: فموي، وريدي، وموضعي. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الأدوية الفموية على سوق أمريكا الشمالية بحصة سوقية تبلغ ٧٤.٨٨٪، وسوق أوروبا بحصة سوقية تبلغ ٧٤.٨٦٪.

- بناءً على نوع السكان، يُقسّم السوق إلى فئات: البالغين والأطفال وكبار السن. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع البالغين على سوق أمريكا الشمالية بحصة سوقية تبلغ ٥٩.٥٢٪، وسوق أوروبا بحصة سوقية تبلغ ٦٢.٨٥٪.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مستشفيات وعيادات ومرافق رعاية منزلية وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المستشفيات على سوق أمريكا الشمالية بحصة سوقية تبلغ ٦٦.٥٤٪، وسوق أوروبا بحصة سوقية تبلغ ٦٩.٣٠٪.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى صيدليات المستشفيات، وصيدليات التجزئة، والصيدليات الإلكترونية، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع صيدليات المستشفيات على سوق أمريكا الشمالية بحصة سوقية تبلغ ٦٦.٤٠٪، وسوق أوروبا بحصة سوقية تبلغ ٦٩.١٧٪.

اللاعبون الرئيسيون

قامت شركة Data Bridge Market Research بتحليل شركة GSK plc. (المملكة المتحدة) وشركة Janssen Pharmaceuticals, Inc. (الولايات المتحدة) وشركة Pfizer Inc. (الولايات المتحدة) وشركة Teva Pharmaceuticals USA, Inc (إسرائيل) وشركة Tillotts Pharma AG. (سويسرا) باعتبارها اللاعبين الرئيسيين في سوق مرض الاضطرابات الهضمية في أمريكا الشمالية وأوروبا.

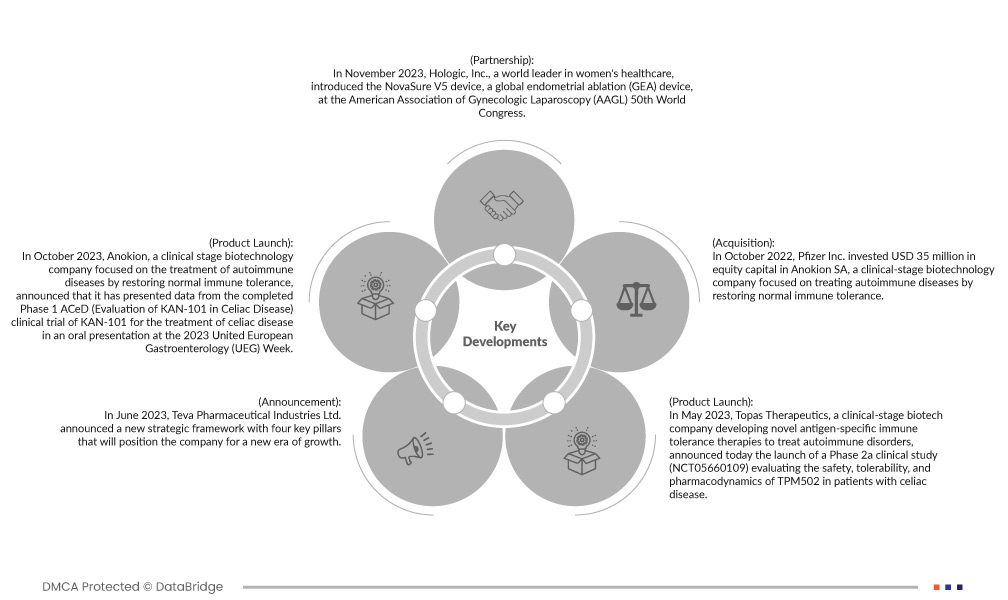

تطوير السوق

- في مايو 2023، أعلنت شركة توباس ثيرابيوتكس، وهي شركة تكنولوجيا حيوية في المرحلة السريرية تُطوّر علاجات جديدة للتحمل المناعي لمستضد محدد لعلاج اضطرابات المناعة الذاتية، عن إطلاق دراسة سريرية من المرحلة 2أ (NCT05660109) لتقييم سلامة وتحمل دواء TPM502 وديناميكيته الدوائية لدى مرضى الداء البطني. ستحدد دراسة المرحلة 2أ قدرة TPM502 على تعزيز التحمل المناعي لدى مرضى الداء البطني، وستؤكد ملف سلامة TPCs. كما ستعزز إمكانات منصة توباس في تطوير عوامل علاجية جديدة لعلاج الأمراض التي تنتقل عبر الخلايا التائية. في نوفمبر 2023، أعلنت شركة مينيرفا سرجيكال، وهي شركة متخصصة في صحة المرأة تُركز على علاج نزيف الرحم غير الطبيعي (AUB)، عن إطلاق تجربة تثقيفية جديدة للنساء: www.aubandme.com. ستُقدّم الشركة هذا الموقع في المؤتمر العالمي الخمسين للجمعية الأمريكية لمناظير أمراض النساء (AAGL) في أوستن، تكساس. وقد ساهم هذا الابتكار في رفع مستوى الوعي لدى النساء حول نزيف الرحم غير الطبيعي.

- في يونيو 2023، أعلنت شركة تيفا للصناعات الدوائية المحدودة عن إطار عمل استراتيجي جديد يعتمد على أربعة ركائز أساسية تُمهّد الشركة لمرحلة جديدة من النمو. تهدف هذه الاستراتيجية إلى تعزيز محفظة الشركة التجارية القوية وأدوية التشابه الحيوي، وتعزيز خط إنتاجها الابتكاري، والحفاظ على مكانتها الرائدة في مجال الأدوية الجنيسة، وتحقيق مركزية أعمالها. من المتوقع أن تُضيف هذه الركائز الأربعة قيمةً وتُعزز تأثيرها الإيجابي على المرضى. تهدف تيفا إلى توسيع خط إنتاجها المبتكر والتركيز على مجالاتها العلاجية الأساسية في علم الأعصاب، وعلم المناعة، وعلم الأورام المناعي، سعياً منها لتكون الشركة الرائدة والأفضل في فئتها.

- في أكتوبر 2023، أعلنت شركة أنوكيون، وهي شركة تكنولوجيا حيوية في المرحلة السريرية تركز على علاج أمراض المناعة الذاتية عن طريق استعادة التحمل المناعي الطبيعي، أنها قدمت بيانات من المرحلة الأولى المكتملة من تجربة ACeD (تقييم KAN-101 في مرض الاضطرابات الهضمية) السريرية لـ KAN-101 لعلاج مرض الاضطرابات الهضمية في عرض شفوي في أسبوع أمراض الجهاز الهضمي الأوروبي المتحد (UEG) لعام 2023. يتميز عرض Encore ببيانات ديناميكية دوائية وحركية دوائية مواتية من دراسة المرحلة الأولى التي أظهرت أن KAN-101 آمن ومقبول لدى البشر المصابين بمرض الاضطرابات الهضمية وحفز التحمل الوظيفي لاستجابات الخلايا التائية الخاصة بالجليادين بعد تحدي الغلوتين. سيساعد العرض الشفوي بعنوان "العرض الديناميكي الدوائي للتحمل المناعي الناجم عن KAN-101"، وهو علاج جديد يستهدف الكبد لمرض الاضطرابات الهضمية، الشركة في تسهيل الموافقة على الدواء.

- في نوفمبر 2023، قدمت شركة هولوجيك، الرائدة عالميًا في مجال رعاية المرأة، جهاز نوفاشور V5، وهو جهاز عالمي لاستئصال بطانة الرحم (GEA)، وذلك خلال المؤتمر العالمي الخمسين للجمعية الأمريكية لتنظير البطن لأمراض النساء (AAGL). يُعد جهاز نوفاشور V5 الجديد والمبتكر، وهو أكثر طرق استئصال بطانة الرحم بحثًا وموثوقية في الولايات المتحدة، التزام هولوجيك المستمر بتحسين تجربة الطبيب.

- في أكتوبر 2022، استثمرت شركة فايزر 35 مليون دولار أمريكي في رأس مال أسهم شركة أنوكيون إس إيه، وهي شركة تكنولوجيا حيوية في المرحلة السريرية تُركز على علاج أمراض المناعة الذاتية من خلال استعادة التحمل المناعي الطبيعي. أبرمت أنوكيون وفايزر اتفاقية لمواصلة التطوير السريري لدواء كان-101، وهو الدواء الرئيسي الذي تُنتجه أنوكيون لعلاج مرض الاضطرابات الهضمية.

التحليل الإقليمي

جغرافيًا، البلدان التي يغطيها تقرير سوق مرض الاضطرابات الهضمية هي الولايات المتحدة وكندا والمكسيك والمملكة المتحدة وألمانيا وفرنسا وإيطاليا وإسبانيا وروسيا وتركيا وبلجيكا وهولندا وسويسرا والدنمارك والنرويج والسويد وفنلندا وبولندا وبقية أوروبا.

وفقًا لتحليل Data Bridge Market Research:

لمزيد من المعلومات التفصيلية حول تقرير سوق مرض الاضطرابات الهضمية، انقر هنا - https://www.databridgemarketresearch.com/reports/north-america-and-europe-celiac-disease-market