金融機構越來越多地利用自助服務終端作為數位交易的重要接觸點,實現無縫現金存款、帳單支付、匯款和其他金融服務。這些自助服務終端在彌補無銀行帳戶和銀行帳戶不足人群的財務缺口方面發揮著至關重要的作用,無需傳統分行即可輕鬆獲得銀行服務。人工智慧驅動的自動化、生物辨識認證和基於二維碼的交易等金融科技的進步正在增強自助服務終端的功能、提高安全性並簡化用戶體驗。隨著數位轉型的加速,自助支付解決方案發展勢頭強勁,促進了金融包容性,減少了對現金的依賴,並推動了數位銀行的廣泛應用。

請參閱完整報告 @ https://www.databridgemarketresearch.com/reports/philippines-payment-kiosk-industry-market

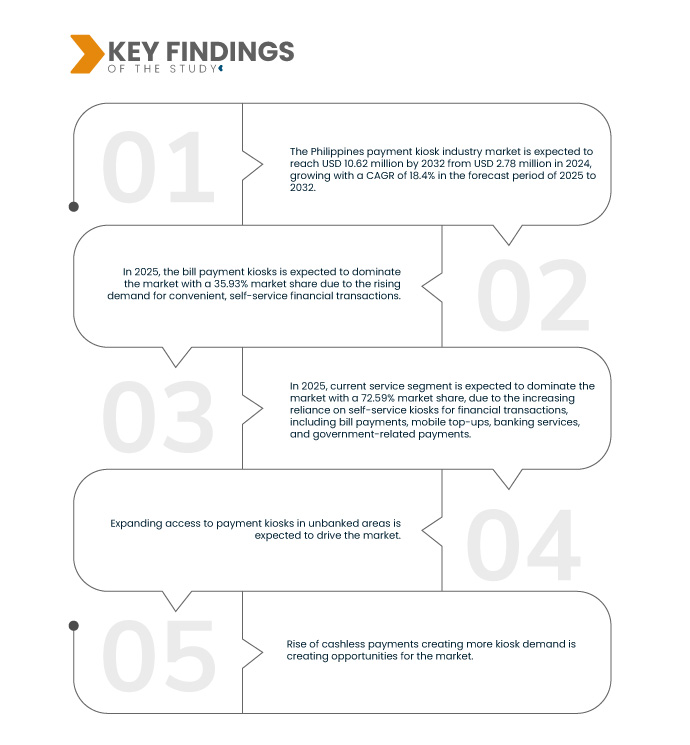

Data Bridge Market Research 分析稱,菲律賓支付亭產業市場預計將從 2024 年的 27.8 億美元增至 2032 年的 106.2 億美元,在 2025 年至 2032 年的預測期內,複合年增長率為 18.4%。

研究的主要發現

自助支付自動化需求不斷成長

消費者和企業越來越尋求更快、更有效率、非接觸式的交易方式,使得自助服務終端成為帳單支付、銀行服務和零售交易的理想解決方案。隨著銀行、金融科技公司和支付提供者擴大其自助服務終端網絡,自助服務自動化正在簡化金融互動、減少等待時間並提高城鄉地區的可近性。

隨著數位化應用的加速,生物辨識認證、二維碼掃描和即時交易處理等先進自助服務終端技術的整合進一步提升了客戶體驗。人們對無現金和自動化服務的日益增長的偏好凸顯了支付亭在塑造菲律賓金融服務的未來、促進金融包容性和營運效率方面發揮的關鍵作用。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2025年至2032年

|

基準年

|

2024

|

歷史歲月

|

2018-2023(2013-2017 年可自訂)

|

定量單位

|

收入(十億美元)

|

涵蓋的領域

|

支付亭類型(帳單支付亭、零售亭、電子商務和匯款亭、交通亭、政府服務亭等)、服務類型(當前服務和管道服務)、支付方式(現金支付、行動錢包、卡支付等)、支付行業(線下、線上和非正式)、應用(自助服務亭、互動亭和銷售點 (PoS) 旅遊亭)、最終用戶(BF

|

覆蓋國家

|

菲律賓

|

涵蓋的市場參與者

|

Diebold Nixdorf, Incorporated(美國)、GCash(菲律賓)、VeriFone, Inc.(美國)、Zebra Technologies Corp.(美國)、Maya(菲律賓)、Electronic Commerce Payments (EC PAY) Inc.(菲律賓)、TouchPay(菲律賓)、XIPHIAS Software Software Technologies Pvt.

|

報告涵蓋的數據點

|

除了市場價值、成長率、市場細分、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。

|

細分分析

根據支付亭類型、服務類型、支付方式、支付產業、應用程式和最終用戶,菲律賓支付亭產業市場分為六個顯著的部分。

- 根據支付亭的類型,菲律賓支付亭產業市場細分為帳單支付亭、零售亭、電子商務和匯款亭、交通亭、政府服務亭等

2025年,帳單支付亭預計將主導菲律賓支付亭產業市場

由於對便利、自助金融交易的需求不斷增長,預計到 2025 年,帳單支付亭將佔據 35.93% 的市場份額,佔據市場主導地位。隨著數位化應用的不斷增加以及政府推動無現金支付的舉措,消費者和企業正在轉向公用事業、電信、銀行和政府服務的自動帳單支付解決方案。

預計到 2025 年,現有服務領域將主導菲律賓支付亭產業市場

到 2025 年,由於人們越來越依賴自助服務亭進行金融交易,包括帳單支付、手機充值、銀行服務和政府相關支付,預計現金服務領域將佔據 72.59% 的市場份額。

- 根據支付方式,菲律賓支付亭產業市場分為現金支付、行動錢包、卡片支付和其他支付方式。 2025 年,現金支付預計將佔據市場主導地位,市佔率達 43.31%

- 根據支付產業,菲律賓支付亭產業市場分為線下、線上和非正式。預計到 2025 年,線下市場將佔據主導地位,市佔率達到 47.83%

- 根據應用,菲律賓支付亭產業市場分為自助服務亭、互動式亭、銷售點 (POS) 亭。到 2025 年,自助服務亭預計將佔據市場主導地位,市佔率達到 61.39%

- 根據最終用戶,菲律賓支付亭產業市場分為零售業、政府業、BFSI(銀行、金融服務和保險)、運輸和旅遊、醫療保健產業等。 2025 年,零售業預計將佔據市場主導地位,市佔率達 34.42%

主要參與者

Data Bridge Market Research 分析了 Diebold Nixdorf, Incorporated。 (美國)、Gcash(菲律賓)、VeriFone, Inc.(美國)、Zebra Technologies Corp.(美國)和 Maya(菲律賓)等是菲律賓支付亭產業市場的主要營運公司

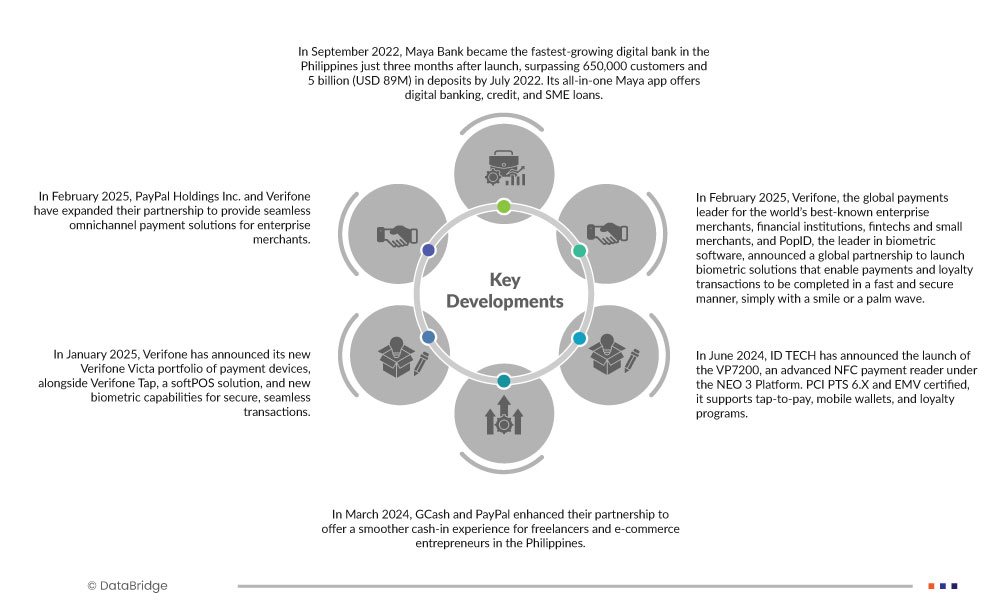

市場發展

- 2025 年 2 月,PayPal Holdings Inc. 與 Verifone 擴大合作夥伴關係,為企業商家提供無縫的全通路支付解決方案。透過將 Verifone 的現場支付技術與 PayPal 的 Braintree 電子商務平台結合,此次合作提供了一個靈活、可擴展的支付系統。憑藉整合的專業知識,兩家公司旨在快速支援全球商家,提高數位和實體通路的交易效率

- 2025 年 1 月,Verifone 宣布推出全新的 Verifone Victa 支付設備系列、軟體 POS 解決方案 Verifone Tap 以及可實現安全無縫交易的全新生物辨識功能。這些創新增強了以客戶為中心的銷售和支付體驗。這些產品將於 1 月 12 日在紐約市 NRF'25 零售盛會上公開展示

- 2024 年 8 月,RBR Data Services 報告稱,Diebold Nixdorf 成為全球第二大自助結帳設備供應商。該公司還在歐洲、中東和非洲地區佔據領先地位,在自助結帳出貨量方面佔有 40% 的市場份額,鞏固了其在零售自動化和數位轉型領域的領導地位

- 2024 年 3 月,GCash 和 PayPal 加強了合作夥伴關係,為菲律賓的自由工作者和電子商務企業家提供更流暢的現金存入體驗。這種改進的整合允許用戶更有效地轉移資金,確保無縫交易。透過此次升級,GCash 繼續賦能數位創業家,為他們提供更快捷、更便捷的金融解決方案,以支持他們在不斷發展的數位經濟中不斷成長的業務

有關菲律賓支付亭行業市場的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/philippines-payment-kiosk-industry-market