Philippines Payment Kiosk Industry Market

Market Size in USD Billion

CAGR :

%

USD

28.32 Billion

USD

97.53 Billion

2024

2032

USD

28.32 Billion

USD

97.53 Billion

2024

2032

| 2025 –2032 | |

| USD 28.32 Billion | |

| USD 97.53 Billion | |

|

|

|

|

Payment Kiosk Industry Market Size

- The Philippines payment kiosk industry market was valued at USD 28.32 billion in 2024 and is expected to reach USD 97.53 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 16.8%, primarily driven by the rising demand for self-service solutions, increased digital payment adoption

- This growth is driven by factors such as the rising demand for self-service options, expansion of digital payment systems, and improved customer experience

Payment Kiosk Industry Market Analysis

- The Payment Kiosk industry represents a rapidly expanding segment within the global fintech and self-service technology landscape. These kiosks are self-service terminals that enable users to perform financial transactions without human assistance, including bill payments, ticketing, retail purchases, mobile top-ups, and banking services. As consumers and businesses increasingly adopt digital payment solutions, payment kiosks serve as a convenient, efficient, and secure channel for completing transactions.

- Payment kiosk manufacturers are integrating advanced technologies such as touchscreen interfaces, NFC (Near Field Communication), QR code scanners, AI, and IoT connectivity to enhance functionality and user experience. These innovations align with the global shift toward cashless economies and enable kiosks to offer secure, real-time transactions. Additionally, the rise in demand for contactless payment options, especially following the COVID-19 pandemic, has accelerated adoption across retail, banking, transport, and government sectors.

- The Philippines is expected to dominate the Payment Kiosk Market and emerge as the fastest-growing region during the forecast period. This growth is driven by increasing digital transformation initiatives, the need for greater financial inclusion, and the expansion of kiosk deployment in both urban and underserved rural areas. Payment kiosks in the Philippines are playing a pivotal role in extending banking and financial services to remote communities with limited access to traditional infrastructure.

- The Bill Payment Kiosks segment is projected to hold the largest market share in 2025, owing to the high demand for self-service bill payment options across utilities, telecom, and government services. These kiosks offer consumers 24/7 accessibility, reduce queuing times, and improve operational efficiency for service providers. Their wide adoption highlights their essential role in facilitating routine financial tasks in a user-friendly manner.

Report Scope and Payment Kiosk Industry Market Segmentation

|

Attributes |

Payment Kiosk Industry Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

Philippines |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Payment Kiosk Industry Market Trends

“Increasing Adoption of Contactless Payment Kiosks”

- In recent years, contactless payment kiosks have become a significant trend in the payment kiosk industry. With the growing preference for hygiene and safety, especially post-pandemic, many consumers are opting for touchless payment solutions.

- These kiosks allow users to make payments using NFC-enabled devices like smartphones or contactless credit cards, reducing the need for physical contact.

- This shift not only enhances convenience but also ensures faster transactions, helping businesses cater to the demand for speed and safety.

- For instance, Retailers, airports, and public transportation systems are increasingly deploying these contactless kiosks to provide a seamless, secure user experience.

- As consumer expectations evolve, the demand for contactless payment solutions is likely to keep rising, further driving innovation in the kiosk market

Payment Kiosk Industry Market Dynamics

Driver

“Banks and Fintechs Expanding Kiosk Services Nationwide”

- As financial institutions enhance accessibility, kiosks are becoming key touchpoints for digital payments, cash deposits, bill settlements, and remittances, catering to the unbanked and underbanked population

- Fintech innovation is further accelerating adoption, integrating AI, biometric authentication, and QR-based transactions to improve efficiency and security. This trend is reshaping the country’s financial landscape, fostering financial inclusion, and boosting the demand for self-service payment solutions

- The expansion of kiosk services by banks and fintechs across the Philippines is transforming the country’s payment landscape

- These self-service kiosks enhance financial accessibility, providing convenient, secure, and efficient transactions for both banked and unbanked individuals. By integrating digital banking with physical touchpoints, they bridge the financial gap, reduce transaction times, and support financial inclusion

- As more institutions invest in kiosk technology, the payment ecosystem will continue evolving toward greater convenience, efficiency, and accessibility for all Filipinos

- For instance, In March 2025, according to an article published by the Bank of Commerce, the bankcom deployed Cash Kiosks in 57 key locations nationwide, allowing clients to deposit cash anytime without teller assistance. These kiosks accepted Php 100, 200, 500, and 1,000 bills, offering a user-friendly and flexible solution for managing deposits. This initiative improved banking convenience, reduced branch congestion, and provided round-the-clock access to essential financial services

- The initiative leveraged technology to enhance daily financial activities. It also supported digital transformation and financial inclusion across the Philippines

Opportunity

“Integrating with Mobile Wallets for Seamless Payments”

- Integrating payment kiosks with popular mobile wallets like Gcash, Maya, and Coins.ph presents a significant opportunity for the payment kiosk market.

- This integration allows for seamless, cashless transactions, enhancing convenience for users who prefer digital payment methods. By enabling customers to load funds, pay bills, or complete purchases directly through their mobile wallets at kiosks, it provides a more efficient and user-friendly experience.

- As mobile wallet usage continues to rise in the Philippines, this integration can help drive wider adoption of kiosks and offer a convenient, secure payment option for users across various sectors.

- For instance,TouchPay, one of the first Automated Payment Machine (APM) providers in the Philippines, offers a fast, secure, and convenient way to process transactions, eliminating long queues for bill payments, government fees, and more

- This real-time processing and broad biller network make kiosk-mobile wallet integration an essential growth driver, offering a hassle-free payment experience and expanding the reach of digital financial services

Restraint/Challenge

“Limited Internet Connectivity in Rural and Remote Areas”

- Limited internet connectivity in rural and remote areas restricts the seamless operation of payment kiosks, preventing users from completing digital transactions efficiently

- Many locations lack the necessary infrastructure to support real-time processing, leading to delays and transaction failures

- This limitation discourages potential users from adopting digital payment solutions, slowing down market expansion. Without stable connectivity, kiosks struggle to provide consistent service, reducing their reliability in underserved regions

- As a result, the full potential of payment kiosks remains unrealized, limiting their reach and impact on financial inclusion efforts

- For instance, In May 2020, as per Opensignal's analysis, mobile networks in the Philippines were more resilient in urban areas than in rural regions during the crisis. Over seven months ending March 31, rural areas experienced a decline in network performance, with Visayas dropping 7.5%, North and Central Luzon by 10.3%, and South Luzon and Mindanao facing the worst reductions at 16.2% and 21.2%, respectively

- The decline in mobile connectivity limited digital transactions in rural regions, affecting the reliability of payment kiosks and restricting financial accessibility

Payment Kiosk Industry Market Scope

The global Cereals market is segmented into five notable segments based on type of payment kiosks, service type, payment mode, payment industry, application, and end-user.

• By Type Of Payment Kiosks

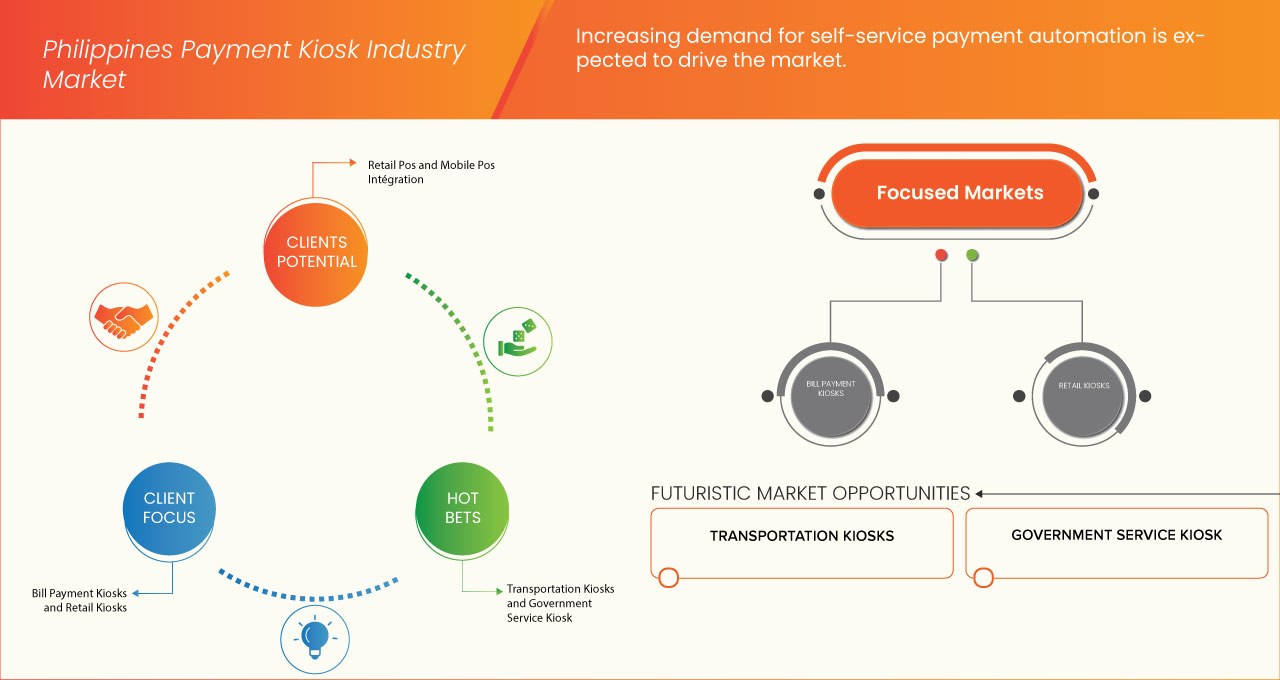

On the basis of type of payment kiosks, the Philippines payment kiosk industry market is segmented into Bill payment kiosks, retail kiosks, e-commerce and remittance kiosk, transportation kiosks, government service kiosk and others. In 2025, bill payment kiosks segment is expected to dominates the philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the rising demand for convenient, self-service financial transactions. With increasing digital adoption and government initiatives promoting cashless payments, consumers and businesses are shifting towards automated bill payment solutions for utilities, telecom, banking, and government services.

By service type

On the basis of service type, the Philippines payment kiosk industry market is segmented into current service and pipeline service. Current service is further sub-segmented into cash in, bills payment, mobile top-ups, transport top-ups. Pipeline service is further sub-segmented into cash out, cardless withdrawals, deposit acceptance. In 2025, current service segment is expected to dominates the Philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the increasing reliance on self-service kiosks for financial transactions, including bill payments, mobile top-ups, banking services, and government-related payments.

By Payment Mode

On the basis of payment mode, the Philippines payment kiosk industry market is segmented into cash payments, mobile wallets, card payments and others. In 2025, cash payments segment is expected to dominate the Philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the country's high cash dependency, especially among the unbanked and underbanked population. Despite the growing adoption of digital payments, many Filipinos still prefer cash transactions for bill payments, remittances, and retail purchases.

By Payment Industry

On the basis of payment industry, the Philippines payment kiosk industry market is segmented into offline, online and informal. In 2025, offline segment is expected to dominate the Philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the country’s continued reliance on physical payment infrastructure, particularly in rural and underserved areas with limited internet connectivity.

By Application

On the basis of application, the Philippines payment kiosk industry market is segmented into self-service kiosks, interactive kiosks, Point-Of-Sale (Pos) kiosks. Self-service kiosks are further sub-segmented into retail payments, banking and financial transactions, ticketing and transportation, utility payments, food and beverage, government services and others. Interactive kiosks are further sub-segmented into information and directory, digital advertising and others. Point-Of-Sale (Pos) kiosks is further sub-segmented into retail pos and mobile pos integration. In 2025, self-service kiosks segment is expected to dominates the Philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the the increasing demand for convenient, automated financial transactions across various industries. With the rising adoption of cashless payments, digital wallets, and contactless transactions, businesses and government agencies are deploying self-service kiosks to streamline bill payments, remittances, ticketing, and banking services.

By End-User

On the basis of end-user, the Philippines payment kiosk industry market is segmented into retail sector, government sector, BFSI (banking, financial services, and insurance), transportation & travel, healthcare industry, and others. All the above segments are further sub-segmented on the basis of type into bill payment kiosks, retail kiosks, e-commerce and remittance kiosk, transportation kiosks, government service kiosk, and others. In 2025, offline segment is expected to dominate the Philippines payment kiosk industry market is expected to be the fastest-growing region in the Market during the forecast period due to the country’s continued reliance on physical payment infrastructure, particularly in rural and underserved areas with limited internet connectivity.

Payment Kiosk Industry Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TouchPay

- eTap Inc.

- CLiQQ

- Electronic Commerce Payments (EC PAY) Inc.

- Cebuana Lhuillier

- Palawan Pawnshop

- SM Store

- BPI

- Maya

- Bayad

- GOTyme

- Gcash

Latest Developments in Philippines Payment Kiosk Industry Market

- In August, RBR Data Services reported that Diebold Nixdorf become the world’s second-largest supplier of self-service checkouts. The company also secured the top position in the EMEA region, holding a 40% market share in self-service checkout shipments, reinforcing its leadership in retail automation and digital transformation

- In July, The Dorfladen Freckenfeld – Powered by EDEKA Paul has reopened in Freckenfeld, Germany, as a 24/7 self-service grocery store after closing in May 2023. Diebold Nixdorf (NYSE: DBD) equipped the store with two DN Series EASY eXpress self-service checkouts, ensuring cashless payments and smooth, unmanned operations. The system automatically deletes incomplete transactions after a set time, keeping the store operational at all hours, including weekends

- In February, The Bangko Sentral ng Pilipinas (BSP) has approved the full launch of GCash Overseas, allowing Filipinos in 16 countries to use the GCash app with their international mobile numbers. Initially in beta for six countries, the service will now expand to the UAE, Saudi Arabia, Kuwait, Qatar, South Korea, Taiwan, Singapore, Hong Kong, Spain, and Germany, enabling seamless financial transactions for OFWs

- In February, PayPal Holdings Inc. and Verifone have expanded their partnership to provide seamless omnichannel payment solutions for enterprise merchants. By integrating Verifone’s in-person payment technology with PayPal’s Braintree e-commerce platform, the collaboration offers a flexible, scalable payment system. With combined expertise, the companies aim to rapidly support merchants

- In January, Zebra Technologies launched three new solutions at its ZONE customer conference: the Zebra Kiosk System, Workcloud Actionable Intelligence 7.0, and ET6x Windows rugged tablets. The KC50 Android Kiosk enhances self-service, while Workcloud 7.0 uses AI for advanced analytics. The ET6x tablets improve warehouse productivity with AI-powered touchscreens. These innovations aim to streamline retail operations, enhance customer experience, and boost workforce efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 VENDOR SHARE ANALYSIS

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPARATIVE ANALYSIS

4.1.1 OVERVIEW

4.2 COMPARATIVE ANALYSIS OF PHILIPPINE MARKET AGAINST OTHER ASEAN MARKETS

4.2.1 OVERVIEW: DIGITAL PAYMENTS AND KIOSK INTEGRATION IN ASEAN

4.2.2 CONTRIBUTION OF KIOSKS TO DIGITAL PAYMENT GROWTH

4.3 LIST OF SOURCES

4.4 MICRO-MARKETS IN THE PAYMENT KIOSK INDUSTRY IN THE PHILIPPINES

4.5 EMERGING FINANCIAL SERVICES: THE NEED FOR CASHOUT, CARDLESS WITHDRAWALS, DEPOSIT ACCEPTANCE, AND OTHER VALUE-ADDED SOLUTIONS

4.5.1 CASHOUT SERVICES

4.5.2 CARDLESS WITHDRAWALS

4.5.3 DEPOSIT ACCEPTANCE

4.5.4 MOBILE PAYMENTS AND DIGITAL WALLET INTEGRATION

4.5.5 PEER-TO-PEER (P2P) TRANSFERS VIA KIOSKS

4.5.6 DIGITAL INSURANCE AND MICRO-INSURANCE OFFERINGS

4.6 TARGETING USER PROFILES FOR THE PHILIPPINE PAYMENT KIOSK MARKET: TAILORED

4.6.1 STRUGGLING PROVIDERS (FRUSTRATED WITH CURRENT PAYMENT INEFFICIENCIES)

4.6.2 HESITANT TRADITIONALISTS (CASH-PREFERRED, SKEPTICAL OF TECH)

4.7 RESPONSIBLE ENTHUSIASTS (EARLY ADOPTERS, TECH-DRIVEN)

4.8 STRATEGIES TO ACHIEVE MARKET DOMINANCE IN THE CASH-IN AND CASH-OUT KIOSK INDUSTRY IN THE PHILIPPINES BY 2032

4.8.1 MARKET LANDSCAPE AND CURRENT STATE OF KIOSK INDUSTRY

4.8.2 TARGET MARKET SEGMENTATION FOR KIOSK EXPANSION: RURAL AREAS AND UNDERSERVED COMMUNITIES

4.8.3 OPERATIONAL EXPANSION STRATEGY FOR 9,000 KIOSKS

4.8.3.1 Technology and Infrastructure Considerations

4.8.3.2 Customer Acquisition and Engagement

4.8.3.3 Financial Projections and KPIs for Growth

4.9 MARKET OPPORTUNITIES AND CHALLENGES FOR STAKEHOLDERS

4.1 SUPPLY AND DEMAND ANALYSIS OF THE PAYMENT KIOSK INDUSTRY

4.11 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.12 PENETRATION AND GROWTH POSPECT MAPPING

4.13 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.14 TECHNOLOGY ANALYSIS

4.14.1 KEY TECHNOLOGIES

4.14.2 COMPLEMENTARY TECHNOLOGIES

4.14.3 ADJACENT TECHNOLOGIES

4.15 TECHNOLOGY MATRIX

4.16 CHALLENGES

4.17 COMPANY SERVICE PLATFORM MATRIX

4.18 USED CASES & ITS ANALYSIS

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 BANKS AND FINTECHS EXPANDING KIOSK SERVICES NATIONWIDE

6.1.2 INCREASING DEMAND FOR SELF-SERVICE PAYMENT AUTOMATION

6.1.3 EXPANDING ACCESS OF PAYMENT KIOSKS IN UNBANKED AREAS

6.1.4 GROWING USE OF GCASH, MAYA, AND COINS. PH WALLETS

6.2 RESTRAINTS

6.2.1 LIMITED INTERNET CONNECTIVITY IN RURAL AND REMOTE AREAS

6.2.2 DATA PRIVACY CONCERNS AMONG CUSTOMERS USING KIOSKS

6.3 OPPORTUNITY

6.3.1 INTEGRATING WITH MOBILE WALLETS FOR SEAMLESS PAYMENTS

6.3.2 RISE OF CASHLESS PAYMENTS CREATING MORE KIOSK DEMAND

6.3.3 POTENTIAL FOR PARTNERSHIPS WITH LOCAL BUSINESSES AND MERCHANTS

6.4 CHALLENGES

6.4.1 HIGH UPFRONT INVESTMENT AND OPERATIONAL COSTS FOR KIOSKS

6.4.2 RISING POS SYSTEM ADOPTION REDUCES KIOSK RELIANCE

7 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY TYPE OF PAYMENT KIOSKS

7.1 OVERVIEW

7.2 BILL PAYMENT KIOSKS

7.3 RETAIL KIOSKS

7.4 E-COMMERCE AND REMITTANCE KIOSK

7.5 TRANSPORTATION KIOSKS

7.6 GOVERNMENT SERVICE KIOSK

7.7 OTHERS

8 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 CURRENT SERVICE

8.2.1 CASH IN

8.2.2 BILLS PAYMENT

8.2.3 MOBILE TOP-UPS

8.2.4 TRANSPORT TOP-UPS

8.3 PIPELINE SERVICE

8.3.1 CASH OUT

8.3.2 CARDLESS WITHDRAWALS

8.3.3 DEPOSIT ACCEPTANCE

9 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT MODE

9.1 OVERVIEW

9.2 CASH PAYMENTS

9.3 MOBILE WALLETS

9.4 CARD PAYMENTS

9.5 OTHERS

10 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT INDUSTRY

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

10.4 INFORMAL

11 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 SELF SERVICE KIOSKS

11.2.1 RETAIL PAYMENTS

11.2.2 BANKING AND FINANCIAL TRANSACTIONS

11.2.3 TICKETING AND TRANSPORTATION

11.2.4 UTILITY PAYMENTS

11.2.5 FOOD AND BEVERAGE

11.2.6 GOVERNMENT SERVICES

11.2.7 OTHERS

11.3 INTERACTIVE KIOSKS

11.3.1 INFORMATION AND DIRECTORY

11.3.2 DIGITAL ADVERTISING

11.3.3 OTHERS

11.4 POINT-OF-SALE (POS) KIOSKS

11.4.1 RETAIL POS

11.4.2 MOBILE POS INTEGRATION

12 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY END-USER

12.1 OVERVIEW

12.2 RETAIL SECTOR

12.2.1 BILL PAYMENT KIOSKS

12.2.2 RETAIL KIOSKS

12.2.3 E-COMMERCE AND REMITTANCE KIOSK

12.2.4 TRANSPORTATION KIOSKS

12.2.5 GOVERNMENT SERVICE KIOSK

12.2.6 OTHERS

12.3 GOVERNMENT SECTOR

12.3.1 GOVERNMENT SERVICE KIOSK

12.3.2 BILL PAYMENT KIOSKS

12.3.3 RETAIL KIOSKS

12.3.4 E-COMMERCE AND REMITTANCE KIOSK

12.3.5 TRANSPORTATION KIOSKS

12.3.6 OTHERS

12.4 BFSI (BANKING, FINANCIAL SERVICES, AND INSURANCE)

12.4.1 E-COMMERCE AND REMITTANCE KIOSK

12.4.2 BILL PAYMENT KIOSKS

12.4.3 RETAIL KIOSKS

12.4.4 GOVERNMENT SERVICE KIOSK

12.4.5 TRANSPORTATION KIOSKS

12.4.6 OTHERS

12.5 TRANSPORTATION & TRAVEL

12.5.1 E-COMMERCE AND REMITTANCE KIOSK

12.5.2 BILL PAYMENT KIOSKS

12.5.3 RETAIL KIOSKS

12.5.4 GOVERNMENT SERVICE KIOSK

12.5.5 TRANSPORTATION KIOSKS

12.5.6 OTHERS

12.6 HEALTHCARE INDUSTRY

12.6.1 BILL PAYMENT KIOSKS

12.6.2 RETAIL KIOSKS

12.6.3 E-COMMERCE AND REMITTANCE KIOSK

12.6.4 GOVERNMENT SERVICE KIOSK

12.6.5 TRANSPORTATION KIOSKS

12.6.6 OTHERS

12.7 OTHERS

13 PHILIPPINES PAYMENT KIOSK MARKET

13.1 COMPANY SHARE ANALYSIS: PHILIPPINES

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TOUCHPAY

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS/NEWS

15.2 ETAP INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS/NEWS

15.3 CLIQQ

15.3.1 COMPANY SNAPSHOT

15.3.2 SERVICE PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 ECPAY, INC

15.4.1 COMPANY SNAPSHOT

15.4.2 SERVICE PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 CEBUANA LHUILLIER

15.5.1 COMPANY SNAPSHOT

15.5.2 SERVICE PORTFOLIO

15.5.3 RECENT DEVELOPMENTS/NEWS

15.6 BAYAD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS/NEWS

15.7 BPI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS/NEWS

15.8 GCASH

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 GOTYME BANK

15.9.1 COMPANY SNAPSHOT

15.9.2 ERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENTS/NEWS

15.1 MAYA

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 PALAWAN PAWNSHOP

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENTS/NEWS

15.12 SM STORE

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS/NEWS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 MICRO-MARKETS IN THE PAYMENT KIOSK INDUSTRY

TABLE 2 PENETRATION AND GROWTH POSPECT MAPPING

TABLE 3 TECHNOLOGY MATRIX FOR THE PHILIPPINES PAYMENT KIOSK INDUSTRY

TABLE 4 COMPANY SERVICE PLATFORM MATRIX

TABLE 5 USED CASE ANALYSIS

TABLE 6 PHILIPPINES REGULATORY FRAMEWORK FOR PAYMENT SYSTEMS

TABLE 7 INSTALLATION AND SUPPORT: SETUP, CONFIGURATION, TRAINING, ONGOING MAINTENANCE, AND SUPPORT SERVICES

TABLE 8 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY TYPE OF PAYMENT KIOSKS, 2018-2032 (USD MILLION)

TABLE 9 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 10 PHILIPPINES CURRENT SERVICE IN PAYMENT KIOSK INDUSTRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 PHILIPPINES PIPELINE SERVICE IN PAYMENT KIOSK INDUSTRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT MODE, 2018-2032 (USD MILLION)

TABLE 13 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT INDUSTRY, 2018-2032 (USD MILLION)

TABLE 14 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 15 PHILIPPINES SELF SERVICE KIOSKS IN PAYMENT KIOSK INDUSTRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 16 PHILIPPINES INTERACTIVE KIOSKS IN PAYMENT KIOSK INDUSTRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 17 PHILIPPINES POINT-OF-SALE (POS) KIOSKS IN PAYMENT KIOSK INDUSTRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 18 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 19 PHILIPPINES RETAIL SECTOR IN PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 20 PHILIPPINES GOVERNMENT SECTOR IN PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 21 PHILIPPINES BFSI (BANKING, FINANCIAL SERVICES, AND INSURANCE) IN PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 22 PHILIPPINES TRANSPORTATION AND TRAVEL IN PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

TABLE 23 PHILIPPINES HEALTHCARE INDUSTRY IN PAYMENT KIOSK INDUSTRY MARKET, BY END-USER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: SEGMENTATION

FIGURE 2 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: DATA TRIANGULATION

FIGURE 3 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: DROC ANALYSIS

FIGURE 4 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: MULTIVARIATE MODELING

FIGURE 10 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: TYPE TIMELINE CURVE

FIGURE 11 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: APPLICATION COVERAGE GRID

FIGURE 12 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: SEGMENTATION

FIGURE 13 SIX SEGMENTS COMPRISE THE PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY TYPE OF PAYMENT KIOSKS (2024)

FIGURE 14 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 BANKS AND FINTECH’S EXPANDING KIOSK SERVICES NATIONWIDE IS EXPECTED TO DRIVE THE MARKET GROWTH DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 BILL PAYMENT KIOSK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET IN 2025 & 2032

FIGURE 18 40

FIGURE 19 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

FIGURE 20 MARKET OVERVIEW

FIGURE 21 BANKCOM CASH KIOSKS ARE NOW AVAILABLE AT 57 LOCATIONS NATIONWIDE (PHILIPPINES)

FIGURE 22 DIGITAL WALLETS IN THE PHILIPPINES

FIGURE 23 4G DECINE IN PHILIPPINES IN MARCH (2020)

FIGURE 24 SHARE OF DIGITAL PAYMENTS IN THE PHILIPPINES (2023)

FIGURE 25 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY TYPE OF PAYMENT KIOSKS, 2024

FIGURE 26 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: BY SERVICE TYPE, 2024

FIGURE 27 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT MODE, 2024

FIGURE 28 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET, BY PAYMENT INDUSTRY, 2024

FIGURE 29 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: BY APPLICATION, 2024

FIGURE 30 PHILIPPINES PAYMENT KIOSK INDUSTRY MARKET: BY END-USER, 2024

FIGURE 31 PHILIPPINES PAYMENT KIOSK MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.